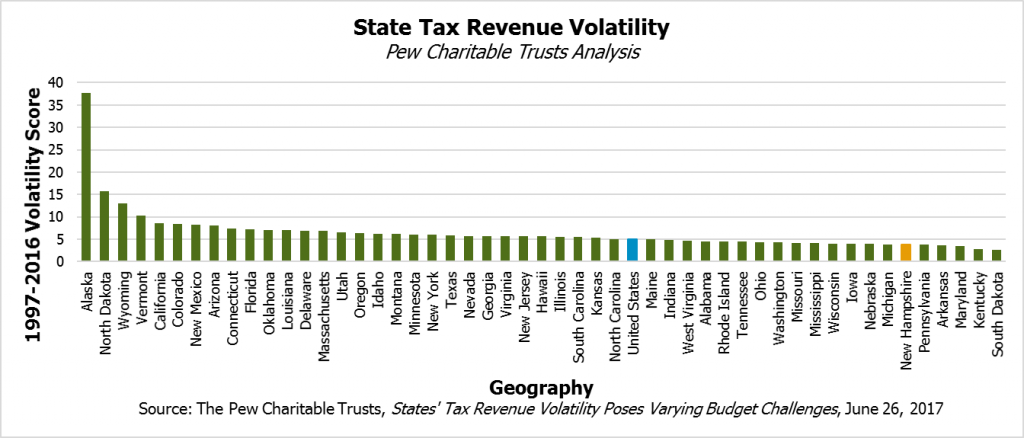

New Hampshire’s state tax revenue is relatively stable, but the State’s largest tax may be among the most volatile types of common taxes, a new analysis from The Pew Charitable Trusts suggests.

Between 1997 and 2016, New Hampshire’s tax volatility, as measured through percentage changes from the prior fiscal year, was only higher than five other states, suggesting New Hampshire’s tax revenues do not typically deviate dramatically from year to year relative to other states.

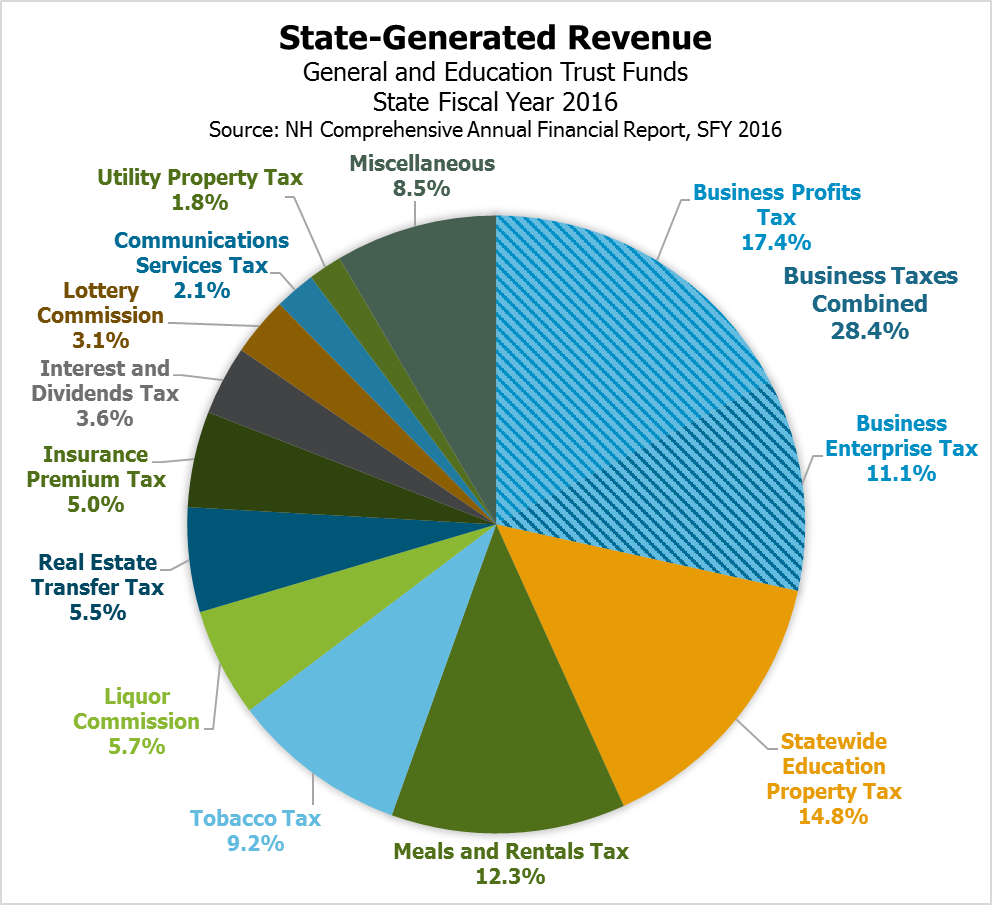

The State’s unique tax structure likely aids this stability. New Hampshire has a relatively diverse set of revenue streams, while other states lean more heavily on single sources. Another Pew analysis of U.S. Census Bureau data show that no single category of taxation accounted for more than 37.2 percent of New Hampshire’s state tax revenue sources in State fiscal year 2016, while Oregon and Virginia collected 69.6 percent and 57.7 percent of state tax revenues, respectively, from personal income taxes, and Texas and Washington used general sales taxes to collect 61.6 percent and 60.9 percent, respectively of state tax revenues. As New Hampshire leans less on one or more large sources for tax revenue than other states, it is likely less susceptible to swings in overall revenue stemming from changes in single sources. Local governments in New Hampshire, however, do not have diverse tax revenue streams; local tax revenue is heavily reliant on property taxation. For more on New Hampshire’s methods for collecting revenues, see NHFPI’s Revenue in Review resource.

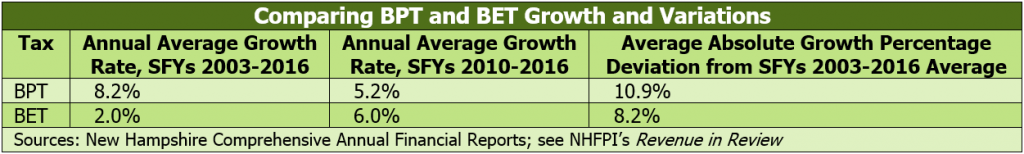

Digging into the diverse revenue streams and drawing on the experiences from other states shows some risk for New Hampshire, however. The new Pew analysis of all 50 states notes that corporate income tax revenue was more volatile than the other major tax sources in 19 of the 24 states in which Pew considered corporate income taxation a major tax. The analysis noted that New Hampshire’s corporate income tax volatility score was the lowest of any of the other states, which in many cases have significantly higher volatility. This stability is likely due to New Hampshire’s relatively stable and broader-based Business Enterprise Tax (BET), which is a tax based largely on compensation and does not depend directly on corporate profits. New Hampshire’s Business Profits Tax (BPT) is structured in a more typical manner relative to other states’ corporate income taxes, and BPT revenue depends more directly on corporate profits and a narrower base than the BET. A larger number of businesses are liable for BET tax payments than BPT tax payments, and BET tax incidence is more broadly distributed across smaller and larger taxpayers than BPT tax incidence, which falls primarily on the largest taxpayers.

The Pew analysis does not separate the BPT and the BET on the New Hampshire level, combining them both into the corporate income taxes category. NHFPI analysis suggests that the BPT has been more volatile than the BET in New Hampshire in recent years, and the Pew analysis of other states suggests that reliance on BPT-like taxes may lead to more revenue volatility.

Data suggest corporate income tax volatility has been a concern for many states recently, with corporate income tax revenues falling short for most states relative to their revenue projections in fiscal year 2016. New Hampshire has had relatively robust business tax revenues during State fiscal years 2016 and 2017, but might not continue to enjoy sustained revenue growth from these sources. The BET likely helps stabilize State business tax revenues, but on June 22 the New Hampshire Legislature approved a State Budget that will substantially reduce the BET rate by 2021, eliminating this stabilizing revenue source’s General Fund contribution and increasing the risk of reduced revenue overall relative to prior tax rates. New Hampshire’s tax system has a wide variety of streams at the State level, but the BPT and BET are among the most important. As both taxes are set to undergo rate reductions, pressure may increase on other State revenue sources, and on the local property tax, if revenues decline and funding for key services needs to be recovered from other sources.