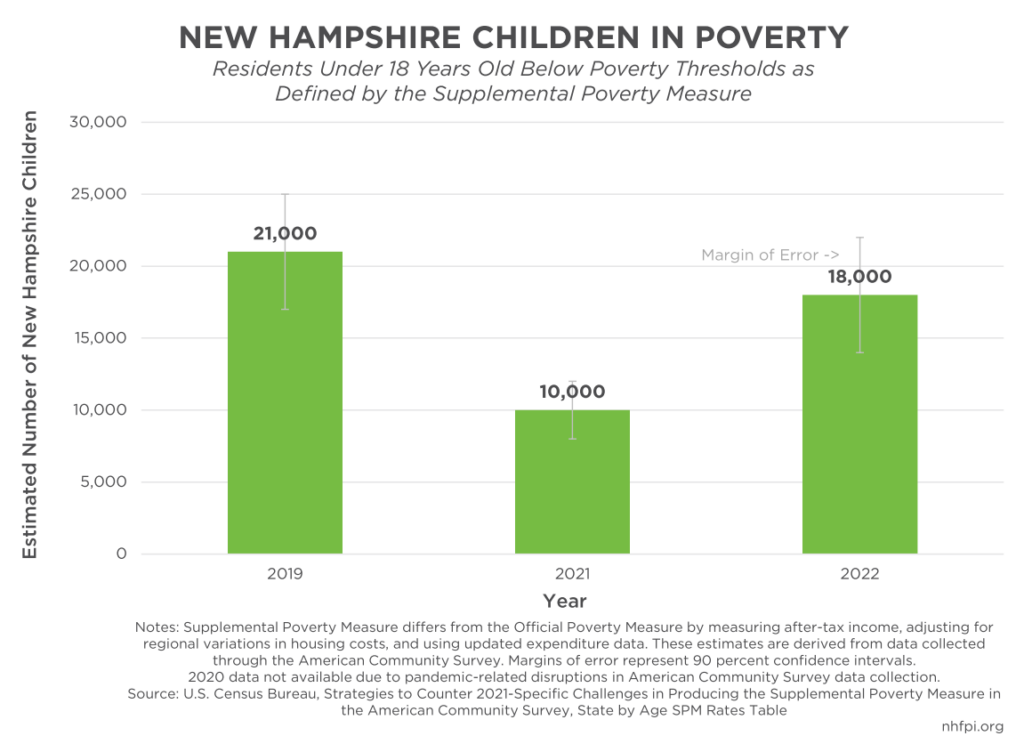

The Supplemental Poverty Measure incorporates taxes, regional differences in housing costs, and other factors beyond those considered in the Official Poverty Measure, which measures gross pre-tax income and is uniform throughout the contiguous 48 U.S. states. The Supplemental Poverty Measure has become more important for understanding hardship since the beginning of the COVID-19 crisis, as significant aid to households was provided in the form of tax credits, including the one-time Economic Impact Payments, or “stimulus checks,” and the enhanced Child Tax Credit. Using estimates based on other data, the U.S. Census Bureau reports the number of individuals at the state-level who are in poverty based on the Supplemental Poverty Measure. Using this measure, approximately 21,000 children were in poverty in New Hampshire in 2019. That figure dropped to 10,000 children in 2021, when more one-time federal aid, including the enhanced Child Tax Credit, was flowing to households. The figure rebounded to an estimated 18,000 children in 2022 after most of the enhanced aid expired.