The month of April is crucial for determining the amount of New Hampshire State revenue available for public services each year, as both quarterly tax payments and tax returns from the prior year are due for key revenue sources. April receipts inform the Legislature as to how well revenues are performing during the current fiscal year, identifying how much money may be available for use this legislative session while also signaling how revenues might trend as the next State Budget cycle approaches in 2025.

Here are seven key takeaways from April 2024’s reported State revenue figures and what they might suggest about the future:

April Revenues Added to the Surplus

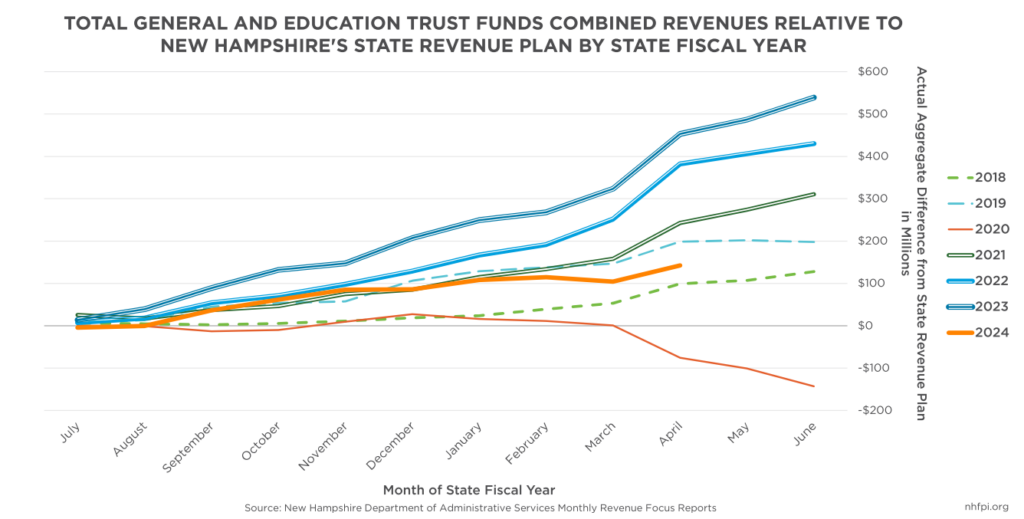

State cash revenues for April 2024 showed revenue collections are somewhat stronger than policymakers forecast when planning the current State Budget. April revenues for the General and Education Trust Funds were $38.2 million (7.9 percent) above the State Revenue Plan amount for April 2024. Total combined General Fund and Education Trust Fund revenues ended the month with $142.4 million (5.3 percent) more than was anticipated thus far in the fiscal year. This cumulative surplus will be impacted by revenues in May and June, before State Fiscal Year (SFY) 2024 ends on June 30. The State’s biennial budget means unused surplus from this year will be rolled forward into SFY 2025.

While this current surplus is significant, and a superior condition for State finances than during the deficit arising at the onset of the COVID-19 pandemic in late SFY 2020, it is substantially less than surpluses of other recent years. Revenues were further above State Revenue Plans, based on prior State Budgets, in April 2019 ($198.5 million), 2021 ($242.9 million), 2022 ($382.0 million), and 2023 ($452.9 million) than in April 2024 ($142.4 million). That comparison does not include inflation adjustments that would diminish the spending power of SFY 2024 revenues relative to prior years.

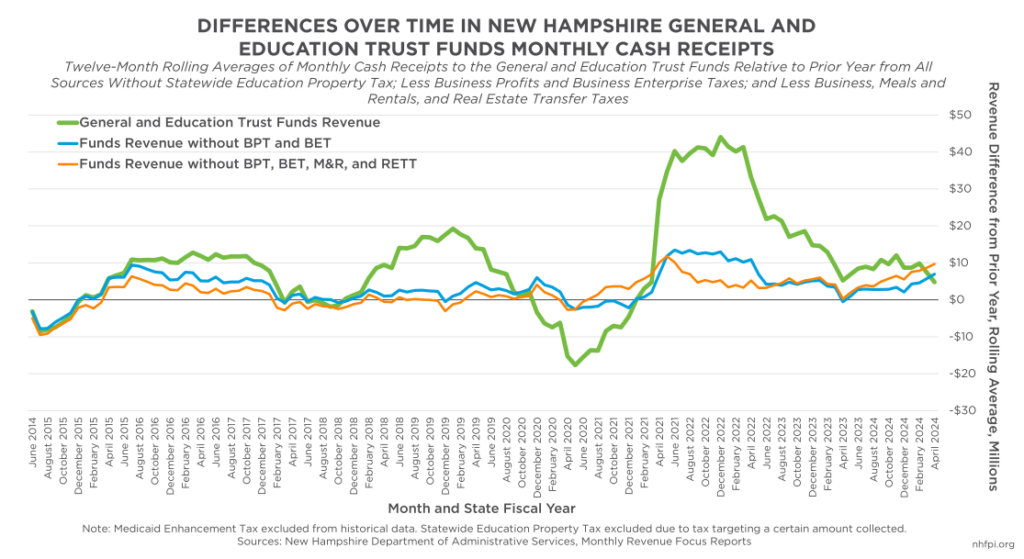

The State’s Key Business Taxes are Not Generating Annual Growth

The composition of the SFY 2024 surplus is also substantially different than in those previous years. During the last four State Budget cycles, the State collected significant revenue surpluses driven primarily by rising national corporate profits that bolstered the Business Profits Tax (BPT). The BPT is the State’s largest tax revenue source and collected more than twice the revenue of the next-largest tax revenue source, the Meals and Rentals Tax, in SFY 2023. BPT revenues have nearly tripled since SFY 2015, while revenues from the companion Business Enterprise Tax (BET) have had much more limited growth. The BET, the State’s fourth-largest tax revenue source in 2023, is based primarily on compensation paid rather than profits reported; the more limited BET revenue growth is likely due in large part due to more aggressive rate reductions than enacted for the BPT.

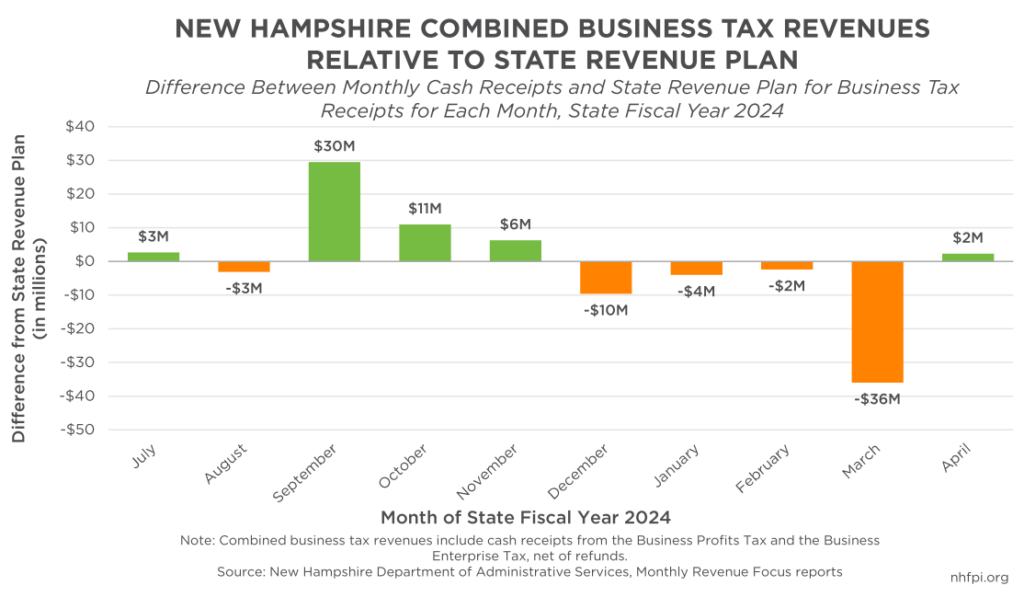

This robust growth in business tax revenues since SFY 2015 did not repeat itself in April 2024’s payments. Tax receipts from combined BPT and BET revenues, which are not parsed out in detail until returns are filed in full, were $11.1 million (3.8 percent) below last year’s revenues, while holding $2.3 million (0.8 percent) above the State Revenue Plan. This result was more favorable than the combined business tax receipts shortfall of $36.0 million (23.0 percent) below the State Revenue Plan in March, but total combined business tax revenues for SFY 2024 thus far were below the Plan by $3.3 million (0.3 percent) and below last year’s revenues by $38.3 million (3.6 percent), without adjusting for inflation.

Business tax revenues may be weaker for several reasons, some of which could have long-term consequences. Corporate profit growth accelerated quickly and robustly following the initial months of the COVID-19 pandemic in the United States. The largest 120 New Hampshire BPT filers paid 42.6 percent of all BPT revenue collected in Tax Year 2021, currently the most recent year for which data are published. Complex, multi-component entities that likely straddle state and national borders paid more than half of BPT collections. National corporate profits likely reflect trends among BPT payers, and New Hampshire’s corporate tax revenue growth lagged behind growth in other states during the 2015 to 2022 period. Those overall national profits slipped in late 2022 and early 2023 before growing again in late 2023. Some of that reduction likely impacted New Hampshire’s BPT returns in April, and may suggest more limited growth to come. The quarterly tax estimate payments for the first quarter of 2024, which were due along with 2023 returns or extension payments for the approximately 90 percent of businesses that use a calendar year for their tax year, were about 9 percent lower than the same period in 2023, suggesting businesses anticipated less taxable economic activity in New Hampshire this year.

State policy changes could also be contributing to weaker revenues relative to the State Revenue Plan. BPT and BET rate reductions, including a 2023 BPT rate reduction, have likely cost the state more than half a billion dollars since SFY 2015; however, components of the impacts of those rate reductions are included in the State Revenue Plan. More likely to be impacting State revenues relative to the Plan are the efforts of State policymakers to reduce the liability from overpayments made to the State by businesses. State legislators capped the amount of money a business taxpayer can hold with the State to 500 percent of its liability, and the rest must be refunded. Relative to April 2023, refunds were $16.3 million (246 percent) higher in April 2024, and are $62.9 million (70 percent) higher for SFY 2024 thus far. The State reports that 48.8 percent of refunds paid so far in SFY 2024 can be attributed to this cap.

Interest on State Cash Reserves is the Largest Source of Growth

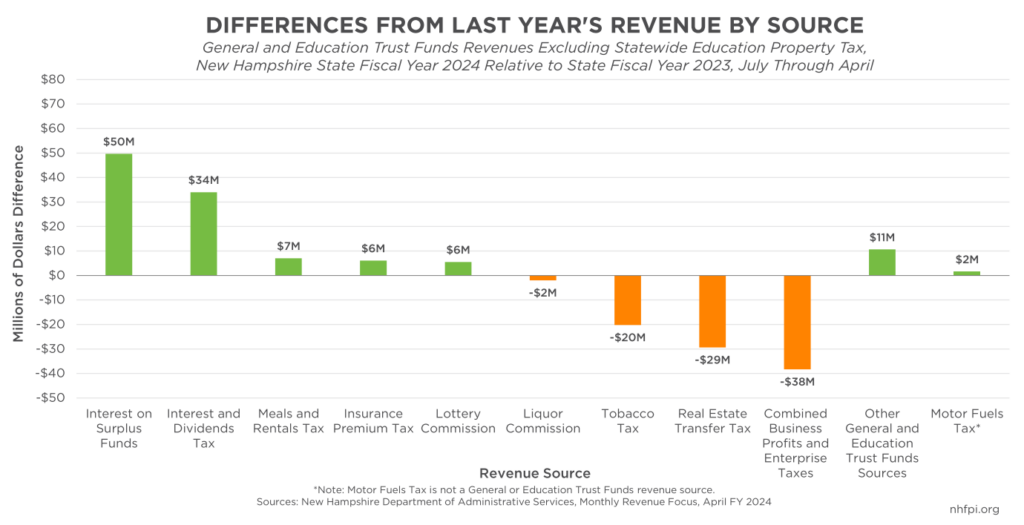

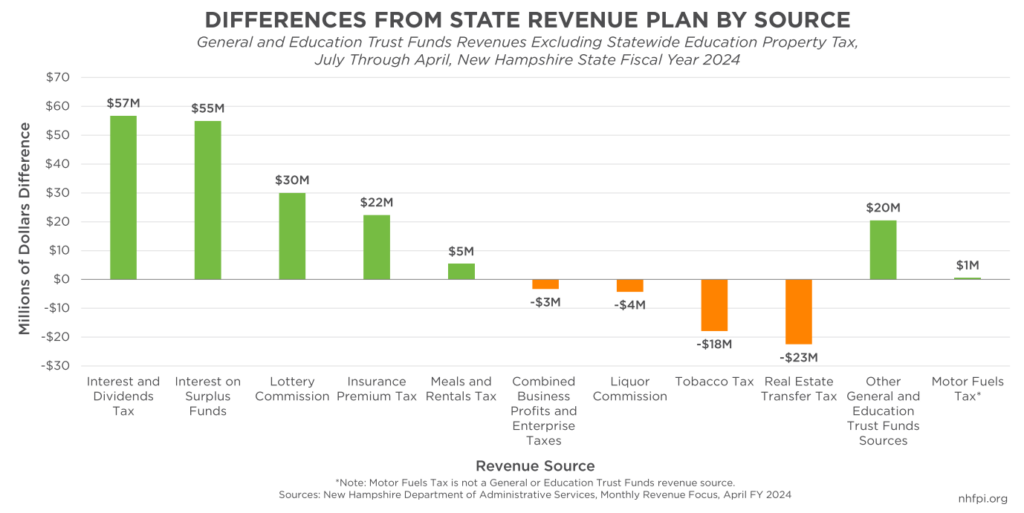

At the end of March 2024, the State Treasury Department reported New Hampshire had $2.13 billion in operating cash balances in liquidity. That total, which is far higher than the $578 million reported in late March 2019, reflects in part the money the State has received from prior State revenue surpluses and through federal aid related to COVID-19 that flowed to the State government and has not yet been spent. Interest payments generated by these cash holdings have contributed $80.8 million to the General Fund so far in SFY 2024, which is $54.9 million (212.6 percent) higher than estimated by the State Revenue Plan and $49.7 million (159.8 percent) higher than SFY 2023 through April.

The relatively high interest rate environment and favorable federal policies permitting State use of interest generated by federal aid have helped generate this interest-driven surplus. The General Fund revenue from interest alone is the equivalent of 38.6 percent of the cash surplus through the end of April, and 40.2 percent of the $123.7 million (4.5 percent) higher General and Education Trust Funds revenues relative to SFY 2023 as of the end of April. However, as the State deploys these funds for services and interest rates, which could potentially decline over time, this source of revenue growth will not be maintained into the future.

Largest Tax Revenue Source Generating Surplus Disappears Next Year

Interest on surplus funds is not the only contributor to the State’s favorable financial conditions that may be temporary. The largest contributor to the surplus is the Interest and Dividends Tax. This tax, owed based on income generated from wealth and that is disproportionately paid by higher income individuals, is due to be eliminated in 2025 under current State law.

The Interest and Dividends Tax has generated $56.7 million (54.2 percent) more than forecast in the State Revenue Plan this year, and $34.0 million (26.7 percent) more than the prior year. Those amounts are the equivalent of 39.8 percent of the total General and Education Trust Funds surplus and 27.5 percent of the revenue growth relative to April 2023. Favorable stock market performance during 2023 relative to 2022 and the higher interest rate environment during 2023 may have helped generate more taxable income from pre-existing wealth and assets. The State reported that higher interest rates, as well as increased audit activity, increased the revenue collected by this tax relative to prior years.

Real Estate Transfer Tax Revenues Continue to Fall Behind

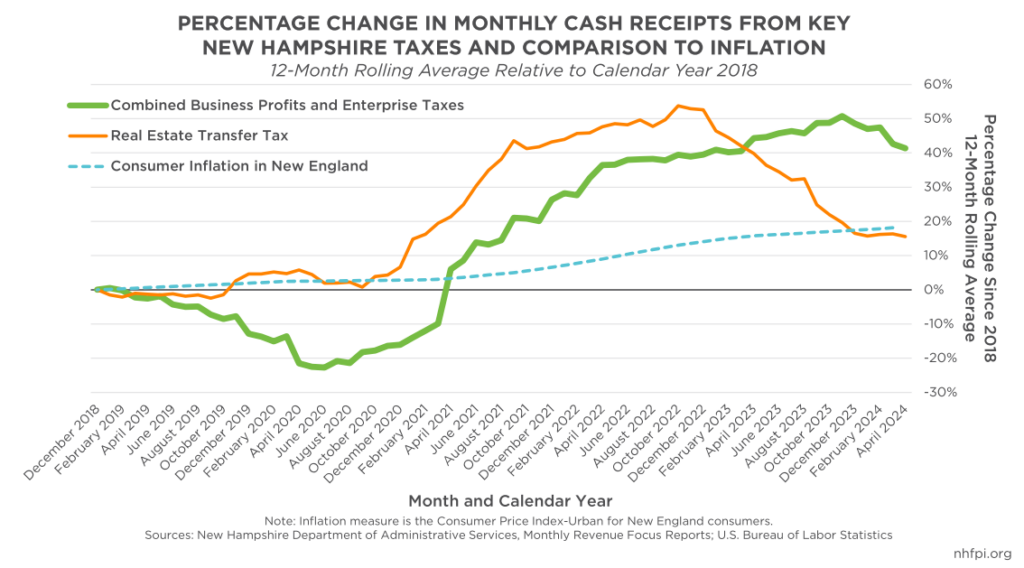

While higher interest rates have helped increase revenue collections from State cash holdings and Interest and Dividend Tax revenues, they have substantially slowed home sales. Although it was a source of significant revenue growth during the COVID-19 pandemic, the Real Estate Transfer Tax (RETT) has yielded declining receipts as the inventory of houses and condominiums for sale in the state has fallen. Tax revenues are largely driven by sales of single-family houses, and higher interest rates have have kept prices unaffordable for many buyers and likely discouraged potential sellers from leaving their existing homes

RETT revenues were $22.5 million (12.9 percent) below the State Revenue Plan at the end of April, and $29.4 million (16.2 percent) below levels from the same time in 2023. RETT revenues performed better than the total SFY 2024 figures in April, but did not reverse the trend of falling behind both the Plan and last year’s receipts. Notably, RETT revenues are still higher than their 2018 levels, but have been surpassed by overall inflation faced by consumers in New England since that time period, indicating that the RETT generates less purchasing power for the State than it did in 2018.

Lottery Commission Receipts Have Been Bolstered by Expanded Gaming

Total revenues collected by the Lottery Commission increased 113.1 percent between SFYs 2015 and 2023, and the Commission’s contribution to the Education Trust Fund rose 151.4 percent in the same time period. The Lottery Commission has now surpassed the Liquor Commission in net revenues to the State, and has been increasing gross revenues faster than the Liquor Commission. April revenues reinforced this trend, as Lottery Commission revenues ended the month $30.0 million (24.8 percent) above the State Revenue Plan for the year thus far, and $5.5 million (3.8 percent) higher than last year.

The Lottery Commission’s significant increase in revenue has been enabled by policy changes at the State level. The legalization of Keno gaming in 2017, sports betting in 2019, and historic horse racing in 2021 have all helped the Lottery Commission collect more revenue from a wider variety of sources.

Burst of Revenue Following the COVID-19 Crisis May Have Plateaued

Total State revenue growth has slowed substantially since the revenue burst following the COVID-19 crisis. Revenues boosted by federal investments in businesses and the economy, as well as the rapid economic expansion in the rebound from the pandemic-induced recession, enabled significant fiscal policy changes at the State level. Recent revenue growth has slowed, and unlike after the initial impacts of the pandemic or the federal corporate tax changes that spurred repatriation of foreign profits after the 2017 Tax Cuts and Jobs Act, growth is not being driven by the State’s two business taxes.

Overall, April revenues provided positive topline revenue figures and added to the State’s surplus. May revenues could also yield a favorable result, particularly as April’s total solar eclipse could provide a one-month boost to Meals and Rentals Tax revenue from tourism surrounding that event, which would be reflected in May receipts. However, long-term concerns remain due to the strengths and weaknesses among the individual State revenue sources. With the current surplus and revenue growth generated in large part by interest on temporary cash holdings and a significant tax revenue source that will be repealed soon, policymakers may face challenges maintaining the services funded in the current State Budget as they formulate the next one in 2025.

– Phil Sletten, Research Director