Updated on May 30, 2017

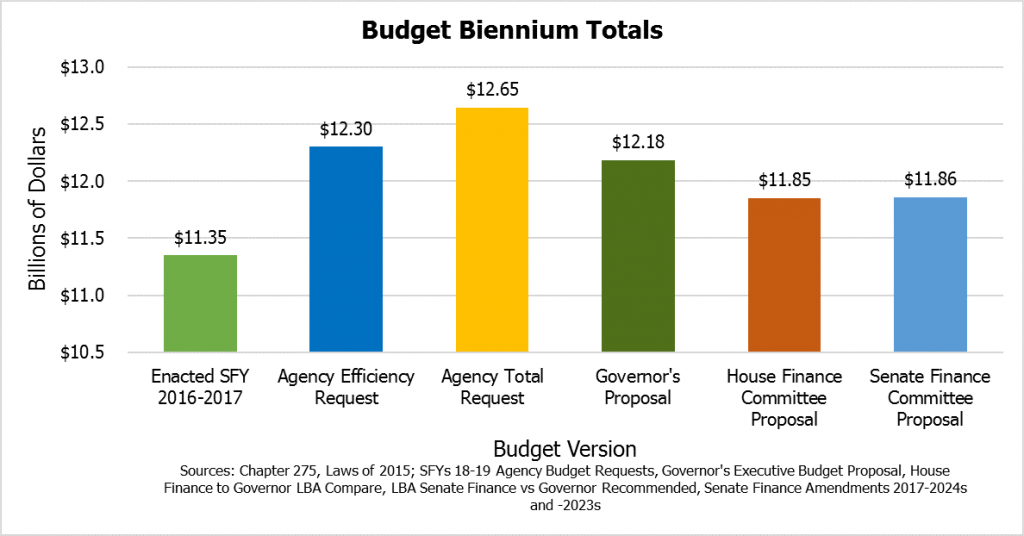

On May 24, the Senate Finance Committee approved a State Budget proposal that would appropriate $11.86 billion in State fiscal years (SFY) 2018 and 2019. This proposal is $324.7 million less than the Governor’s proposed budget, which the Senate Finance Committee used as a baseline for its decisions, and $5.9 million higher than the House Finance Committee’s budget. It contains substantial differences from both versions, both in funding allocation and policy decisions attached in the Trailer Bill, which is House Bill 517 in the Senate. To learn more about the Governor’s proposed budget, see NHFPI’s Issue Brief.

Tax Changes

The Senate Finance Committee approved reductions in the State’s two primary business taxes. The Business Profits Tax, under this plan, would be reduced to 7.7 percent in 2019, and 7.5 percent in 2021, from the current level of 8.2 percent (which is likely to be reduced under a revenue-trigger law to 7.9 percent for 2018). The Business Enterprise Tax would be lowered to 0.6 percent in 2019, and 0.5 percent in 2021, from the current level of 0.72 percent (with the likely revenue-trigger reduction to 0.675 percent for 2018). The deduction for certain allowable business property expenses would also increase from $100,000 to $500,000, following the already-approved increase from $25,000 for 2017. For more on State revenue sources, see NHFPI’s Revenue in Review resource.

Assumption Adjustments

Relative to the Governor’s budget, the Senate Finance Committee made some key changes to assumptions that reduced the budget total. Revised enrollment projections for public charter and non-charter school enrollment reduced anticipated spending by approximately $15.3 million, and an $11.1 million reduction in all funds stems from an assumed 2 percent drop in Medicaid Managed Care caseloads rather than the 1 percent assumed by the Governor’s budget.

The Senate Finance Committee also removed certain anticipated federal fund transfers from the Governor’s version of the State Budget. For example, $70.1 million was removed from the federal funds allocation to the Medicaid-to-Schools program, but the expectation is that transfers into this program will be accepted as a transfer later by the Governor and Council and the Joint Legislative Fiscal Committee. The same expectation exists for $20.8 million in consolidated federal aid budgeted for the Department of Transportation in the Governor’s budget proposal.

New Hampshire Health Protection Program Work Requirements

The Senate Finance Committee’s proposed budget would also require the Department of Health and Human Services to seek a waiver from federal government rules regarding work requirements for certain participants in the New Hampshire Health Protection Program (NHHPP), which is the State’s version of expanded Medicaid under the Affordable Care Act. The State Budget language would require the Department to seek waivers to require unemployed childless able-bodied adults who do not meet certain conditions to spend 30 hours per week employed, collecting work experience or on-the-job training, searching for jobs, engaging in community service programs, providing child care services, or participating in certain education programs. Should the federal government not grant a waiver to permit New Hampshire to enact these work requirements, the NHHPP shall not be reauthorized and participants would be given notice of the program’s end date of December 2018. The Committee’s budget also includes a provision from the Governor’s proposed budget that Medicaid coverage for children and pregnant women would be reinstated as it was prior to the NHHPP if the program does end.

Surplus Spending and Infrastructure

Governor Sununu’s proposed Infrastructure Revitalization Trust Fund was modified by the Senate Finance Committee to narrow its intended scope of school building construction projects. The “Public School Infrastructure Revitalization Trust Fund” would permit the Governor, with the approval of the Fiscal Committtee and the Executive Council, to spend $14.6 million in SFY 2017 surplus dollars on projects at schools with structural deficiencies that present clear and imminent danger or a substantial risk to the life or safety of the occupants. The fund money may also be used to improve security at public schools and other infrastructure projects. This provision leaves the Governor with broader discretion than the House Finance Committee’s budget, which funneled money through existing aid programs.

The Senate Finance Committee’s budget would allocate all the surplus dollars anticipated to be available at the end of SFY 2017 to the Public School Infrastructure Revitalization Trust Fund except for approximately $7 million, which would be used to bring the Rainy Day Fund to a balance of $100 million. The Senate Finance Committee’s budget also would modify the Rainy Day Fund to permit transfers from legal settlements deposited in the Rainy Day Fund to exceed the current statutory cap on the Fund.

The Senate Finance Committee would also change infrastructure, environmental, and energy laws by:

- Establishing a New Hampshire Drinking Water and Groundwater Advisory Commission to consult and advise the State on the use of the Drinking Water and Groundwater Trust Fund, which holds funds associated with a major water pollution legal settlement.

- Authorizing a study of placing a service plaza, with State liquor stores, on Interstate 95 in Hampton that could be similar to the Hooksett service plaza on Interstate 93.

- Clarifying Department of Transportation definition of projects to include buildings and fixtures, and the definition of highways to include roads currently used by bicycles and pedestrians but excluding bridge, trails, or paths intended for use by off-highway recreational vehicles.

- Establishing an account to manage dollars allocated to refitting State buildings with heating systems following problems with Concord Steam and allocating $2.5 million from SFY 2017 surplus dollars to the Concord School District for heating conversion costs.

- Modifying the Governor’s proposed limitation on Public Utilities Commission spending on implementation of an energy efficiency resource standard.

Substance Abuse Disorder and Sununu Youth Services Center Funding

The Senate Finance Committee followed Governor Sununu’s recommendation and doubled the required percentage of the Liquor Commission’s gross profit contribution to the Alcohol Abuse Prevention and Treatment Fund from 1.7 percent to 3.4 percent. However, the Committee did not include the Governor’s proposed provision to boost the requirement to 4 percent if the funds used or claimed for use reach 80 percent for a fiscal year. The Senate Finance Committee’s budget also directs funds from the Alcohol Abuse Prevention and Treatment Fund to operational costs at the Sununu Youth Services Center without requiring Fiscal Committee approval.

The Senate Finance Committee’s proposed budget also makes changes to the statutes surrounding juvenile justice and the use of the Sununu Youth Services Center. The proposed budget limits the extent to which minors may be committed to facilities for drug possession violations, and requires that minors be retained for only 21 days or less while awaiting placement or hearing except in certain circumstances. The State would also have to develop a plan to move at least 35 minors who are not serious violent offenders from the Sununu Youth Services Center to Medicaid-eligible settings. Excess capacity at the Sununu Youth Services Center would also be redeveloped, with a sum of $2 million for SFY 2018, to provide inpatient and outpatient drug treatment services for eligible youth.

Mental Health

Regarding facilities for those with mental illness, the Committee-proposed budget requires the Department of Health and Human Services to seek vendors to provide 20 transitional and community residential beds in SFY 2018 and 40 beds in SFY 2019. The Department must also develop a plan to safely move the remaining 24 youths at New Hampshire Hospital and continue to provide them needed care by November 2017, and must seek proposals for mobile crisis teams and apartments. The Department also must appoint a mental health medical supervisor to collect information on patients and treatment options and assist in assignment of appropriate services. The proposed budget provides for a universal online prior authorization form for drugs used to treat mental illness and sets a timeline for approval of prior authorization requests, with failure to approve or disapprove by the following business day leading, in most cases, to automatic approval. The Bureau of Mental Health Services received an approximately $4.3 million boost from the Senate Committee over the Governor’s budget proposal.

Child Protection

The Committee-proposed budget would create an Associate Commissioner position at the Department of Health and Human Services specifically charged with overseeing the Division of Children, Youth, and Families, among other duties. It also establishes an independent Office of the Child Advocate attached administratively to the Department of Administrative Services, with authority and access to most records within the scope of its mission. The proposed budget would also clarify the definition of an “unfounded report” in the Child Protection Act and permit those unfounded reports to be admissible in proceedings to establish a pattern of conduct.

Other Health and Human Services Funding

The Senate Finance Committee proposed additional changes to the operations of the Department of Health and Human Services and other human service-related programs. The proposed budget:

- Requires the Department of Health and Human Services produce a plan for the relocation of the designated receiving facility for people with developmental disabilities that is currently on the Laconia State School property by June 2021.

- Creates a Medicaid home and community-based behavioral health services program for children with severe emotional disturbances whose needs cannot be met through traditional behavioral health services.

- Incrementally increases the reimbursements counties must make to the State for certain Medicaid payments for nursing home care.

- Retains the Governor’s proposed linking of the Temporary Assistance for Needy Families monthly cash benefit to 60 percent of the federal poverty guidelines, with annual adjustments.

- Provides contingent funding, dependent on matching dollars from counties, to develop a long-term care plan for the Medicaid-eligible nursing home population and expected demographic changes.

- Increases funding for a news and information service for those who are blind or otherwise unable to read newsprint from $28,000 to $31,500 annually.

Retired State Employee Health Premium Contributions

The Senate Finance Committee’s budget would retain the Governor’s proposed requirement that retired state employees contribute to their health insurance premiums. However, it modifies the proposal by exempting employees born in 1948 or earlier, as did the House Finance Committee’s budget. Retired employees eligible for Medicare Parts A or B due to age or disability would have to pay 10 percent of the total monthly premiums, with the Commissioner of Administrative Services having authority to increase the percentage with the approval of the Fiscal Committee. Those not eligible for Medicare would pay 20 percent of the health insurance premium cost, which is an increase from 12.5 percent.

Education and Workforce Training

Governor Sununu’s proposal to include an $18 million full-day kindergarten subsidy for municipalities was removed from the State Budget, and has been modified and moved through the Senate and two House Committees as a separate bill. The Senate Finance Committee also eliminated the Governor’s proposed $20.8 million Gateway to Work program from the State Budget.

The Senate Finance Committee budget proposal also:

- Authorizes the Governor’s Scholarship Program for certain students attending approved post-secondary training and education programs in New Hampshire and provides $5 million per year in funding.

- Retains certain modifications to laws surrounding charter schools proposed by the Governor and modifies the grant amount paid by the State to charter schools, employing a set dollar figure rather than the Governor’s proposed percentage of state average public school per-pupil operating costs; a chartered public school program officer position is also established in the Department of Education.

- Establishes a Robotics Education Fund to promote science, technology, engineering, and mathematics education and future career opportunities among elementary school students.

- Incorporated the Governor’s suggestion while presenting his proposed budget to the House Finance Committee that the operating expenses grant to the Community College System be increased by $6 million over the biennium; the University System does not receive an increase in funding under the Senate Finance Committee’s proposal.

Department Reorganization

The Senate Finance Committee retained the Governor’s reorganization of the Department of Resources and Economic Development and the Department of Cultural Resources into two new departments: the Department of Business and Economic Affairs and the Department of Natural and Cultural Resources. The Committee also retained the Governor’s proposal to seek efficiencies through changes to Department of Administrative Services consolidation efforts and transfer of certain Department of Health and Human Services information technology operations to the Department of Information Technology, although it enabled the latter without allocating funds as the Governor proposed.

Judiciary and Corrections

The Senate Finance Committee version of the State Budget also:

- Permits two additional full-time judges to serve on the circuit court.

- Amends the requirement, previously written in law, that a $1.1 million appropriation be used to install six full body security scanners at State correctional facilities by removing the requirement that six scanners be installed and redirecting some of the appropriation to fund two canine teams.

- Eliminates changes to state corrections officers application standards.

Next Steps

The full Senate will hear a presentation from the Senate Finance Committee on this budget proposal on Tuesday, May 30. Then, on Thursday, June 1, the Senate will have the opportunity to amend and vote on the State Budget. After that vote, the House will likely ask for a Committee of Conference, which must be formed by June 8. The Senate Finance Committee has incorporated by reference in to its State Budget, for the purposes of the Committee of Conference only, the House Finance Committee’s version of the State Budget’s House Bills 1 and 2, which will enable the House members to argue for the positions in the House Finance Committee’s budget. Members of the House and Senate may make changes to the State Budget during the Committee of Conference to produce a final version that must pass both the House and the Senate before going to the Governor’s desk. The Committee of Conference may also revise revenue estimates; if so, it will be the fifth group to address revenue estimates in this State Budget process. During the State Budget process thus far, revenue estimates came from former Governor Hassan’s administration during the agency budget process, from Governor Sununu for his budget proposal, and from both the House and Senate Ways and Means Committees. The House Ways and Means Committee produced revenue estimates in March, and revisited them in May; the Senate Ways and Means Committee finalized their revenue estimates after two meetings in May.

To learn more about how the State collects revenue, see NHFPI’s Revenue in Review resource. For more on the process of creating the State Budget, see NHFPI’s Building the Budget resource.

This post was updated on May 30 to reflect a change to expected surplus allocated to the Public School Infrastructure Revitalization Trust Fund.