The State of New Hampshire has issued its final report on revenues for state fiscal year (SFY) 2016, which confirms that revenues came in higher than legislators anticipated when they originally built the current state budget in 2015. The Comprehensive Annual Financial Report was released on January 31 and contains the final, audited numbers for the State’s financial position during SFY 2016, which ended on June 30, 2016.

Revenues were $150.5 million (6.6 percent) higher than projected in the budget. State government spending came in $16.5 million (0.7 percent) higher than initially planned, following post-budget appropriations and missed lapse targets. The Business Profits Tax was $86.9 million (25.6 percent) above the plan in the budget, while the Business Enterprise Tax was $45.9 million (20.3 percent) above plan. The Real Estate Transfer Tax also significantly contributed to the surplus, bringing in $16.2 million (13.7 percent) more than planned. Other taxes performing better than planned included the Meals and Rentals, Tobacco, Insurance, and Utility Property taxes, while the Interest and Dividends and Communications taxes, and Liquor Sales and Distribution revenue, underperformed relative to plan. These higher revenues, after certain accounting adjustments and legal requirements, left $88.5 million in unassigned General Fund surplus for SFY 2017.

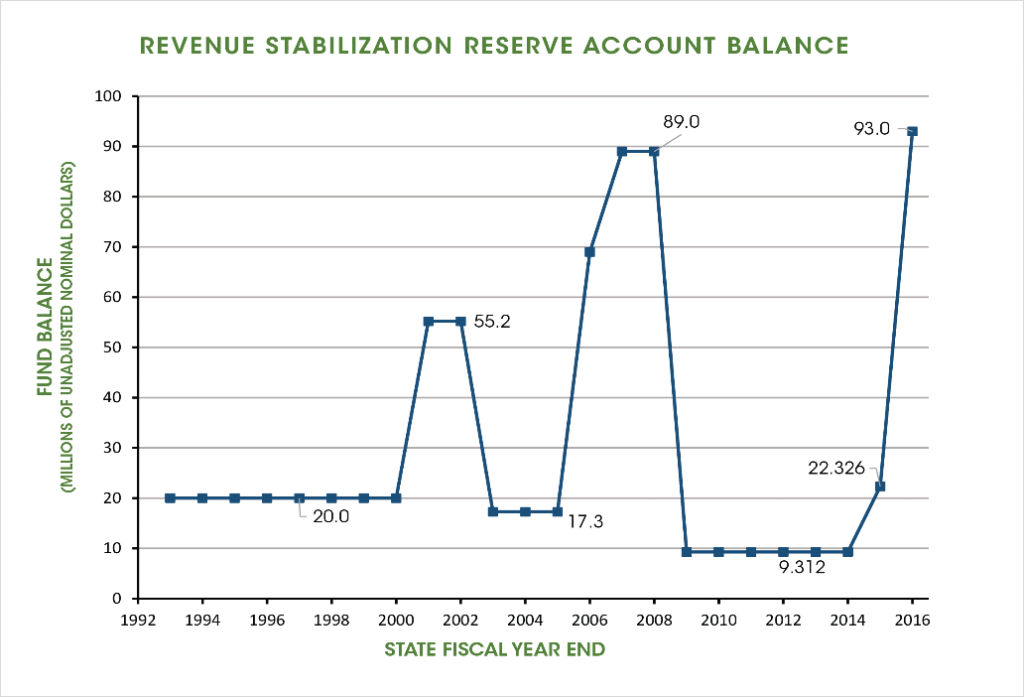

In addition to that $88.5 million, $40 million went to the State’s Revenue Stabilization Reserve Account, also known as the Rainy Day Fund. This Account is at its highest level at least since 1993, and likely in the history of the 30-year-old Account. The balance stands at $93.0 million, following transfers of $30.7 million from ExxonMobil’s payment to the State after being found responsible for drinking water contamination and $40.0 million from the SFY 2016 surplus, both required by State law. This $93.0 million balance at the end of SFY 2016 represents a 316.6 percent increase over SFY 2015 year-end levels, and an 898.7 percent increase over SFY 2014. (Learn more about the Revenue Stabilization Reserve Account in our December blog post.)

While this surplus suggests legislators may have more flexibility entering negotiations over the State Budget, there are potential costs which could impact State coffers in the near-term which have not yet been fully addressed. The State’s Department of Health and Human Services recently estimated an operating deficit of $65.97 million for SFY 2017, but also estimated it would have $22.0 million available in lapse funds, slightly above its target lapse. Legislators may allocate some of the current surplus to fill this deficit prior to the end of SFY 2017 on June 30. Legislators may also opt to spend approximately $25 million to pay for costs associated with issues facing Concord Steam services to State buildings with surplus dollars, rather than allocating money from SFY 2018 or bonding for a capital project. There may be additional appropriations made outside of the State budget process by the Legislature to address urgent needs or other spending priorities during this session. Finally, businesses which have money sitting with the State from overpaid taxes credited to subsequent tax years, currently totaling $173.4 million from more than 17,000 businesses, could recall those credits if they decide to do something else with the money; while it is unlikely all of these businesses will recall their credits, that is a potential risk to the surplus.

The surplus is real, but not invincible. Recent reports suggest the State is still benefiting from receipts above plan, currently at about $45 million for SFY 2017 thus far, but the high surplus we saw in SFY 2016 may not be a trend. These continuing questions and others will be on the minds of legislators as they make policy choices over the course of the next few months.