State revenues in April, the most important month for revenues on the calendar, followed similar patterns to revenues for most of the fiscal year thus far: underwhelming and short of target, but not low enough to dramatically change the outlook for the next biennium. These April figures provide the last significant piece of information before the Senate Ways and Means Committee makes revenue projections for the next State Budget biennium to guide the Senate Finance Committee’s decisions.

The Topline April Numbers

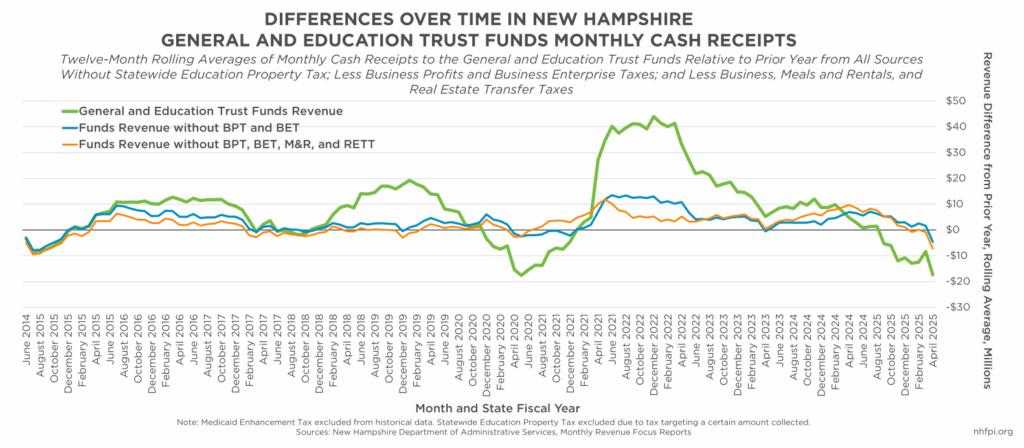

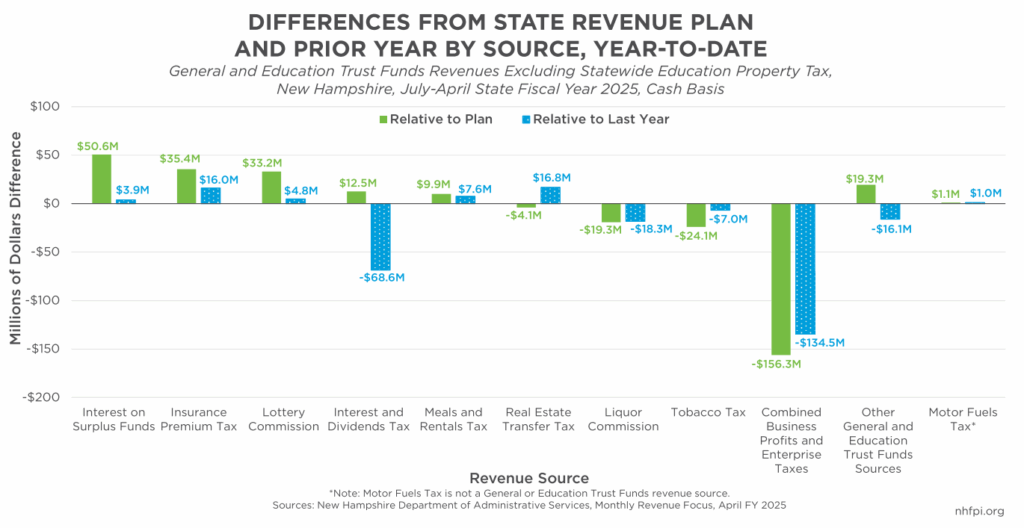

The State was projected to collect $809.1 million for the combined General and Education Trust Funds in April, based on the State Revenue Plan. Actual revenues, however, totaled $774.1 million, or $35.0 million (4.3 percent) short of the target amount. On a cash basis, these two funds have a revenue deficit of $41.6 million (1.5 percent) for State Fiscal Year 2025 thus far with two months to go. This shortfall came on the heels of February and March revenues being higher than planned, but April’s results provided strong indications that those months were likely temporary deviations from the trend for the year.

The collection month for the Statewide Education Property Tax shifted from March to April for 2025, complicating year-over-year comparisons. However, as the Statewide Education Property Tax is set to raise the same amount of money each year, removing it from consideration altogether shows the differences among variable revenue sources. Without the Statewide Education Property Tax, revenues in April were $115.1 million (21.9 percent) below April 2024 receipts.

Repeal of Interest and Dividends Tax Begins to Drag on Revenues

The primary drivers of the year-over-year decline in revenues were the repeal of the Interest and Dividends Tax, which was previously boosting revenue growth, and the continued underperformance by the State’s two primary business taxes.

The Interest and Dividends Tax and interest payments earned by the State on its cash holdings combined comprised almost all of the revenue surplus in State Fiscal Year 2024. However, growth in interest receipts has stalled as the State spends more of its cash reserves. The Interest and Dividends Tax repeal started to impact revenues substantially in April without the payment of first quarter estimates that would have been due last month had the tax still been in effect.

Interest and Dividends Tax revenues were $57.1 million (66.0 percent) below April 2024 receipts. They were also $9.2 million (23.8 percent) below planned amounts, showing underperformance in receipts from the last year of the tax’s implementation. These lower receipts were reportedly due to higher refunds, likely because there would be no tax next year to carry forward a balance to pay; taxpayers may have also not been tracking the incremental rate reductions and been overpaying based on the five percent rate that had been in effect from 1977 to 2022, rather than last year’s three percent rate.

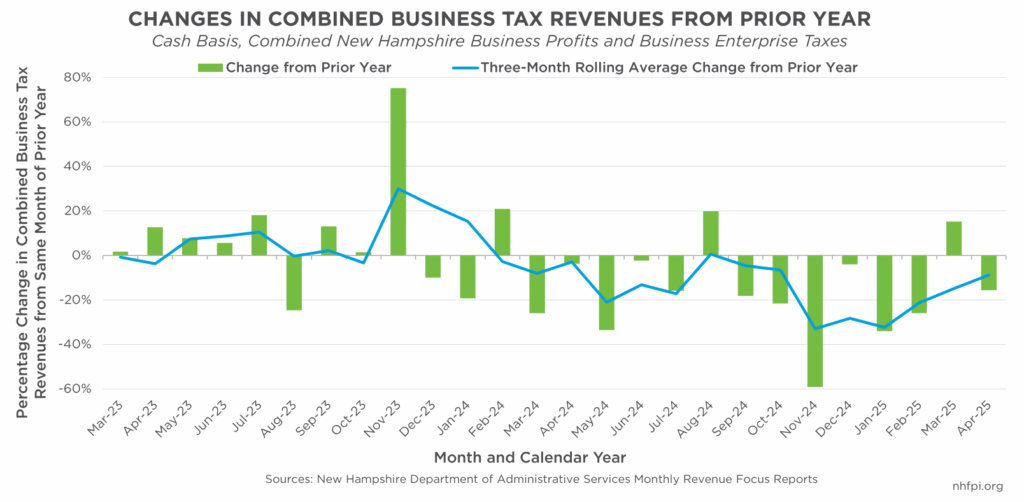

Business tax revenues were also substantially below targets, but improved somewhat relative to the first eight months of State Fiscal Year 2025. From July to February, average monthly business tax receipts were 19.8 percent lower than they had been in the same month of the prior year. March 2025’s receipts were actually higher than those of March 2024, suggesting the partnership returns due on March 15, which may represent smaller organizations, may have showed more favorable profits. April’s receipts included annual returns from other types of entities, including corporations and Water’s Edge filers, that likely reflect larger, multinational entities that pay a significant portion of business tax revenues.

April receipts were down from the prior year by $44.3 million, or 15.6 percent. While this drop was substantial, this result was still closer to the prior year than the 20 percent reduction that appeared very possible going into April’s tax return season.

Peering into the Future

The Senate Ways and Means Committee will have to estimate revenues for the next budget biennium, including for the remainder of this year. Some indications below the topline numbers might give a few insights.

While April’s State revenues included tax returns from last year’s activity, the business tax receipts also included the first quarter’s estimate payments from non-partnership businesses. Previously, the first quarter estimate payments for the Interest and Dividends Tax would have also been filed, but with the repeal of the tax, those were not collected this year and only returns from last year’s activity generated revenue.

Combined returns and extensions, which are based on last year’s activity, from March and April 2025 were 16.1 percent below the same period in 2024, according to Department of Revenue Administration data. However, the combined estimates from March and April 2025, which should reflect the first quarter for businesses, were 6.4 percent lower than the same collections for March and April 2024. While those lower revenues, unadjusted for inflation, suggest businesses are expecting less taxable activity in 2025 than they were in early 2024, they are more favorable than the overall business tax receipt decline for the fiscal year thus far of 13.1 percent.

Real Estate Transfer Tax revenues and Insurance Premium Tax revenues continue to perform better than last year, with April receipts up $1.1 million (9.3 percent) and $16.0 million (10.0 percent) above last April, respectively.

However, policymakers will have to continue to grapple with the repeal of the Interest and Dividends Tax and deflated business tax receipts, all while service needs continue, as they project revenues and craft the next State Budget.