State revenues were closer to expectations in May after three months of abnormal receipts, with most major sources bringing in about as much revenue as planned for May and the largest deviation coming from a rebounding Real Estate Transfer Tax. Although May is not an important month for the state’s two main business taxes, receipts from these two sources only contributed modestly to the surplus and showed a small decline from May of last year.

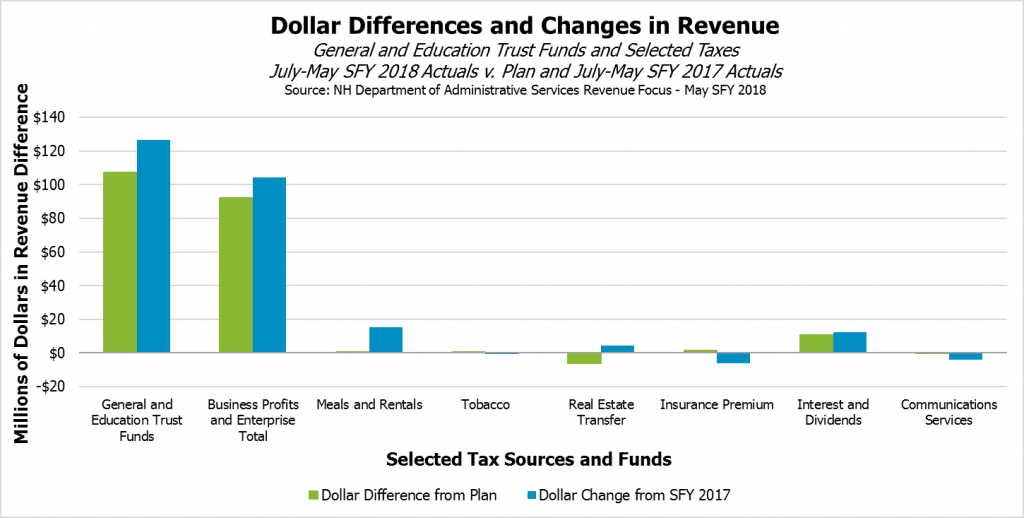

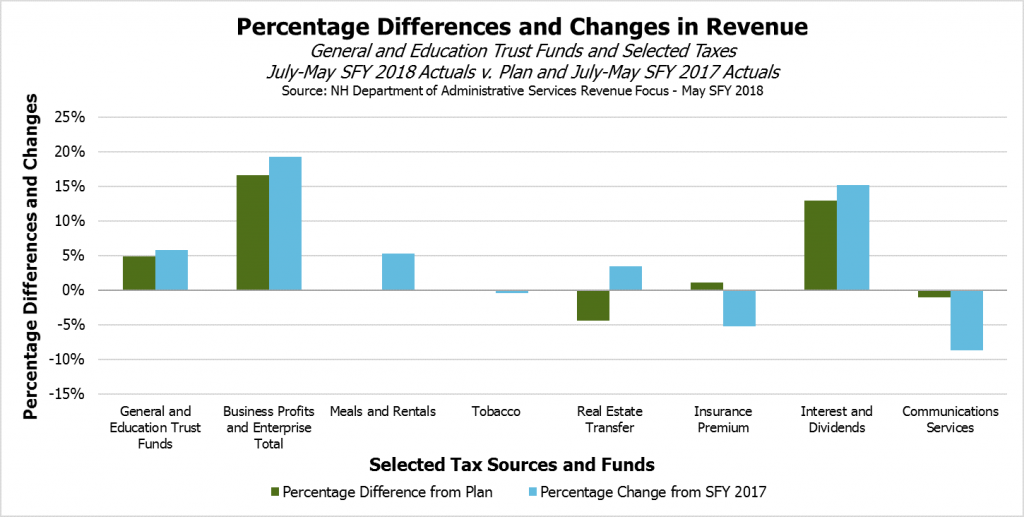

The New Hampshire Department of Administrative Services reported unaudited cash revenues for the General and Education Trust Funds exceeded the State revenue plan for May by $7.9 million (7.5 percent), increasing the undesignated revenue surplus to $107.2 million (4.9 percent). Notably, this amount and more was appropriated by the Legislature, drawing on other sources of expected revenue, for additional expenditures beyond the State Budget during the last days of the legislative session. May’s surplus provides additional cushion if revenues do not come in as planned during June and State fiscal year 2019, which begins July 1.

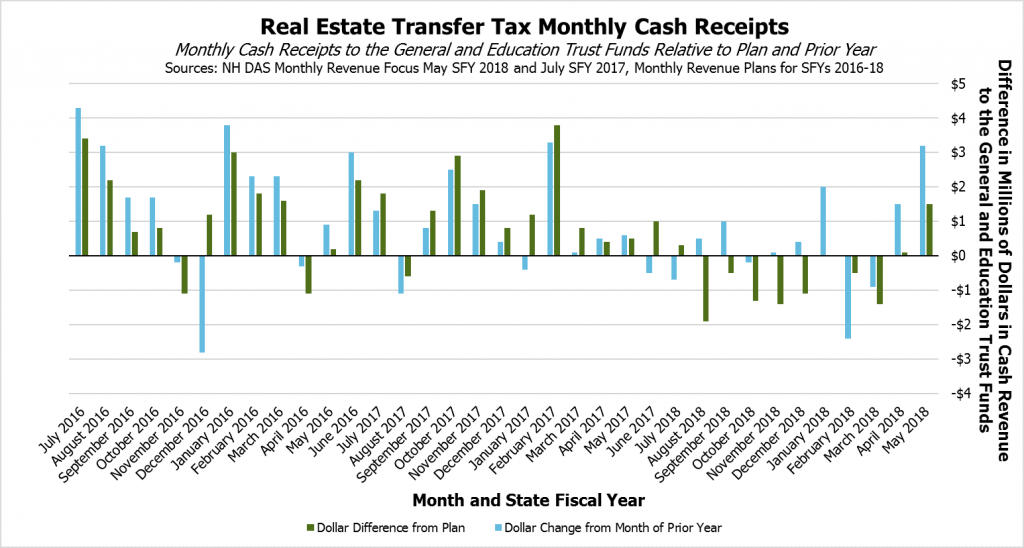

Some hope for additional surplus comes from the Real Estate Transfer Tax. With a very limited supply in the housing market and rising prices, the Real Estate Transfer Tax has been lackluster for much of this State fiscal year, as supply limitations have likely dampened sales volume even as prices have risen. However, revenues are dependent on both sales price and volume, and sales in April (which drive May receipts) were reportedly up 9.4 percent compared to April 2017, while transaction values were up 37.7 percent, according to the Department of Revenue Administration. With this boost, the Real Estate Transfer Tax came in $1.5 million (13.6 percent) above plan in May, but it remains $6.2 million (4.4 percent) below plan for the year.

May revenues also suggest business taxes may be returning to a more predictable pattern. The state’s two primary business taxes, the Business Profits Tax and the Business Enterprise Tax, are due quarterly, and most businesses have a calendar year tax year, so May is not a significant month for receipts and does not provide definitive indications of trends. However, as business taxes have behaved abnormally in recent months, particularly due to at least one large payment in February, seeing receipts return to normal for these large, important state revenue sources is noteworthy. Revenue from the two business taxes combined (they are typically filed together and only distinguished definitively from one another in the final returns) were $1.0 million (5.5 percent) above plan for the month and were actually down $2.8 million (12.7 percent) from May of the prior year. June and September will provide considerably better insights into the future trends of the business taxes, which are running a surplus equivalent to 85.9 percent of the entire General and Education Trust Funds surplus.

Other major tax revenue sources continued to generate revenue on par with expectations in May. Tobacco Tax revenues were ahead for the month by about $1.2 million (6.8 percent), bringing the total receipts from this slowly declining revenue source to near the levels expected in the State revenue plan. The Meals and Rentals Tax continues to perform better than last year but does not generate a significant surplus. Interest and Dividends Tax receipts were on target in May, and the surplus generated earlier in the year has not eroded.

Other revenue sources present a mixed picture. Securities revenue was ahead of plan in May but still down for the year overall, and revenue from the Liquor Commission reached plan in May and was $3.1 million (2.4 percent) below plan for the year through the end of May. Lottery Commission revenues were higher than anticipated in both May and for the year overall, with a net $7.0 million (10.5 percent) surplus for the year thus far. May also saw early payments to the Utility Property Tax of $1.1 million, but those payments may have only shifted timing from June and may not be a permanent addition to the surplus; however, similarly high early payments in November did not appear to impact the surplus in December.

For more information on State revenue sources, see NHFPI’s Revenue in Review resource.