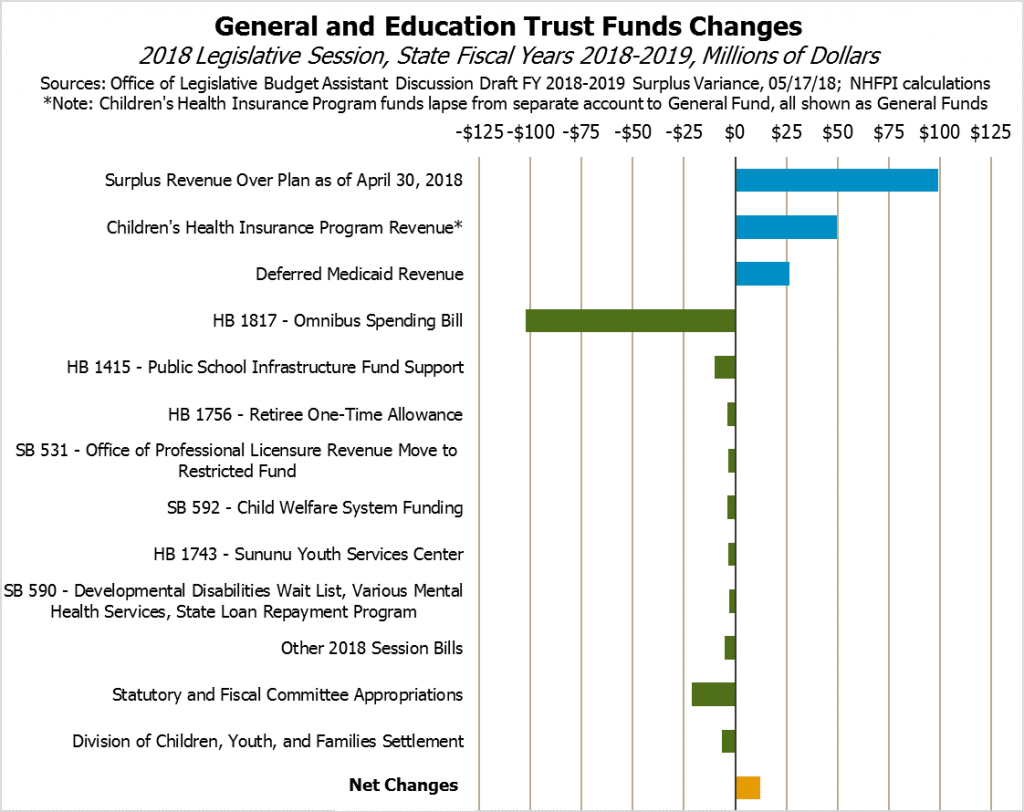

On May 23, the Legislature passed several bills with fiscal impacts, including the omnibus spending bill that behaved like a miniature budget this legislative session. The total expenditures passed amount to approximately $129.1 million in new General and Education Trust Funds spending, with additional expenditures outside of these two funds and certain changes to revenues. This total is quite substantial for a non-budget year and reflects the Legislature’s willingness to use the large revenue surplus, collected primarily from the previous three months, without leaving a significant cushion for the second fiscal year of the State Budget. With abnormally high revenues not expected to be sustained, the Legislature is leaving fewer available resources for State Budget negotiations and any unanticipated costs next year.

During the Committee of Conference for the omnibus spending bill, House Bill 1817, several changes were made from the State Senate’s proposed version. The total changes increased the General and Education Trust Funds impact of the total bill from $93.9 million to $102.3 million, largely because of an additional $10.4 million added to municipal bridge aid. Other changes relative to the Senate’s version:

- Reduce the New Hampshire Housing Finance Authority appropriations for assisting those leaving mental health or substance use disorder treatment facilities with transitional housing from $5 million to up to $2.5 million, with a contingency based on the submission of a plan.

- Remove the tax credit against the Business Profits Tax, Business Enterprise Tax, and Insurance Premium Tax for recovery-friendly workplace programs and replacing it with a $1 million appropriation to the New Hampshire Community Development Finance Authority for the purpose of supporting recovery-friendly workplace programs offered by nonprofits, including public awareness.

- Remove the tax rate reduction of the Real Estate Transfer Tax for first-time homebuyers.

- Reduce the appropriations to the State Loan Repayment Program from $1 million to $300,000.

- Remove the $750,000 appropriation to restart the congregate housing program and the $100,000 appropriation for the foster grandparent program.

- Remove the $100,000 appropriation to support businesses within non-profit incubators from the Department of Business and Economic Affairs.

- Remove provisions that may have appropriated more funding for full-day kindergarten, replacing them with language that clarifies that full-day kindergarten districts that charge parents for a portion of the cost would still be able to collect the new full-day kindergarten subsidy in State fiscal year 2019, expected to lead to approximately $800,000 in additional State costs based on known districts in these situations.

- Add language pertaining to the agreement with hospitals regarding uncompensated care payments, which adds contingencies for potential changes in federal law or funding and changes a limit for payments to certain hospitals.

This bill, in combination with other bills, would leave the General and Education Trust Funds surplus for State fiscal years 2018 and 2019 at approximately $12.3 million, assuming revenues come in at the State revenue plan after April 2018.

The Legislature is taking a risk by making these appropriations during the middle of a State Budget, rather than at the end of the biennium. With a spending plan in place for another year and uncertain revenues going forward, using surplus tax revenues, which are likely a direct result of the federal tax overhaul and may be fleeting, and other one-time funds on a mixture of one-time and ongoing expenditures exposes the State to a greater probability that the second half of the State Budget sees a revenue shortfall or has insufficient flexibility to address unanticipated costs.

For more information on the 2018 legislative session’s spending bills and the current revenue surplus, see NHFPI’s Common Cents post Legislature Considers Mini-Budget, Many Other Spending Bills as Session Ends. For more on the regular State Budget process, see NHFPI’s Building the Budget resource.