The National Association of State Budget Officers published a survey of state fiscal situations this month, devoting particular attention to the money states keep in budget stabilization reserves, or “rainy day funds.” These funds allow states to stabilize their budgets in response to unexpected expenditures, or drops in revenue, and to preserve or improve state bond ratings. Better bond ratings permit states to borrow money at lower interest rates, reducing the costs of capital projects. The survey found that state rainy day funds, in aggregate, had climbed from a Recession low of 2.0 percent of general fund expenditures in fiscal years 2010 and 2011 up to 5.2 percent and 5.1 percent in fiscal years 2015 and 2016, respectively. This increase indicates not only a recovery in the health of these funds, but also a higher balance relative to general fund expenditures than the pre-Recession peak in fiscal year 2008.

New Hampshire’s relevant fund ended State fiscal year (SFY) 2015 with the equivalent measure of 1.6 percent ($22.3 million), below the national average, and will likely end SFY 2016 with 6.6 percent (approximately $93 million), improving to above the national average. New Hampshire’s Revenue Stabilization Reserve Account, also known locally as the “rainy day fund,” was created in 1986. Money deposited in the rainy day fund cannot be used to for any purpose other than to, at the end of a budget biennium, balance a State General Fund operating budget deficit when it is accompanied by a shortfall in general fund revenues relative to projections. The rainy day fund may be used to fill the smaller of either the budget deficit or the revenue shortfall. All other uses of money in the fund must be approved by a two-thirds supermajority of the House and the Senate and have the governor’s approval.

Statute requires that at the close of each biennium, and after the State’s Comprehensive Annual Financial Report (CAFR) is completed, any surplus must be deposited into the rainy day fund. Once the fund reaches 10 percent of unrestricted General Fund revenues from the previous State fiscal year (SFY), any additional surplus is unrestricted General Fund surplus. After a law change in 2014, the rainy day fund also receives the first 10 percent of any judgement or settlement money from lawsuits yielding more than $1,000,000 for the State Department of Justice. Additionally, in 2016 the Legislature removed the cap on the sum that could be deposited into the fund within a single year. However, the Legislature has frequently prescribed specific amounts to be deposited in the rainy day fund, or withheld from the fund, at the end of recent biennia. As such, the rainy day fund has swung from flush, to nearly depleted, and back to a substantial portion of capacity since budgets prior to the Recession, fulfilling its intended purpose while also being affected by the biennial funding decisions of the Legislature.

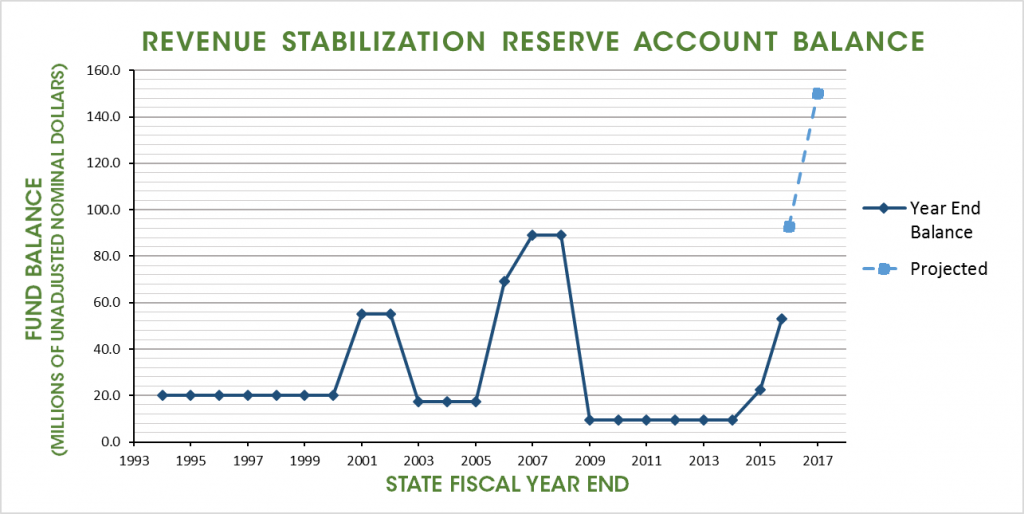

The graph shows the rainy day fund’s balance in contemporary budget dollars, which are unadjusted for inflation; in other words, the graph does not show that the value of each dollar has eroded significantly in real terms and as a percent of the budget over time. The stretches of consistent levels generally show the Legislature intervening to divert surplus dollars elsewhere. The drop from SFYs 2008 to 2009 indicates the use of the rainy day fund during and after the Recession, when revenues declined substantially. At the end of SFYs 2009 through 2014, the rainy day fund remained at just over $9.3 million (0.7 percent of budgeted SFY 2014 General Fund expenditures), down from $89.0 million (5.7 percent of budgeted SFY 2008 General Fund expenditures) at year end for SFYs 2007 and 2008.

The recent trend, shown in both the actual balances and the projections, indicates the rainy day fund is not only substantially replenished from its post-Recession low, but it may reach its 10 percent limit after SFY 2017. Recent estimates from the Governor’s office and the State Treasury indicate the limit may be between $140 million and $160 million for SFY 2017; the final number will not be determined until the CAFR is released in January 2017. As for the existing surplus, SFY 2016 resulted an unaudited surplus of $130.2 million, and $40 million of that is slated to go into the rainy day fund. For SFY 2017, revenues were $23.2 million above plan as of November, with high business tax refunds suppressing the total but business tax revenue overall still stronger than anticipated in the current operating budget.

If these projections hold and expenditures are near to the budget plan, the Revenue Stabilization Reserve Account will have risen from $9.3 million, an amount the SFY 2014 CAFR’s authors called “significantly less than ideal” to “absorb any unpredicted financial challenges,” to completely full in the span of the three years from SFYs 2014 to 2017. However, we will not know for certain if the rainy day fund is full to capacity until the SFY 2017 CAFR is completed, and economic conditions, policy changes, or both could intervene and quickly change the current projections.