New Hampshire’s April revenue numbers came in strong. Many annual taxes from the 2016 calendar year must be filed in April, so it is an important month for evaluating tax collections. March also has filing deadlines, and both are typically strong months for revenue, which informs the budget planning process and helps legislators understand the amount of year-end revenue available to allocate to other priorities. (See NHFPI’s Building the Budget resource for more details.)

Relative to the plan the State crafts to anticipate monthly revenue, April revenues were $40.2 million (15.1 percent) above plan, led by the New Hampshire’s two business taxes (the Business Profits Tax and Business Enterprise Tax) collectively coming in at $33.3 million (40.0 percent) above plan. While this increase above plan is certainly good news for State revenues, the increase is not solely due to a growing economy and successful businesses. The Department of Revenue Administration attributes much of this increase, both relative to plan and relative to April of last year, to 2016 tax law changes that switched reporting dates to match requirements for the federal government; this year is the first year corporations are required to file their final returns on April 15th and partnerships are required to file their returns on March 15th, which is a month earlier than partnerships had to file previously (and a month later for corporations). Not all businesses may have been aware of these changes, so analyzing March and April business tax revenues independently of one another this year risked missing the full picture. The Department of Revenue Administration notes the April increase in estimated tax payments was 8 percent.

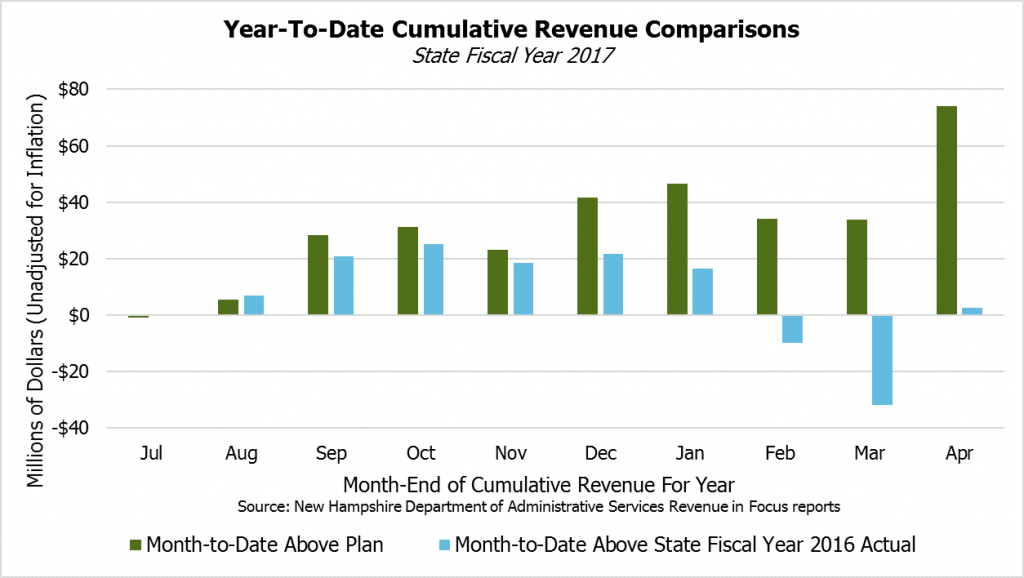

For legislators projecting the size of the surplus, this report showed a substantial increase from $33.7 million to $73.9 million above plan, suggesting that dollars, combined with those from State fiscal year (SFY) 2016, will be left over at the end of this budget for use on other priorities or to fill the Rainy Day Fund. The surplus which had been building each month eroded in February and March, dropping from $46.7 million to $33.7 million. The surplus could of course erode again, but having a larger number at the end of April is reassuring for those seeking to use it to fund priorities, especially given only two more months remain before the new State Budget begins on July 1.

However, projecting forward into the years of the next State Budget, the March and April revenue reports combined do not necessarily inspire confidence. After a large growth in revenue between SFYs 2015 and 2016, the first half of SFY 2017 was continuing to show year-over-year growth relative to the year before. As of the end of October, total revenues from SFY 2017 were ahead of the end-of-October SFY 2016 revenues by $25.2 million, but SFY 2017 revenues then fell behind SFY 2016 in subsequent months. That lead had disappeared and dropped to a $31.9 million deficit relative to SFY 2016 through the end of March. The strong April SFY 2017 revenues outpaced those of last year by $34.5 million, erasing this deficit and bringing total revenue for SFY 2017 to be $2.6 million (0.1 percent) higher than SFY 2016 revenues at this date. Although bringing SFY 2017 revenues back up to match SFY 2016 revenues is encouraging, these numbers do not indicate the significant growth in revenues seen between SFYs 2015 and 2016 will continue, and brings future growth rates into question.

Relative to last year’s total revenues at this date, business taxes are $3.3 million (0.6 percent) ahead. Meals and Rentals Tax revenues continue to grow robustly, at $12.3 million (4.9 percent) above SFY 2016 year-to-date, and the Real Estate Transfer Tax brought in $8.9 million (7.9 percent) more revenue so far this year than it did at this point last year. These taxes are also above the plan for this year, while the Tobacco Tax, Interest and Dividends Tax, and Communications Tax are significantly behind planned revenue.