The New Hampshire Senate voted to pass its version of the State Budget on June 6, modifying the version provided by the House and proposing major new initiatives in health and social services. Incorporating several bills passed independently by the Senate, the Senate Budget would expand home- and community-based services for children, establish a new job training program, and invest in a secure psychiatric unit facility and other mental health facility infrastructure. The Senate also voted to increase Medicaid reimbursement rates for all providers with a $60 million appropriation, which would help ensure the provision of health services to residents with limited resources and assist in bolstering the health care workforce. The Senate Budget aims to eliminate the wait list for developmental disability services and proposes an ongoing investment in affordable housing. The House plan for family and medical leave insurance was carried forward into the Senate Budget, and the Senate voted to add a significant number of child protection workers and mobile crisis services for children. With a relatively strong economy and a revenue surplus, New Hampshire policymakers have an opportunity to comprehensively address long-term challenges facing the state and build a more resilient economy for all Granite Staters. The Senate version of the State Budget takes certain key steps toward addressing those challenges through the deployment of one-time funds, the establishment of certain ongoing commitments, and new initiatives detailed in the policies attached to the Senate Budget proposal.

The Senate Budget would freeze the business tax rates at 2018 levels, halting reductions taking effect this year and in 2021 under current law. Stopping the planned rate reductions would generate an additional $93.1 million to fund State services during the two years of the budget, according to the Senate’s plan. Revenue projections used in the Senate Budget were also more optimistic than those used by the House, suggesting a total of $148.0 million more in revenue would come in during the remainder of this State fiscal year and during the budget biennium. However, the Senate Budget relies on current and projected revenue surplus for this State fiscal year, carried forward into the next two years of the biennium, to maintain a balanced budget. The Senate did not retain the expansion of the Interest and Dividends Tax base to include capital gains, which was proposed by the House to fund additional aid to communities with low property values per student and higher percentages of students eligible for free and reduced-price meals.

The Senate would boost the amount of State aid directed at local school districts through per pupil education grants, and fully fund stabilization grants, by approximately $93.8 million relative to current law. However, relative to the House Budget’s funding levels, this would be an approximately $71.6 million decrease. The Senate voted to direct more aid to communities with low property values per student, and to separately appropriate $40 million in one-time unrestricted revenue to municipalities based on their resident student populations, with an emphasis on students with low incomes.

This Issue Brief explores key components of the Senate Budget, including both the Senate Operating Budget Bill (House Bill 1) and Trailer Bill (House Bill 2) proposals.[i]

Overall Figures and the Operating Budget Bill

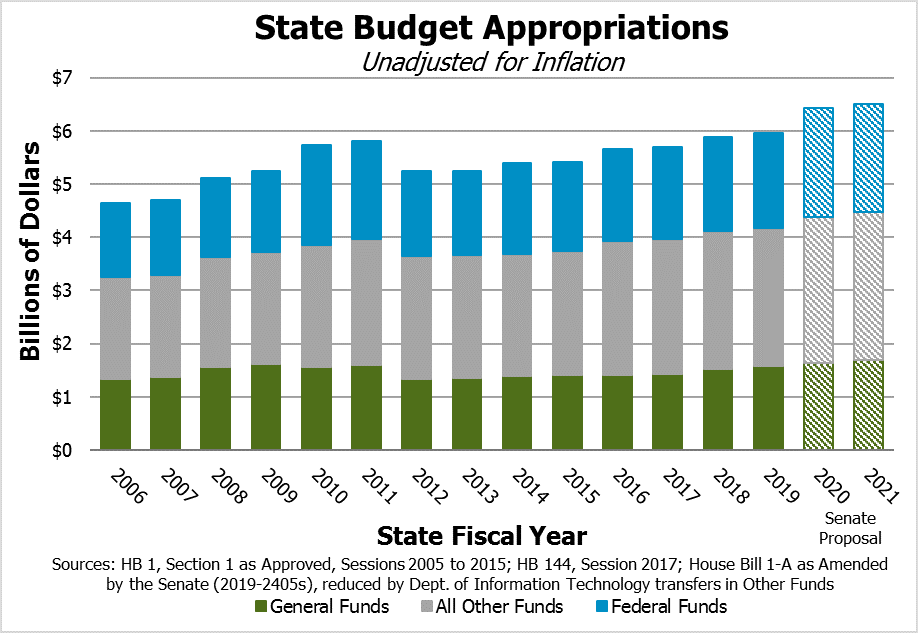

The Senate Operating Budget Bill would expend $13.329 billion during State Fiscal Year (SFY) 2020 and SFY 2021. However, the Senate removed approximately $201 million each year in double-counting of interagency transfers, bringing the total to $12.927 billion for the two-year period. Using these two figures and not adjusting for federal funds removed from the SFYs 2018-2019 State Budget or inflation, this biennial budget proposal grows 12.4 percent without the removal of double-counted appropriations and 9.0 percent with those appropriations included. The Governor’s Operating Budget Bill for SFYs 2020-2021 grew 10.4 percent relative to the prior budget as passed without the removal of interagency transfers, and the House Budget increased by 13.1 percent relative to the prior budget. On a year-over-year basis and including double-counted funds, the Senate budget proposal would grow 8.2 percent from SFY 2019 as currently authorized to SFY 2020, and 1.2 percent between SFY 2020 and SFY 2021. Considering only the General Fund of the Senate Budget, the House proposal would increase by 7.2 percent for the biennium over the SFYs 2018-2019 State Budget’s General Fund, which is smaller than the 9.2 percent the prior State Budget’s General Fund increased relative to its predecessor. Notably, funding for key initiatives in the Senate Budget, similar to the structure of the Governor’s Budget proposal, are included in the Trailer Bill and not included in the Operating Budget Bill, and thus not included in the figures above. The House also made appropriations through the Trailer Bill, but made many fewer appropriations overall.[ii]

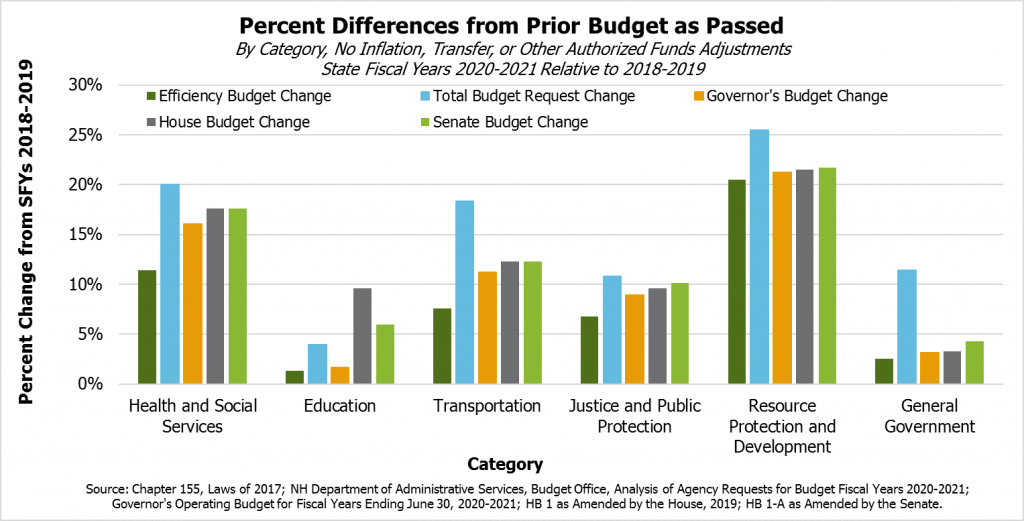

The Senate Operating Budget Bill, similar to those proposed by the Governor and the House, funds most budget categories of State services at levels between agency Efficiency Budget requests for the biennium and the Total Budget Requests, which include State agency priorities categorized as Additional Prioritized Needs.[iii] The key exception is Education, where the Senate budget added significant new funding to local public education aid and public higher education, although at levels lower than those proposed by the House. The category of Education is appropriated $102.0 million (3.29 percent) less in the Senate’s Operating Budget Bill than in the House Budget. All other categories were appropriated remarkably similar aggregate amounts, although significant amounts of appropriations were shifted within those totals. The Senate appropriated $10.9 million (0.97 percent) more than the House to General Government, $6.8 million (0.47 percent) more to Justice and Public Protection, $1.1 million (0.16 percent) more to Resource Protection and Development, $804,328 (0.01 percent) less to Health and Social Services, and $11,366 (0.001 percent) less to Transportation. While these differences, outside of Education, are remarkably small as a percentage of the State Operating Budget, the differences between the House and Senate Budget proposals widen when the appropriations in the Trailer Bill are included, where the Senate made many of its significant appropriations.

Comparisons to the SFYs 2018-2019 State Budget discussed here do not adjust for federal and other funds removed by the Legislature from the last State Budget, nor do they adjust for the inclusion in the SFYs 2020-2021 agency requests, the Governor’s proposal, the House Budget, and the Senate Budget of a major water infrastructure-related fund under Resource Protection and Development that was operating but not accounted for in the prior State Budget. These figures also do not account for funding deployed by the Trailer Bills and outside of the Operating Budget Bills.

Funding Public Services

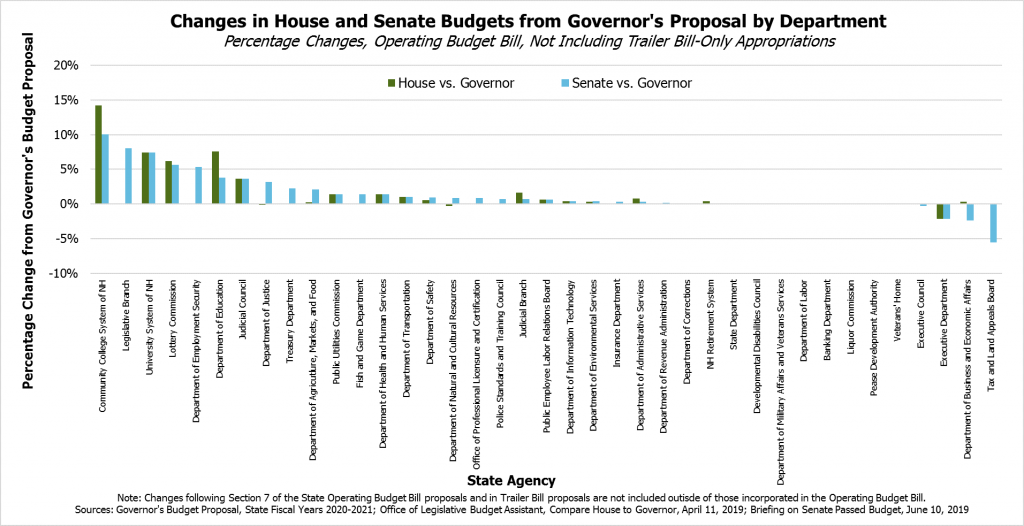

Relative to the Governor’s Budget proposal, the Senate and House Budgets both add significantly to the Department of Education, the Community College System of New Hampshire, and the University System of New Hampshire. The Senate incorporated the new Legislative Branch budget and added a significant amount of funding to New Hampshire Employment Security to support the job training programming proposed in the Trailer Bill. The Senate also voted to reduce the funding for the Department of Business and Economic Affairs marketing appropriations and eliminated a position at the Board of Tax and Land Appeals. The Senate voted to shift the Governor’s Scholarship Program to the Treasury Department and add staff to the Justice Department. Many significant changes related to health and human services proposed in the Senate Budget are not incorporated directly into the Operating Budget Bill, and instead receive appropriations through the Trailer Bill as proposed by the Senate. As such, significant policy and funding changes in the Trailer Bill do not have a significant aggregate impact on the Department of Health and Human Services (DHHS) in the Operating Budget Bill.

Health Services

The Senate proposed many substantial changes to health services in its version of the State Budget, including one-time special initiatives and incorporating bills passed separately by the Senate into the Trailer Bill. While the Senate did not significantly alter overall appropriations to the DHHS relative to the House Budget, the Senate included significantly more appropriations in the Trailer Bill than the House Budget incorporated, including broad Medicaid reimbursement rate increases, funding for mental health facilities, and home- and community-based services for children. The universal Medicaid reimbursement rate increases constitute the largest single appropriation made by the Senate that was absent in the House version of the State Budget.

Medicaid Reimbursement Rate Increases

The Senate voted to appropriate $60 million in State funds to increase Medicaid reimbursement rates for nearly all Medicaid providers and services by 3.1 percent in SFY 2020 and an additional 3.1 percent in SFY 2021. The 3.1 percent increase in SFY 2020 incorporates the 2.5 percent increase in developmental disability services reimbursement rates proposed by the Governor and retained in the House Budget, and incorporates a small amount of the appropriations to county nursing home and long-term supports and services waiver funding in the House Budget. The total new appropriation added by the Senate to the House Budget for this rate increase would be $52,128,000. This rate increase would exclude any provider rate increases for inpatient-only substance use disorder treatment services.

An additional $5 million would be appropriated to providing enhanced rates for mental health and substance use disorder inpatient and outpatient services. This appropriation is designed to match the reimbursement rate increases required by the legislation reauthorizing the expanded Medicaid program last year.[iv] The Senate Budget would also establish a committee to study differences in pay between independent case managers and case managers who are part of the Medicaid managed care program.

Expanded Medicaid Funding Structure

The Senate proposal would permit funding for New Hampshire’s expanded Medicaid program to draw on General Fund revenues as needed to fund the non-federal share of the program. The federal government is paying for 93 percent of all service expenditures in 2019, with the percentage of funding for service expenditures dropping to 90 percent in 2020 and future years. Expanded Medicaid in New Hampshire provides health coverage for approximately 50,000 people with low incomes.

The current funding structure for the non-federal share may not support the additional funding needed following Medicaid provider rate increases, or support the non-federal share of program if costs grow substantially for other reasons, such as an economic recession increasing the percentage of the population that is eligible. The funding structure relies on Insurance Premium Tax revenues collected specifically from the expansion of coverage to expanded Medicaid enrollees, an assessment on health insurance companies associated with a high-risk pool, a contribution of 5 percent of the Liquor Commission’s gross profits from liquor sales, any voluntary contributions, and any savings generated by managed care organizations keeping costs below certain thresholds. However, the funding structure limits the high-risk pool assessment on health insurance companies to 50 percent of the total non-federal share or the amount covered by the sum of Insurance Premium Tax revenues and the Liquor Commission contribution. As such, if the contribution from those two sources falls short of 50 percent of the needed to cover the non-federal share, the program could have a funding shortfall, which would trigger an automatic end to the program under current State law. The Senate Budget would permit General Funds to be requested and used in the event of such a shortfall.

Mental Health

The Senate proposed making substantial investments in facilities to assist those in need of mental health-related services. The largest dollar value investment proposed in the Senate budget is $17.5 million for a secure psychiatric unit facility on the grounds of New Hampshire Hospital, which would have 25 beds and be designed to transfer appropriate persons from the State prison to this facility. The statute would require the Department of Administrative Services (DAS) to prioritize this facility within its workload, and both the DHHS and the DAS would be required to provide quarterly reports to the Senate and House Finance Committees and the Joint Legislative Fiscal Committee on the progress of the project. The facility would be administered by the DHHS, and the State would not be permitted to contract with a private or for-profit prison company for the construction or operation of the facility.

The Senate also voted to make other investments in mental health-related facilities, including:

- $6 million in SFY 2019, which would not lapse, for the purpose of obtaining and renovating a new treatment facility for children in need of acute impatient psychiatric treatment, with an additional nonlapsing appropriation of $5.5 million for SFY 2020 to operate the facility. After completion of the design of the facility but before any contractual obligation is accepted, the DHHS would be required to provide a report detailing age- and developmentally-appropriate education, recreation, and rehabilitation services, and staffing and security considerations to make the facility no less effective or protective than services currently in place at New Hampshire Hospital. The total appropriation for this purpose is $6.5 million more than appropriated in the House budget.

- $4 million, including $1 million from New Hampshire Hospital trust funds, to repurpose the children’s section of New Hampshire Hospital for up to 48 adult beds. The total funds appropriated is the same total as the House Budget, but it is funded with $1 million less in General Funds because it draws on the New Hampshire Hospital trust funds.

- $5 million for 40 transitional housing beds for forensic patients or those with complex behavioral health conditions, on the condition of the Joint Legislative Fiscal Committee receiving a plan from the DHHS. The Senate budget would appropriate twice the dollar amount proposed by the House budget and appropriate those dollars in SFY 2019 rather than in SFY 2020, with the goal of funding twice as many beds; the House budget did not make the funding contingent on a plan from the DHHS.

- $900,000 for community housing and related expenditures under the Bureau of Mental Health Services.

- $500,000 for assistance to hospitals for the needs of involuntary emergency inpatient admissions, with a restriction on receiving hospitals being further than 30 miles from an established mobile crisis team or designated receiving facility, and that no single hospital shall receive more than $100,000. The House budget included $1 million for this purpose.

- extending the permission for the DHHS to use up to $500,000 for supported housing for those with serious mental illness through the end of the biennium, preventing the funding set aside from lapsing.

- alter Senate Bill 11, already passed and signed into law, relative to designated receiving facility beds to reduce the appropriation from $4.4 million to $1.0 million in State funds, with a reduced number of total designated receiving beds and resources for these contracts targeted to hospitals in Sullivan and Cheshire counties. The changes would also appropriate $976,000 in federal and State funds to increase certain rates for designated receiving facility services.

Substance Misuse

The Senate version of the State Budget retained many House proposals to address substance misuse, and added several new provisions. Alongside the additional nearly $12 million in federal funds appropriated in the House version of the budget under the State Opioid Response Grant, the Senate voted to appropriate $1 million in State funds to upgrade existing and create new substance use disorder treatment and recovery housing facilities. The Senate Budget would appropriate $375,000 per year to existing Safe Stations in Manchester and Nashua, and alter the Controlled Drug Prescription Health and Safety Program to permit more sharing of certain information between departments. The Senate Budget would also clarify that liquids related to electronic cigarettes containing nicotine or cannabis, or other liquid for inhalation and the devices used to deliver them cannot be sold to minors.

Relative to enforcement, the Senate voted to appropriate $2.4 million to county and local law enforcement agencies for funding overtime costs associated with substance abuse enforcement. Additionally, the Senate Budget would appropriate $587,700 to the Department of Safety for funding overtime at the State forensic laboratory resulting from increased narcotics-related enforcement and investigations and for funding State police overtime for narcotics enforcement and investigation.

Developmental Disability Services

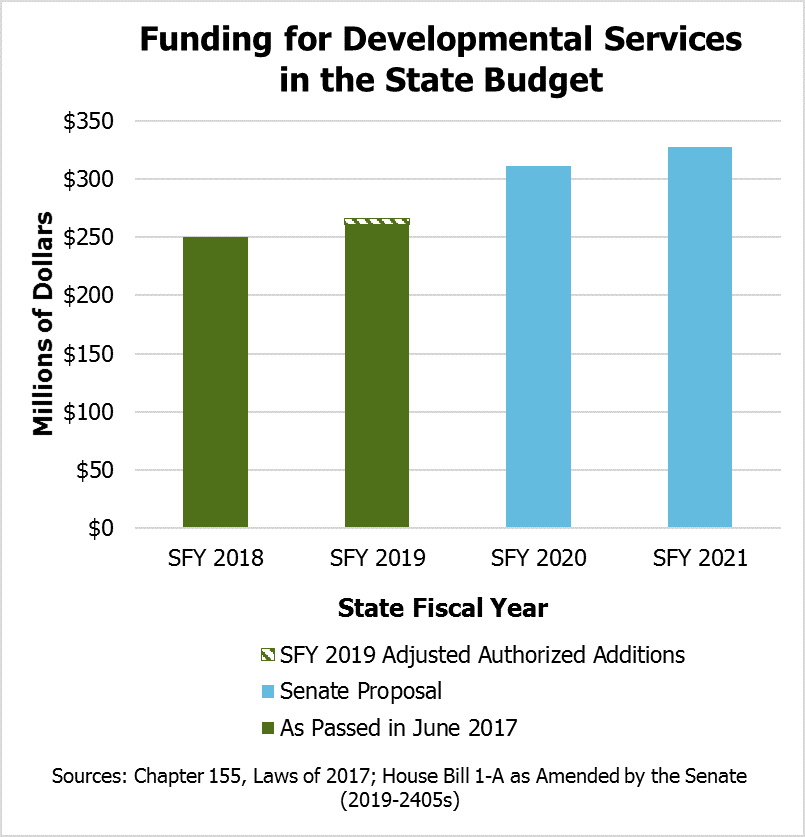

Like the Governor’s budget proposal and the House budget, the Senate aims to eliminate the projected wait list for services in SFY 2020. The Senate identified a budgeting error in the prior versions of the State Budget, however, which permitted them to trim $10 million in combined General and federal Medicaid Funds from the developmental services appropriation. In total, the increase in appropriations proposed by the Senate budget relative to the State Budget for the current biennium as passed by the Legislature in June 2017 is $127.8 million, with approximately half of those funds coming from federal Medicaid matching grants.

Child Services and Protection

The Senate Budget would direct the DHHS to expand home and community-based behavioral health services for children through the establishment of a care management entity, a family support information clearinghouse, and a system of care advisory committee. This section mirrors Senate Bill 14, which has been signed into law. As a part of this section of the Trailer Bill, the Senate Budget would:

- require the DHHS to contract with third-party entities to ensure that all children under 21 in the state have access to mobile crisis response and stabilization services, with less than a one-hour response time statewide;

- require that at least 10 percent of funding received by the DHHS for children’s behavioral health services be used for evidence-based practices by July 1, 2020, ramping up to 25 percent by 2022 and 50 percent by 2025;

- expand requirements around contracts with providers for behavioral health services to children; and

- appropriate $19.2 million over the biennium for new requirements related to child welfare behavioral health services.

The Senate also voted to ensure that more employees relative to child protection would be hired at the DHHS’s Division of Children, Youth, and Families. Contingent upon the passage of Senate Bill 6, which has been signed into law separately since these sections were added to the Trailer Bill by the Senate Finance Committee, the Senate Budget would appropriate $6.1 million to hire 57 more child protective services workers and $2.5 million more to hire 20 child protective supervisors by the end of the biennium.

Choices for Independence Medicaid Waiver and Nursing Home Services

Counties are responsible for certain long-term supports and services provided to their residents, including nursing home services, such as through county-operated nursing homes, and services delivered through the Choices for Independence (CFI) Medicaid Waiver. CFI Medicaid Waiver services provide long-term care coverage for eligible adults of limited means in home- and community-based settings. They are delivered through providers who are reimbursed by federal, county, and state government funds for delivering home- and community-based care. Counties paid 93 percent of the non-federal costs of these services in SFY 2018.[v] The primary tax revenue source for counties is the property tax.

The House Budget reduced the appropriation from the Governor’s budget for nursing home and CFI Medicaid Waiver services by $20 million, primarily to limit county obligation growth to 2.5 percent annually. The Senate budget would increase that rate to 3.0 percent annually, increasing the county obligation and trimming General Fund appropriations to these services by about $1.8 million over the biennium and increasing the county obligation by the same amount. Separately, the Senate appropriated an additional $2 million, to be matched with $2 million in federal Medicaid funding, for skilled nursing services in the Division of Long-Term Supports and Services, some of which would apply to adults at nursing facilities.

The Senate budget would alter language regarding payments to county nursing homes from the State to base the payments on the State’s Medicaid plan, rather than apportioned based on total county nursing home Medicaid use, and alters the manner in which the county payments are needed relative to the federal Medicaid match.

Dental Benefits and Cliff Effects Research

The Senate budget would establish two frameworks for researching policy issues, retaining cliff effects research initiatives from the House budget and setting up a working group to plan for an adult dental benefit in Medicaid.

The Senate did not propose or fund adult dental coverage during the budget biennium, as the House budget would, but it would establish a working group, convened by the DHHS and comprised of legislators, dentists, a dental insurance carrier, and other medical professionals. The DHHS, in consultation with this working group, would be required to prepare a plan to incorporate an adult dental benefit in Medicaid that would take effect in SFY 2022. The DHHS would be required to produce a report on needed statutory changes to support this benefit by October 2019, and would be required to report monthly on the development of the dental plan to the Joint Legislative Fiscal Committee and the Oversight Committee on Health and Human Services.

The Senate also voted to retain the House’s proposal to study the “cliff effect,” which occurs when individuals on a public assistance program have an increase in income, such as from a new job, or another change in their status that makes them no longer eligible for a program, and results in a sudden end to benefits. In some cases, this may end up reducing overall income for that individual. The Senate budget would, in an effort to coordinate poverty reduction strategies across State agencies and employers, require the DHHS to create a plan to close the cliff effect, create a “benefits cliff calculator” to measure the effects of increased income on individuals, and create a working group to report policy recommendations starting in December 2019 and continuing quarterly throughout the biennium. The Senate, like the House, appropriated only $1 in each year of the biennium for the development and implementation of this plan.[vi]

Temporary Assistance for Needy Families Reserve Funds

TANF funds are provided through block grants of about $38.4 million per year from the federal government. TANF reserves are particularly important during times of unforeseen need, such as economic recessions, to provide temporary assistance to families who lose income.

The estimated balance of the TANF reserve was $70.1 million at the end of SFY 2017, but it is projected to fall to $35.6 million by the end of SFY 2019, as expanded benefits and additional appropriations of TANF dollars to other programs have drawn on the reserve. Both the Governor’s budget proposal and the House budget proposal would have produced projected TANF deficits of $17.4 million and $5.8 million, respectively, by the end of the biennium.[vii]

The Senate sought to bring the TANF reserve fund into balance by reducing funding set aside for the Granite Workforce Pilot Program. The Senate removed $16 million in TANF appropriations to the Granite Workforce Pilot Program, which would subsidize employers of participants in the Granite Advantage expanded Medicaid program for up to $2,000 for the first three months of employment, with an additional subsidy of up to $2,000 after nine months of employment. The Senate Budget would limit participating employers who would receive funds, which would be TANF-funds for TANF-eligible participants, to subsidize employment of Granite Workforce participants to 501(c)(3) entities. The DHHS would be permitted, but not required, to use TANF funds to support the Granite Workforce Pilot Program. The Senate would also replace $8 million in General Funds for the Child Development Program with TANF funds produced from Granite Workforce Pilot Program savings. TANF funds would also be shifted to fund Family Resource Center contracts in SFY 2021, with SFY 2020 covered by an appropriation of $1.5 million in General Funds. In total, these changes were projected to bring the TANF reserve to a positive balance of $5 million at the end of the biennium. Updated projections may change this figure.[viii]

Other Health Services Changes

In addition to the investments and changes from the House Budget summarized above, the Senate budget would:

- appropriate approximately $24.8 million in federal and State funds over the biennium for New Hampshire Medicaid Management Information System operating costs;

- launch a pilot program to help low-income individuals aged 65 and older pay for prescription drugs after they reach the coverage limit under Medicare, with an initial $2 million appropriation;

- add $1.2 million in General Fund dollars above the House Budget allocations for family planning programs to supplant a reduction in federal funds;

- set aside $642,137 during the biennium to fund one public health nurse consultant and a contract to implement lead testing procedures required in State law;

- switch the funding source for a proposed study of causes of high levels of pediatric cancer from General Fund appropriations to the Drinking Water and Groundwater Trust Fund;

- funds the New Hampshire Foster Grandparents program with a $200,000 appropriation;

- adds $100,000 for domestic violence crisis centers;

- seeks to establish, though an amendment to a federal waiver, a Medicaid for Older Employed Adults with Disabilities Work Incentive Program to allow working persons age 65 and older to receive health services through Medicaid similar to the existing Medicaid for Employed Adults with Disabilities program, which applies to those aged 18 to 64;

- repeals a provision in law requiring “all eligible Medicaid members are enrolled in the managed care model under contract with the department no later than 12 months after the contract is awarded to the vendor or vendors of the managed care model,” which appears to repeal part of the initial plan for all mandatory Medicaid enrollees to be in managed care by July 1, 2012;

- changes the repeal of presumptive eligibility program for nursing facility services, as was passed in the House Budget, to a suspension;

- requires a study of the service delivery system for those with developmental disabilities, which the Governor originally proposed in his budget; and

- establishes the Child Abuse Specialized Medical Evaluation Program, as proposed in the House Budget.

Education

The House increased funding for education more substantially in its version of the budget relative to the Governor’s Budget than any other broad category of State appropriations. The Senate retains a portion of the House’s proposed increase, but reduces funding for education by more than any other category in its modifications of the House Budget. The Senate does not propose a major revision of the Adequate Education Aid formula, but includes a smaller but significant revision while restoring stabilization grants to their original amounts and funding full-day kindergarten. While there are definite similarities, including in the structure of the shared formula revision, education remains the area where the House, Senate, and Governor’s budgets differ most significantly in terms of appropriations.

Adequate Education Payments to Local Schools

Education aid to local governments is the area of largest contrast between the Senate budget and the House budget that reduced funding relative to the House proposal. The Senate and House proposed very similar policies for SFY 2020, but the Senate proposal would make fewer additions to the Adequate Education Aid formula than the House proposed in SFY 2021, resulting in significantly less funding directed to local education aid. The Senate did add significantly more unrestricted aid to local municipal governments than the House (see section within “Major New Initiatives” below), but that aid, while based on resident students, would not necessarily be used for education. Both education and non-education aid may be used to offset property taxes, depending on local government decisions. The Senate removed the expansion of the Interest and Dividends Tax to include capital gains as taxable income, which the House proposed using to pay for significant portions of the increased Adequate Education Aid in SFY 2021.

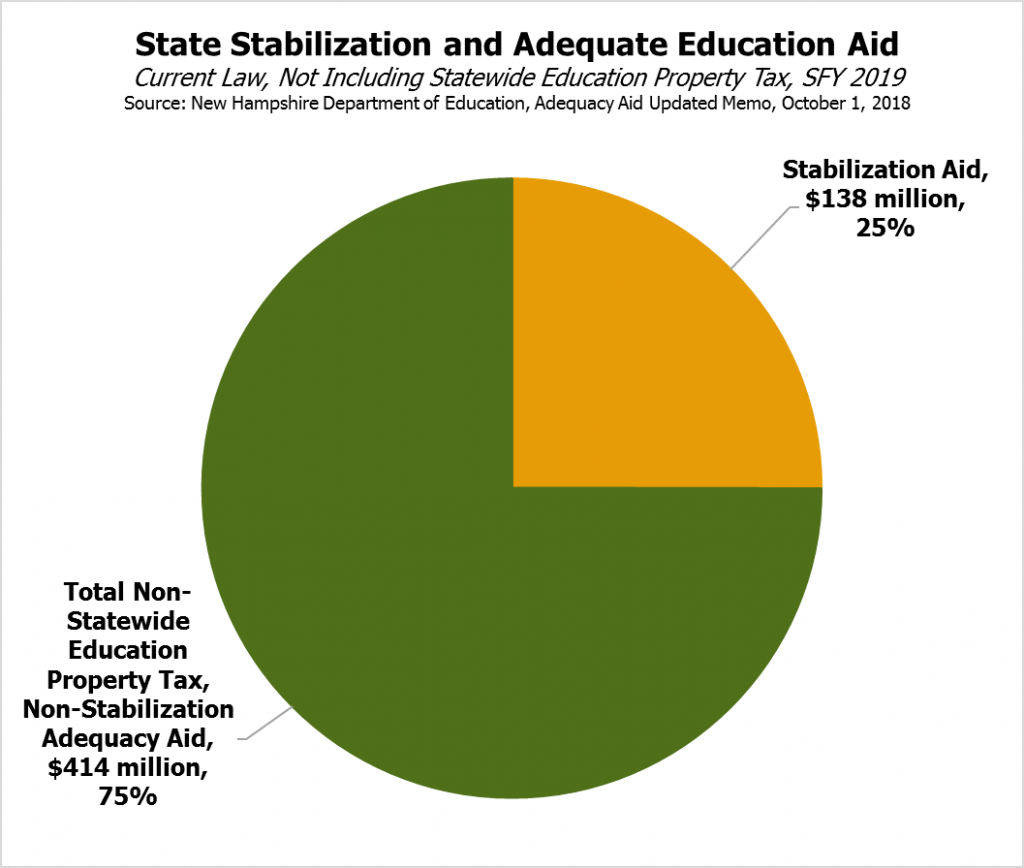

For the first year of the biennium, the House and Senate would both restore stabilization grants, which have been declining since SFY 2017, to their original levels provided in SFYs 2012-2016. Both the House and Senate budgets would also increase education aid for full-day kindergarten pupils to the levels provided for students in grades one through 12 starting in SFY 2020, rather than the half-day grants augmented by the additional $1,100 per student provided associated with the legalization of Keno that is established in current law.[ix]

However, for SFY 2021, the House would eliminate stabilization grants and instead establish fiscal disparity aid and additional aid for municipalities with higher concentrations of students eligible for the Free and Reduced-Price School Lunch Program. While the House budget eliminates stabilization grants in SFY 2021, it guarantees that no municipality, except for those which raise sufficient revenue locally to fund their allotted Adequate Education Aid through the Statewide Education Property Tax, receives a smaller appropriation than in the previous year. The House budget also caps additional education aid appropriated to municipalities at 120 percent of SFY 2020 levels in SFY 2021, and caps growth at two percent more than the prior year in every year thereafter.

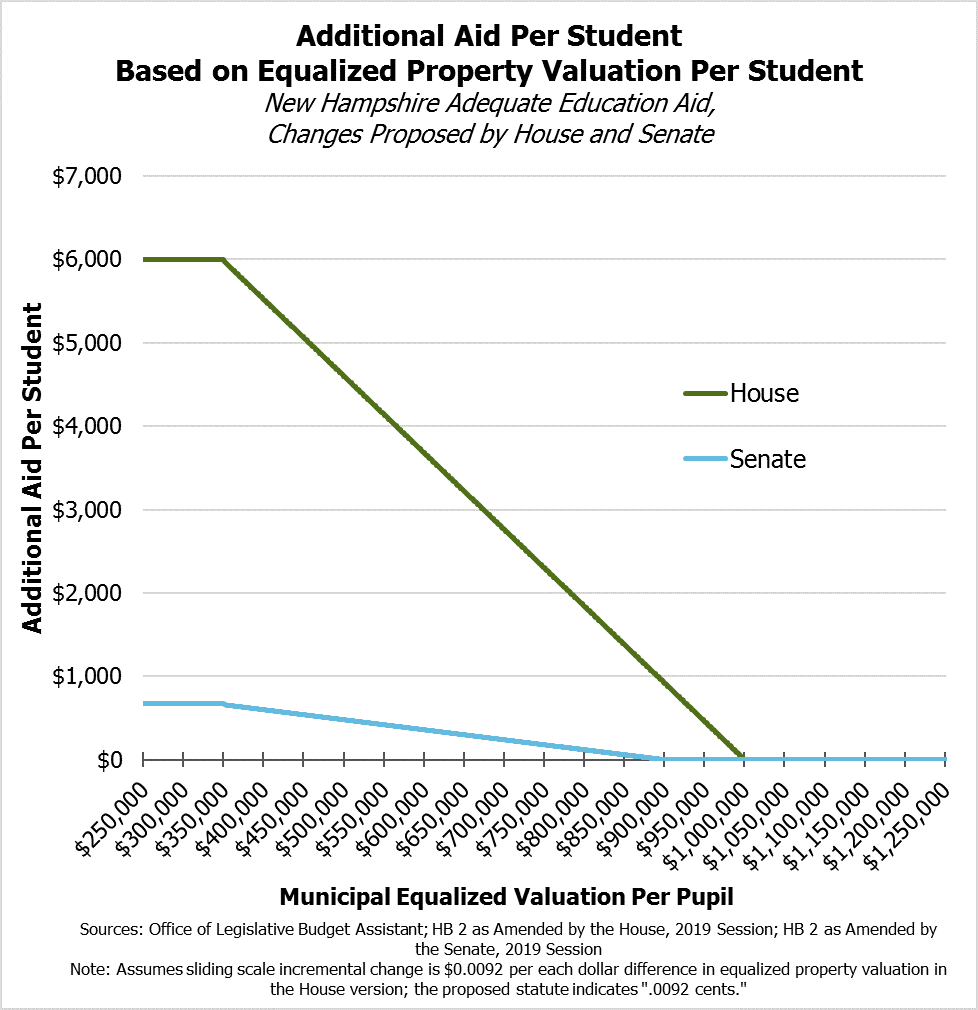

The House proposed a sliding scale or additional per student grants based on the municipality’s equalized valuation per pupil, a measure of the property tax base divided by the number of students in residence. The House would have provided additional per pupil education aid for each resident student for municipal governments for those that had less than $1,000,000 in equalized valuation per pupil, with aid increasing to an additional $6,000 per pupil for municipalities with less than $350,000 in equalized property valuation per pupil. The Senate retained this model, but limited both its scope and the cap on the maximum amount of aid based on this metric. The Senate reduced the threshold at which local governments would receive additional aid to a $900,000 equalized property valuation per pupil, and decreased the maximum aid amount to $675 in additional aid per pupil. Examining this component of the policy proposal alone, the House version of the budget’s appropriations would provide additional aid to municipalities home to an estimated 67.2 percent of students statewide, based on the most recently available data. The Senate targeted aid more narrowly, appropriating aid to municipalities with approximately 43.3 percent of all students with its proposal.

The House proposed appropriating additional education aid to municipalities with higher concentrations of students eligible for the Free and Reduced-Price School Lunch Program, which is targeted at students from households with low incomes. The Senate eliminated this provision. However, the Senate retained and expanded the establishment of and funding for a commission to study school funding in New Hampshire, as proposed in the House Budget.

The Senate voted to increase assistance for charter school tuition grants by approximately $2.5 million, stemming from an increase of $374 per student in tuition aid.

School Building and Other Local Education Aid

The Senate voted to reduce the additional funding appropriated by the House Budget to the existing school building aid program. While the House increased school building aid through the existing program by $19.3 million, the Senate voted to roll back that increase by $12.1 million, resulting in an increase of $7 million over the Governor’s Budget proposal. The Senate’s decrease included a $3.5 million reduction resulting from changes in cost estimates. Notably, neither the House nor the Senate voted to retain the Governor’s proposed Targeted School Building Aid Reserve Fund, which would have appropriated $63.7 million from the Education Trust Fund for school building aid dispensed under the direction of State officials in a new structure established by the Governor’s Trailer Bill proposal. The Senate Budget would continue the authorization of the Public School Infrastructure Fund and permit the Department of Education to keep 3 percent of the total annual appropriation to administer the disbursement of the Fund; disbursement funding purposes would be modified to explicitly include helping schools comply with Americans with Disabilities Act regulations.

The Senate retained the House Budget provisions to fully fund anticipated special education expenditures for students who have higher cost needs, appropriating $61.6 million over the biennium. The Senate voted to reduce tuition and transportation aid relative to the House Budget by $3.8 million, of which $2.6 million was the result of a reduction in agency estimates of projected need. The Senate also reduced grants for the New Hampshire Robotics Fund by $500,000.

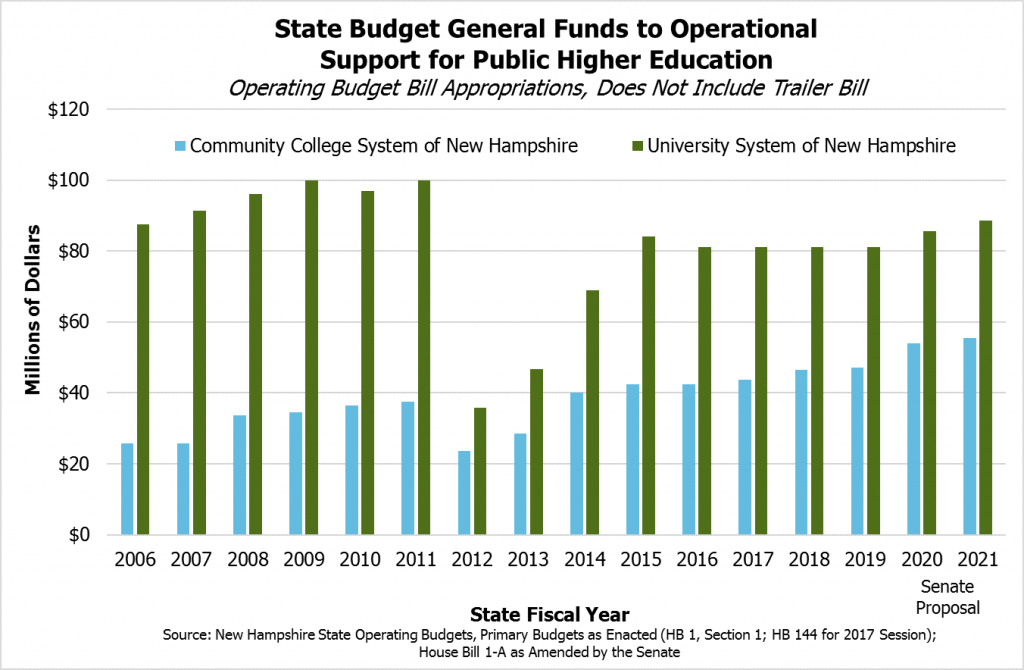

Higher Education Aid

The Senate did not alter the appropriations for the University System of New Hampshire from the House Budget proposal. Under these plans, the University System would receive an increase in operating funding support of $12 million relative to the current biennium. Neither the Senate nor the House incorporated the Governor’s proposal for $24 million in one-time, directed funds for the University System aimed at bolstering the health care and manufacturing workforce as well as supporting capital projects at Plymouth State University, or the $6 million in surplus-contingent funds to create an early childhood development center on the University of New Hampshire campus.

The Senate added $900,000 to provide scholarships and grants for the dual and concurrent enrollment programs, including Running Start, and removed the proposed Governor’s Finish Line New Hampshire Scholarship Program from the Trailer Bill, reducing expenditures by $900,000. Funds for the Governor’s Finish Line New Hampshire Scholarship Program were removed from the General Fund line for the Community College System of New Hampshire. Also removed from the appropriation made from the House Budget’s General Fund for the Community College System was $3.2 million relative to one-time information technology investments, but those appropriations were incorporated into the Trailer Bill.

The Senate voted to move the Governor’s Scholarship Program, currently located at the Office of Strategic Initiatives, to the Treasury Department, rather than to the Department of Education as proposed in both the Governor’s and the House’s budgets. The Senate reduced appropriations for the Governor’s Scholarship Program to $3 million per year, a reduction of $8 million over the biennium. The administration of the Program would be conducted by the College Tuition Savings Plan Advisory Commission. The Senate Budget would also alter the New Hampshire Excellence in Higher Education Endowment Fund.

Relative to students loans and health services, the Senate Budget would fund the State Loan Repayment Program for clinicians in Carroll, Cheshire, and Coos counties working in mental health and substance use disorder services with a $7.5 million appropriation.

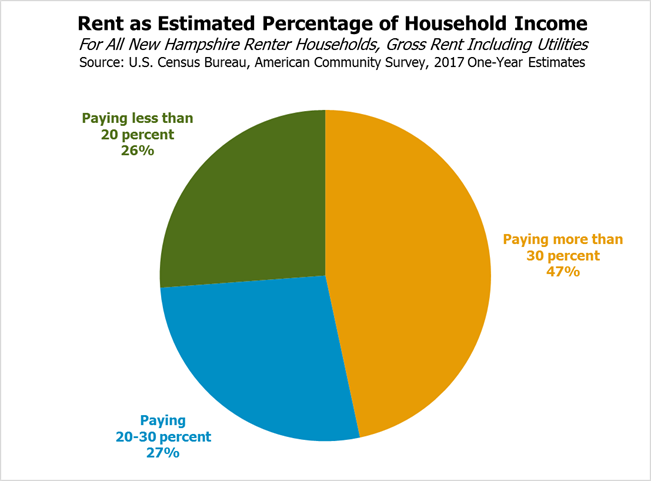

Housing

The Affordable Housing Fund, administered by the New Hampshire Housing Finance Authority, provides grants and low-interest loans for building or acquiring housing affordable to families and individuals with low-to-moderate incomes.[x] Like the House Budget, the Senate Budget would appropriate $5 million in General Fund dollars to the Affordable Housing Fund for SFY 2020. Unlike the House Budget, the Senate Budget would appropriate $5 million annually from the Real Estate Transfer Tax to the Affordable Housing Fund starting in SFY 2021 and continuing each subsequent State fiscal year.

The Senate Budget Trailer Bill includes a proposal for a Housing Appeals Board, which would be comprised of three members appointed by the Supreme Court who would hear land disputes in an effort to avoid superior court challenges. The Board would have the authority to affirm, modify, or reverse decisions of municipal boards, committees, or commissions related to housing and housing development.

The Senate proposed trimming $500,000 over the biennium for rapid re-housing programs from the House Budget proposal.[xi] The Senate largely retained the House Budget provisions adding $1 million over the biennium for homeless services case management, $2 million for eviction prevention assistance, and $400,000 in outreach to homeless youth.

The Senate establishes the Lead Paint Hazard Remediation Fund and provides a $3 million appropriation in SFY 2020 to the Fund, which would be used to make loans for single family homes with a child under 6 years old or a pregnant woman where household income is less than the median household income of the area or county, multi-unit residential properties with lower incomes, or child care facilities, which would be permitted to use the loan for remediating lead in water as well.

The Senate also removed the suspension of the congregate housing program, which was included in the House Budget.

Transportation

The Senate Budget would retain most of the House Budget proposals related to transportation funding and policy. The proposal includes about $14.7 million over the biennium appropriated for the Department of Transportation’s fleet equipment replacement program and repairs to other equipment. The proposal would also appropriate $400,000 to assist public transit operators and $345,475 to study statewide snowplow route optimization and manage salt reduction. The proposal would dedicate about $1.4 million to preventative maintenance through bridge painting and installing intelligent transportation system technologies such as traffic cameras, message boards, and weather monitoring systems. The Senate proposal would, as with the House proposal, raise about $16.8 million over the biennium for the Highway Fund by redirecting revenue from permitted plea-by-mail submissions related to motor vehicle fines to the Highway Fund, rather than counting them as agency income for the Department of Safety. Both proposals would increase the fee for Real ID Act compliant license issuance or renewal for most drivers to $60 from $50, and project increased Highway Fund revenue of $955,000 over the biennium from that change.

The Senate voted to retain the House Budget proposal to permit the use of Turnpike toll credits, which are projected future revenues from tolling operations, to complete the project development phase of the New Hampshire Capital Corridor design, environmental review, and financial plan for rail and bus services expansion, including parking facilities. The Senate Budget, as with the House Budget, would permit the State to sell or transfer certain Department of Transportation-owned property in bulk. It would also repeal the Maine-New Hampshire Interstate Bridge Authority, removing a New Hampshire statutory prohibition on tolling the three bridges connecting Portsmouth to Kittery, Maine. In a small change from the House Budget proposal, the Senate Budget would clarify statute shifting responsibility for staffing of Department of Transportation rest areas to the Department of Business and Economic Affairs.

Major New Initiatives

As with both the Governor’s Budget proposal and the House Budget, the Senate proposes major new initiatives in its State Budget proposal. Several of these new initiatives, as with some of the health services investments discussed above, were incorporated from separate Senate bills passed independently. Others, most notably the Family and Medical Leave Insurance provisions, were carried forward from prior versions of the State Budget.

Paid Family and Medical Leave

The Senate voted to retain the House’s Family and Medical Leave Insurance in the State Budget’s Trailer Bill. The Senate did not amend this plan after it crossed over from the House.

The proposed Family and Medical Leave Insurance would provide up to 12 weeks of benefits for an eligible employee who has been enrolled in the program for at least six months and has worked enough to have earned total wages relative to a certain threshold based on the minimum wage within the last year, or four of the last five calendar quarters. Benefits would be 60 percent of the weekly average income collected in the highest income levels from those previous quarters. Benefits would not be permitted to be lower than $125 per week, or to be greater than 85 percent of the average weekly wage in New Hampshire. Family and Medical Leave would be defined as leave from work due to the birth of a child within the past year, placement of a child with the individual for adoption or foster care, a serious health condition of the individual or a family member, or qualifying situations around foreign deployment in the Armed Forces or care for a service member with a serious injury or illness.

Many of the mechanics associated with administering this program would match those in the existing Unemployment Insurance program. Willfully making false statements or failure to report relevant facts to obtain benefits from the Family and Medical Leave Insurance Program would result in being barred from receiving any benefits for 26 weeks. Employees would be required to provide at least 30 days of notice to employers before taking leave for reasonably foreseeable circumstances, and employers covered by the federal Family and Medical Leave Act are required to continue providing health insurance and restore employees to the position held prior to receiving Family and Medical Leave Insurance payments or an equivalent position.

New Hampshire Employment Security would be responsible for administering this program and continuously monitoring program solvency, with the authority to alter benefits and premiums by 10 percent from the amounts set in statute to maintain the solvency of the program as needed.

The plan would require private employers to participate in the program or provide another form of equivalent or higher-level benefit, as certified by the State, to its employees. Insurance payments would be funded by participating employers providing quarterly payments equivalent to 0.5 percent of all wages paid per employee in the preceding quarter. Employers would not be allowed to withhold more than 0.5 percent of wages per week per employee to make these payments, and must supply employees with approved information regarding the program benefits. Estimates for the original House bill, which had the same funding mechanism, suggested that the quarterly payments would total $168.6 million, based on the most recent historical data available, and did not assume any local government employer participation in those calculations. The proposal would appropriate $9.9 million to cover startup costs during the biennium, which the program would be required to refund after it began.

Unrestricted Aid for Local Governments

The Senate Budget proposal would send $40 million, in installments of $20 million by October in each year of the biennium, to cities, towns, and unincorporated places for unrestricted use. The amount of revenue directed to each municipality would be determined in part by the total number of students living in the municipality as a portion of the total State student population, and in part by the number of students found eligible for the Free and Reduced-Price School Lunch Program as a percentage of total eligible students statewide. These two factors are weighted in the distribution formula, with 80 percent of the funds allocated based on the Free and Reduced-Price School Lunch Program resident students, and 20 percent of the funds based on the number of students enrolled. These funds are not distributed on a per student basis and are not identified as education aid, but are an unrestricted appropriation based on the number of resident students.

This is an increase from the $12.5 million proposed by the House, which would have been deployed through the prior revenue-sharing formula. That prior formula is based on the amount of revenue municipal governments received following the separation of education and non-education revenue in 1999, following the creation of the Education Trust Fund and the Adequate Education Grants.

Job Training Program

The Senate Budget alters the Job Training Program in the House Budget, calling it the “Granite State Jobs Act of 2019” and both including and expanding on the provisions forwarded in Senate Bill 2. Among retaining other provisions from the House Budget, it provides that no more than $500,000 from sources other than the WorkReadyNH program can go to support WorkReadyNH, certificate programs or apprenticeships for high school students, marketing of New Hampshire’s workforce development initiatives, or training for individuals not eligible for other state or federal assistance. This cap also applies to new funding for supports such as child care and transportation assistance unavailable from other programs, and recruitment and coordination of services for those who are homeless, are experiencing a substance use disorder, need training to change careers, are older, have disabilities, are transitioning from being incarcerated to the general population, or are legal immigrants or speakers of languages other than English. Some of the specifications included in the House Budget around the eligibility for grants are not included in the Senate Budget.

Powers for the Department of Administrative Services and Other Reorganizations

The Senate Budget retains some of the expanded powers for the Department of Administrative Services (DAS) and reorganizations proposed in the Governor’s budget. The Senate Budget retains the consolidation of certain state agencies and operations into the Department of Military Affairs and Veterans Services, reorganizing and codifying structures within the DAS, increasing flexibility for the Department of Corrections to move funding for personnel between budget lines, and shifting the State Commission for Human Rights under the administration of the Department of Justice. The Senate Budget includes a requirement, originally proposed by the Governor but removed by the House, that the DAS conduct a comprehensive review of the State’s personnel system; the Senate also adds an appropriation of $150,000 for this purpose. Additionally, the DAS would receive $1.3 million for scheduling software.

The Senate Budget retains the Governor’s proposal expanding the authority of the DAS over other personnel in other agencies. In an effort to effectuate consolidation or deconsolidation of human resources, payroll, and business processing functions within State government, the DAS would have the authority, with the approval of the Joint Legislative Fiscal Committee and the Governor and Executive Council, to make transfers of funds for operational purposes to the DAS from any other agency to effectuate consolidation or deconsolidation of human resources, payroll, and business processing functions within State government. The DAS may also, with approval from the Governor and the Executive Council, eliminate unnecessary positions or transfer any positions within or between the DAS or any other agency “if the commissioner of administrative services concludes that such transfers or eliminations are necessary to effectuate the efficient consolidation or deconsolidation of human resources, payroll, or business processing functions within state government.” Additionally, the DAS may establish a total number of personnel required for human resources, payroll, and business processing functions within the Executive Branch of State government.

The Senate retained the Governor’s proposal to provide the DAS with the authority to not comply with the requirements under a 2016 Executive Order related to the identification and implementation of energy efficiency projects and the monitoring of energy and water use, use of fossil fuels, and greenhouse gas emissions during the biennium. Other State agencies would also be required to annually pay the DAS 75 cents per square foot of space they occupy in DAS-maintained and serviced buildings, a figure the Senate increased from 50 cents as proposed by the Governor and retained by the House, and the DAS would not have to comply with certain Legislative Budget Assistant audit recommendations.

Other Policy Changes

The Senate Budget would make numerous other appropriations and policy changes that were not proposed in, or were altered from, the Governor’s and House Budget proposals, including provisions that would:

- add a new detective position, funding for anticipated State Police overtime, and additional appropriations for part-time auxiliary State Troopers;

- provide $300,000 per year for juvenile diversion programs and $450,000 per year for funding existing supervised visitation centers;

- provide a reallocation or pay raise for State Police Troopers with a $2.1 million appropriation;

- suspend the requirement that the State must reimburse a city or town for providing certain welfare services to an individual;

- extend funding for public water and wastewater infrastructure projects to those substantially completed by December 2019, whereas the House Budget extended those projects only through the end of December 2018, with the Senate Budget totaling approximately $3.7 million in additional aid to these projects over the Governor’s Budget proposal SFY 2020 and $3.8 million in SFY 2021;

- reduce marketing funding for the Tourism Development Fund by $1.5 million relative to the House Budget;

- reduce funding to address invasive aquatic species by $1.5 million relative to the House Budget;

- increase funding for the Land and Community Heritage Investment Program by $3.0 million over the course of the biennium following an increase in the fee for each deed, mortgage, mortgage discharge, or plan at the county level from $25 to $35;

- establish a fund at the Department of Agriculture, Markets, and Food that would assist municipalities with the cost of caring for animals pending the resolution of any legal action related to animal cruelty;

- alter the right-to-know statute, including establishing the office of the right-to-know ombudsman; and

- remove language restricting the use of funding by the Public Utilities Commission to implement an energy efficiency resource standard and requires that no less than 20 percent of the portion of funds used for low income energy efficiency programs.

Revenue Policy Changes

The Senate proposed several changes to revenue policy, including carrying forward or slightly modifying several key proposals from both the Governor’s Budget and the House Budget.[xii]

The Senate incorporated revenue projections for the biennium that increased expected General and Education Trust Funds collections to $75.0 million more than the Governor’s forecast and $148.0 million more than the House forecast for SFYs 2019, 2020, and 2021 combined under current policy. The House and Governor’s office have since updated their revenue estimates, but were working with less revenue when they crafted their budgets.[xiii]

The Senate modified the Tobacco Tax expansions to include electronic cigarettes included in the Governor’s and House Budget proposals. The Senate proposal would tax nicotine substances that are closed cartridges or containers of liquid at $0.30 per milliliter or, for containers of liquid that are intended to be opened, at 8 percent of the wholesale price. The language in the Senate’s proposal includes language that makes the changes contingent on the passage of House Bill 595.

In a major change from the House version of the State Budget, the Senate removed the expansion of the Interest and Dividends Tax to include capital gains that was proposed by the House. The Senate also does not incorporate revenue from the legalization and taxation of cannabis in its State Budget calculations.

Business Tax Rates

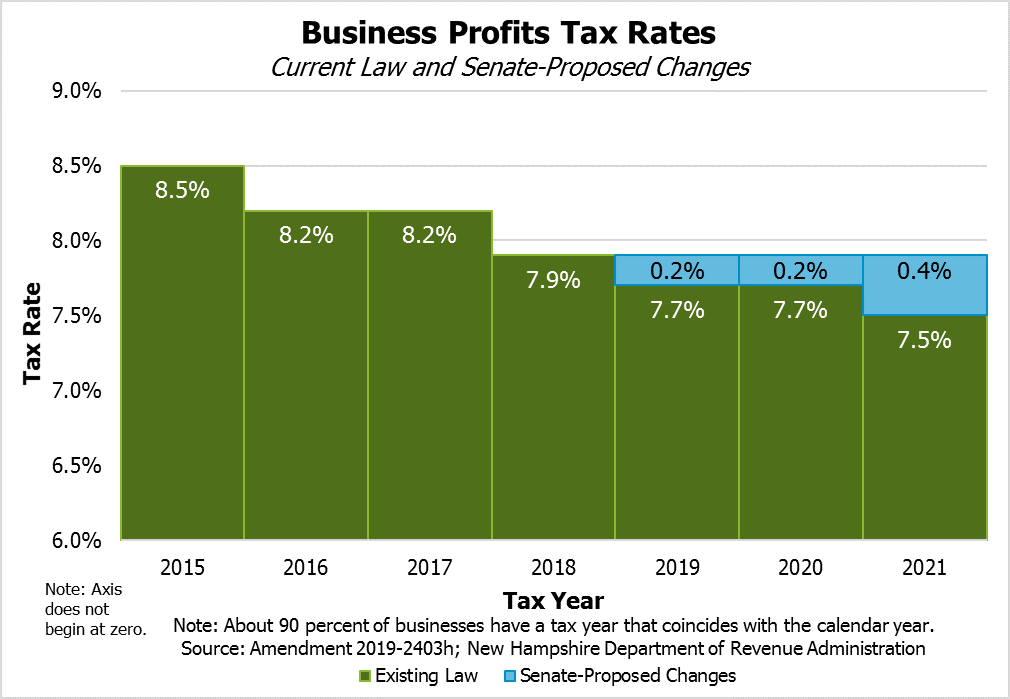

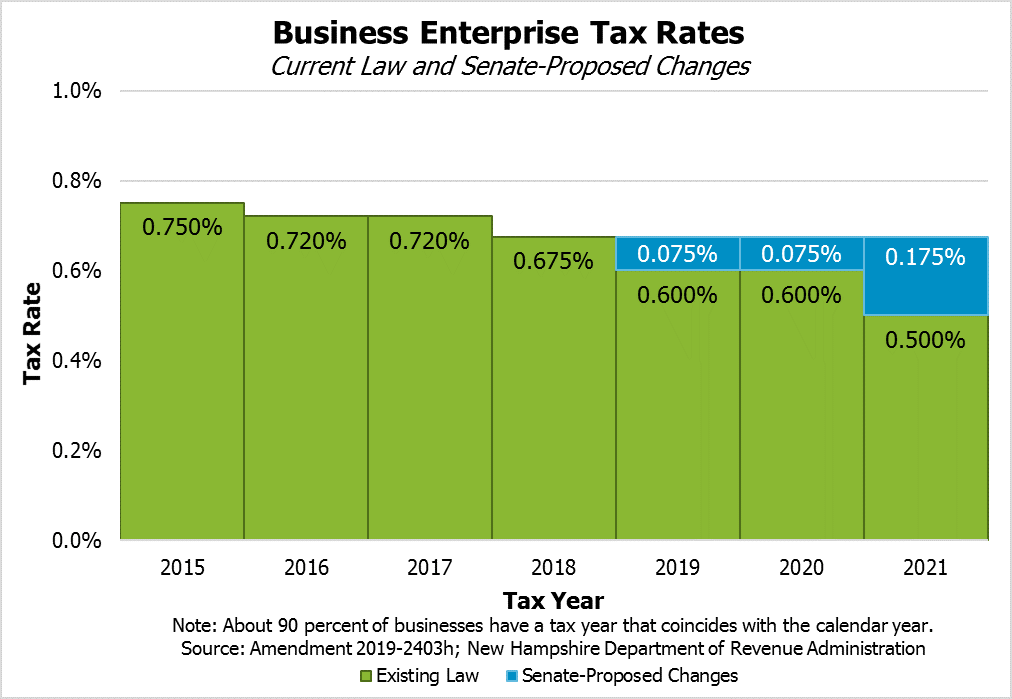

The Senate retained the changes proposed by the House to the statutes for present and future business tax rates. The changes to the State’s two primary business taxes, the Business Profits Tax and the Business Enterprise Tax, would generate $93.1 million additional dollars for State services during the biennium.

The Business Profits Tax is undergoing a series of rate reductions under current law, from a rate of 8.5 percent for 2015 to 7.5 percent for 2021. The Business Enterprise Tax is also undergoing rate reductions on the same schedule, falling about 33 percent from a rate of 0.75 percent in 2015 to 0.50 percent in 2021. Although often cited for spurring economic growth and leading to increased revenues, the several business tax rate reductions that have taken affect in New Hampshire in recent years do not appear to be responsible for the recent revenue increases, and policymakers should not expect to generate additional revenue through tax rate reductions.[xiv]

The House and the Senate both proposed holding the Business Profits Tax and Business Enterprise Tax rates at 2018 levels, which are 7.9 percent and 0.675 percent, respectively. Some businesses have likely already paid quarterly estimates under the lower 2019 rates under current law, but final tax liabilities for 2019 will be paid in March or April of 2020.

Additionally, the Senate Budget retained the House proposal to extend the Coos County Job Creation Tax Credit against the Business Enterprise Tax until 2027. The Senate also added a new, multi-state auditor that would be expected to bring in more revenue during the next biennium.

Federal Business Tax Conformity

In a change from the House, the Senate proposed updating references to the federal tax code in New Hampshire law to conform with the federal law changes following the Tax Cuts and Jobs Act, passed by Congress in December 2017. New Hampshire’s Business Profits Tax uses part of the federal corporate income tax base as a basis for State business tax liability calculations, and currently that law conforms to the December 31, 2016 federal tax code. Following the December 2017 federal tax overhaul, several base-broadening provisions have the potential to simplify business tax filings and bring in more revenue for the State. The Senate voted to adopt all these changes with the exception of the Global Intangible Low-Taxed Income provisions, over concerns related to double-taxation.[xv] The Senate voted to remain decoupled from the Internal Revenue Code 179 deduction for business capital purchase expenses as well as bonus depreciation deductions and deductions for certain domestic production activities.[xvi] The Senate estimated conforming to the new federal tax code would result in an additional $40 million during the biennium.

Business Tax Apportionment

Business tax liability for New Hampshire for a business that operates in many different states is calculated through a process called apportionment. Apportionment for the Business Profits Tax is currently determined based on a combination of the fraction of a business’s property, payroll, and sales that are in New Hampshire. Sales of services are determined by where the majority of the cost of performance of that sale is incurred. The Senate voted to shift the State’s apportionment formula to market-based sourcing for the accounting of service sales, which would account for the fraction of the market that New Hampshire service sales compose of a business’s sales, rather than where the cost of that performance in most incurred. This change would take effect in 2021, during the biennium, and generate an estimated $10 million in SFY 2021, according to the Senate’s plan.

The Senate also voted to remove the property and payroll portions of the apportionment formula, moving to “single sales factor” as the only determinate for the fraction of a business’s tax liability that is owed to the State of New Hampshire. The Senate did not schedule this change to occur until 2022, so any revenue impacts would be projected for the next biennium.[xvii]

Communications Services Tax Base Adjustments

Following a long decline in this existing revenue source, the Senate added specific provisions to the Communication Services Tax to broaden the tax base. The Senate voted to remove a provision that excluded basic communications services and specifically added prepaid wireless telecommunications services and voice over internet protocol. Prepaid wireless telecommunication services, such as phone cards, would be taxed at the point of transaction or from the seller if the delivery is to a customer in New Hampshire. Voice over internet protocol services would be taxed if they permit a user to receive calls from, or send calls into, the public switched telephone network. The Senate projected this base-broadening to add $4 million in General Fund revenue during the biennium.

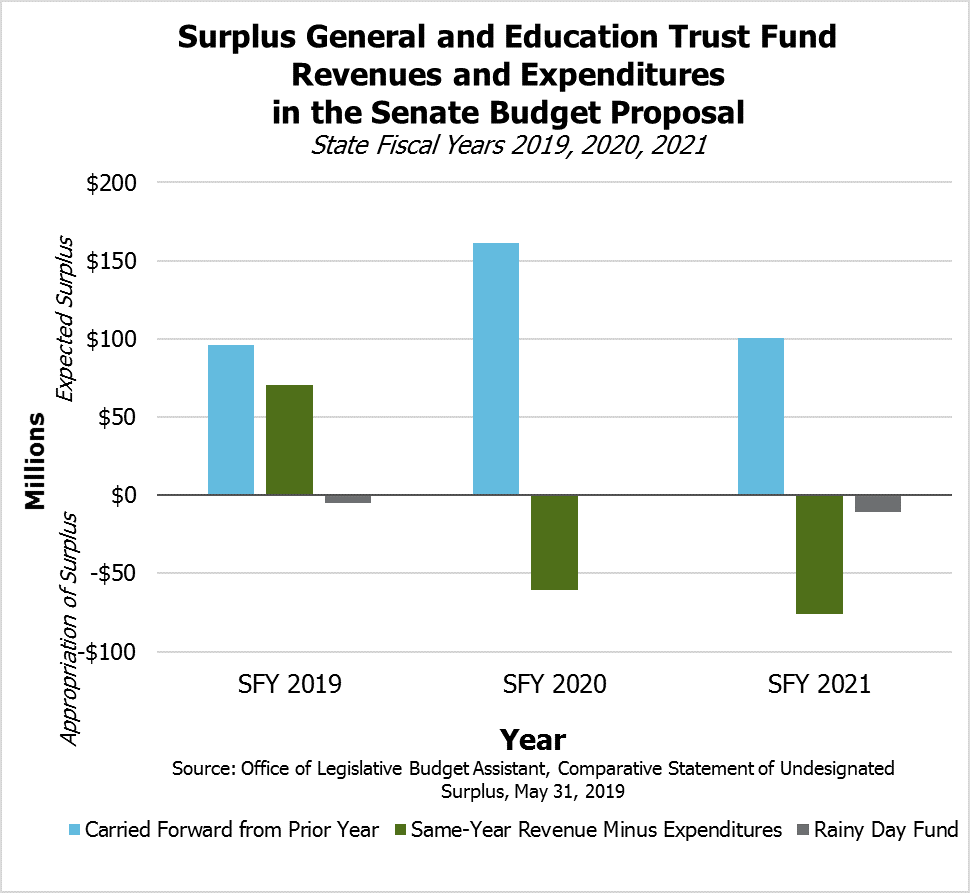

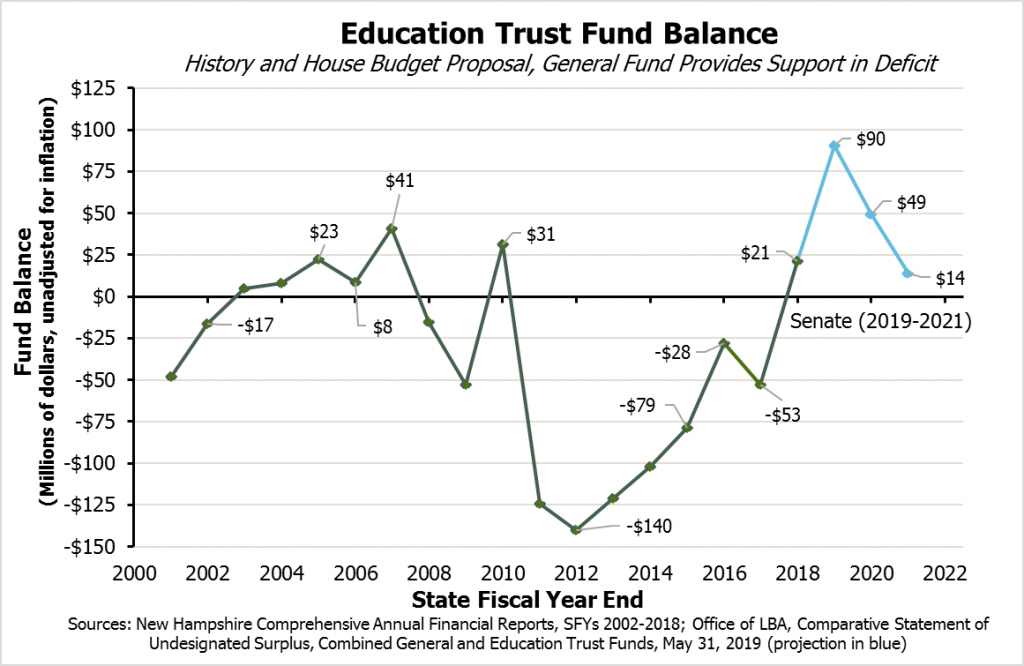

The Surplus and Savings Funds

As with the House Budget, the Senate Budget would retain the Education Trust Fund and deposit revenue into the Rainy Day Fund both at the beginning and the end of the biennium.[xviii] Both versions of the State Budget have a positive balance at the end of the biennium, but both State Budgets also rely on surplus revenues carried forward to remain in balance, as the plans would spend more than they collect in revenue during the biennium. The Senate Budget is projected to end the biennium with approximately $125.7 million in the Rainy Day Fund and $13.6 million in the Education Trust Fund. Additional revenues may be needed to support future services if same-year revenues and expenditures do not come into balance in this proposed budget or in future budgets, as one-time tax receipts supporting the current revenue surplus are not expected to be repeated.

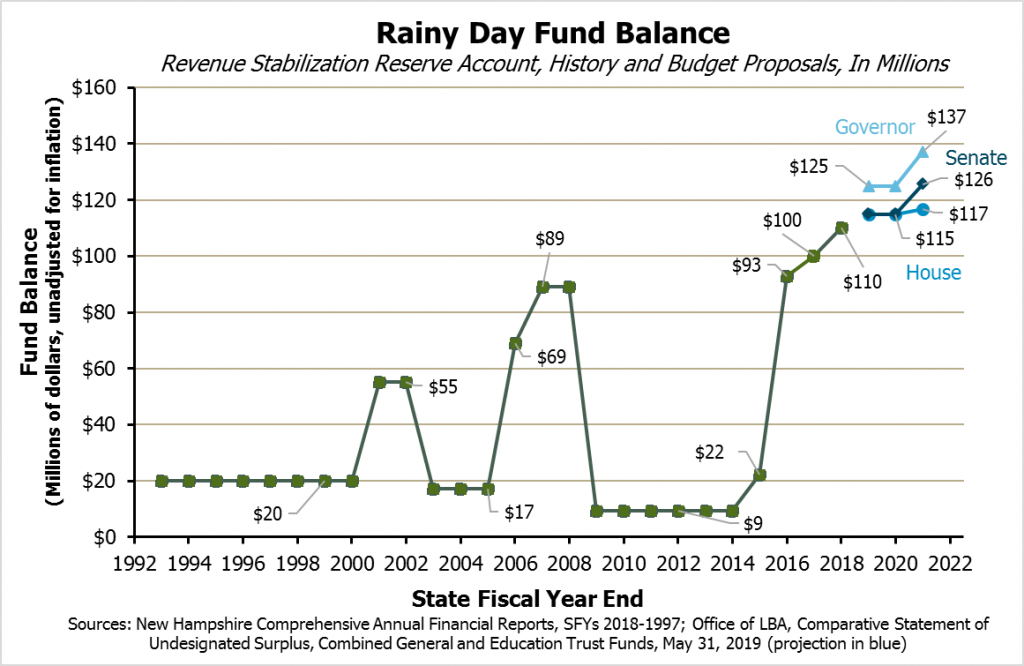

The Rainy Day Fund

The Senate Budget would add $5 million to the Rainy Day Fund from the SFY 2019 surplus. This contribution would bring the total to $115 million for the start of the biennium. The Senate anticipates adding $10.7 million to the Rainy Day Fund at the end of the biennium. The House would add $5 million at the beginning of the biennium and about $1.7 million at the end of the biennium, while the Governor’s Budget anticipated adding $15 million in SFY 2019 and $12.3 million in SFY 2021.

The Sunny Day Fund

The Senate Budget would newly establish a Sunny Day Fund. This nonlapsing fund would be used by the Department of Business and Economic Affairs for the purpose of obtaining public or private grant funding that would increase competitiveness and attract talent to New Hampshire and target existing and potential growth areas. The Sunny Day Fund’s investments would be targeted at supporting research and development as well as business development and expansion, and evaluated through a survey. The Senate appropriated $3 million to this fund.

The Education Trust Fund

The Governor proposed eliminating the Education Trust Fund while diverting funding sources to the General Fund and the Sweepstakes Fund. Both the House and the Senate retained the Education Trust Fund in their versions of the State Budget.

The Education Trust Fund is required to retain any surplus it carries forward, rather than allowing it to lapse to the General Fund. In most years, the Education Trust Fund runs a deficit and must be supported by a transfer from the General Fund, but surplus revenue resulting in part from one-time effects following the federal Tax Cuts and Jobs Act have pushed the Education Trust Fund into surplus, which it retains absent other changes in law.[xix]

The Senate plan projects that the Education Trust Fund will retain a surplus throughout the biennium, despite the increased expenditures on Adequate Education Aid. The Senate Budget also proposes shifting the source of funds for school building aid, tuition and transportation aid, and special education aid to the Education Trust Fund temporarily, for the biennium, while the House proposed shifting the sourcing for those expenditures permanently to the Education Trust Fund.

Concluding Discussions

The Senate Budget would appropriate significant new resources to health and social services and would send aid to municipalities with a mix of ongoing and temporary assistance. The Senate’s key investments in the state’s health care infrastructure and services, most notably through Medicaid reimbursement rate increases to all providers and by adding facilities to help those facing mental illness, would likely help alleviate challenges to effective service delivery. The Senate’s proposed ongoing funding commitment to affordable housing, as well as the retention of most of the housing-related services proposed in the House Budget, would likely help alleviate a key cost for families and a constraint on workforce growth. Establishing paid family and medical leave insurance would also provide added certainty for those with limited means, who may be less able to absorb the negative financial and other life impacts of an illness or misfortune for a family member. The Senate’s efforts to bolster the Temporary Assistance for Needy Families reserve, which has been significantly diminished and is best kept at a healthy balance to be able to respond to economic downturns or other unexpected needs, also help support services for Granite Staters in the long term.

The Senate’s proposed commitments to local governments are more robust than in the Governor’s Budget proposal, but appear to be more temporary than the House version. The Senate’s proposed investments in funding for local public education are significant, particularly the establishment of aid based on disparities in property tax base values per student, but much of the aid is funneled through fully funding stabilization grants; these grants are based on historical funding changes and are not necessarily responsive to changes in community needs. The Senate voted to send additional unrestricted aid to municipalities using an updated formula. This aid would be distributed in a one-time fashion; as the Senate Budget relies on surplus funds likely stemming from one-time revenues collected this year, such one-time appropriations are warranted. But significant steps to provide more aid to local governments in an ongoing manner would likely reduce upward pressure on local property taxes.

The Senate Budget, with several attached policy proposals, takes steps to address long-term challenges facing Granite Staters. No two-year budget can solve every longstanding concern around supporting needed services, but the Senate Budget makes key steps toward supporting New Hampshire residents in need and establishing frameworks for future investments.

Next Steps

As the State Budget process enters the last remaining weeks of the existing State Budget, the Senate and the House will meet in a Committee of Conference to produce a compromise document between their two versions. The House has already voted to not concur with the Senate changes, meaning a Committee of Conference comprised of House and Senate members will need to complete their agreed-upon changes to the State Budget by June 20. The full House and Senate must act on the State Budget by June 27 and agree on the final version to be sent to the Governor. The current State Budget expires after June 30, 2019, and a new plan to fund State services must be in place before July 1.[xx]

With the economy performing well overall and current revenues less constrained than in prior budget cycles, policymakers are exploring opportunities in the next budget to help sustain a vibrant economy and invest in Granite Staters. The State Budget is a statement of New Hampshire’s priorities, and with funds available now to make long-term investments that will pay dividends in the future, policymakers should wisely deploy public resources to help ensure widespread prosperity for all New Hampshire residents.

Endnotes

[i] Source materials related to the Governor’s State Budget proposal, the House Budget, and the Senate Budget are available on the Office of Legislative Budget Assistant’s web page for the SFYs 2020-2021 budget process. These source materials are used throughout this Issue Brief.

[ii] For more information on how the State Budget is organized and for discussions on the correct metrics for comparisons of the sizes of State Budgets, see NHFPI’s Issue Brief Measuring the Size of New Hampshire’s State Budget, published September 11, 2017. For more on comparisons between State Budgets and measuring baselines, see NHFPI’s February 28, 2017 Issue Brief, Governor Sununu’s Proposed Budget, specifically the section titled “A Technical Note on Comparing Budgets.” For an explanation of the New Hampshire State Budget process, see NHFPI’s Building the Budget resource. For more information on the currently operating State Budget, see NHFPI’s Issue Brief The State Budget for Fiscal Years 2018 and 2019, published July 13, 2017. For more information on the Governor’s State Budget proposal, see NHFPI’s Issue Brief The Governor’s Budget Proposal, State Fiscal Years 2020-2021, published March 29, 2019. For more information on the House Budget, see NHFPI’s Issue Brief The House State Budget for State Fiscal Years 2020 and 2021, published April 25, 2019.

[iii] To learn more about the Efficiency Budget process and State agency requests, see NHFPI’s November 18, 2016 Common Cents post New Process Will Guide Formation of Next State Budget.

[iv] For more information on New Hampshire’s expanded Medicaid program, also known as the New Hampshire Granite Advantage Health Care Program, see NHFPI’s March 2018 Issue Brief Medicaid Expansion in New Hampshire and the State Senate’s Proposed Changes and NHFPI’s May 10, 2018 Common Cents post Senate Approves Medicaid Expansion Bill as Amended by the House.

[v] Data provided by the New Hampshire Department of Health and Human Services on August 21, 2018.

[vi] For more information on the cliff effect, see the New Hampshire Department of Health and Human Services, Helping Business Thrive and Families Prosper, April 26, 2019.

[vii] Information provided by the Office of Legislative Budget Assistant, including in the document “TANF Information, DHHS 3/22/2019.”

[viii] For comparisons and notes from Senate deliberations, see the Senate Finance Committee Budget Decision Sheet – DHHS Division of Economic and Housing Stability, page 48, May 28, 2019.

[ix] For more on kindergarten funding in New Hampshire, see NHFPI’s November 8, 2017 Common Cents post Elections Highlight Continuing Questions About Keno Revenue.

[x] For more on the Affordable Housing Fund, see the New Hampshire Housing Finance Authority Financing Programs web page.

[xi] This reduction was designed to reflect the amounts approved and tabled by the Senate earlier for these purposes in Senate Bill 84.

[xii] To learn more about the State’s revenue sources, see NHFPI’s Revenue in Review resource.

[xiii] For more information on revenue projections from this legislative session, see NHFPI’s May 2019 Issue Brief Funding the State Budget: Recent Trends in Business Taxes and Other Revenue Sources.

[xiv] For more information on the causal factors for business tax receipt fluctuations, see NHFPI’s May 2019 Issue Brief Funding the State Budget: Recent Trends in Business Taxes and Other Revenue Sources.

[xv] For more on Global Intangible Low-Taxed Income, see the Federal Register, Guidance Related to Section 951A.

[xvi] For more on New Hampshire business taxes and the federal tax overhaul, see the resources accessible through the New Hampshire Department of Revenue Administration’s Federal Tax Reform web page.

[xvii] For more information about market based sourcing and single sales factor, see Kerrin A. Rounds and Melissa Rollins, Market Based Sourcing and Single Sales Factor Analysis, New Hampshire Department of Revenue Administration, June 19, 2017.

[xviii] The Rainy Day Fund is formally known as the Revenue Stabilization Reserve Account and is part of the General Fund. For more on the Revenue Stabilization Reserve Account, see NHFPI’s December 28, 2016 Common Cents post Sun Shining on the Rainy Day Fund.

[xix] For the requirement that the Education Trust Fund be non-lapsing, see RSA 198:39. To see a recent history of Education Trust Fund deficits, see the Department of Administrative Services, New Hampshire Comprehensive Annual Financial Report for the Fiscal Year Ended June 30, 2018, page 150. For more information on surplus revenues from the federal Tax Cuts and Jobs Act, see NHFPI’s May 2019 Issue Brief Funding the State Budget: Recent Trends in Business Taxes and Other Revenue Sources.

[xx] See the Senate calendar for information about upcoming legislative deadlines.