The next two-year State Budget will fund State-supported services in an uncertain economic environment and following a period of substantial increases in State revenue. These revenue increases, primarily driven by an increase in national corporate profits that has accelerated since the start of the COVID-19 pandemic, have provided the State with substantial opportunities to address immediate needs and longstanding challenges. However, the corporate profits fueling business tax revenues may decline if an economic slowdown or recession occurs during the next State Budget biennium. Concurrently, public service needs may increase with a slowing economy as more people lose employment and income. If the economy weakens substantially, continuing to provide key public services during the next State Budget biennium will be essential for directly supporting individuals and families as well as for providing economic stimulus, and reducing State revenue could put these key services at risk.[1]

The Governor’s State Budget proposal would allocate significantly more funds to State services than were approved for the current State Budget biennium in 2021. The increases in this proposal reflect an acceleration in inflation that has increased the costs of providing services, the winding down of federal COVID-19 funding availability, and several new initiatives forwarded by the Governor to deploy revenue surpluses generated since the start of the COVID-19 pandemic. Key components of the higher funding totals include increased appropriations for health services, such as operations at a newly-acquired State mental health hospital for children and higher Medicaid reimbursement rates, as well as a substantial boost in overall education funding through changes to the State’s school funding formula. The Governor would also devote one-time financing for capital projects and housing initiatives, increase pay for State employees to reduce vacancies in State government, and eliminate State license requirements for certain professions. The Governor projected revenues would decline slightly, partly due to the proposed inclusion of repealing the Communications Services Tax and the continued phaseout of the Interest and Dividends Tax. This Issue Brief examines the Governor’s State Budget proposal, including both funding and associated policy, for State Fiscal Years 2024 and 2025.[2]

The Topline Changes

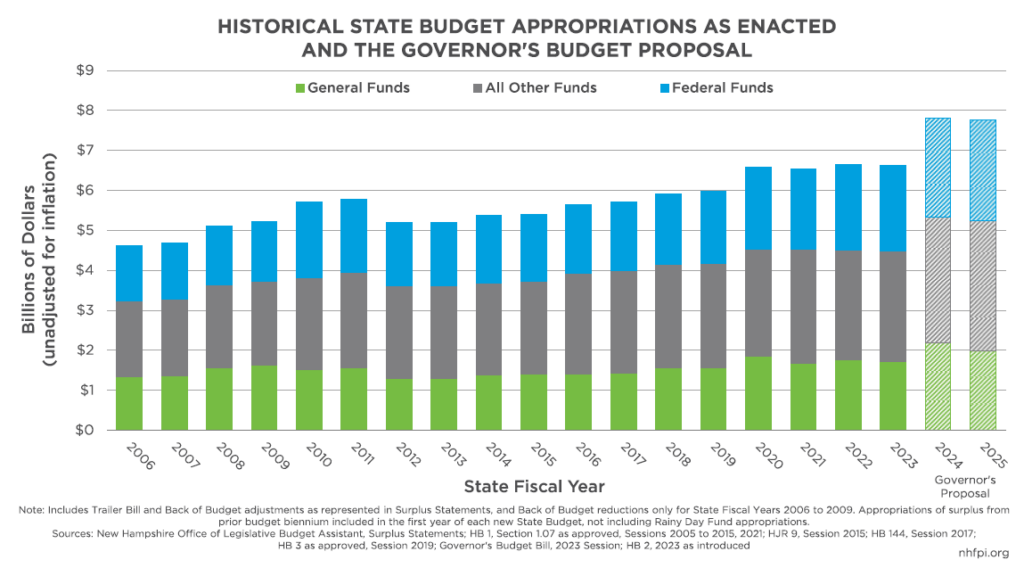

The Governor’s proposed budget for State Fiscal Year (SFY) 2024 and SFY 2025 would spend substantially more, unadjusted for inflation, than prior State Budgets and continue the trend of increasing aggregate appropriations from budget cycles since the SFYs 2012-2013 State Budget. The Governor’s proposal, net of interagency transfers related to information technology services, would appropriate $15.57 billion during SFYs 2024 and 2025, a 17.3 percent increase from the comparable SFYs 2022-2023 State Budget total allocated in the final operating budget bill.[3] Some of this increase likely reflects faster growth in the cost of providing the same services due to inflation.[4]

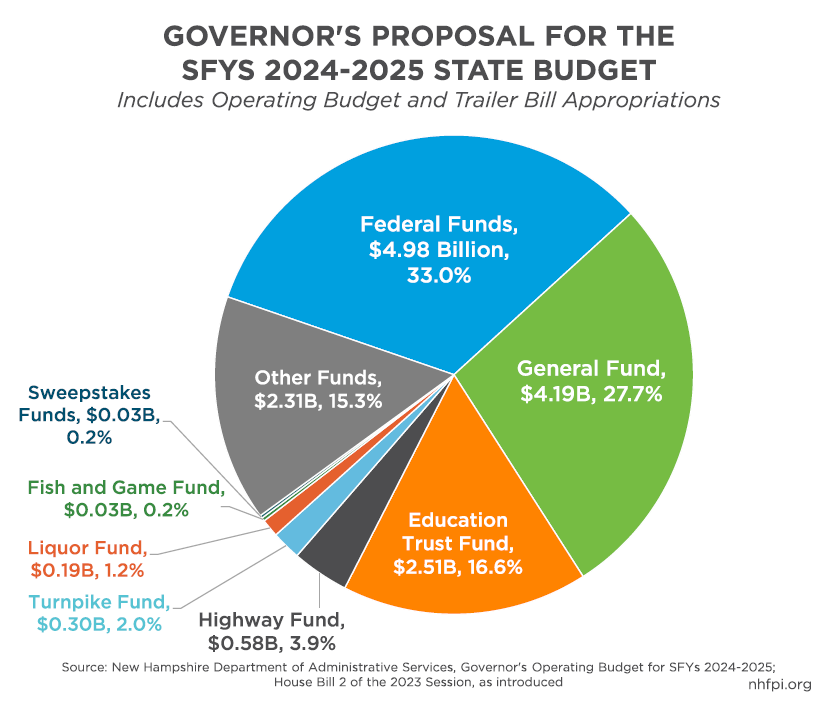

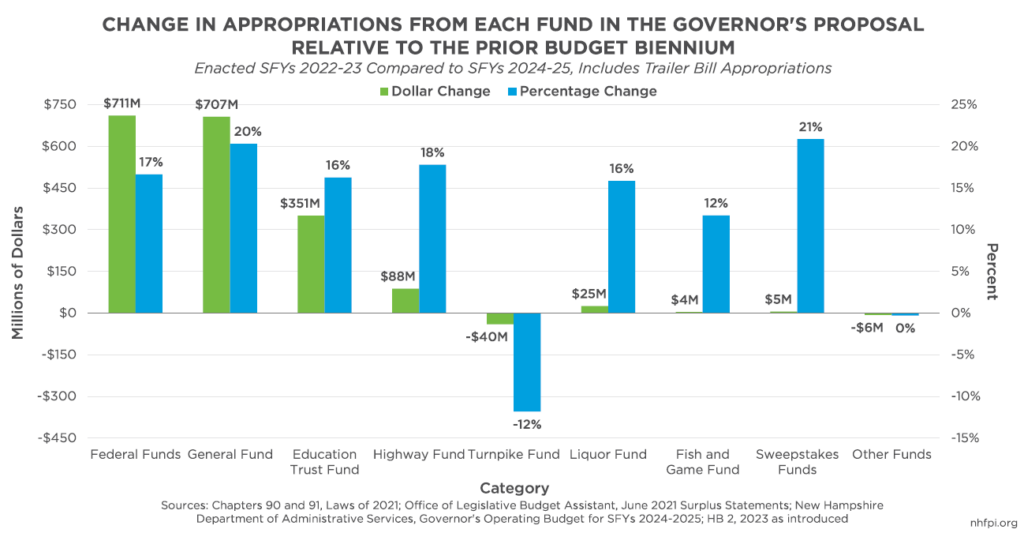

Not all funding areas would expand evenly under the Governor’s State Budget proposal. Of the State Budget’s major funds, which are the legal structures organizing State Budget appropriations, the Governor budgets for the largest dollar increase in Federal Funds. The Governor anticipates that transfers from the federal government to fund State Budget expenditures would increase by $711.4 million (16.7 percent) in the upcoming biennium relative to the amounts anticipated by the current State Budget as passed in 2021. The Governor’s State Budget proposal does not appear to include the flexible aid to the State provided by the federal American Rescue Plan Act, which has been allocated outside of the lawmaking process and through the Joint Legislative Fiscal Committee and the Executive Council.[5]

The Governor’s budget would expand General Fund expenditures by $707.1 million (20.3 percent) relative to the prior biennium, constituting the second-largest increase in dollars among the major funds and only slightly behind the Federal Funds. The percentage increase in General Funds is larger than the 17.3 percent increase in the overall State Budget, comparing the current biennium as enacted in 2021 to the Governor’s proposal. These appropriations include the allocations of General Funds made from surplus revenue over expenditures in the current State Budget. Both the surplus and the Governor’s revenue projections reflect the substantial increase in State revenues since SFY 2020, supported by the rebounding economy following the worst periods of the COVID-19 pandemic and soaring national corporate profits that have contributed to Business Profits Tax receipts.[6]

The Governor would appropriate more dollars from the Highway Fund but reduce appropriations from the Turnpike Fund. The Highway Fund would increase by $88.0 million (17.8 percent) under the Governor’s budget proposal relative to the amounts budgeted in 2021 for the current biennium, while the Turnpike Fund would decline by $39.7 million (11.8 percent).

The Governor would appropriate more than the current State Budget to the Education Trust Fund, which holds the funding for grants for local public education to school districts. This increase reflects several of the proposed increases in education funding, for both local public schools and by drawing on the Education Trust Fund for additional school building aid, Education Freedom Accounts, and other expenses. The total increase in Education Trust Fund spending would be $351.4 million (16.3 percent) relative to the current State Budget as enacted in 2021.

Expenditure by Category of Government Services

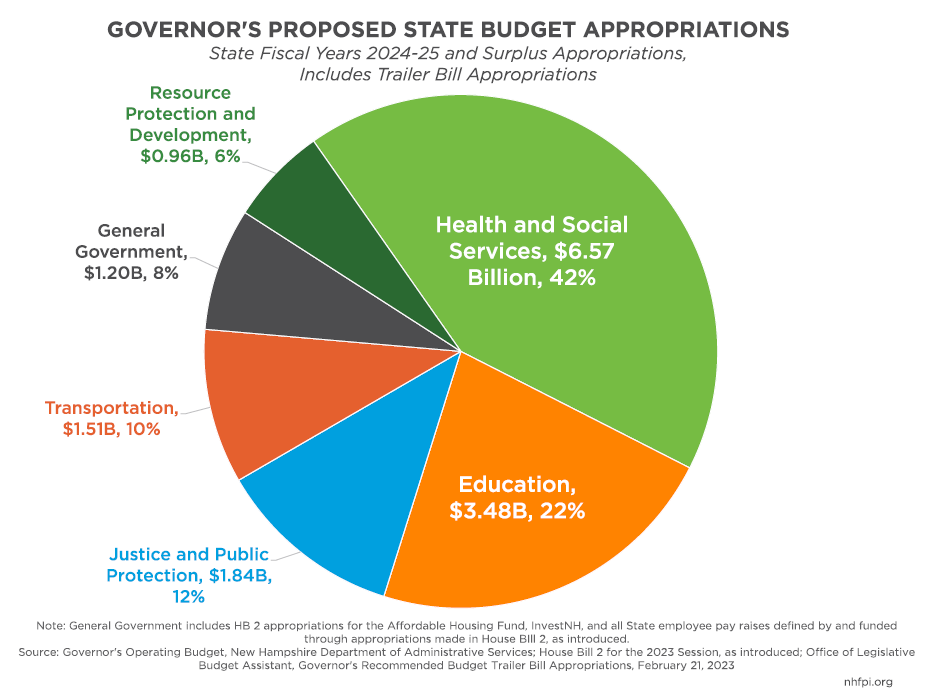

All State Budget expenditures are allocated to one of six categories based on the service area of each department. These six categories are designed to cover all areas of State government operations, and include General Government, Justice and Public Protection, Resource Protection and Development, Transportation, Health and Social Services, and Education.

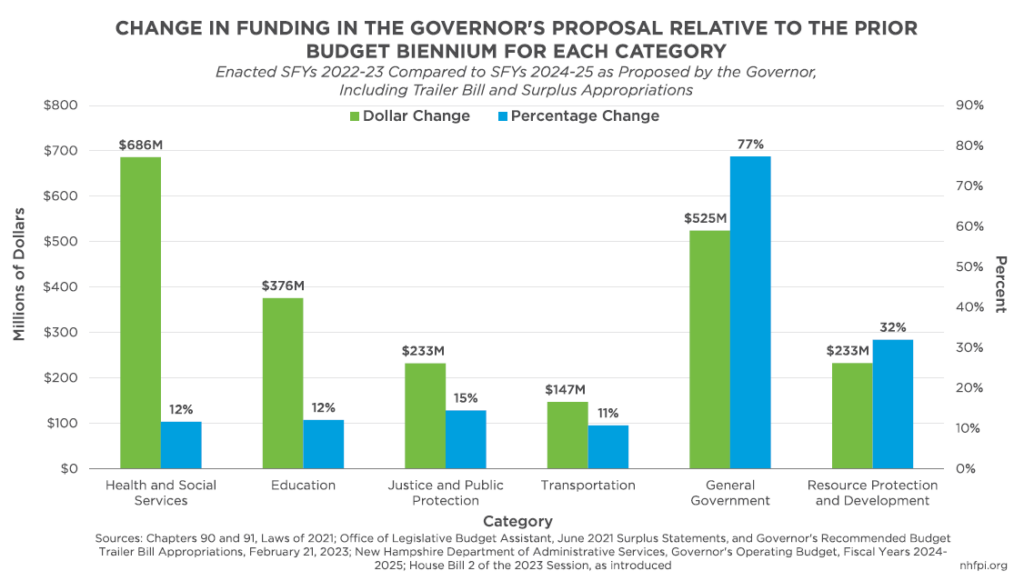

Similarly to the current State Budget, the Governor’s budget proposal would allocate the plurality of funds, totaling $6.57 billion (42.2 percent), to Health and Social Services. Education would receive just over a fifth of appropriations, totaling $3.48 billion (22.4 percent). Justice and Public Protection would receive the next largest appropriation, with $1.84 billion (11.8 percent) appropriated during the biennium, including General Fund and Federal Fund appropriations as well as appropriations from all other funds. Transportation would follow with $1.51 billion (9.7 percent), General Government with $1.20 billion million (7.7 percent), and Resource Protection and Development with $960.6 million (6.2 percent).

The largest dollar increases, relative to the current State Budget as passed, would go to Health and Social Services, although the category would decline as a percentage of the entire State Budget. Health and Social Services, which is almost entirely comprised of the New Hampshire Department of Health and Human Services (DHHS) budget, would rise by $686.0 million (11.7 percent). This increase reflects additional funding for health coverage for residents through Medicaid, including for developmental services, as well as the addition of funding for Hampstead Hospital into the State Budget, which the State purchased and began operating with flexible federal funds from the American Rescue Plan Act during the current State Budget biennium.

Education, the next-largest category in the State Budget, would see a higher amount relative to funding from the current biennium’s appropriations under the Governor’s proposal as well. The majority of expenditures in this category are driven by the Adequate Education Aid paid primarily based on per pupil grants to local governments to help fund public education. This category also includes funding for the University and Community College Systems and operations at the New Hampshire Department of Education, the Police Standards and Training Council, and the Lottery Commission, which generates revenue to support the Education Trust Fund. The Governor proposed increases in Adequate Education Aid, as well as increases in funding for Education Freedom Accounts, school building aid, aid to charter schools, and in State funds for both the University System and the Community College System. These changes and other funding enacted since the current State Budget was finalized contribute to the significant increase in funding in the Education category, which would rise $376.0 million (12.1 percent) relative to the current State Budget. While this increase is significant, like Health and Social Services, the percentage increase would be less than the overall increase in State Budget appropriations proposed by the Governor.

General Government would see the largest percentage increase and the second-largest dollar increase, rising $524.7 million (77.4 percent) over the prior State Budget biennium as enacted. This increase is driven largely by four factors:

- one-time appropriations for constructing a legislative parking garage and purchasing a new building for use by the Department of Justice, which is currently housed in the building that would be demolished to create space for the legislative parking garage

- one-time contributions to the Affordable Housing Fund and the InvestNH Fund

- State employee pay increases appropriated separately from the budget lines of individual agencies, which are accounted for in General Government but would support operations in other categories

- the re-incorporation into the State Budget of the funds shared with municipalities from revenue collected by the State from the Meals and Rentals Tax, which had been included in prior State Budgets but was moved to an off-budget fund in the current State Budget

Other shifts in the Governor’s proposal are smaller in magnitude, and all categories would see appropriations grow. Resource Protection and Development would increase $233.0 million (32.0 percent) relative to the current State Budget as enacted, primarily because of the inclusion of federal funds related to clean water and drinking water programs that were not included in the current State Budget. Justice and Public Protection funding would rise by $232.6 million (14.5 percent), bolstered by increases in both General Fund appropriations and federal dollars, and Transportation would rise by $147.3 million (10.8 percent) with the support of more Highway and Other Funds, but fewer federal and Turnpike Fund appropriations through the State Budget.

Overall, the largest increase in funding would be in Health and Social Services, followed by General Government. The Health and Social Services increase reflects both expanded activities made possible by federal pandemic-related aid as well as investments in Medicaid to help bolster the health care workforce and support service provision. The increase in General Government reflects both State employee pay increases, which will support workers throughout all categories of public funding, and the recognition of funds previously moved outside of the State Budget. The next largest increase, in the Education category, reflects the Governor’s proposed changes to the State’s primary local public education funding formula, as well as additional dollars proposed for Education Freedom Accounts, school building aid, and operating support for public higher education.

Proposed Changes by State Agency

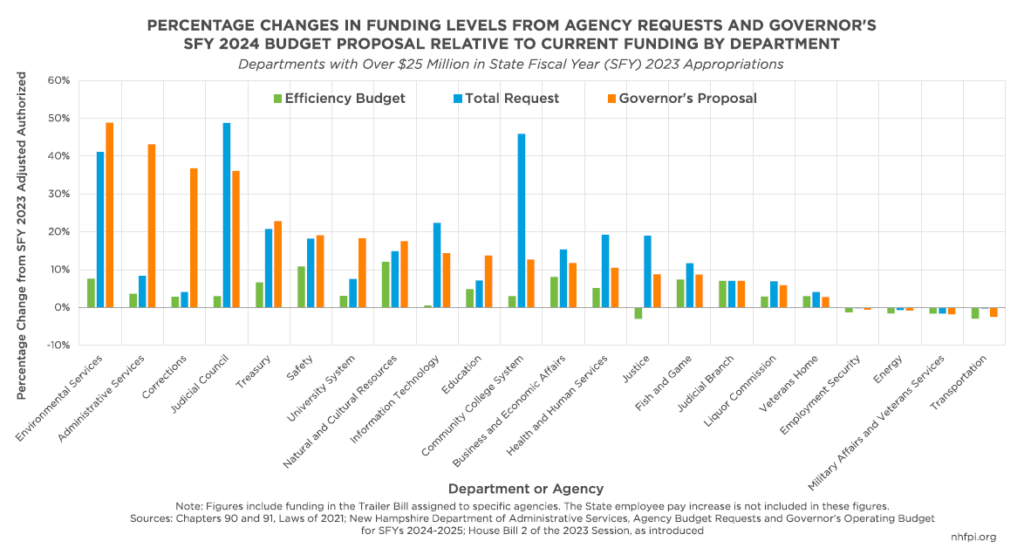

State agency-level analysis provides additional insight into the changes proposed by the Governor’s budget. The previous analyses comparing budget categories and funds provide comparisons between the two-year budget proposed by the Governor and the two-year State Budget approved by policymakers in 2021. The analysis of State agency budgets in this section compares the SFY 2023 budget, with any adjustments or additional expenditure authorizations made since the State Budget was approved, with the Governor’s proposed budget for SFY 2024.

State agency-level comparisons also offer the opportunity to compare the Governor’s SFY 2024 proposed allocations to the levels State agencies submitted in their October 2022 budget requests. The requests included two levels: an Efficiency Budget request, based on targeted expenditure levels provided by the Governor’s office in August 2022, and an Additional Prioritized Needs request, which identifies any priorities that could not be funded under the Efficiency Budget expenditure target. Together, the Efficiency Budget and the Additional Prioritized Needs constitute the Total Request.

Comparisons to the agency requests allow for some understanding of prior agency expectations around programs that were previously planned to change, whether there was a planned reorganization of duties within or between agencies, or agency expectations regarding service needs. However, with both the economy and federal policies changing relatively quickly, projected needs have been changing quickly as well, and agency forecasts from October may not accurately reflect expectations in February, when the Governor’s budget proposal was released.

The year-over-year comparisons of funding, contrasting current SFY 2023 levels with SFY 2024 as proposed by the Governor, permits a comparison of continuity or changes in services that would happen next year, with adjustments that policymakers have already made for SFY 2023 incorporated into the comparison. These comparisons are also based on the budget lines in the Governor’s operating budget bill, which does not include the application of the proposed 10 percent pay increase for all State employees that will translate into higher budgets for departments once the pay increase is incorporated into individual agency budgets.[7]

The percentage changes in State agency funding levels show 10 of the 39 agencies (25.6 percent) with comparable appropriations across the two years would have funding levels within five percent of their SFY 2023 appropriations under the first year of the Governor’s budget proposal. A total of 32 agencies (82.1 percent) would have funding increases between SFY 2023 and SFY 2024, while six (15.4 percent) would see decreases and one, the Legislative Branch, was unchanged in the Governor’s proposal as the Governor typically does not recommend the Legislature make changes to its own budget.

The Department of Transportation is one of the agencies that would experience a funding decrease in SFY 2024 under the Governor’s proposal relative to the currently authorized figures for SFY 2023. This decline in funding would be about $19.0 million (2.4 percent) in SFY 2024. However, funding would rise in SFY 2025 to above SFY 2023 levels by $5.8 million. Additionally, the Governor’s funding level for the Department of Transportation would be above the Efficiency Budget levels requested by the agency in both SFYs 2024 and 2025, and below the Total Request amount. The other agencies that would see a decline in funding relative to SFY 2023 levels in SFY 2024 are the Department of Energy, the Department of Military Affairs and Veterans Services, the Department of Employment Security, the Pease Development Authority, and the Tax and Land Appeals Board. All these proposed declines relative to current budgeted amounts are below $1 million each, and funding for the Department of Employment Security would rise back above current funding levels in SFY 2025.

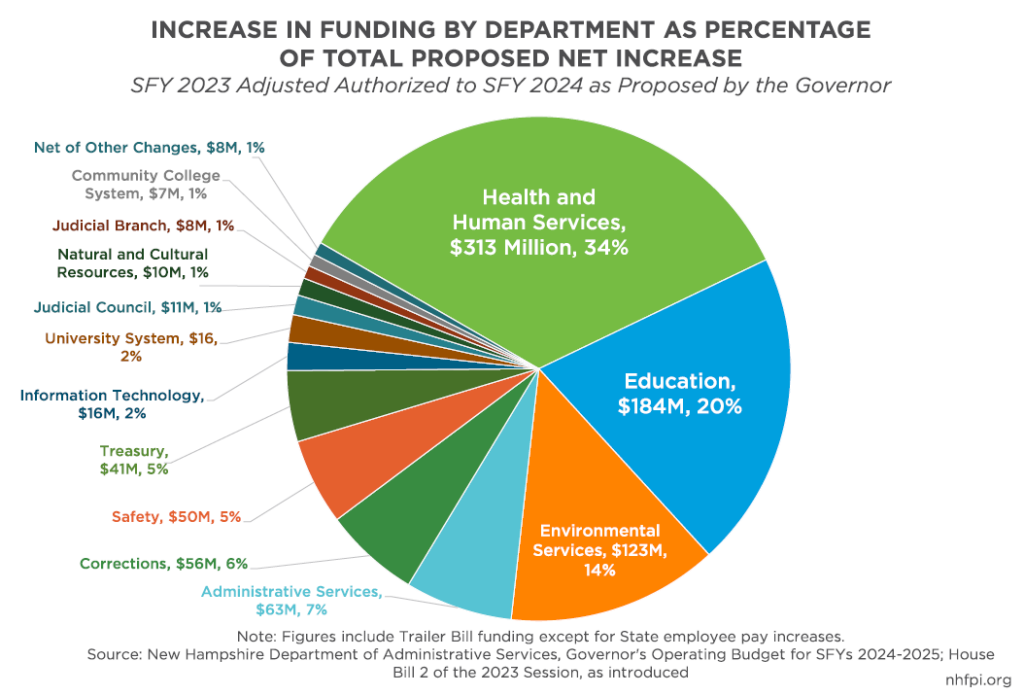

About half of the total new dollars allocated to State agencies in the Governor’s SFY 2024 proposal relative to SFY 2023 funding levels would go to either the DHHS or the Department of Education. These changes reflect both expansions in the DHHS operations scope, including the addition of Hampstead Hospital, and the Governor’s proposed increases to funding for local public education. The funding boost at the Department of Environmental Services is primarily due to a substantial increase in federal funds that are not included in the current State Budget, such as funding related to drinking water infrastructure, increases in federal water pollution mitigation funding, and federal support for waste management, coastal resilience, and emerging contaminants. Funding increases for the Departments of Administrative Services and Corrections are primarily associated with capital projects, such as the construction of a new legislative parking garage, the purchase of a new building to house the Department of Justice, the construction of a successor facility to the Sununu Youth Services Center, and the initial $50 million for funding a new State prison for men. Other agencies had smaller increases in funding, while six agencies had decreases in funding between SFY 2023 and the Governor’s SFY 2024 proposal, including the Department of Transportation.

While comparing direct appropriations in SFY 2023 to SFY 2024 as proposed by the Governor provides substantial insights, the Efficiency Budget requests provide additional context for the Governor’s proposal. Although the Efficiency Budgets are based in part on spending targets provided by the Governor’s office, deviations from the Efficiency Budgets in the Governor’s proposal provide insights into shifts in prioritization, different evaluations of need, or new information collected by the Governor’s office during the budget creation process.

As noted with the Department of Transportation, most State agencies received higher funding levels than proposed by their Efficiency Budgets, while being appropriated less than their Total Requests, which include the Additional Prioritized Needs identified by the State agency staff. Of the 39 agencies, 33 (84.6 percent) have appropriations higher than their Efficiency Budget requests, while the New Hampshire Retirement System, the Tax and Land Appeals Board, the Department of Military Affairs and Veterans Services, the Veterans’ Home, and the Judicial Branch all fell short of their Efficiency Budgets by less than one percent in the Governor’s proposal for SFY 2024. Of the 33 State agencies with increases relative to their Efficiency Budget requests, 21 had increases of less than 5 percent.

In most circumstances, the Governor’s State Budget proposal’s funding levels for SFY 2024 were below the Total Requests, including Additional Prioritized Needs, from State agencies. Of the 39 State agencies, six (15.4 percent) had funding levels higher than their Total Requests, while 31 (79.5 percent) were lower than their Total Requests. Within this group, 21 agencies with less than their Total Requests had levels within 5 percent of Total Requests.

Health and Human Services

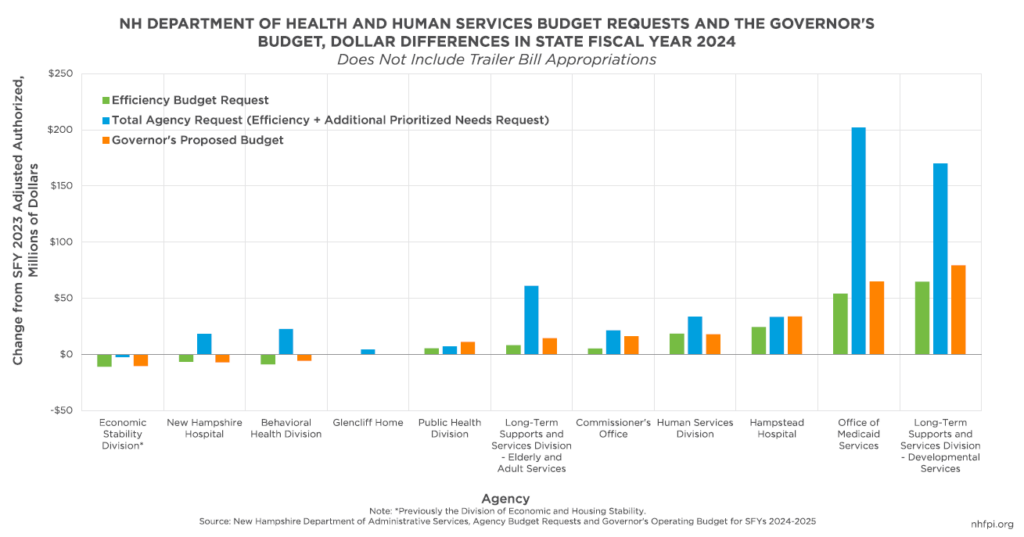

The DHHS is the largest State agency and includes several critical programs, including Medicaid, the Food Stamp Program, and Temporary Assistance for Needy Families, all of which have significant amounts of support from federal funds. Medicaid, which provided health coverage for more than 250,000 Granite Staters at the end of January 2023, totaled approximately $2.3 billion in expenditures in SFY 2021, with approximately 63 percent of expenditures funded by the federal government.[8]

The Governor’s budget proposal would increase funding to the DHHS in each year of the biennium. Comparing appropriations in the primary State Budget lines and before separate special appropriations, funding in the Governor’s proposal, relative to the current State Budget as passed in 2021, would increase by $608.8 million over two years. About $247.4 million of that increase would be General Fund dollars, and $301.7 million be the result of an increase in Federal Funds.

Relative to the DHHS’s requested budget amounts and including the Trailer Bill appropriations suggested by the Governor, the proposed funding level for DHHS falls between the two agency request benchmarks. The Governor’s proposed appropriations amount to about $302.3 million more than the DHHS included in its Efficiency Budget proposal during the biennium. However, funding levels proposed by the Governor for the biennium fall $643.6 million short of the DHHS’s Total Request, which includes the identified Additional Prioritized Needs.

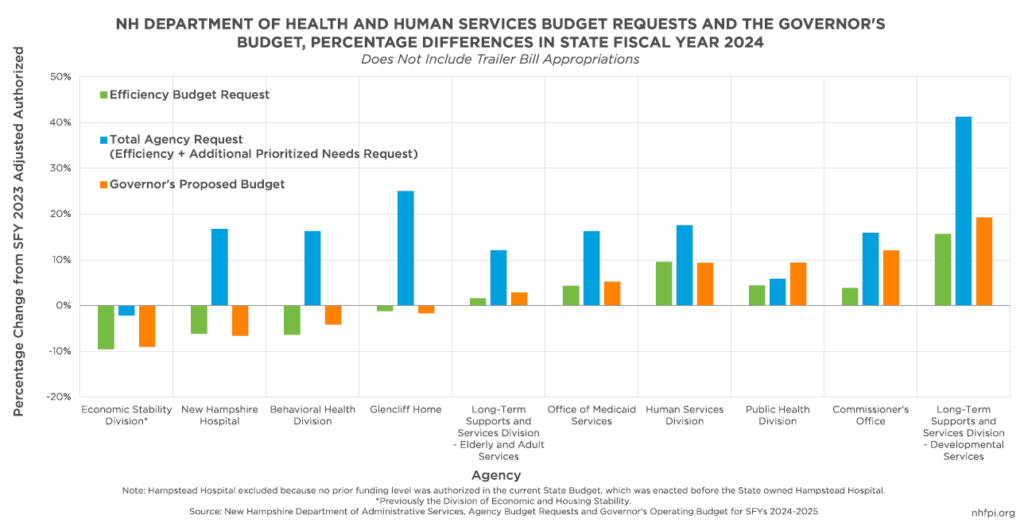

Within the budget of the DHHS are separate agencies, including divisions, offices, and institutions. These agencies each operate significant portions of the services provided by the DHHS, but vary substantially in size. While the DHHS budget would increase overall under the Governor’s budget proposal, not all areas of the DHHS budget would increase.

Medicaid Funding and Rate Increases

The Governor’s budget proposal would boost funding for Medicaid generally, with several different components interacting to lead to higher levels of funding. These proposed increases are in the context of the waning of the COVID-19 pandemic and associated policies designed to address it, which led to tens of thousands of additional residents enrolling in Medicaid who otherwise likely would not have done so without the pandemic.[9]

Funding would increase in the Office of Medicaid Services, which includes the budget lines for the State’s contracts with Medicaid managed care organizations.[10] Medicaid services are funded with federal matching dollars, which are included in the State Budget, resulting in increases in State General Fund support for Medicaid being matched dollar-for-dollar by corresponding increases in federal funds in most cases. Funding would increase a total of $65.0 million (5.2 percent) between the currently authorized amount for SFY 2023 and SFY 2024 as proposed by the Governor. The primary budget line for the Medicaid managed care contracts would increase by 3.4 percent, from $725.9 million currently authorized for SFY 2023 to $750.9 million in SFY 2024, with a much smaller increase of 1.2 percent over SFY 2024 in the SFY 2025 proposed appropriation. These appropriations are all lower than the reported actual amount spent of $823.0 million in SFY 2022. The budgeted amounts suggest that the Governor is forecasting, after the end of the federal continuous enrollment provision associated with the COVID-19 pandemic, that enrollment will drop substantially, but that a combination of enrollment and costs will be higher in SFY 2025 than in SFY 2024.[11] Elsewhere in the State Budget proposal, the Governor would appropriate $16.4 million in General Funds help offramp funding for the reduction of enrollment associated with the end of the continuous enrollment provision. The DHHS reported that the increase in Medicaid funding relative to currently-appropriated funds would be sufficient to support a 3 percent Medicaid reimbursement rate increase.

Similarly, the Children’s Health Insurance Program portion of Medicaid, which helps ensure kids with household incomes below 323 percent of the federal poverty guidelines have access to health services, also saw an increase in funding.[12] The Governor proposed a $15.8 million (16.3 percent) increase in funding between SFY 2023 and SFY 2024, with a 1.4 percent increase in the second year. Both the currently-appropriated amount and the proposed SFYs 2024 and 2025 values were well below the $132.4 million reported as spent in SFY 2022. The DHHS reported the Governor’s proposed funding boost in funding for the Children’s Health Insurance Program would be sufficient to cover a 3 percent reimbursement rate increase, suggesting the overall increase in funding may be due in part to higher projected enrollment.

The Governor also proposed a separate appropriation of $17 million in General Funds each year to support Medicaid rate increases. This total appropriation of $34 million would likely be matched with at least the same amount of federal funds, spurring an increase of at least $68 million in expenditures on Medicaid during the biennium. These funds are specifically identified as for Medicaid reimbursement rate increases, but do not specify a rate or that an increase must be applied evenly across all providers.

For the Office of Medicaid Services as a whole, the Governor appropriated approximately $21.0 million (0.8 percent) more in his proposal than the DHHS requested in the Efficiency Budget for the SFYs 2024-2025 biennium, and $220.6 million (7.8 percent) less than the DHHS’s Total Request, which includes the DHHS-identified Additional Prioritized Needs.

The Governor’s budget proposal also includes a provision that permits the DHHS to cover a limited set of preventative care health benefits under Medicaid, including nicotine use cessation drugs and diabetes prevention.

Developmental Services and Acquired Brain Disorders

The Division of Developmental Services contracts with providers, including ten designated Area Agencies, to administer services for individuals enrolled in Medicaid with developmental disabilities or acquired brain disorders. The Governor’s budget proposal allocates $52.1 million (15.0 percent) more payments to providers and contracts for services to fund aid for developmental disabilities in SFY 2024 than is currently authorized in SFY 2023, and adds $1.3 million (0.3 percent) in SFY 2025. Funding in SFY 2025 would total about $69.0 million more than SFY 2022 actual expenditures recorded under the Governor’s proposal. Funding for Medicaid services for individuals with acquired brain disorders would rise by $11.3 million (39.8 percent) in SFY 2024 relative to SFY 2023 in the Governor’s proposal, and another $14.9 million (38.5 percent) from SFY 2024 to SFY 2025.

Within the DHHS budget’s subagencies, the Division of Developmental Services had the largest dollar and percentage increases of any DHHS primary budget area between the currently-authorized SFY 2023 appropriations and SFY 2024 under the Governor’s proposal. For the State Budget biennium, the Governor’s proposal for the Division is $57.1 million (6.1 percent) higher than the DHHS Efficiency Budget proposal, and is $272.9 million (21.5 percent) lower than the DHHS Total Request. The Governor would also permit unused funds to be carried forward into future State fiscal years.

Older Adults and Adults with Physical Disabilities

The Governor’s budget proposes an increase in Medicaid services appropriations for both nursing home Medicaid reimbursements and in-home or community-based supports for older adults and adults with physical disabilities through the Choices for Independence Medicaid Waiver program.

Medicaid funding for nursing facility care would rise $6.2 million (2.7 percent) between the current SFY 2023 adjusted authorized amount and the Governor’s proposed SFY 2024 appropriation, with another increase of $8.3 million (3.5 percent) in SFY 2025. SFY 2022 actual expenditures, however, were slightly higher than the Governor’s proposed appropriation, and the Governor’s office expects nursing facility enrollment to increase by 6.1 percent in SFY 2024 relative to SFY 2023, and another 2.0 percent in SFY 2025.[13] These relative increases in appropriations and enrollment would suggest potentially fewer dollars available per enrollee in SFY 2024 and SFY 2025 than are currently authorized in SFY 2023.

The Choices for Independence program would see an increase of $15.3 million (19.6 percent) in SFY 2024 relative to SFY 2023, and an additional $27.2 million (29.0 percent) in SFY 2025, across two different sets of appropriations.[14] These increases in appropriations are not specified to increase reimbursement rates or to fund higher projected enrollment, but the Governor’s office projected a similar percentage increase in enrollment as the projections for nursing facilities, and the DHHS reported that there would be sufficient funding for a 3 percent rate increase.[15] Recent NHFPI research suggests key Medicaid reimbursement rates and overall funding for the Choices for Independence Medicaid Waiver program have fallen behind inflation during most of the 2011-2021 timeframe.[16] The Governor’s proposal for Choices for Independence Medicaid Waiver funding is $2.0 million (1.1 percent) higher than the DHHS Efficiency Budget request during the biennium, and $42.9 (18.2 percent) lower than the DHHS Total Request.

Counties are expected to fund a significant portion of the non-federal Medicaid dollars used to provide long-term services and supports for their residents who are older adults or adults with physical disabilities. The Governor’s budget proposal would limit the year-over-year growth in the county share of costs to 2 percent annually, as is required under State law.

The Governor’s budget proposal would suspend reimbursements to the Senior Volunteer Grant Program for the foster grandparent programs, which provides stipends and covers expenses for volunteers, for the biennium.[17] The proposal would also suspend congregate housing services funded through a Medicaid waiver under the DHHS Bureau of Elderly and Adult Services.

Additionally, the Governor proposes that, during the budget biennium, the income eligibility threshold for adult clients of the Social Services Block Grant program would increase annually. That increase would correspond to the cost-of-living adjustments made to social security benefits under federal law. This provision was included in the current and previous State Budgets as well.

Mental Health and Substance Use Disorder Services

Funding would decline for New Hampshire Hospital, which provides inpatient psychiatric services to residents with severe and persistent metal illness, under the Governor’s State Budget proposal in SFY 2024 relative to SFY 2023. Funding would be $7.1 million (6.6 percent) below SFY 2023 levels in SFY 2024, which was below the DHHS Efficiency Budget request for that year. Most of this change in funding is due to reductions in salary and benefits budget lines relative to SFY 2023, potentially reflecting an expectation that unfilled staff positions may not be filled. The DHHS reported that the average staff vacancy rate was 23 percent, and that the Governor’s budget proposal did not include requested funding for wage enhancements and equipment. Relatedly, the Governor’s proposal does include a separate $200,000 appropriation for funding vehicles and clinical equipment at the Hospital. A previously-funded 24-bed forensic hospital to be constructed and operated by New Hampshire Hospital is not funded in the Governor’s proposed budget, as the opening date has been delayed due to construction timelines; the Governor’s proposal would delay opening until July 2025.

Hampstead Hospital, which was purchased by the DHHS with flexible funding from the American Rescue Plan Act, is now a part of the DHHS budget. These flexible federal funds were also used to support operations, which include providing mental health treatments to children and young adults in need of acute psychiatric stabilization. The Governor’s State Budget proposal funds Hampstead Hospital with $33.6 million in SFY 2024, higher than the DHHS Total Request and including $9.3 million in General Funds. The DHHS revised its original Total Request down in SFY 2025 from its original requested levels, and they now closely match the Governor’s proposed appropriations as well. Separately, the Governor’s budget proposal also includes $1.5 million for peer-to-peer counseling for juveniles who have experienced loss, including losses due to suicide and drug overdose.

The Division of Behavioral Health Services would have a funding reduction of $5.8 million (4.1 percent) in SFY 2024 under the Governor’s proposal relative to SFY 2023. The Governor’s proposal fell between the DHHS Efficiency Budget proposal, which would have reduced funding by $8.9 million, and the Total Request, which would have yielded a $22.6 million increase. While the budget proposal projects that some federal funding will expire during the biennium, the Governor’s proposed decrease in funding is relatively even across revenue sources, and may reflect actual expenditures falling below budgeted appropriations in SFY 2022 in the Bureau of Mental Health Services within the Division. Underspending in this area is more likely to be due to workforce constraints hindering service delivery than a lack of need for these programs.[18]

The Governor’s proposal appropriates $3 million during the biennium to the Governor’s Commission on Alcohol and Other Drugs in a separate allocation to help support student assistance programs, including supporting youth risk behavior surveys in middle schools to inform high quality and data-driven prevention programs. Another $2.1 million appropriation to the Governor’s Commission would be used to support Granite United Way’s administration of the Recovery Friendly Workplace Initiative. The Governor’s budget also includes a proposed statutory change that would broaden the number of potential care providers who are legally permitted to administer Naloxone, and an additional $2.1 million to the Department of Safety and to local governments for substance abuse enforcement activities.

Sununu Youth Services Center

The Governor’s State Budget proposal would allocate $10 million to the Department of Administrative Services to help fund the successor facility to the Sununu Youth Services Center. The Governor has also indicated he has set aside $15 million of the remaining flexible federal funds from the American Rescue Plan Act to support the construction project. However, the DHHS would also receive $11.1 million in SFY 2024 and $11.4 million in SFY 2025 to operate the existing Sununu Youth Services Center before the transition to a new facility is completed.

Economic Stability and Food Assistance

The Division of Economic Stability, which was previously called the Division of Economic and Housing Stability but has been renamed in DHHS budget materials, would see a decrease in funding under the Governor’s budget proposal in SFY 2024 relative to SFY 2023. A key component of the reduction is in federal funds associated with the Temporary Assistance to Needy Families program; the Governor’s budget proposal appears to anticipate fewer enrollees in the program receiving cash payments through the Bureau of Family Assistance. Separately, the Governor appropriates a total of $6 million to support the federal requirements the State faces regarding continued receipt of Temporary Assistance to Needy Families federal block grant funding, including to show the State is maintaining its own efforts.

Outside of the Division of Economic Stability’s budget lines, the Governor’s proposal includes $3.4 million per year to support reimbursement rates for nutrition and transportation services. The budget also includes $125,000 for information technology upgrades related to Food Stamp Program eligibility reviews.

Family Assistance and Support

In a specific appropriation, the Governor’s budget includes $1.0 million per year to support Family Resource Centers. The funding would be targeted at, but not limited to, enhancing coordination with early childhood programs, supporting home visiting and community collaboration, and better serving families.

The Governor’s budget would also enhance foster care payment rates with a total appropriation of $870,481 in SFY 2024 and $957,529 in SFY 2025.

Hospital Licensing Requirements

The Governor’s budget includes a proposal to require hospitals licensed in the state to have a certain number of designated receiving facility beds. The number of beds would vary based on the size of the hospital, rising from a minimum of two beds up to nine beds for hospitals with more than 200 licensed beds of all kinds.

Hospitals would also have another State Budget biennium of suspended catastrophic aid payments under the Governor’s proposal, continuing a suspension from the current State Budget.

Education

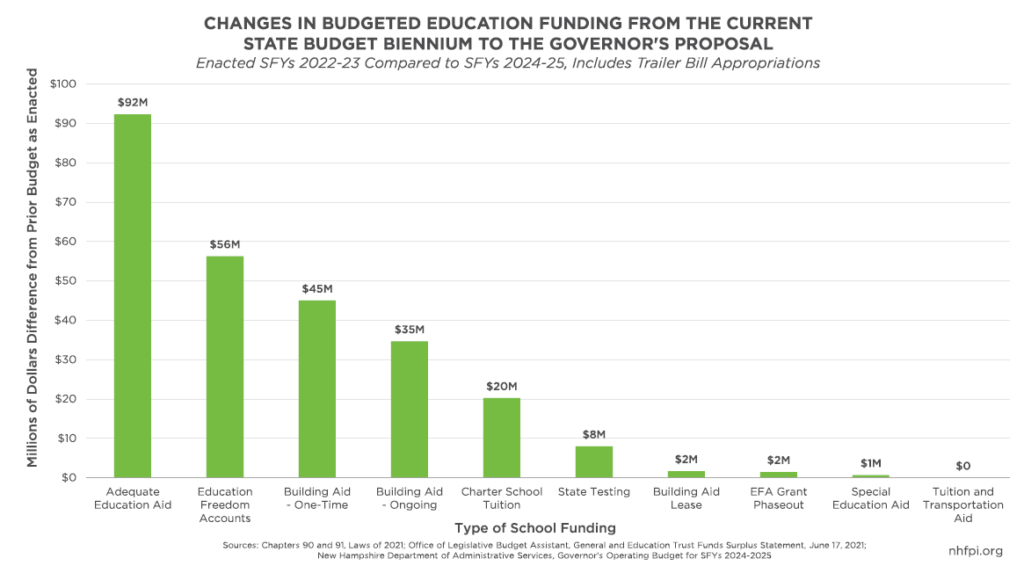

The Governor’s budget proposes significant increases in funding for education relative to the current biennium. This increase stems from the Governor’s proposed changes in funding for local public education through the State’s education funding formula, as well as boosts for Education Freedom Accounts, school building aid, public charter school tuition payments, and operating and project-based grants for public higher education.

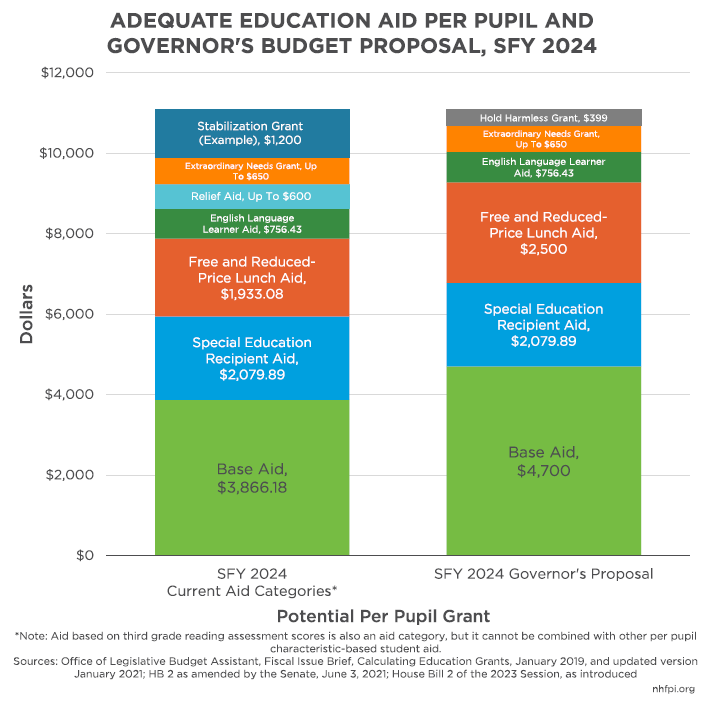

Adequate Education Aid for Local Public Schools

The primary mechanism through which State funding is supplied to local public schools for supporting education is Adequate Education Aid. The majority of this assistance comes in the form of per pupil Adequate Education Grants, which include base grants of $3,866.18 per full time student in SFY 2024, under current law, with additional per pupil funding for students eligible for free and reduced-price school meals, students receiving special education assistance, and English language learners. In SFY 2024, following the biennial inflation adjustment required by statute, those additional per-pupil grants include:[19]

- $2,079.89 for each special education student with an Individualized Educational Plan

- $1,933.08 per student eligible for free and reduced-price school meals, commonly due to having a household income below 185 percent of the federal poverty guidelines

- $756.43 for each student receiving English language instruction because they are English Language Learners with a different primary language

- for students who do not qualify for the other three categories of differentiated aid, the school district receives an additional $756.43 if a student does not score at least proficient on their third grade reading State assessment

Additionally, schools have community-based grants established by the Legislature. These grants include:

- Stabilization Aid, which was established as a method of offsetting the negative impacts on some communities of a significant revision of the per pupil education formula that took effect in SFY 2012, essentially holding those communities harmless by ensuring there was no immediate drop in State funding with the new formula[20]

- Relief Aid, which is based on the percentage of a community’s resident students who are eligible for free and reduced-price school meals, with grants per pupil increasing on a sliding scale to a maximum of $600 per free or reduced-price school meal eligible pupil when 48 percent or more of pupils are free and reduced-price meal eligible

- Extraordinary Needs Grant, which is based on the amount of taxable property value in a community per student eligible for free and reduced price school meals, adding a maximum of $650 per eligible student with a sliding scale reduction as a community has more taxable property value[21]

In SFY 2023, the Adequate Education Aid funding formula distributed $6,091.34 for each student counted in the public schools in New Hampshire as defined for deploying these funds.[22] The December 2020 report of the Commission to Study School Funding identified that, “[o]n average, New Hampshire provides approximately $5,900 per student from state funding sources, or about 32 percent of total spending per student.”[23] In the 2021-2022 school year, New Hampshire local public school districts reported average operating expenses of $19,034.08 per pupil, with added costs of tuition, transportation, facility purchase or construction, capital costs, and interest bringing the total average per student cost to $22,020.58.[24] The difference between the resources provided by the State and the average school district costs per pupil is largely bridged by funding from local property taxes.[25]

The Governor’s State Budget proposal would invest more funding in Adequate Education Aid through changes to the funding formula. These changes pushed the total amount of Adequate Education Aid to local public schools up by $92.3 million (4.7 percent) relative to the amounts enacted in the current State Budget, as passed in 2021, and are $131.9 million (6.9 percent) higher than the amount projected by the Department of Education in its budget request for the SFYs 2024-2025 biennium.

The Governor proposes key, immediate changes to the funding formula for Adequate Education Aid. For SFY 2024, these changes include:

- Increasing the base amount provided per pupil from $3,866.18 to $4,700

- Increasing the grant for free and reduced-price meal eligible students from $1,933.08 to $2,500

- Adjusting the funding formula dollar amounts for inflation annually, rather than biennially under current law

- Eliminating the additional aid for pupils who scored below proficient on the State third grade reading test

- Eliminating Stabilization Aid

- Eliminating Relief Aid

- Adding a temporary Hold Harmless Grant for communities that would see a drop in funding between SFY 2023 and SFY 2024 to ensure no communities receive a reduction in funding

While Relief Aid targeted at communities with higher concentrations of free and reduced-price meal eligible students and Stabilization Aid would be eliminated, the increased funding for communities based on the enhanced per pupil allocations and amounts for free and reduced-price meal eligible students would boost funding for many communities. The remaining communities that otherwise would see a funding shortfall would benefit from the Hold Harmless Grant, which would distribute an estimated $87.1 million to communities that would have otherwise lost funding, according to early estimates from the New Hampshire Office of Legislative Budget Assistant.

These estimates also suggest that the communities that will receive the most new funding under this revised formula are those that may not have benefitted substantially from the Stabilization Aid or the Relief Aid, but educate a large number of students. Patterns of aid vary in part because of the loss of Stabilization Aid; for example, Manchester has an annual grant of $12.5 million from Stabilization Aid under current law, while Nashua has $4.8 million. Under the Governor’s proposed formula, Nashua would receive an additional $3.1 million in total relative to current law, while Manchester would not receive any additional aid in SFY 2024. The dollar increases in total assistance would be highest in communities with high student populations that may have received less of the targeted assistance through Relief Aid or historical aid based on Stabilization Aid; the largest increases would be in Bedford ($3.4 million in SFY 2024), Nashua ($3.1 million), Dover ($3.0 million), Salem ($3.0 million), Hudson ($2.6 million), Windham ($2.5 million), and Merrimack ($2.4 million). Communities that have previously been the recipients of targeted aid, both prior to the creation of Stabilization Grants and through modern Relief Aid, appear less likely to receive additional funding during the biennium; Allenstown, Berlin, Claremont, Franklin, Manchester, Newport, Pittsfield, Rochester, Somersworth, Stratford, and Winchester are all examples of communities that would receive no additional funding with this formula revision, according to early estimates from the Office of Legislative Budget Assistant.

Starting in SFY 2026, the formula would change each biennium to phase out the Hold Harmless Grants and increase the importance of the Extraordinary Need Grant. The Hold Harmless Grants would lose 20 percent of their SFY 2024 value each biennium until disappearing entirely by SFY 2034. On the same schedule, the maximum amount of per pupil aid that can be granted through the Extraordinary Need Grant would increase by 50 percent each biennium from the current cap of $650. That increase of 50 percent each biennium leaves the cap at a maximum of $4,935.94 per student starting in SFY 2034, when the increases halt. Under the proposed statute, however, this maximum aid would likely be available to fewer communities, as the benchmarked amount of property value per pupil used in the sliding scale that determines the aid amount are not adjusted for inflation or another index or metric of housing or property values.

The increases in Extraordinary Needs Grants over time may offset the phaseout of Hold Harmless Grants for many school districts, but actual aid amounts will depend on enrollment, the family incomes of school children, and property values within a community. However, during the upcoming State Budget biennium, the Governor’s proposed Hold Harmless Grants would ensure that no community would receive less Adequate Education Aid from the State than in SFY 2023.

Education Freedom Accounts

When it was enacted, the current State Budget established the Education Freedom Account (EFA) program. This program permits parents who have children that are not enrolled in school districts to apply for and receive the Adequate Education Aid funding that a school district would have received to support that student in an EFA. Money in this EFA may be used by parents for a wide variety of education expenses, including tuition and fees at a private school, Internet services and computer hardware primarily used for education, non-public online learning programs, tutoring, textbooks, school uniforms, certain therapies, and other expenses approved by a State-recognized approved scholarship organization.

To be eligible, a student must be a state resident eligible for public school from a household with an annual household income at 300 percent of the federal poverty guidelines or below at the time of application. However, that student’s household does not need to maintain incomes below that level to continue to be enrolled and receive funding through the EFA program.

School districts no longer receive the Adequate Education Aid associated with a student who is leaving to receive an EFA, but the State supplies two years of transition funding after the student departs the district. Districts will receive 50 percent of the original amount for the newly-disenrolled student in the first following school year, and 25 percent in the second year. The grant disappears after the second year following a student’s transition to using an EFA. These transition grants will not be provided to school districts for students who disenroll after July 1, 2026. The Governor’s State Budget proposal includes $1.5 million to support these phaseout grants during SFYs 2024 and 2025. As of September 2022, about 58 percent of participants since the beginning of the EFA program are students who were not previously in public school, suggesting they were already in private school or being homeschooled.[26]

The Governor’s office and the Department of Education reported that $9.0 million was spent on Education Freedom Accounts in SFY 2022, while the cost was $14.7 million in SFY 2023, totaling $23.7 million during the biennium.[27] The Governor’s proposal would appropriate $59.7 million in total for SFYs 2024 and 2025, or 151.9 percent more than the amount spent in the first two years of the EFA program.

The growth in costs is likely affected by several factors. First, enrollment may increase over time in this relatively new program. Second, the changes in the education funding formula proposed by the Governor also increase the amount of the EFA grants, as the calculation is based on the formula for funding public schools. Third, the Governor is proposing expanding eligibility for EFAs to more households.

The Governor’s proposal would keep the 300 percent of federal poverty guidelines threshold requirement for the family at the time of application. However, certain students may be eligible with household incomes up to 500 percent of the federal poverty guidelines at the time they are applying for an EFA. Students are eligible if they:

- are in foster care

- have made a physical move recently associated with a parent who is a migrant worker in fishing or agricultural industries

- are homeless

- have a parent who is a member of the armed forces or National Guard

- are an English Language Learner

- have been the victim of three or more bullying incidents as defined by statute during a single school year

- are a child with a disability

- have a documented manifest educational hardship that limited their ability to receive an education

- are attending a school that does not meet certain performance or graduation rate metrics

- are within the geographic jurisdiction of a school identified as a persistently dangerous school

- are eligible for free or reduced price school meals

These expansions to the potentially eligible student population proposed by the Governor may contribute to growth in program enrollment and cost to the Education Trust Fund.

School Building Aid

The Governor’s State Budget proposal adds funding for school building aid to local school districts in two forms. First, the proposal would increase aid in the State Budget line that funds both ongoing aid for paying bonds for existing projects and funding new projects. That line would increase by $34.7 million (66.7 percent) over the amounts enacted in the current State Budget as passed in 2021.

Second, the Governor would establish a State Building Aid Fund within the Education Trust Fund. This Fund would be used to distribute school building aid to school districts and approved chartered public schools, as well as to develop a 10-year school facilities plant of potential public school grant projects. Under the Governor’s proposal, the Fund would receive a $75 million transfer from the Education Trust Fund at the end of the State Budget biennium on June 30, 2025. As a result, these funds would not be available for use through the State Building Aid Fund until SFY 2026. The Department of Education would be permitted to retain up to 3 percent of the total annual appropriations from the State Building Aid Fund to administer the school building aid program.

The Governor has also proposed allocating $12.5 million from the Education Trust Fund to specifically renovate the Sugar Hill Valley Regional Technical Center in Newport.

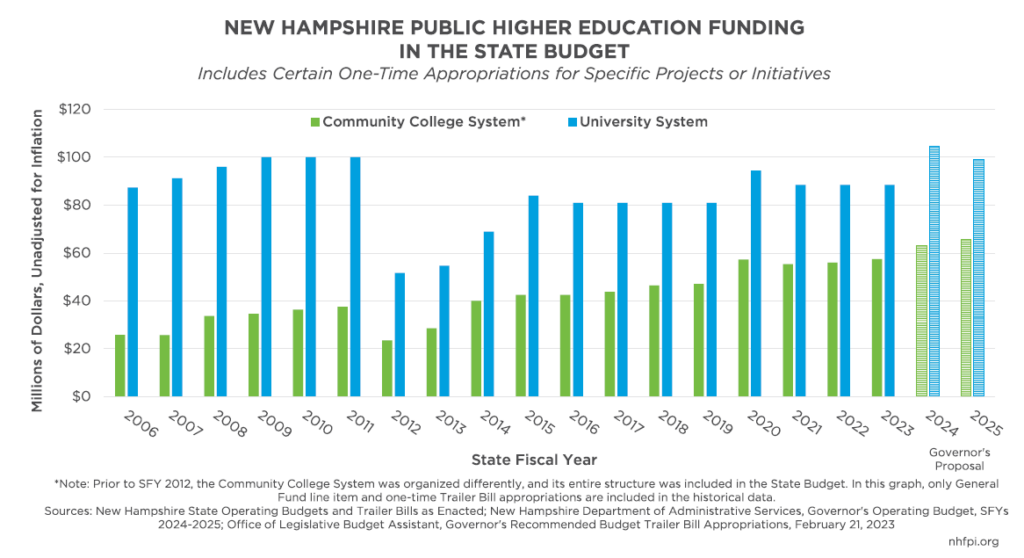

Higher Education

The Governor proposed increasing funding for New Hampshire’s public higher education institutions during the next State Budget biennium. In SFY 2022, New Hampshire trailed all other states in higher education funding when measured on a per capita basis as well as relative to the amount of personal income in the state.[28]

The University System of New Hampshire would receive an increase in general operating support during the next State Budget biennium in the Governor’s proposal, although operating support would fall just short of its annual peak of $100 million during the Great Recession, unadjusted for inflation. The Governor’s proposal would increase operating funding from $88.5 million in SFY 2023 to $95.2 million in SFY 2024 and $99.2 million in SFY 2025. Additionally, the Governor’s budget proposal would provide $8.0 million to help renovate and expand a sports arena at the University of New Hampshire, and $1.5 million for a program to analyze the interoperability of blockchain technology at the University of New Hampshire.

The Community College System of New Hampshire would also see an increase in State operating funding support. Operating funding would rise from $56 million in SFY 2023 to $61.13 million in SFY 2024 and $63.53 million in SFY 2025. The Governor’s proposal would also broaden dual and concurrent enrollment beyond coursework related to technical education, science, technology, engineering, and math, and increase the number of courses a student may take in this program. The Community College System has a $1.5 million separate appropriation for the current dual and concurrent enrollment program, and the Governor’s proposal would increase that funding to $2 million per year.

Additionally, the Governor’s proposal would not include Community College System employees who begin employment after January 1, 2024 in the New Hampshire Retirement System.

Student Education Debt Assistance

The Governor’s budget proposal would alter the New Hampshire Excellence in Higher Education Endowment Fund, which collects revenue from two 529 College Tuition Savings Plans sponsored by the State of New Hampshire. Currently, the Fund supports financially disadvantaged New Hampshire students to attend post-secondary institutions located in the State.[29] The Governor would direct the majority of the disbursements from the renamed New Hampshire Excellence in Higher Education Trust Fund to the Workforce Development Student Debt Relief Program. This program would provide debt relief for a person working full time in New Hampshire, with a degree from a regionally-accredited institution, who is not participating in any other student debt forgiveness program, and is working in biotechnology, in a licensed medical profession, or in an industry determined to be eligible though periodic evaluation by the Department of Business and Economic Affairs. People working as a nurse at New Hampshire Hospital, the State’s Glencliff nursing home, or the State’s veterans’ home would also be eligible.

Programs for Educators and Curricula

The Governor’s budget would establish a Computer Science Educator Program, supported by a $4 million appropriation. This program would provide bonuses for completing the first three years of full-time teaching in an approved computer science education program, receiving $5,000 after the first year and $2,500 each in the second and third years. The State Budget would appropriate an additional $500,000 to encourage educators to pursue industry-recognized credentials in computer science. Another $455,000 would be used to implement experimental robotics platforms in all New Hampshire classrooms for grades 6-12.

The Governor also proposed allocating $250,000 to expand the Teacher of the Year program through promotions, training, professional development, and additional collaboration.

Policy language included in the Governor’s proposal would also establish the Commission on New Hampshire Civics. The Commission would include the chair of the organization NH Civics and civics teachers as well as top New Hampshire officials in the judicial and executive branches of government and appointees from the Legislature. Supported by a $2 million appropriation, the Commission would be required to make a textbook available to New Hampshire civics classrooms by August 2025 that would be designed to help New Hampshire students and teachers explore the history and principles of the New Hampshire Constitution and the resultant government.

Other Initiatives

The budget presented by the Governor includes both proposed funding and policy changes, including many significant new initiatives that interact with many areas of State operations and services.

Professional Licensing Structure Overhaul

The Governor’s State Budget proposal includes a significant overhaul of the State’s licensing requirements and regulatory structure related to a large number of professions, particularly in the health care and environmental fields.[30] For various licenses and fields of employment, the Governor’s office proposed to eliminate licenses, eliminate regulatory boards, combine regulatory boards, turn regulatory boards into advisory boards, and shift the duties of those advisory boards to the staff of the Office of Professional Licensure and Certification (OPLC).

Eight boards or other groups are entirely eliminated, and their duties shifted to the OPLC, including the:

- Board of Directors of Allied Health Professionals

- Board of Foresters

- Board of Landscape Architects

- Board of Natural Scientists

- Board of Registration of Medical Technicians

- Court Reporters Advisory Board

- Manufactured Housing Complaint Board

- Medical Imaging and Radiation Therapists Advisory Board

Several boards would be reformed into advisory boards, with whom the OPLC executive director would be required to consult in key decision-making regarding the professions in question, including the:

- Board of Acupuncture Licensing

- Board of the Certification of Assessors

- Family Mediator Certification Board

- Guardian Ad Litem Board

- Manufactured Housing Installation Standards Board

- Midwifery Council, which also had its membership reduced from six individuals to three

- Naturopathic Board of Examiners

- Board of Nursing Home Administrators

- Dental Hygienists Advisory Board, with a reformed governing statute

Additional boards would remain intact as governing entities but would have some of their duties and responsibilities transferred to the OPLC or their membership modified, including the:

- Board of Auctioneers

- Board of Accountancy

- Boxing and Wrestling Commission

- Professional Bondsmen

- Board of Licensing for Interpreters for the Deaf, Deafblind and Hard of Hearing

- Mechanical Licensing Board

- Board of Nursing, which would have its membership reduced from eleven to five

- Pharmacy Board, which would reduce in size from seven to five

- Board of Home Inspectors, which has proposed membership changes

- Electricians Board, and would add certain military experience as qualifying toward electrician licensure

- Board of Dental Examiners, which would be reduced from nine members to five

- Board of Chiropractic Examiners

- Board of Architects

- Board of Veterinary Practice, which would be reduced from seven members to five

- Board of Professional Geologists

- Real Estate Appraiser Board, which would be reduced in size from seven to five

- Embalmers and Funeral Director’s Board

Four new boards would be created by merging the duties of other boards, eliminating those previously-independent boards. The new boards that would be created include the:

- Advisory Board of Massage Therapists, Reflexology, Structural Integration, and Asian Bodywork Therapy

- Board of Mental Health Practice

- Board of Professional Engineers and Land Surveyors

- Board of Medicine, and would remove the membership of the DHHS commissioner from representation

The OPLC also reported the Governor’s proposal would entirely repeal 34 licenses. These licenses include a significant number of both environmental and medical professions. The environmental professions include soil and wetlands scientists as well as foresters. The eliminated medical licenses include, among many others, medical technicians, nuclear medicine technologists, radiation therapists, and cardiac electrophysiology specialists. Licensed nursing assistants would also no longer require licenses, and would simply be called nurse aides or nursing assistants, although references to licensed nursing assistants remained elsewhere in the Governor’s budget proposal’s language.

State Employee Pay Increase

Attached to the Governor’s State Budget proposal is a $225.5 million appropriation for the biennium to raise the salaries of all State employees. The funding amounts and pay schedule increases target a 10 percent salary increase for all workers in SFY 2024, and another 2 percent increase in SFY 2025. This appropriation includes both State and matching federal funds for workers employed in services that receive federal matching funds.

Housing Initiatives

The Governor proposed appropriating $55 million to two housing-related initiatives. First, the Governor proposed depositing $25 million into the Affordable Housing Fund for administration by the New Hampshire Housing Finance Authority. This fund receives a regular annual contribution of $5 million from the State, and this one-time contribution would supplement those funds.

Second, the Governor would establish the InvestNH program in statute. This program currently exists outside of State law, as it has been funded by flexible dollars from the American Rescue Plan Act and approved for operation in conjunction with those funds only by the Joint Legislative Fiscal Committee and the Executive Council.[31] The Governor would fund the program with a $30 million General Fund contribution. The language directing the use of these funds, which do not have the limitations of the American Rescue Plan Act funds, is brief. The proposed text states simply that grants and loans can be made to municipalities or to housing developers, and that the Department of Business and Economic Affairs shall promulgate rules for the program by July 2024.

The proposal would create a Historic Housing Preservation Tax Credit against the Business Profits Tax, the Business Enterprise Tax, and the Insurance Premium Tax. Properties would be eligible to receive funding under this program if they are indented for residential use and to be income-generating properties, although not solely for residential use by the owner, and must have historical characteristics that make them worthy of preservation. Structures on the National Register or State Register of Historic Places, possessing characteristics that make them eligible for listing on either of those Registers, or that are recognized by the National Park Services are all eligible, but other structures may be eligible as well. Specific projects can be targeted by investors through this tax credit program. Recipients can be a public entity, or a non-profit or for-profit entity licensed to do business in the state.

The Governor’s proposal would continue the suspension of congregate housing services under a Medicaid waiver.

Regulatory Review

The Governor’s budget proposal includes language that would establish an Office of Regulatory Review, Reduction, and Government Efficiency within the Department of Business and Economic Affairs. This Office would have the power and duty to petition for, initiate, appear, or intervene in any rulemaking by a government entity that involves the interests of private industry in New Hampshire in order to represent the interests of those industries.

This Office would be required to establish objective scoring criteria to assess proposed regulations for their propensity to impose unnecessary burdens. All executive branch agencies would be required to submit all proposed rules to the Office at least 30 days prior to their initial public hearings.

Border Security Operations Reimbursement

The Governor’s budget includes the proposed creation of the Northern Border Alliance Program. This Program would make grants available to, and reimburse, State, county, and local law enforcement for working to reduce crime and illicit activities within 25 air miles of the Canadian border. Funding can be used for overtime for officers, purchasing equipment, and training costs. The State Police would be the lead coordinating agency, and participating officers must be trained on relevant federal policies and be relieved of taking other calls while participating, except for in emergency circumstances. The total program appropriation proposed by the Governor is $1.4 million from General Fund surplus dollars.

Police employees participating in this program would also have expanded powers within 25 miles of the Canadian border, including the authorities of forest rangers and officials of the State Division of Forests and Lands.

Other Provisions

The State Budget proposed by the Governor includes a wide variety of other provisions and appropriations, including but not limited to proposals that would:

- appropriate $50 million during the biennium for the designing and construction of a new State prison for men, which does not yet have a known location and will require additional appropriations or bonding

- provide $27.9 million in funds to municipalities for water pollution control

- recognize polychlorinated bi-phenyl as a widespread contaminant and establish a fund to better understand and mitigate the impacts on aquatic life in the state, providing a $6 million contribution to these efforts

- shift certain duties and responsibilities currently held by environmental councils, including the Water Wetlands, Waste Management, and Air Resources Councils, to the authority of a hearing officer employed by the Department of Justice, and make the councils advisory in regard to administrative appeals

- appropriate $15 million to support the construction of a new legislative parking garage where the Department of Justice is currently located in downtown Concord

- allocate $21 million for the State to purchase 2 Granite Place in Concord to relocate the Department of Justice after the existing building is torn down to create the legislative parking garage

- fund the purchase of 52 new State Police cruisers with an appropriation of $3.51 million

- appropriate $2.9 million for a State and local government cybersecurity grant program

- provide $1.0 million in additional funds for matching grants to local governments purchasing body-worn or dashboard cameras for law enforcement

- remove the upper limit on the number of personnel who may be included in the Auxiliary State Police

- raise the limitation on the percentage of funds in the Victims’ Assistance Fund that can be used for the administrative costs of administering these funds and the associated commission from 15 percent to 30 percent of the money in the fund

- appropriate funding for information technology infrastructure, including $20.5 million, to be matched with federal funds, for one-time maintenance the Medicaid Management Information System at DHHS as well as $7.8 million to the Department of Administrative Services for State payroll, budgeting, and financial systems

- repeal the Advanced Manufacturing Education Advisory Council

- appropriate $500,000 for the design, construction, and maintenance of a statute of Christa McAuliffe on the grounds of the State House

- suspend a limitation on the percentage of Highway Funds that can be allocated to the Department of Safety

- provide $250,000 to the Department of Energy to perform regional energy advocacy

- repeal the COVID-19 Micro Enterprise Relief Fund

Revenue Projections and Tax Policy Changes

As part of the proposed State Budget, the Governor provided both revenue projections and a suggested change to tax policy for the upcoming biennium. The Governor’s revenue projections suggest limited growth in the economy, particularly the tax bases for key State revenue generators; projected revenues are substantially impacted by the current State Budget’s policy to phase out the Interest and Dividends Tax. The new tax policy change suggested by the Governor would eliminate the Communications Services Tax.

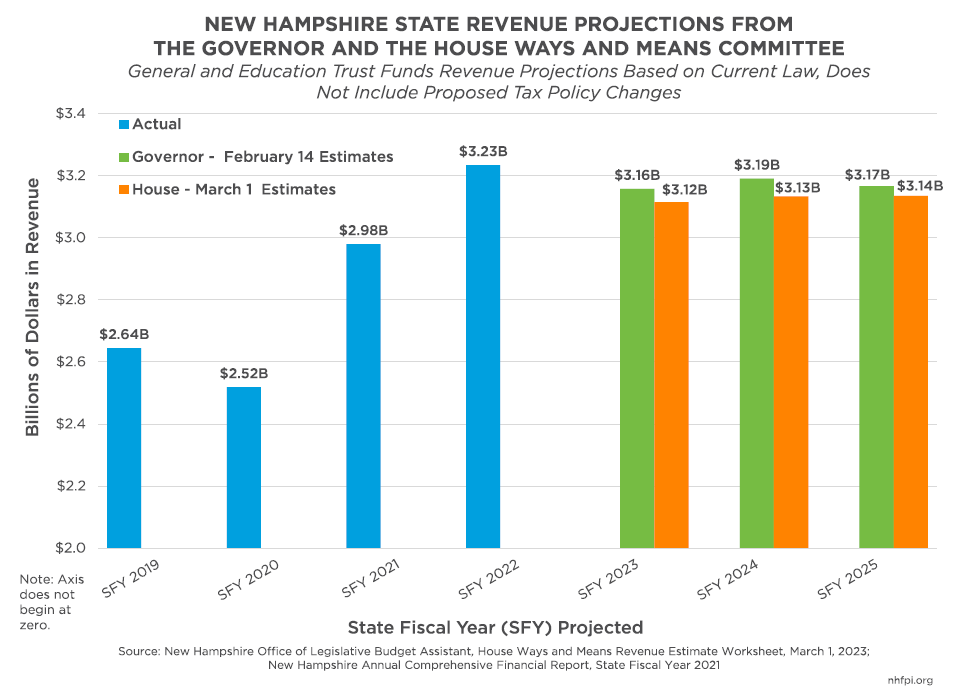

Governor and House Revenue Projections

The Governor proposed revenue projections that suggest relatively limited economic growth, but neither point clearly to an economic recession nor to the continued presence or absence of inflationary pressures. The Governors’ revenue projections are relatively static, with revenues falling due to reduced Interest and Dividends Tax income and total revenues behaving similarly in SFYs 2023, 2024, and 2025.

The Governor’s revenue projections show an approximately $67.8 million loss due to the previously-enacted phaseout of the Interest and Dividends Tax, which would also reduce revenues in future biennia. The Governor also anticipated combined Business Profits Tax and Business Enterprise Tax revenues would decline between SFYs 2023 and 2025, and both Meals and Rentals Tax and Tobacco Tax revenues would be flat across the next biennium. The Governor estimated growth in the Real Estate Transfer Tax would stall, but that higher levels would be maintained.

While the Governor’s revenue estimates suggested no revenue growth, the Governor’s plan does envision that, by the end of the next State Budget biennium, an additional $181.4 million in surplus General Fund revenues would be available to deposit into the Rainy Day Fund.

The House Ways and Means Committee also produced revenue estimates for the budget biennium, and those estimates are less optimistic than the Governor’s projections. Across SFYs 2023, 2024, and 2025, those estimates project about $131.0 million less for the General and Education Trust Funds than anticipated by the Governor. The House Ways and Means Committee was more optimistic than the Governor relative to receipts from the Meals and Rentals Tax. However, House Ways and Means Committee projected that Real Estate Transfer Tax revenues would slow considerably, and that the revenue from the two primary business taxes would drop further than the Governor projected. The Committee was also less optimistic with regard to revenues from the Tobacco Tax and the Utility Property Tax.[32]

The Communications Services Tax

The Governor proposed to eliminate the Communications Services Tax starting on July 1, 2023 through the State Budget. The Governor does not project this tax will bring in any revenue during the State Budget biennium with this policy change, resulting in a loss of approximately $57.8 million in General Funds during those two years.

The Communications Services Tax is a 7 percent tax on two-way communications services, including telephone, two-way commercial radio, voice over internet protocol, facsimile transmission, telegraph, and mobile and prepaid wireless communication services. The tax payments to the State are made monthly by most retailers providing these communications services based on the prior month’s activity. The tax itself is paid by the consumers, such as through their monthly phone bills, but collected by the retailers selling these services before being transferred to the State.[33]

The Communications Services Tax was first established in 1990, with a rate of 3 percent and an additional surcharge that effectively raised that rate and varied during the early years of implementation; a rate of 7 percent was established in law in 2001, and made into a single tax rate in 2003. This tax previously applied to certain internet services, but internet services were explicitly exempted starting in SFY 2013. Tax revenue rose to $64.6 million in SFY 2002, and continued rising to a peak of $81.0 million in SFY 2010. The exclusion of internet services caused revenue to drop by $22.0 million (27.7 percent) between SFYs 2012 and 2013, collecting only $57.4 million in the second year. Declining landline phone service purchases and more use of internet service for communications has likely led to a smaller tax base, and the Communications Services Tax collected $29.9 million in SFY 2022.

The loss of $57.8 million in revenue during the State Budget biennium would be approximately equal to the State’s SFY 2023 General Fund contribution to the Community College System of New Hampshire in SFY 2023, or about half the amount of revenue shared with municipalities as a result of revenue collections from the Meals and Rentals Tax in SFY 2023.[34] Annual revenue generated by the Communications Services Tax is projected to be about equivalent to the funds used for New Hampshire DHHS’s Bureau of Infectious Disease Control annually.

Education Trust Fund Tax Revenues

The Governor also proposed changing the manner in which revenues from the two primary business taxes are split between the General Fund and the Education Trust Fund. Currently, the Business Profits Tax primarily funds the General Fund, but the revenue estimated to be generated by 1.5 percentage points of its 7.5 percent rate is directed to the Education Trust Fund. The Business Enterprise Tax rate is also split, with the first 0.5 percentage points of the Business Enterprise Tax rate dedicated to the Education Trust Fund, leaving 0.05 percentage points of the 0.55 percent rate for the General Fund.[35]

The Governor’s proposal would simplify the split. Under this proposal, 35 percent of the revenue from the Business Profits Tax would flow to the Education Trust Fund, and the rest would go to the General Fund. The Business Enterprise Tax would have the same split, with 35 percent of revenue flowing to the Education Trust Fund and the balance going to the General Fund. According to estimates from the Office of Legislative Budget Assistant, this would likely generate more revenue for the General Fund relative to current law.

Conclusion

The next State Budget will fund public services during an economically uncertain time, with both the State government and Granite State families and individuals facing higher costs for the same goods and services and an economy that continues to be unsettled following the COVID-19 pandemic. The Governor’s budget proposal provides a potential framework, and the Legislature, informed by subsequently available information, will build on this framework in the coming months.

The Governor’s proposal would boost funding for most State agencies, with particularly significant increases to match the increased need for State funding of health services and the Governor’s proposed education funding reforms. Paying for these services relies on revenues continuing to stay elevated near their post-pandemic highs, although the Governor did not project revenue growth, due in large part to the Governor’s inclusion of a proposal to eliminate the Communications Services Tax and the continued phaseout of the Interest and Dividends Tax.

Funding for services has become more expensive, including for the State and for health care providers. A boost in pay for State employees may help recruit workers to unfilled positions, helping the State more effectively provide services. Similarly, many health care providers in the State need more funding to attract and retain workers to provide publicly-funded Medicaid services, which are typically delivered to individuals and families with very limited financial resources.

The proposed changes to education funding put forward by the Governor present an opportunity to re-examine the State’s methods of funding local public education. The Governor’s proposals to raise the base amount provided per pupil, adjust for inflation more frequently, and boost aid associated with students eligible for free and reduced-price meals could help narrow the gap between the State’s contribution to funding for local public education and the actual costs school districts pay per pupil. The Governor’s proposal to eliminate certain historically-rooted and targeted aid in the formula increases the risk that some communities will lose funding in the future, despite the overall increase in aid to local public education, and warrants further consideration.

Public policy can help build an inclusive, equitable, and sustainable economy. Assistance to individuals and families with low incomes can both permit those households to make ends meet and effectively boost economic growth. Both direct services from the State government and assistance to local communities and organizations providing these services can help support a strong recovery and help ensure it reaches all Granite Staters. As the state continues into a period of potential economic uncertainty, the next State Budget will need to wisely and purposely deploy sufficient resources to successfully help foster an equitable and inclusive economy for all New Hampshire residents.

Endnotes

[1] For more information on the economic impacts on different policies stimulating the economy, see NHFPI’s March 14, 2023 blog Households with High Incomes Disproportionately Benefit from Interest and Dividends Tax Repeal and NHFPI’s February 8, 2021 Issue Brief Designing a State Budget to Meet New Hampshire’s Needs During and After the COVID-19 Crisis.

[2] Unless otherwise noted, the source material for this Issue Brief includes material collected by the Office of Legislative Budget Assistant for the SFYs 2024-2025 Operating and Capital Budget and SFY 2024-2025 Revenues.

[3] This comparable amount includes the appropriations allocated in the State Budget’s Trailer Bill in the current State Budget and in the Governor’s proposed Trailer Bill. The Governor’s Trailer Bill, which is House Bill 2 for the 2023 Session as Introduced, includes nearly $684.3 million not included in House Bill 1 for the 2023 Session as Introduced, the Operating Budget Bill, which appropriates $14.88 billion. In the SFYs 2022-2023 State Budget as enacted, changes outside of the State Budget lines in House Bill 1 totaled about $192.6 million, and were about $161.2 million in the SFYs 2020-2021 State Budget.

[4] For national context, see the Pew Charitable Trusts January 11, 2023 research article Elevated Inflation Raises Risk of Fiscal Stress for States.

[5] For more information, see NHFPI’s December 6, 2022 presentation Federal Pandemic-Related Funding in New Hampshire: Impacts, Opportunities, and Benefits.

[6] Learn more about State revenues since the beginning of the COVID-19 pandemic in NHFPI’s January 17, 2023 presentation New Hampshire State Revenues and the Economy.

[7] Other Trailer Bill appropriations are included in these figures, based on the department or agency they are assigned to by the Trailer Bill language.

[8] Medicaid enrollment data from the New Hampshire Department of Health and Human Services, New Hampshire Medicaid Enrollment Demographic Trends and Geography, January 2023. For the cost of Medicaid, see the New Hampshire State Treasury’s State of New Hampshire General Obligation Capital Improvement Bonds 2022 Series A, March 10, 2022, Information Statement page 47. For the percentage of New Hampshire Medicaid paid by the federal government, see the Kaiser Family Foundation’s webpage Federal and State Share of Medicaid Spending for FY 2021. The 63 percent figure is for federal fiscal year 2021, whereas the State expenditures cover SFY 2021.

[9] To learn more about Medicaid in New Hampshire during the COVID-19 pandemic, see NHFPI’s January 2023 Issue Brief The Effects of Medicaid Expansion in New Hampshire and June 30, 2022 blog Thousands of Granite Staters Risk Losing Medicaid Health Coverage at the End of the Public Health Emergency.

[10] For more information on Medicaid managed care organizations, see NHFPI’s March 2018 Issue Brief Medicaid Expansion in New Hampshire and the State Senate’s Proposed Changes and NHFPI’s July 2022 publication Long-Term Services and Supports in New Hampshire: A Review of the State’s Medicaid Funding for Older Adults and Adults with Physical Disabilities.

[11] For more information on the end of the continuous enrollment provisions in Medicaid associated with the COVID-19 pandemic, see NHFPI’s January 2023 Issue Brief The Effects of Medicaid Expansion in New Hampshire.

[12] Read more about the Medicaid Children’s Health Insurance Program in the New Hampshire Bureau of Family Assistance Program Fact Sheet, March 2023.

[13] See the DHHS Budget Book, SFYs 2024-2025, for the Division of Long-Term Supports and Services, page 11, to see the projected increase in enrollment.