In the second State Budget proposal of his tenure, Governor Chris Sununu prioritized the health and well-being of certain vulnerable populations while supporting certain significant new expenditures and policy initiatives with one-time funds rather than ongoing commitments. The Governor’s proposal takes advantage of a recent influx of revenue to support building and capacity projects, particularly related to the State’s health system and infrastructure, but does not shift significant revenue to local public education or back to cities and towns on a continuing basis. With a relatively strong economy in New Hampshire and favorable State revenues, budget writers have an opportunity to invest and build a stronger, more resilient economy. Governor Sununu proposes certain key investments, but primarily does so with one-time funding or important but relatively modest changes.

The Governor’s budget proposal appropriates significant additional funding to health and social assistance, including services for those with developmental disabilities, mental health needs, children in need of assistance or protection, and workers with barriers to participation in employment. The Governor’s budget does appropriate significant additional funding to support local governments on a one-time basis, but funding for these projects would be directed by newly proposed statute or state-level appointees rather than through adjustments to state aid for public school district education, general revenue sharing, or resuming assistance programs suspended or curtailed during the Great Recession.

The Governor’s proposal relies on one-time, surplus funds for supporting many key initiatives beyond funding ongoing operations. A significant portion of the surplus revenues collected recently are associated with the federal tax overhaul’s policy changes. Given the uncertainty around the continuation of these revenues, the Governor appropriates surplus dollars to physical infrastructure projects, one-time assistance to higher education and other priorities, and the Rainy Day Fund. The Governor expands two revenue sources, but projects revenue will decline during the biennium, reflecting the likelihoods that one-time revenues will disappear, reduced rates of the State’s two primary business taxes will lead to smaller amounts of revenue collected, and economic growth may slow in the next two years.

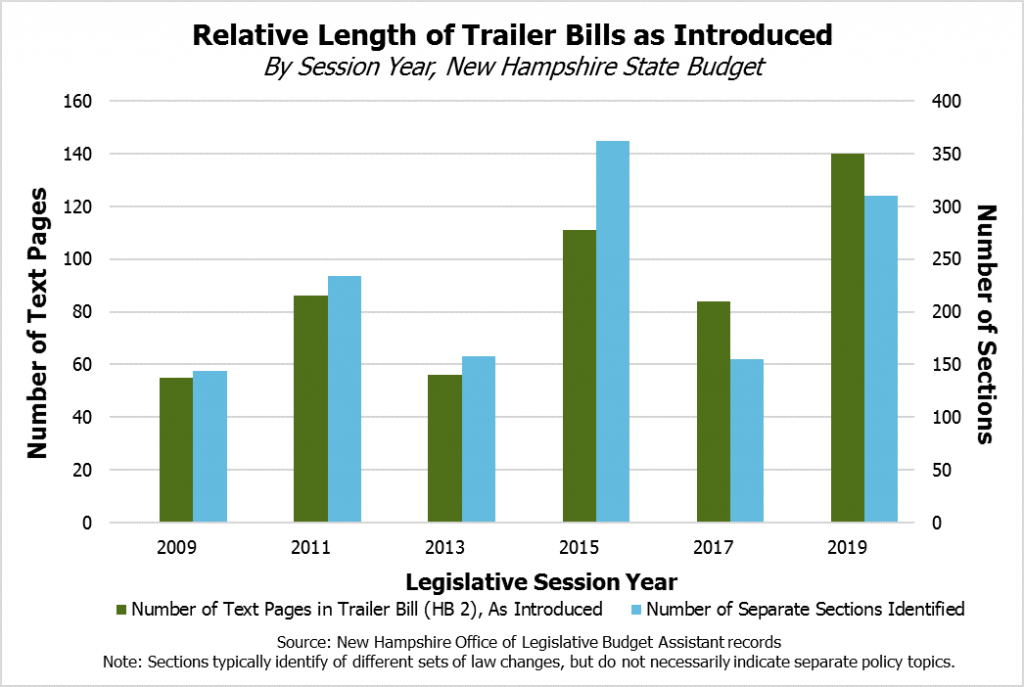

This Issue Brief explores key components of Governor Sununu’s budget proposal, released publicly in February and March, including both the Governor’s Operating Budget Bill (House Bill 1) and Trailer Bill (House Bill 2) proposals.[1] The Governor forwarded numerous policy changes in association with his State Budget proposal, which included the longest Trailer Bill proposed by any Governor in at least the last ten years. The appropriations in the Governor’s Operating Budget Bill, based in part on State agency requests, would increase overall funding for State government, but prioritizes certain areas, including health services, relative to current funding or agency requests.[2]

The Big Picture and Overall Figures

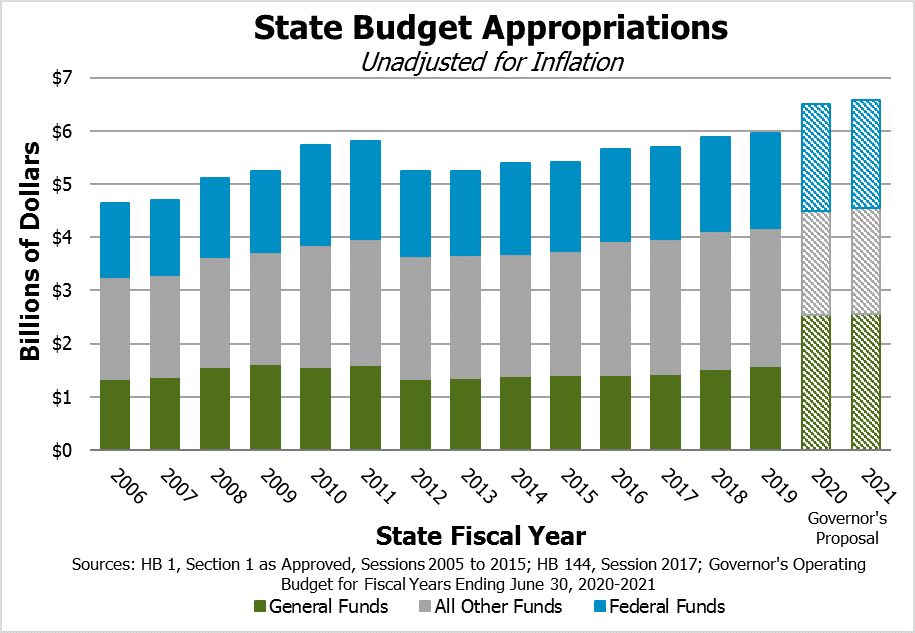

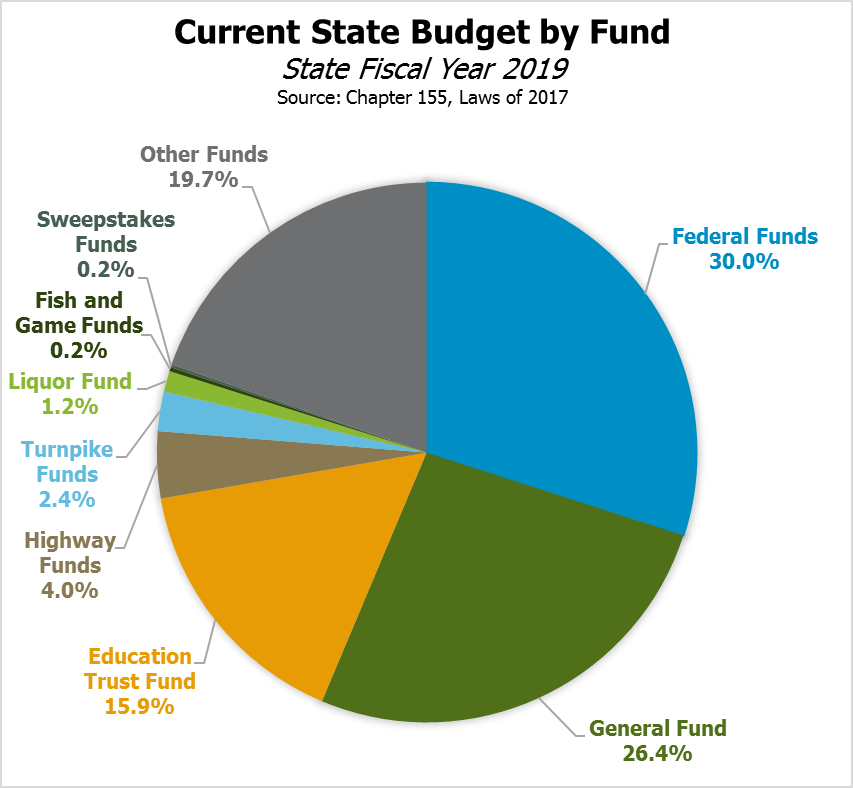

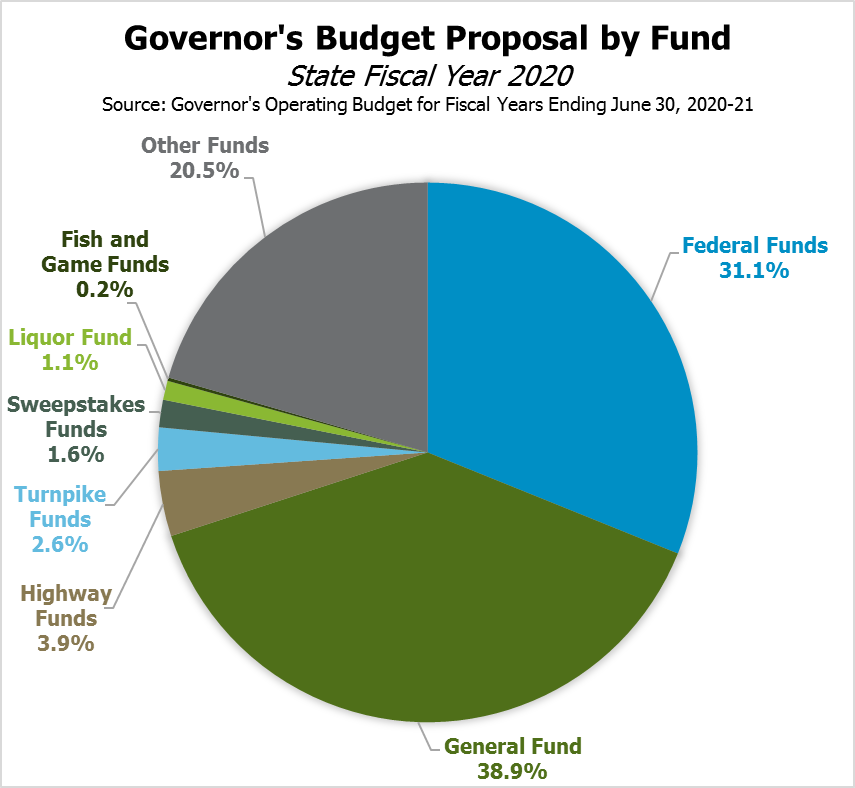

Governor Sununu’s $13.087 billion budget proposal for State Fiscal Year (SFY) 2020 and SFY 2021 grows overall from the amounts authorized for SFY 2019.[3] The bottom line of the budget, not including the deployment of certain surplus dollars, would increase 6.4 percent in SFY 2020 relative to the currently authorized SFY 2019 budget, unadjusted for inflation, and 1.0 percent in SFY 2021 relative to the prior year.[4] A significant portion of that increase stems from federal funds, which typically provide about 30 percent of State Budget funding. The Governor’s budget anticipates approximately $494 million more in federal funds over the course of the biennium than the Legislature anticipated when it passed the SFYs 2018-2019 State Budget. Although a significant portion of this difference can be attributed to the Legislature choosing not to account for certain anticipated federal grants in the State Budget, the Governor’s budget anticipates more federal funding overall and plans for greater use of certain federal funds currently available, particularly by the Department of Health and Human Services and the Department of Transportation.

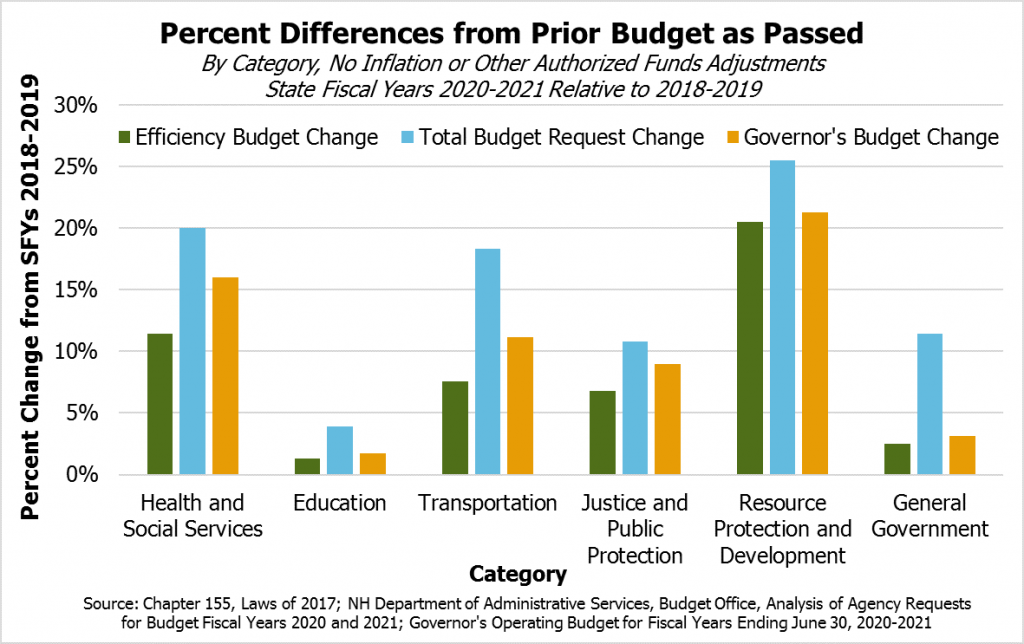

The Governor’s budget proposal at $13.087 billion for the biennium falls between the two sets of budget requests from State agencies to fund public services. State agencies made an Efficiency Budget request that totaled $12.770 billion, which represents State agency requests within a certain expenditure cap set by the Governor’s office, representing their highest priorities for operation. The Total Budget Request, which includes both the Efficiency Budget and the Additional Prioritized Needs identified by the agency that rose above the expenditure caps, totaled $13.568 billion.[5] The Governor’s budget proposal funded each category above the aggregate Efficiency Budget request, although Education, Resource Protection and Development, and General Government were only marginally above their requests. Health and Social Services and Transportation had levels of growth notably higher than their Efficiency Budget requests, but both fell short of their full requests.

Comparisons to the SFYs 2018-2019 State Budget discussed here do not adjust for federal and other funds removed by the Legislature from the last State Budget, nor do they adjust for the inclusion in both the SFYs 2020-2021 agency requests and Governor’s proposal of a major water infrastructure-related fund under Resource Protection and Development that was operating but not accounted for in the prior budget.

Support for State Public Services

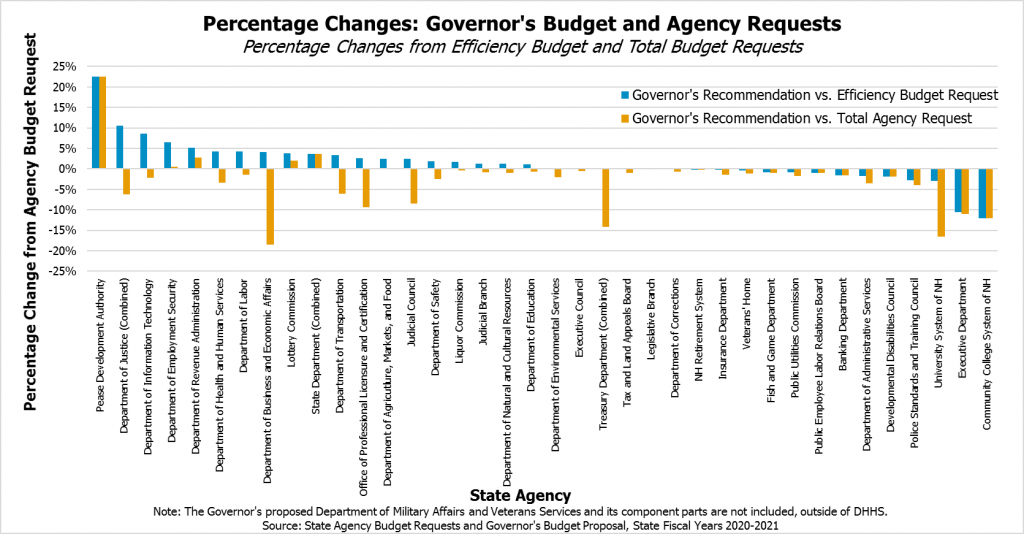

The Governor’s budget proposal increases funding overall, but it does not increase funding consistently across all types of public services. Relative to agency requests, some services received significantly more than they requested in their Efficiency Budgets, but only a few received the same as or more than their Total Budget Requests. Several of the largest percentage increases over State agency Efficiency Budget requests came in the Department of Justice, the Department of Information Technology, New Hampshire Employment Security, and the Department of Revenue Administration. The biggest declines relative to agency requests, however, included the Community College System and the University System as well as the Department of Administrative Services and the Executive Department, due in part to shifting responsibility for the Governor’s Scholarship Program to the Department of Education.

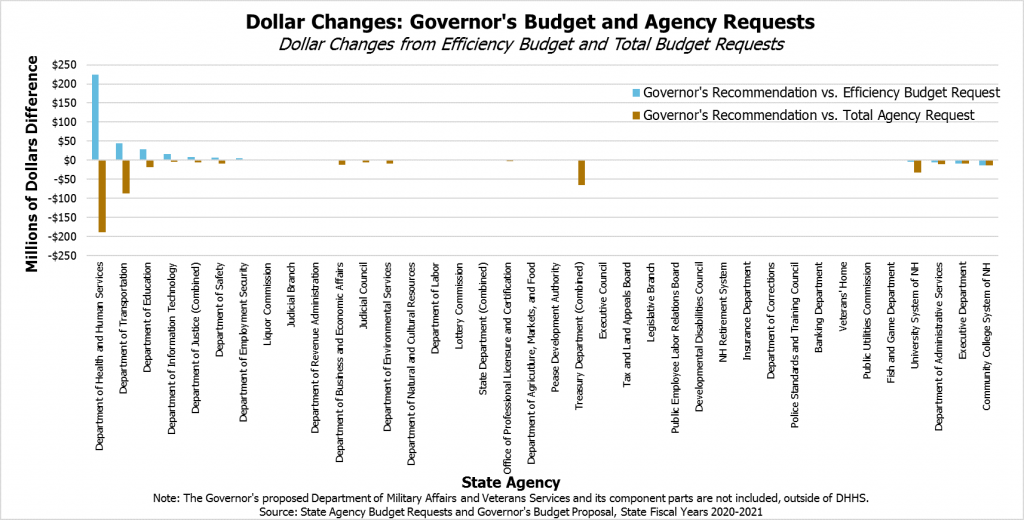

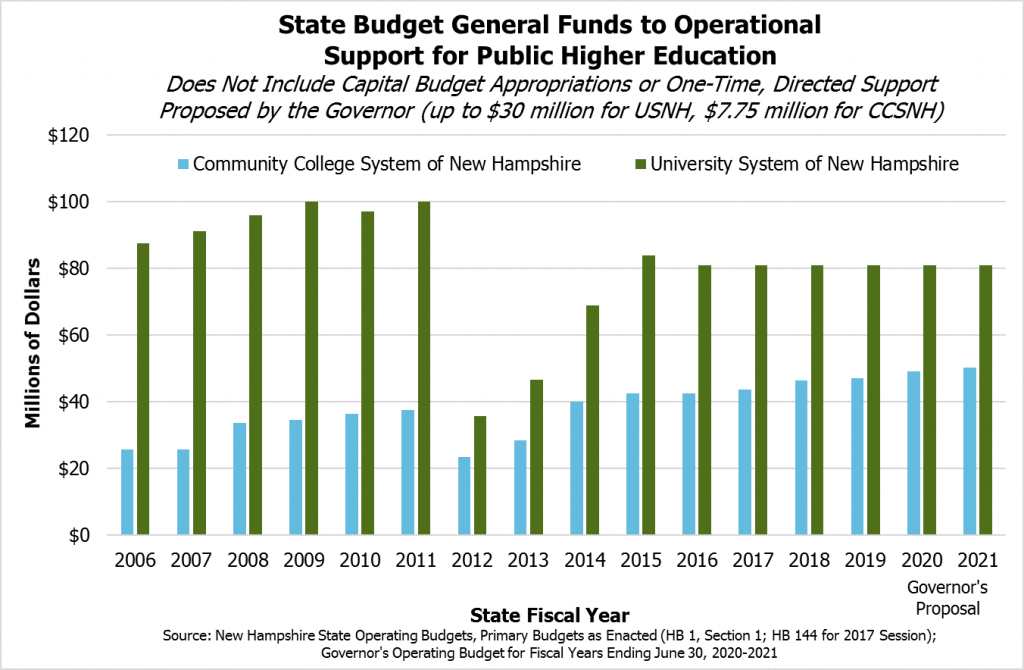

While percentage terms provides context for the Governor’s prioritization of funding public services relative to the cost of providing them per agency requests, the allocation of dollars also allows for comparisons for prioritization of resources across different types of services. These comparisons emphasize some of the services that cost the most because of external factors, such as health care services and road construction, but do permit comparisons that are more difficult to discern when only considering percentages. The State agencies delivering some of the most key and most widely used services are apparent at the extremes of the comparisons, where relatively small percentage deviations from the agency requests can lead to large dollar changes. The Department of Health and Human Services, the Department of Transportation, and the Department of Education show the three of the five largest dollar increases in the Governor’s proposed budget relative to their efficiency budget requests, but also show some of the largest dollar decreases from their Total Budget Requests. At the other end of the spectrum, the Community College System, the University System, and the Department of Administrative Services all received at least $5 million less than they requested in the Governor’s Operating Budget Bill, with the University System, which still receives a smaller annual appropriation than it did prior to the Great Recession, falling $32 million short of its total budget request. Notably, certain one-time funds not included in the Operating Budget Bill are appropriated to the University System and other agencies in the Trailer Bill.

Comparisons to actual authorized funding levels in SFY 2019 permit a comparison of not only where funding for services may have been changed relative to agency requests, but also relative to the actual funding those services are budgeted in the current year. Comparing without the context of agency requests does not permit understanding of planned department reorganizations or policy changes, so some increases or reductions may not reflect weighed policy choices as much as the evolution of agency structures or accounting units.

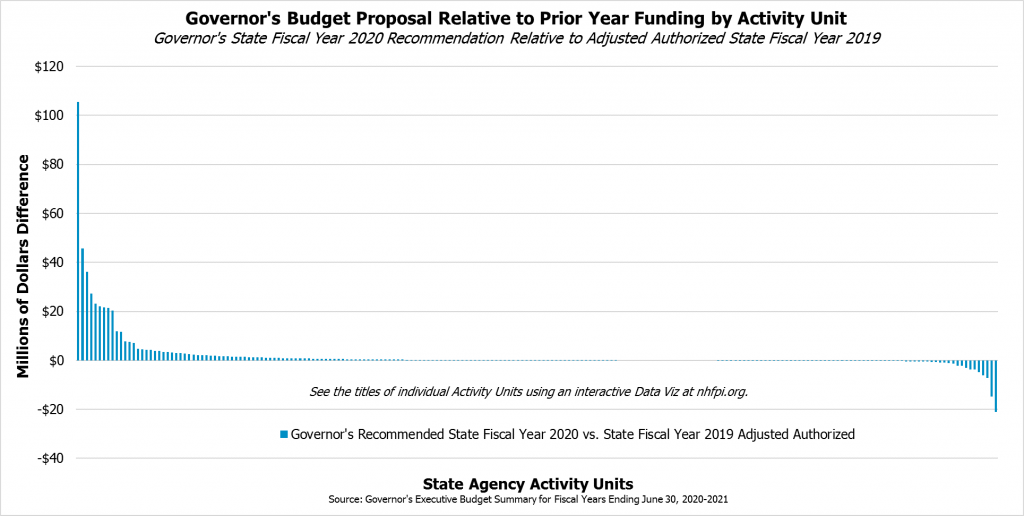

With those caveats in mind, an examination of the funding for Activity Units, which offer a greater level of granular analysis than State agencies as whole, show that 40.3 percent of Activity Units would receive the same amount of money or less in SFY 2020 under the Governor’s proposal as they did in the SFY 2019 adjusted authorized figures, which account for changes made after the SFYs 2018-2019 State Budget was enacted in June 2017. The percentage of Activity Units receiving fewer dollars in SFY 2020 than in the current year under the Governor’s proposal would be 30.6 percent.

Some of the largest increases by Activity Unit are in the Office of Medicaid Services, reflecting the increase in expected Medicaid uncompensated care payments to hospitals, as well as for the Division of Developmental Services, nursing home and Choices for Independence Waiver services for individuals receiving care in their homes, the Bureau of Family Assistance funding for individuals receiving support from Temporary Assistance for Needy Families dollars, the Turnpikes Division, and consolidated federal aid under the Department of Transportation. A significant portion of these increases are funded with federal dollars. Some of the largest decreases are in the Department of Health and Human Services Office of Information Services and the Bureau of Child Development, as well as in the Treasury Department, the Department of Education’s Division of Workforce Innovation, and the Governor’s Office of Strategic Initiatives.

The Governor’s Trailer Bill establishes the Capital Infrastructure Revitalization Fund, which deploys $168.44 million in expected and planned surplus dollars over the course of the biennium outside of the Operating Budget Bill. This total does not include the $63.7 million expected to be distributed through the Targeted School Building Aid Reserve Fund, which would also be established by the Governor’s Trailer Bill. The Capital Infrastructure Revitalization Fund is established with an $80 million transfer, and includes any surplus after certain amounts reserved for the Rainy Day Fund. A full list of Capital Infrastructure Revitalization Fund proposals, which range in individual costs from $30,000 to $26 million, is available from the Office of Legislative Budget Assistant.[6]

Health and Human Services

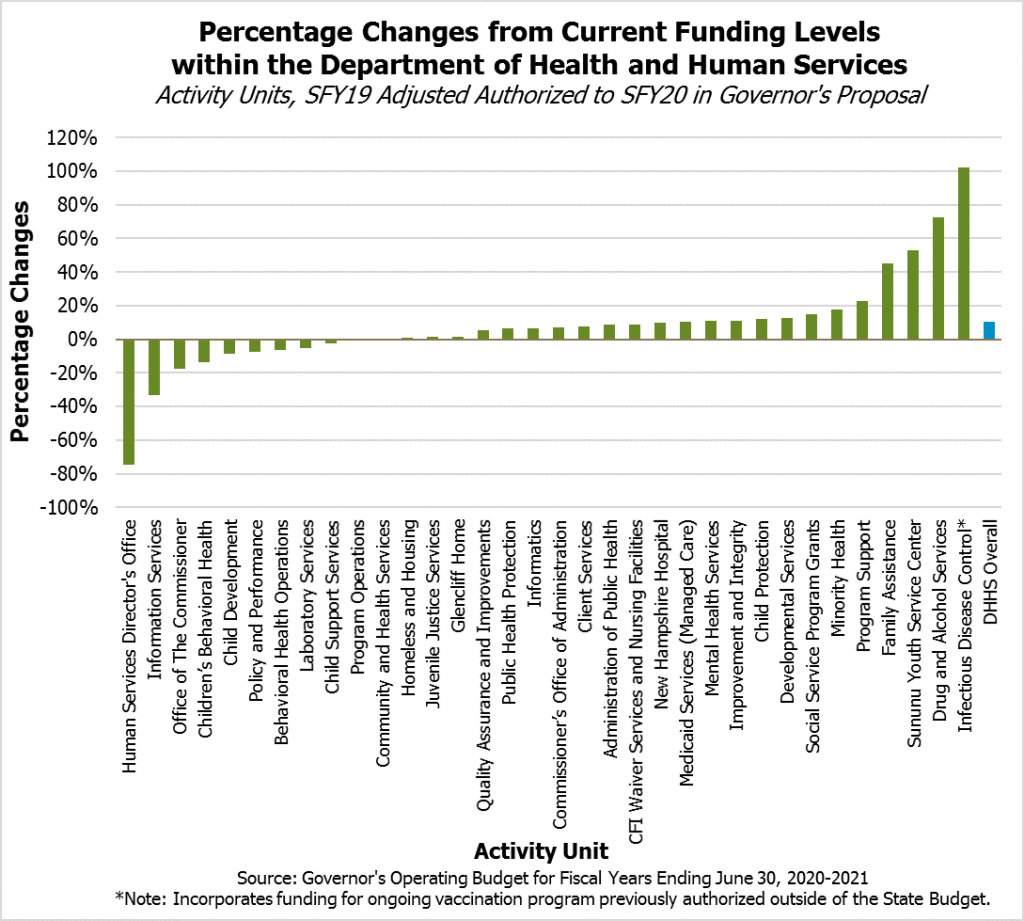

The New Hampshire Department of Health and Human Services (DHHS) provides needed services to individuals and families, including food assistance and health care coverage for children and adults with low incomes, aid and care for those with disabilities or mental health needs, assistance to address substance misuse, child support and protection, disease control, and overall public health. In the Governor’s Operating Budget Bill proposal, DHHS accounts for approximately 42 percent of all State Budget expenditures. These appropriations include federal funding provided through the Medicaid program, which serves approximately 179,000 Granite Staters, and other federal programs such as the Supplemental Nutrition Assistance Program.[7] The Governor’s Operating Budget Bill proposal increases the SFY 2020 DHHS budget from the SFY 2019 adjusted authorized appropriations by 10.7 percent, and increases the SFY 2021 DHHS budget by 1.2 percent over the SFY 2020 figure.

The largest program areas in percentage increases by Activity Unit include the Bureau of Infectious Disease Control, which is largely due to accounting decisions; the Bureau of Drug and Alcohol Services, reflecting the newly-acquired federal grant funding for opioid response; the Sununu Youth Services Center; and the Bureau of Family Assistance, which includes the increased deployment of Temporary Assistance for Needy Families (TANF) federal block grant funding.

Granite Workforce and Benefit Cliff Effects Supports

The additional use of TANF funds stems in part from two policy changes in the Governor’s proposal. First, the Governor proposes modifying and extending the Granite Workforce Pilot Program, which would subsidize employers of participants in the expanded Medicaid program in New Hampshire, known as Granite Advantage, for up to $2,000 for the first three months of employment, with an additional subsidy of up to $2,000 after nine months of employment. For employees enrolled in Granite Advantage and also eligible for TANF, TANF dollars would be used, but the Governor’s proposal also expands the Granite Workforce pilot program’s funding beyond federal TANF dollars for families not eligible for TANF services, including job training and other Granite Advantage appropriations. Granite Workforce participants may continue to receive services as needed if their incomes rise above the eligibility levels for the Granite Advantage program within certain limits and within a nine-month period.

Second, the Governor’s Trailer Bill seeks to help those receiving TANF supports to more easily transition to higher income employment. The bill includes an exemption for the New Hampshire Employment Program and the Family Assistance Program for the first six months of income from any new income received from employment when determining eligibility. This would permit individuals on TANF to continue to receive their benefits for six months while earning the initial income from a new position of employment, rather than losing those benefits immediately, which is often referred to as a benefit “cliff.” This policy change would reduce the benefit “cliff effect” and provide additional incentive for employment as well as additional financial support for those in the initial months of a new job.

Developmental Disability Services and Other Key Medicaid Changes

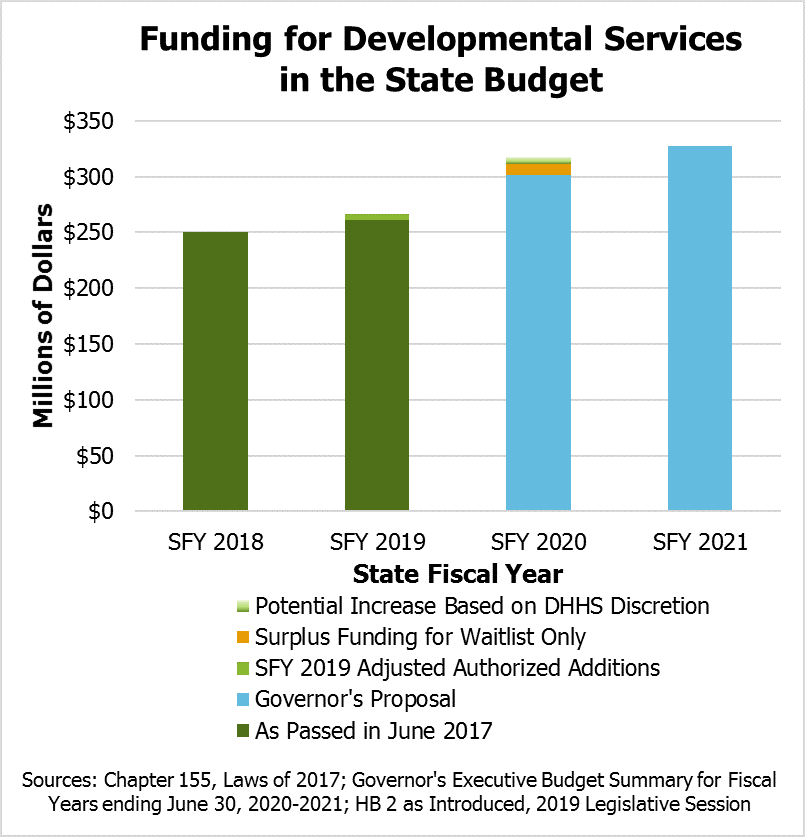

In terms of dollars, the largest increases in the DHHS budget are around Medicaid services, particularly those services to those with disabilities and those who receive treatment in their homes or communities. Services to those with developmental disabilities, delivered through designated non-profit Area Agencies that provide or subcontract these services, received a significant boost in funding; comparing the SFY 2020 appropriation, including funding specifically for those on the waitlist for services, to the SFY 2019 adjusted authorized appropriation reveals a boost of $45.1 million (16.9 percent). Comparing the Governor’s proposal to the SFY 2018-2019 State Budget as approved by the Legislature, the total difference over two years is a $127.8 million (25 percent) increase from the prior budget. The Governor’s Trailer Bill also provides the DHHS Commissioner with the authority, based on the Commissioner’s discretion, to allocate an additional $6,145,000 to certain priorities, which could include developmental services, acquired brain disorder services, in-home support services, and various other information services funds.

Aside from funding alone, the Governor’s proposal includes certain changes for the developmental disability community. On the State accounting side, funding for developmental services would be appropriated to a separate, non-lapsing developmental services fund, which would mean unused dollars would not be returned to the General Fund at the end of each biennium. The Governor’s proposal also authorizes the DHHS to provide funding to organizations which are not designated Area Agencies for the provision of services for those with developmental disabilities, and provides $500,000 to study the State’s developmental disability services system.

Other changes to Medicaid include increased funding for nursing home and Choices for Independence Medicaid Waiver services, and increased funding for uncompensated care to hospitals. Nursing home and Choices for Independence Medicaid Waiver services for adults who are chronically ill or have a disability see a funding increase between the SFY 2019 adjusted authorized amount and SFY 2020 in the Governor’s proposal of $21.2 million (8.3 percent). These increases are supported in large part by the federal Medicaid matching funds and by county governments, as property taxpayers at the county level fund long-term supports and services; General Fund appropriations from State government remain relatively flat in these new appropriations, and the cap on the amount of funding counties supply to fund these services is increased. Uncompensated care payments to hospitals increased substantially over the SFY 2019 State Budget appropriations in the Governor’s proposal, likely reflecting changes to agreements with hospitals and the decreased compensation provided through expanded Medicaid under the new Granite Advantage program.

The Governor’s State Budget proposal included funding for certain Medicaid reimbursement rate increases, but did not include a broad Medicaid reimbursement rate increase including most or all providers. Medicaid reimbursement rates, which define the amounts the Medicaid program reimburses providers for delivering certain services, provide key income to agencies serving populations with limited resources and help determine whether those agencies can pay wages to sufficiently attract and retain workers to provide needed care.[8]

Mental Health

The Governor’s Operating Budget Bill incorporates new federal grant funding into the Bureau of Mental Health Services. This new funding includes, but is not limited to, approximately $2 million each year of the biennium to support ProHealth NH, which is a program designed to support people aged 16 to 35 with severe emotional disturbance or mental illness.[9] Relative to funding levels for SFY 2019 adjusted authorized, about two-thirds of the additional funds for the Bureau of Mental Health Services over the biennium are from federal grants and one-third are from General Funds.

The Governor’s proposed Capital Infrastructure Revitalization Fund in the Trailer Bill includes several initiatives critical to health and social services in the state, particularly mental health services. These initiatives seek to address certain recommendations of the State’s 10-Year Mental Health Plan, including new designated receiving facility beds and repurposing space at New Hampshire Hospital.[10] Among appropriations of one-time, surplus dollars not already discussed, the Trailer Bill as proposed includes:

- $26 million for a new 60-bed forensic psychiatric hospital, which would have to be planned by November 2019 and operational by June 2021

- $5 million to construct 40 new transitional housing beds for forensic patients or those with complex behavioral health conditions

- $1.5 million for grants to hospitals for new designated receiving facility beds

- $1.0 million in assistance to hospitals to address immediate needs of involuntary admissions patients in emergency rooms

Additional appropriations, contingent on available surplus revenue, would be made to create a new facility for children in need of acute inpatient psychiatric treatment, to repurpose the children’s unit at New Hampshire Hospital for adult beds, and to conduct outreach public related to mental health.

Substance Misuse

The Governor’s proposal incorporates the federal funding from the opioid treatment-related grants in the budget for the Bureau of Drug and Alcohol Services. This grant totals approximately $3.5 million in each year of the biennium. Funding for the Bureau coming from the Governor’s Commission on Alcohol and Drug Abuse, Prevention, Treatment, and Recovery rises to $10 million each year, likely reflecting the use of anticipated voluntary donations from hospitals to the Alcohol Abuse Prevention and Treatment Fund for drug and alcohol services.

Another policy change specific to substance misuse in the Governor’s proposal is a section of the Trailer Bill that would add protections for those individuals with life, life annuity, and disability insurance. The language would prevent companies from denying or disenrolling an individual from coverage, or limiting their coverage, solely because the individual filled a prescription for naloxone, a medication used to block the effects of opioid overdoses.

Other Initiatives

The Trailer Bill also includes several key appropriations or policy changes affecting certain services. The Trailer Bill as proposed by the Governor would:

- appropriate $3.5 million to fund voluntary services at the Division of Children, Youth, and Families until federal funds become available in SFY 2021

- make additional appropriations, contingent on available surplus revenue, to study pediatric cancer in New Hampshire, to monitor and provide education about Lyme disease, and to support Medicaid’s information systems

- increase the Social Services Block Grant program’s income eligibility for adult clients each January by the percentage amount of the cost of living increase in social security

- clarify that those who are clinically ineligible for federal cash benefits but otherwise eligible for public assistance programs for those who are totally disabled, blind and in need, or of old age would receive those benefits under state law

- repeal the Senior Volunteer Grant Program and the Congregate Services Program, and suspend reimbursements to the Foster Grandparent Program

- repeal the presumptive eligibility program for nursing facility services

- repeal direct graduate medical education payments and catastrophic aid payments to hospitals

- expand the circumstances under which new continuing care facilities may be constructed

- protect certain children and pregnant women from losing coverage and reinstates open enrollment if expanded Medicaid were to be repealed

Education Changes and Initiatives

Governor Sununu’s State Budget proposal includes several large, one-time investments in education infrastructure and smaller ongoing investments.

Local Public Education

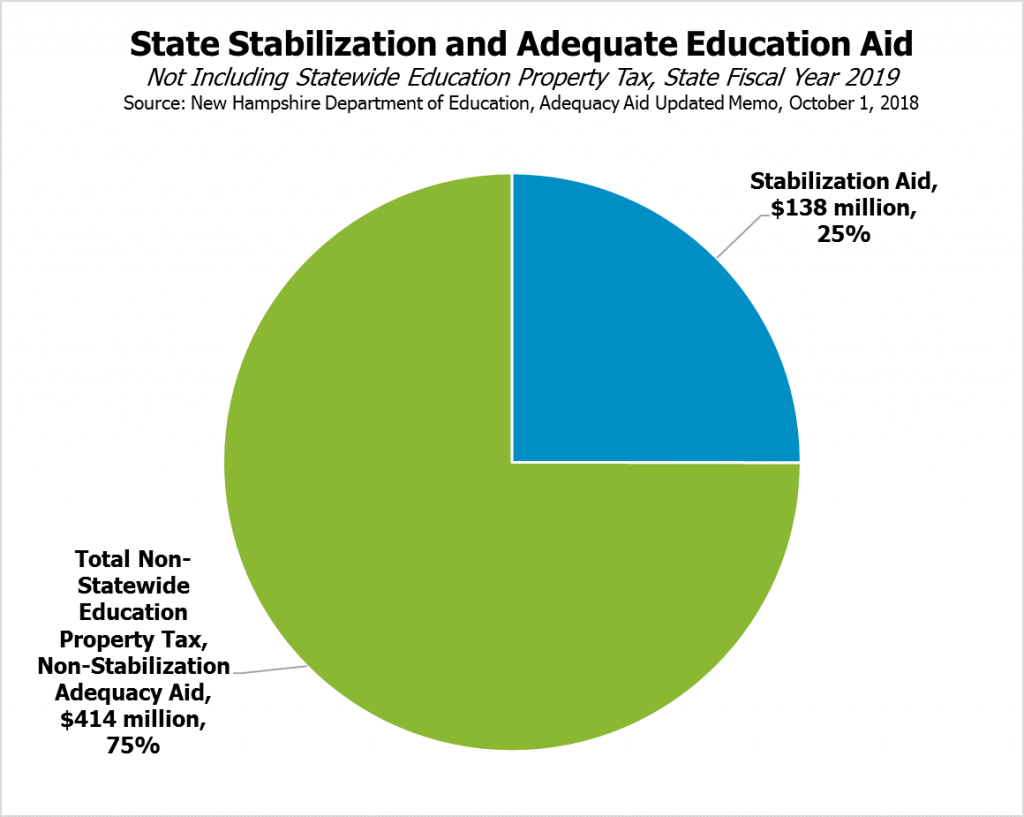

The Governor’s proposal does not alter the adequate education aid funding formula, which dispenses state aid to local school districts. The proposal also does not halt the annual four percent decline in stabilization grants, which provide support to school districts that would have received less funding after the overhaul of the State’s education funding formula in 2011 without those stabilization grants.[11]

However, the Governor’s proposal would provide an estimated $63.7 million in one-time funds to local school districts through the Targeted School Building Aid Reserve Fund. The suspension of the regular school building aid program would continue, with exceptions for structural deficiency that presents substantial risk to the life or safety, or an imminent danger, to building occupants or others, which may be granted waivers by the Commissioner of Education with a recommendation from the State Fire Marshal. The new fund, the Targeted School Building Aid Reserve Fund, would be governed by a commission of eight members, including the Commissioner of Education or a designee, three gubernatorial appointees, two State Representatives, and two Senators. The commission would award funds based on applications from public district or charter schools, and decisions would be guided by rules prioritizing factors such as significant poverty reflected in property values and median incomes, consolidation or cost efficiency, life safety, and other factors. No more than 25 percent of the funds, which will be based on Education Trust Fund surplus for State Fiscal Year 2019, may be awarded in any one year.

The Trailer Bill would extend the Public School Infrastructure Fund, which was established in the SFYs 2018-2019 State Budget and has been used primarily to fund security upgrades at schools, indefinitely. Aid to charter schools for leasing building space also receives a dedicated budget line in the Governor’s proposal, totaling $500,000 per year statewide and set at no more than $30,000 per year for any single school. Additionally, the Governor’s proposal adds $4 million to special education aid, bringing levels of budgeted special education aid from $22.3 million in SFY 2019’s adjusted authorized budget to $26.3 million.

The proposed Trailer Bill would also create the Office of Early Childhood Education within the Department of Education that will report jointly to the Commissioner of Education and the Commissioner of the Department of Health and Human Services to coordinate efforts between the Department of Education and the DHHS related to improving early childhood education.

Elimination of the Education Trust Fund

One of the more significant budgetary accounting policy changes proposed by the Governor’s budget is the elimination of the Education Trust Fund as a separate entity. The Education Trust Fund houses the dollars that support the adequate education grants, which provide State funding for local public education established following the requirements set forth by the New Hampshire Supreme Court’s Claremont decisions in the 1990s. The Governor’s proposal would consolidate the revenue streams that currently support the Education Trust Fund into the General Fund, except for the Lottery Commission revenues, which would be restricted to funding education.

The basic mechanics of funding education would remain the same, but the General Fund and Education Trust Fund, the latter of which draws on the former in most years to balance revenues with expenditures, would no longer be separate accounting units.

This change would limit the certainty for taxpayers that specific revenue sources are only supporting education aid. For example, the Statewide Education Property Tax would technically support the General Fund, as would the Tobacco Settlement payments and the entire Tobacco Tax, as opposed to explicitly supporting education aid in whole or in part. It would simplify accounting for the division of revenues between the two funds, particularly relative to the State’s two primary business taxes and other revenue sources that are split between these two funds.

Public Higher Education

The University System of New Hampshire and the Community College System of New Hampshire receive General Fund support through the State Budget. They are independent entities that are not treated as state departments, which have detailed line item appropriations in the State Budget, but receive operational support in the form of block grants of General Fund appropriations. The Governor’s proposed Operating Budget Bill would incrementally increase the Community College System’s appropriation from $47.075 million in SFY 2019 to $49.055 million in SFY 2020 and $50.36 million in SFY 2021. The proposal would keep funding for the University System of New Hampshire at the same annual $81 million level it has been funded at since SFY 2016, which remains below the $100 million annual State Budget appropriations in the SFYs 2009 and 2011.

However, the Governor’s proposal would provide dollars for certain initiatives to the University System and Community College System in a one-time fashion and through tuition grants for particular students. One-time funding totaling $24 million for the University System of New Hampshire, which would be contingent on approval of plans submitted to the Governor and the Executive Council, would include:

- $9 million to the University of New Hampshire to add a nurse practitioner program with specializations in mental health and acute care, add occupational therapy doctorate and assistant programs, and increase the number of speech and language pathology program and nursing program graduates

- $9 million to Keene State College for advanced manufacturing programs, increasing nursing graduates, adding licensed drug and alcohol counselor programs, and building partnerships with community colleges for nursing-related education pathways

- $6 million to Plymouth State University for a new robotics and electromechanical technology lab, a new lab for cyber-security and big-data purposes, and modernizing health sciences learning spaces

Additional funding contingent on surplus dollars being available in SFY 2020 would include:

- $6 million to create an early childhood development center on the University of New Hampshire campus

- $3.25 million to the Community College System for information technology investments in infrastructure and online learning

- $4.5 million to the Community College System to implement an industry-wide education pathways program

Scholarships and Debt Relief

The Governor’s budget proposal would support individuals who are attending or have attended higher education institutions through two new programs. The Trailer Bill proposed by the Governor would establish the Governor’s Finish Line New Hampshire Scholarship Program under the Community College System of New Hampshire, which would provide tuition grants for students who have already completed 30 credits, are over 25 years of age, and are enrolled in a field identified as being in high demand by employers in New Hampshire. This is separate from the Governor’s Scholarship Program established in the SFYs 2018-2019 State Budget, which would be extended and moved to the Department of Education under the Governor’s SFYs 2020-2021 proposal.

The Governor’s proposal would establish a student debt relief program under the Business Finance Authority to help defer or forgive payment of existing debts from postsecondary education for individuals working in certain industries, to be determined by the State, for at least five years. It also creates a Workforce Development Fund, which would receive annual State appropriations, could accept gifts or other funds, and would receive any remaining funds from the New Hampshire Excellence in Higher Education Endowment Trust Fund.

Additionally, the Governor proposes a one-time appropriation of $500,000 to the Department of Education’s vocational rehabilitation program to support the program until additional federal funds become available in SFY 2021.

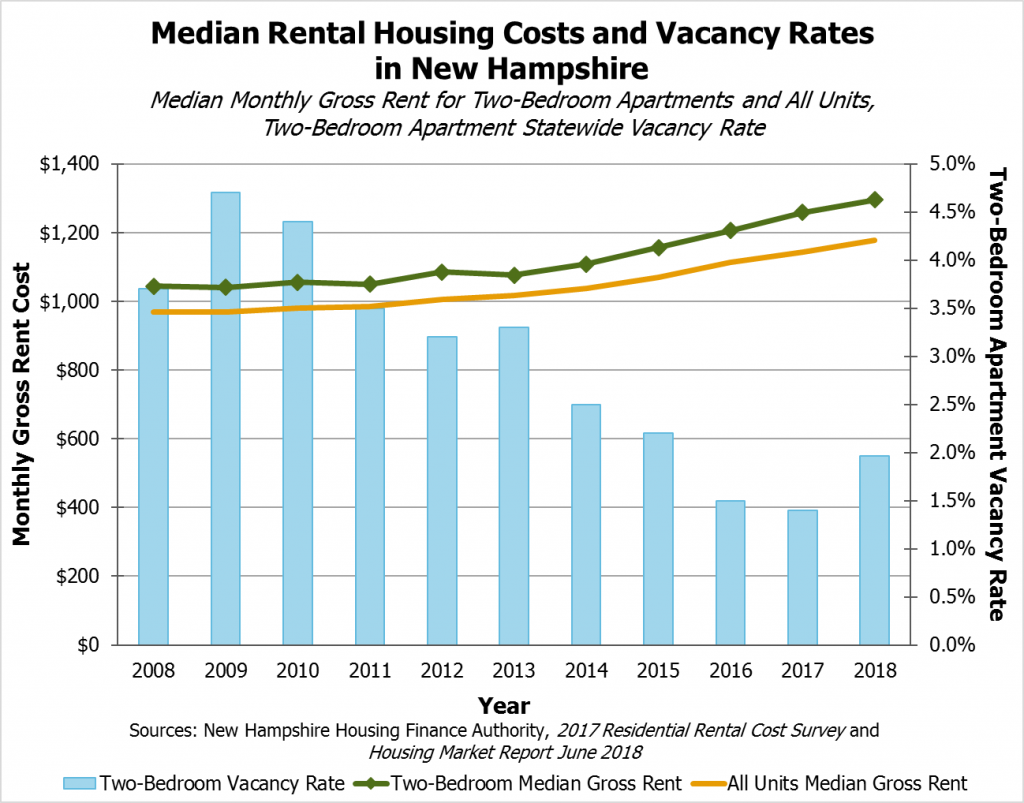

Housing, Transportation, and Other Physical Infrastructure

The Governor’s budget proposal makes important but relatively modest investments in improving the State’s physical infrastructure, particularly relative to addressing the state’s shortage of affordable housing. Rising rents and the relatively low levels of home construction both reflect and exacerbate a constrained housing supply in the state, which increases the cost of living in New Hampshire, particularly for people with low incomes.[12]

The Trailer Bill would make an appropriation to the State’s Affordable Housing Fund of $1.5 million from the SFY 2020 surplus and $3.5 million from the SFY 2021 surplus, if those surplus dollars are available. Beyond this investment proposal, the Governor’s budget does not address housing directly.

The Capital Infrastructure Revitalization Fund proposal includes a $4 million one-time investment in “red list” dam projects throughout the state. Should sufficient surplus revenue be available, the Fund would also pay for an additional $2.8 million to fund “red list” dam projects and provide $1.48 million to support municipal dam repair projects.

The Governor’s Trailer Bill would suspend a requirement in statute requiring a certain percentage of Highway Fund revenues go to the Department of Transportation. The proposed suspension would remove the restriction that at least 73 percent of Highway Fund appropriations are allocated to the Department of Transportation, with no more than 26 percent appropriated to the Department of Safety and 1 percent appropriated to all other agencies. With that requirement suspended, appropriations of motor fuels tax, registration fee, and other revenues could be appropriated to agencies differently, within the limits of the State Constitution.[13] The Capital Infrastructure Revitalization Fund also includes various smaller transportation projects, including clearing State structures for a highway bypass around Conway and, last on the priority list for the Fund and thus very contingent on surplus revenue generation, is up to $3 million in grants to municipalities for the development of new bicycle trails. The Trailer Bill would also permit the State to sell or transfer certain Department of Transportation-owned property in bulk, and would repeal the Maine-New Hampshire Interstate Bridge Authority, removing a New Hampshire statutory prohibition on tolling the three bridges connecting Kittery and Portsmouth.

Major New Initiatives

Components of the Trailer Bill proposed by the Governor establish entirely new programs or include substantial changes to existing law and State agency authority. While some proposals likely have relatively limited impact on the State population overall, several proposals alter key services, sources of revenue, or the organization of State government.

Paid Family and Medical Leave

Governor Sununu proposes creating the Twin State Voluntary Leave Plan, which is a paid family and medical leave plan that would provide employees missing work for eligible reasons 60 percent of their average weekly wage, capped at the federal Social Security program’s maximum taxable earnings, for up to six weeks per year. The plan calls for the State, in concert with Vermont, to contract with private firms to supply this leave coverage. The plan would be voluntary for non-state employees in New Hampshire and Vermont, but would include state employees in both states as the base population to attract private firms, with the requirement that the same coverage must be available for private and other public employers.

Eligible reasons for paid leave would include the birth of a child within the last year, the placement of a foster child with the individual, a serious health condition of a family member, a serious health condition of the individual unrelated to employment, or the foreign deployment with armed forces or certain care for service members by family members.

While restrictions on differences in rates are included in the proposal, many of the details would be left largely up to the private firms bidding on the State contract. The base period for average weekly wage determination, tenure requirements, and waiting or elimination periods would be determined through the request for proposal and request for information processes. The request for proposals would also determine the minimum participation requirement for non-State employers, parameters for open enrollment periods, procedures for payroll deduction and remittance, and procedures for plans with varying levels of employee contributions to employer coverage costs. Final contracts would have to be approved by the Governor and the Executive Council before taking effect.

Participating firms with 20 or more employees would be requested to restore employees who take leave to the position held prior to taking leave or an equivalent position, and would not be able to discriminate or retaliate against an employee for accessing these wage replacement benefits. Individuals would be permitted to contract with the company holding the State contract independently, outside of their employer, in certain circumstances through a State-administered pool.

In the proposal, if Vermont did not enact appropriately similar authorizing legislation, New Hampshire would move forward with the program as a single state. A smaller base of State employees and a smaller overall population that would be covered in that scenario may limit the attractiveness of the program to private firms.

Association Health Plans

Taking advantage of alternative health insurance arrangements newly permitted by the federal government, Governor Sununu proposed the legalization of association health plans in New Hampshire, which would permit related business entities to combine their employee plans and self-insure.

The proposal would require arrangements to have a board of trustees oversee the fiscal operations and be comprised of employers associated with each other through a similar trade, industry, profession, or geography. Groups or associations would need at least one substantial business purpose other than providing health coverage or other benefits to employees or members, could not be a health insurance issuer or be owned or controlled by one, and could not make its benefits available to the public. The proposal does not necessarily require that associations be nonprofit or be established by an existing association of employers or professionals that has been organized for some period of time and for other purposes prior to application.

Coverage would have to include the 10 essential health benefits under the Affordable Care Act, except pediatric dental and vision coverage may be offered through a stand-alone dental or vision plan. Groups or associations would not be able to condition employer membership based on any health factor or any individual. Variations in premium rates for small employers are permitted by age or tobacco use, but for no other reason, and must be fixed for 12-month periods.

Expanded Powers for the Department of Administrative Services

The Department of Administrative Services (DAS) would be appropriated new powers over other State agencies under Governor Sununu’s proposed policy changes, with oversight of certain powers from the Governor and Executive Council and the Legislature’s Joint Fiscal Committee.

The DAS would be required to complete a comprehensive study of the State’s personnel system by November 1, 2019, including all related laws, administrative rules, and collective bargaining agreements. The proposed laws state that, in an effort to effectuate consolidation or deconsolidation of human resources, payroll, and business processing functions within State government, the DAS would have the authority, with the approval of the Fiscal Committee and the Governor and Council, to make transfers of funds for operational purposes to the DAS from any other agency to effectuate consolidation or deconsolidation of human resources, payroll, and business processing functions within State government. The DAS may also, with approval from the Governor and Council, eliminate unnecessary positions or transfer any positions within or between and DAS or any other agency “if the commissioner of administrative services concludes that such transfers or eliminations are necessary to effectuate the efficient consolidation or deconsolidation of human resources, payroll, or business processing functions within state government.”

Additionally, the DAS may establish a total number of personnel required for human resources, payroll, and business processing functions within the Executive Branch of State government. Other State agencies would also be required to annually pay the DAS 50 cents per square foot of space they occupy in DAS-maintained and serviced buildings. The DAS would not have to comply with certain Legislative Budget Assistant audits or requirements related to responsibility for the State House, Legislative Office Building, the State House Annex, the State Library, and all New Hampshire Hospital Property during the biennium. The Governor’s proposal also provides the DAS with the authority to not comply with the requirements under a 2016 Executive Order related to the identification and implementation of energy efficiency projects and the monitoring of energy and water use, use of fossil fuels, and greenhouse gas emissions.

Department Reorganizations

The Governor’s proposal seeks administrative efficiencies by reorganizing State agencies and consolidating smaller agencies to be administratively attached to larger ones. The Governor’s proposed changes include:

- creating the Department of Military Affairs and Veterans Services, which would include the National Guard, the State Guard and militia, and certain veterans services, including the Veterans Council, the Division of Community-Based Military Programs, and management of the State Veterans Cemetery

- moving the State Commission for Human Rights under the administration of the Department of Justice

- consolidating oversight of visitors and welcome centers within the Bureau of Visitor Service in the Office of the Commissioner of the Department of Business and Economic Affairs

The Surplus and Proposed Additional Revenue

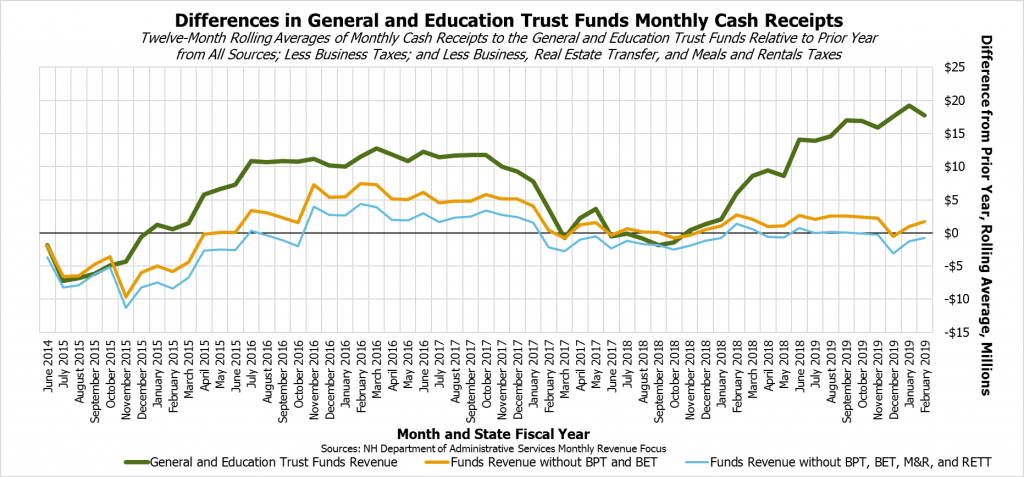

The Governor makes use of surplus dollars identified as one-time appropriations based on the unanticipated increases in revenue from the State’s two primary business taxes following the passage of the federal tax overhaul in December 2017. These federal policy modifications prompted changes in business behavior, such as the repatriation of profits and mergers and acquisitions, which increased revenues at the State level. As such, recent revenue growth has been driven primarily by the State’s Business Profits Tax and Business Enterprise Tax, increasing the uncertainty around the extent to which recent revenues are one-time revenues.[14] These one-time revenue dollars provide the State with the opportunity to invest in New Hampshire’s residents and build resiliency for the most vulnerable Granite Staters while the economy is performing well and resources are more plentiful than they would be with a less vibrant economy.

Surpluses and the Rainy Day Fund

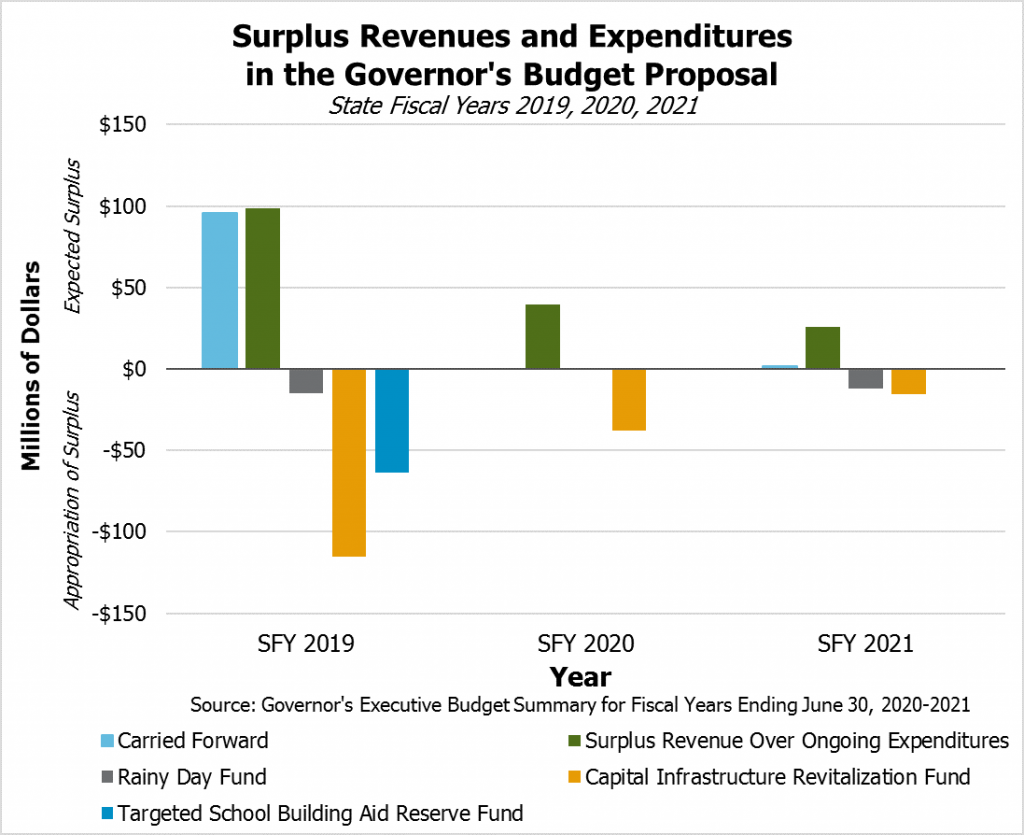

As of the end of February 2019, the General and Education Trust Fund revenue surplus was $138.2 million over the current State Budget’s revenue plan, which does not account for other pieces of legislation appropriating funding outside of the State Budget.[15] The Governor projects a General and Education Trust Fund surplus at the end of SFY 2019 of $98.4 million, with surplus carried forward from SFY 2018 of $95.8 million, leaving $194.2 million in aggregate surplus at the end of SFY 2019.

The Governor would immediately appropriate $15 million to the Rainy Day Fund, formally named the Revenue Stabilization Reserve Account, at the end of SFY 2019. He would also appropriate the $63.7 million that is specifically Education Trust Fund revenue surplus to the Targeted School Building Aid Reserve Fund, and the remaining $115.5 million of General Fund surplus would flow to the Capital Infrastructure Revitalization Fund. According to the Governor’s plan, revenues would then exceed expenditures in the regular budget by $39.5 million in SFY 2020, and the Governor would set aside and additional $37.6 million for the Capital Infrastructure Revitalization Fund. Revenue surpluses in SFY 2021 would be dedicated first to the Rainy Day Fund, with an appropriation of $12.3 million, and the remaining $15.3 million of the planned surplus would be deposited in the Capital Infrastructure Revitalization Fund.

The Rainy Day Fund would grow to $137.3 million by the end of the biennium, and the Capital Infrastructure Revitalization Fund would have $168.44 million in surplus dollars appropriated to it over the course of the biennium.

Expands Tobacco Tax Base to Include Electronic Cigarettes

Governor Sununu’s proposal includes an expansion of the Tobacco Tax base to include nicotine products intended for human consumption, and specifically includes electronic cigarettes. The expanded Tobacco Tax would not include tobacco cessation products being marketed and sold exclusively for such purposes. Electronic cigarettes would be defined as including the liquid or substance containing nicotine intended to be used in a device or the device itself or its components when sold with the nicotine substance. The Governor’s proposal would require electronic cigarette vendors to be licensed under the authority of the Liquor Commission. The Governor expects this revenue policy change to increase Tobacco Tax collections modestly.

Sports Betting

Again taking advantage of a new federal policy, this one created following a U.S. Supreme Court ruling, Governor Sununu seeks to legalize sports betting to raise revenue for education. His proposal establishes sports betting under the Lottery Commission. Such betting would be prohibited for those under 18 years of age, for employees of the Lottery Commission or immediate relatives, employees of agencies contracted with the Lottery Commission to conduct sports betting activities, and athletes or other individuals directly related to sports teams or governed by the same sport’s governing body. Bets would not be placed on college and high school sports events or amateur sports events where the participants are under 18 years old. Municipalities would be able to decide whether to allow sports betting within their borders, but Internet-based mobile sports betting would be permitted throughout New Hampshire, with certain limitations on the volumes of betting permitted on a daily, weekly, and monthly basis. The Governor estimates about $10 million in General Fund revenue would be generated by sports betting in SFY 2021. Currently, Internet-based lottery sales are being challenged by the federal government.[16]

The Governor’s proposal would eliminate the portion of Keno revenue designated for problem gambling research, prevention, intervention, and treatment that currently funds efforts at the DHHS. Instead, ten percent of revenues collected by the State from sports betting after administrative costs to the Lottery Commission would be set aside for treatment and prevention services for those individuals with challenges around gambling. The Governor also proposes establishing the Council for Responsible Gambling, which would be administratively attached to the Lottery Commission.

Other Policy Changes

The Governor proposed many other policy initiatives or alterations in his 140-page Trailer Bill proposal. Several key proposed changes include:

- eliminating the Civil Legal Services Fund and altering the language regarding the geographies that the funding supports for civil legal services to low-income individuals provided by New Hampshire Legal Assistance, while also reducing annual funding from $1.2 million to $650,000

- continuing the suspension of revenue sharing to cities and towns through the biennium and freezing the Meals and Rentals Tax distribution to municipalities at current levels

- continuing the suspension of State aid grants from the Department of Environmental Services for new infrastructure projects

- repealing catastrophic aid payments to hospitals

- setting that the premium attributable to each non-Medicare eligible State retiree or spouse shall be 20 percent, holding that percentage until the DAS Commissioner determines it necessary to seek a revision from the Fiscal Committee, rather than permitting a range, with other retirees born in 1949 or later having premiums set at 10 percent

- establishing a Lead Paint Remediation Fund to supplement, but not supplant, federal funds for properties housing individuals with incomes below the median for the area, and transferring $2.5 million in funds from the Renewable Energy Fund to the new fund while repealing the authorization for loans to support lead hazard remediation projects enacted in 2018

- appropriating up to $10 million to the FRM Victims’ Contribution Recovery Fund and requiring that recipients who are victims of the Financial Resources Management fraud relinquish any related claims they have against the State, and amending statute to remove the cap on the compensation of the administrator hired to manage the fund

- appropriating up to $1 million to a new Community Development Fund for New Hampshire

- establishing the Chief Nursing Officer and chief pharmacist positions in the Department of Corrections and permitting the Department to fill unfunded positions during the biennium if total expenditures do not surpass amount budgeted for personnel

Concluding Discussions

Governor Sununu’s State Budget proposal makes key investments, some of which are long overdue, but leaves other fiscal policy concerns unaddressed or temporarily alleviated with one-time funding. The investments in the State’s mental health infrastructure should help to reduce the number of mental health patients in hospital emergency rooms and law enforcement facilities. Efforts to invest in higher education will likely help ease key workforce constraints. Continuing commitments to those with developmental disabilities and permanent policy changes to support employment and reduce benefit reductions for workers with low incomes are particularly beneficial for some of the most vulnerable Granite Staters. Establishing paid family and medical leave coverage would help provide certainty around income for those with medical needs or who must provide family care that keeps them from working, although the proposed program itself may be limited by the potential reliance on both decisions in Vermont and the willingness of private insurers facing a somewhat uncertain pool. The Governor’s inclination to plan for surplus and one-time dollars to be used for health and social assistance efforts does not guarantee ongoing services, but does provide opportunities for additional funding of key supports for New Hampshire’s residents.

However, the Governor’s budget proposal does not take advantage of the favorable revenue environment to work to correct underlying, structural fiscal issues. Although funds are sent to local school districts in the form of State-directed construction aid, and to local governments more generally through State-defined specific projects, these funds may offset upward pressure on local property taxes only temporarily. Education funding remains a primary concern for many people in the state, particularly in property-poor communities, but the Governor’s budget does not propose changes to the adequacy formula or in the ongoing reductions in stabilization aid to property-poor communities. General revenue sharing with municipal governments remains curtailed, and county governments, which depend on property tax revenue, will be expected to pay more for nursing home services and other long-term supports and services. Reimbursement rates for many medical services are not changed substantially in the Governor’s budget proposal, despite the workforce constraints health care providers face, and the housing shortage remains a persistent issue that the Governor’s proposal only addresses in a limited fashion.

While no two-year budget can solve every longstanding concern regarding funding for services to Granite Staters, the State Budget constitutes the best opportunity to make comprehensive progress every two years. The Governor’s proposed appropriations and policy changes take important steps toward addressing some of those longstanding concerns and making key investments in vulnerable populations. The Legislature now has the opportunity to do more to solve some of the underlying challenges in supplying and funding services for New Hampshire’s residents.

Next Steps

The Governor’s proposed budget serves as the basis for the Legislature’s deliberations going forward, with the House Finance Committee preparing a version of the State Budget for the full House, which will amend and vote on their version of the State Budget. After the House finishes with the State Budget on April 11, the Senate will have an opportunity to amend and pass its own version of the State Budget by early June. The two chambers will have to reach agreement on a single, final version of the State Budget before sending it to Governor Sununu’s desk. The current State Budget expires after June 30, 2019, and a new plan to fund State services must be in place before July 1.

With the economy performing well overall and revenues less constrained than in prior budget cycles, policymakers have an opportunity to help sustain a vibrant economy and invest in Granite Staters with the State’s two-year spending plan. The State Budget is a statement of New Hampshire’s priorities, and with resources available now to make long-term investments that will pay dividends in the future, legislators and the Governor should wisely deploy public resources to help ensure widespread prosperity for all New Hampshire residents.

Endnotes

[1] For more information on how the State Budget is organized and for discussions on the correct metrics for comparisons of the sizes of State Budgets, see NHFPI’s Issue Brief Measuring the Size of New Hampshire’s State Budget, published September 11, 2017.

[2] Source materials related to the Governor’s State Budget proposal are available on the Office of Legislative Budget Assistant’s web page for the SFYs 2020-2021 budget process. For an explanation of the New Hampshire State Budget process, see NHFPI’s Building the Budget resource.

[3] The adjusted authorized figures for SFY 2019 used throughout are those presented in the Governor’s Operating Budget Bill proposal as published on February 14, 2019.

[4] For more on comparisons between State Budgets and measuring baselines, see NHFPI’s February 28, 2017 Issue Brief, Governor Sununu’s Proposed Budget, specifically the section titled “A Technical Note on Comparing Budgets.” For more information on comparisons between State Budget proposals, see NHFPI’s Issue Brief Measuring the Size of New Hampshire’s State Budget, published September 11, 2017.

[5] To learn more about the Efficiency Budget process and State agency requests, see NHFPI’s November 18, 2016 Common Cents post New Process Will Guide Formation of Next State Budget.

[6] See the full list of proposed projects and the supporting materials from the Governor’s budget proposal on the Office of Legislative Budget Assistant’s web page for the SFYs 2020-2021 budget process.

[7] For more on the Medicaid program in New Hampshire, see NHFPI’s Issue Brief Medicaid Expansion in New Hampshire and the State Senate’s Proposed Changes from March 30, 2018 and its references. According to the DHHS February caseload report, as of February 28, 2019, there were 179,492 individuals enrolled in Medicaid in New Hampshire.

[8] For more on Medicaid reimbursement rates, see NHFPI’s March 15, 2019 Issue Brief Medicaid Home- and Community-Based Care Service Delivery Limited by Workforce Challenges.

[9] For more information, see the DHHS August 8, 2018 press release NH DHHS Receives $10 Million Grant to Improve the Health and Wellness of Young People with Severe Mental Illness and Severe Emotional Disturbance.

[10] The complete New Hampshire 10-Year Mental Health Plan is available on the DHHS website.

[11] See Chapter 258, Laws of 2011.

[12] For more information on the housing situation in New Hampshire, see NHFPI’s February 22, 2019 presentation New Hampshire’s State Budget and Families in the Post-Recession Economy as well as NHFPI’s June 4, 2018 Issue Brief New Hampshire’s Economy: Strengths and Constraints. See also the New Hampshire Housing Finance Authority’s Housing Market Reports and other resources.

[13] Part 2, Article 6-a of the New Hampshire State Constitution reads: “All revenue in excess of the necessary cost of collection and administration accruing to the state from registration fees, operators’ licenses, gasoline road tolls or any other special charges or taxes with respect to the operation of motor vehicles or the sale or consumption of motor vehicle fuels shall be appropriated and used exclusively for the construction, reconstruction and maintenance of public highways within this state, including the supervision of traffic thereon and payment of the interest and principal of obligations incurred for said purposes; and no part of such revenues shall, by transfer of funds or otherwise, be diverted to any other purpose whatsoever.”

[14] For more on recent trends in New Hampshire tax revenues, see NHFPI’s January 15, 2019 presentation to the House Ways and Means Committee, New Hampshire Funding Sources and Recent Trends.

[15] For examples from the 2018 Legislative Session, see NHFPI’s Common Cents post from May 24, 2018, Legislature Spends Most of Surplus, Raising Questions for Next Year.

[16] See the press release and attached documents from Governor Sununu’s office from February 15, 2019, State of New Hampshire Challenges U.S. Department of Justice Wire Act Opinion.