State revenue collections in January continued to improve the State’s fiscal bottom line overall, while still sending mixed signals about the future strength of ongoing revenue sources.

The New Hampshire General Fund and Education Trust Fund collected a combined $193.1 million in revenue in January, $8.3 million (4.5%) more than planned. However, a total of $16.5 million was collected from the State’s 2.5-month-long tax amnesty program during January. Continuing a trend from December, the tax amnesty program was the reason for a revenue surplus last month, as the total combination of other revenue sources would have fallen short of the target.

Tax Amnesty Buoys Receipts

The tax amnesty program, enacted as part of the current State Budget, allows people and businesses with unpaid taxes to pay past-due amounts without the usual nonpayment penalties that the State typically charges, and permits lower interest costs due to the later payments than typically would be charged. The program runs from December 1, 2025 through February 15, 2026.

The Legislature projected the tax amnesty program would generate $5.0 million for the combined General and Education Trust Funds. The previous tax amnesty program, implemented in State Fiscal Year (SFY) 2016, generated $19.0 million. So far, the SFY 2026 tax amnesty program has generated $62.3 million, with about half of the month remaining before the one-time program expires.

Without the tax amnesty program, combined revenues to the General and Education Trust Funds would have been $14.0 million (1.0%) below amounts anticipated by the State Revenue Plan and behind last year’s collections by $25.3 million (1.9%). These figures suggest that other revenue sources would not have generated enough revenue to help ensure a balanced State Budget without the boost from tax amnesty receipts, and that revenues are not growing relative to last year.

The lack of yearly growth is due in large part to the repeal of the Interest and Dividends Tax, which eliminated a major State revenue source; however underperformance in key revenue sources have also contributed to lower receipts.

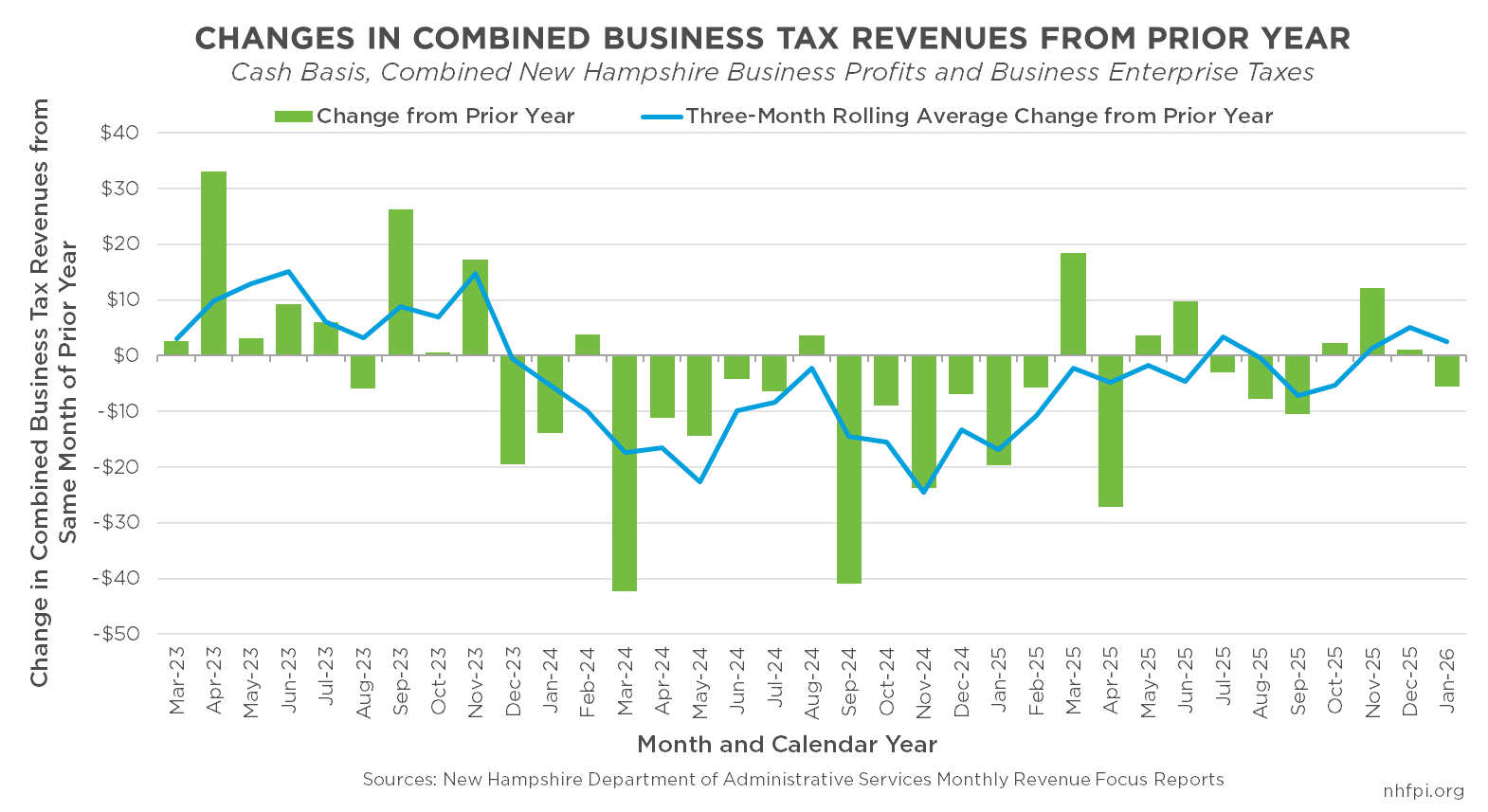

Business Taxes Sink, Breaking Recovery Trend

January is not a particularly important month for receipts from the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), as these two business taxes are typically paid quarterly by filers and most businesses do not have a quarterly estimate payment due in January. However, as business taxes accounted for about 34% of all State tax revenue last fiscal year, they remain important sources of revenue relative to most others in every month of the year.

Combined BPT and BET revenues were $19.2 million (37.1%) below the amount expected by the State Revenue Plan in January, and $5.5 million (14.5%) below last year’s January receipts. For SFY 2026, which began on July 1, total business tax revenues are $40.1 million (7.7%) behind plan and $11.2 million (2.3%) short of last year as of the end of January.

The January shortfall breaks a three-month trend during which business tax revenues grew faster than receipts from the same month the previous year. In October, November, and December, combined business tax revenues were higher than in the same months of the previous year; this was the first three consecutive months of year-over-year growth since September to November 2023. For all but five of the 22 months between November 2023 and October 2025, business tax receipts had dropped relative to the year before, even prior to adjusting for inflation. Whether January revenues signal a resumption of a trend of lower revenues or are an aberration on a path to resumed business tax revenue growth will be revealed when more months of data are available.

Other Revenue Growth Helpful But Limited

The General and Education Trust Funds benefited from certain other revenue sources performing better than anticipated.

Lottery Commission revenues were above planned amounts by $8.4 million (42.4%) in January, propelled by one high jackpot amount. However, Video Lottery Terminals have continued to come online more slowly than anticipated and generated $1.9 million in January, $4.0 million below the $5.9 million target.

Real Estate Transfer Tax revenue remained strong, continuing a streak of year-over-year increases thus far in SFY 2026. Receipts were $3.8 million (21.8%) above anticipated amounts for January, reflecting both a larger number of transactions and higher transaction prices for properties. Some of these transactions, however, were due to delayed receipts from Hillsborough County and reflect about a week of activity that actually occurred in November, while the rest of January’s revenues reflect December sales.

The State continues to collect more than anticipated from interest on cash holdings. State cash holdings include funds from prior surpluses and federal funds, particularly one-time COVID-19 pandemic-related funds. While these revenues are about $19.3 million higher than those incorporated into the State Revenue Plan to date in SFY 2026, they are $18.0 million lower than last year. The decline likely reflects the spenddown of one-time federal funds, the use of dollars from prior revenue surpluses, and lower interest rates. This revenue source has supported the State’s General Fund substantially for some time while other revenue sources have fallen below their targets, but is a declining resource itself.

Forecasts Suggest Trend Will Continue

As required by law, the State’s Department of Administrative Services published an updated revenue forecast in January, using data from its own revenue sources and other agencies, for the period through the end of the budget biennium on June 30, 2027. The forecast suggests that some of the revenue trends observed to date will continue.

According to the forecast, lottery revenues are expected to be strong, while video lottery terminal revenues specifically will likely fall short and offset lottery’s overall overperformance. Interest on cash holdings will be stronger in the first year of the budget than expected, but weaker in the second year. Liquor Commission profits will be lower than originally anticipated. Highway Fund revenues are expected to fall short of target, in part due to lower-than-anticipated motor vehicle title and registration revenues.

The New Hampshire Department of Revenue Administration did not recommend changes to its forecasts at this time, suggesting that total business tax receipts, Real Estate Transfer Tax revenues, and other key State tax revenue sources may remain on target. In total, ongoing revenue sources are forecast to be under planned amounts, but the tax amnesty program’s receipts will bring total General and Education Trust Funds combined revenues into surplus for the biennium.

While the existing trends and forecasts are informative, key months of the fiscal year remain ahead, and it is only the first fiscal year of the two-year budget biennium. State revenue collections for SFY 2026 to date total about 45.3% of the expected amount for the year, indicating that less than a quarter of revenue collections for the State Budget’s duration have occurred. Collections in March, April, and June will be key to assessing whether State revenue sources are meeting their targets this fiscal year and to inform planning for the next State Budget.