State revenues continue to come in strong, with unaudited numbers from last year and new numbers from July both showing revenue growth. Preliminary accrual figures for State fiscal year 2018, which ended June 30, 2018, showed General and Education Trust Fund revenues were over the prior year’s figures by $168.3 million (7.0 percent). July revenues were pushed above the State Budget’s planned amount by $8.7 million (8.0 percent), including a larger surplus amount attributable to solely business tax receipts. However, several other major revenue sources were down between last year and the year before, and July’s revenues continued to show weakness in a few key areas and raise ongoing questions regarding elevated business tax receipts.

July Revenues

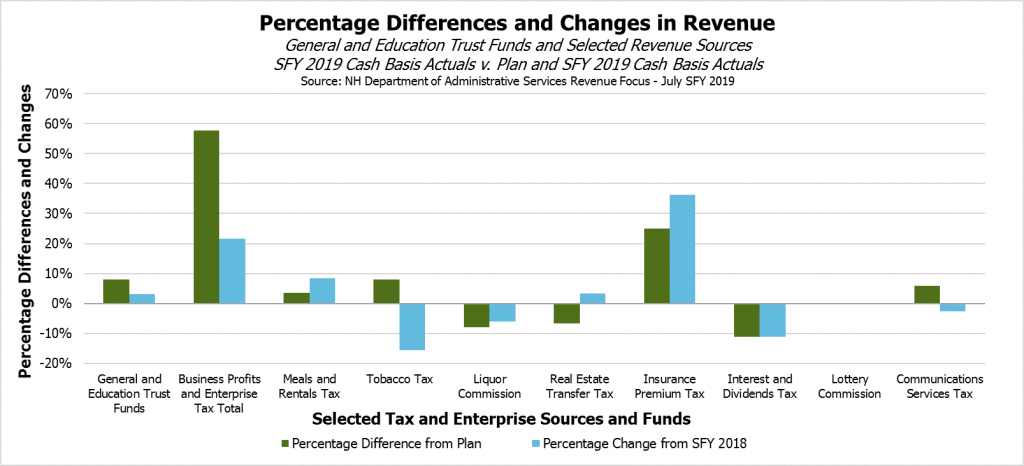

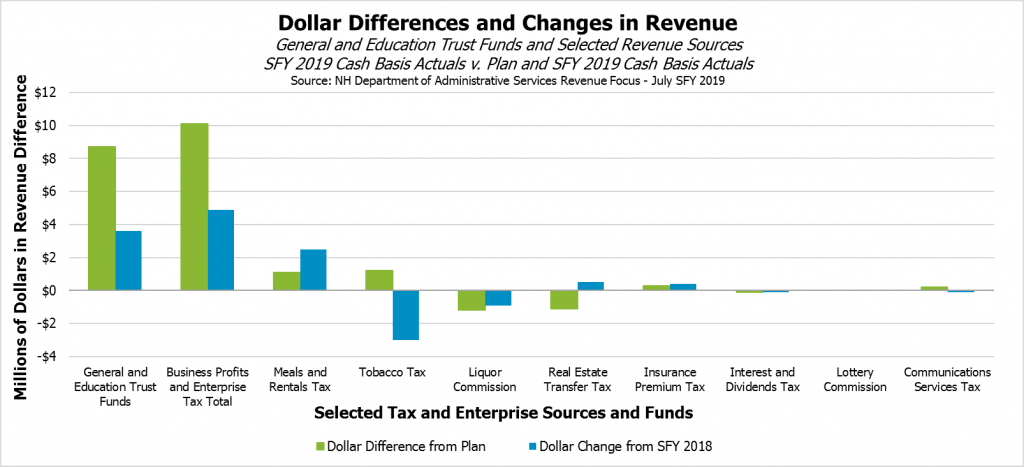

Revenues for the first month of the newly-begun State fiscal year (SFY) 2019 suggest business taxes continued to perform over expectations, but certain other revenue sources continue to underperform, and there remains significant uncertainty around whether business taxes will continue to overperform.

The combined receipts from the Business Profits Tax and the Business Enterprise Tax totaled $27.6 million, which was $10.1 million (57.7 percent) more than anticipated in the State revenue plan for July and higher than last July’s collections by $4.9 million (21.6 percent). July is not an important month for business taxes, but certain indicators suggest ongoing irregularities in business tax payments following the abnormally high receipts collected earlier in the year. Estimated payments, which are the quarterly payments businesses owe based on their estimated liability during the year, were in line with July SFY 2018’s payments, but revenue from extensions was up 473 percent over the prior year. Extensions occur when businesses do not have a completed tax return but are required to pay the entire amount they expect to owe. High extension payments were a major driver of high April receipts as well; extensions were up 85.5 percent in April, while revenue from completed returns was down 14.3 percent, suggesting that businesses may be facing additional complexity this year due to the new federal tax law and may be paying up front but later determining actual amounts owed in detail when the returns are completed, which increases the risk for the State of refund requests. July continued this trend, not only with extension revenue up 473 percent from the prior year, but revenue from returns was also down 77 percent from July SFY 2018. Returns were the lowest dollar figure, unadjusted for inflation, for the month of July since SFY 2011. The New Hampshire Department of Revenue Administration noted these “anomalies” in extension payments alongside high tax notice payments and lower returns. July revenues indicate the business tax environment is likely far from settled.

Other major revenue sources presented a mixed picture. The Meals and Rentals Tax brought in more revenue than July of last year and was $1.1 million (3.5 percent) above plan for the month. The Tobacco Tax was similarly above plan for the month, but was $3.0 million (15.6 percent) below last July. The Real Estate Transfer Tax continues to perform better than the prior year but worse than planned in the State Budget; revenue was below plan by $1.1 million (6.6 percent) in July, which is based on June transactions. The Department of Revenue Administration again reported that the number of transactions was down in June (which is the basis for July State revenues) while transaction values were up, likely stemming from a housing market that continues to be constrained by low inventories. Insurance Premium Tax revenue was a significant percentage over plan and the prior year, but as July is a relatively slow month for receipts from this tax, this surplus only added $0.3 million to the total surplus figure.

After flagging relative to both the prior year and the State revenue plan during SFY 2018, transferred revenue from the Liquor Commission continued to be lower in July. Revenues were $1.2 million (7.9 percent) below plan and $0.9 million (6.0 percent) below the prior year. The other major enterprise revenue source for the General and Education Trust Funds, the Lottery Commission, did not report revenue for July, which was in line with the State revenue plan.

Preliminary Accrual for Last Year’s Revenues

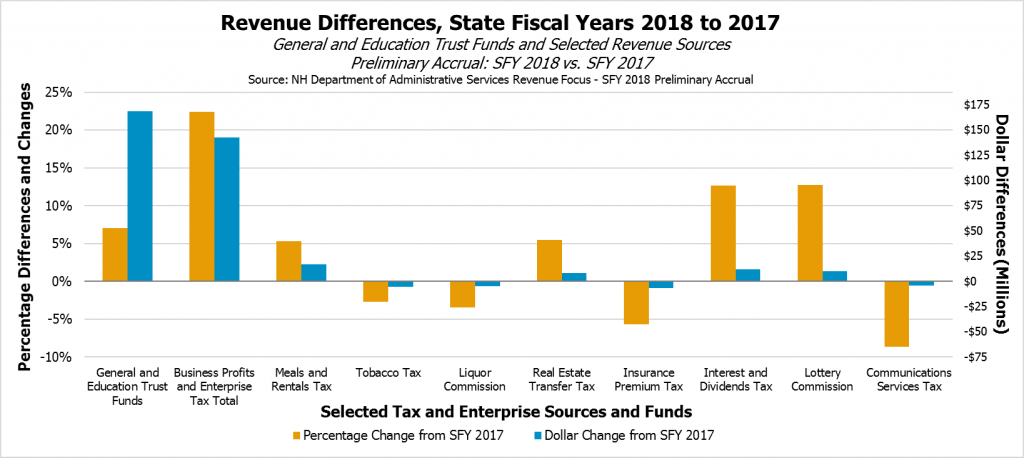

The Department of Administrative Services published year-end revenue figures in the preliminary accrual publication for SFY 2018; these figures are unaudited, but they provide an early view of revenues from the prior fiscal year that includes more information than the monthly cash basis reports.

Relative to SFY 2017, SFY 2018 saw notable growth in receipts from the state’s two primary business taxes and a mixed picture from most other revenue sources. The Business Profits and Business Enterprise Taxes combined brought in $142.3 million (22.4 percent) more in SFY 2018 than in the prior year; as the Business Profits Tax is the State’s single largest tax revenue source and the Business Enterprise Tax ranks fourth, changes in these two taxes disproportionately affect the State’s available revenue. The General and Education Trust Funds increased by $168.3 million (7.0 percent) from SFY 2017, and the two primary business taxes accounted for the equivalent of 84.6 percent of that increase. The lack of support for the surplus from other revenue sources makes the uncertainty around the sustainability of elevated business tax receipts important for forecasting the adequacy of State revenue to fund needed services.

The four other large revenue sources that contributed the most to growth in the General and Education Trust Funds were the Meals and Rentals Tax, the Lottery Commission, the Interest and Dividends Tax, and the Real Estate Transfer Tax. The Meals and Rentals Tax continues to grow at a steady clip, adding $16.8 million (5.3 percent) to SFY 2017’s total, but it did not contribute significantly to the budget surplus because growth was in line with projections in the State revenue plan. The Lottery Commission profits transferred to the Education Trust Fund, including from racing and charitable gaming activities, grew $9.7 million (12.7 percent) over the prior year. Interest and Dividends Tax revenue was also higher by $11.9 million (12.7 percent), possibly due to a growing economy and rises in stock values. Real Estate Transfer Tax revenue also rose over SFY 2017 by $7.8 million (5.5 percent), but that was slower growth than projected in the State revenue plan, so the higher receipts did not contribute to the budgetary surplus.

Four major revenue sources declined relative to the prior year. Insurance Premium Tax revenue to the General Fund was down $6.9 million (5.7 percent), the largest dollar decrease of the key revenue sources for these two funds. The Tobacco Tax continued to erode as a revenue source, as cigarette sales in New Hampshire are in long-term decline; revenue was $5.9 million (2.7 percent) lower than in SFY 2017. Revenue transferred from the Liquor Commission to the General Fund was down $4.9 million (3.4 percent) in SFY 2018 relative to the prior year. The Communications Services Tax continues its decline following the Legislature’s decision to stop collecting tax on internet services in 2012, dropping $4.1 million (8.7 percent) from the amount collected in SFY 2017. Communication Services Tax revenue peaked at $81.0 million in SFY 2010, and was estimated at $43.2 million for SFY 2018.

Looking Ahead

Both the July SFY 2019 cash revenues and the preliminary accrual report for SFY 2018 show that the two primary business taxes continue to drive growth in state revenues. The abnormally high business tax receipts are likely due to continued adjustments associated with the new federal tax law, and these increases may be temporary. Higher net revenue levels may dissipate quickly after refunds are requested following completed returns, if businesses find they have overpaid in filed extensions, and assessments of the new tax statutory and regulatory environment by large corporations. Large multi-state and multi-national corporations, for whom New Hampshire taxes are a relatively small liability but upon which New Hampshire’s State revenue system relies, may have filed extensions prior to determining the details of New Hampshire tax law relative to federal tax law. If this is the case, overpaid amounts may be requested through refunds or be applied to taxes in subsequent years, reducing cash revenue to the State. Conversely, some of the federal changes may have increased New Hampshire revenue associated with repatriated income from overseas and remain a part of the New Hampshire tax base, reducing the risk of large refunds. However, these revenues would also be associated with a transitory period following the federal tax overhaul and not necessarily a permanent source of revenue growth, and also may be dependent on the outcomes of potential litigation.

While the economy is growing, the surge in business tax revenues is likely due to short-term changes, which may not be permanent, and not likely due to fundamental or major economic changes in either the New Hampshire or national economies due to business tax changes at the State or federal levels. Lawmakers should be very cautious when incorporating information from recent months into revenue expectations to fund critical services in the future.

For more information on State revenue sources and trends, see NHFPI’s Revenue in Review resource. For more information on revenue uncertainties going forward, see NHFPI’s Issue Brief Business Tax Rate Reductions Add to Uncertain Revenue Picture.