This ranking is based on a mix of website views, online engagement, and requests for interviews and presentations.

Calendar Year 2023 saw significant public policy decisions and unusual actions in the New Hampshire State Legislature, from Medicaid Expansion renewal to a State Budget accepted by the Legislature without a Committee of Conference. The New Hampshire Fiscal Policy Institute (NHFPI) is honored to have been a trusted, reliable, and up-to-date source of information and analyses every step along the way. NHFPI is the only organization in New Hampshire that focuses on the State Budget, State revenue, and the implications of fiscal policy decisions on the economic security of Granite Staters. Our work informs policymakers’ decisions, journalists’ reporting, and the strategic budgeting processes of many of New Hampshire’s leading nonprofits to most effectively meet community needs. We invite you to review NHFPI’s most sought-after Issue Briefs and blogs of 2023.

Issue Briefs

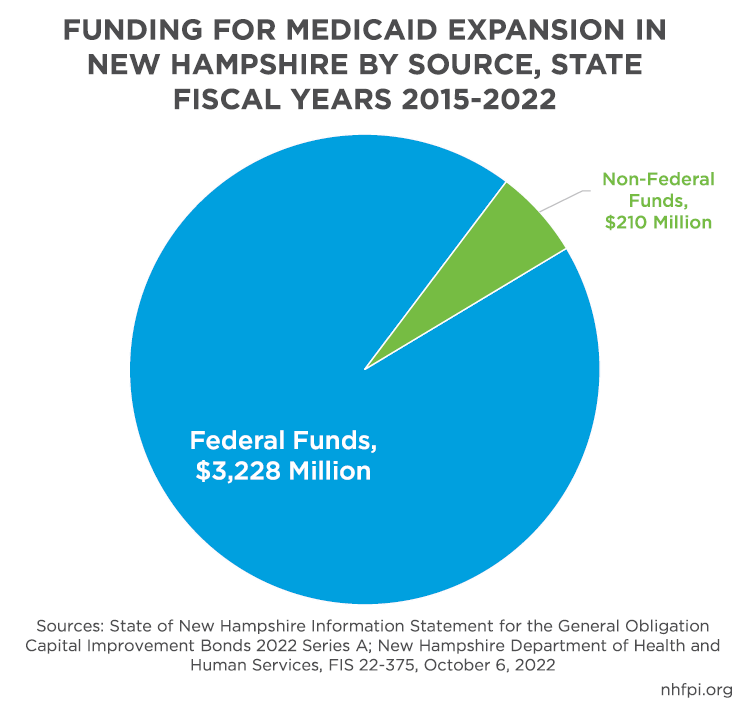

The Effects of Medicaid Expansion in New Hampshire

January 17, 2023

“Since the program’s beginning in 2014, over $3.2 billion from the federal government has funded health care for Granite Staters, providing financial stability for households experiencing hard times and helping ensure access to doctors, hospitals, and treatments for mental health or substance use disorders. These dollars have also helped the economy, and made more resources available for key parts of the health care system, including front-line health care staff and rural hospitals.”

| IMPACT | |

|---|---|

| Media Outlets Citing Resource | 19 |

| Top 3 Examples |

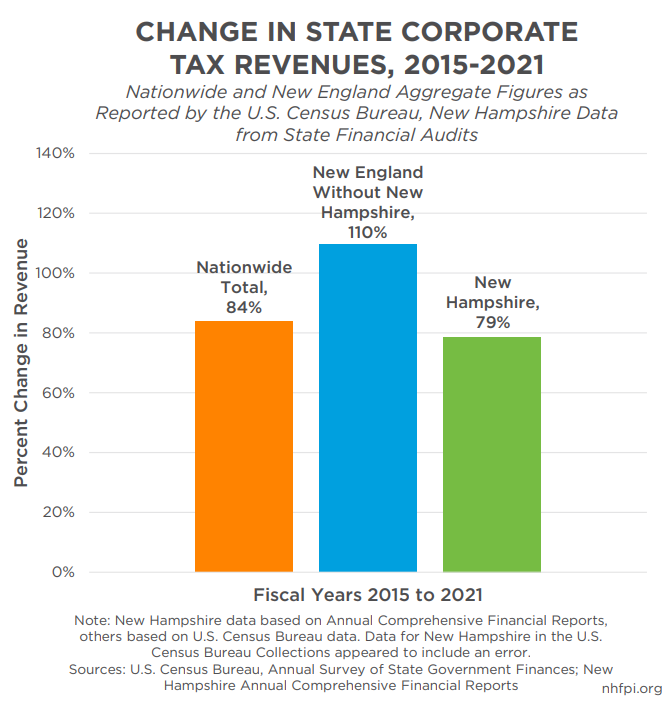

State Business Tax Rate Reductions Led to Between $496 Million and $729 Million Less for Public Services

August 2, 2023

“In total, between fiscal years 2015 and 2021, the most recent year with comprehensive data available from the U.S. Census Bureau, state corporate income tax revenues grew 84 percent nationally, and 110 percent in the New England states excluding New Hampshire, while New Hampshire’s combined [Business Profits Tax] and [Business Enterprise Tax] revenues grew 79 percent. State BPT rate changes were not likely the primary driver of these significant BPT revenue increases.”

| IMPACT | |

|---|---|

| Media Outlets Citing Resource | 13 |

| Top 3 Examples |

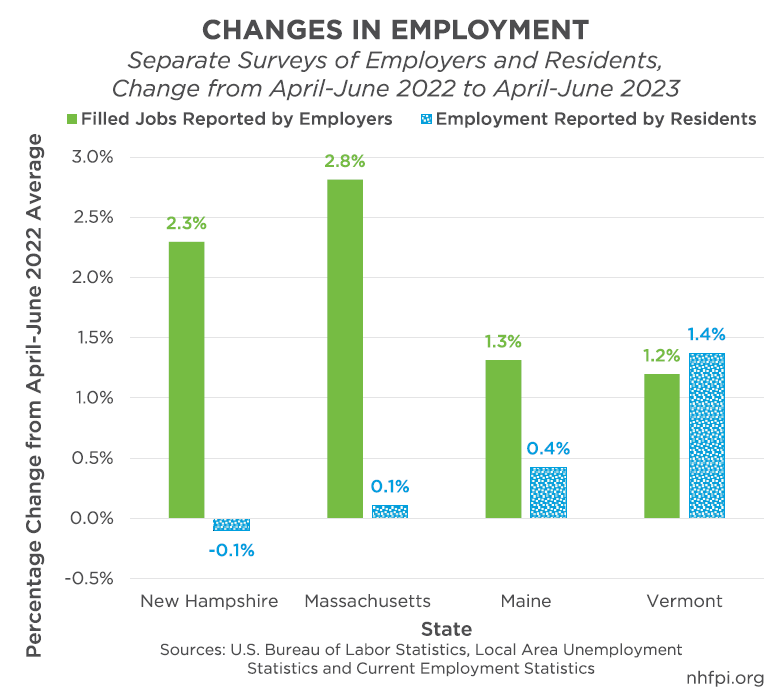

Granite State Workers and Employers Face Rising Costs and Significant Economic Constraints

August 31, 2023

“While a significant portion of New Hampshire’s workforce constraint is likely due to residents who have reached a traditional retirement age leaving the labor force, the lack of access and affordability of both child care and housing are key constraints that can be more readily addressed by policy, such as some of the initiatives in the recently-enacted State Budget. However, these constraints are significant, and will likely remain without further significant investment.”

| IMPACT | |

|---|---|

| Media Outlets Citing Resource | 9 |

| Top 3 Examples |

Blogs

New Hampshire Policy Points

January 25, 2023

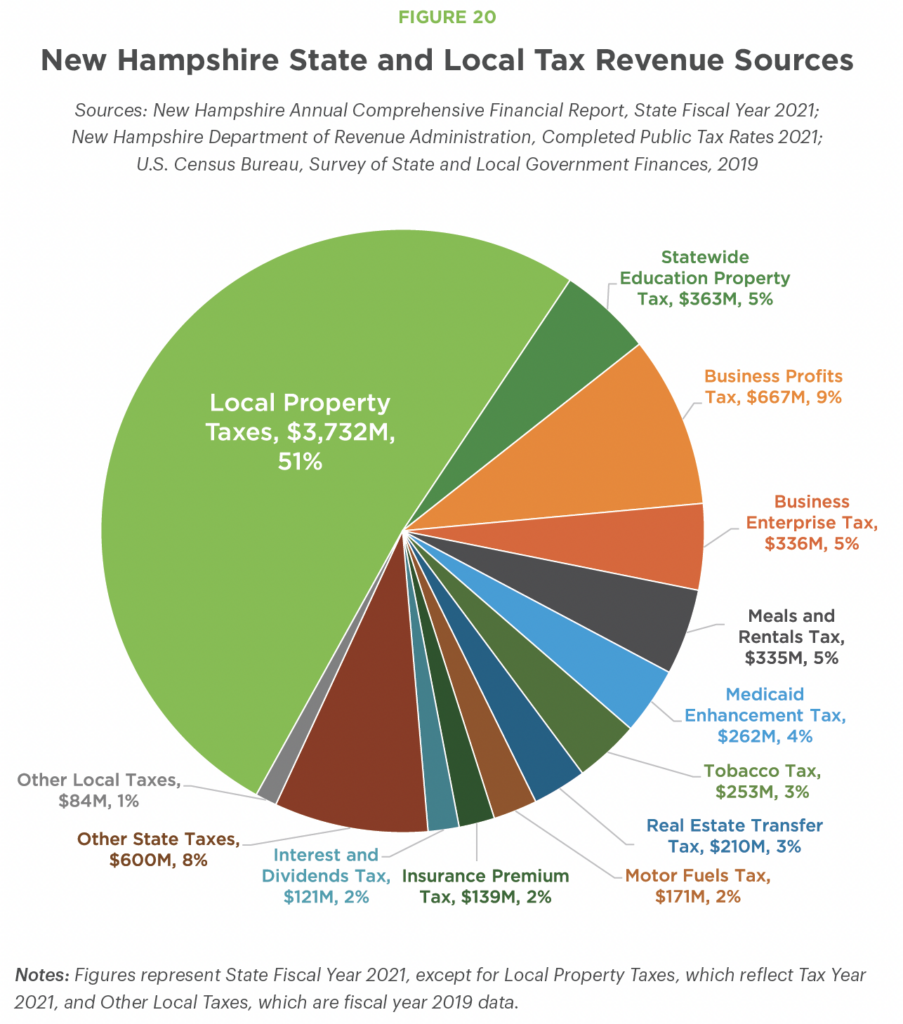

“When State policy decisions reduce revenue available to fund [State-supported programs for public services like road, bridge, and water infrastructure], such as during and in the year following the Great Recession, total program funding may decline. Local governments may increase property taxes to make up revenue shortfalls and keep funding for these programs stable, effectively shifting the cost for funding services from State revenues to local property taxes.”

This text was originally published as part of the inaugural edition of New Hampshire Policy Points. A free printed copy of this resource guide was sent to all current members of the New Hampshire Legislature and the State’s leading news outlets. Printed copies were also dispersed among Leadership New Hampshire’s 2023 class as well as the board of directors for nonprofits like the Endowment for Health.

| IMPACT |

|---|

| This text was originally published as part of the inaugural edition of New Hampshire Policy Points. A free printed copy of this resource guide was sent to all current members of the New Hampshire Legislature and the State’s leading news outlets. Printed copies were also dispersed among Leadership New Hampshire’s 2023 class as well as the board of directors for nonprofits like the Endowment for Health. |

Ten Facts About the New Hampshire State Budget

February 1, 2023

“The New Hampshire State Budget is a two-year plan for spending on State operations, grants to local governments, and contracts with private entities for delivering services. While 30 states have a new State Budget process each fiscal year, New Hampshire is one of 20 states that has a biennial budget, lasting two years.”

| IMPACT | |

|---|---|

| Media Outlets Citing Resource | 7 |

| Top 3 Examples |