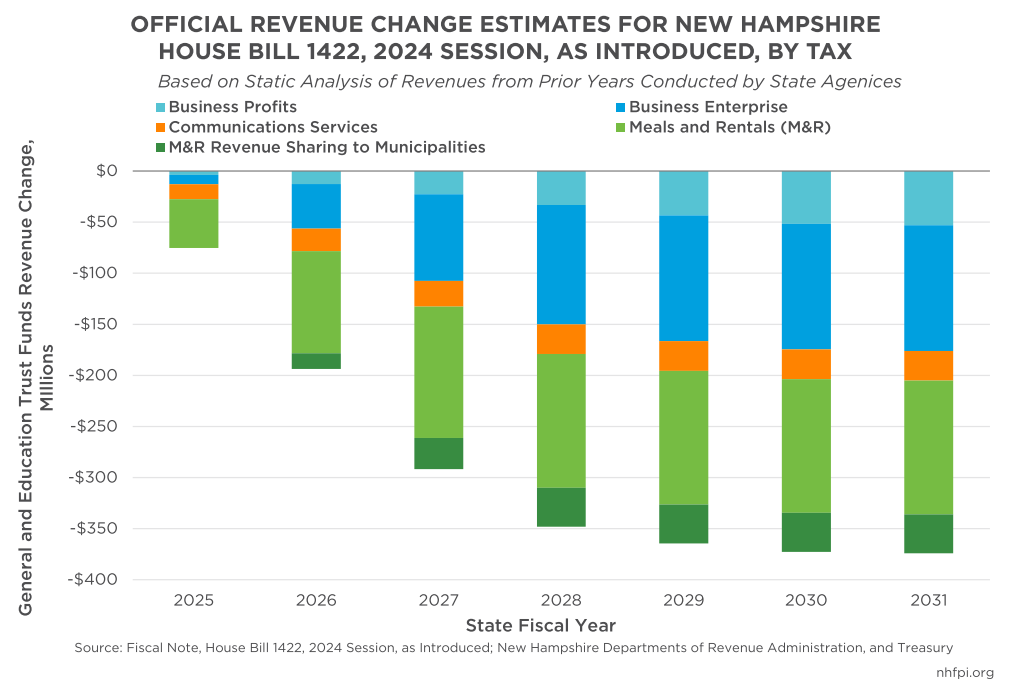

The New Hampshire House of Representatives is considering several pieces of legislation that would substantially reduce revenue available for public services. This array of legislation includes a bill that would reduce the Meals and Rentals Tax rate for restaurant meals, and another that would exempt businesses from taxation under the Business Profits Tax, reducing State revenue by an estimated $230 million annually. One piece of legislation, House Bill 1422, would reduce revenues more substantially by lowering the tax rates of three key state tax revenue sources and eliminating a fourth tax. Official estimates, using static analysis, approximate the reduction in revenues associated with this bill at $2 billion over six years. When fully phased in, the tax changes in HB 1422 would reduce State General and Education Trust Funds revenue by $374.1 million per year, which is equal to about 12 percent of all unrestricted revenue collected by those two funds combined last fiscal year.

While the benefits to most Granite Staters from the tax reductions would likely be limited, the reductions in revenue would require substantial adjustments to services relative to the tax rates under current law. As these bills only address tax law and are being considered outside of a State Budget process, they do not identify reductions in services corresponding to the official estimates of lost revenues.

Reductions to the Meals and Rentals Tax

The Meals and Rentals Tax, sometimes referred to as the rooms and meals tax, is an 8.5 percent tax on restaurant and other prepared food and beverage purchases such as “to go” meals, hotel room rentals, and automobile rentals in the state. The meals portion of the tax base accounts for about 80 percent of taxes paid statewide.

In State Fiscal Year (SFY) 2023, the Meals and Rentals Tax was the State’s second-largest tax revenue source. Revenues grew steadily before the COVID-19 pandemic, and have grown robustly during the recovery from the pandemic as consumers have returned to tourism and dining away from home, and as food prices, including restaurant meals, have increased. The Meals and Rentals Tax generated a total of $448.5 million for the General Fund, the Education Trust Fund, State aid distributed to municipalities on a per capita basis, and school building aid debt service. Receipts from the Meals and Rentals Tax comprised 15.2 percent of General Fund revenues in SFY 2023.

Revenues from this tax are considered a metric for tourism activity. While many restaurant meals are likely sold to New Hampshire residents visiting a local establishment, some meals may be sold to tourists, while hotel rooms and rental cars are likely disproportionately used, and the tax paid, by tourists and other visitors. Historically, 3.15 percent of the revenues from the Meals and Rentals Tax have been dedicated to fund the State’s Division of Travel and Tourism, although the law requiring that transfer has been suspended repeatedly.

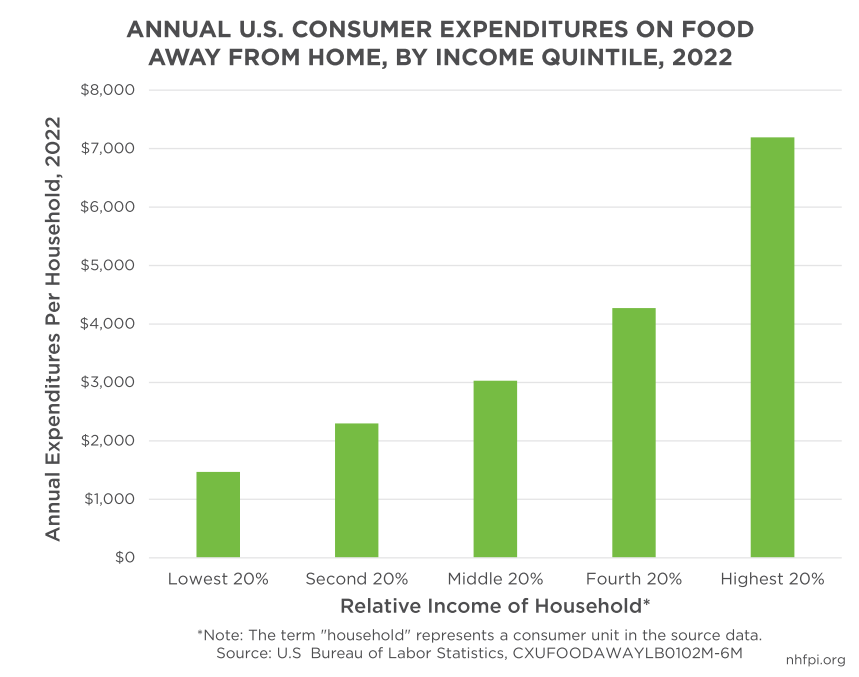

Consumer expenditures on food away from home, which is separate from groceries to be prepared and used at home, have grown substantially since the pandemic. National data indicate spending has grown by 27.6 percent between 2020 and 2021, and another 20.1 percent in 2022. Spending on food away from home in higher income households grew substantially faster than in the lowest income households in 2022. The amount of this type of spending was nearly five times higher for the top 20 percent of households than for the bottom 20 percent by income, and 2.4 times the middle 20 percent of income-earners. In short, people with higher incomes tend to spend more money going out to eat.

In New Hampshire, estimated expenditures on food and accommodation services per capita in 2022 were $3,757, including taxes. If all those food and accommodation services were in the Meals and Rentals Tax base, then about $294.33 per New Hampshire resident were paid in Meals and Rentals Tax, using the effective 8.5 percent tax rate, during 2022.

The pending piece of legislation with the largest fiscal impact, HB 1422, proposes reducing the Meals and Rentals Tax rate from 8.5 percent to 6 percent. Another bill proposes lowering the Meals and Rentals Tax to 7.5 percent for meals, but not for the hotels or rental cars portions. If the tax rate had been 6 percent in 2022, rather than 8.5 percent, annual per capita savings would have been $86.57, if all those savings flowed to New Hampshire consumers. A tax rate of 7.5 percent would have saved consumers $34.63 annually. Much of these savings would likely flow to residents of other states who are visiting New Hampshire, particularly revenue generated by hotel room and rental car transactions. National data suggest the tax reductions on restaurant meals would disproportionately benefit higher-income households.

Official estimates for the proposal to lower the Meals and Rentals Tax to 6.0 percent between SFYs 2025 and 2028 suggest that cumulative State revenue lost within that time period would be $406.7 million; the bill would also require that additional revenue be diverted from other State purposes to municipal aid to keep the State’s distribution of funds to municipalities relatively consistent over time.

Proposed Business Tax Rate Reductions

HB 1422 would also substantially reduce business tax revenues, which are comprised of two different taxes that were separately the State’s largest and fourth-largest tax revenue sources in SFY 2023. The Business Profits Tax (BPT) would be reduced from 7.5 percent to 7.0 percent incrementally between 2025 and 2029, and the Business Enterprise Tax (BET) rate would be reduced by more than half, from 0.55 percent currently to 0.25 percent when the phased reductions would be completed by 2027.

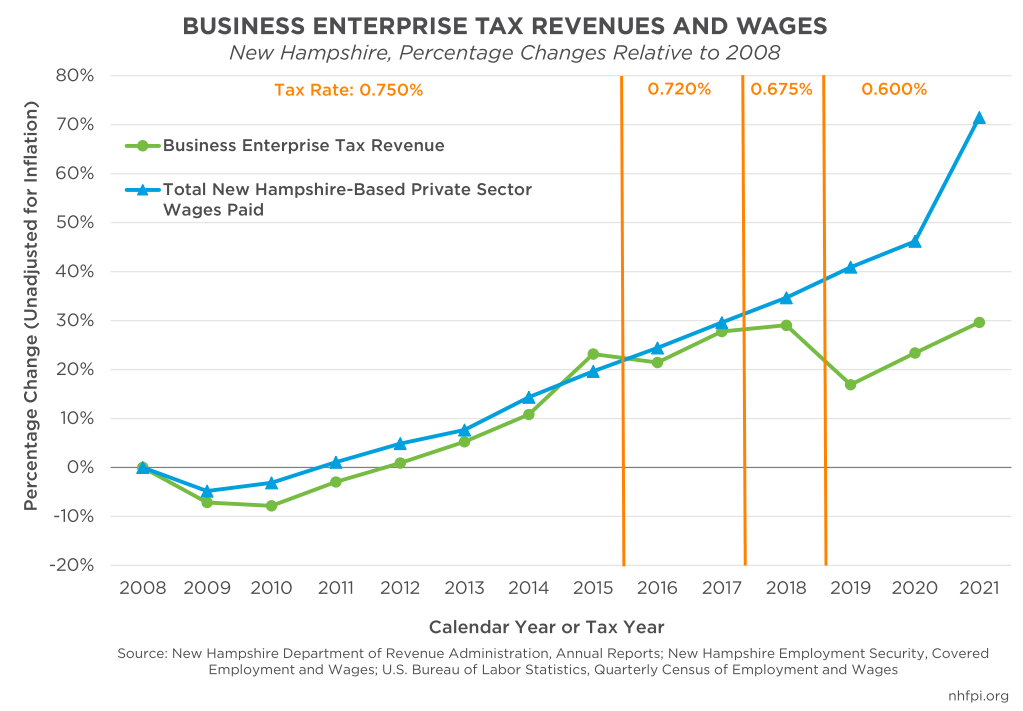

BET rate reductions have been accompanied by reductions in revenue, indicating reducing BET rates has not generated sufficient economic activity to spur overall revenue growth in recent years. The BET is based largely on compensation paid to employees by businesses, as well as interest and dividends paid by businesses. The BET rate was lowered in Tax Years 2016, 2018, and 2019. Revenues fell in 2016 and 2019 relative to the prior years, and grew only 1.0 percent in 2018, which was a slower increase than the overall 3.9 percent growth in wages paid by New Hampshire employers in that year. BET revenues in 2020 were less than they were in 2017 and 2018 without adjusting for inflation, and draft 2021 figures suggest revenues were about the same as they were in 2018.

While BET revenues have decreased with rate reductions, BPT revenues have grown since 2015, although not consistently. BPT revenues declined between Tax Years 2015 and 2016, which followed a rate reduction from 8.5 percent to 8.2 percent. Between 2016 and 2021, BPT revenues grew approximately 110 percent, and have likely grown more since then as combined business tax revenues have risen. Meanwhile, the BPT rate was reduced in 2018 and 2019, and has been reduced twice since Tax Year 2021.

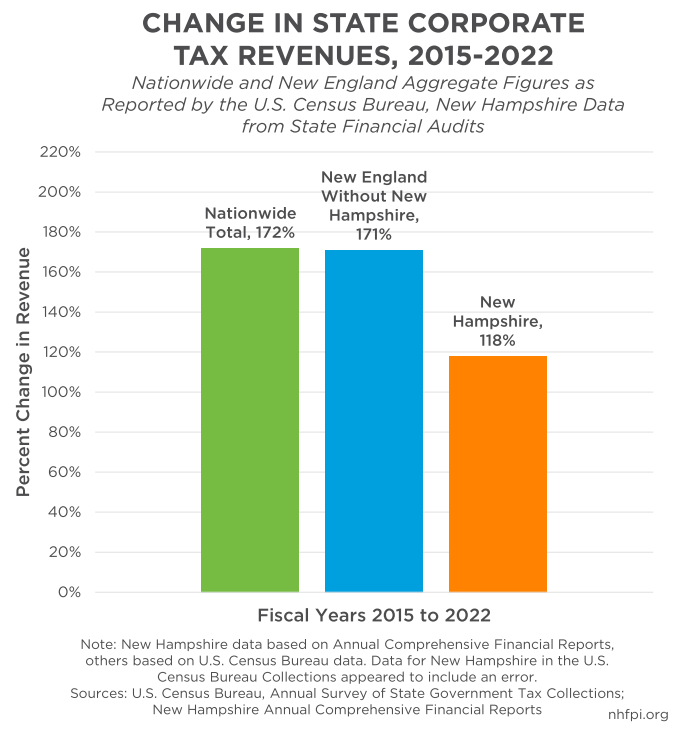

The rate reductions, however, have not spurred sufficient economic growth in New Hampshire to explain the increase in revenues. Rate reductions would have needed to increase economic activity in a measurable manner to lead to such substantial tax revenue growth. However, between 1970 and 2022, no clear correlation exists between BPT rates and employment, or between those rates and economic growth in New Hampshire relative to the rest of New England. National and multi-state research also finds few or limited impacts of state corporate tax rate reductions on overall economic growth.

Total corporate tax revenue growth in New Hampshire during this time period also lagged behind corporate tax revenue growth in other states. Between fiscal years 2015 and 2022, state corporate tax revenue collections grew 172 percent nationally, while corporate tax revenues increased 171 percent in the New England states, not including New Hampshire, during this period. New Hampshire’s business tax revenues grew by 118 percent during this period, which was dramatic, but substantially slower. This suggests that rising national corporate profits during this period, rather than New Hampshire policy decisions, spurred this tax revenue growth. The increase in New Hampshire’s BPT revenues was also likely slowed, relative to growth in other states, by the recent rate reductions.

Elimination of the Communications Services Tax

The pending HB 1422 legislation would also eliminate the Communications Services Tax. The Communication Services Tax is a 7 percent tax on two-way electromagnetic communications, primarily taxing telephone, paging, and specialized radio services, exempting services for health, safety, and welfare, as well as one-way broadcast services. Revenue from this tax declined following the Legislature’s decision to stop collecting taxes on internet services in 2012; Communication Services Tax revenue peaked at $81.0 million in SFY 2010, but was only $28.1 million in SFY 2023.

While phasing out and eliminating this tax as proposed in HB 1422 would cost the State an estimated $90.8 million between SFYs 2025 and 2028, benefits to consumers in the state may be fairly limited. The Cellular Telecommunications and Internet Association reported that the monthly average private-sector revenue collected by surveyed industry membership per wireless telephone line, wireless broadband modem, tablet, or other connected device in 2022 was $34.56 per month. Published estimates of landline telephone costs vary widely. A New Hampshire Public Utilities Commission publication from 2020 identified companies offering landline services in each community; one of the two most geographically widespread companies offered an internet-based home phone plan for $19.99 per month.

Assuming the 7 percent Communications Services Tax was applied to the entire $34.56 monthly charge for one wireless telephone line in 2022, the tax would have cost the consumer $29.03 per year, suggesting that eliminating the Communications Services Tax may not generate a profound difference in the finances of Granite Staters. If the Communication Services Tax was repealed, a previously-taxed multi-line account with a $120 per month charge to consumers would include $100.80 less in taxes annually.

Reductions in Revenue

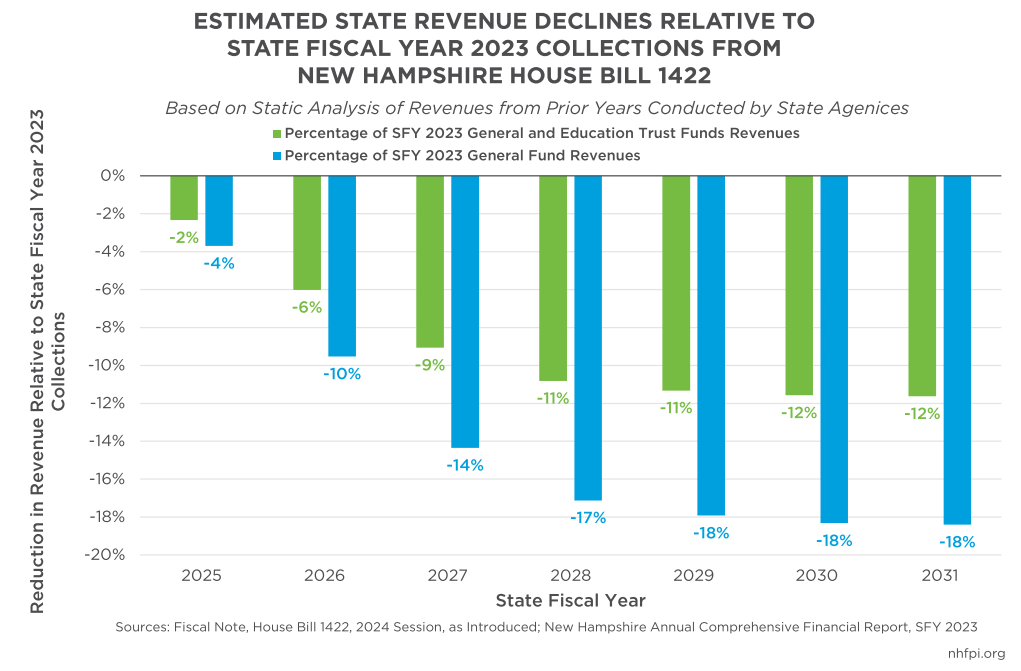

The impacts of substantially reducing the BPT, BET, and Meals and Rental Tax rates and eliminating the Communications Services Tax, as proposed by HB 1422, are very significant. As the bill only considers revenue policy and does not prescribe reductions in services to maintain an expenditure balance with the State Revenue Plan, impacts on services are not definitively known; the service impacts would likely depend on the health and permanence of the State’s unrestricted revenue surplus, or the extent to which the State is underspending its budget. The changes proposed in HB 1422 would reduce revenues by $75.2 million in SFY 2025, during this State Budget biennium, according to official estimates. The anticipated reduction during the next budget biennium, relative to baseline revenues and using a static estimate, would be $485.5 million in SFYs 2026-2027. Foregone revenue for State services funded through the General and Education Trust Funds would total $374.1 million in SFY 2031 alone, according to the static estimates. The aggregate amount of foregone General and Education Trust Funds revenue would be $2.02 billion from SFYs 2025 to 2031.

Static estimates are inherently limited, as they do not adjust for inflation, changes in the economy, or shifts in the tax base spurred by other factors. Dynamic estimates can show more of the impacts of tax changes on the economy, such as the stimulative impacts of providing targeted tax breaks and infusions of resources, including the Child Tax Credit, Earned Income Tax Credit, and targeted property tax relief, into the budgets of households with low and moderate incomes. However, static estimates can provide important context for the magnitude of potential revenue reductions, particularly given the limited evidence that corporate tax rate reductions lead to economic growth sufficiently substantial to produce more state revenue.

As a percentage of combined General and Education Trust Funds revenue collected during SFY 2023, the tax rate reductions proposed in HB 1422 would drop tax revenue collections by about 12 percent, based on official estimates, once fully phased in. The General Fund must fill any shortfall in the Education Trust Fund to help it meet its obligations under current law, and business tax revenues were recently rebalanced to target the desired amount of revenue in the Education Trust Fund. If revenue reductions for HB 1422 were to fall entirely on the General Fund, revenues to that fund would be 18 percent lower, based on these static estimates.

While the actual reductions are not known, the eventual $374.1 million per year reduction in General Fund revenue, based on the static analysis, can be compared to State agency budgets to help provide insight into the significant impacts these revenue changes would have on funding for services. State agencies rely on both General Funds and other funds, including federal dollars matched with General Funds, to support State-funded services. The $374.1 million in lost General Fund revenue is the equivalent of, accounting for mid-budget adjustments through January 2023, the SFY 2023 General Funds budgeted for the Department of Safety, the Community College System, the Department of Corrections, and the entire Judicial and Legislative branches of government combined.

Alternatively, the $374.1 million reduction would be about 39 percent of the Department of Health and Human Services General Fund allocation in SFY 2023. Removing nearly $374 million in General Funds from that Department in that year would have required eliminating, in lieu of reductions in other areas, these funds for child protection, child development, juvenile justice services, children’s behavioral health, family health and nutrition, family-centered services, prevention and wellness services, mental health services, New Hampshire Hospital, the Glencliff Home, State funding for nursing facility and Choices for Independence Medicaid services, family assistance through administration of cash and food assistance, grants for social services programming, housing and unhoused services, drug and alcohol services, infectious disease control and laboratory services, emergency preparedness and response, and quality assurance, improvement, integrity, and legal and regulatory services.

The small dollar figures associated with reductions in the Meals and Rentals Tax and the Communications Services Tax, combined with the limited evidence that reductions in business tax rates spur more revenue growth or substantially more economic growth, indicate the primary effect of this legislation would be to reduce resources available for public services. Key research suggests economic growth can be most effectively stimulated through providing targeted resources and assistance to individuals and families with low and moderate incomes.

– Phil Sletten, Research Director