Business tax revenues, propelled higher by certain unusual trends, continued to overperform in September, which is the largest revenue month in the new fiscal year thus far. Business tax extension revenues continued to be well above normal, suggesting more or larger businesses are delaying their final business tax filings. Revenue from estimated payments, which are due for many businesses in September, grew at a steadier pace relative to prior years, and revenue from final business tax returns remained lower. Other tax revenues were a mixed bag in September and during the year thus far, with business taxes accounting for nearly all the revenue surplus over the budget plan in the first quarter.

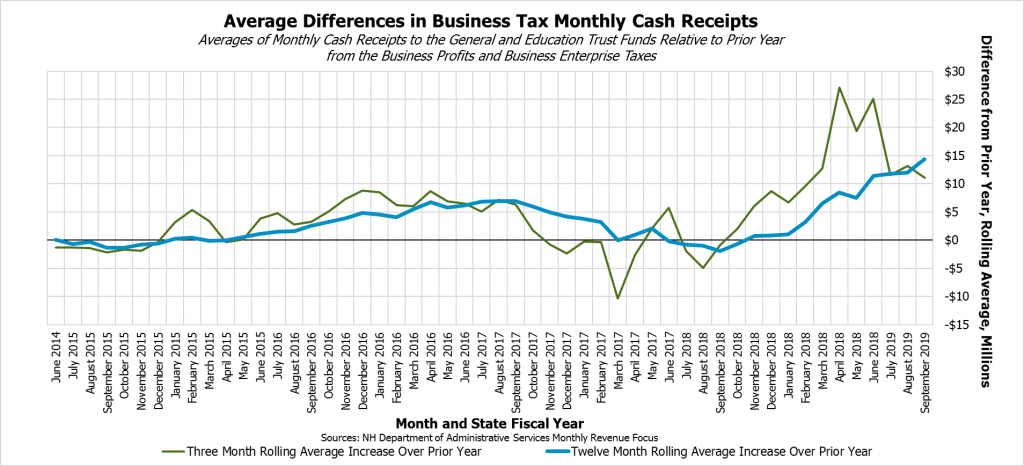

The Business Profits Tax and the Business Enterprise Tax have both been behaving abnormally since February of State Fiscal Year (SFY) 2018, which began July 1, 2017. Receipts have been considerably higher than normal for these two taxes, which are filed together and are not separated into distinct revenue streams until filings at the end of a tax year. Business tax revenues grew steadily with a growing economy in 2015 and 2016, but recent increases have been much sharper and very likely spurred by federal tax policy changes in late 2017.

The two business taxes are filed annually, with most businesses providing quarterly estimated payments and 90 percent of filing businesses using a calendar year as their tax years. The quarterly estimated payments made September the largest revenue month thus far in SFY 2019. For calendar year businesses, final returns are due in March or April, depending on the kind of business, unless the business files for an extension. An extension permits a business to not file a completed tax return, but requires that business to pay the entire amount they expect to owe. A business with a complex tax return may wish to file a completed return later, but is still be required to pay the State the amount owed in taxes at the time of the extension request, when the full return would have been filed absent the extension.

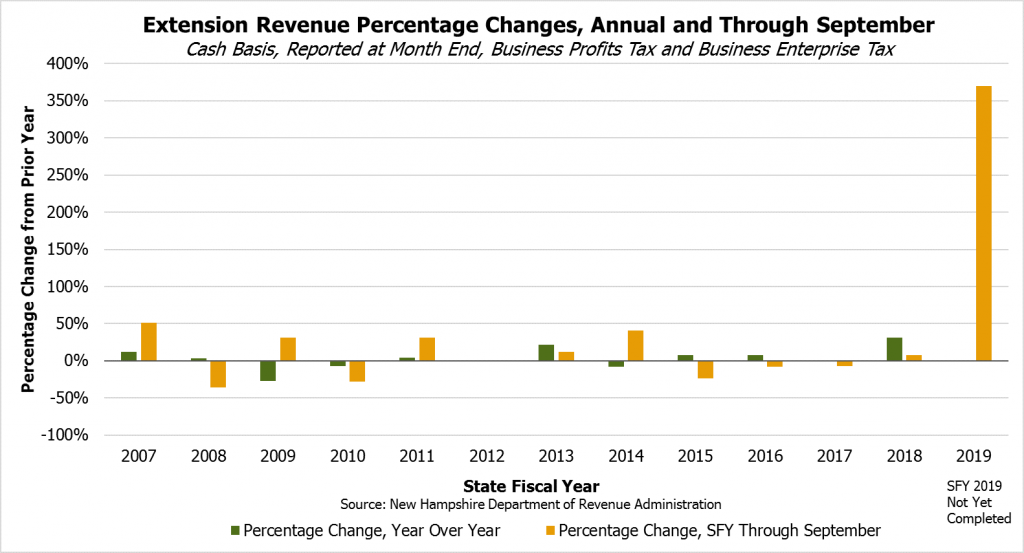

Extension revenues are considerably higher thus far in SFY 2019 than they have been in any comparable period in the last 12 years. While the largest annual change between revenue collected through extensions in the first quarter of each State fiscal year between 2007 and 2018 was 51 percent, revenue from extensions in the first quarter of SFY 2019 was up 370 percent over the first quarter of SFY 2018. Revenue from completed returns was down 46 percent, while revenue from estimated payments was up a more ordinary 7 percent.

This continued high level of extension revenue relative to last year strongly suggests the business tax environment is far from settled. SFY 2019’s high figures follow extension revenues coming in up 86 percent in April SFY 2018 over the prior year, as well as up 65 percent in May and 78 percent in June. The New Hampshire Department of Revenue Administration will likely start collecting final returns from the March and April extensions throughout October and November, which may provide more insight into whether the extension revenues are permanent or may be requested through refunds at a later date.

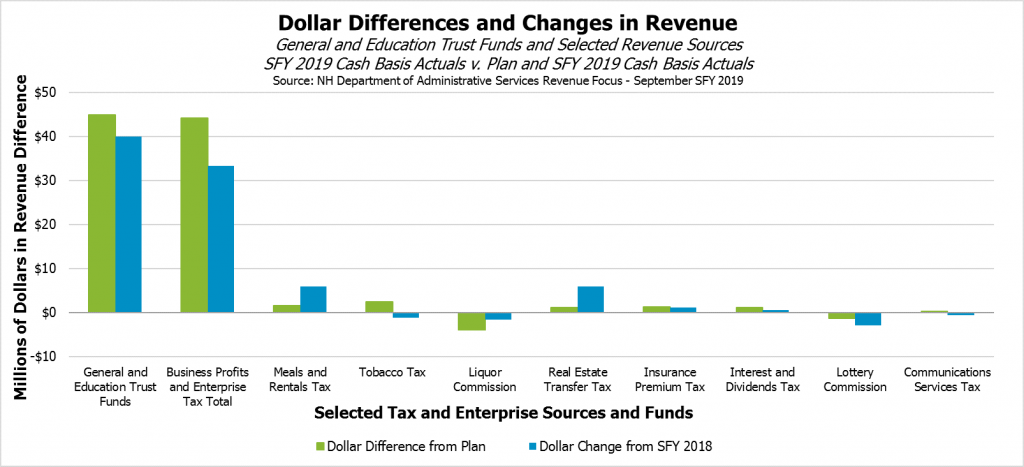

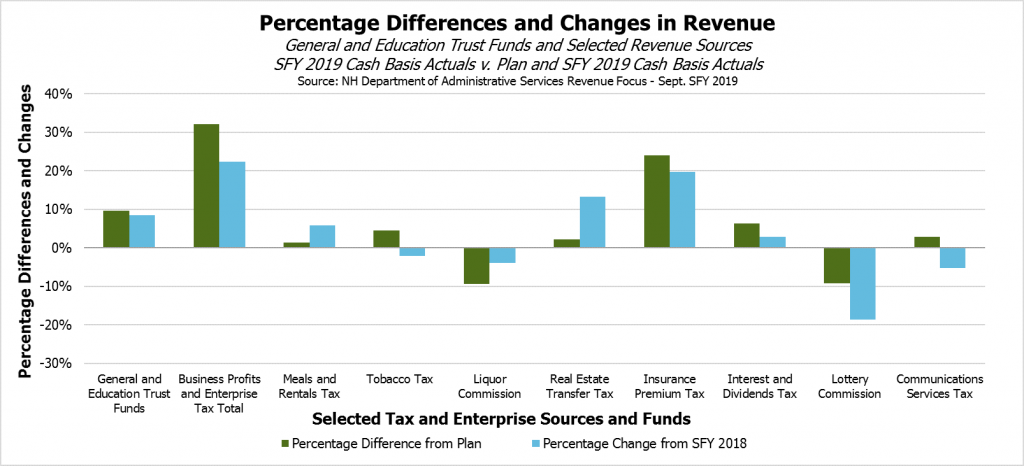

The Business Profits and Business Enterprise Taxes generated the vast majority of the surplus cash basis revenues in the General and Education Trust Funds through September SFY 2019. These two taxes brought in $182.0 million so far this year, which is $44.2 million (32.1 percent) above the State revenue plan. The total unrestricted revenue surplus was $44.9 million (9.6 percent) for the year through the end of September.

Smaller surplus increases relative to plan have stemmed from the Meals and Rentals Tax, which continues to grow at a healthy clip, and a recovering Real Estate Transfer Tax. The Insurance Premium Tax, the Interest and Dividends Tax, and, somewhat surprisingly, the Tobacco Tax, which will likely be a declining source of revenue in the future, have also contributed at least $1 million (but less than $3 million) each to the State’s revenue surplus. Meanwhile, Liquor Commission revenues transferred to the General Fund were $4.0 million below plan in the first quarter, and Lottery Commission revenues were also down $1.3 million despite the new revenue source Keno adding to Lottery Commission revenues and not being included in the State revenue plan.

For more information on State revenue sources and trends, see NHFPI’s Revenue in Review resource. For more information on revenue uncertainties going forward, see NHFPI’s Issue Brief Business Tax Rate Reductions Add to Uncertain Revenue Picture.