The U.S. House of Representatives passed the latest budget reconciliation bill, referred to as the One Big Beautiful Bill Act (OBBBA), on the morning of Thursday, May 22. Changes were made to the bill up until the final day of passage, including a 42-page amendment Wednesday evening.

As a result, many provisions of the OBBBA have implications that have not been fully analyzed, but several would have significant impacts on the lives of Granite Staters. These impacts include, but are not limited to:

- increasing resources available for all households funded by boosting the federal debt, but reducing resources available for households with the lowest incomes while increasing resources for those with the highest incomes

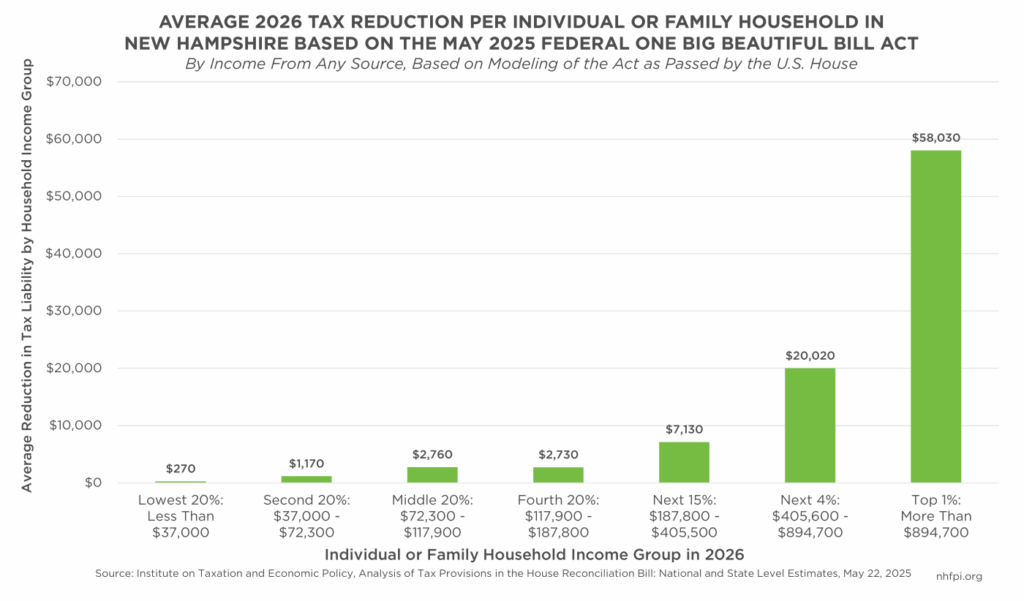

- reducing taxes for Granite Staters with the highest one percent of incomes by an average of $58,030 in 2026, while reducing taxes by an average of $270 for those earning the least

- the projected loss of Medicaid health coverage for 20,000 Granite Staters

- the potential for $38 million more in State food assistance costs to maintain services due to federal downshifting

- putting access to food assistance at greater risk for 15,000 New Hampshire residents

- the elimination of certain renewable energy credits and reduced student loan aid

The U.S. Senate will work on legislation next, considering the provisions of the OBBBA proposed by the House and likely making its own changes.

The Upshot by Income: Households with More Would Benefit More

According to an analysis from the U.S. Congressional Budget Office, U.S. households would see an increase in resources on average as a result of OBBBA policy changes, but those benefits would not be distributed evenly. Using calculations based on most provisions of the bill, resources for the lowest ten percent of households by income would decline by the equivalent of about four percent of those households’ incomes during 2029 through 2033. Resources would increase for households within the highest-income ten percent by as much as four percent of income in 2027, with smaller increases in the 2029 through 2033 period.

Most of the changes to household incomes resulting from the OBBBA’s provisions would be due to tax policy changes and cash transfers. However, the loss of income for households at the low end of the income scale would be primarily due to likely reductions in the amounts of, and access to, key federal assistance. These benefit reductions are primarily in Medicaid, which provides health coverage to people with lower incomes and certain health conditions or disabilities, and the Supplemental Nutrition Assistance Program (SNAP), which provides resources to purchase food for individuals and households with incomes below or near poverty levels.

Extending Tax Reductions Primarily Benefitting Higher Income Households

The OBBBA would permanently extend the core individual income tax reductions first enacted in the Tax Cuts and Jobs Act (TCJA) that passed in 2017. The TCJA reduced taxes for most households by lowering rates and making other changes, such as creating larger standard deduction and Child Tax Credit amounts. However, most of the benefits of the TCJA went to the highest-income households, particularly those with certain types of business income and those that benefit from intergenerational transfers of significant wealth.

The OBBBA would extend or make permanent most parts of the TCJA’s individual income tax code changes, while also making other changes to tax law. However, the alterations proposed relative to tax policy do not shift the overall direction relative to the TCJA’s impact. New analysis of the OBBBA from the Institute on Taxation and Economic Policy (ITEP) identified that, if the TCJA tax policy changes were extended into 2026, $121 billion in net tax cuts would flow to the highest-income one percent of households that year, which would exceed the estimated $90 billion of tax reductions that would benefit the entire bottom 60 percent of taxpayers by income.

In New Hampshire, households in the lowest 20 percent, with incomes below $37,000 per year, would receive an average tax reduction of $270 in 2026. Households with incomes from $72,300 to $117,900, in the middle 20 percent of the income scale, would see an average federal income tax reduction of $2,760. For households with incomes above $894,700, or the top one percent, the average tax reduction would be $58,030.

For context, the median income was about $53,800 among the approximately 157,000 households that rented their homes in New Hampshire during 2023. This modeling suggests that, under the OBBBA in 2026, the estimated tax reduction for the average taxpayer in the top one percent of the income scale would be approximately equivalent to the entire 2023 median income for a Granite State renter household.

The cap on the amount of state and local tax payments an individual could deduct from their federal taxes would increase from $10,000 to $40,000 for joint filers with incomes under $500,000.

Temporary Boosts to Child Tax Credit, Aid to Older Adults, and Tipped Workers

Not all the individual tax changes proposed by the OBBBA would disproportionately benefit higher-income households, although the overall bill would in aggregate if it became law.

The Child Tax Credit would be temporarily increased to $2,500 through 2028 before dropping back to $2,000, with a refundable portion capped at $1,400. The 2021 Child Tax Credit expansion under the American Rescue Plan Act was largely responsible for reducing the child poverty rate by nearly half, lifting about 11,000 children out of poverty in New Hampshire relative to 2019 levels; however, that expansion was much larger than this proposed increase. The tax credit became fully refundable temporarily in 2021, which was critical for the lowest-income households to access the benefit.

The OBBBA would also eliminate federal income taxes on qualifying tips for workers through 2028, when the tax break would expire, with qualifying tip income limited to occupations that “traditionally and customarily” receive tips and excluding highly-compensated employees. The premium portion of overtime payments and interest on car loans for people earning less than $100,000 per year who purchased cars assembled in the United States would also not be taxed through 2028.

The standard deduction on federal income taxes would also be temporarily increased, and a new deduction, which would also be temporary, would be available to older adults; filers age 65 years and older with incomes below $75,000 for an individual or $150,000 for a couple would have a $4,000 deduction.

Taxes would also be increased on college endowments, certain private foundations, and remittances.

Removing Tax Credits and Subsidies for Non-Fossil Fuel Energy Sources

The OBBBA would reduce funding, including subsidies through the tax code, for renewable and non-fossil fuel energy sources. The bill would end key tax incentives for residential solar electric, wind, geothermal heat pump, battery storage, energy efficiency improvements, and new energy-efficient home construction. Both individual and commercial tax credits for electric vehicle purchases would end after 2025. Credits for certain clean energy generation and the production or manufacturing of related products, such as solar and wind energy components and batteries, would be repealed.

In Tax Year 2022, the most recent year with detailed data, 19,880 filers in New Hampshire used the Residential Energy Tax Credit, with $38.5 million in tax relief provided to those Granite Staters.

Medicaid Work Reporting Requirements and Administrative Checks

While there were many proposed changes to Medicaid in the OBBBA, the proposed change that would have the biggest impact on federal finances and the experiences of Granite State enrollees would be the creation of work and reporting requirements for certain Medicaid beneficiaries.

The OBBBA would require Medicaid enrollees age 19 to 64 to be working, or participating in other qualifying activities, for at least 80 hours per month by the end of 2026. Individuals would need to be compliant at least a month before applying for Medicaid. Compliance with the requirements would also be checked at redetermination, which currently occurs annually for most enrollees in New Hampshire but would be required to occur every six months for the Medicaid Expansion population under the OBBBA. States would have the flexibility to make the timelines and checks on these requirements more stringent, so State policymakers would have additional decisions to make regarding the work requirements. States would also have to implement outreach programs.

The required hours may be fulfilled with paid work, work programs, community service, or at least half-time enrollment in an educational program. The drafted work requirements have exemptions for people who are pregnant, parents or guardians for an individual with a disability or a dependent child, medically frail or have a physical or developmental disability, have a substance use or mental health disorder, in a drug treatment program, already qualifying for work requirement under certain other federal programs, and in certain other situations, with flexibility given to federal officials to set specific rules.

The Center on Budget and Policy Priorities estimated that, based on the OBBBA’s language and the experience of Arkansas’ briefly-imposed Medicaid work requirements, about 20,000 Granite Staters would likely lose Medicaid coverage. National-level Congressional Budget Office projections from the version of the bill considered earlier in the week, which had work requirements beginning in 2029 rather than by the end of 2026, estimated at 7.6 million more people would lack health insurance in 2029 under the OBBBA than would be with current policy.

The OBBBA would add significantly to Medicaid administration requirements, including more frequent eligibility redeterminations for enrollees, new requirements for checks on enrollee contact information, delaying rules that would have changed eligibility processes until 2035, and limiting retroactive coverage to one month prior to application. These new requirements may both generate State administrative costs and make enrolling, and remaining enrolled, in Medicaid more difficult for Granite Staters.

According to 2023 data from the Kaiser Family Foundation, approximately 64 percent of Medicaid adults, age 19 to 54 years and not enrolled in certain disability assistance programs, are already working at least part-time, with around 44 percent engaged in the workforce full-time. Approximately 29 percent of enrollees faced barriers to employment, including caregiving responsibilities (12 percent), illness or disability (10 percent), and school attendance (7 percent). The remaining 8 percent identified that they were retired, unable to find work, or another reason not specifically indicated. Data specific to New Hampshire estimated that about 65 percent of New Hampshire’s Medicaid-enrolled adults are working, which is similar to the national figure.

Potential Medicaid Cost Shift to States or Changes in Coverage

An OBBBA provision that could potentially impact New Hampshire would reduce federal matching rates for the entire Medicaid Expansion population, which was 59,539 Granite Staters at the end of April 2025, for states that provide Medicaid coverage to recent immigrants who have lawful legal status. Certain legal immigrants who are non-citizens would still be allowed to access coverage without a state being impacted under this provision, but the Medicaid Expansion federal matching rate for states providing coverage to other non-citizen immigrants would drop from 90 percent to 80 percent. New Hampshire expanded Medicaid coverage to these legally-recognized non-citizen immigrants who are children or are pregnant in the current State Budget. However, one of the last changes made on the floor of the U.S. House in its amendment process would exempt children and pregnant people from triggering this provision, which could exclude New Hampshire from its impacts.*

If the federal match rate for Medicaid Expansion dropped from 90 percent to 80 percent, that would trigger a New Hampshire law that would end New Hampshire’s Medicaid Expansion program automatically within 180 days. Were New Hampshire to change its law to avoid the program’s end and see its match reduced, the State would have to incur additional costs. If the State had an 80 percent federal match for Medicaid Expansion in this fiscal year, rather than the current 90 percent match, the increased estimated cost to the State would have been $63 million in that year alone.

The proposed language would also limit provider taxes, which New Hampshire uses to fund significant components of the Medicaid program, but this provision would not directly impact New Hampshire policy currently; it would limit policy options in the future more than current federal law does.

Shifting Costs for Food Assistance to States and More Work Requirements

The OBBBA would make changes to SNAP, likely reducing funding for food assistance to individuals and families with low incomes. The Congressional Budget Office estimated that the OBBBA’s policy changes in SNAP would, in total, reduce expenditures by $294.6 billion nationally from Federal Fiscal Years 2025 to 2034.

These changes include adding time-limitation restrictions for adults not meeting the work requirements in SNAP to people aged 55 to 64 and or parents with children over age six. This expanded work requirement would, according to the Center on Budget and Policy Priorities, put an additional 15,000 Granite Staters enrolled in SNAP at risk of losing access to this food assistance. The U.S. Congressional Budget Office estimated 3.2 million fewer people nationwide would be enrolled in SNAP because of the changes to work requirements and to the ability of states to waive them for economically disadvantaged geographies.

States would incur higher costs because of a required change in how benefits would be funded. Currently, the administrative costs of the program are split between the states and the federal government, but the SNAP benefits themselves are completely federally funded. The OBBBA would require states to pay at least 5 percent of benefit costs, and the required amount would increase to up to 25 percent based on the state’s error rate; this rate measures underpayments and overpayments in state-level SNAP, and a higher error rate would lead to higher state contribution requirements, up to a maximum 10 percent error rate. States may keep existing benefits and eligibility, paying more of the cost themselves, but states may also modify benefits, eligibility, or participation in federal SNAP. The U.S. Congressional Budget Office estimated benefits would be reduced or eliminated for 1.3 million people nationwide as a result of this cost shift.

Th OBBBA would also reduce by half the amount of funding states receive for SNAP administration and would expand the instances that count as errors. New Hampshire’s error rate in 2023 was 12.53 percent, which under the OBBBA rules would require the state to pay $38 million more for SNAP as it currently operates. New Hampshire’s error rate has been as low as 3 percent in the years since 2003, but only one U.S. state, South Dakota, has never had an error rate above 6 percent during that period.

At the end of April 2025, 75,886 Granite Staters, including 26,442 children, were enrolled in SNAP, according to the New Hampshire Department of Health and Human Services. In 2024, New Hampshire received about $154.4 million in federal funds to pay for SNAP benefits to state residents.

Adding to the National Debt

There are a wide array of proposed reductions to services in OBBBA beyond the Medicaid and SNAP benefit changes. For example, proposed changes to the structures of student loans and limiting eligibility for education aid to students with low incomes would reduce federal expenditures by more than $300 billion through 2034. The OBBBA also proposes new expenditures, including enhanced farm subsidies and border security expenditures.

The revenue changes through reduced taxation, however, generate the most significant changes to the national debt relative to current policy. The Congressional Budget Office estimated revenues would fall by $3.8 trillion through 2034 as a result of the U.S. House Ways and Means Committee’s tax reductions. The Committee for a Responsible Federal Budget, an independent nonprofit, estimated that the national debt, including interest, would increase by $3.1 trillion relative to current policy over the next decade under the OBBBA. The OBBBA would raise the federal debt limit by $4 trillion.

With the U.S. Senate likely seeking to make changes, June will be an important month for Congress to seek to reach an agreement, as top legislators identified passage by July 4 as a target. Congress will likely need to take some action before the federal government’s deadline to raise the debt limit and avoid a default by the middle of August.

*Note: This information was updated on May 29, 2025 with the late floor amendment exempting coverage for non-citizen children and pregnant people with legal status from the federal match reduction, which did not originally appear on the Congressional website displaying the text of the OBBBA.