State revenues collected during March fell short of the amount planned to fund the State Budget, reducing the current revenue surplus in two key funds and making the upcoming April tax returns more critical for understanding the trajectory of State tax collections.

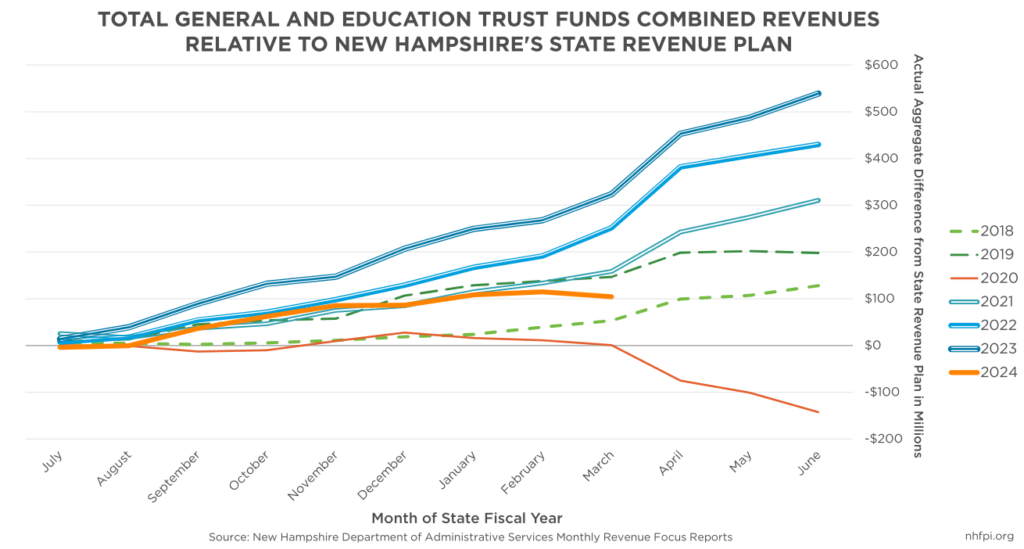

During the last four State Budget cycles, the State collected significant revenue surpluses driven largely by rising national corporate profits bolstering the Business Profits Tax, higher house prices due to limited supply that spurred growth in the Real Estate Transfer Tax base, and resilient Meals and Rentals Tax revenues. As a result, months during which State revenues have fallen substantially behind expectations have been relatively rare, outside of the initial effects of the COVID-19 pandemic in early 2020. However, combined revenues to the State’s General and Education Trust Funds in March were $10.4 million (1.4 percent) lower than the expected amounts established in the State Revenue Plan.

The General and Education Trust Funds still benefit from revenue surpluses in prior months, leaving a cash revenue surplus of $104.2 million for the year through the end of March. This month’s shortfall does not dramatically change the overall condition of resources available for services in these two key State funds.

Examining the underlying reasons for the shortfall may generate some cause for concern regarding future revenues. The combined revenues from the State’s two primary business taxes, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), slipped behind the State Revenue Plan by $2.4 million (9.8 percent) in February. However, combined BPT and BET revenues were still generating a net surplus of $30.4 million (5.2 percent) for State Fiscal Year (SFY) 2024 overall due to more substantial receipts earlier in the year. That situation changed substantially in March, when combined business tax revenues were $36.0 million (23.0 percent) below the State Revenue Plan for the month and shifted to a $5.6 million deficit for the year.

March business tax revenues include the quarterly estimate payments and tax returns from the prior year for partnerships, which are businesses organized in a certain ownership structure, that use a calendar year as their tax year. About 90 percent of all businesses that pay BPT and BET have a tax year that coincides with the calendar year. The State requires that business tax filers produce estimates of expected tax liabilities for their tax years, and file estimate payments on the fourth, sixth, ninth, and twelfth month of each tax year. As such, April, June, September, and December are important months for business tax revenues, which makes them very important months for revenues overall; the BPT was by far the State’s largest tax revenue source, and the BET was the fourth-largest tax revenue source, in SFY 2023. April is also the month during which most calendar year businesses, including corporations, proprietorships, and other types of businesses that are not organized as partnerships, are required to file their final tax return or request an extension for the prior tax year. Only businesses organized as partnerships are required to file in March.

Lower than expected March returns have some implications for business taxes generally. Partnerships accounted for 12 percent of BET revenue and 15 percent of BPT revenue in 2021. Business activity by partnerships may not be representative of the profits and other taxable activities of businesses organized as corporations, proprietorships, combined reporting or Water’s Edge filers, or fiduciaries that pay their quarterly estimates and annual returns in April. The month of April was expected to bring in 15.2 percent of all revenue collected during SFY 2024 in the original State Revenue Plan.

One trend that does appear indicative, however, is the increase in refunds paid by the State to businesses. State reporting indicates $129.9 million in business tax refunds have been paid year-to-date, which is 84.8 percent more than the $70.3 million in refunds as of the end of March SFY 2023 and 158.8 percent higher than the $50.2 million year-to-date in March SFY 2022.

The increased refunds appear to be spurred by a relatively new State law. State legislators had expressed concern over the amount of money businesses were leaving with the State as credit carryovers from business tax overpayments, which could be requested as refunds or used to pay future business taxes later. This credit carryover liability for the State had grown to $297.4 million in SFY 2021. It increased further to $412.6 million from 18,325 filers (24.6 percent of all filers) in SFY 2023, which was the equivalent of about one out of every three dollars collected by the two business taxes during that year. Policymakers sought to reduce that financial risk to the State by including language in the State Budget passed in 2021 that would cap the amount businesses could carryover. The cap starts by limiting businesses to leaving no more than 500 percent of their annual tax liability with the State as a credit carryover and refunding the rest. The credit carryover limit will be reduced to 250 percent in Tax Year 2025 and 100 percent in Tax Year 2027 under current law.

The 500 percent cap first applied to Tax Year 2022. The New Hampshire Department of Revenue Administration reported that 46.4 percent of refunds so far in SFY 2024 are due to the 500 percent cap being in effect. This statute has the potential to substantially limit business tax revenues collected in April, as well as to generate more refunds in October after extension filings are completed.

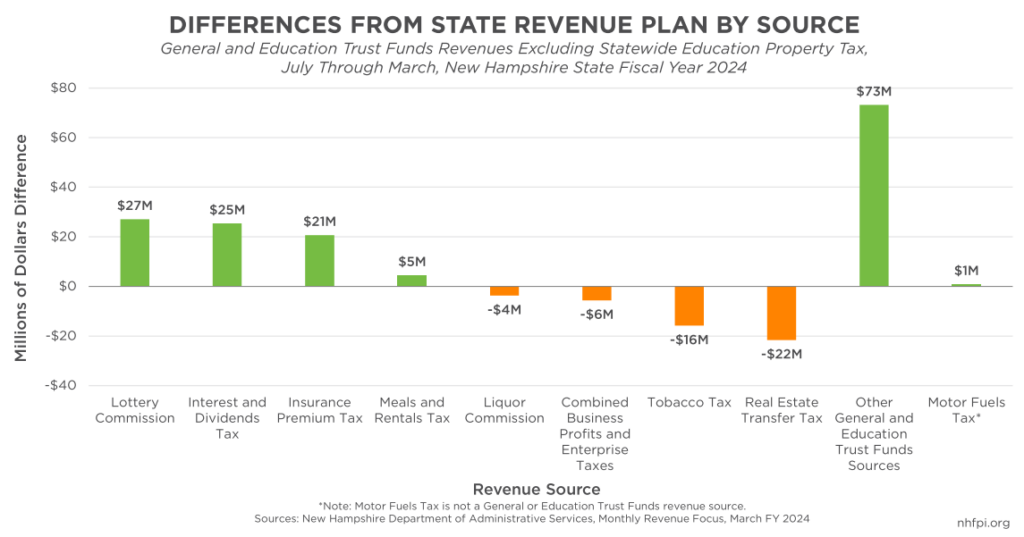

Other revenue sources continue to generate mixed performances relative to the State Revenue Plan. Real Estate Transfer Tax revenues have been diminished due to fewer home sales occurring as a result of higher prices and interest rates. While this revenue source nearly met the State Revenue Plan’s targets in March, for SFY 2024 thus far it is $21.6 million (13.3 percent) below the State Revenue Plan. Tobacco Tax revenues were $15.8 million (9.8 percent) below Plan targets as of the end of March.

Revenues from the Insurance Premium Tax had generated a surplus of $20.7 million (14.1 percent) above the State Revenue Plan for SFY 2024 through March. Interest and Dividends Tax revenues also helped bolster the surplus, with $25.4 million (51.4 percent) more in revenue than expected. However, the Interest and Dividends Tax, which taxes income generated by the ownership of wealth and collects most of the revenue from high-income households, will disappear in 2025 due to a statute attached to the current State Budget. Lottery Commission revenues were also above the State Revenue Plan target by $27.1 million (25.4 percent), due in part to sports betting.

The primary generator of the current revenue surplus continues to be interest payments to the State on saved cash, including one-time federal transfers associated with the COVID-19 pandemic, that the State continues to hold. These interest revenues are identified as “Other” revenue in State reporting. “Other” revenues were up $68.5 million (126.6 percent) above the State Revenue Plan for that collection of revenue sources at the end of March. As the State spends one-time federal dollars, that revenue source will dwindle.

Policymakers are nearing the final weeks of the 2024 legislative session. April revenue collections will be critical for understanding the status of the surplus, and the remaining funds available to deploy or save, for the remainder of SFY 2024. The revenue surpluses of the years following the start of the pandemic, which were driven largely by favorable national corporate profits pushing up BPT revenues, may not be repeated in SFY 2024, and policymakers may need to alter appropriations decisions to reflect limited revenue growth or bolster revenue sources to fund services.

– Phil Sletten, Research Director