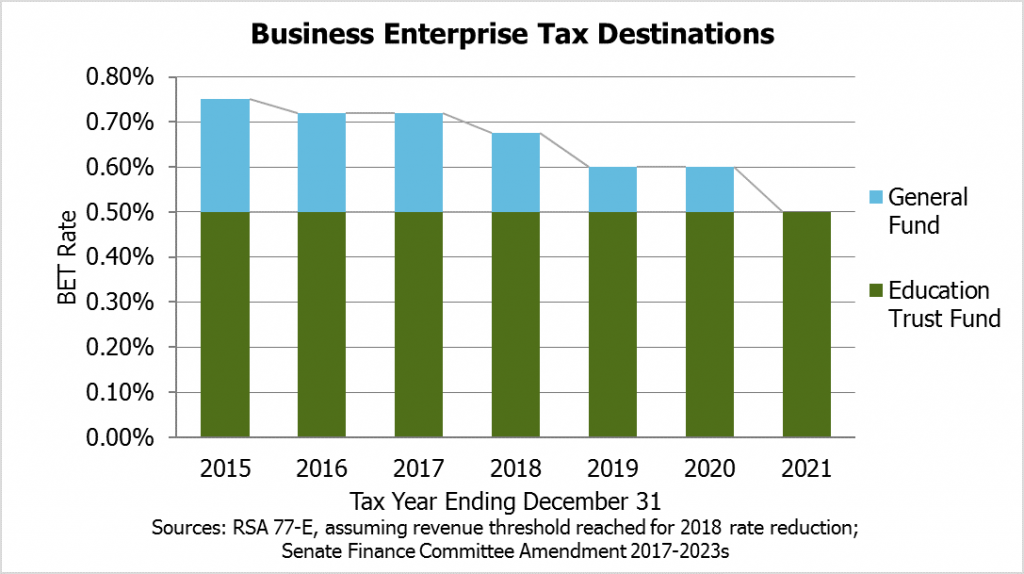

The Senate Finance Committee’s version of the budget proposes lowering the Business Enterprise Tax (BET) to 0.60 percent in 2019 and 0.50 percent in 2021. The proposal comes as additional business tax cuts, which became law in 2015, are still being phased in; if revenue meets a certain threshold set in statute, which is widely expected, the BET rate, which had remained steady at 0.75 percent since 2001 until dropping to 0.72 percent in 2016, will drop again to 0.675 percent in 2018. The reduction to 0.50 percent by 2021 would make the BET rate two-thirds of its level in 2015. In State fiscal year (SFY) 2015, the last SFY without a BET rate change, the BET brought in $218.2 million in revenue, of which $71.9 million went to the General Fund, the State’s primary operating fund; this revenue was raised from the portion of the tax between 0.75 percent and 0.50 percent of the BET rate.

While the proposed rate reduction is significant on its own, it would also statutorily require all funds from the BET to go to the Education Trust Fund, removing any direct contribution by the BET to the General Fund. The BET (established in 1993, before the creation of the Education Trust Fund) currently contributes to both funds.

The BET statute requires that revenue produced by 0.50 percentage points of the current 0.72 percent BET tax rate be transferred to the Education Trust Fund, which must be used for adequate education grants to municipal school districts, charter schools, kindergarten program funding, and the low- and moderate-income homeowners property tax relief program (a rebate for the Statewide Education Property Tax). The proposed change does not affect this provision of the BET statute. As such, if the rate were to be reduced to 0.50 percent in 2021, all the revenue collected would be used to support the Education Trust Fund, and the portion going to the General Fund would be eliminated. While this change would likely not affect the Education Trust Fund’s operations directly, it would remove a source of funding for the General Fund that provided $91.3 million, or 6 percent of General Fund revenue, in SFY 2016. For context on the significance of $91.3 million, the General Fund was budgeted in SFY 2016 to contribute $106.1 million to the Department of Corrections (of $110.0 million in total Department appropriations), $81 million to the University System of New Hampshire, and $25.9 million to New Hampshire Hospital (of $67.3 million total in New Hampshire Hospital appropriations).

This change may also be significant because of the broader tax base the BET draws from relative to the other primary business tax levied by the State government, the Business Profits Tax (BPT). The BET taxes all business compensation, interest, or dividends paid or accrued; even businesses that are not earning a profit pay BET, and a significantly larger number of businesses had BET liability in 2014 (the most recent year for which the Department of Revenue Administration has published data) than had BPT liability. While both the BET and BPT draw a significant portion of their revenue from businesses with large liabilities, the BET is less reliant on these larger businesses than the BPT. A slight majority of the money collected through the broader BET was paid by a small number of businesses; 0.8 percent, or 525 filers in total, paid 50.1 percent of all BET dollars in 2014. However, 4.0 percent of filing businesses, or 2,781 filers, paid 91.0 percent of BPT revenue, narrowing to 1.2 percent, or 793 filers, that paid 77.4 percent of all BPT revenue in 2014.

Although not all recent data provide strong evidence for this characteristic, the BPT has historically exhibited bigger swings and higher levels of revenue volatility than the BET. The BPT’s narrower tax base enables year-over-year changes in revenue that, in the past, have been more dramatic than changes in the BET over the same time period, and average BPT deviation from the average annual growth rate has been larger. (See the NHFPI’s Revenue in Review publication’s sections on business taxes for more details.)

Removing the BET contribution may increase the exposure of the General Fund to these larger swings in revenue, as a revenue stream which may provide more stability (the BET) than one whose base is subject to changes in corporate profits (the BPT) would be removed. Any further reductions to the BET beyond those proposed in the Senate Finance Committee’s budget would likely reduce Education Trust Fund revenue.

The General Fund also often contributes to the Education Trust Fund, with the General Fund providing additional money in eight of the last ten SFYs. The contribution in SFY 2016 was $28.1 million, but the highest contribution in the last ten years was $140.1 million in SFY 2012, which was a significant draw on the General Fund (10.2 percent of total General Fund revenue that year). Although it is less likely to be directly affected by these changes to the BET than the General Fund, the Education Trust Fund may also feel pressure from a reduced availability of General Fund dollars for transfer. For more information on these funds and the State’s revenue system, see NHFPI’s resources Building the Budget and Revenue in Review.