The next two-year State Budget will fund State-supported services in an uncertain financial and economic environment, with significant potential costs and following substantial decreases in State revenue. These revenue decreases are primarily the result of slower growth in national corporate profits, which accelerated substantially in the years following the start of the COVID-19 pandemic, and State policy choices that have reduced revenue, including the elimination of the Interest and Dividends Tax in 2025.[1]

Other key expenditures may impact the State’s fiscal stability in the next two years. While the costs for delivering existing State services continue to increase, other one-time and less predictable expenses could upend the best efforts of policymakers to craft a State Budget for the upcoming biennium. These expenses include costs associated with both settlements and court cases stemming from decades of alleged abuses of children in the State’s care at the former Youth Development Center and contracted agencies, any changes made to State obligations related to education funding currently being considered by the State Supreme Court, funding a new State prison for men, and any changes to federal funding that reduce resources available for the State of New Hampshire or its residents. Nearly one-third of the dollars funding the Governor’s State Budget proposal are federal funds, totaling $5.23 billion during State Fiscal Years (SFYs) 2026 and 2027, which is a typical level of reliance on federal funds for the New Hampshire State Budget.[2]

Any one or two of these factors could generate substantial fiscal uncertainty for the next budget biennium independent of the others. The Governor’s State Budget proposal arrives at a time when forecasting expenses and revenues for the next two years is exceptionally difficult, with the potential of all these factors converging on this biennium.

This report examines the Governor’s State Budget proposal as introduced in February 2025. This report reviews topline figures associated with expenditures in the Governor’s proposal, as well as expenditures and policy changes in each key policy area of the State Budget. This report provides context for critical policy areas, such as housing and early care and education, that receive supports through the State Budget, and reviews the revenue projections provided by the Governor and transfers of other resources used to fund the budget proposal.[3]

Summary of Significant Proposed Changes

The Governor’s State Budget proposal for SFYs 2026-2027 largely retains current appropriations for State agencies. While some significant shifts occur, most State agencies would be funded near current levels under the Governor’s proposal. Appropriations increases may not be sufficient to match the increase in the costs of service provision over the next two years, and the Governor did not repeat one-time appropriations, which would leave some agencies with lower total appropriations than in the current State Budget even while retaining funding for core operations.[4] Key changes to appropriations proposed by the Governor included:

- Boosting funds to the New Hampshire Retirement System to increase benefits for certain police and firefighting public employees, particularly those who had expected Retirement System benefits altered after modifications to in 2011, with a $32.9 million appropriation during the biennium

- Increasing access to Education Freedom Accounts by eliminating the income eligibility cap for students transferring from public schools, which resulted in an appropriation of $73.5 million in total for SFYs 2026 and 2027, or 47.6 percent more than the amount spent on Education Freedom Accounts in the current biennium

- Expanding available Special Education Aid for school districts, allocating an additional $32.0 million (47.2 percent) toward Special Education Aid relative to the current State Budget’s appropriations for a total of $99.8 million over the biennium

- Increasing funding for nursing facilities and drawing on dedicated funding for developmental services carried forward from unspent funds in prior years

- Increasing funding for housing shelter services, including at least $15 million for a combination of both higher reimbursement rates for shelters and support for individuals experiencing homelessness related to opioid addiction or another substance use disorder

- Decreasing budgeted funding for the University System of New Hampshire, the Choices for Independence Medicaid waiver program for older adults and adults with physical disabilities, and payments to hospitals for uncompensated care

The Governor also proposed significant policy initiatives in her budget proposal, including changes to the bail system, requiring Medicaid copayments or premiums for certain enrollees with children or those with higher-than-poverty incomes participating in the Granite Advantage program, and establishing a Solid Waste Site Evaluation Committee.

The Governor’s appropriations were supported by relatively favorable revenue estimates, which have an optimistic view of the economy for the next two years and include rebounding receipts from the State’s two primary business taxes and from the taxation of real estate transactions. The Governor also proposed adding a new revenue source, video lottery terminals, to help offset the revenue shortfall caused by the repeal of the Interest and Dividends Tax and lower revenues from other sources.

The State Budget proposal put forward by the Governor does not include funding for several significant future or potential costs. The Governor did not appropriate funding for the new State prison for men, for settlements or court cases associated with past abuses at the Youth Development Center, for potential changes to education funding obligations, or possible changes in federal funds.

The Topline Changes and Expenditure Differences by Category

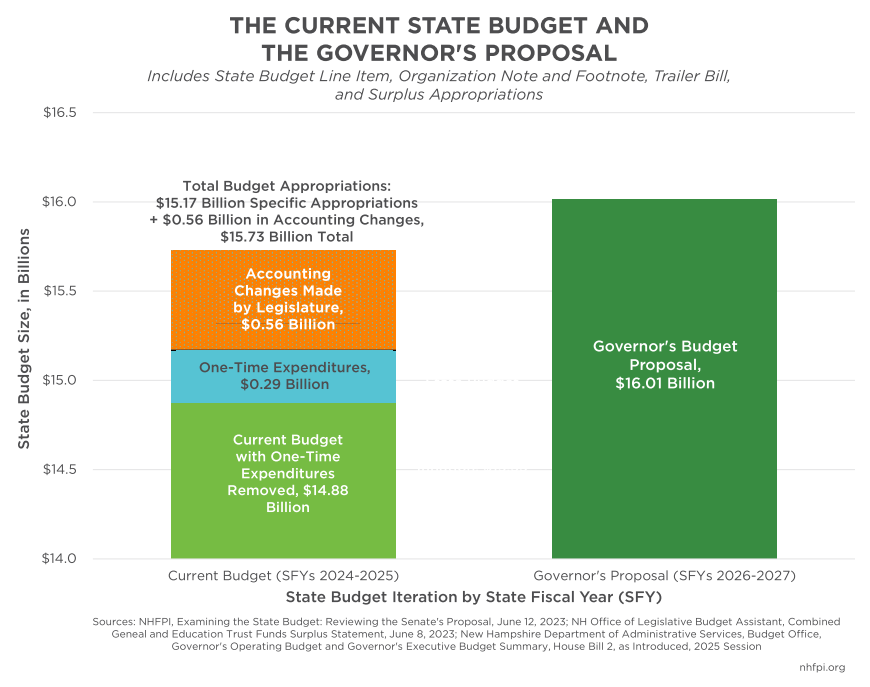

The Governor’s budget proposal would authorize $16.01 billion in expenditures from all funds for the two-year period. That total includes about $10.3 million in appropriations in the Governor’s proposed Trailer Bill and $80.0 million in funds authorized by an organization note in the Operating Budget Bill for use during the biennium out of the Developmental Services Fund, the Acquired Brain Disorder Services Fund, and the In-Home Support Waiver Fund.[5]

Total appropriations proposed in the Governor’s budget would appropriate 5.6 percent more dollars than the approximately $15.17 billion approved by the Legislature, and signed by the previous Governor, in the current budget as approved in June 2023.[6] That comparison of the current two-year State Budget to the Governor’s proposal is not adjusted for inflation, nor does it include accounting changes typically made by the Legislature relative to the Governor’s proposal. Adjusting for some of the accounting changes made by the Legislature, the Governor’s budget would grow by about 1.8 percent from the current approximately $15.73 billion, which is likely below cost inflation. The current budget also includes about $293 million in expenditures that were structured as one-time appropriations, while the Governor devoted relatively few dollars to one-time costs such as capital projects or infusions of cash into special funds in her proposal.

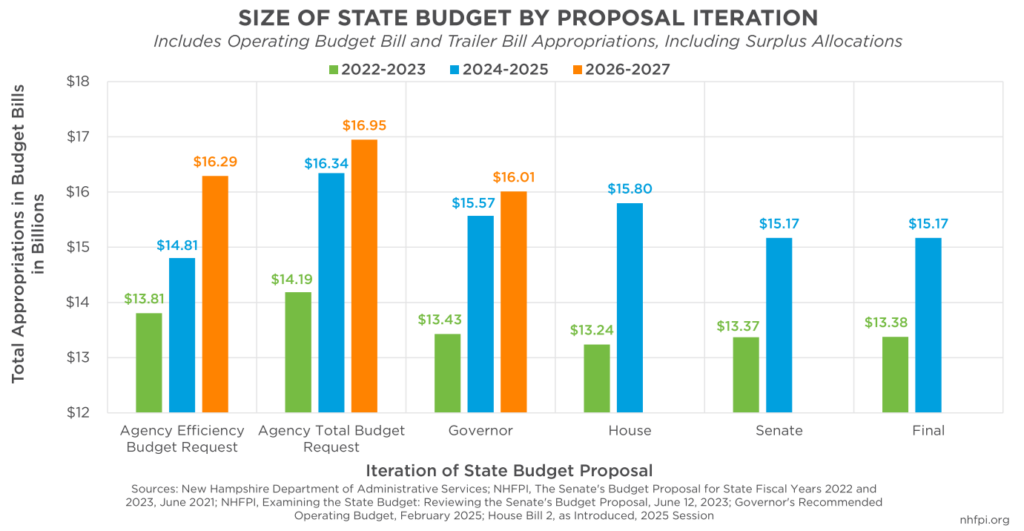

The Governor’s budget proposal is smaller than both the Total Agency Budget request and the Efficiency Budget request produced by the agencies for the biennium. The Governor’s proposal for the next biennium is $0.94 billion (5.5 percent) smaller than the Total Agency Budget request, which includes both the Efficiency Budget and the Additional Prioritized Needs identified by the State agencies. The Governor also appropriated $0.28 billion (1.7 percent) less than the Efficiency Budget request from the State agencies. While neither the 2021 nor 2023 gubernatorial budget proposals were larger than the Total Agency Budget request, the 2023 proposal from the Governor was larger than the Efficiency Budget request, enabled in part by more favorable projected business tax revenues.[7]

Changes by Category

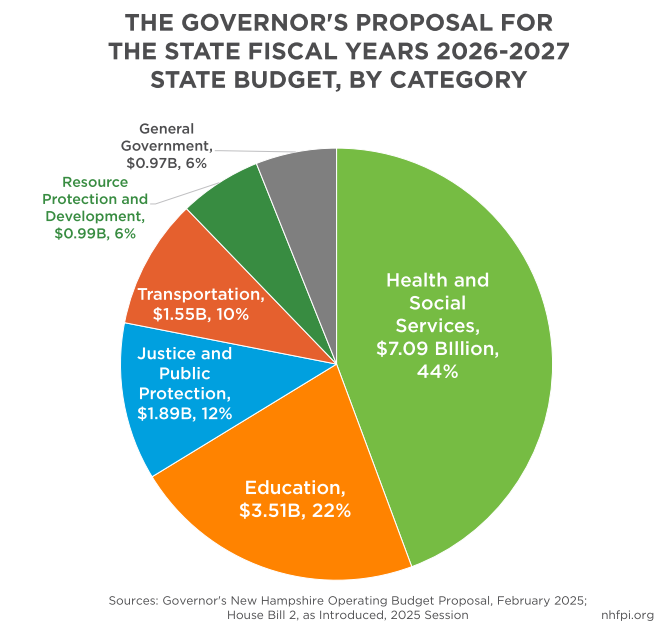

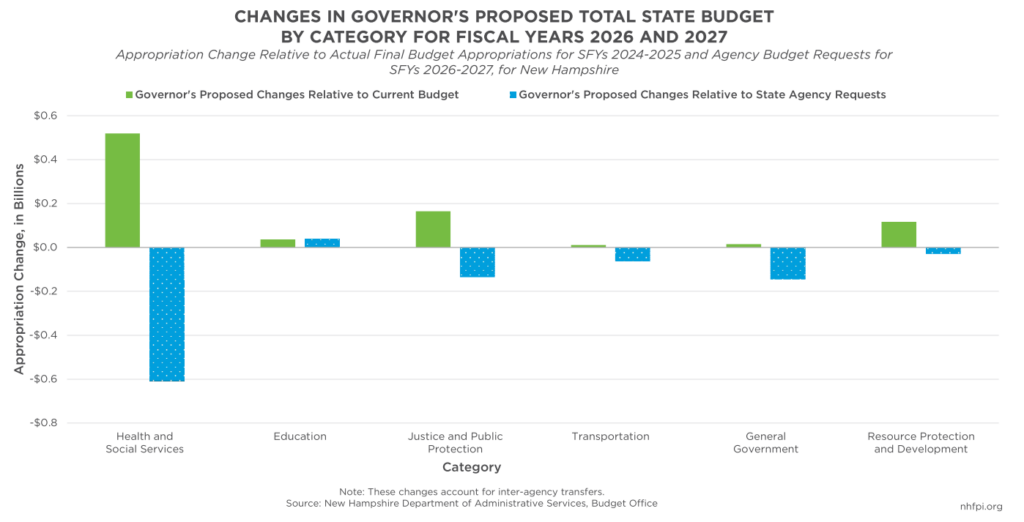

While the overall budget would grow under the Governor’s proposal, not all service areas would grow equally. All expenditures in the State Budget are divided up into six categories covering broad service areas. Changes in these six categories provide a high-level indication of shifts in spending across government activities. The six categories, in order of appropriation size in the New Hampshire State Budget, are: Health and Social Services, Education, Justice and Public Protection, Transportation, Resource Protection and Development, and General Government.

The Resource Protection and Development category would experience the largest percentage increase (13.5 percent, $117.3 million) between the two biennia in the Governor’s State Budget proposal. The second largest percentage and monetary increase (9.5 percent, $164.2 million) would be among the category of Justice and Public Protection. The Health and Social Services category, the largest in the State Budget, would receive the third-highest percentage increase but the largest monetary increase (7.9 percent, $519.6 million). All other categories would increase by less than two percent, including General Government (1.6 percent, $15.5 million), Education (1.0 percent, $36.4 million), and Transportation (0.7 percent, $11.5 million). The Education category was the only category across the Governor’s State Budget to be funded at its full Agency Request, which was $3.47 billion. The Health and Social Services category was funded approximately $608.0 million below the amounts requested by Agencies under this category.

Health and Social Services

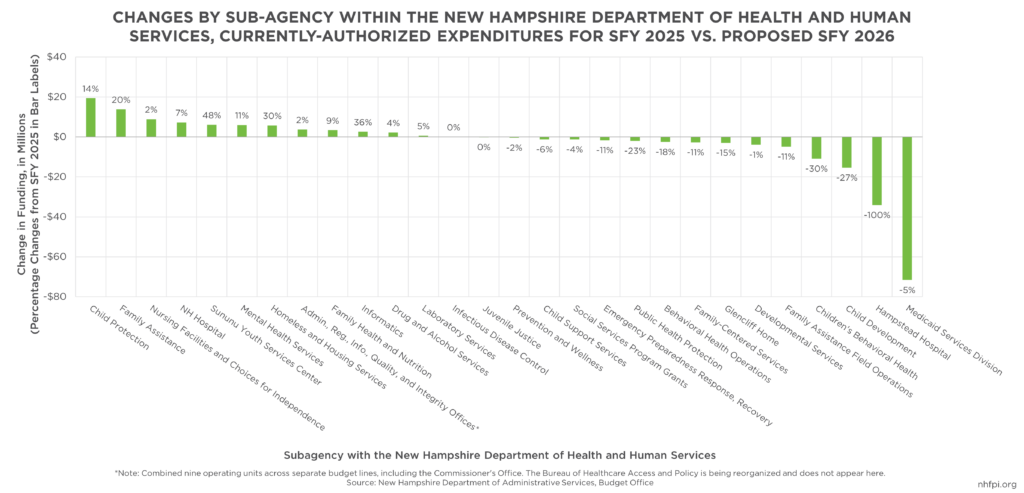

The Health and Social Services category of the State Budget is comprised almost entirely of the State Department of Health and Human Services (DHHS), which is responsible for several vital programs, including Medicaid, the Supplemental Nutrition Assistance Program (SNAP), the New Hampshire Child Care Scholarship Program (NHCCSP), child protection, public health services, and many others. The Governor’s State Budget proposed a total of $7.0 billion for the DHHS across the biennium, which is an increase of 6.5 percent from the $6.6 billion allocated in the current State Budget as enacted June 2023. Close to half (48.3 percent) of the DHHS’s State Budget is funded with federal dollars, as proposed by the Governor for the biennium; General Funds contribute close to a third (31.9 percent) of total DHHS proposed State Budget appropriations. While the overall DHHS Budget would increase under the Governor’s proposal, 13 of the 28 sub-agencies, or activity units, within the DHHS would have funding declines in SFY 2026 relative to the currently authorized appropriations for SFY 2025.

Outside of the DHHS, the State Veteran’s Home comprises the rest of the State Budget under the category of Health and Social Services. According to the Governor’s proposal, the Veteran’s Home would receive about $103.4 million across the biennium, an increase of 21.0 percent from the $85.4 million allocated in the current State Budget. When comparing the Adjusted Authorized amount for SFY 2025 with the proposed amount for SFY 2026, the Veteran’s Home would receive a 10.2 percent increase under the Governor’s proposal.

Medicaid Funding Changes

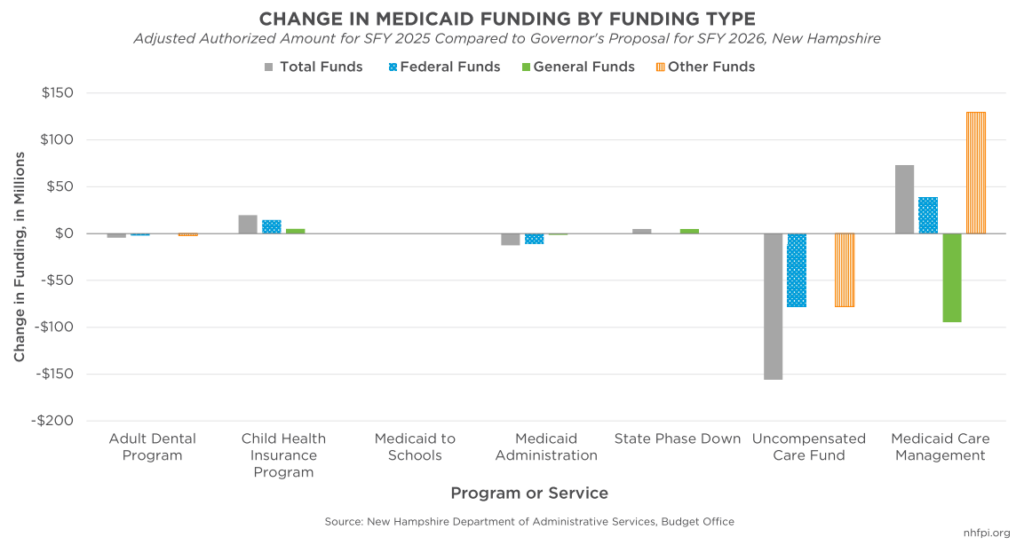

When comparing the current Adjusted Authorized amount budgeted for SFY 2025 with the Governor’s proposal for SFY 2026, the State’s Division of Medicaid Services experienced a decline of approximately $71.6 million (5.1 percent). Declines in the Medicaid Budget are largely due to an expired agreement between the State and hospitals regarding changes to uncompensated care payments to hospitals that does not yet have a successor agreement. These uncompensated care payments, which are supported by the Medicaid Enhancement Tax (MET) paid by hospitals and matching federal Medicaid funds, are used to support hospitals that provide health care services for Granite Staters who are uninsured or receive coverage through Medicaid, which typically has lower reimbursement rates than private insurance or Medicare.[8] Under the Governor’s proposal, allocations to the uncompensated care pool through the State Budget would decline by $138.3 million (61.0 percent) between the Adjusted Authorized SFY 2025 amount ($244.8 million) and the proposed amount for SFY 2026 ($88.7 million).

The budget lines for the State’s contracts with Medicaid managed care organizations would see an increase of about $73.2 million (8.8 percent) between the current SFY 2025 Adjusted Authorized appropriation and the Governor’s SFY 2026 proposed appropriation of $905.7 million. However, funding streams supporting this appropriation would shift under the Governor’s proposal. Medicaid services are funded with federal matching dollars, which are included in the State Budget, with State contributions typically coming from the General Fund. According to the Governor’s State Budget, however, more funding for managed care organizations would be supplied with MET revenue as a result of declines in the uncompensated care pool budget line. Under the Governor’s proposal, funding sourced from General Funds for Medicaid care management would decline by $94.5 million (41.7 percent) between the SFY 2025 Adjusted Authorized appropriations and SFY 2026. If the State and hospitals reach an agreement in the coming weeks and funding for uncompensated care payments increases, legislators would likely need to find additional General Fund dollars from elsewhere in the State Budget to support managed care organizations.

The Adult Dental Program would also experience declines in funding, according to the Governor’s State Budget. Allocations for the program would decline by $4.5 million (38.3 percent), between the adjusted authorized amount for SFY 2025 ($11.7 million) and the proposed amount for SFY 2026 ($7.4 million). The budgeted amounts for both SFYs of the 2026-2027 biennium are also lower than the SFY 2024 actual amount spent, which was reported as $11.5 million. While proposed funding would decline, the budgeted amount is in alignment with the agency’s requested amount submitted; enrollment in the program is expected to remain relatively flat, and the annual cost per beneficiary is projected to decline, from $3,041 in SFY 2025 to $1,876 in SFY 2026.[9]

The Governor’s Trailer Bill includes policy to return to regular eligibility redeterminations for Medicaid beneficiaries renewing their coverage. Prior to the COVID-19 Public Health Emergency (PHE), the DHHS was required to redetermine eligibility annually for most Medicaid enrollees. However, to help ensure health coverage access, the federal government permitted states to keep Medicaid beneficiaries continuously enrolled in the program without needing to renew their coverage.[10] Since the expiration of the continuous enrollment provision in March 2023, redeterminations have been completed for all Medicaid beneficiaries, bringing total enrollment down from a peak of 251,491 on March 31, 2023 to 187,067 individuals as of January 31, 2025.[11]

To lighten State administrative workload during the redetermination process following the provision, New Hampshire adopted Section 1902e(14)(A) waivers that allowed for ex parte renewals, also known as automated renewals. With ex parte practices, the State can utilize information already made available, such as income information, to automatically retain individuals without requiring them to complete renewal paperwork.[12] Since December 2023, 75 percent of Medicaid renewals have been redetermined using ex parte practices, according to the Division of Medicaid Services.[13] The Governor’s Trailer Bill proposes the expiration of these temporary Section 1902e(14)(A) waivers upon the start of the new Budget biennium, returning to normal eligibility redetermination processes that were in place prior to the PHE.

The Governor’s State Budget also proposes changes to preferred pharmaceutical drugs for Medicaid beneficiaries. Under current state law, the Medicaid program is required to always use generic medications first. However, due to federal rebates, the cost of a brand-name drug may be cheaper than a generic drug in certain circumstances. Language in the Governor’s State Budget proposal would permit the State’s Medicaid program to purchase the lowest-cost pharmaceutical drugs, whether they would be brand name or generic. According to cost saving projections from the Division of Medicaid Services, this switch would save the state a total of $3.9 million in General Funds during the biennium.[14]

The Governor’s Trailer Bill also allows the DHHS to accept and expend additional federal funds for the Medicaid to Schools Program without prior approval from the Joint Legislative Fiscal Committee if budgeted amounts for the program are insufficient. The State’s Medicaid to Schools Program is only federally funded in the Governor’s proposal, with $34.0 million allocated to the program across the SFYs 2026-2027 biennium.

Copayment Requirements for Medicaid Enrollees

Under the Governor’s proposal, New Hampshire would seek a federal waiver to establish premiums for the state’s Granite Advantage Health Care Program among enrollees who have incomes at or above 100 percent of the federal poverty guideline. According to DHHS testimony during a House Finance Committee work session, approximately 11,000 adults in the Granite Advantage program would be required to pay premiums. Households with children enrolled in the Children’s Health Insurance Program (CHIP) component of New Hampshire’s Medicaid program would also be required to pay a premium if they earn at or above 255 percent of the federal poverty guidelines. In alignment with federal law regarding cost shares for Medicaid beneficiaries, premiums would not exceed 5 percent of a household’s income. In addition, cost shares among adults on the Granite Advantage program would be limited to 10 percent of the cost of care for both inpatient and outpatient services.[15]

While the Governor’s State Budget would not add premiums for other populations enrolled in Medicaid, the Budget proposes increasing prescription drug copayments on preferred drugs from $1-2 to $4 for beneficiaries, subject to any federal limitations and regulations. According to the Division of Medicaid Services, Granite Advantage and CHIP enrollees paying premiums would be excluded from these higher prescription drug cost shares.

According to the DHHS, adding cost shares for individuals enrolled in Granite Advantage would contribute to $12.0 million in cost savings towards the Granite Advantage Healthcare Trust Fund for SFY 2027 alone. Revenue collected from premiums for CHIP enrollees would supply $3.3 million in SFY 2026 and $11.0 million in SFY 2027, according to projections from the state’s Medicaid Services; increased prescription drug copayments would add $750,000 in revenue for each year of the biennium and reduce the Medicaid federal match by an equivalent amount.[16] Cost savings from both CHIP premiums and higher pharmacy cost shares are factored into the General Fund portion of the Medicaid Budget, suggesting that revenue would not be held in a separate fund and, in turn, could be used outside of DHHS funding. According to testimony from the DHHS, estimating additional administrative costs for establishing and requiring cost shares require both additional policy decisions and analysis, as well as determining procedures for when Medicaid enrollees are unable to pay copayments and premiums. According to the Governor’s Trailer Bill, any necessary State Medicaid Plan amendments would be required to be processed on or before January 1, 2026 for both CHIP premiums and higher prescription drug cost shares, and on or before July 1, 2026 for Granite Advantage premiums.

Developmental and Acquired Brain Disorder Services

Within the DHHS’s Division of Long-Term Services and Supports, the Bureau of Developmental Services contracts with providers to supply services for Medicaid enrollees with developmental disabilities or acquired brain disorders. In the Governor’s State Budget proposal, the traditional budget lines for these services have $9.3 million (2.1 percent) less allocated for developmental services in SFY 2026 compared to the Adjusted Authorized amount for SFY 2025. Acquired brain disorder services also experience a decline of $21.4 million (37.9 percent) between the Adjusted Authorized amount for SFY 2025 and the Governor’s proposed amount for SFY 2026. While fewer dollars are allocated in each budget line, the DHHS is authorized to use up to $30.0 million in funds for SFY 2026 and up to $50.0 million for SFY 2027 carried forward from prior years’ unused funds, drawing on available amounts in the Developmental Services Fund, the Acquired Brain Disorder Services Fund, and the In-Home Support Waiver Fund. The Division’s budgeted lines for developmental services increase in the second year of the biennium, with the proposed amount for SFY 2027 ($466.3 million) higher than both the authorized amount for SFY 2025 ($447.3 million) and the proposed amount for SFY 2026 ($438.0 million), even before the transfers from the carry-forward funds.

Older Adults and Adults with Physical Disabilities

The Division of Long Term Supports and Services budget includes appropriations for both nursing home Medicaid reimbursements as well as the Choices for Independence (CFI) Medicaid Waiver program, providing home- and community-based supports for older adults and adults with physical disabilities.

Medicaid funding directly provided to the State’s nursing facilities would increase by $57.4 million (23.4 percent) between the Adjusted Authorized amount for SFY 2025 and the proposed amount for SFY 2026, with another proposed increase of $22.3 million (7.4 percent) between SFY 2026 and SFY 2027. The Governor’s total proposed Medicaid allocations for nursing facilities in each year of the upcoming biennium are higher than the actual amount spent for SFY 2024, which was $263.2 million. Nursing facilities would also have an aggregate increase in funding resulting from the Nursing Facility Quality Assessment, a tax on nursing facilities that is then matched with federal Medicaid funds and paid in assistance to nursing facilities through Medicaid Quality Incentive Payments; these funds would rise $8.7 million (10.2 percent) between the SFY 2025 Adjusted Authorized appropriation and SFY 2026 under the Governor’s proposal, with another $2.4 million (2.5 percent) increase in SFY 2027. However, the Governor’s Budget proposal anticipates lower ProShare payments to county nursing facilities, dropping $7.2 million (11.5 percent) between SFY 2025 Adjusted Authorized levels and SFY 2026, while still including more funding than the SFY 2024 actual expenditures. ProShare payments are also anticipated to be funded entirely with federal funds in the Governor’s budget proposal.[17]

While nursing facilities would experience an aggregate increase in the Governor’s proposal across the three budget lines that appropriate resources to nursing facilities, Medicaid funding available for the CFI program would decline. According to the Governor’s State Budget, funding for the CFI program would decline by $16.5 million (11.6 percent) between the current SFY 2025 Adjusted Authorized amount and the proposed amount for SFY 2026; the CFI program would experience an increase of $9.5 million (7.6 percent) between the proposed amounts for SFY 2026 and 2027. Similarly to funding for nursing facilities, the Governor’s proposed funding amounts for CFI are higher than the actual spent amount of $108.6 million in SFY 2024. However, a significant expansion of available funding for the CFI program starting with the SFY 2024 budget, including higher reimbursement rates that were not fully phased-in until halfway through SFY 2024, suggest that actual expenditures and services delivered may be substantially higher in SFY 2025 than in SFY 2024.[18]

Counties are required to contribute a large portion of the non-federal Medicaid dollars used to provide long-term support for their residents, including older adults and adults with physical disabilities. Under current State law, year-over-year growth in the county share of costs is limited to two percent annually; under the Governor’s Budget proposal, growth would be limited to this two percent cap.

Mental Health and Substance Use Disorder Services

Under the Governor’s State Budget proposal, the Bureau of Mental Health Services would have an increase of approximately $6.0 million (11.2 percent) between the Adjusted Authorized amount for SFY 2025 and the proposed amount for SFY 2026. This rise is almost entirely due to an increase in allocations for uncompensated care at community mental health centers in the state. This increase would be funded with General Fund dollars, with an additional $6.0 million allocated in SFY 2027 for the same purpose.

The Bureau for Children’s Behavioral Health would experience a decline of around $10.9 million (30.1 percent) between the Adjusted Authorized amount for SFY 2025 and the Governor’s proposed amount for SFY 2026, with the entirety of decreased allocations among community-based services under the State’s system of care. Approximately $9 million of this total decline was due to a reorganization of funds into Medicaid Services and the Division of Children, Youth, and Families, rather than a change in available services for youth. However, the Children’s Behavioral Health Resource Center (CBHRC) was not funded in the Governor’s State Budget proposal, contributing to around $1 million of this total decline; the State’s CBHRC provides youth and families with wraparound services for locating providers, acquiring needed information, and other case management support.[19]

Funding for the Bureau of Drug and Alcohol Services remained relatively flat between the Adjusted Authorized amount for SFY 2025 and the proposed amount for SFY 2026, increasing by $2.2 million (4.4 percent) between the two fiscal years. Funding among the Bureau includes $1.0 million across the biennium to support the Recovery Friendly Workplace Initiative, although this amount is a decline from the $2.1 million allocated in the current State Budget biennium.

Hampstead Hospital was removed from the State Budget, following its recent approved lease, and operational oversight change, to Dartmouth Health.[20] The Hospital had been under DHHS’s operation since 2022, when the state purchased the facility to provide inpatient mental health treatment in an effort to bring down long wait times for care, particularly for children. The lease of Hampstead Hospital, and shifting the costs of operations off of the State Budget, equates to a decline of around $59.5 million between the amount appropriated by the current State Budget for SFYs 2024-2025 and the upcoming State Budget biennium; around $18.4 million of this total was funded with General Fund dollars.

New Hampshire Hospital, a separate facility which provides inpatient mental health treatment to residents with severe and persistent mental health concerns, would experience an increase in its appropriations under to the Governor’s proposal. The proposed budgeted amount for the Hospital totals $118.1 million in SFY 2026, an increase of $7.3 million (6.6 percent) from the Adjusted Authorized amount for SFY 2025.

Sununu Youth Services Center

According to the Governor’s State Budget, the Sununu Youth Services Center received the largest percentage increase in funds across all DHHS agencies between the Adjusted Authorized amount for SFY 2025 and the proposed amount for SFY 2026, compromising a rise of around $6.1 million (47.8 percent). The majority of increased funds are allocated for overtime pay for employees, which totaled more than $3.0 million in actual spending in SFY 2024 while only having $500,000 originally budgeted for that year, as well as contracts for operational services at the Center. The Legislature has made several efforts to close the Sununu Youth Services Center entirely, including in the SFYs 2022-2023 State Budget, as the number of individuals served by Center has been a substantially smaller number than the facility’s capacity in recent years.[21]

Youth and Family Services

The largest monetary increase among the DHHS would be within Child Protection, within the larger State Division of Children, Youth, and Families; Child Protection would receive an increase of $19.4 million (14.0 percent) between the Adjusted Authorized amount for SFY 2025 and the proposed amount for SFY 2026. The largest increases were within Child and Family Services, with around $4.6 million of this increase due to a rise in funding for Title IV-E foster care services. The Governor’s proposal would also shift funding from the Bureau of Children’s Behavioral Health to Child Protection, which contributed partially to the proposed increase.

The second largest monetary increase within the DHHS would be in the Bureau of Family Assistance, within the larger Division of Economic Stability, in the Governor’s budget proposal. The Bureau experienced an increase of $13.8 million (19.6 percent) between the Adjusted Authorized amount for SFY 2025 and the proposed amount for SFY 2026; almost all of this increase was due to an additional $12.0 million (37.3 percent) for the Temporary Assistance to Needy Families (TANF) Program, funded by an increase in both General Fund and federal fund appropriations for payment to clients and grants for public assistance and relief.

Early Care and Education

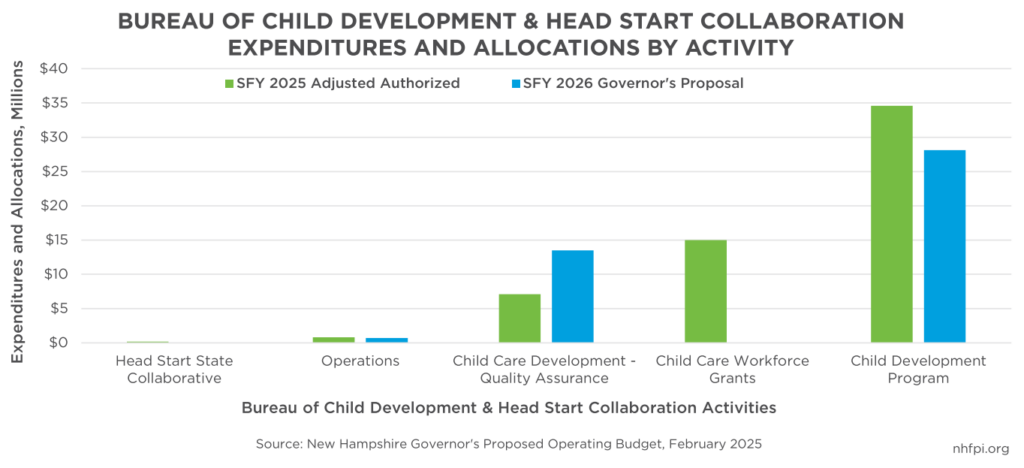

The Governor’s budget proposal reduces overall expenditures for DHHS’s Bureau of Child Development and Head Start Collaboration (BCDHSC) by approximately $15.4 million (27 percent) from the SFY 2025 Adjusted Authorized amount. This Bureau includes most early care and education (ECE) funding and administrative supports, as well as distributes funds for New Hampshire’s Child Care Scholarship Program (NHCCSP), which is a state-federal partnership that provides child care assistance to families with low and moderate incomes. These figures reflect a decrease of approximately $17.8 million in General Funds and a $2.4 million increase in total federal funds for BCDHSC activities.

The largest share of funding is proposed for the Child Development Program, the funding mechanism for the NHCCSP. The proposed amount for SFY 2026 ($28.1 million) is over $6 million less than the Adjusted Authorized amount for SFY 2025. This net change reflects a reduction of $3.5 million of “Protect & Prevent Child Care” funds that would be relocated to the Division of Children and Families, a new $3 million allocation added to “contracts for program services,” and a decrease of nearly $6 million in the “Employment Related Child Care” line, which funds the NHCCSP. The change in NHCCSP funding may reflect an adjustment due to the underutilization of the program in SFY 2024 that resulted in approximately $6.1 million in unused funds.[22] The proposed 2026 figure is more closely aligned with the $27 million spent on the program in SFY 2024. Despite underutilization in SFY 2024, there was an uptick in NHCCSP use in the third and fourth quarters of SFY 2024 that likely reflects the NHCCSP’s expanded eligibility, which was first implemented in January 2024.[23] Household income eligibility levels were also increased based on the annual federal update to the poverty guidelines.[24] In the first year of extended eligibility, NHCCSP utilization increased by 46 percent, from 2,660 children in December 2023 to 3,884 in December 2024.[25]

The average cost per child enrolled in the NHCCSP in SFY 2024 was $9,502.[26] If scholarship funding per child remained the same as SFY 2024 levels and no additional children enrolled in the program after December 2024, the State would need $36.9 million to meet 2024 funding levels for the 3,884 children using NHCCSP funds as of December 2024. As many as 55,000 children under 13 years old may be eligible for the NHCCSP, or approximately 32 percent of all children under 13 in New Hampshire in 2023, the most recently available data from the U.S. Census Bureau.[27] If all eligible children were utilizing funds from NHCCSP at the 2024 average cost per child rate, the annual cost for the program would be over $522.6 million.

The Governor’s budget proposal allocates approximately $28.1 million for each year of the SFYs 2026-2027 biennium budget under the Child Development Program. This allocation makes up approximately 0.35 percent of the Governor’s proposed $16.01 billion State Budget for SFYs 2026 and 2027. Using DHHS Division of Economic Stability’s projected average cost per child in the NHCCSP for SFYs 2026-27 ($8,874), the proposed allocations would allow approximately 3,165 children to utilize NHCCSP funding annually, or 5.8 percent of all potentially eligible children in the state.

Under federal rules and regulations, states can utilize up to 30 percent of TANF funding for child care assistance if NHCCSP funds are depleted and additional families are eligible for the program. At the end of SFY 2024, New Hampshire had a TANF balance of approximately $74.5 million dollars.[28] If 30 percent of TANF reserves available at the end of SFY 2024 were transferred to the Child Care Development Fund (CCDF; the state-federal fund from which child care assistance is drawn), there would be an additional $22.3 million available for the program. Using the SFY 2026 projected cost per child, these additional funds would allow approximately 2,518 additional children to utilize NHCCSP funding. However, the TANF balance would not be a consistent form of funding for an extended period if the state consistently draws down the funds for multiple years to supplement CCDF funding.

The Governor’s proposed budget for Child Care Quality funding in SFY 2026 has a funding increase of approximately $6.4 million (90.9 percent) from Adjusted Authorized funds in SFY 2025, nearly all of which increase funding for “Grants for Public Assistance and Relief.” Funding in this line supports contracts for quality initiatives, including the ECE workforce professional development, web-based health and safety training, the 2027 market rate survey, the child care resource and referral program, and the NH Connections data management system. According to budget testimony from March 3, 2025, the Bureau anticipates increased NHCCSP utilization, which may result in drawing down TANF reserves.[29] TANF funds that are converted to CCDF funds must be utilized in the same manner as original CCDF funding which includes devoting 12 percent of funding to quality initiatives.[30] The $6.4 million increase may reflect additional quality funding that would become available if TANF funds are converted to CCDF funds due to increased NHCCSP usage.

Finally, the Governor’s proposed budget eliminates a $15 million appropriation for the Child Care Workforce Grant program intended to increase the recruitment and retention of the ECE workforce. As written in the current SFYs 2024-2025 State Budget, DHHS is directed to “…incorporate in its biennial appropriation request pursuant to RSA 9:4 an amount necessary to fully fund the child care workforce programs…[31] Although these funds were not included in the Governor’s proposed budget, the Community College System of New Hampshire (CCSNH) has $1.25 million earmark in its budget for “Early Childhood Education tuition and program support” to help offset educational costs for the current and future ECE workforce pursuing coursework at a CCSNH institution.[32]

Education

The Governor’s budget proposal includes increases for both K-12 education and the Community College System of New Hampshire (CCSNH), but a decrease for the University System of New Hampshire (USNH), relative to the current biennium. Changes in K-12 education funding reflect increases in Adequate Education Aid to local public schools, special education aid, Education Freedom Account funding, and charter school tuition.

Adequate Education Aid

The primary mechanism through which State funding is supplied to local public schools for supporting education is Adequate Education Aid. Most of this assistance comes in the form of per pupil Adequate Education Grants, which includes base grants of $4,265.64 per full time student in SFY 2026, under current law, with additional per pupil funding for students eligible for free and reduced-price school meals, students receiving special education assistance, and English language learners. Additional funding for students who do not meet third grade reading proficiency scores was eliminated as part of changes in the SFYs 2024-25 State Budget. In SFY 2026, following the biennial inflation adjustment required by statute, those additional per-pupil grants include:

- $2,184.84 for each special education student with an Individualized Educational Plan

- $2,392.92 per student eligible for free and reduced-price school meals, commonly due to having a household income below 185 percent of the federal poverty guidelines

- $832.32 for each student receiving English language instruction because they are English Language Learners with a different primary language[33]

Some schools may also have access to additional funding through Extraordinary Needs grants, which are provided by the State based on community-level characteristics, rather than those of individual students. These funds are calculated using the amount of taxable property value in a community per student eligible for free and reduced price meals, adding a maximum of $11,500 per eligible student with a sliding scale reduction as taxable community property value increases.[34] As of SFY 2025, districts also receive funding at a rate of 0.15 of full-time student aid for each course credit taken by a local community student who is home schooled. Hold Harmless Grants, first instituted in SFY 2024 to ensure school districts did not receive less funding after the funding formula changes that year, will be reduced to 80 percent of their original value between SFYs 2025 and 2026.[35]

In SFY 2025, the Adequate Education Aid funding formula distributed an average of $5,279.81 for each public school student in New Hampshire.[36] This figure includes the base adequacy amount as well as differentiated aid for students qualifying for free or reduced priced meals, special education, and as English language learners. A December 2020 report from the legislatively-established Commission to Study School Funding identified that, “[o]n average, New Hampshire provides approximately $5,900 per student from state funding sources, or about 32 percent of total spending per student.”[37] In the 2023-2024 school year, New Hampshire local public school districts reported average operating expenses of $21,545.17 per pupil, with added costs of tuition, transportation, facility purchase or construction, capital costs, and interest bringing the total average per student cost to $26,320.12.[38] The difference between resources provided by the State and average school district costs per pupil is largely bridged by funding from local property taxes.[39]

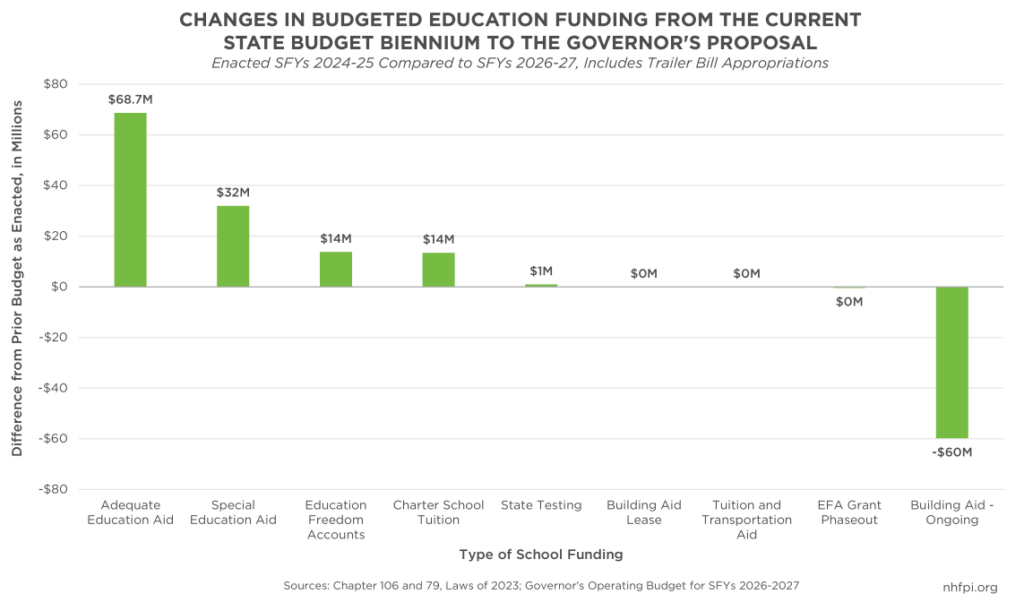

The Governor’s State Budget proposal would increase Adequate Education Aid by approximately $68.7 million across the biennium. This figure likely reflects an estimate of changes in public school enrollment, and the anticipated need of enrolled students, to meet the required 2 percent annual increase that went into effect at the start of SFY 2024.

Special Education Aid

Special Education Aid is different than differentiated special education funding provided through the education adequacy formula, which is based on the number of students with Individualized Education Plans. Special Education Aid funding is in addition to the adequacy formula aid and is intended to help schools pay for the education of students who have significant special education costs beyond the average cost per pupil. Special Education Aid comes in two forms. One form is allocated to schools based on students with special education costs that exceed 3.5 times the estimated State average cost per pupil based on the preceding school year. The school district is responsible for all costs below 3.5 times the average amount, but the State will pay 80 percent of the costs between 3.5 times and ten times the state average per-pupil expenditure. If the cost rises above ten times the amount, the State pays the entire cost beyond that threshold.

The second form of Special Education Aid was added as part of the SFYs 2024-2025 budget cycle and addresses the costs for educating students who require an “episode of treatment,” which is defined in statute as “when a child needs to be placed by the [DHHS] in a DHHS-contracted and/or certified program to receive more intensive treatment and supports and has the objective of helping children in crisis avoid or reduce the use of psychiatric hospitals or emergency rooms.”[40] Special education costs related to an episode of treatment and the determination of placements by New Hampshire DHHS are to be covered in full by the State under the new law and the current State Budget. The Governor’s proposal would draw funding for this purpose from the Education Trust Fund.

The current State Budget appropriated $67.8 million toward the first type of Special Education Aid and $9.2 million in total for the second, of which any unused funds will roll forward into the next State Budget. The Governor’s proposed SFYs 2026-2027 budget allocates an additional $32.0 million toward Special Education Aid for a total of $99.8 million over the biennium. This increase likely reflects adjustments intended to meet school districts’ special education collective reimbursement requests in SFY 2025.[41]

Education Freedom Accounts

Education Freedom Accounts (EFAs), enacted as part of the SFYs 2022-2023 biennium budget, allow families with children who are not enrolled in school districts to apply for and receive Adequate Education Aid. Money in EFAs may be used by parents for a wide variety of education expenses, including tuition and fees at a private school, Internet services and computer hardware primarily used for education, non-public online learning programs, tutoring, textbooks, school uniforms, certain therapies, and other expenses approved by a State-recognized scholarship organization.

To use an EFA, a student must be a state resident eligible for public school from a household that earns no more than 350 percent of the federal poverty guidelines at the time of application. The student’s household does not need to maintain income below that level to continue to be enrolled and receive funding through the EFA program.[42]

School districts no longer receive Adequate Education Aid associated with a student who leaves the district and enrolls in the EFA program; however, the State supplies two years of transitional funding after a student departs the district. Districts receive 50 percent of the original aid for a newly-disenrolled student in the year following a student’s departure, and 25 percent in the second year. The transition grants will not be provided to school districts for students who disenroll after July 1, 2026. The Governor’s State Budget proposal includes approximately $1.1 million to support these “phaseout grants” during SFYs 2026 and 2027.

The Department of Education reported that $22.1 million was spent on Education Freedom Accounts in SFY 2024, while the cost was approximately $27.7 million in SFY 2025, totaling $49.8 million during the biennium.[43] The Governor’s proposal would appropriate $73.5 million in total for SFYs 2026 and 2027, or 47.6 percent more than the amount spent in the past biennium. The proposed allocation for SFY 2027 ($44.1 million) is approximately 444 percent higher than in SFY 2022 ($8.1 million), the first year of expenditures for the program.

The growth in costs is likely influenced by three factors. First, enrollment may increase over time in this relatively new program. Second, the recent changes in the education funding formula also apply to EFA grants, as the calculation is based on the formula for funding public schools, which boosts the cost to the State of each EFA. Third, the Governor is proposing expanding eligibility for EFAs to more households.

Under the Governor’s proposal, income eligibility guidelines for EFAs would remain at or below 350 percent of the federal poverty guidelines for households with students who do not currently attend public school. The program would have universal eligibility, regardless of household income, for all children in grades K-12 who attended a district or chartered public school full-time for the year prior to enrolling in the EFA program. As of September 2024, about 64 percent of all EFA program participants since the start of the program were students who were not previously in public school, suggesting they were already in private school or being homeschooled.[44]

School Building Aid

The Governor’s State Budget proposal allocates approximately $14.8 million in SFY 2026 and $12.0 million in SFY 2027 toward school building aid, which would reduce this funding line by about $60 million from the SFYs 2024-2025 budget. The amounts appear to align with obligated payments to schools for SFYs 2026-2027 but would not allocate additional funding for new school building aid during the upcoming biennium.[45]

Cell Phone-Free Education

The Governor has proposed policy language in the State Budget that would prohibit student use of cell phones and other personal electronic devices during the school day, except when needed as part of students’ individualized education or 504 plans, or to support English language learning students. The proposed budget includes a $1.0 million allocation for a cell phone-free education grant program for SFY 2026 to support school boards in developing policies that help enact this legislation.

Higher Education

The Governor’s budget proposes increasing funding for CCSNH and decreasing funding for USNH during the next State Budget biennium. Increases in allocations for CCSNH in the Governor’s proposal would enable a continued tuition freeze at all of New Hampshire’s community colleges, continue investments in dual and concurrent enrollment programs for 10th-12th graders as well as dedicate funding for career and technical education and workforce credentialling programs for in-demand occupations.

In fiscal year 2025, New Hampshire trailed all other states in higher education funding when measured on a per capita basis as well as relative to the amount of personal income in the state.[46]

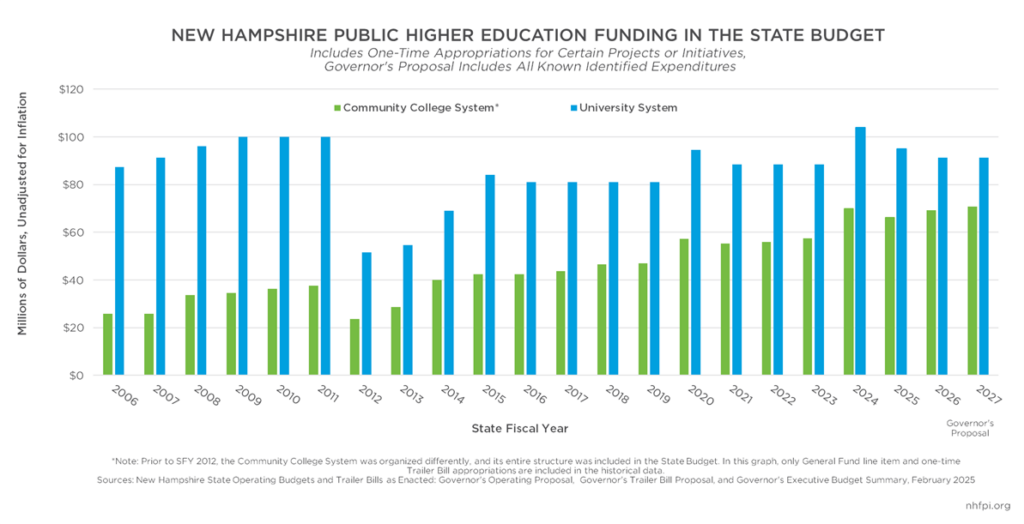

The Governor’s proposed budget would allocate $69.2 million and $70.9 million in SFYs 2026 and 2027, respectively, for the CCSNH. These allocations equate to a 2.9 percent increase from the current biennium allocations, including all one-time appropriations incorporated into the budget Trailer Bills for both budget cycles. The proposed appropriation over the upcoming biennium would include $6.0 million for dual and concurrent enrollment programs, which allow high school students in grades 10th-12th opportunities to take as many as four college courses a year, up to four credits each; $2 million for workforce credentials; $450,000 for Math Learning Communities, which allow districts to offer certain CCSNH math courses at their schools; and $4.4 million to keep tuition rates flat for students. The Governor’s proposed budget would reduce the USNH allocation by $16.5 million (8.3 percent) for SFYs 2026-2027 relative to the current State Budget’s appropriations. If the $9.0 million in one-time allocations from the SFYs 2024-2025 budget for the State’s public four-year institutions are removed, the USNH change is reduced to approximately $7.5 million, or an overall decrease of about 4.0 percent.

Housing

Despite appearing in multiple expenditure categories of the State Budget, funding dedicated to providing and expanding housing options makes up a relatively small portion of regular expenditures. State actions regarding zoning regulations, permitting changes, purchases of land, and other policy-related decisions can impact housing. However, there are only three areas where funding flows directly through the State Budget for initiatives that support resident access to housing or housing construction efforts each biennium. This includes:

- $5 million each State fiscal year in transfers from the Real Estate Transfer Tax to the Affordable Housing Fund, which provides grants and loans to developers looking to construct or rehab affordable housing for those with low and moderate incomes.

- Funding for the Judicial Branch’s Community Housing Program, which provides temporary housing to individuals involved with the criminal legal system who are also experiencing substance use disorders (SUD), including those participating in a drug court program or entering back into the community under parole or probation.

- Funding for the Bureau of Homeless Services, which provides support and resources for those experiencing homelessness or at risk of being unhoused, largely known as the Continuum of Care.

When combined, these three allocations total approximately $61.7 million across the Governor’s proposed $16.01 billion State Budget biennium for SFYs 2026 and 2027, or approximately 0.4 percent for all appropriations.

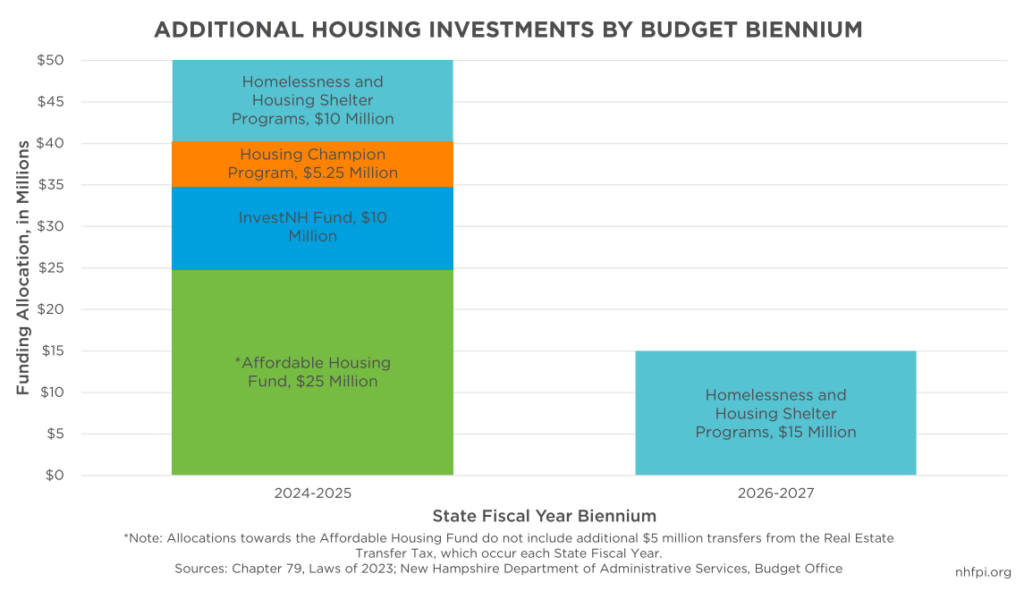

The current State Budget for SFYs 2024-2025 included $50.25 million in one-time investments for housing initiatives, including funding for the Affordable Housing Fund ($25 million), InvestNH Fund ($10 million), homelessness and housing shelter programs ($10 million), and the Housing Champions Program ($5.25 million). The majority ($8 million) of the added $10 million for homelessness services was dedicated to increasing rates paid to shelters across the state, which increased from $20 to $27 per day.[47] While the proposed Budget does not repeat any of these one-time investments, these increased rates paid to shelters have been maintained in the Governor’s State Budget. According to the Division for Behavioral Health, $5 million will be allocated across the SFY 2026-2027 biennium for the preservation of increased rates, which is in alignment with the passage of Senate Bill 406 during the 2024 legislative session.[48]

In addition to the $2.5 million each State fiscal year for increased rates paid to shelter programs, the Governor’s State Budget added $10 million across the biennium from the State’s Opioid Abatement Trust Fund to increase services for people experiencing homelessness who are also experiencing opioid use disorder or another co-occurring SUD. All funding for homelessness services is located under the Bureau for Homeless Services’ budget lines, within the larger Division for Behavioral Health.

While funding for the Housing Champions Program has not been repeated in the new biennium, the Governor’s State Budget proposed extensions for lapsing funds until June 30, 2026. The Governor’s budget also incorporates $621,440 in funds into the funding lines for administration of the program, which provides incentives for municipalities to make zoning and other infrastructure changes to support increased workforce housing.

Expedited Permitting

In addition to monetary allocations, the Governor’s State Budget proposed changes to the State’s permitting process for permits, approvals, or written authorizations related to shoreland, wetland, water quality, and construction of driveways off of public roads, which may involve the construction of new housing. In policy language incorporated into the Governor’s budget proposal, State departments reviewing permit applications would be required to provide decisions within 60 days or less. If a department is unable to provide a determination within 60 days, then the permit would be automatically approved.

Applicants are able to provide written approval for extending the State timeline if they do not need a determination within the 60-day window. In addition, any allotted time needed to collect additional information from applicants would not count against the State’s 60-day timeline.

The expedited permitting process in the Governor’s proposal is associated with larger policy changes regarding interactions between state agencies relative to environmental permitting. Under the proposal, departments reviewing permits are able to consult with the state’s Department of Environmental Services, which will then involve the Departments of Fish and Game or Natural and Cultural Resources, on any environmental matters concerning endangered species and potential impacts of building in certain locations.

Justice and Public Protection

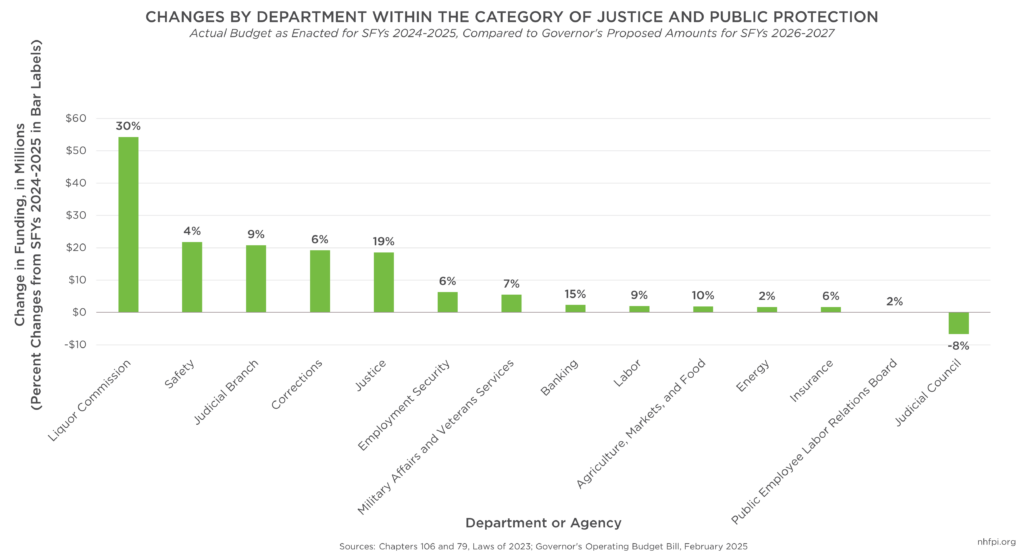

Among the fourteen State departments and other agencies that are within the expenditure category of Justice and Public Protection, all except one, the Judicial Council, saw proposed increases between the two biennia.

The largest proposed increase ($54.3 million, 30 percent) was among the Liquor Commission, which appears to be primarily due to differences in accounting between the two biennia. The Governor’s proposed budget included allocations to account for the transferring of funds from the Liquor Commission to other agencies, such as funds dedicated to the New Hampshire Granite Advantage Health Care Trust Fund and the Alcohol Abuse and Prevention Treatment Fund; transfers were not accounted for in the SFYs 2024-2025 Budget, which appears to explain the increase in the Liquor Commission’s Budget for SFY 2026-2027 as proposed by the Governor.

Under the Governor’s State Budget proposal, the Department of Safety would have an increase in appropriations of around $21.8 million (4.2 percent). One of the largest rises between the SFY 2025 Adjusted Authorized appropriations and the Governor’s proposed SFY 2026 was reserved for the Division of State Police to fund contracts for operational services to meet security needs at New Hampshire Hospital; the Governor’s Budget totals $4.4 million across the biennium for these contracts, and total funding from New Hampshire Hospital security would rise from $1.8 million in the current year to about $4.6 million in both SFYs 2026 and 2027. The proposed State Budget for the Department of Safety also included funds for the continuation of the State’s Granite Shield Program and newly-proposed Northern Shield Program, with both initiatives aimed at drug trafficking prevention efforts and totaling around $3.5 million across the biennium when combined.

Under the Governor’s State Budget, the Department of Corrections would experience an increase of $19.2 million (5.9 percent) between the two biennia. About $326.0 million was allocated to the Department in the current State Budget for SFYs 2024-2025, with around $4.4 million in additional adjusted authorized appropriations made through the Joint Legislative Fiscal Committee, as of January 30, 2025.[49] Large increases in allocations between the two biennia may be in part due to pay increases for State employees, which were enacted in the current State Budget but not distributed to individual agency budget lines in the accounting of those appropriations.

The final agency to see a proposed increase of over $15 million was the Justice Department ($18.6 million, 19.1 percent), with almost all of this boost reserved for the Attorney General’s Office. Some of this increase was due to an added $3.0 million across the biennium to fund Child Advocacy Centers, as well as $800,000 during the biennium for funding the Internet Crimes Against Children Task Force.

While the Judicial Council saw a decline in its budget between the two biennia, this change is not uniform by individual State fiscal year and is driven largely by the Governor’s proposal not repeating one-time appropriations totaling $6.8 million to support the public defender program and contract counsel costs.[50] The Adjusted Authorized amount for SFY 2025 is relatively similar to the proposed amount for SFY 2026 for the Judicial Council.

Proposed Changes to the Bail System

Outside of monetary allocations, the Governor’s Trailer Bill included proposed changes to RSA 597:2, the state’s bail law outlining procedures for individuals entering into the criminal legal system.

Changes between the current law and the Governor’s proposal include, but are not limited to:

- The elimination of magistrates. Three magistrates were appointed to the State’s judicial system following the passage of House Bill 318 during the 2024 legislative session. Under this change, magistrates were granted authority to preside over bail hearings. The Governor’s proposed overhaul language does not include this authority.

- Lower standards of proof and higher risk considerations when determining bail amount. The State’s current bail law requires a higher standard of proof, being clear and convincing evidence, when considering the amount one must post for bail. It also limits a judge to solely consider the person’s risk of failing to appear in future proceedings. Under the proposed change, only probable cause would be needed when considering the bail amount. The change would also allow the court to consider various broader factors outside of the sole risk of failing to appear, including whether the person is at risk of committing a new crime or violating a condition of bail.

- Increased triggers for detention without the possibility of bail. Under the State’s current bail law, individuals can be detained if they have failed to appear three times in three years, or twice in their current pending case. The Governor’s proposal includes language increasing triggers for detention; a person could be detained if they failed to appear, committed another crime, or violated bail conditions during any prior offense or the current one.

- New considerations around child custody. In the proposal, the court can now consider whether keeping a person in custody would leave a child without a caretaker, and in turn, involve the Child Protection Services.

In addition to proposed policy changes among the state’s bail system, the Governor’s Budget includes around $3.6 million across the biennium towards the Judicial Branch to account for costs associated with bail reform.

Transportation

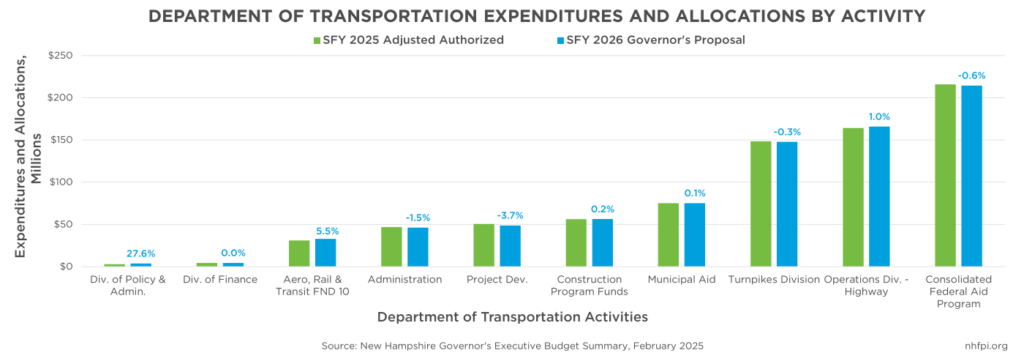

The Transportation expenditure category in the State Budget is entirely comprised of the New Hampshire Department of Transportation (DOT) budget and does not include any other departments or agencies. The Governor’s budget for SFY 2026 keeps funding relatively stable for the DOT with a modest decrease of approximately $200,000, less than a one percent change compared to Adjusted Authorized funding for SFY 2025. Compared to appropriations for the SFYs 2024-2025 biennium, total funding would increase $15.1 million (1.0 percent) in SFYs 2026-2027 combined, which likely reflects relatively few changes and a funding increase that would likely be below future inflation.

Most DOT funding comes from federal funds as well as the State’s Highway and Turnpike Funds, with only $1.8 million of General Funds allocated for DOT for each year of the biennium in the Governor’s proposed budget. The largest DOT activities, consolidated federal aid program, ops division highway, and the turnpikes division, spend the majority of allocated funds on construction materials, new and replacement equipment costs, and wages and benefits.

The largest percentage increase within the Governor’s proposed DOT budget, a $3.7 million (27.8 percent) increase within the Division of Policy and Administration, would be the result, in part, of overhead cost increases, increased wage costs at the Office of Asset Management , and a federal training grant. Aggregate aero, rail, and transit funding increases would also be funded by additional federal supports.

The current State Budget appropriated nearly $1.9 million to rural and urban transit agencies to match available federal funds. The Governor’s proposal does not appear to repeat this appropriation.[51]

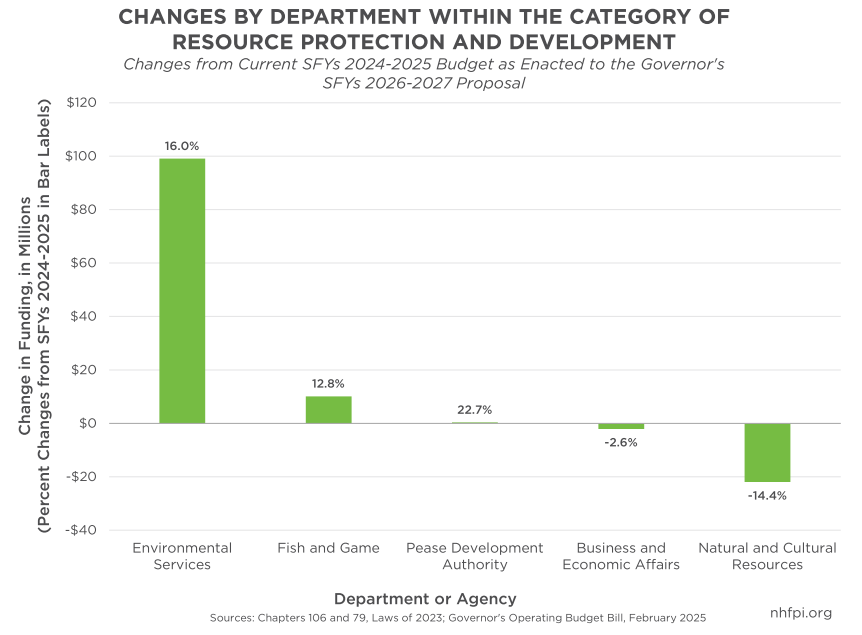

Resource Protection and Development

Funding for agencies within the Resource Protection and Development category increased in aggregate, but changed to different extents within agencies because of several key shifts. The Department of Environmental Services (DES), the largest agency in this category, would have the largest increase in funding under the Governor’s proposal. DES appropriations would rise $99.1 million (16.0 percent) relative to the SFYs 2024-2025 biennial State Budget as enacted. Accounting changes, particularly with regard to federal funds and revolving loan funds for water infrastructure projects, comprise some of these changes, but a significant new appropriation in the DES budget stems from reimbursements from the Drinking Water and Groundwater Trust Fund that would occur only in SFY 2026. This Fund was supported with an appropriation of $277 million resulting from a State lawsuit against ExxonMobil for groundwater and drinking water contamination.[52]

The Governor’s budget proposal would reduce funding at the Department of Natural and Cultural Resources relative to the SFYs 2024-2025 State Budget. This decrease in funding is primarily due to the Governor not proposing to repeat one-time funding from the current biennium, including $18.0 million in General Funds for the Cannon Mountain Aerial Tramway, which the Governor proposes transferring back to the General Fund and replacing with an appropriation in the Capital Budget. Other unrepeated one-time appropriations included General Funds dedicated to renovating Northwood Meadows Lake Dam and the Christa McAuliffe Memorial on the State House grounds.[53]

Funding for the Department of Business and Economic Affairs would decline by $2.1 million (2.6 percent) under the Governor’s proposal relative to funding for the SFYs 2024-2025 biennium. While budgeted appropriations for the Division and Travel and Tourism Development would increase $3.3 million (31.0 percent) between the SFY 2025 Adjusted Authorized total and SFY 2026 under the Governor’s proposal, that increase was offset by the one-time funds appropriated to the InvestNH Fund. Allocations to this Fund were designed to support housing construction in the state and were held within the Department of Business and Economic Affairs in the SFYs 2024-2025 State Budget; however, they were not repeated in the Governor’s proposal. The Governor’s proposal would also establish, within the Department of Business and Economic Affairs, the Division of Planning and Community Development.

Changes at the Department of Fish and Game between SFY 2025 Adjusted Authorized appropriations and the Governor’s SFY 2026 proposal were distributed across several budget lines and not concentrated in any single function or operation.

The Governor’s proposal would repeal planned appropriations, authorized in the current State Budget, of $15 million in each of the years SFYs 2026 and 2027 for local government wastewater infrastructure projects.[54]

In her budget proposal, the Governor proposed withdrawing $10.0 million from the Renewable Energy Fund. The Renewable Energy Fund is used to support renewable energy rebate and grant programs as well as renewable energy generation and technology projects. The Governor would use this $10.0 million transfer to support the General Fund in SFY 2026, as identified in the funds transfer section of this report.[55]

Solid Waste Site Evaluation Committee

The Governor proposed the creation of a Solid Waste Site Evaluation Committee, comprised of five members drawn from the Waste Management Council, the DES, and three gubernatorial appointees. This Committee would evaluate the local and statewide benefits and detriments of proposed non-municipal solid waste facilities that accept more than 100,000 tons of waste per year for storage, separation, processing, treatment, transfer, or disposal.

A certificate from the Committee shall be required before any facilities of this magnitude are constructed in the state. The Committee may set terms governing the facility’s construction, operation, and maintenance, which must be followed in addition to any other federal, state, or local permits or approvals. Once an application for a certificate is submitted, the Committee must hold public information sessions and, within 180 days of acceptance of the application, must issue or deny a certificate. Both the Committee and the applicant are required to hold public hearings in the municipality where the proposed facility would be located.

Permitting and Endangered Species Protection

The Governor’s budget proposal includes key changes to environmental policies that, as noted in the housing section of this report, are designed to speed the timelines for permitting processes. Under current policy, State agencies that undertake permitting processes must avoid and minimize harm to endangered species; these State agencies, under normal processes, would consult with the Fish and Game Department to understand risks to endangered or threatened animal species and with the Department of Natural and Cultural Resources for risks to plants. The Governor’s proposed policy would allow State agencies to avoid, minimize, or mitigate harm to endangered or threatened species and their habitats, rather than only avoiding or minimizing harm, and would allow agencies to choose whether to consult with the DES to fulfill that requirement. The DES would be assisted by the Departments of Fish and Game or Natural and Cultural Resources. The DES would also have a fee structure to support these permit reviews.

The reviews would be time-limited in key instances. With certain exceptions for processes that require more information or have permission from the applicant, review processes are limited to 60 days to default to providing permission to the applicant seeking to complete a project. This time constraint would apply to permitting processes associated with wetlands, shorelands, wastewater and other water-related permitting, and driveway construction that interacts with certain public roads.

Permit Fees and Regulations

The Governor’s budget proposal would raise fees for DES permitting and services that are set in statute, as well as provide for automatic inflation adjustments in future years. The permitting fees that would be increased include:

- Dredge and fill projects, including shoreline and dock application fees

- Terrain alteration, with a new category of fee for terrain alterations greater than 200,000 square feet

- Annual registration fees and new applications for dams

- Plans for subdivisions, including those with sewage or waste disposal systems

The procedures for certain external reviews of projects would be altered to reduce the number of potential review venues, including by the New Hampshire Rivers Council. The Governor’s proposal also includes provisions that would remove fees for public water system operational permits, eliminate the requirement that powerboats registered outside of New Hampshire and operating in New Hampshire public waters buy an aquatic invasive species decal from DES, and no longer require a fee for the submission of plans to the DES for the construction of sewerage systems.

The Governor’s proposal also establishes a definition for boathouses that regulates these structures built over public waters, restricting the size and purpose of these structures.

Several councils would also have membership altered under the Governor’s proposal, including the Air Resources, Waste Management, Water, and Wetlands Councils.

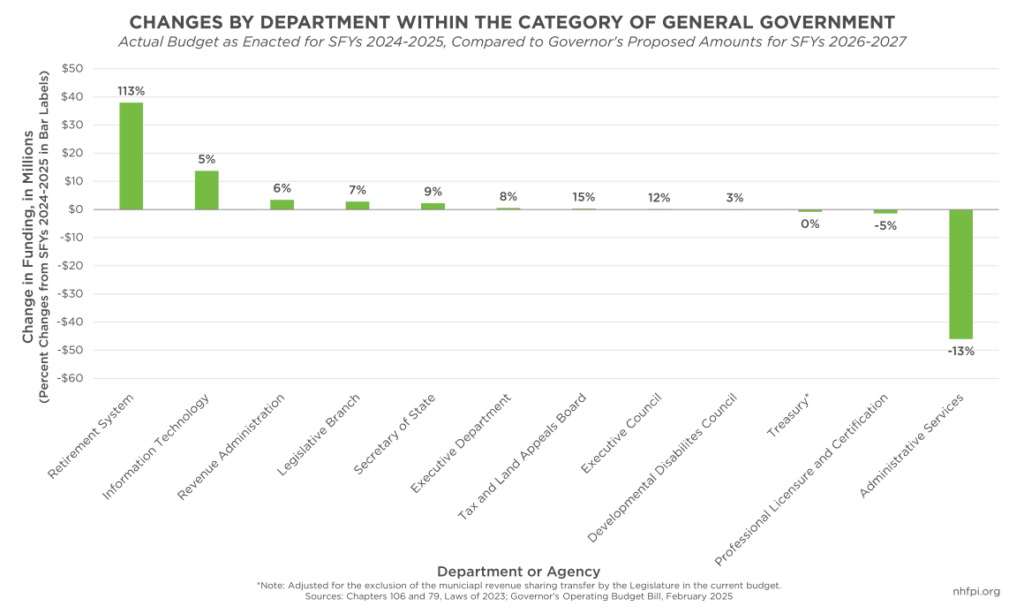

General Government

Within the agencies of the General Government category, two significant shifts from the current State Budget constituted most of the changes in funding. First, one-time funds associated with capital projects and purchases allocated to the Department of Administrative Services in the current biennium have not been repeated, which reduced the relative funding at that Department. In the current State Budget, the Department of Administrative Services was allocated a combined $38.2 million in General Funds for the purchase of a building to house the Department of Justice, for State House Annex renovations, State building maintenance, moving and fit-up costs at buildings, and for upgrades to the State’s financial, payroll, and budgeting systems. The Governor’s budget proposal does not repeat those allocations, which accounts for 83.0 percent of the decline in funding to the Department of Administrative Services.[56]

Second, the Governor proposed adding $32.9 million in General Funds to the New Hampshire Retirement System, which would constitute the largest component of an overall increase of $38.0 million (112.7 percent) for the System in the Governor’s proposed State Budget relative to the SFYs 2024-2025 budget as enacted. This increase would be followed by a $27.5 million contribution each year until SFY 2034, under State law proposed by the Governor. Structured similarly to changes to State law discussed in 2023 but not enacted, this appropriation would fund retirement contributions and support subsequent benefits policy changes for State and local fire and police employees who were not vested into the New Hampshire Retirement System prior to 2012, when significant changes were made to retirement benefits; these employees would have been vested prior to September 1, 2013, which would be a change in State law from the limit of January 1, 2012. The change would also define “vested” explicitly in State law relative to participation in the New Hampshire Retirement System, and make future incremental changes in benefit eligibility for certain retirees in the years 2026 through 2033.[57]

The Governor’s proposal would also transfer authority over certain mechanical and electrical inspectors from the Office of Professional Licensure and Certification to the Department of Safety. The Office of Professional Licensure and Certification would also have more administrative responsibilities and oversight of barbering, cosmetology, and esthetics, with reduced inspection requirements for shops that meet certain certification thresholds.

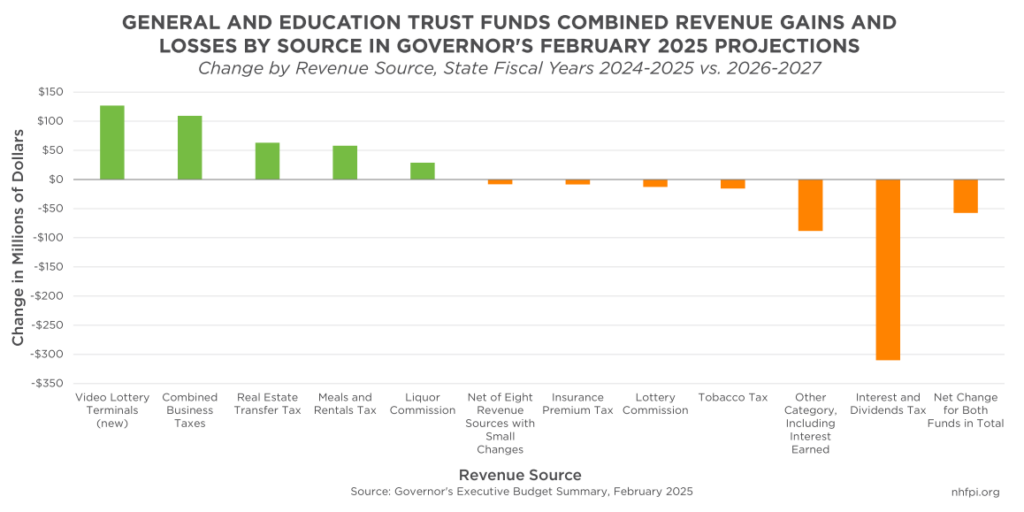

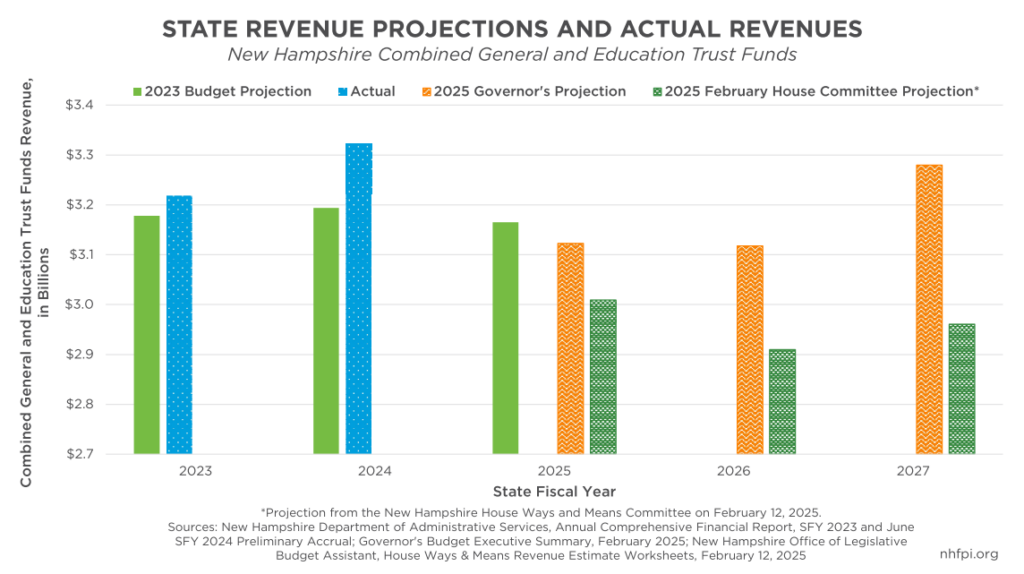

Revenue Projections and Policies

The growth in the Governor’s budget proposal is supported by revenue projections with a relatively optimistic view of the New Hampshire economy in the next two years.[58] Overall, the Governor’s revenue projections estimate that total revenues to the General Fund and the Education Trust Fund will be lower in SFY 2025 than they were in SFY 2024, and will not reach SFY 2024 levels in either SFYs 2026, when they will slip further, or SFY 2027. While those topline figures do not suggest robust growth, they include the repeal of the Interest and Dividends Tax after SFY 2025, which comprised an estimated 5.6 percent of combined General and Education Trust Funds revenue in SFY 2024. Other revenue sources needed to grow sufficiently to offset forgone revenue with the repeal of that tax, as well as the waning of interest revenue associated with State cash holdings, to keep revenues from falling further in the Governor’s projections.[59]

To offset the loss in revenue, the Governor made several key projections. First, the Governor anticipated that video lottery terminals, a new revenue source, would generate $127 million during the biennium, with most revenue ($117 million) coming in the second year of implementation.

Second, the Governor projected combined business tax revenues would grow 8.0 percent between SFY 2025 and SFY 2026, and add another 3.0 percent between SFY 2026 and SFY 2027. While business tax revenues can be volatile and the Governor is projecting an 8.7 percent drop between SFYs 2024 and 2025, 8.0 percent growth would match the compound annual growth rate over the last ten years, when business tax receipts have grown robustly, buoyed by surging national corporate profits.[60] This growth rate would represent a rapid recovery from current business tax revenues, which are currently 17.5 percent lower, as of the end of February SFY 2025, than they were at the same point last year.[61]

Third, the Governor projected Real Estate Transfer Tax revenue growth would exceed both its ten-year and twenty-year compound annual growth rates, suggesting housing prices would have to continue increasing and inventory would need to be sufficient to keep the volume of sales moving.[62] The Governor projected Real Estate Transfer Tax revenues would grow 8.0 percent in each year of the State Budget, while the compound annual growth rate for Real Estate Transfer Tax revenues from 2015 to 2024 was 4.6 percent.

Fourth, the Governor projects Meals and Rentals Tax revenue growth will align with the relatively robust growth rates of recent history, rising 5.0 percent in each of the fiscal years of the budget biennium. This growth rate would match the 2015-2024 period, and be somewhat higher than the 4.4 percent of the 2005-2024 period.

In total, the Governor projected the General Fund and the Education Trust Fund would collect $9.39 billion in SFYs 2025-2027, including $6.27 billion during the biennium, under current policy. The Governor’s total for the biennium would rise to $6.4 billion after adding in video lottery terminal revenues. However, revenue projections from the House Ways and Means Committee total $5.92 billion for the biennium and $8.88 billion for SFYs 2025-2027. These totals are $513.5 million less than the Governor under current policy, and $640.5 million less than the Governor’s estimates including the video lottery terminals. The House has not yet decided whether to change revenue policies in its State Budget proposal.[63]

Video Lottery Terminals

As identified in the revenue projections, the Governor’s State Budget proposes adding a revenue source. The Governor’s budget would rename the Lottery Commission to be the Lottery and Gaming Commission, and put the newly-named agency in charge of “video lottery terminals” (VLT). VLTs are devices that accept and dispense money, vouchers, or other credits to players who participate in games of chance at machines with spinning reels or video displays that are not connected to the internet. VLTs would only be allowed at licensed locations under the Governor’s proposal.

VLT revenue would be collected through wagers, which would be limited to $25 per wager. The average daily aggregate minimum payback must be 88 percent for all VLTs at a facility, under the Governor’s proposal. Licensees would be required to collect at least 45 percent of VLT-generated revenue for State or charitable purposes. Of the 45 percent of all revenue collected, 35 percent of that total must be provided to charitable organizations under contract with the VLT licensee. The rest of the 45 percent would be distributed evenly between the State’s General Fund and Education Trust Fund. No Lottery Commission revenues currently support the General Fund; all Lottery Commission profits support the Education Trust Fund.[64]

Education Trust Fund Revenue Distribution Changes

The Governor proposed changing the distribution of funds from four key revenue sources between the General Fund and the Education Trust Fund. Currently, 41 percent of the revenue collected by the Business Profits Tax is sent to the Education Trust Fund, while the remainder supports the General Fund. The Business Enterprise Tax has the same percentage split, while the Real Estate Transfer Tax devotes about one-third of the revenue collected to the Education Trust Fund, and the Tobacco Tax has a split based on the tax rate for packs of 20 cigarettes that is applied to all tobacco products sold. The Governor proposes devoting 34 percent the revenue from all four taxes to the Education Trust Fund and the rest to the General Fund.[65]

In aggregate, these changes in transfers would result in less revenue flowing to the Education Trust Fund. Relative to current policy and based on the Governor’s revenue estimates, these changes would result in $176.4 million less flowing to the Education Trust Fund during the biennium, and the equivalent amount in addition to the dollars going to the General Fund, than without the policy changes.[66]

This change would permit more General Funds to be available for other obligations while reducing the amount of surplus carried forward in the Education Trust Fund. The unaudited Education Trust Fund balance at the end of SFY 2024 was $136.2 million, and the Governor projects the balance will be $128.9 million at the end of SFY 2025. With less revenue flowing to the Education Trust Fund under the Governor’s proposed policies, the balance would, based on the Governor’s projections, fall to $14.0 million by the end of SFY 2027 as Education Trust Fund expenditures outpace revenues.

The Governor’s proposal would also expand the potential uses for the Education Trust Fund to include funding the dual and concurrent enrollment program at the Community College System of New Hampshire, to fund certain forms of special education, to provide grants for limiting cell phone use in local school districts, and to fund Department of Education operating costs.

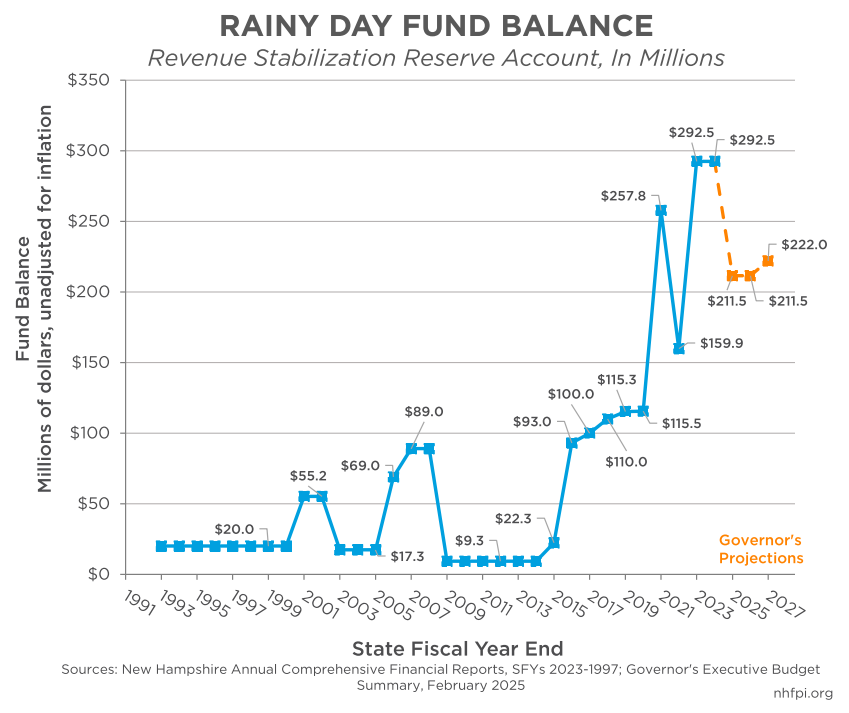

Rainy Day Fund and Other Transfers

To help fund the State’s General Fund and offset revenue shortfalls, the Governor would rely on transfers from other funds and untapped appropriations. First, the Governor projects that State agencies will underspend their budgets by $70.0 million, generating a General Fund lapse at the end of June 30, 2025 that would help offset the revenue shortfall for the year. Second, the Governor anticipates transferring $81.0 million from the State’s Revenue Stabilization Reserve Account, also known as the “Rainy Day Fund,” to the General Fund to put the budget in balance for the biennium. The Rainy Day Fund’s projected balance of $292.5 million can support an $81.0 million transfer; however, the last instance of a transfer being needed from the Rainy Day Fund for reasons related to a revenue shortfall was SFY 2009, as the poor economic environment generated by the Great Recession of 2007-2009 had negatively impacted State revenues. Recent economic conditions have been much more favorable than in 2009.[67]

The Governor would also bolster General Fund revenue from two sources during the biennium. First, the Governor proposed allowing an $18.0 million General Fund appropriation made by the current State Budget for the operation and maintenance of the Cannon Mountain Aerial Tramway to lapse back to the General Fund in SFY 2026. The Governor’s capital budget requests $20.0 million for the Tramway, potentially to pay for upgrades that would have been funded with General Fund cash that has not yet been spent.[68]