This first edition of New Hampshire Policy Points provides an overview of the Granite State and the people who call New Hampshire home. It focuses on some of the issues that are most important to supporting thriving lives and livelihoods for New Hampshire’s residents.

New Hampshire Policy Points is intended to provide an informative and accessible resource to policymakers and the general public alike, highlighting areas of key concern. Touching on some important points but by no means comprehensive, each section within New Hampshire Policy Points includes the most up-to-date information available on each topic area as of October 2022.

The following section, How We Fund Public Services, is one of nine sections that frame this resource guide. Other sections cover Population and Demographics, Income and Economic Security, Economy and Jobs, Housing, Health, Education, Broadband Internet, and Transportation. The facts and figures included within this book provide useful information and references for anyone interested in learning about New Hampshire and contributing to making the Granite State a better place for everyone to call home.

To purchase a print copy or download a free digital PDF of New Hampshire Policy Points, visit nhfpi.org/policypoints

From roads and bridges to education and public health, New Hampshire governments provide a wide range of programs and services that benefit all Granite Staters. Public services in New Hampshire are provided and supported through state, county, and local governments, the last of which includes cities, towns, villages, school districts, and other local governing bodies.

Cities and most towns provide and support key services for their residents, including police and fire protection, waste management, and public infrastructure, among others. Local school districts, which can be integrated within municipalities or be governed separately, provide public education. Local governments fund these services primarily through the collection of taxes, with the majority of both tax and non-tax local revenue raised through property taxes.

County governments oversee the register of deeds, county attorneys, county sheriffs, correctional facilities, and county nursing homes. They are also responsible for funding most of the non-federal portion of Medicaid for long-term services and supports provided to eligible older adults and adults with physical disabilities who are county residents. County revenues rely on property taxes, Medicaid and limited Medicare payments, fees, and other locally-generated revenues to fund these services.

State government provides the widest variety of services in New Hampshire. Responsibilities of the state government include public health, human services, education, public utilities, economic development, environmental protection, public safety, transportation, and other areas. The State also regulates gambling and liquor sales, and raises revenue through taxes and fees. Like the federal government, the State government is divided into the executive, legislative, and judicial branches. The Governor and Legislature are responsible for crafting and adopting a State Budget every two years, which is the primary method of directing public investments to support residents, businesses, and the overall economy.

The State Budget

The New Hampshire State Budget funds most public services and programs at the state level.

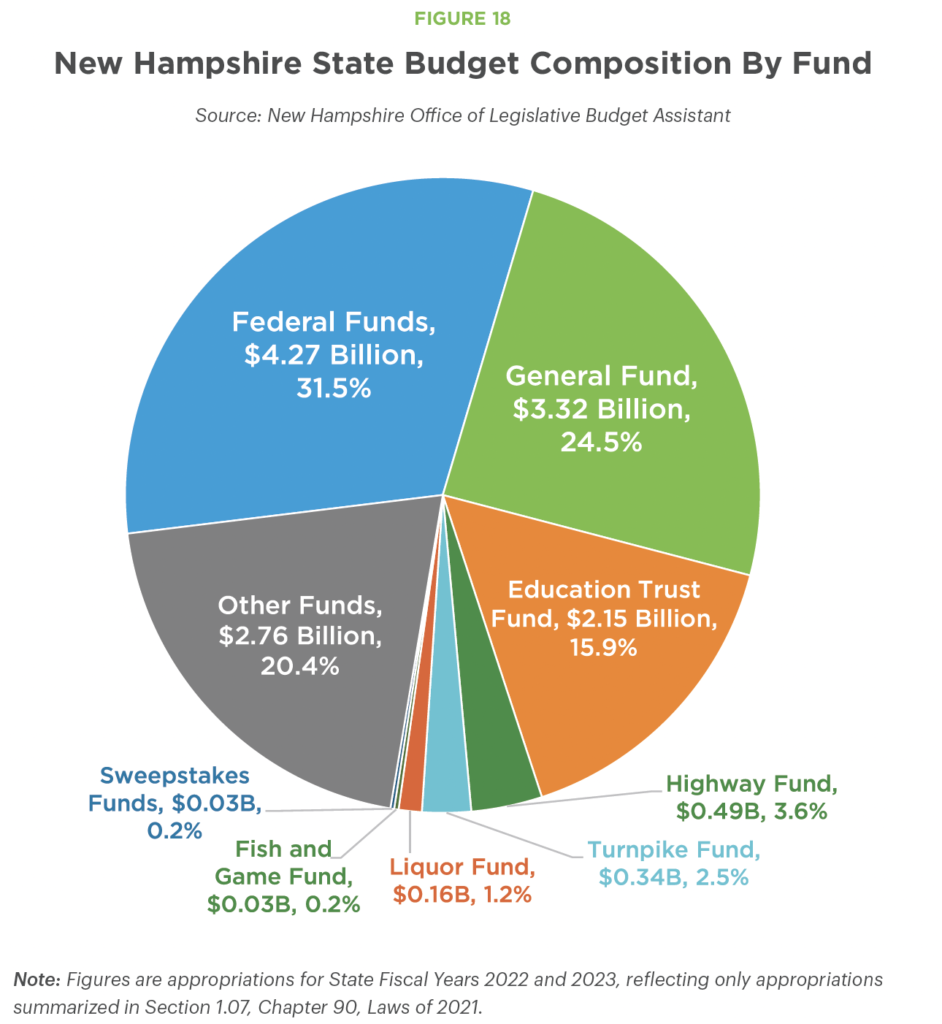

The State Budget is organized into funds serving different purposes, including funds for education, highways, wildlife management, and other areas. About 30 percent of State Budget-funded operations are supported by revenue from the federal government, including funding for key programs such as transportation, clean drinking water infrastructure and management, and aid to individuals and families through Medicaid and food assistance programs. State dollars can be used to leverage additional federal dollars as well, and New Hampshire is relatively typical among states in its reliance of federal funds for supporting needed services.

State Budget funds can be thought of as accounts, similar to those at a bank; revenue flows in from different sources for each fund, and money in different funds is used for designated purposes. The State Budget’s General Fund holds the resources that State policymakers can use for the widest variety of purposes, as revenues are primarily generated by State taxes. The Education Trust Fund is dedicated to funding the Adequate Education Grants, which provide resources on a per pupil basis to New Hampshire school districts to help cover costs. These two funds are often analyzed together, as they are frequently balanced together.

Examinations of State revenue often primarily focus on the dollars flowing to these two funds, as they draw on many of the same revenue sources. However, revenue flowing to the Highway, Turnpike, and Fish and Game Funds are also used to support specific State services.

State Revenue: Where Does the Money Come From?

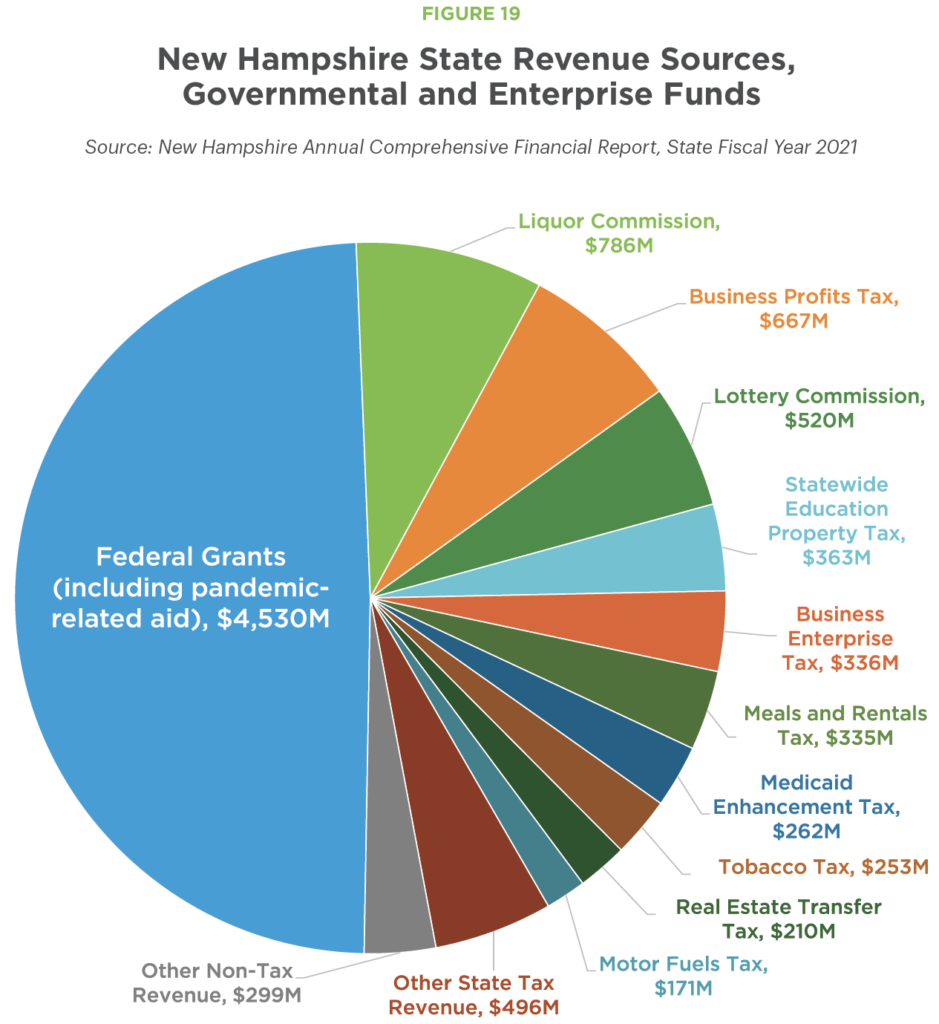

The State government has a relatively wide variety of revenue sources to help pay for public services. These include both various taxes and non-tax revenue sources, such as lottery ticket sales.

The Two Business Taxes

In Fiscal Year 2021, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET) were the single largest and third largest tax revenue sources, respectively. Often analyzed together, these two taxes jointly contribute about one-third of the annual revenue deposited into the General and Education Trust Funds. The BPT is similar to a traditional state corporate income tax, which is primarily based on net business revenues, while the BET is unique to New Hampshire and taxes businesses based on compensation, interest, and dividends paid or accrued. A company that doesn’t earn a profit likely will not need to pay BPT, but may still owe BET. Since 2015, both taxes have had a series of significant rate reductions.

Other Major State Revenue Sources

The Statewide Education Property Tax (SWEPT) is unique among tax sources because its revenues are not actually collected by the State, but are retained in local school districts to support State funding for Adequate Education Grants to support local public education. The State requires municipalities to charge this tax to fund amounts determined by the State. This tax raises $363 million each year, which is set in law and not adjusted for inflation, unless the total is altered by policymakers changing State law.

The Meals and Rentals Tax charges an 8.5 percent tax on food or beverage purchases from restaurants, including take-out meals and prepared meals or opened products from grocery stores. The 8.5 percent tax is also charged on hotel room and automobile rentals in the state for time periods of less than 180 days. In addition to contributing to the General and Education Trust Funds, portions of the tax have supported the State’s travel and tourism development agency, municipalities at an amount based on their population, and school building bonds.

The Tobacco Tax charges $1.78 per pack of 20 cigarettes and adjusts proportionally for the number of cigarettes in packs of different sizes. The first $1.00 of the $1.78 goes to the General Fund, with the remaining $0.78 per pack supporting the Education Trust Fund. Other tobacco products are taxed at 65.03 percent of the wholesale price.

The Real Estate Transfer Tax is paid by both the buyer and the seller in any sale of, or sale of interest in, real estate, and is largely driven by single-family home purchases. The tax is $0.75 per $100 charged to the buyer and the seller, with one-third of tax revenues going to the Education Trust Fund and the remainder going to the General Fund.

The Interest and Dividends Tax raises revenue from individuals who earn passive income collected through existing assets they own, and is largely paid by people who have high incomes. Interest earned from bank accounts, bonds, debt payments, and other investments are taxed at 5 percent, as are dividends and distributions collected from owning stocks and other forms of company ownership. The first $2,400 for individuals or $4,800 from joint filers is exempt, with additional exemptions for older individuals or individuals with certain disabilities. Interest and Dividends Tax revenue supports the General Fund, but this tax is being phased out under current law.

The State also collects revenue through the Insurance Premium Tax on insurance companies, the Motor Fuels Tax on gasoline and other fuels, the Medicaid Enhancement Tax for certain health services provided by hospitals, the Communications Services Tax applied to select two-way communications technologies, and the Utility Property Tax on property owned by utility companies. Key non-tax revenue sources include alcohol sales through the Liquor Commission, gaming revenue through the Lottery Commission, and revenue from tolling on New Hampshire turnpikes.

Local Revenue: Where Does the Money Come From?

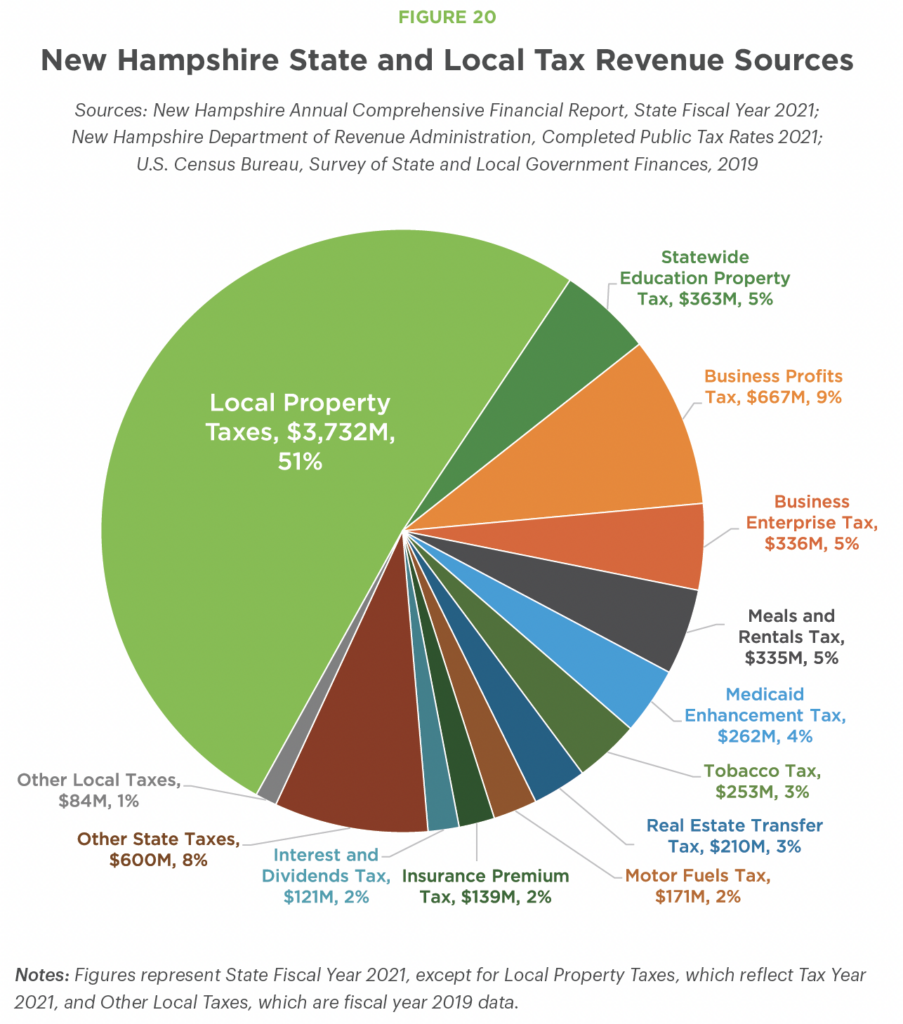

While the tax revenue picture is relatively diverse and varied at the State level, local tax revenues are dominated by property taxes, which comprise 98 percent of all local tax revenues.

Local Property Taxes

Prior to the arrival of COVID-19 relief funds from the federal government, approximately 60 percent of all local government revenue, including State and federal grants, came from property taxes. The majority of all State and local tax dollars paid in New Hampshire are property taxes. For New Hampshire businesses specifically, about half of all State and local tax dollars collected from businesses come through property taxes, even when accounting for the State’s two business-focused taxes. Local taxes account for the majority of all tax revenue collected by State and local governments in New Hampshire.

State Aid to Local Governments

The State government provides financial support to local governments in a variety of ways. The State shares revenue with school districts through Adequate Education Grants provided on a per-pupil basis, school building aid through an application process, and additional support for students with special education needs. The State shares some Meals and Rentals Tax revenue with municipal governments based on their populations. Other revenue sharing programs include assistance for water and environmental infrastructure improvements as well as dedicated revenues for road and bridge work.

When State policy decisions reduce revenue available to fund these programs, such as during and in the year following the Great Recession, total program funding may decline. Local governments may increase property taxes to make up revenue shortfalls and keep funding for these programs stable, effectively shifting the cost for funding services from State revenues to local property taxes.

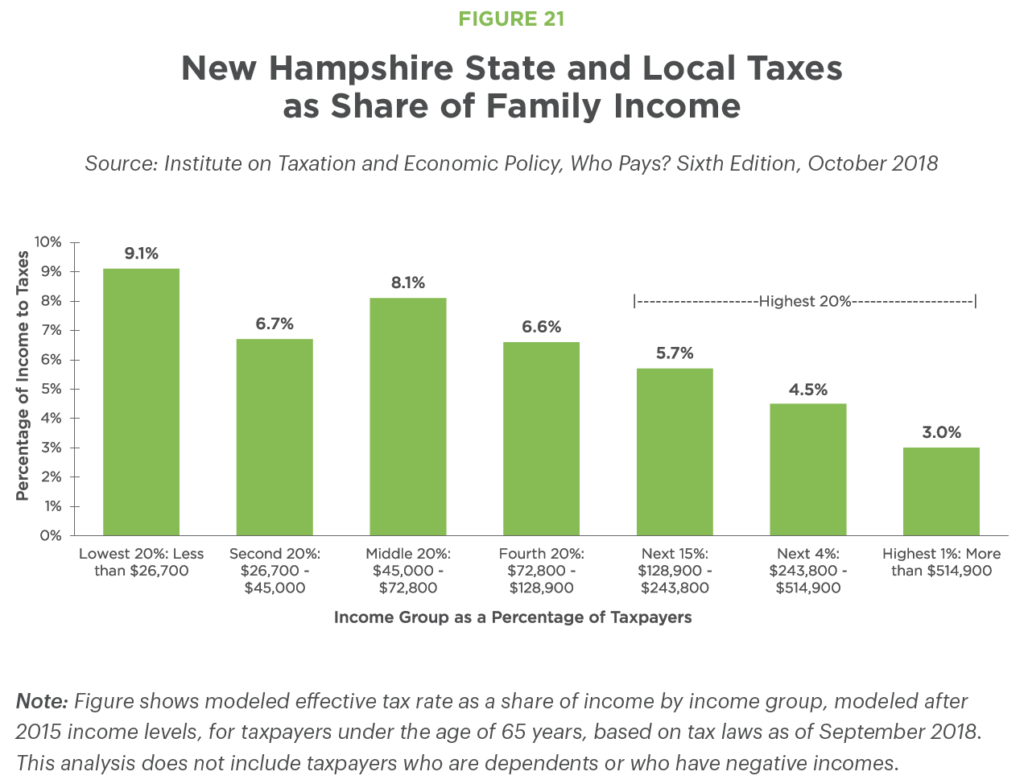

Impact of State and Local Taxation

Property taxes, the largest of any type of State or local tax in New Hampshire, are not directly responsive to people’s ability to pay. As a result, taxes paid to state, county, and local governments in New Hampshire accounted for about 9.1 percent of income for the lowest 20 percent of income earners who are not older adults, according to a 2018 analysis from the Institute on Taxation and Economic Policy. For the middle 20 percent of income earners, the percentage of income going to state, county, and local taxes was 8.1 percent, and for the top 1 percent of earners, the effective tax rate fell to an estimated 3.0 percent.

Property taxes and taxes on sales, such as the Meals and Rentals Tax, had the largest impacts on individuals with low and moderate incomes, while the percentage of income required to pay the Interest and Dividends Tax was highest for the top 1 percent of income earners.

Pandemic Related Federal Aid

Signed into law on March 11, 2021, the federal American Rescue Plan Act (ARPA) was designed to provide direct support to individuals, families, states, and local governments to address the health and economic impacts of COVID-19. ARPA provides grants for specific purposes as well as significant flexible funds to be used by state and local governments for four broad purposes: to respond to the negative health and economic impacts of the pandemic, to provide premium pay for essential workers, to offset losses in public revenue, or to invest in water, sewer, and broadband infrastructure. Within this framework, these funds can be used to improve long-term health and economic outcomes and support communities disproportionally impacted by the pandemic. The combined federal funding that flowed to New Hampshire’s State and local governments in flexible federal ARPA funds was nearly $1.5 billion.

The State also received flexible funding from the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Neither set of these flexible federal funds have been allocated through the traditional State Budget process as of mid-2022.

• • •

This publication and its conclusions are based on independent research and analysis conducted by NHFPI. Please email us at info@nhfpi.org with any inquiries or when using or citing New Hampshire Policy Points in any forthcoming publications.

© New Hampshire Fiscal Policy Institute, 2022.