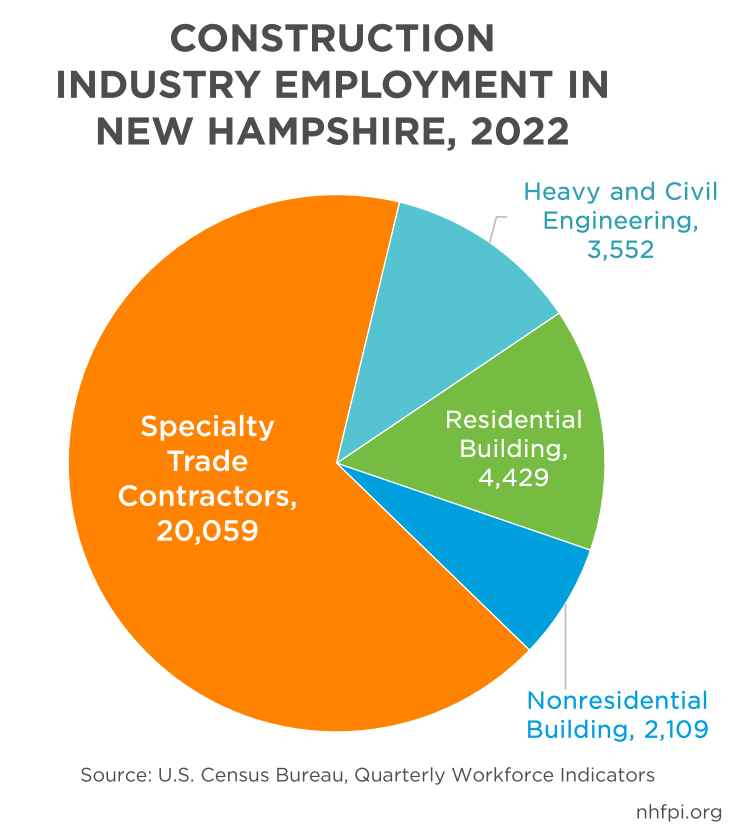

The construction of new housing units in New Hampshire is critical to the growth of the state’s workforce.1 Residential building construction and specialty trade contractors, which may subcontract with residential construction firms, employed a combined average of approximately 24,500 private-sector workers in New Hampshire throughout 2022.2

Industry Sectors and Employment

The construction industry overall contributed approximately $3.35 billion to New Hampshire’s Gross State Product (GSP), a measure of the size of the state’s economy, and an estimated $64 million in federal, state, and local tax revenues in 2022. Construction accounted for about 3.2 percent of total GSP in 2022, and was approximately the same percentage of the total economy throughout the 2017 to 2022 period. The construction industry grew an average of approximately 5.5 percent each year during this period, slightly faster than overall GSP. However, adjusting for inflation using a relative measure of prices and outputs shows no growth in construction from 2017 to 2022, while annual economic growth averaged 2.1 percent.3

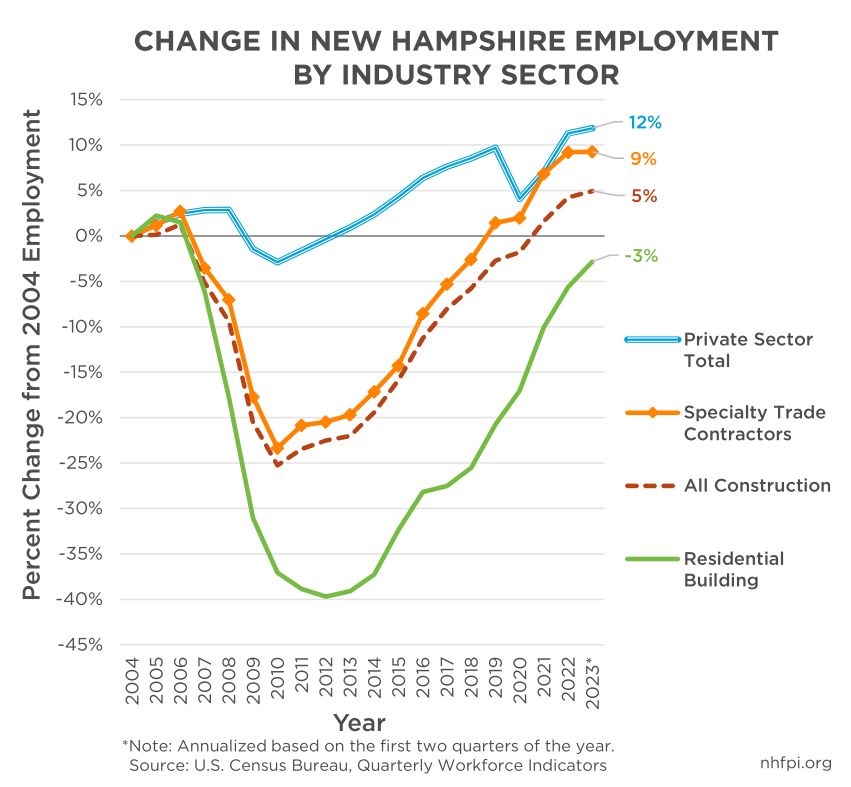

Following the early 2000s housing boom, construction industry employment based in New Hampshire declined substantially, particularly during the Great Recession of 2007-2009.4 While total private sector employment was only 2.9 percent below 2004 levels at its lowest point in 2010, overall construction employment was 25 percent below 2004 levels in 2010, and residential construction employment reached its low point in 2012 at 40 percent below 2004 employment levels. These declines had profound, lasting impacts on the industry, which potentially lost career employees to other industries. Overall employment recovered to 2004 levels by 2013; specialty trade contractor employment did not recover until 2018, and dedicated residential building employment was still 2.8 percent lower than 2004 and 5.0 percent lower than its 2005 peak.

Wages and Workforce

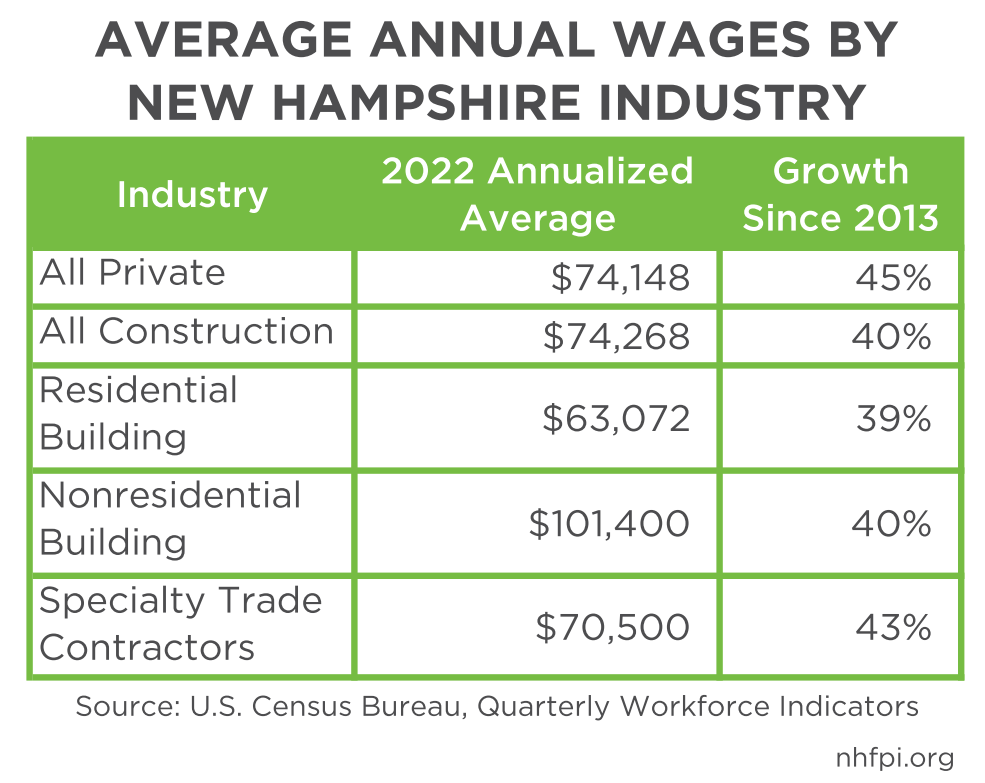

Average income in construction has generally grown more slowly than the average wage across all private industries in the last ten years, and residential building construction wages have increased slightly more slowly than specialty trade contractors. Nonresidential building construction wages are generally higher than other construction industries, and are higher than private worker pay in the overall economy. Contracting practices of firms may impact wages in industry subsectors.

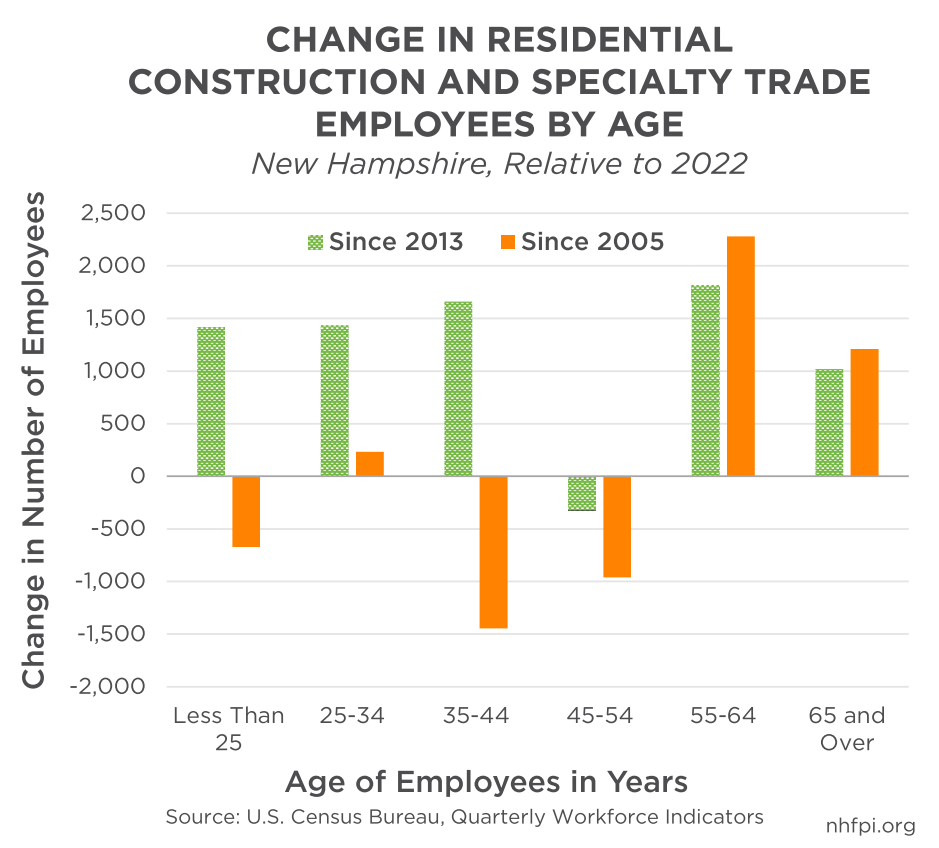

In 2022, the combined employment in the construction of buildings and specialty trade contractors in the state had risen by 644 (2.5 percent) since 2005 and 7,016 (36 percent) since 2013. Positions filled by workers under age 55 years was 2,844 (12 percent) lower in 2022 than 2005, while age 55 and up employment grew 3,488 (110 percent).

Economic Outputs

Housing permits issued in New Hampshire reached more than 9,000 per year in both 2004 and 2005, but fell to just 2,101 units in 2011. The number of housing permits grew to 5,726 (173 percent) in 2022, with nearly half of permitted units in populous, southeastern Hillsborough and Rockingham counties.5

Both housing construction itself and the population new units bring to an area boost economic growth. Research suggests aggregate economic and job growth, as well as migration to an area, increases when housing units are added.6 Estimates by the National Association of Home Builders, published in 2015, indicated that building 100 single-family homes would generate $37.4 million (in January 2024 dollars) in local income and 394 jobs in the first year, and add $5.3 million (in January 2024 dollars) in local income and 69 local jobs recurring annually.7

Endnotes

1 NHFPI, Granite State Workers and Employers Face Rising Costs and Significant Economic Constraints, August 2023.

2 U.S. Census Bureau, Quarterly Workforce Indicators – QWI Explorer, accessed February 2024. U.S. Bureau of Labor Statistics, Industries at a Glance – Construction: NAICS 23, accessed February 2024. Specialty trade contractors focus on specific building-related tasks such as pouring concrete, plumbing, painting, electrical, or other work and may subcontract with residential construction firms.

3 U.S. Bureau of Economic Analysis, Regional Economic Accounts and Regional Definitions, accessed February 2024.

4 Federal Reserve Bank of New York, The Supply Side of the Housing Boom and Bust of the 2000s, October 2012.

5 New Hampshire Office of Planning and Development, Housing and Household Data, accessed February 2024.

6 American Economic Journal, Housing Constraints and Spatial Misallocation, 2019. The Journal of Economic Perspectives, The Economic Implications of Housing Supply, January 2017. ECONorthwest, Housing Underproduction in California, July 10, 2019. The Journal of Urban Economics, The Effect of New Market-Rate Housing Construction on the Low-Income Housing Market, January 2023. Federal Reserve Bank of St. Louis, Peaks in Housing Construction as a Recession Signal, September 2022.

7 The National Association of Home Builders, The Economic Impact of Home Building in a Typical Local Area, April 2015. Converted to January 2024 dollar values using the U.S. Bureau of Labor Statistics, Consumer Price Index-Urban.