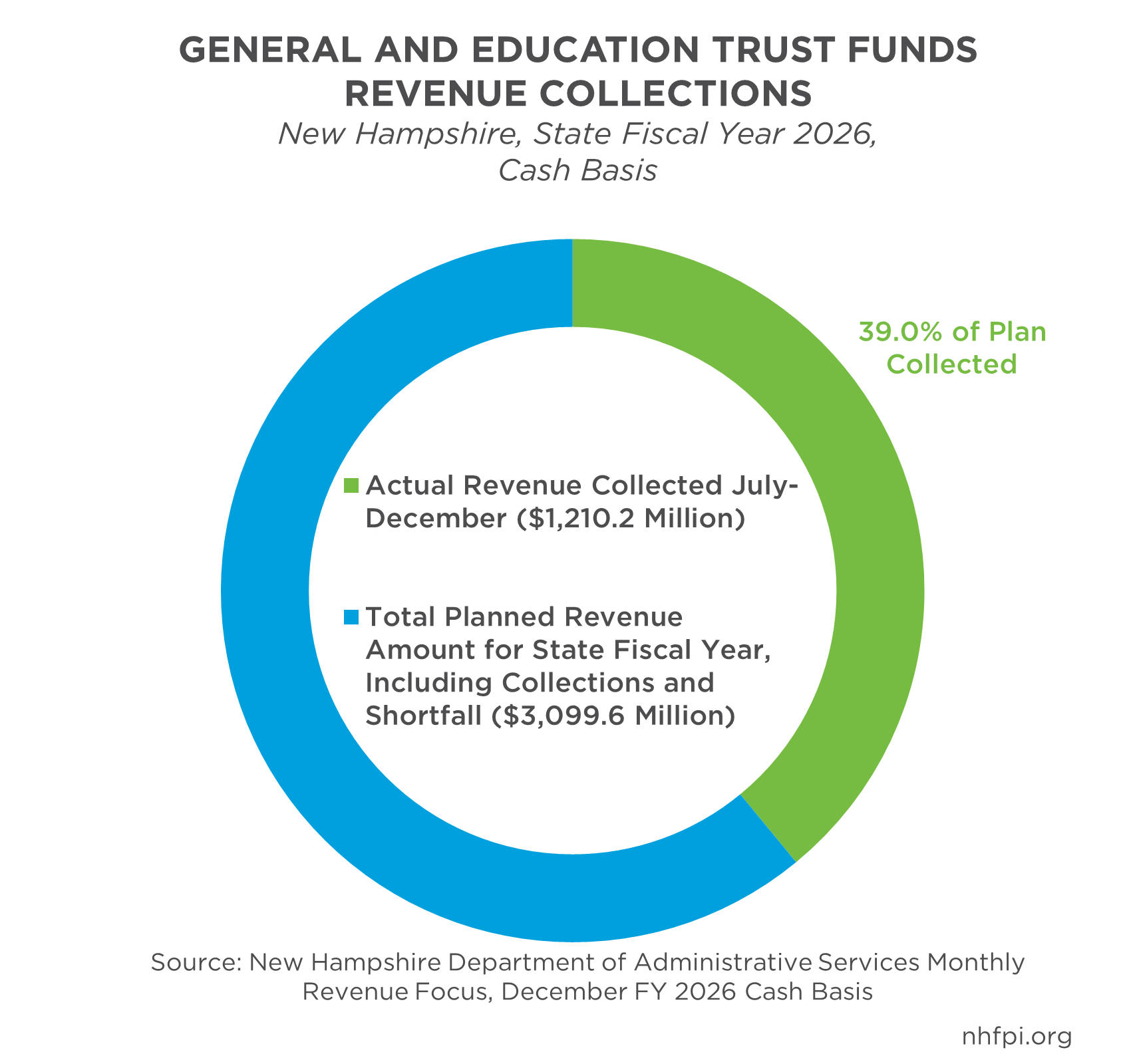

State revenue collections in December, a key month for State revenues, offered both good news for the State’s overall financial picture and more cautionary signs for underlying revenue strength.

The New Hampshire General Fund and Education Trust Fund collected a combined $339.1 million in revenue in December, or $42.1 million (14.2 percent) more than planned. However, a total of $45.8 million was collected from the State’s temporary tax amnesty program, while other revenue sources combined fell short of the amounts planned to be collected during the month.

Tax Amnesty Program Brings in More Revenue than Projected

As part of the final State Budget, New Hampshire lawmakers instituted a tax amnesty program. This program allows people and businesses with unpaid taxes to pay without the penalties for nonpayment that the State typically charges. Taxpayers also only have to pay 50 percent of the interest costs they would normally have to pay on overdue taxes. The program applies to most State taxes, and runs from December 1, 2025 to February 15, 2026.

The majority of the dollar value of outstanding unpaid taxes is likely in business taxes. Most Business Profits Tax and the Business Enterprise Tax payments are made on a quarterly basis, and December is a typical month for most business filers to make one of the quarterly payments. As a result, December revenues may account for a substantial portion of tax amnesty collections, and the underlying data offer insights into the strength of business tax revenues more broadly.

The Legislature projected the tax amnesty program would generate $5.0 million for the combined General and Education Trust Funds. The previous tax amnesty program, implemented in State Fiscal Year (SFY) 2016, generated $19.0 million.

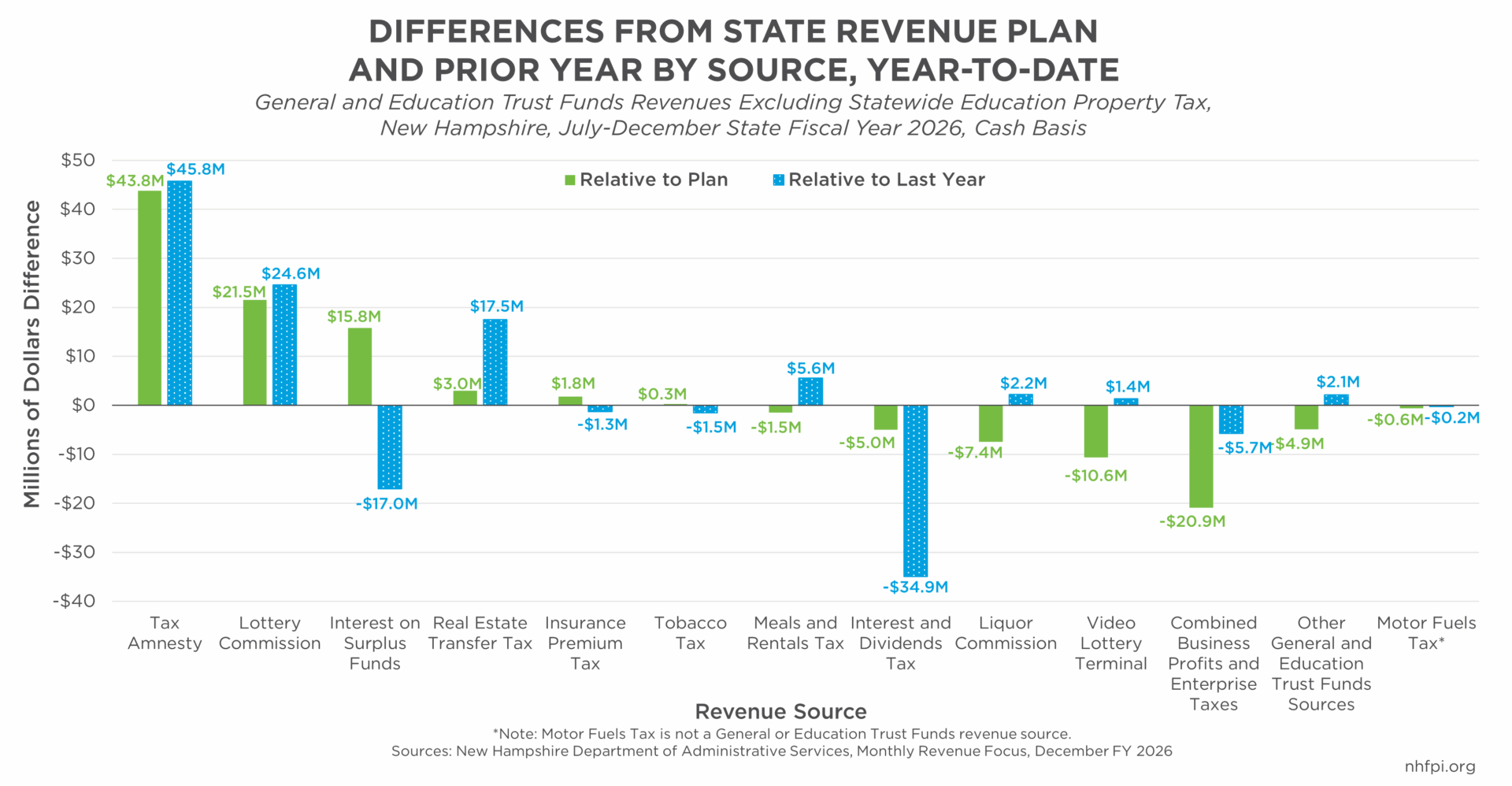

In December, the current tax amnesty program yielded $45.8 million in revenue, or $43.8 million more than the $2.0 million included in the State Revenue Plan for the month.

Other Revenue Growth Limited

The tax amnesty revenues helped generate a year-to-date surplus for SFY 2026 of $35.9 million (3.1 percent) for the first six months of the fiscal year. Without those tax amnesty revenues, however, these two State funds would still be in collective deficit.

Revenues outside of the tax amnesty program were $1.7 million (0.1 percent) behind the State Revenue Plan for December. That is a smaller shortfall than any other month this fiscal year so far, except for November, which benefited from two temporary boosts from sources outside of the tax amnesty program.

Business Tax Revenue on Target for December But Still Below Expectations for the Year

Business tax revenues exceeded expectations by $1.8 million (1.1 percent) last month. However, business tax revenues are still below expectations by $20.9 million (4.4 percent) for the year thus far, and are below last year’s collections by $5.7 million (1.2 percent) without adjusting for inflation. Although business tax revenue coming in ahead of planned amounts for the month helps State finances, particularly since December is typically a key month for business tax revenues, it may not yet be a signal of a turnaround, especially given the lack of year-over-year growth.

Video Lottery Terminal Revenue Slow to Start

Video lottery terminals, a new revenue source for the State, have not been coming online and generating revenue as fast as anticipated. The State projected about $12.0 million in revenue at this point in the year, but only $1.4 million has been collected. Other Lottery Commission revenues are up above planned amounts in both December and for the year thus far overall, outpacing projections by $21.5 million (27.6 percent) during the first six months.

Key Sources Offer Mixed Results

Most other revenue sources had relatively little impact on the overall financial picture in December. Liquor Commission revenues were below expectations by $1.5 million (9.4 percent) in December, while Tobacco Tax collections were $1.2 million (7.6 percent) higher than projected amounts for the month. Utility Property Tax revenues also helped the overall revenue picture on the margins, with revenues $2.1 million (20.0 percent) higher than expected. Real Estate Transfer Tax receipts were $1.3 million (6.8 percent) below the targeted amount in December.

Boost Helps State Finances, At Least Temporarily

With the Legislative Session underway, the tax amnesty program has already generated a surplus relative to expectations, and may continue to over the next two months. The next key months for tax revenue will arrive in March and April, which will inform the Legislature’s ability to fund any new initiatives.

However, policymakers may also seek to use available revenues, particularly one-time revenues, to backfill components of the State Budget. Lawmakers anticipated certain spending reductions, including the funds expected to be unused and lapsed by the State agencies, that could have fewer direct impacts on services if a revenue surplus exists. Offsets for prior policy decisions and new initiatives may compete for any surplus generated. However, baseline State revenues do not yet indicate that surpluses will be sustained in the second half of the year.