The size of the State’s surplus continues to climb as a result of February’s revenues, with receipts from the two primary business taxes providing almost all of the boost while most other sources underperformed. The State collected $105.9 million in February, $15.5 million (17.1 percent) more than the $90.4 million projected by the State revenue plan. Business tax receipts were $19.9 million (189.5 percent) higher than plan, which anticipated only $10.5 million for the month.

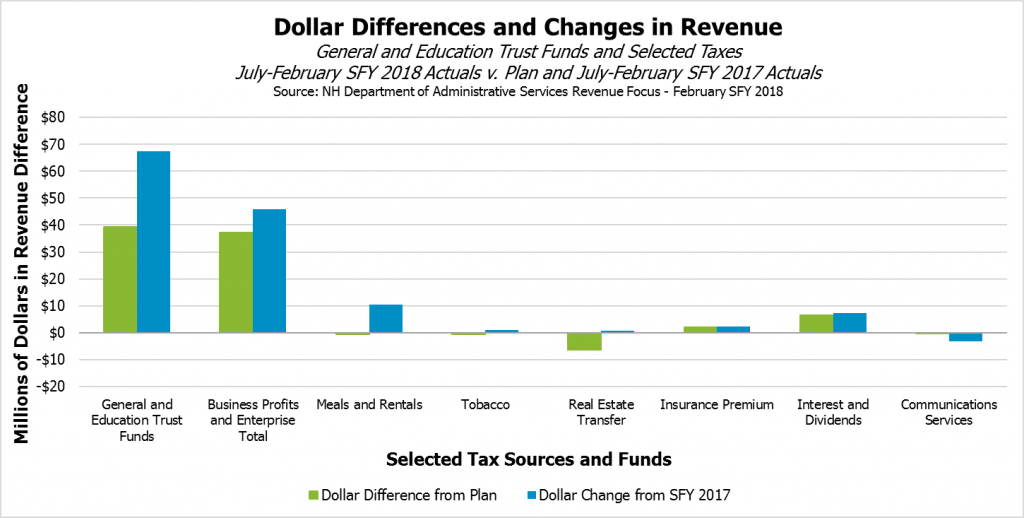

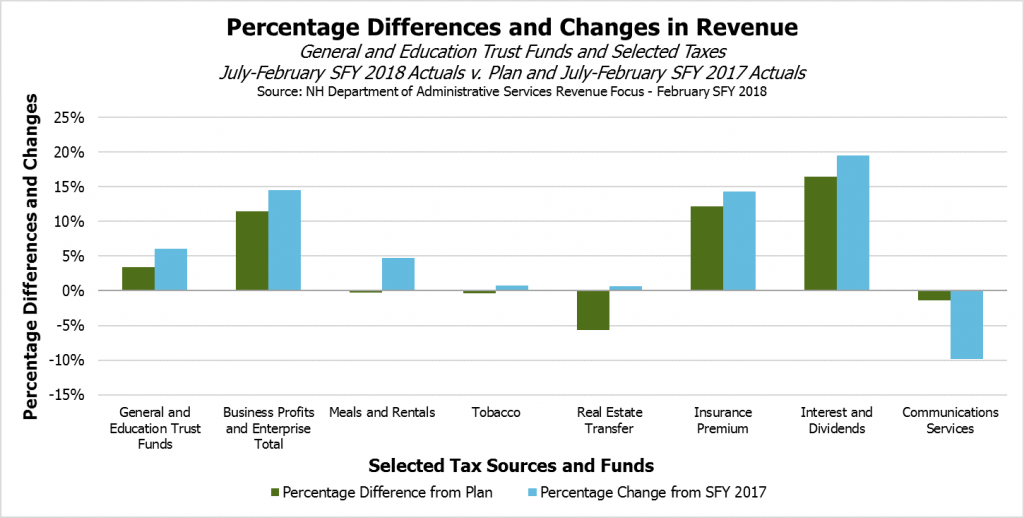

For State fiscal year (SFY) 2018 through the end of February, the unrestricted revenue surplus for the General and Education Trust Funds was $39.3 million (3.4 percent) above plan and $67.5 million (6.1 percent) above the prior year. The two primary business taxes, the Business Profits Tax (BPT) and Business Enterprise Tax (BET), were $37.2 million (11.4 percent) above plan for the year, accounting for almost all the unrestricted revenue surplus. February’s receipts increased the size of the year-to-date surplus attributable to the BPT and the BET by 115.0 percent.

February is not typically a large month for business tax receipts. Businesses are required to file quarterly estimated payments in the fourth, sixth, ninth, and twelfth months of their tax years, and final returns in the third or fourth month (depending on the type of business) following the end of their tax years, for the BPT and the BET. The New Hampshire Department of Revenue Administration (DRA) reports that about 90 percent of businesses follow a calendar year for their tax years. As such, large payments through the two primary business taxes are expected in March, April, June, September, and December. February estimated payments drove the increase; estimated payments in February SFY 2018 were $17.0 million (270.3 percent) above their SFYs 2009-2017 average, while returns, extensions, and tax notices were all within approximately $0.6 million of their SFYs 2009-2017 averages, unadjusted for inflation.

The cause for these high February receipts is difficult to determine. The DRA noted these increases were a result of “one-time anomaly payments,” and the number of business taxpayers involved is unknown. The DRA did not indicate this was an early March or April payment, so these dollars may not be offset by reduced revenue later. Additionally, the formal separation between the revenue from the BPT and BET is not completed until year-end returns are filed, with the monthly reported separation based on an estimated ratio, so whether the source is the BET or the BPT cannot be determined through publicly-available documents at this time.

The anomalous payments may be related to the December 2017 passage of the federal Tax Cuts and Jobs Act, which substantially changed corporate taxes nationally. Experts have speculated about the possible revenue changes at the state corporate income tax level stemming from the federal overhaul, and New Hampshire’s primary business taxes are structured differently those in other states, making direct comparisons difficult. A possible one-time revenue source for states stemming from these national changes would be from “deemed repatriation,” which allows multinational corporations to return profits held in subsidiaries overseas to the United States at reduced tax rates. Some states, including Vermont and Maine, anticipated potential increased revenue from these sources, while others have tax codes that are not structured to capture these revenues. A report prepared by Ernst & Young LLP for the Council on State Taxation’s State Tax Research Institute found long-term potential for the corporate tax base to be broadened if New Hampshire conforms to certain federal tax overhaul provisions, but it did not consider one-time deemed repatriation in its analysis. In January, the New Hampshire Department of Administrative Services projected business taxes would be “relatively strong” in the final six months of SFY 2018, but did not elaborate on potential causes.

Beyond the BPT and the BET, February’s receipts were sluggish overall. The Meals and Rentals Tax was slightly below the State revenue plan in February, pulling it below plan for the year by $0.5 million (0.2 percent), although it remains $10.5 million (4.8 percent) above prior year. This major revenue source has been roughly on target but not contributing to the surplus. The Tobacco Tax is also behind plan by $0.5 million (0.3 percent) for the year thus far after falling behind plan by $1.3 million in February, and is only managing slightly higher receipts than last year.

The Real Estate Transfer Tax, which has been lackluster all year, fell short of February’s plan by $0.5 million to be $6.4 million (5.7 percent) behind plan year-to-date and only $0.7 million (0.7 percent) above this time last year. That $6.4 million gap is made up for through the Interest and Dividends Tax, which was $0.7 million ahead of plan in February and remains $6.4 million (16.5 percent) ahead of plan for the year following December’s high receipts; those receipts were likely spurred by the federal tax law changes and may only be a temporary boost. The DRA noted that the Interest and Dividends Tax increases in February over last year were due to a delay in processing December and January payments, so this performance may not be indicative of revenue growth going forward.

Although the Insurance Premium Tax remains above plan for the year, the surplus attributable to it was reduced by $1.1 million in February’s receipts, falling to $2.0 million (12.2 percent) above plan. The Department of Administrative Services also noted in its January projections that the Insurance Premium Tax was likely to bring in less General Fund revenue than in the State’s revenue plan over the course of the year for reasons related to the New Hampshire Health Protection Program.

The Liquor Commission was $1.6 million (17.0 percent) below plan in February, and for the year was below both plan (by $3.2 million, or 3.3 percent) and the prior year (by $5.5 million, or 5.6 percent). The Lottery Commission provided $1.2 million (19.0 percent) less than planned for February, although Lottery Commission receipts remain $4.7 million (10.2 percent) above plan for the year in aggregate. The Communications Services Tax continues to be a declining revenue source.

For more information on State revenue sources, see NHFPI’s Revenue in Review resource. For an evaluation of the State’s revenue picture at the beginning for this calendar year, see NHFPI’s January 2018 Issue Brief Business Tax Rate Reductions Add to Uncertain Revenue Picture.