The Committee of Conference for the State Budget bills, House Bills 144 and 517, made relatively limited changes to the Senate’s version of the State budget, which it used as a basis for amendments. The House acceded to many of the Senate’s positions, in part because some issues had been dealt with through other bills that were not completed when the House Finance Committee drafted its budget. Several modifications were made to the proposed statutory language in House Bill 517, but the Senate’s version, amended based on the Governor’s proposed budget, was largely intact.

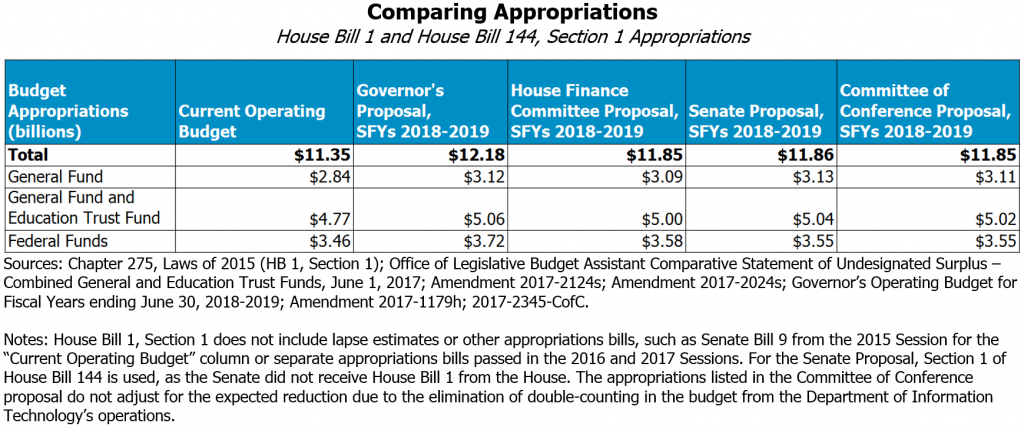

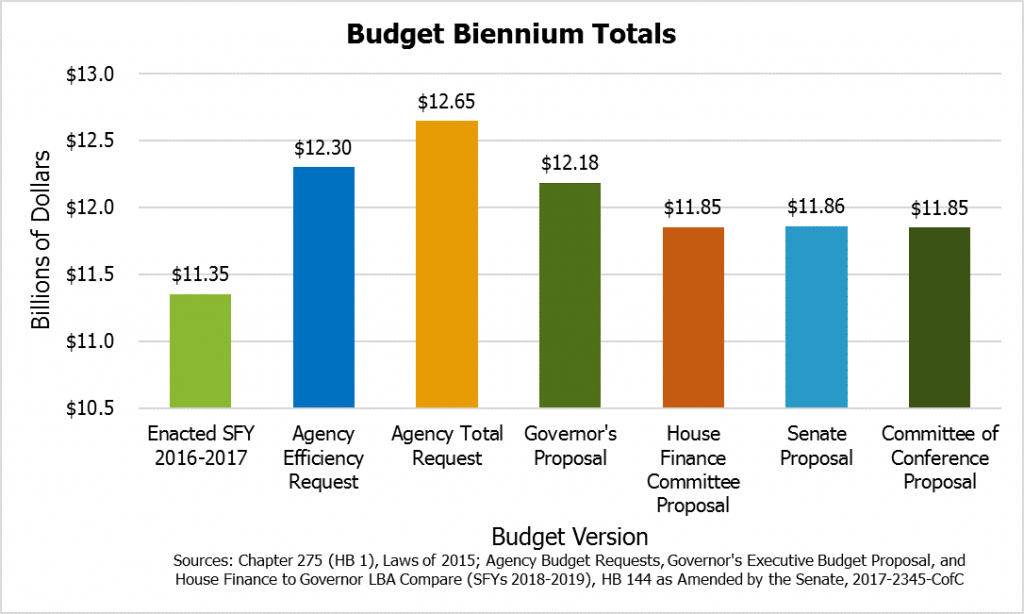

The Committee of Conference proposal total for House Bill 144, Section 1, is $329.9 million (2.707 percent) smaller than the total for House Bill 1, Section 1 of the Governor’s budget proposal; $0.7 million (0.006 percent) larger than the House Bill 1, Section 1 total from the House Finance Committee proposal; and $5.2 million (0.044 percent) smaller than the Senate’s HB 144, Section 1 total.

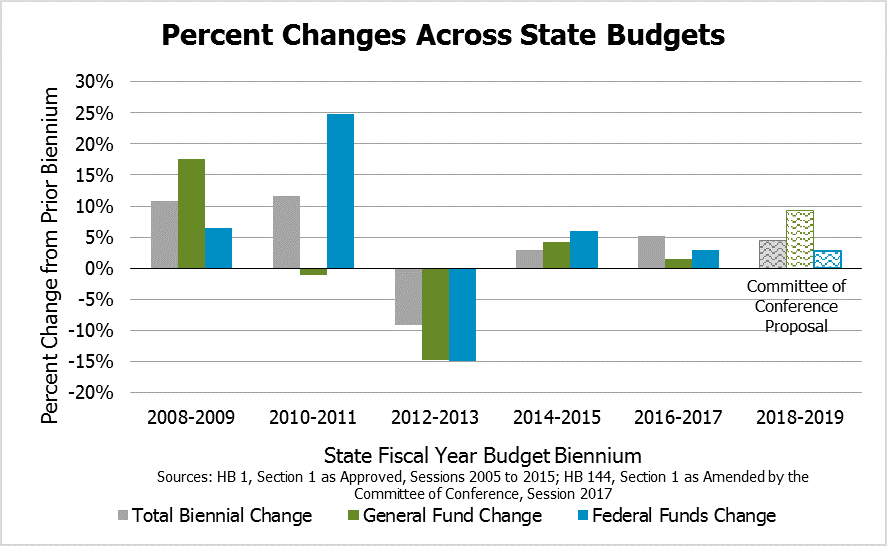

Relative to the House Bill 1, Section 1 totals approved in the 2015 legislative session for State fiscal years (SFYs) 2016-2017, the Committee of Conference budget increases by 4.4 percent comparing the set of two fiscal years, unadjusted for inflation. Considered in isolation, the General Fund’s budgeted spending grows by 9.2 percent.

Key changes from the State Senate’s proposed budget made by the Committee of Conference include:

- Modifying the provisions allowing the Department of Health and Human Services to fund Sununu Youth Services Center non-drug treatment operations with the Alcohol Abuse Prevention and Treatment Fund to require an emergency and Joint Legislative Fiscal Committee approval

- Bringing forward the start date for new Medicaid services for children with severe emotional disturbances by six months, to January 1, 2018

- Establishing mobile lottery games, which is expected to generate $13 million over the biennium

- Eliminating the Electricity Consumption Tax in 2019, which currently brings in about $6 million per year in revenue

- Adding funding to rate increases for foster care families and early intervention services, and modifying proposed provider compensation rate increases

- Defunding three nurse positions and delaying the start date of four other positions at the new women’s prison

- Removing funding for five new State Trooper positions in SFY 2019, and giving the Department of Safety the option to go to the Fiscal Committee and request more money for those five positions as required

- Adding $1 million in funding for highway rest areas and removing $1.5 million from the Tourism Development Fund

- Narrowing the scope of the new Office of the Child Advocate to focus on oversight of the Division of Children, Youth, and Families

- Establishing a juvenile justice reform advisory group

- Eliminating funding for eight peer crisis respite mental health beds, the foster grandparents program, and the congregate housing program

- Removing $600,000 in funding for civil legal services aid

- Shifting $5 million of funding for the first year of the Governor’s Scholarship Program from SFY 2018 General Funds to SFY 2017 surplus funds

- Shifting $13.9 million in SFY 2017 surplus funds to the General Fund and funding the Department of Safety through the bolstered Highway Funds

- Removing $1.2 million for the Concord School District for Concord Steam-related upgrades

- Adding a provision to require less double-counting in future budgets related to Department of Information Technology Services, but the provision does not have any immediate impact on the budget totals presented

The Committee of Conference budget retains the Senate’s proposed rate reductions for the Business Profits Tax and Business Enterprise Tax (BET). The proposal would also phase out the BET contribution to the General Fund, which is the fund that offers legislators with the most flexibility to meet needs and adjust to changing economic conditions. (See NHFPI’s May 30 blog post for more details.)

The Committee of Conference budget did not include provisions for a full-day kindergarten subsidy, as the Governor proposed, or Keno gaming revenue, as the House Finance Committee proposed. Kindergarten funding and Keno games were both addressed in a separate piece of legislation, Senate Bill 191.

Both the House and Senate are expected to vote on the two budget bills on June 22.