The budget proposal presented by Governor Sununu shows a pattern of targeted investments in specific areas, rather than a marginal increase to many areas, and a bevy of proposed policy changes. The entire proposed budget grows by 4.5 percent between the current year and the Governor’s first proposed year while 39.4 percent of program areas would be flat-funded or experience declining appropriations. Several new policy initiatives would provide the framework for both spending in this proposed budget and discussions of future biennial budget proposals.

Governor Sununu’s budget proposal to the Legislature was introduced in two parts. The proposed line-item appropriations for State fiscal years (SFY) 2018 and 2019 were presented on February 9, to coincide with the Governor’s budget address; this document, called House Bill 1, provided detailed appropriations proposals for the $12.185 billion budget. On February 21, the second part of the Governor’s budget proposal, called House Bill 2, was made public; it includes policy language enabling certain proposed House Bill 1 appropriations, recommended law fixes from State agencies, and new programs proposed by the Governor.[1]

This Issue Brief reviews Governor Sununu’s proposed SFYs 2018-2019 operating budget as presented in House Bills 1 and 2. For more information on the budget process itself, key budget terms, and recent funding trends, please see NHFPI’s Building the Budget resource available at nhfpi.org.

The Big Picture

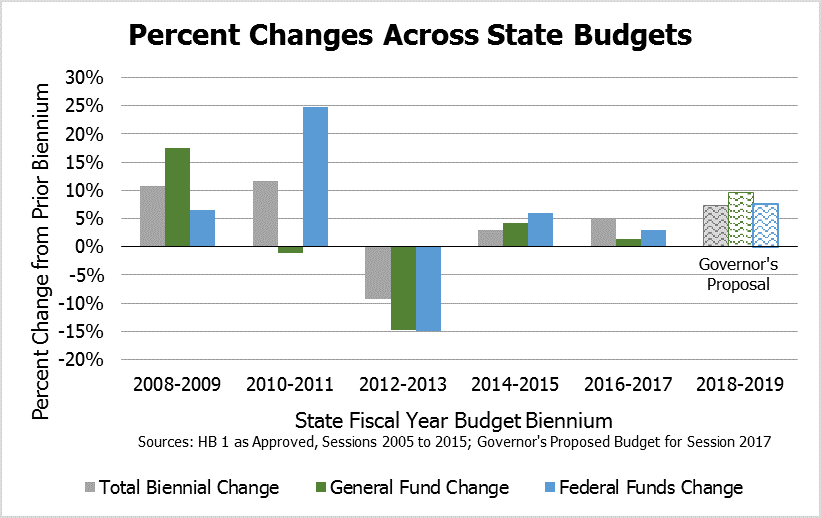

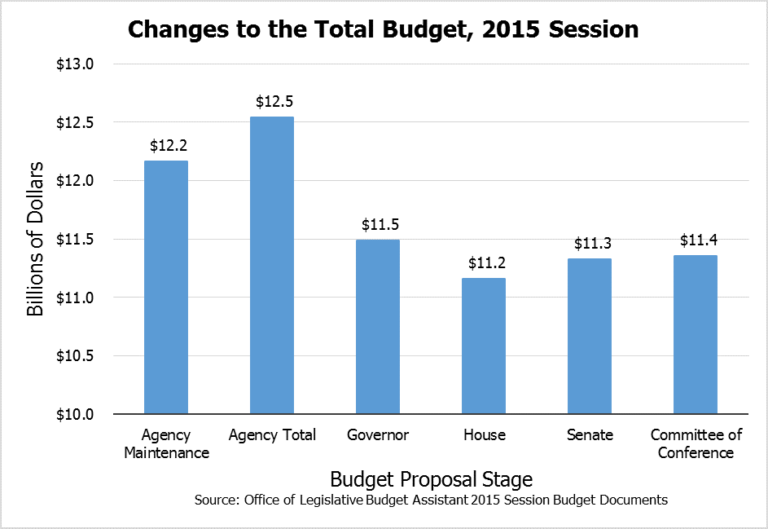

Governor Sununu’s operating budget proposes growing overall spending by 7.3 percent above the current (SFYs 2016-2017) biennium’s originally authorized budget. Should the Governor’s budget be enacted unchanged, this growth would be higher than the 5.1 percent growth of this biennium’s budget over its SFYs 2014-2015 predecessor, or the 3.0 percent growth of that final budget over the SFYs 2012-2013 budget. The General Fund, which is unrestricted revenue and does not include dedicated funds, would grow by 9.8 percent, or $278.5 million over its predecessor in the Governor’s proposal. This growth rate would be the highest in appropriated General Fund spending between budgets since the SFYs 2008-2009 budget, but SFY 2018’s General Fund would remain a lower total number of dollars, unadjusted for inflation, than General Fund appropriations for SFYs 2008 through 2011. Governor Sununu’s budget shows increasing reliance on anticipated Federal Funds as well, which grow faster (7.6 percent) over the current operating budget’s appropriations than the proposed budget as a whole.[2]

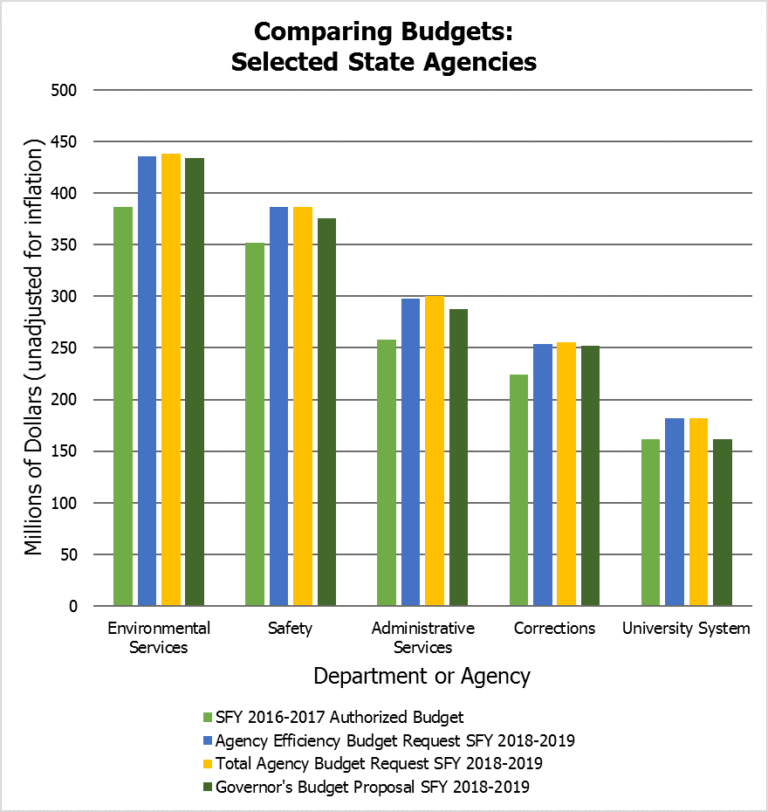

State government expenditures are organized into six broad Categories describing appropriations to similarly-purposed agencies. Growth rates in the Governor’s budget proposal relative to the current operating budget differed among these Categories, reflecting both ongoing trends and deliberate policy decisions.[3] The Categories proposed to grow at rates greater than the budget as a whole are Administration of Justice and Public Protection (12.2 percent), Resource Protection and Development (11.7 percent), General Government (9.9 percent) and Health and Social Services (9.2 percent). Transportation (5.2 percent) and Education (1.4 percent) grow less than overall budget growth (7.3 percent) in this proposal.

The Governor’s Decisions on Agency Budget Requests

The State agency budget requests, as finalized by the agencies in October of 2016, listed both an Efficiency Budget request, capped by expected revenues and targets set by outgoing Governor Hassan, and an Additional Prioritized Needs request, which included other items of particular interest to State agencies that did not fall under the Efficiency Budget cap. Governor Sununu’s $12.185 billion proposal is $115.6 million short of the total Efficiency Budget request and $461.2 million below the total request including Additional Prioritized Needs. These reductions are not spread evenly, however; Governor Sununu made decisions to target resources in certain areas and used a lower overall revenue total than the cap set by then-Governor Hassan.

A Technical Note on Comparing Budgets

Various baselines can be used to measure the resource allocation decisions made in the Governor’s budget request. Using the actual amount spent in each line item in SFY 2016, the amount authorized in the original SFY 2016-2017 budget, the adjusted authorized SFY 2017 amount accounting for subsequent changes to appropriations made during the biennium, or the Efficiency Budget or Additional Prioritized Need requests for SFY 2018 may all yield different evaluations of the budget proposal, and no one method is necessarily more correct than the others. For example, the Department of Health and Human Services (DHHS) was authorized to spend $4.450 billion in the SFY 2016-2017 budget, had an Efficiency Budget request of $4.897 billion and a total request (including Additional Prioritized Needs) of $4.985 billion for the SFYs 2018-2019 budget, and is appropriated $4.861 billion in the Governor’s proposal. Measuring the Governor’s proposal against these different benchmarks in isolation would yield different conclusions as to the Governor’s prioritization of the DHHS budget.

Comparisons made in this analysis, between the SFY 2018 Efficiency Budget request and the Governor’s proposed budget for SFY 2018 unless otherwise noted, do not necessarily represent cuts or increases relative to current appropriations or expenditures. However, these comparisons do indicate instances where Governor Sununu selected different priorities relative to the State agencies and, to a certain extent, former Governor Hassan. Efficiency Budget requests also account for planned changes, reorganizations, or new programs at agencies that may be tied to federal policy or other requirements; these changes do not appear as wild swings in funding between the SFY 2018 Efficiency Budget request and the Governor’s proposed budget, while they could when comparing SFY 2017’s approved budget to any budget proposals for SFY 2018.

For additional information comparing select SFY 2017 adjusted authorized appropriations to those in Governor Sununu’s proposed budget, see The Governor’s Proposed Budget – Summary Fact Sheet and other resources at nhfpi.org.[4]

Targeted Investments

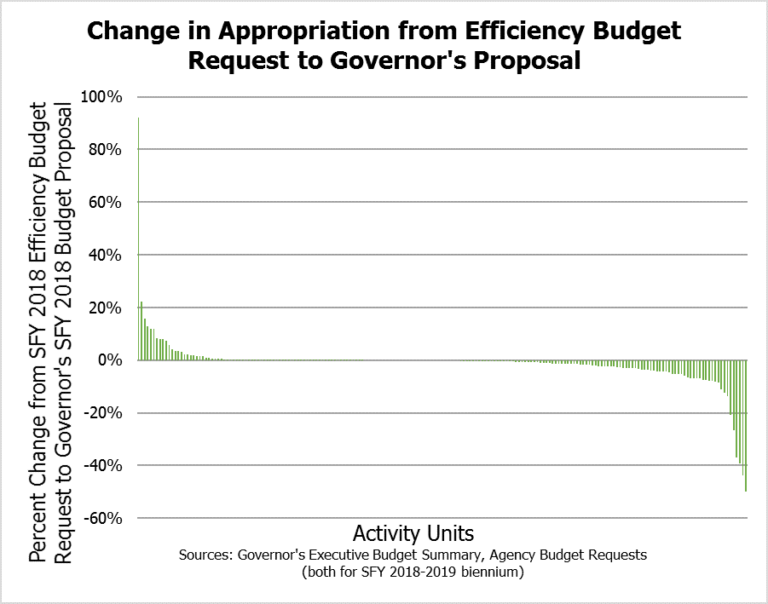

When presenting his budget, Governor Sununu noted he targeted specific priorities for funding within a frugal budget. When examined by Activity Unit, which offers a greater level of granularity within State agencies, this targeting in the proposal is apparent.[5] Although the entire budget increases a proposed $264.7 million (4.5 percent) between the authorized adjusted amount for SFY 2017 and the SFY 2018 proposal, 64 of the 208 Activity Units (30.8 percent) decline in appropriations between the two SFYs, and another 18 (8.7 percent) have no dollar change. Of the Activity Units with increases between SFY 2017 and the Governor’s proposed SFY 2018 budget, 37 (17.8 percent of the total) have increases less than the average of approximately 4.5 percent. Nine of these Activity Units shifted with the proposed creation of new departments and the decommissioning of certain Activity Units, so they do not appear in the agency budget request but are matched with SFY 2017 Activity Units in the Governor’s budget.

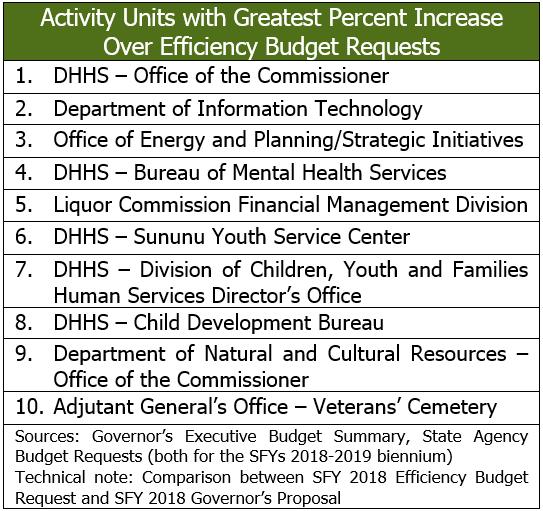

Comparing the Governor’s proposed budget for SFY 2018 to the State agency Efficiency Budget requests for the same year, the pattern is similar. Of the 199 Activity Units with matching request and proposed identifiers, 94 (47.2 percent) are appropriated less than the Efficiency Budget request, 31 (15.6 percent) were allocated exactly the request amount, and of the 74 (37.2 percent) Activity Units that received more than the Efficiency Budget request, 57 (28.6 percent) had increases of less than two percent over the request. Overall, this comparison shows Governor Sununu targeted increases in a few areas, while 62.8 percent of comparable Activity Units are allocated exactly the Efficiency Budget request or less, and 39.4 percent of comparable Activity Units are allocated exactly their SFY 2017 authorized adjusted appropriations or less.

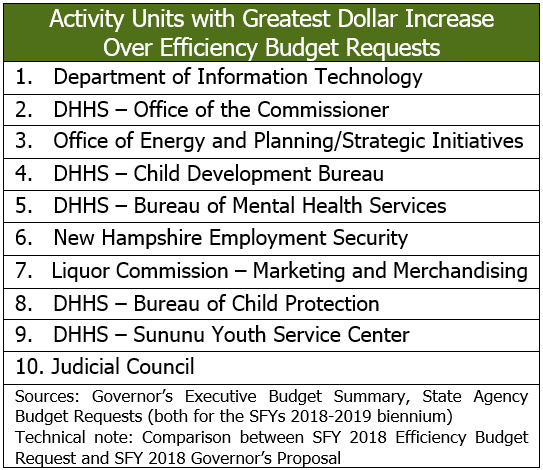

Activity Units with Large Increases

Examining the largest percentage and dollar changes across Activity Units in the Governor’s proposed budget relative to the Efficiency Budget requests reflects both the Governor’s stated priorities and ongoing policy shifts. The largest increase, an additional $10.0 million annually to the DHHS Office of the Commissioner, is budgeted for Medical payments to providers as part of the Governor’s proposed initiative for Provider Workforce Development and Nursing Salary Enhancements. The Department of Information Technology, under the Governor’s proposal, consolidates data management, cybersecurity, and other services and support currently housed at the DHHS, boosting the former agency’s budget by nearly $19.1 million above its Efficiency Budget request. Governor Sununu proposes to rename the Office of Energy and Planning, housed in the Governor’s office, to be the Office of Strategic Initiatives and include the proposed Governor’s Scholarship Program funded with $5.0 million each year of the biennium. The DHHS’s Bureau of Mental Health Services received a boost in funding to contract for Community Mental Health program services, and the Child Development Bureau received funding increases for employment-related child care services and contracts for quality assurance services. New offices are proposed to be changed or established under the DHHS Division of Children, Youth, and Families and the proposed Department of Natural and Cultural Resources.

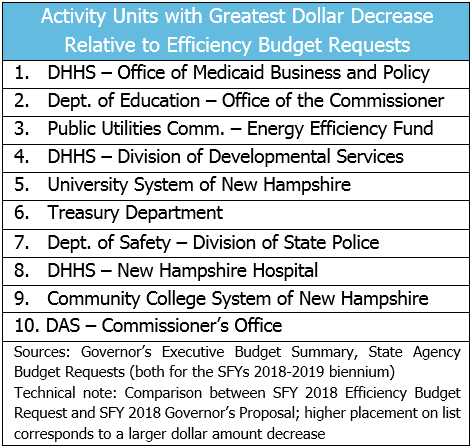

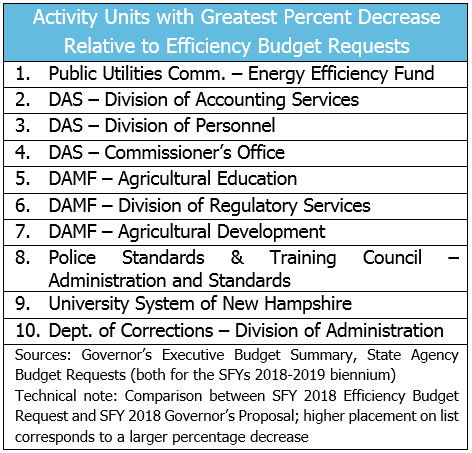

Activity Units with Large Decreases

Certain agencies were allocated significantly less in the Governor’s proposed budget, either in total dollar terms or in percentage terms, than their Efficiency Budget requests. The Public Utilities Commission’s Energy Efficiency Fund is funded by the Regional Greenhouse Gas Initiative program’s allowance sales, so this halved appropriation is expected to be agency income and not from other sources in the Governor’s budget. The Department of Administrative Services (DAS), under the language proposed in House Bill 2, would be permitted to deconsolidate some services to gain efficiencies through sending certain services to other departments. The Department of Agriculture, Markets and Food (DAMF) would be appropriated a significant percentage decrease relative to its Efficiency Budget requests for three divisions; Agricultural Education was given a smaller increase than requested over its present budget, the Division of Regulatory Services was trimmed relative to SFY 2017 appropriations but was still funded substantially higher than SFY 2016’s actual expenditures, and Agricultural Development was flat-funded relative to SFY 2017 at $22,000, rather than receiving the requested increase to $30,000.

The University System of New Hampshire is also flat-funded in the Governor’s proposed budget. The Community College System received a $3.0 million operating funding boost each year, but was funded at $2.48 million below the SFY 2018 Efficiency Budget request.[6] Although the DHHS Office of Medicaid Business and Policy does receive a boost of nearly $89.9 million in the Governor’s proposed budget relative to SFY 2017’s adjusted authorized amount, the suggested appropriation still fell almost $33.9 million short of the $1.396 billion requested for this line in the Efficiency Budget, which encompasses the bulk of Medicaid program spending in the State. Similarly, the Office of the Commissioner at the Department of Education includes all of the adequate education grants to municipalities, including the Governor’s proposed sliding scale subsidy for full-day kindergarten. The Governor proposed $1.041 billion for this Activity Unit in SFY 2018, a $725,184 increase over SFY 2017 appropriations and $14.0 million short of the requested amount. The Governor’s office is relying on declining overall student enrollments in the public school system, leading to reduced adequate education grant costs, to fund both $9.0 million per year in targeted kindergarten aid and a boost in funding for charter schools.

The DHHS Division of Developmental Services received, relative to SFY 2017, a funding boost of $18.8 million in SFY 2018 of the Governor’s proposed budget, which also eliminated the distinction between the waitlist and regular waiver services line and permitted the entire line to be non-lapsing through the biennium. Despite this funding boost to the Division, which totaled $61.0 million for the biennium more than the SFYs 2016-2017 budget’s funding levels, the proposed SFY 2018 allocation was $10.9 million below this Activity Unit’s Efficiency Budget request.

House Bill 2 Policy Changes

Although House Bill 2, as proposed by the Governor, is considerably shorter than House Bill 1, Governor Sununu’s key proposed initiatives that require changes to State law to operate are presented in the omnibus legislation.

Full-Day Kindergarten Subsidy

Governor Sununu proposed targeted aid to communities through Kindergarten Initiative Development Support (KIDS) grants. This program would base funding for full-day kindergarten on three factors in a municipality: a free and reduced meal program factor, an English language learner factor, and a property wealth factor (which is double-weighted relative to the other two). These factors are calculated in different manners, and all appear to be targeted at comparing a municipality to statewide averages. The factors are combined, multiplied by the number of kindergarteners in the municipality, and multiplied by the statewide number of dollars allocated per kindergarten pupil.

- The free and reduced meal program factor is the percentage of pupils from the municipality eligible for the free or reduced-price meal program divided by the statewide percentage of similarly eligible pupils.

- The English language learner factor is calculated differently than the free and reduced meal factor; this formula divides the percentage of the State’s English language learner pupils who are within the municipality by the percentage of pupils who are English language learners statewide.

- The property wealth factor is the statewide average equalized property valuation per pupil divided by the municipal equalized property valuation per pupil.

While this program is likely to undergo changes in the Legislature, the Governor’s proposal made some key policy choices. The characteristics of the municipality’s pupils as a whole, not just the individual pupils themselves, were considered in the grant; in other words, a town with a larger percentage of students qualifying for free or reduced-price meals would receive more of the KIDS grant money per student even if a particular student does not qualify, which deviates from the student-dependent current formula for adequate education grants. Also, this subsidy is not limited to particularly high-need municipalities but is a sliding scale, as even municipalities with no English language learner or free and reduced-price meal pupils will still receive some funding as long as the municipality has kindergarten pupils and the State funds the KIDS program. Additionally, this program does not specify funding levels, meaning future lawmakers can keep the program intact with any funding amount and no additional changes to statute.

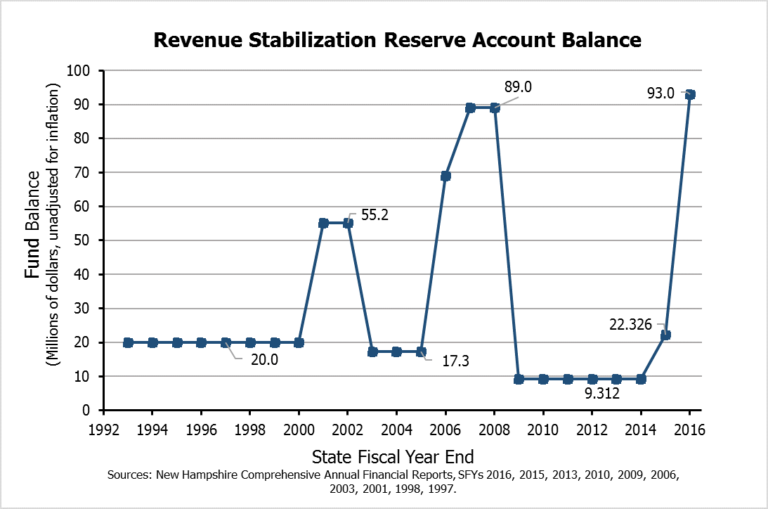

Surplus Used for Infrastructure

Governor Sununu proposed an Infrastructure Revitalization Trust Fund (IRTF) be established and collect surplus revenue from SFY 2017. The Governor’s Executive Budget Summary states the IRTF would double grants to towns for roads and bridges, assist local schools with addressing health and safety issues, fully reinstate Granite Hammer to combat the opioid crisis, and provide targeted student loan debt forgiveness for clinicians and nurses.[7] This proposal would cap the amount going into the Revenue Stabilization Reserve Account, also known as the “Rainy Day Fund,” at $100 million; the statutory cap for the Account is $153 million for this year, so the Account would be at the highest level since at least 1993, but not full. After adding the $7 million to the Account to move it from its current level of $93 million to $100 million and paying for certain other expenses associated with SFY 2017, Governor Sununu anticipates depositing $84.4 million into the IRTF.[8]

The IRTF’s written intent, in the proposed statute, is to target grants to fund select local and State infrastructure projects. Funds may be used for infrastructure, including roads, bridges, and school building needs. There are no guarantees in the legislation as drafted that portions of this fund be allocated to certain priorities, projects, or levels of government. While there is a stated intent to fund infrastructure needs and certain potential project areas are specifically identified, the Governor appears to have broad authority to, with the approval of the Joint Legislative Fiscal Committee and the Executive Council, expend IRTF money on selected projects after consulting with the proposed Infrastructure Revitalization Commission. This Commission would include four members of the Legislature (selected by legislative leadership in each chamber), the Commissioners or their designees from the Departments of Education and Transportation, one municipal official appointed by the Governor, and three other members appointed by the Governor without restriction. The Commission members would meet monthly, would not have terms or term limits for members, would not be compensated except for the legislators receiving mileage reimbursements, and must at least annually review funded projects.

There are no requirements that the IRTF or the Commission be closed or disbanded at a certain time. Funds are non-lapsing, meaning they can be carried forward across budgets, and the State Treasurer is required to invest the money in the IRTF and deposit any earnings back into the IRTF. There are no provisions to appropriate money to the IRTF except for the surplus money from SFY 2017.

Department Reorganization

The Governor has proposed a reorganization of the Department of Resources and Economic Development (DRED) and the Department of Cultural Resources (DCR) into two new departments, with the proposed names of the Department of Natural and Cultural Resources and the Department of Business and Economic Affairs. The Department of Natural and Cultural Resources would house six divisions, including the Divisions of Forests and Lands and Parks and Recreation from DRED and four Divisions adopted from DCR functions: Libraries, Arts, Film and Digital Media, and Historical Resources. This new department would employ 205 staff.

The stated purpose of the proposed Department of Business and Economic Affairs is to efficiently coordinate two divisions, the Division of Economic Development and the Division of Travel and Tourism Development, which are currently within DRED. The new Department’s stated aim would be to provide unified direction for policies, programs, and personnel in these two related areas of State government, and as a whole would be much smaller than the reorganized Department of Natural and Cultural Resources, with 69 employees.

Other Proposed Changes

The long list of policy changes proposed in House Bill 2 includes the following:

- Payments from the State to charter schools authorized by the State Board of Education are linked to the State average cost per pupil for public school operating expenses, rising from 48.5 percent to 54 percent between SFYs 2018 and 2021. This change to the formula, which is currently indexed to inflation excluding health care costs, would boost charter school adequacy grant appropriations as reflected in House Bill 1, rising from $33.1 million authorized adjusted in SFY 2017 to a proposed $43.7 million in SFY 2019.

- The Department of Administrative Services must collect at least 10 percent of a retired State employee’s monthly health insurance premium cost from the retiree. Currently, these retirees are not required to pay a portion of their health insurance premiums after becoming eligible for Medicare Parts A and B due to age or disability.

- The Alcohol Abuse Prevention and Treatment Fund is modified in statute to increase from collecting 1.7 percent of the Liquor Commission’s gross profits from liquor sales to 3.4 percent, with a provision to increase the percentage to 4.0 percent if at least 80 percent of the Fund in any SFY is encumbered.

- The maximum monthly cash benefit under New Hampshire’s family assistance program, funded through the federal Temporary Assistance for Needy Families program, is adjusted to 60 percent of the federal poverty guidelines and updates that cash benefit maximum annually. This program is not currently indexed to the federal poverty guidelines, which for 2017 identify $20,420 or less as poverty for a three-person household. The proposed maximum benefit would effectively increase the cap in this program, barring a reduction in the federal poverty guideline thresholds.[9]

- Twenty percent of the money paid into the Renewable Energy Fund during the biennium must be rebated to ratepayers eligible for the State’s electric assistance program.

- The Governor’s Scholarship Program is established and funded, with $5.0 million appropriated per year. The program is required to disburse up to $5,000 in scholarship aid per eligible student or resident meeting certain requirements and seeking to attend post-secondary educational institutions in the University System, the Community College System, or other programs approved by the Office of Strategic Initiatives (formerly the Office of Energy and Planning).

- The laws governing pet sales and vendors are overhauled, including expanding the definition of pet vendor and removing a pro-rating provision from pet vendor licensing application fees.

- Funds transferred from the Conservation Number Plate Fund to the proposed Department of Natural and Cultural Resources may be used for expanded purposes, including management and public information for native plant species and the restoration of historic sites on State Parks land.

- The Department of Administrative Services shall offer for sale land formerly used by the Laconia state school, except those lands and buildings required for State use.

- State corrections officers no longer must meet the same requirements related to physical fitness and health as certified police and probation-parole officers.

- Banks and certain other financial product brokers must respond more quickly to consumer complaints and conduct investigations within a shorter timeline in response to complaints.

- Up to 30 percent of the money in the highway and bridge betterment account may be allocated to maintenance, repair, replacement, and preservation needs on a regional basis.

- The Department of Administrative Services has the authority to deconsolidate or reconsolidate any business or human resources function in State government to seek cost effective or beneficial arrangements.

- Suspensions of State aid programs for school buildings, certain environmental infrastructure projects, and meals and rentals tax distributions to municipalities are extended through the biennium. Meals and rentals tax revenue credited to the Division of Travel and Tourism Development also has an extended suspension.

- Reimbursements to the foster grandparent program are suspended, which is an extension of a past suspension.

- The Department of Transportation is given authority to perform construction, reconstruction, alteration, or maintenance on buildings or facilities supporting transportation; that authority was previously transferred to the Department of Administrative Services. The Department of Transportation may also declare property acquired after 1945 as surplus and dispose of it.

- Red List bridges shall include structurally deficient highway bridges and railroad bridges over highways, and structurally deficient is defined in statute.

- The name of catastrophic aid payments for special education students is changed to special education aid.

A Brief Look at Revenue Projections

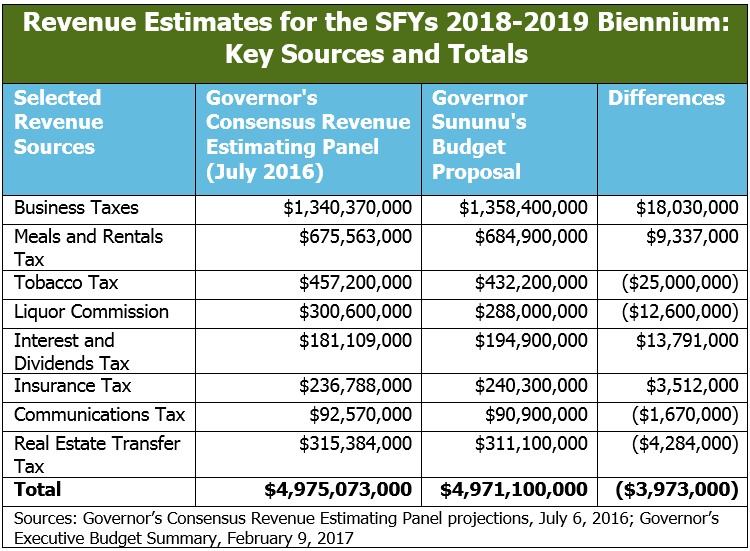

Governor Sununu’s proposed budget includes revised revenue estimates. Proposed changes to the structure of revenue streams are minor, so comparisons to past revenue projections provide insight into the Governor’s choices and assumptions. Former Governor Hassan created, through Executive Order, the Governor’s Consensus Revenue Estimating Panel, which met periodically to generate public revenue projections.[10] The Panel last convened in July 2016, and Governor Sununu did not reconvene the Panel to produce his own revenue estimates. However, comparing Governor Sununu’s estimates with the July estimates reveals a similar outlook for revenue, with Governor Sununu’s estimate, having the benefit of another half-year of generally favorable revenue data, projecting approximately $4.0 million less than the Panel’s projections out of more than $4.97 billion projected across the biennium, or a drop of 0.08 percent.

Notable differences included in the Governor’s estimates are more pessimistic projections on the Tobacco Tax ($25.0 million less over the biennium), Liquor Commission receipts ($12.6 million less), and the Real Estate Transfer Tax ($4.3 million less). The Governor was more optimistic on the State’s two main business taxes ($18.0 million more over the biennium), the Interest and Dividends Tax ($13.8 million more), and the Meals and Rentals Tax ($9.3 million more) than the Panel was in July 2016.

Sources

Next Steps

The House Finance Committee has begun examining the Governor’s budget and will craft its own version before passing it to the Senate in early April. If trends from recent budget cycles continue, the House Ways and Means Committee may generate more conservative revenue estimates, and the House Finance Committee will craft a smaller budget. The Senate often benefits from knowing revenue totals from March and April, which tend to be favorable months for revenue collections, and may boost the size of the Senate version of the budget. However, Governor Sununu’s proposed budget may be larger than the final product, which would hold a trend from the last three budget cycles. Other issues may arise, however, causing substantial shifts from the Governor’s budget proposal. For example, lawsuits or mandatory expenditures may force lawmakers to reprioritize. Some hospitals in the State have already expressed concern about the less-than-expected amount allocated to Disproportionate Share Program payments, which are required reimbursements to hospitals from the State for uncompensated care costs. The Governor has also set aside $50.1 million to address expected budget shortfalls related to Medicaid during SFY 2017, which the Legislature may prefer to divert elsewhere.[11] Other non-budget policy may also be attached to House Bill 2, and separate pieces of legislation currently being considered may be folded into the State budget debate.

Although the Governor’s budget provides insight into his preferences and is a key starting point of debate in the Legislature, the only legal authority Governor Sununu has to support his budget proposal is his decision to sign, veto, or withhold his signature from the State budget when it reaches his desk in June 2017.

Endnotes

[1] House Bill 1 and House Bill 2, as proposed by the Governor, as well as the agency budget requests may be accessed through the Office of Legislative Budget Assistant.

[2] Past operating budgets may be accessed through the Office of Legislative Budget Assistant.

[3] See New Hampshire Fiscal Policy Institute, Building the Budget, February 9, 2017, pgs. 13-14.

[4] See NHFPI’s NH State Budget resource page for more information.

[5] See Transparent NH, Glossary, accessed February 2017, and Governor Sununu’s Executive Budget Summary and Recommended Operating Budget.

[6] The Governor’s written budget submission did not include any additional operating funding for the Community College System, but the Governor later transmitted his intention to the Legislature to allocate $6.0 million over the biennium to the Community College System. This analysis assumes $3.0 million is allocated each year and that no other after-submission changes have been made.

[7] See Governor’s Executive Budget Summary, pg. 5. Granite Hammer is the name given to a State subsidy to municipalities and counties to curb drug dealing and reduce backlogs of evidence in the State Police Forensic Lab.

[8] For more on the Revenue Stabilization Reserve Account, see NHFPI’s Common Cents blog posts Sun Shining on the Rainy Day Fund and A Good Year for State Revenues; see also the Office of Legislative Budget Assistant’s Fiscal Issue Brief “The Rainy Day Fund.”

[9] See the U.S. Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation for federal poverty guidelines and the New Hampshire Department of Health and Human Services, Family Assistance Manual, Section 601, Table B (both accessed February 2017).

[10] See the archived website for the Governor’s Consensus Revenue Estimating Panel.

[11] See Comparative Statement of Undesignated Surplus, Governor’s Executive Budget Summary, pg. 10.