The Low and Moderate Income Homeowners Property Tax Relief program provides rebates to eligible taxpayers who submit applications by the end of the month. Property taxes typically account for a greater percentage of income for people with low and moderate incomes in New Hampshire than those with higher incomes.

Eligibility and Recent Expansion

Established by legislation in 2001 as a credit against the newly-established Statewide Education Property Tax, the State’s Low and Moderate Income Homeowners Property Tax Relief program provides tax rebates for residents with incomes under certain thresholds. The program’s income eligibility thresholds had not been adjusted for inflation for twenty years until two years ago, when a law was passed and signed to raise the income thresholds from the original levels and boost benefits.

This change substantially expanded eligibility and boosted potential relief for lower-income homeowners. The income cap was raised to $37,000 for an individual and $47,000 for a married couple or head of household. In 2021, about 1 in 4 New Hampshire households, or roughly 151,000, had incomes below $50,000 per year.

The program provides a rebate calculated based on income and the home’s value up to a certain dollar amount based on local assessments and other adjustments. As part of the program’s 2021 expansion, the net assessed value cap on the portion of a home’s value eligible for a rebate was increased to $220,000, meaning more of an owner’s home can be used in calculating the size of the credit. This change was significant given the rapid increase in home prices, as the prior qualifying threshold of $100,000 has become a smaller fraction of the median home’s total value and, potentially, the associated property taxes derived from assessed values. The income eligibility limits and value-based credit cap are not adjusted automatically for inflation and may require future changes to keep pace with home prices.

Important But Limited Tax Relief

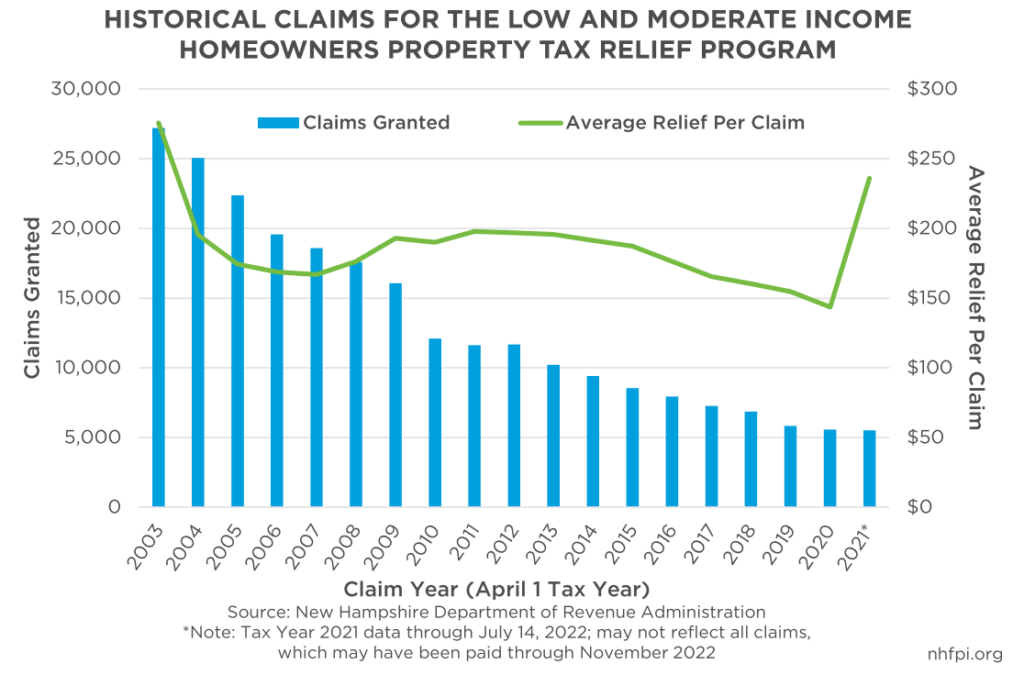

The eligibility expansion was the first in two decades, a time period during which participation in the program declined significantly. While there were 27,208 claims granted in Tax Year 2003, claims had fallen to 5,572 by Tax Year 2021, based on preliminary 2021 data. This substantial drop in claims over time likely reflects the lack of adjustment in the eligibility requirements, as inflation made a smaller portion of New Hampshire’s population eligible for participation.

The long-term trend of reduced enrollment may also be related to a lack of taxpayer awareness about their eligibility. Without enhanced awareness, the recent program expansion means that under-enrollment relative to eligibility may be even higher going forward. The State has access to flexible federal funds through the American Rescue Plan Act that can be used to fund public benefit navigators, who could raise awareness of, and access to, this property tax relief. Navigation support could help Granite Staters in underserved populations, those who have limited English proficiency, or both. If such navigators also helped individuals and families access federal benefits, the state economy could see a boost in overall activity.

Another reason for under-enrollment may be the relatively limited value of the benefit compared to household property taxes paid by homeowners. State law and the Department of Revenue Administration tax form suggest a married couple with a total adjusted gross income of $30,000 in 2022 and a home assessed at $285,000 would receive a rebate of $162.36, assuming no impact on home values from the equalization ratio. This rebate is calculated by reducing the net assessed home value to the cap of $220,000, dividing that capped assessed home value by 1,000 ($220), multiplying $220 by the Statewide Education Property Tax rate ($1.23 per $1,000 statewide average in 2022, yielding a total of $270.60), and then multiplying the resulting $270.60 by a decimal that corresponds to the tax rebate bracket based on household income (0.60 for a married couple earning at least $29,400 and less than $35,300), which has higher rebates for lower-income households.

This rebate is relatively small compared to the average property tax charged to Granite Staters, which totaled about $7,470 for every household in 2021. The most recently available data suggests, however, that the average claim size increased substantially in Tax Year 2021 to $236, up from $143 in Tax Year 2020. This upward trend likely reflects the early effects of expanded homeowner eligibility and home value thresholds, which was signed into law July 2021, and applied to property taxes assessed on or after April 1, 2021. While still much smaller than property taxes in New Hampshire overall, the increased rebate amount reflects the expansion’s success in getting more valuable rebates to households with lower incomes.

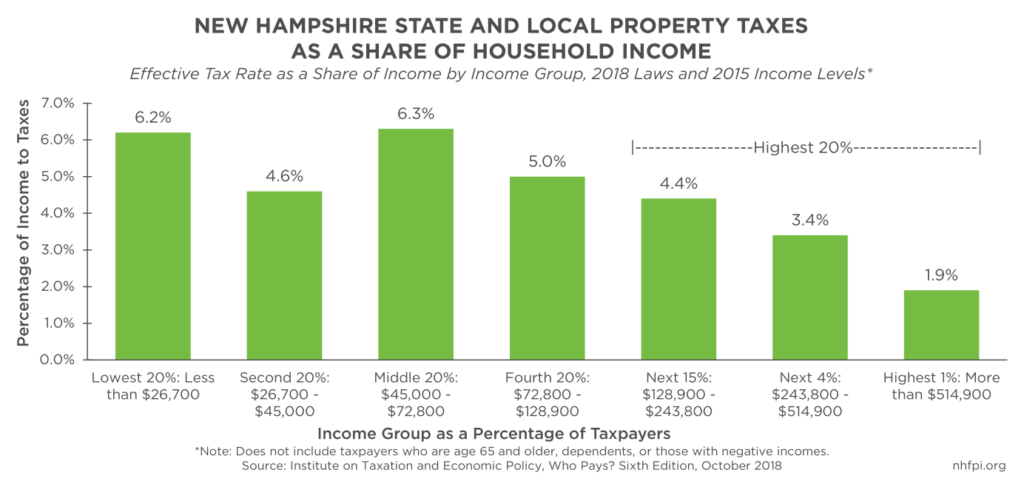

Despite those relatively small rebate values, the expanded program helps to address the disproportionate percentage of property taxes paid in relationship to household income by low- and moderate-income homeowners. A 2018 analysis by the Institute on Taxation and Economic Policy estimated that state and local property taxes in New Hampshire amounted to the equivalent of 6.3 percent of income for middle-income earners under age 65, and 6.2 percent for those in the lowest 20 percent of income-earners. The households with incomes in the highest one percent paid an estimated 1.9 percent of their incomes in property taxes.

Accessing Property Tax Relief

Eligible taxpayers have until June 30, 2023 to file a claim for this property tax relief. The Department of Revenue Administration permits claims to be filed online through the Granite Tax Connect portal, and also provides forms that can be printed and mailed. New Hampshire residents can learn more about the program, including reading the answers to frequently asked questions, on the Department’s website.

Economic modeling suggests that policies directing assistance to residents with lower incomes are among the most effective forms of economic stimulus. Connecting eligible Granite Staters to aid programs can help to build a more vibrant and inclusive economy in New Hampshire.

– Nicole Heller, Senior Policy Analyst