The State Senate, using the Governor’s operating budget proposal from February as a baseline, crafted a State operating budget that reduces spending though changes to program funding levels and to anticipated federal funds. The Senate reduced appropriated spending from the Governor’s budget by $324.7 million, accomplished in part by planning to authorize up to $237.8 million through other mechanisms outside of the State Budget. About 63 percent of the program areas were funded at levels proposed by Governor Sununu’s budget, and while the Senate budget grows from the current State fiscal year (SFY) 2017 budget by approximately 1.7 percent for SFY 2018, about 41.3 percent of program areas would receive the same funding or less in SFY 2018.

Relative to the Governor’s budget proposal, the Senate boosted funding to key areas related to child protection, mental health care, new Medicaid services, payments to medical providers, travel and tourism marketing, and support for certain State retiree health premiums. While it retained the Governor’s proposal for a scholarship program, the Senate eliminated the Governor’s proposed full-day kindergarten subsidy and Gateway to Work programs, revised downward expected student enrollment statewide, reduced Medicaid caseload projections, decreased funding for certain positions in the judicial branch and the prison system, and reduced the rates of the State’s two key business taxes. The Senate also trimmed funding for the Sununu Youth Services Center while requiring partial repurposing of the Center and permitting a new funding stream to open up from the Alcohol Abuse Prevention and Treatment Fund.

This Issue Brief reviews the Senate’s SFY 2018-2019 operating State Budget proposal as presented in House Bills 144 and 517, with an emphasis on changes from the Governor’s proposed budget.[1] Most dollar-value changes presented in this Issue Brief are changes for the biennium relative to the Governor’s proposal. The vessels for the two State Budget bills are typically House Bills 1 and 2, but neither bill passed the House, so two different House bills were amended to include the Governor’s proposal. For more information on the Governor’s State Budget proposal, which the Senate Finance Committee used as a basis for its amendments, see NHFPI’s Issue Brief, Governor Sununu’s Proposed Budget. For more information on the New Hampshire State Budget process and recent funding trends, see NHFPI’s Building the Budget resource. Both are available online at nhfpi.org.

The Topline Numbers

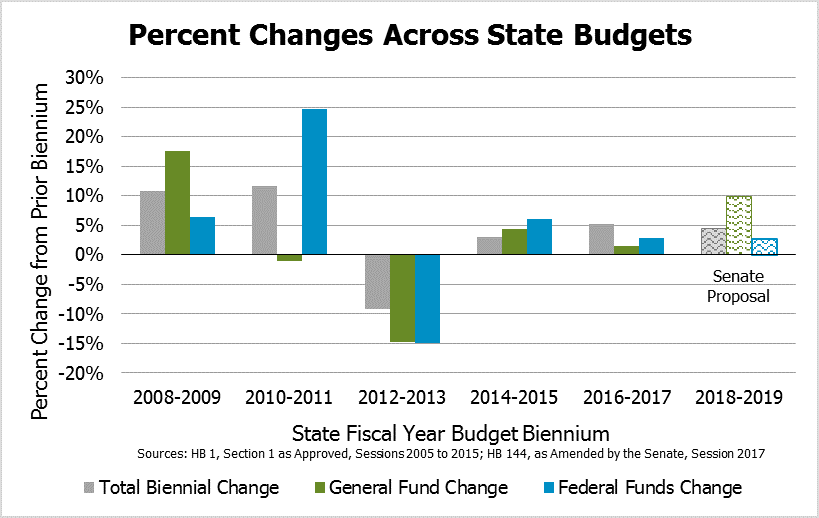

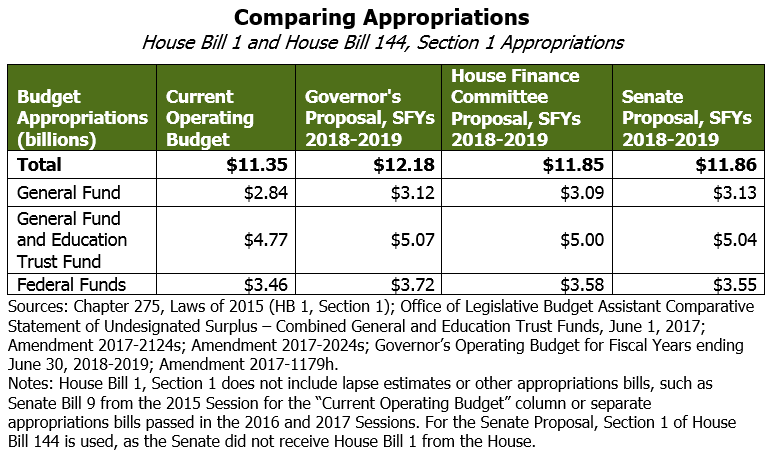

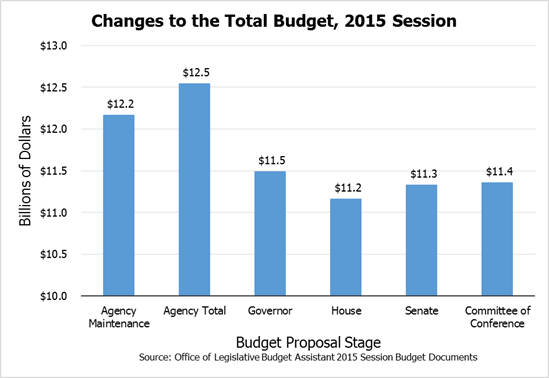

The Senate’s proposed budget appropriates less money than the Governor’s proposal, reducing the $12.185 billion topline number proposed by Governor Sununu by $324.7 million to $11.860 billion. The growth rate over the biennium relative to the SFY 2016-2017 State Budget (as passed in House Bill 1, Section 1, Laws of 2015) is 4.5 percent, lower than both the Governor’s proposal at 7.3 percent and the growth of the SFY 2016-2017 budget over its predecessor, which was 5.1 percent for all funds. Relative to the House Finance Committee’s budget proposal, the Senate’s budget is $5.9 million (0.05 percent) higher in total. The General Fund portion is $38.0 million (1.23 percent) larger in the Senate budget than the House Finance Committee’s budget and $3.8 million (0.12 percent) larger than the Governor’s proposal, while appropriations of federal funds transfers are $28.3 million (0.79 percent) smaller than the House Finance Committee budget and $169.5 million (4.56 percent) smaller than federal funds included in the Governor’s proposed budget. Without inflation adjustments, the Senate proposal’s General Fund appropriations are smaller than the SFYs 2008-2009 and SFYs 2010-2011 budgets, but larger than the biennial budget appropriations in the intervening years.

Relative to the Efficiency Budget requests from State agencies, which were capped by expected revenues forecast by former Governor Hassan’s administration, the Senate budget proposal removes $440.4 million in budgeted expenditures. State agencies had requested $12.300 billion in their Efficiency Budget requests, which used revenue estimates that were approximately $23.7 million higher than those used by the State Senate in its budgeting decisions.[2] The larger difference in spending decisions relative to revenue projections stems, in part, from decisions regarding use of the expected surplus from SFYs 2016 and 2017 and budgeting decisions regarding federal transfers.

Changes in Budgeted Federal Transfers

Over 30 percent of the current operating State Budget is funded through federal transfers. These appropriations are generally associated with specific federal programs that provide the State with grants or matching dollars to perform certain functions. The largest of these programs is Medicaid, a health insurance program for certain disadvantaged or vulnerable populations, which accounted for approximately $2.0 billion in State expenditures in New Hampshire in SFY 2016. The base federal matching rate for Medicaid requires that the State provide one dollar for each dollar provided by the federal government, with different matching rates for other facets of the Medicaid program.[3]

Certain federal transfers may be accepted through appropriations made by the Joint Legislative Fiscal Committee, which meets most months and manages certain changes to the operating budget over its duration. The Fiscal Committee, which includes five members of the House and five of the Senate, has the authority to accept transfers, reallocate funds, and authorize certain new expenditures during the budget biennium without convening the entire Legislature to alter the State Budget, often in conjunction with approval from the Governor and the Executive Council. In recent years, the Fiscal Committee has approved approximately $200 million in additional appropriations during budget biennia.[4]

Both the House Finance Committee and the Senate removed expected federal transfers included in the Governor’s budget. The House Finance Committee anticipated up to approximately $219.1 million coming through the Fiscal Committee or another legal authority and removed it from the State Budget appropriations.[5] The Senate removed just under $237.8 million in federal and other alternatively-authorized funds from its version of the State Budget that were identified as expenditures expected to be moved through the Fiscal Committee or through another authorizing authority.[6]

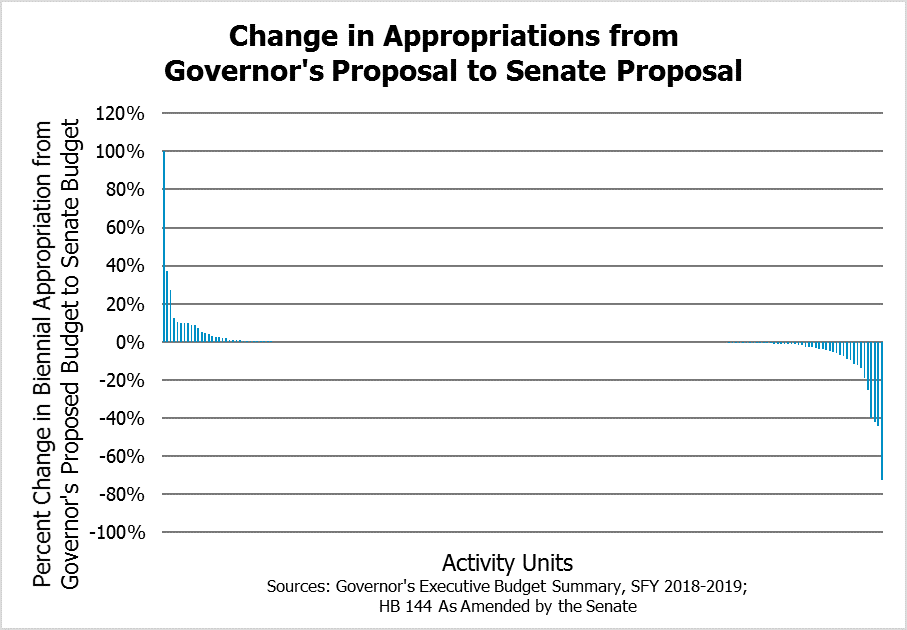

Overall Comparisons with the Governor’s Budget and the Efficiency Budget

The State Senate made some substantial changes from the Governor’s proposed budget, but retained the Governor’s proposed spending levels in the majority of State activities. The Governor’s proposed budget and the Senate’s budget proposal are divided up into 208 Activity Units, which offer more granularity than analyzing funding at the State agency level. Of these Activity Units, 131 (63.0 percent) were unchanged from the Governor’s proposed budget. The Senate increased funding in 32 Activity Units (15.4 percent), and decreased funding in 45 Activity Units (21.6 percent).

Relative to the Efficiency Budget request from State agencies, the Senate boosted fewer Activity Units above the requested amounts than the Governor did. Of the 199 Activity Units with matching identifiers (some Activity Units do not have a matching pair across budgets due to agency reorganizations), the Senate increased funding for 65 (32.7 percent) of them, relative to the Governor’s proposed increase to 74 (37.2 percent) of Activity Units above the Efficiency Budget requests. The Senate allocated less than the Efficiency Budget request to 108 Activity Units (54.3 percent) than the Governor’s budget, which proposed appropriating less than the Efficiency Budget amounts to 94 Activity Units (47.2 percent).

The adjusted authorized funding levels for SFY 2017’s existing operating budget offers a point of comparison for the Senate’s proposed SFY 2018 budget, but does not account for planned reorganizations of agencies or previous changes in law that are coming into effect (those changes are accounted for in the Efficiency Budget request). The Senate’s version of the budget grows from the SFY 2017 Authorized Adjusted budget by $101.3 million (1.75 percent) for SFY 2018. Considering 208 matched Activity Units, 122 (58.7 percent) are larger in the Senate proposal, 18 (8.7 percent) are appropriated the same amount as in SFY 2017, 68 (32.7 percent) receive less funding. The Governor’s proposed budget reduced funding in SFY 2018 relative to SFY 2017 Authorized Adjusted amounts for 64 Activity Units (30.8 percent).

Expenditure Changes by Category

Through both adjustments to proposed appropriations in House Bill 144 and changes to legal language in House Bill 517, the State Senate’s proposed budget makes changes to the planned operations of State agencies. An overview of those changes, organized by the six broad budget categories, is provided below.[7] Changes in funding are presented for the two-year biennium and relative to the Governor’s proposal unless otherwise indicated.

Health and Social Services

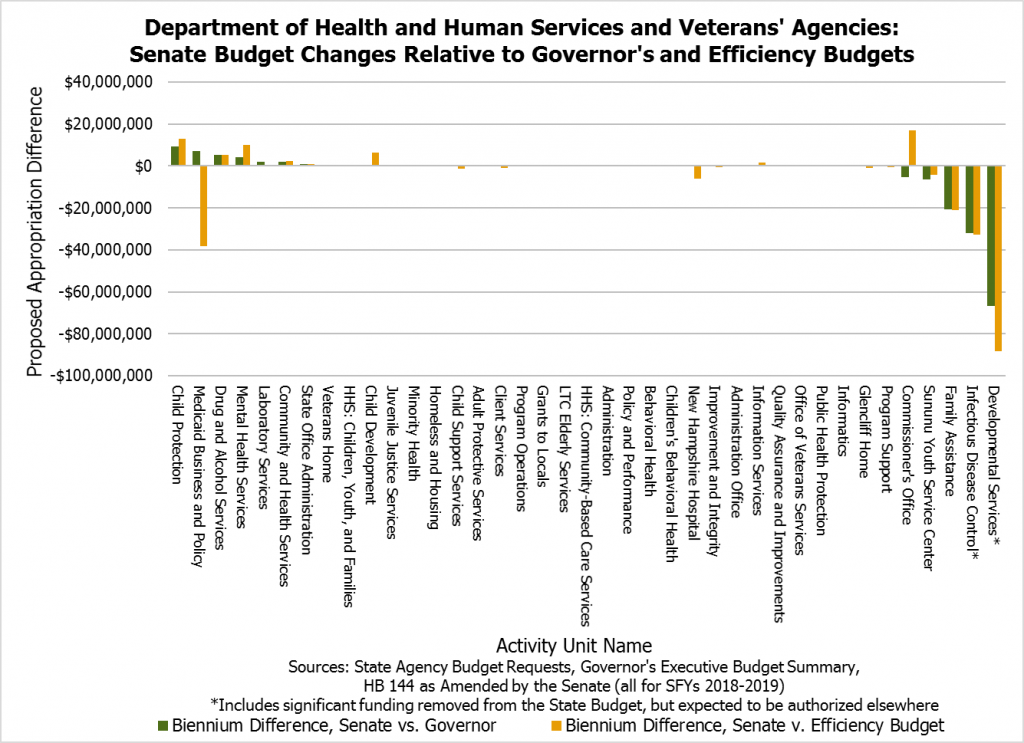

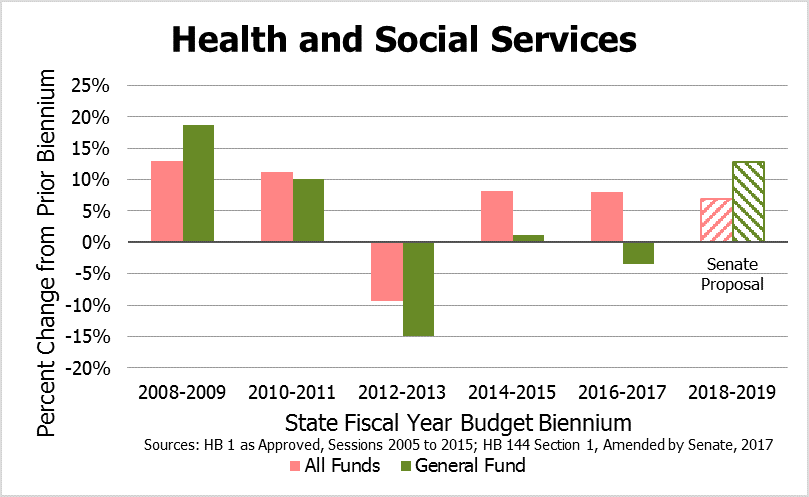

The Health and Social Services category is the largest category of spending in the State Budget, accounting for roughly 40 percent of all appropriations. This category consists, by appropriation, almost entirely of the Department of Health and Human Services (DHHS), with the New Hampshire Veterans’ Home and the Office of Veterans’ Services as the only agencies categorized as Health and Social Services and outside of the DHHS.

The graph presented above shows how the Senate’s version of the State Budget compares to the Governor’s budget proposal (in green) and the Efficiency Budget proposal (in orange) from the State agencies prior to the budget process beginning. The names listed are the names of Activity Units, and vary greatly in the total amount of dollars allocated to them; only the changes between budgets are shown here, ordered by the Senate’s changes relative to the Governor’s proposed budget.

The large negative changes in the Division of Developmental Services are the result of $70.1 million in federal funds for the Medicaid-to-Schools program being removed from the State Budget with the expectation that the Fiscal Committee, the Governor, and the Executive Council will accept the federal transfers when they come in. Appropriations for payments to providers for those with developmental disabilities increased $53.9 million over the last biennium in both the Governor’s budget and Senate budget proposals, with the Senate adding a provision authorizing the Fiscal Committee, Governor, and Executive Council to allocate $4.0 million more in General Funds in each year if expenditures are greater than appropriations. Similarly, the Bureau of Infectious Disease Control saw a $32.0 million reduction in the Senate’s version of the budget for vaccine purchases, but the Senate determined funds could be authorized through a non-budget statute, so the appropriation was removed from the budget. Reductions at the Division of Family Assistance are due to the Senate’s elimination of the Gateway to Work program that was proposed in Governor Sununu’s budget.

Mental Health and Medicaid Funding

The Bureau of Mental Health Services received an approximately $4.3 million boost from the Senate Committee over the Governor’s budget proposal. The Senate’s proposed budget requires the DHHS to seek vendors to provide 20 transitional and community residential beds in SFY 2018 and up to 40 beds in SFY 2019, providing $7.7 million over the biennium for the initiative between allocations to the Bureau of Mental Health and the Medicaid office. The DHHS must also develop a plan to safely move the remaining 24 youths at New Hampshire Hospital and continue to provide needed care by November 2017. Additionally, the DHHS must seek proposals for mobile crisis teams and apartments. The Senate also allocated $0.6 million for eight peer crisis respite beds to the Bureau of Mental Health. The funding for Assertive Community Action Teams was reduced by $3.0 million relative to the Governor’s proposal, and approximately $4.9 million was allocated to fund one mobile crisis team and apartments, split between the Bureau of Mental Health and the Medicaid office Activity Unit lines in the budget. Also split between those two Activity Units were just over $1.2 million for up to 20 designated receiving facility beds. The Senate’s budget requires the DHHS to appoint a mental health medical supervisor to collect information on patients and treatment options and assist in assignment of appropriate services. The proposal provides for a universal online prior authorization form for drugs used to treat mental illness and sets a timeline for approval of prior authorization requests, with failure to approve or disapprove by the following business day leading, in most cases, to automatic approval.

The Senate budget proposes creating a Medicaid home and community-based behavioral health services program for children with severe emotional disturbances whose needs cannot be met through traditional behavioral health services. This service, funded at over $5.3 million, would include wraparound care coordination and participation, in- and out-of-home respite care, and family and youth peer support.

The Senate also included an $11.1 million reduction in Medicaid funding, which stems from an assumed 2 percent drop in Medicaid Managed Care caseloads in SFY 2018, rather than the 1 percent assumed by the Governor’s budget.

Rate Increases and Child Protection

Changes at the Commissioner’s Office and the Bureau of Child Protection are related to provider rate increases. The Governor allocated $20.0 million to the Commissioner’s Office to boost payments to providers; the Senate added directions for those funds in a footnote and made corrections to the mix of federal and General Fund dollars, which resulted in a reduction. The Bureau of Child Protection in the Division of Children, Youth, and Families received a funding boost of $8.7 million over the Governor’s proposed budget for provider rate increases and additional bed capacity for community placement of youths eligible for the Sununu Youth Services Center. The Senate also added $5.9 million for rate increases for nursing home Medicaid services.

The proposed budget would clarify the definition of an “unfounded report” in the Child Protection Act and permit those unfounded reports to be admissible in proceedings to establish a pattern of conduct. There is a $1.0 million increase in funding for domestic violence crisis centers at Child Protection, and a $400,000 decrease in employee training appropriations in the second year of the budget relative to the Governor’s proposal. The budget would also create an Associate Commissioner position at the DHHS specifically charged with overseeing the Division of Children, Youth, and Families, among other duties.

Sununu Youth Services Center and Alcohol Abuse Prevention and Treatment Fund

The Senate shaved $6.6 million off the Governor’s proposal for the Sununu Youth Services Center budget. The proposed budget also makes changes to the statutes surrounding juvenile justice and the use of the Sununu Youth Services Center. The proposed budget limits the extent to which minors may be committed to facilities for drug possession violations, and requires that minors be retained for only 21 days or less while awaiting placement or hearing except in certain, court-approved circumstances. The DHHS would also, by September 2017, have to develop a plan to move at least 35 minors who are not serious violent offenders from the Sununu Youth Services Center to Medicaid-eligible settings. Excess capacity at the Sununu Youth Services Center would then be redeveloped, with a sum of $2.0 million for SFY 2018, to provide inpatient and outpatient drug treatment services for eligible youth.

The proposed budget also enables funds from the Alcohol Abuse Prevention and Treatment Fund to be used for operational costs at the Sununu Youth Services Center without requiring Fiscal Committee approval, and identifies certain amounts to be directed to specific purposes, including funding for two positions in the Governor’s Office of Substance Use Disorders and Behavioral Health and for the Boys and Girls Clubs’ “Smart Moves” program. The Senate followed Governor Sununu’s recommendation and doubled the required percentage of the Liquor Commission’s gross profits contribution to the Alcohol Abuse Prevention and Treatment Fund from 1.7 percent to 3.4 percent. However, the Committee did not include the Governor’s proposed provision to boost the requirement to 4 percent if 80 percent of the dollars allocated to the fund are encumbered in any SFY.

Temporary Assistance for Needy Families Funds

The Child Development Program’s funding stream changes in part, with $5.8 million of General Fund appropriations being replaced by $5.8 million from Temporary Assistance for Needy Families (TANF) federal funds. Another $2.2 million in TANF funds would replace General Fund spending in the Bureau of Child Protection, also without an overall funding change. The Senate’s budget also retains the Governor’s proposed linking of the TANF monthly cash benefit to 60 percent of the federal poverty guidelines, with annual adjustments.

The Governor’s proposed Gateway to Work program, which would have been funded with $20.8 million in TANF dollars in the Governor’s proposal, was not included in the Senate version of the State Budget.

Other Changes

The Senate’s proposed budget:

- Requires the DHHS to produce a plan for the relocation of the designated receiving facility for people with developmental disabilities that is currently on the Laconia State School property by June 2021.

- Raises the cap on county payments to the State for long-term care services.

- Reestablishes, and funds at $200,000, the previously-suspended foster grandparent program and, with $750,000 in funding, the congregate housing program.

- Provides contingent funding, dependent on matching dollars from counties, to develop a long-term care plan for the Medicaid-eligible nursing home population and expected demographic changes.

- Reduces funding for utilities at the Glencliff Home by $265,000 to account for the conversion to biomass energy.

- Increases funding for a news and information service for those who are blind or otherwise unable to read newsprint from $28,000 to $31,500 annually.

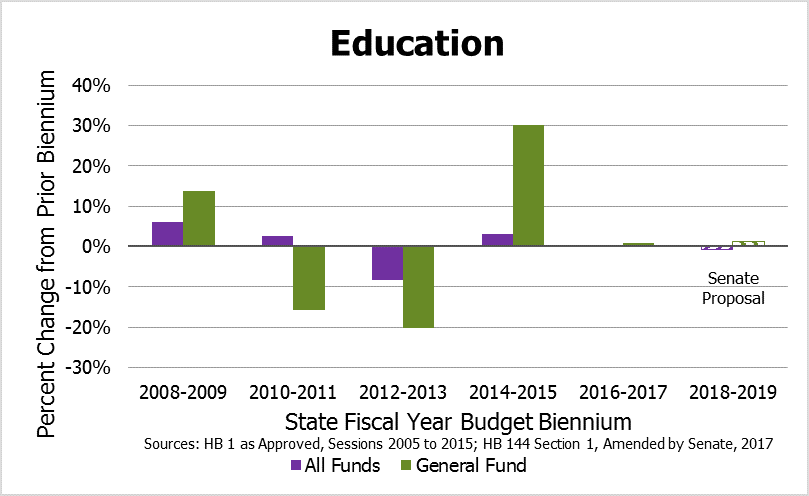

Education

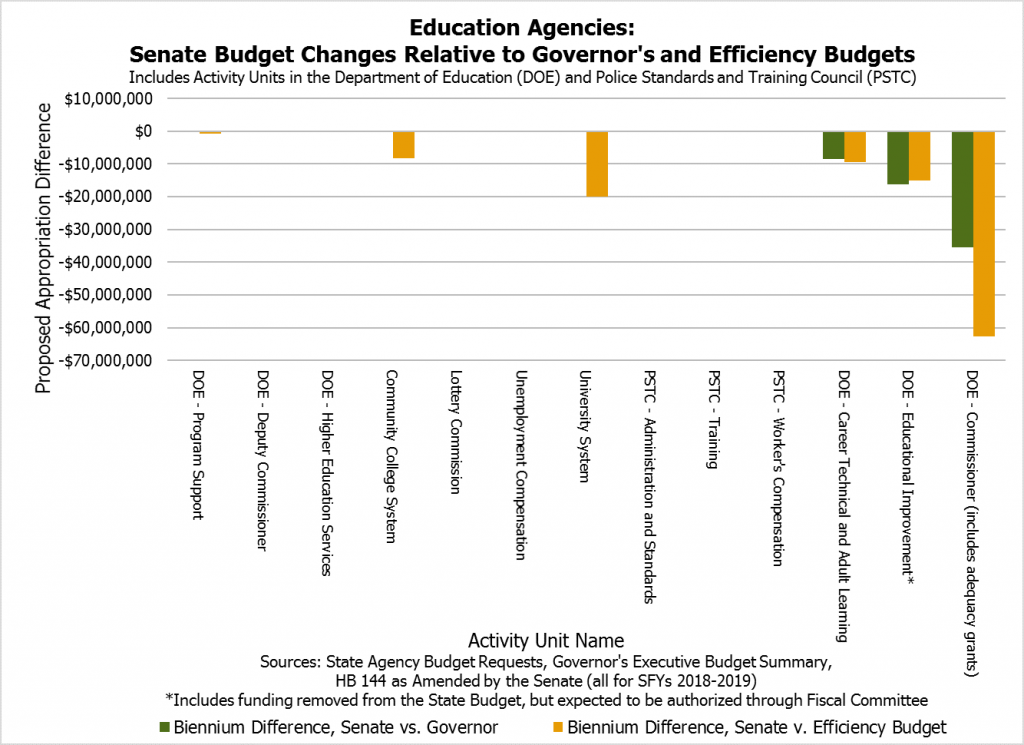

The Education category accounts for about 25 percent of all expenditures in the State Budget. The largest line item in this category, which was appropriated $2.849 billion in the SFYs 2016-2017 budget, is the adequate education grants allocated to municipalities to pay the State’s portion of student education costs. Adequate education grants were appropriated $1.928 billion (67.7 percent of the Education category) in the SFYs 2016-2017 State Budget. The category includes the Department of Education (DOE), the Police Standards and Training Council, the Lottery Commission (which collects money for the Education Trust Fund), and the General Fund contributions to the Community College System of New Hampshire and University System of New Hampshire operating budgets. Neither the entire budgets for the Community College System nor the University System are budgeted line-by-line in the State Budget; only the State government’s contribution to these Systems is included in the budget, and the Systems manage their own revenues and expenditures independently.

Adequacy Grants

The Senate made the largest changes relative to both the Governor’s budget and the Efficiency Budget in the Activity Unit for the DOE Commissioner’s Office, which includes funding for the adequate education grants. The Senate assumed a larger decrease in student population requiring adequate education grants than the Governor projected, reducing payments to municipalities by approximately $7.3 million and charter school tuition funding by $8.0 million relative to the Governor’s proposal. The Senate also removed the $18.0 million from the Governor’s budget proposal to boost adequacy payments for kindergarten pupils in municipalities offering full-day kindergarten. The Senate’s version of the State Budget does not include a full-day kindergarten provision, although a separate bill may serve as a vessel for establishing and funding full-day kindergarten.[8]

Federal Funds Changes and Gateway to Work

The downward revisions at the DOE Division of Educational Improvement relative to the Governor’s proposal and the Efficiency Budget is primarily due to nearly $16.3 million in federal funding that was removed from the Senate version of the budget and would be expected to be authorized through the Fiscal Committee, if necessary and available.

The decline in funding relative to the Governor’s proposed budget and the Efficiency Budget at the DOE Division of Career Technical and Adult Learning stems from two sources. First, the Senate expects federal funding for field programs, specifically vocational rehabilitation client assistance for individuals with disabilities seeking to obtain or retain work, to be $6 million lower than the Governor included in his proposed budget; the Governor appropriated $18.8 million, the Senate appropriated $12.8 million, and the SFY 2016-2017 State Budget appropriated $12.0 million. Second, the DOE Division of Career Technical and Adult Learning’s funding declined in the Senate budget relative to the Governor’s proposal due to the Senate’s elimination of the Gateway to Work program, which would have funneled $2.45 million from the DHHS.

Charter Schools

Relative to SFY 2017 levels, charter school per-student tuition payments were boosted in the Senate’s budget, except for the Virtual Learning Academy Charter School, by $250 in SFY 2018 and $375 in SFY 2019. Relative to the Governor’s budget proposal, the Senate retained certain modifications to laws surrounding charter schools proposed by the Governor, but employed a set dollar figure for tuition payments rather than the Governor’s proposed percentage of state average public school per-pupil operating costs. As a result, the Senate reduced charter school tuition payments relative to the Governor’s budget by $2.5 million. The Senate also established a chartered public school program officer position in the DOE, and funded the Virtual Learning Academy Charter School with an additional $75,958 to adjust tuition with inflation annually rather than biennially.

Community College and University Systems Funding

Funding for the Community College System of New Hampshire’s operations was lower than the Efficiency Budget request in the Senate budget, but increased nearly $7.3 million relative to the SFY 2016-2017 State Budget, which would bring the total General Fund appropriation to the Community College System to $93.5 million for the biennium. The University System of New Hampshire’s budget is under its Efficiency Budget request and remains the same as the prior biennium’s allocation, at $162.0 million for the biennium.

The Senate’s budget also:

- Establishes a Robotics Education Fund to promote science, technology, engineering, and mathematics education and future career opportunities among elementary school students, funded at $375,000 in SFY 2018 and $0 in SFY 2019, anticipating funds from donations.

- Appropriates $217,032 to fund a new DOE communications position and DOE website improvements.

- Allocates $100,000 for the DOE to implement database and reporting improvements as well as website upgrades.

- Retains the Governor’s proposal to rename “catastrophic aid” to “special education aid.”

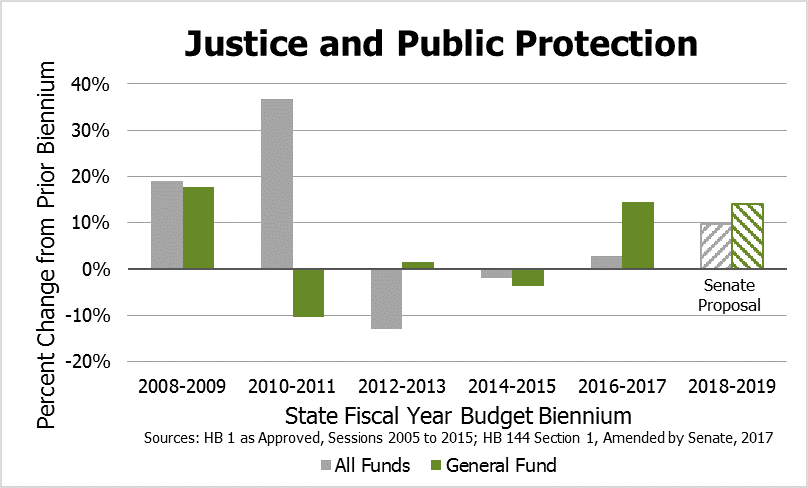

Justice and Public Protection

The category of Justice and Public Protection, which is about 10 percent of SFY 2017 appropriations, includes the Judicial Branch, the Adjutant General, the Departments of Safety, Justice, Corrections, Agriculture, Labor, Employment Security, the Insurance and Banking Departments, the Public Utilities Commission, the Liquor Commission, and other agencies. The Senate made many changes from the Governor’s budget in this category.

The Senate shifted the funding sources for certain Department of Safety enforcement activities from the Highway Fund to the General Fund, which would make more Highway Fund dollars available for Department of Transportation operations. The Senate removed approximately $18.6 million in federal funds from the Governor’s proposed budget with the expectation that the Fiscal Committee, Governor, and Executive Council would authorize the funds if they become available. The Gateway to Work program’s removal also reduced the appropriation for the Department of Employment Security’s budget by just under $2.8 million.

The Liquor Commission’s budget, relative to the Governor’s proposal, was reduced by over $1.6 million in debt service because the Commission withdrew requests for two new capital project requests, and the Commission is using the sale of other assets to pay for debt service. The Senate also proposed moving authority for the purchase of $240,000 of preliminary breath test equipment from the Liquor Commission to the Department of Safety’s Division of State Police.

Relative to the Governor’s proposed budget, the Senate delayed many of the expenditures associated with opening the new women’s prison, reflecting policy choices and modifications to the expected timeline for the prison being ready to be staffed. The Senate budget, related to the women’s prison and other Department of Corrections spending, makes the following changes relative to the Governor’s budget proposal:

- Removes just under $2.0 million, which defunds seven new corrections officers’ positions and two higher-ranked positions at the new women’s prison for SFY 2018, unfunds seven additional new corrections officers at the women’s prison for SFY 2019, and decreases the utilities class line.

- Removes over $1.5 million, which defunds three new registered nurse positions for SFY 2018 at the new women’s prison and decreases medical payments to providers.

- Delays the hiring of three new registered nurse positions from July to October 2017, and delays new maintenance technician, laundry manager, and chef positions until November 2017, for the new women’s prison.

- Removes $150,790 in appropriations by abolishing and defunding a new chaplain position for the women’s prison.

- Reduces overtime and benefits appropriations at the men’s State prison by $0.9 million.

- Reduces appropriations by just under $0.7 million by abolishing three new probation or parole officer positions and staggering the start dates of three additional new probation or parole officer positions.

- Amends the requirement, previously written in law, that an approximately $1.1 million appropriation be used to install six full body security scanners at State correctional facilities by removing the requirement that six scanners be installed and redirecting $110,000 of the appropriation to fund two canine teams.

- Eliminates changes to state corrections officers’ application standards.

The Senate budget proposal made other staffing changes in this category relative to the Governor’s budget as well:

- Reduces appropriations to the Judicial Branch by approximately $2.3 million to eliminate a proposed new superior court judge position, a court monitor position, and three circuit court positions in SFY 2018 and two in SFY 2019.

- Permits two additional full-time judges to serve on the circuit court.

- Establishes a new maintenance mechanic position in SFY 2019 and a new full-time technical support specialist under the Adjutant General with $234,437 in appropriations.

- Converts a new attorney position at the Department of Justice from full-time to part-time status, changes three prosecutor positions and two Victim Witness Specialists to temporary full-time positions, changes an analyst position to temporary full time, and shifts funding for a new administrative position from partially General Funds to all federal funds.

- Adds a new full-time investigator at the Department of Justice, with $193,954 in appropriations, to enforce election, voting, and lobbying laws.

- Transfers the Division of Children, Youth, and Families legal director from the DHHS to the Department of Justice.

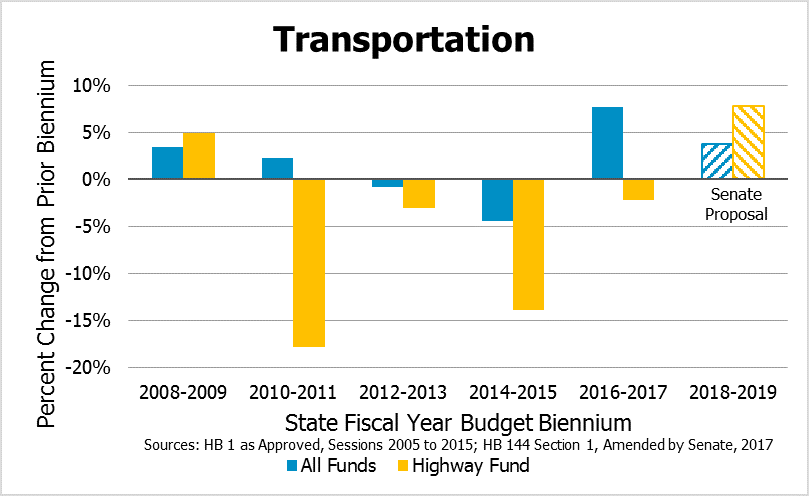

Transportation

The Transportation category includes the Department of Transportation, which is about 10 percent of SFY 2017 appropriations. Many of the transportation-related infrastructure improvements proposed by the Governor’s budget, which primarily relied on surplus dollars from SFY 2017 and a proposed new commission to help determine which projects would be addressed, have been removed from the budget and addressed through a separate bill.[9] The Senate made some adjustments from the Governor’s budget proposal, including adding $5.5 million to municipal block grants to meet apportionment requirements and shifting $450,000 in funding from General Funds to the airways toll tax on aircraft fuel.

The Senate budget also modifies the provisions governing the collection of the aircraft fuel tax, requiring the State Treasurer to credit the revenue to the Department of Transportation as restricted revenue, to continually appropriate the revenue, and to treat the revenue as non-lapsing. Additionally, the Senate’s version of the budget clarifies the Department of Transportation’s definition of projects to include buildings and fixtures, and the definition of highways to include roads currently used by bicycles and pedestrians but excluding bridges, trails, or paths intended for use by off-highway recreational vehicles.

The Senate’s budget would authorize a study to examine, and acquire land for, placing a service plaza at the location of the existing State liquor stores on Interstate 95 in Hampton. The language in the Senate budget is modeled after the study of the Hooksett service plaza on Interstate 93.

The largest dollar value change in the Transportation category is a $20.8 million reduction in consolidated federal aid in the Senate budget relative to the Governor’s budget. These dollars are expected to be authorized later through the Fiscal Committee, with the approval of the Governor and Executive Council, as necessary.

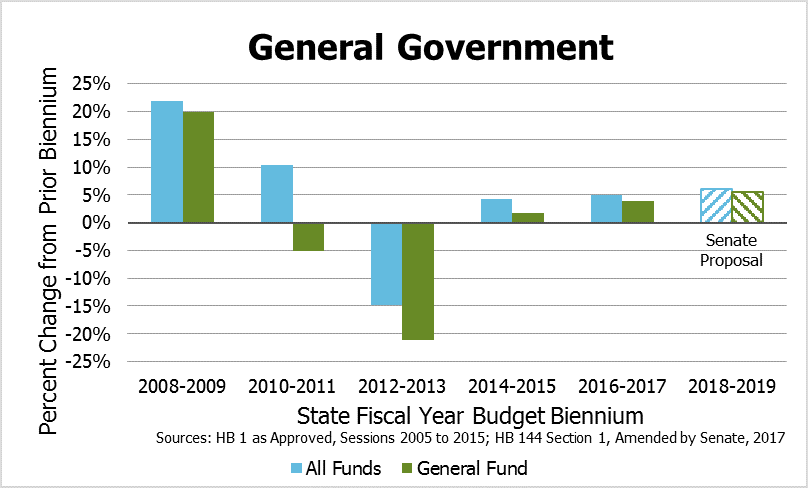

General Government

Incorporating the Executive and Legislative offices, the Departments of State, Administrative Services, Treasury, Revenue Administration, Information Technology, Cultural Resources, and other agencies, the General Government category accounted for about 9 percent of SFY 2017 appropriations.

Department of Information Technology Consolidation

The largest dollar change in this category relative to the Governor’s budget proposal resulted from the Senate deciding to give the Department of Information Technology the authority to consolidate certain DHHS information technology operations under its operations, as the Governor proposed, but not providing funding for the transfer. This reduced the Department of Information Technology’s appropriation by approximately $40.1 million. Additional information technology service payments from other departments were also adjusted, including $0.7 million to fund the electronic health records system at the Department of Corrections.

Retired State Employee Health Premium Contributions

The Senate retained the Governor’s proposed requirement that retired state employees contribute to their health insurance premiums. However, it modified the proposal by exempting employees born in 1948 or earlier, as did the House Finance Committee’s budget. Retired employees eligible for Medicare Parts A or B due to age or disability would have to pay 10 percent of the total monthly premiums, with the Commissioner of Administrative Services having authority to increase the percentage with the approval of the Fiscal Committee. Those not eligible for Medicare would pay 20 percent of the health insurance premium cost, which is an increase from 12.5 percent. To pay for this exemption for older retirees that the Governor did not propose, the Senate increased the General Fund contribution to the Department of Administrative Services by over $2.5 million relative to the Governor’s budget. (The Judicial Branch also saw an appropriations increase of approximately $1.0 million for this change from the Governor’s budget.)

Office of the Child Advocate

The Office of the Child Advocate is established under the Department of Administrative Services. This Office would have a separate director and be required to provide independent oversight of the State’s child protection system; it would have authority and access to most records at the DHHS within the scope of its mission. The DHHS would be required to report certain events, such as a child death, to the Office. This new Office would be funded with a $0.7 million appropriation and include three new positions.

Staffing Changes

Relative to the Governor’s proposed budget, the Senate budget would make staffing changes in several General Government category departments:

- The Department of Revenue Administration would gain three positions, including two auditors and one compliance officer, who are expected to identify and collect revenue owed to the State.

- The Secretary of State would lose eight positions and gain six, most of which would be in the Corporations Division. A new Elections Investigator position would be one of the new positions.

- The Department of Administrative Services would have new positions for a Deputy Comptroller and a Business Analyst, with a $459,882 combined appropriation.

- Certain expenses, including benefits, increase within the Governor’s office by $187,665.

- The Office of Professional Licensure and Certification would receive $104,958 for a new Licensing Clerk.

Other Provisions

The Senate opted to retain the Governor’s proposal to rename the Office of Energy and Planning to the Office of Strategic Initiatives. It also voted to keep a $10.0 million appropriation for the Governor’s Scholarship Program, which is for certain students attending approved post-secondary training and education programs in New Hampshire.

The Joint Committee on Legislative Facilities voted to make changes to the budget line items of the House and the Senate, which the Senate incorporated into its budget. The Department of Revenue Administration’s Low and Moderate Income Homeowners Property Tax Relief program also saw expected expenses trimmed by $170,000 in the Senate’s version of the budget, with the Senate citing that use of the program has been trending downward.

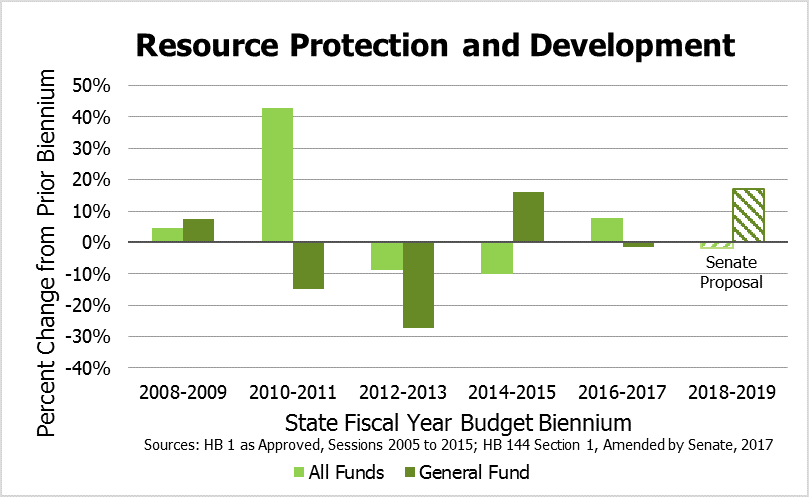

Resource Protection and Development

The smallest category by appropriation, Resource Protection and Development accounted for about 5 percent of the SFY 2017 appropriations. It includes the Departments of Resources and Economic Development, the Department of Environmental Services, the Fish and Game Department, and two other authorities.

The largest organizational change in this category, proposed by the Governor and retained with some modifications by the Senate, is the reorganization of the Department of Cultural Resources and the Department of Resources and Economic Development into two new departments: the Department of Business and Economic Affairs and the Department of Natural and Cultural Resources.

Among the organizational changes, the Senate budget would allocate $1.5 million more to the Tourism Development Fund for promotional marketing expenses. The Senate also shifted $1.5 million granted to the Fish and Game Department from the General Fund to be sourced from the Fish and Game Fund.

The largest dollar change in this category is $80.0 million removed from the Clean Water and Drinking Water State Revolving Funds in the State Budget for loans, loan repayments, and administration. These dollars would be expected to be authorized by the Fiscal Committee in the future. The Senate’s budget would also establish a New Hampshire Drinking Water and Groundwater Advisory Commission to consult and advise the State on the use of the Drinking Water and Groundwater Trust Fund, which holds funds associated with a major water pollution legal settlement.

Tax Law Changes

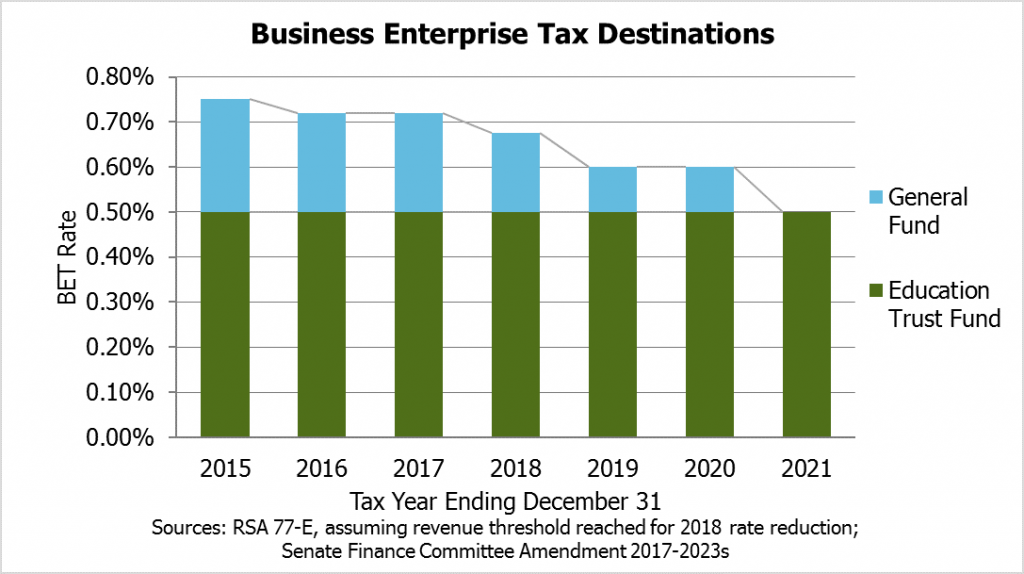

The Senate voted to include reductions in the State’s two primary business taxes. The Business Profits Tax (BPT), at 8.2 percent for 2017, would be reduced to 7.7 percent in 2019, and 7.5 percent in 2021. The BPT is likely to be reduced from 8.2 percent to 7.9 percent for 2018, as a reduction in the rate would be triggered in existing law based on a revenue target that is likely to be met. The BPT was set to 8.5 percent in 2015, where it had been since 2001. BPT revenues are split between the General Fund and the Education Trust Fund, the latter of which receives revenues resulting from 1.5 percentage points of the BPT rate.

Under the Senate’s budget proposal, the Business Enterprise Tax (BET) would be lowered to 0.6 percent in 2019, and 0.5 percent in 2021, from the 2017 level of 0.72 percent. The BET also has a revenue trigger mechanism, which will likely lead to a rate reduction for 2018 to 0.675 percent. The BET was set to 0.75 percent in 2015, where it also had been since 2001. The Education Trust Fund receives the first 0.5 percentage points of the BET rate, and the remainder goes to the General Fund for unrestricted use. Dropping the BET to 0.5 percent, which is 33 percent below where the rate was in 2015, would require all dollars collected by the BET to go to the Education Trust Fund, making this relatively stable and important revenue source for the General Fund disappear unless dollars are later transferred from the Education Trust Fund to the General Fund.

The Department of Revenue Administration, using static revenue estimates (i.e., not accounting for inflation or other revenue volatility), estimated these tax cuts would reduce revenue by $11.0 million in SFY 2019, $85.9 million in SFYs 2020-2021, and $81.1 million in SFY 2022 alone. The dollar amounts foregone are likely to be larger due to inflation, and growth patterns in the economy are difficult to predict; these key revenue sources, particularly the BPT, rely on certain aspects of the economy performing well. Reducing tax rates substantially increases the risk that revenue sufficient to fund ongoing operating expenses will not be collected.

The Senate proposal also increases the deduction for certain allowable business property expenses under the Internal Revenue Code Section 179 from $100,000 to $500,000. This increase matches the federal deduction and follows the already-approved State increase from $25,000 for 2017. While estimating the financial impact on the State of this change in the deduction is difficult, the estimated a maximum negative impact is $9.7 million for SFY 2019, which was derived from Department of Revenue Administration calculations. For more on State revenue sources, see NHFPI’s Revenue in Review resource at nhfpi.org.

Surplus Spending and the Rainy Day Fund

The Senate modified the Governor’s proposed Infrastructure Revitalization Trust Fund in its version of the budget. The “Public School Infrastructure Revitalization Trust Fund” would permit the Governor, with the approval of the Fiscal Committee and the Executive Council, to spend an estimated $14.6 million in SFY 2017 surplus dollars on projects at schools with structural deficiencies that present clear and imminent danger or a substantial risk to the life or safety of the occupants. The fund money may also be used to improve security at public schools and other infrastructure projects. This provision leaves the Governor with broader discretion than the House Finance Committee’s budget, which funneled money through existing aid programs. The $14.6 million estimated allocation assumes $36.8 million moves to road and bridge infrastructure through other legislation, accounts for the $18.0 million in Concord Steam-related appropriations already signed into law, and adjusts for other existing appropriations and bills the Senate expected to pass and include SFY 2017 surplus dollar expenditures. The Senate proposal would allocate $2.5 million surplus dollars to the Concord school district for heat and hot water upgrades related to Concord Steam.[10]

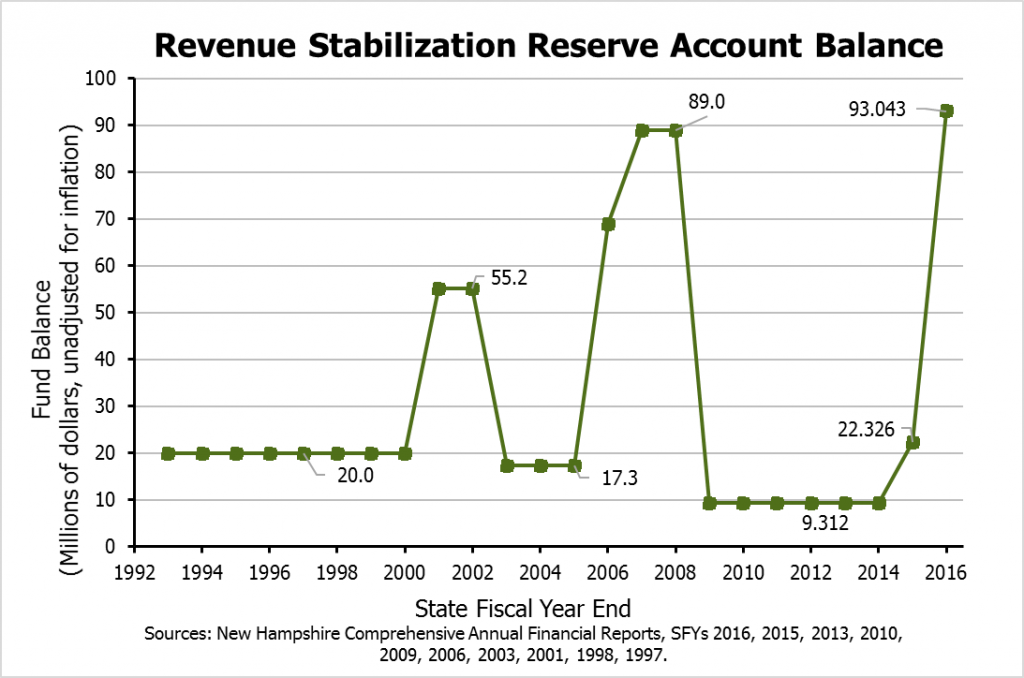

The Senate budget would allocate the $14.6 million surplus dollars anticipated to be available at the end of SFY 2017 to the Public School Infrastructure Revitalization Trust Fund after appropriating approximately $7.0 million, which would be used to bring the Revenue Stabilization Reserve Account, also known as the Rainy Day Fund, to a balance of $100.0 million. The Senate budget would modify the Rainy Day Fund to permit transfers from legal settlements deposited in the Rainy Day Fund to exceed the current statutory cap on the Fund, which is 10 percent of unrestricted General Fund revenues from the prior SFY.[11]

New Hampshire Health Protection Program Work Requirements

Although the New Hampshire Health Protection Program (NHHPP), which is the State’s version of expanded Medicaid under the Patient Protection and Affordable Care Act, is not included in the Senate’s version of the State Budget, the Senate included a requirement that the State apply to the federal government for a waiver to include work requirements for certain participants in its version. The State Budget language would require the DHHS to seek waivers to require unemployed childless able-bodied adults who do not meet certain conditions to spend 30 hours per week employed, collecting work experience or on-the-job training, searching for jobs, engaging in community service programs, providing child care services, or participating in certain education programs. Should the federal government not grant a waiver to permit New Hampshire to enact these work requirements, the NHHPP shall not be reauthorized and participants would be notified, by November 2017, of the program’s end date of December 2018. The Senate’s budget also includes a provision from the Governor’s proposed budget that Medicaid coverage for children and pregnant women would be reinstated as it was prior to the NHHPP if the program does end.

Next Steps

The Committee of Conference, with select members from both the House and the Senate, will draft a compromise budget. The Senate made its preference for including the House Finance Committee’s positions in the final Committee of Conference clear; the Senate included a clause in its version of the budget that incorporated House Bill 1 and House Bill 2 from the House Finance Committee by reference for the purposes of Committee of Conference negotiations.

If events transpire as planned, the Committee members will agree on compromise revenue estimates and expenditures and produce a State Budget proposal by June 15, 2017. That Committee of Conference budget, before becoming law, must garner majority support in the House and Senate chambers individually. The current legislative calendar sets a deadline of June 22, 2017, for Committee of Conference reports to pass; the budget would then go to the Governor for his acceptance or rejection.

Endnotes

[1] For SFY 2018-2019 budget documents, which are the source materials for most of the information in this Issue Brief, see the Office of Legislative Budget Assistant’s FY 2018-2019 Operating and Capital Budget webpage. This page includes information on the Capital Budget, which is not discussed in this Issue Brief. For more information on the Governor’s operating budget proposal, see NHFPI’s Issue Brief, Governor Sununu’s Proposed Budget.

[2] See the revenue projections section of NHFPI’s Issue Brief, Governor Sununu’s Proposed Budget, and NHFPI’s Common Cents blog post from May 22, 2017, “Senate Ways and Means Committee Increases Revenue Estimates.”

[3] See the State of New Hampshire Information Statement, March 24, 2017, page 46.

[4] For more discussion of the Joint Legislative Fiscal Committee, see page 7 of NHFPI’s Building the Budget resource. See also RSA 14:30-a and the Joint Legislative Fiscal Committee webpage.

[5] See NHFPI’s Common Cents blog post from March 28, 2017, “House Finance Committee Finalizes Full Budget.”

[6] See the Office of Legislative Budget Assistant’s comparison of the Senate-passed Budget to the Governor’s recommendation and the House Finance Committee’s amendment to House Bill 1 from March 27, 2017. The funds removed from the budget include federal funds and funds authorized under existing law, through RSA 141-C:17-a.

[7] See NHFPI’s Building the Budget resource for more information on budget categories.

[8] See Senate Bill 191 of the 2017 Session.

[9] See Senate Bill 38 of the 2017 Session.

[10] See the Office of Legislative Budget Assistant’s Comparative Statement of Undesignated Surplus, June 1, 2017, Schedule 2.

[11] For more on the Rainy Day Fund, see NHFPI’s Common Cents blog post from December 28, 2016, “Sun Shining on the Rainy Day Fund.”