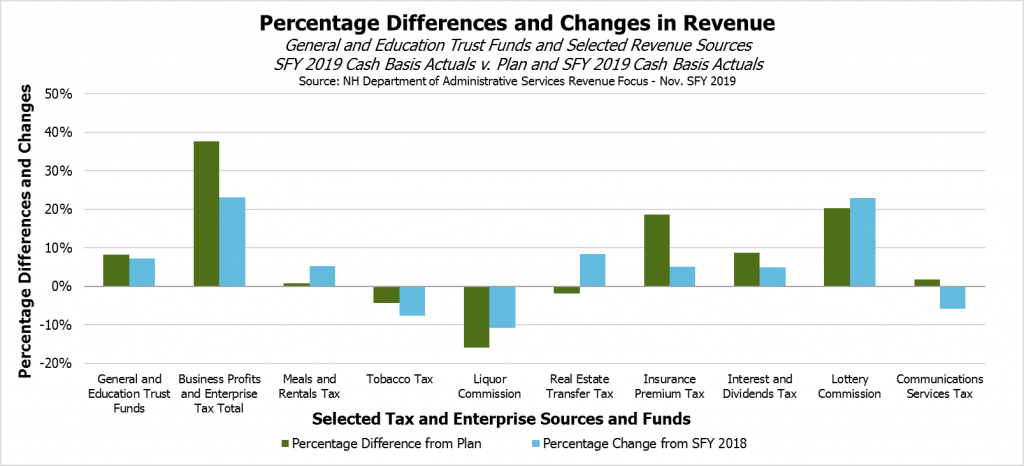

The fortunes of State revenues continue to rise and fall with New Hampshire’s two primary business taxes, which provided positive signs for near-term revenue but have not shown these levels are sustainable. While the two business taxes remained healthy, other revenue sources were relatively flat overall, leaving the State with a revenue surplus entirely dependent on the two business taxes. The lack of growth in other revenue sources combined with the uncertainty around business taxes creates an environment in which it will be very difficult to accurately project revenues for the new State Budget biennium.

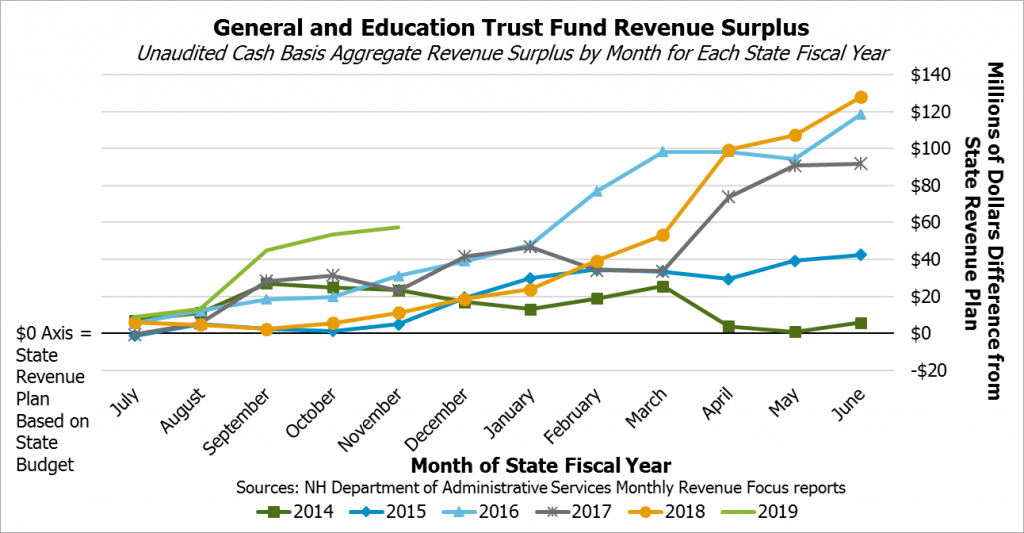

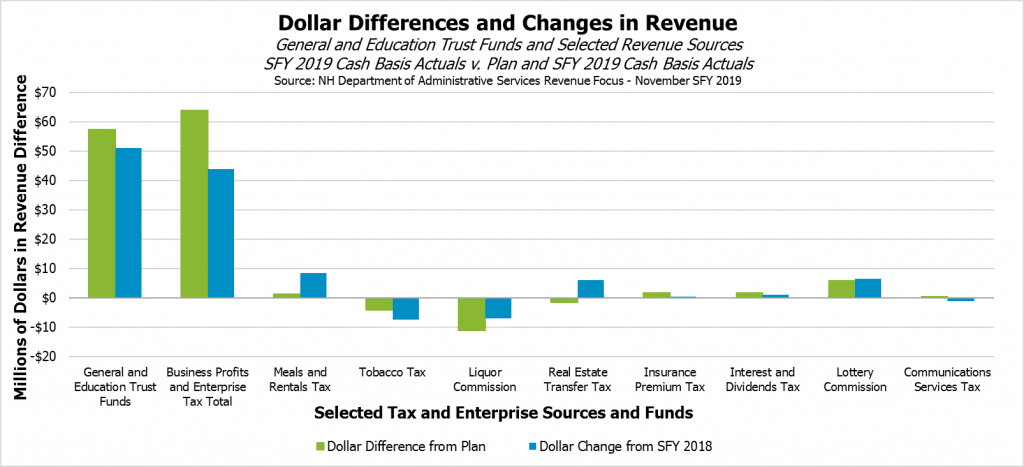

The State reported revenues as of November 30 for the General and Education Trust Funds were $57.3 million (8.2 percent) above the State Revenue Plan, creating a relatively high undesignated surplus. These higher revenues were also $51.0 million (or 7.2 percent) above last year’s revenues as of this time in the State Fiscal Year (SFY), which began July 1.

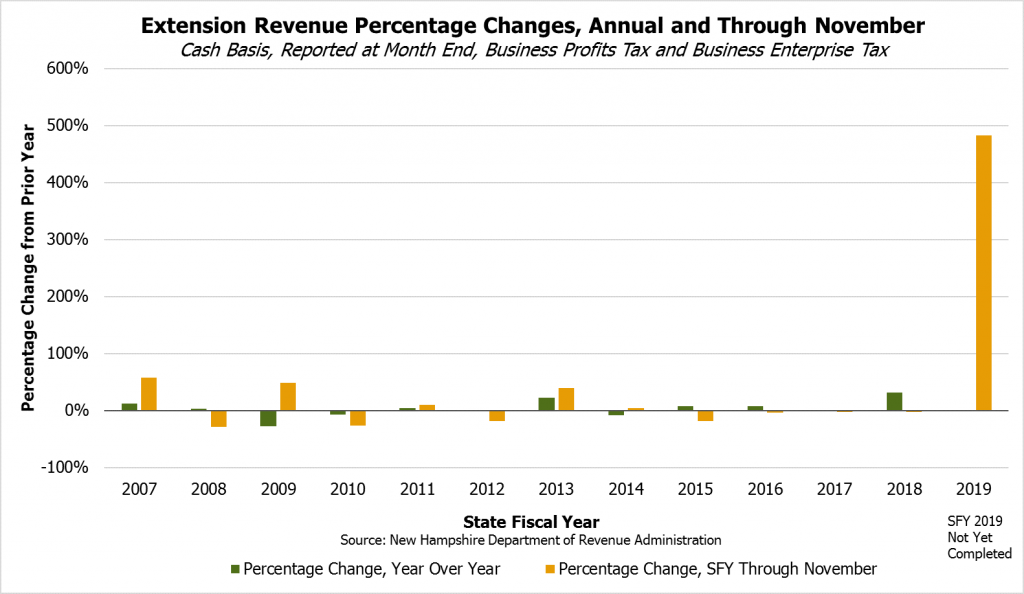

Revenues from the Business Profits Tax, the State’s single largest tax revenue source, and the Business Enterprise Tax remained strong throughout October and November. While October and November were not critical revenue months for these two business taxes generally, they were key months for potential business tax refunds; while refunds were higher than last year in both months, neither were higher than SFY 2017, suggesting relatively typical behavior. However, business taxes continued to exhibit certain abnormal behavior. Extension revenues in lieu of full tax return filings remained very high, up 482 percent from the same point in SFY 2018 (and up 4,000 percent in October alone), suggesting more businesses are delaying full state tax filings. With the federal government still issuing proposed regulations following the December 2017 tax overhaul, and more clarity reportedly needed for at least some of the proposed regulations, the corporate tax environment remains unsettled, which likely will continue to affect New Hampshire revenues for some time. Exactly how State revenues might be affected in the medium- and long-terms remains an open question.

While the two primary business taxes continue to generate the equivalent of all the State’s current undesignated revenue surplus, other revenue sources have been relatively flat. The Meals and Rentals Tax was $8.4 million (5.3 percent) above last year’s revenues as of the end of November, but was only contributing $1.2 million (0.7 percent higher than plan) to the revenue surplus. The Tobacco Tax was under both last year’s and planned amounts, reducing the surplus by about $4.1 million (4.4 percent under plan). The Real Estate Transfer Tax has been performing better than last year relative to plan but continues to fall short, bringing in $1.5 million (1.9 percent) less than planned through November 30. The Interest and Dividends Tax and the Insurance Premium Tax boosted the surplus by $1.7 million and $1.6 million each, respectively, and the Utility Property Tax was $2.5 million (24.5 percent) above plan due to early receipt of payments expected next month.

Major non-tax revenue sources presented a mixed picture. The Liquor Commission was $11.1 million (16.0 percent) below plan for the year thus far, but the State Revenue Plan accounted for a $5.0 million transfer to the Alcohol Abuse Prevention and Treatment Fund to support Medicaid expansion in the State in January; however, the transfer actually occurred in November, meaning a portion of these lower General Fund revenues may be offset by January’s figures when they arrive. Revenues from the Lottery Commission were higher than plan by $5.9 million (84.3 percent), driven by large prizes offered in October and November and potentially associated increases in sales of other tickets and in Keno gaming.

As legislators look ahead to crafting the next State Budget, projecting revenues accurately will be key to ensuring sufficient funding for needed services during the subsequent two years. With recent large, likely one-time business tax fluctuations and an unsettled overall revenue picture, each month of revenues leading up to final budget negotiations in June gives policymakers additional insights regarding the abilities of existing revenue sources to pay for critical public services.

For more information on State revenue sources and trends, see NHFPI’s Revenue in Review resource. For more information on revenue uncertainties going forward, see NHFPI’s Issue Brief Business Tax Rate Reductions Add to Uncertain Revenue Picture.