In an unusual move, the Senate Ways and Means Committee opted to revisit the revenue estimates for the General and Education Trust Funds they had decided and voted upon individually on May 17. The Committee concurred with the House Ways and Means Committee revenue projections for the Fish and Game Fund, and adopted the projections from the Governor’s proposed budget for the Highway Fund. The Committee then reopened the General and Education Trust Fund revenue estimates, and after a series of recesses, decided to increase projected revenues for the Business Profits and Business Enterprise Taxes, the Interest and Dividends Tax, and the Real Estate Transfer Tax for the upcoming State Budget biennium. (For more on the General, Education Trust, Highway, and Fish and Game Funds, see NHFPI’s Building the Budget resource.)

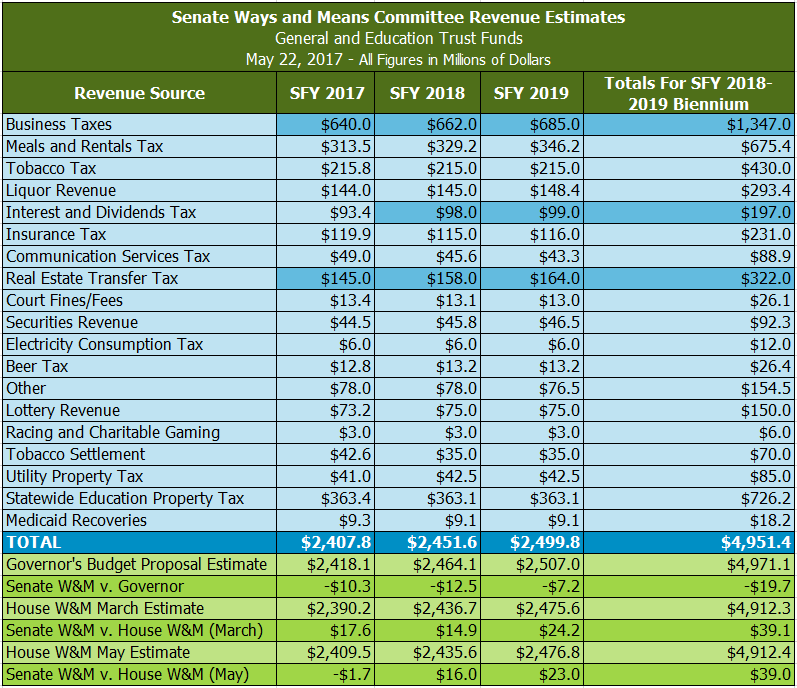

The revenue projections that were adjusted since the May 17 votes are shaded in the table below. The total revenue for the biennium, at $4,951.4 million, is $19.7 million below the Governor’s estimate, and above the House Ways and Means Committee estimate from March by $39.1 million. The $53.2 million increase in projected in revenue from the May 17 estimates stemmed from a $36.0 million increase in expected revenue from business taxes, an $11.8 million increase in expected Real Estate Transfer Tax revenue, and a $5.4 million increase in Interest and Dividends Tax revenue. Adjustments to the State fiscal year 2017 estimates were also boosted by increases in projected revenue from the two business taxes and the Real Estate Transfer Tax.

The differences across these revenue estimates indicate the extent to which projections can change for a two-year budget. The economic uncertainty is compounded by changes in the groups making the projections. Throughout the process of creating a budget, there are at least five different sets of revenue estimates, potentially made by five different groups of people. Revenue estimates are likely to change over these iterations due to updated revenue collection data and other factors. (For more on the different iterations of revenue estimates, see NHFPI’s Building the Budget resource.)