On April 25, the House Finance Committee voted to make several changes to the Medicaid expansion reauthorization bill, which would authorize a new version of the program, currently providing health coverage to approximately 52,000 low-income Granite Staters, for five years. These changes include reversing several of the changes to the work requirements made previously by another House committee and clarifying several components of the funding structure while adding a potential revenue source. None of the changes alter the fundamental structure of the State Senate’s proposal, which shifts the Medicaid-served population currently participating in the individual marketplace to the purview of the managed care organizations (MCOs), private firms that contract with the states to administer Medicaid health coverage operations.

The bill, which previously passed the Senate, came to the House Finance Committee after the full House adopted the amendment from the House Health, Human Services, and Elderly Affairs Committee. For more information on New Hampshire’s current expanded Medicaid program and the State Senate’s version, see NHFPI’s Issue Brief: Medicaid Expansion in New Hampshire and the State Senate’s Proposed Changes. See NHFPI’s Common Cents post on the House Health, Human Services, and Elderly Affairs Committee amendment.

Work Requirements

The House Finance Committee removed the language proposed by the House Health, Human Services, and Elderly Affairs Committee aimed at providing expanded Medicaid enrollees with a longer timeframe to comply with the required hours of qualifying activities. The House Health, Human Services, and Elderly Affairs Committee amended the bill to provide more flexibility for seasonal workers, requiring 600 hours over six months, rather than the 100 hours per month proposed by the Senate. The House Finance Committee restored the timeframe to a one-month window. National research on work requirements suggests narrower windows for compliance may result in more instances of discontinuous coverage, as work hours vary from month-to-month for many low-income workers, increasing the risk that these individuals would not have access to care.

Self-employment was also removed as an explicit, acceptable activity for fulfilling the work requirement hours. Those who are medically frail would have to be certified as such, with proof provided annually, to be exempt from work requirements. Exemptions for those parents and caretakers with children were limited to children under age six, changed from under 13 years old in the Senate version, and the exemption was defined as only applying to one parent in a two-parent household. Good cause exemptions for those with children aged six to twelve years related to difficulty accessing child care were required to be included in State rules, with monthly verifications by the State required for continuing qualification. Additionally, all rules related to expanded Medicaid work requirements and their exemptions to be drafted by the State Department of Health and Human Services would need to be reviewed by the Joint Legislative Fiscal Committee for recommendations before they could proceed through the normal rule approval process in the Joint Legislative Committee on Administrative Rules.

The MCOs would be required, under the House Finance Committee proposal, to monitor and encourage work and community engagement activities. The proposal retains the language from the State Senate version that would conform to the terms and conditions set forth by a waiver, pending approval, from the federal government permitting work requirements. However, the proposal would explicitly require the waiver request to include the structure identified in statute and for any deviations in the final, granted waiver to be reported by the State Department of Health and Human Services.

Funding Structure

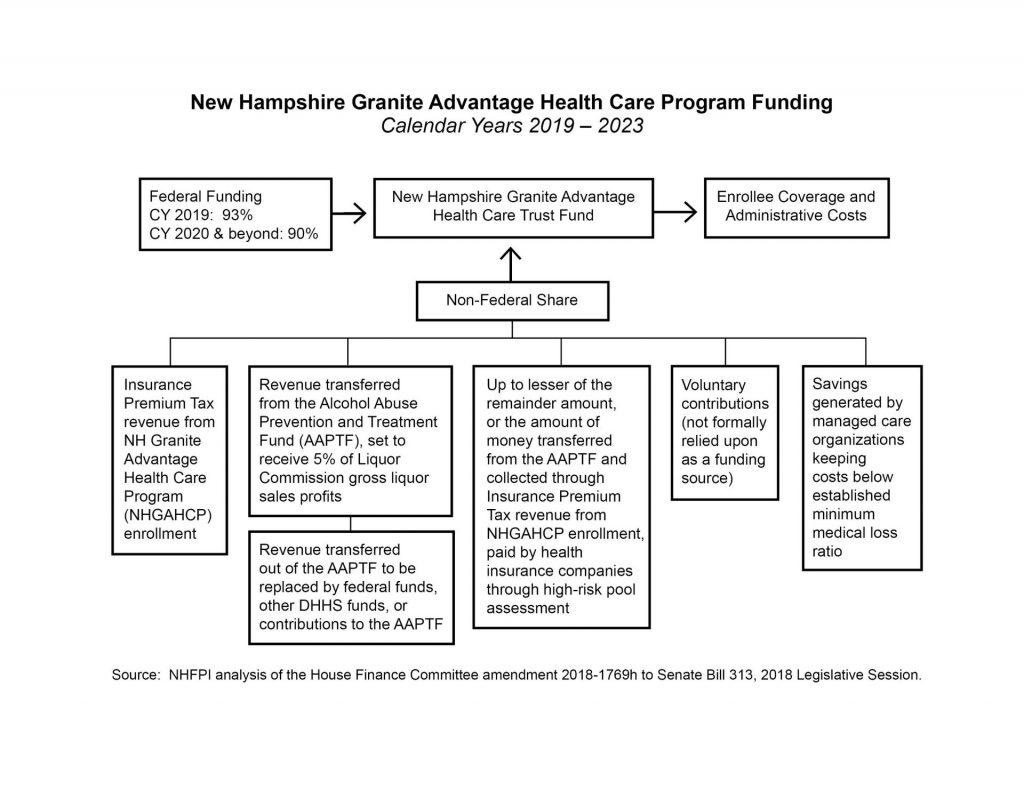

Many of the revisions to the bill regarding the funding structure are clarifying language, but several changes are substantive.

Alongside a more explicit enumeration of permissible funding sources, the House Finance Committee identified a new funding source for the New Hampshire Granite Advantage Health Care Trust Fund. This source results from the bill calling for the creation of a minimum medical loss ratio for MCOs, which would be required to be actuarially sound and encourage cost-efficiency. If the MCOs manage costs below the medical loss ratio, then surplus funds would be used to support the Trust Fund and pay for the nonfederal share of the Medicaid expansion program costs.

Under the House Finance Committee proposal, no General Funds may be deposited into the Trust Fund. This may prevent undesignated revenue surplus dollars from General Fund revenue sources from being deposited into the Trust Fund to fill funding gaps, as may be done with other programs when a revenue surplus is available. Reimbursements to the federal government for expanded Medicaid overpayments would also be drawn from the Trust Fund.

The proposal also adds language to ensure that funding transferred from the Alcohol Abuse Prevention and Treatment Fund to the New Hampshire Granite Advantage Health Care Trust Fund only come from revenues initially sourced from the Liquor Commission and not other revenue sources. Donations to the Alcohol Abuse Prevention and Treatment Fund, including potential contributions from hospitals, and other revenue sources would not be transferred to support Medicaid expansion under this language.

Commission Members and Powers

The House Finance Committee proposal retains the establishment of the Commission to Evaluate the Effectiveness and Future of the New Hampshire Granite Advantage Health Care Program. However, this proposal would narrow the scope of voting membership and provide the Commission with more influence over the continuation of the program.

The Commission would be required to issue two reports: an interim report in December 2020 and a final report in December 2022. Both reports would be required to include a recommendation as to whether the Program should continue. If the Commission recommends the Program be discontinued, the Legislature’s leadership would be required to initiate legislation that would repeal the Program.

Commission membership remains the same as in the version passed by the House Health, Human Services, and Elderly Affairs Committee. However, only the six members who are also members of the Legislature, including three members of the Senate and three members of the House, with one minority party member from each body, would be voting members. All other members would serve in an advisory capacity. The proposal also identifies that four of the six voting members constitutes a quorum.

Granite Workforce Program

The structure of the Granite Workforce pilot program’s eligibility requirements and employer subsidies were changed by the House Finance Committee proposal. The Granite Workforce program, which is not part of the Medicaid program, was linked more directly to Medicaid expansion in the House Finance Committee proposal than in past iterations.

To be eligible for Granite Workforce, an individual would have to be enrolled in Medicaid expansion. However, those whose incomes rise above 138 percent of the federal poverty threshold while they are in the first nine months of working for an employer receiving a subsidy may continue to be enrolled as long as their incomes remain below 250 percent of the federal poverty threshold. After nine months, the income eligibility threshold appears to drop back to 138 percent of the federal poverty threshold.

The subsidies for employers, which are at the core of the program’s mechanisms intended to boost employment, were restructured by the House Finance Committee. The new structure would require an employer to employ an enrollee for three months before the first Granite Workforce subsidy, which would be 50 percent of the employee’s wages for the prior month but no more than $2,000. The second payment to employers would come after nine months of employment, with the same subsidy structure. This is a shift from the Senate version, which would have paid employers $2,000 upon hiring an enrollee and another $2,000 after three months.

The new proposal also includes two triggers to end the Granite Workforce program. First, if Temporary Assistance for Needy Families program funding reserves, which provides funding for the Granite Workforce program, drop below $40 million, the Granite Workforce program would end within 20 business days. Second, if the New Hampshire Granite Advantage Health Care Program ends, the Granite Workforce program would also be terminated.

Other Changes

Several other significant changes to the bill made by the House Finance Committee include:

- The New Hampshire Granite Advantage Health Care Program would automatically be repealed if the federal Medicaid program is changed into a block grant program.

- The State Department of Health and Human Services would be required to evaluate whether the Program’s nonfederal share is sufficiently funded quarterly, an increase in frequency from every six months, for the next six-month period. Projected funding shortfalls would also trigger an automatic end to the Program.

- For instances that would trigger an automatic end to the Program, the House Finance Committee amendment outlines reporting requirements, including notifying enrollees within 10 business days of the triggering event, and requires termination of the Program must be compliant with federal terms and conditions.

- The State would seek permission from the federal government to allow state and county correctional facilities to make presumptive eligibility determinations for incarcerated individuals.

The House is expected to vote on the House Finance Committee’s amendment during the week of April 30. For more on Medicaid in New Hampshire, see NHFPI’s Common Cents blog and NHFPI’s Issue Brief Medicaid Expansion in New Hampshire and the State Senate’s Proposed Changes.