This analysis provides a detailed rundown of key provisions in the House Finance Committee’s State Budget proposal. Access a short Fact Sheet about the Committee’s recommended changes to the Governor’s State Budget proposal with this link.

This post and the Fact Sheet linked above do not reflect changes made to the House version of the State Budget on through amendments by the entire House of Representatives on April 10; learn more about those changes in NHFPI’s blog post House Changes Budget with Last-Day Amendments, Bills Move on to Senate.

The House Finance Committee voted on Thursday, April 3, to adopt amendments to the Governor’s proposed versions of House Bills 1 and 2, the two bills that comprise the State Budget, for State Fiscal Year (SFY) 2026 and 2027.

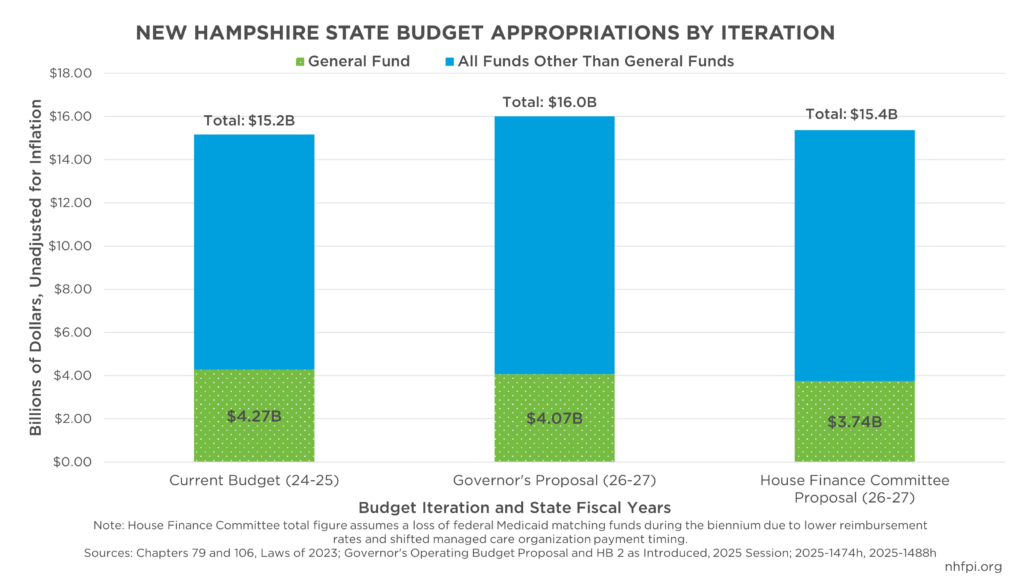

The House Finance Committee proposed reducing funding for services by about $643 million relative to the Governor’s proposal, bringing total State Budget funding proposed for the biennium down approximately 4.0 percent from the Governor’s proposed $16.0 billion budget to $15.4 billion. Unadjusted for inflation, which averaged 2.9 percent annually for New England consumers in 2023 and 3.2 percent in 2024, the House Finance Committee’s proposed budget for the next two fiscal years is about $198 million (1.3 percent) larger than the current SFYs 2024-2025 State Budget.

However, State General Fund appropriations would decline in the House Finance Committee’s proposal. General Fund dollars are a subset of the State Budget, and they are the most flexible dollars State policymakers have access to because they are solely from State revenue sources, rather than federal transfers or dedicated funds protected by law or the State Constitution. General Fund dollars are about 28 percent of the current State Budget. If the House Finance Committee’s proposal were enacted, General Fund appropriations would be reduced as other funds are drawn on to fund some services while other services would be curtailed or eliminated, reflecting that the House’s revenue estimates were lower than the Governor’s projections. The House Finance Committee’s General Fund appropriations were about $326 million (8.0 percent) lower than the Governor’s proposed appropriations for the biennium, and about $526 million (12.3 percent) lower than the General Fund appropriations made for the current, SFYs 2024-2025 State Budget.

The funding changes include $95.5 million in back-of-the-budget reductions, which are requirements that State agencies reduce their expenditures without specifying which budget lines would be impacted.

The House Finance Committee’s proposed budget identifies 326 positions that would be abolished if it became law as presented. These positions include vacant and filled State government positions.

At the end of the biennium, the House Finance Committee projects that the General Fund will have $113 million in otherwise uncommitted and unused General Funds to transfer to the Rainy Day Fund.

The sections below summarize key changes by category of State government expenditure and other aspects of the House Finance Committee’s proposed State Budget amendments to House Bill 1 and House Bill 2.

Health and Social Services

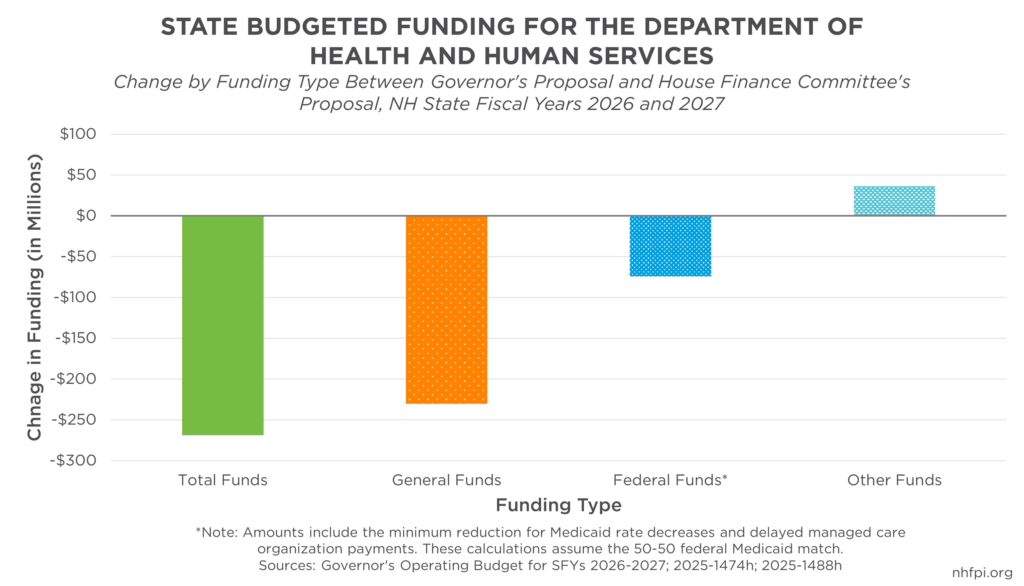

The Health and Social Services category of the State Budget is made up almost entirely of the Department of Health and Human Services (DHHS). Under the House Finance Committee’s proposal, the DHHS’s appropriations would decline by approximately $269 million (3.8 percent) from the Governor’s State Budget proposal, including federal funds likely to be forgone from key changes and added revenue from the sale of property at State facilities being used for health-related purposes. Reductions were proposed across several agencies and operations within DHHS, including Medicaid, services for older adults and individuals with physical or developmental disabilities, community mental health support, and public health initiatives, among other program areas.

Medicaid Services

One of the largest changes proposed by the House Finance Committee included a three percent reimbursement rate reduction for all Medicaid service providers in the state. The provision would go into effect January 1, 2026, reducing General Funds for the DHHS by $17.5 million in SFY 2026 and $35.0 million in SFY 2027. The DHHS would also be required to work with the Department of Administrative Services (DAS) to reduce the associated federal Medicaid match funds, also known as the Federal Medical Assistance Percentage (FMAP). The federal government currently funds at least 50 percent of all Medicaid program costs in the state, and 90 percent of costs for the component of Medicaid for adults with low incomes known as the Granite Advantage Health Care Program. These reductions follow a three percent across-the-board Medicaid rate increase that was implemented in the current State Budget. Targeted higher rate increases were allocated for critical services, such as community mental health and home and community-based supports, with increases equating to $134.2 million in General Funds across the SFY 2024-2025 biennium.

The House Finance Committee also proposed delaying June 2027 Medicaid payments to Managed Care Organizations (MCO) until the next biennium, with funds to be dispersed at “the start of” SFY 2028. This change would likely not impact services, but would shift payment outside of the budget biennium to help the next budget balance within the window of its duration. This amendment would reduce General Fund appropriations by $25.0 million in SFY 2027, in addition to likely equivalent federal Medicaid matching dollars, and assumes greater availability of funds during the next biennium.

In addition to rate reductions and delayed payments, the House Finance Committee also proposed several adjustments among Medicaid Services, including:

- changes to funding mechanisms for the Granite Advantage Program, including the repeal of the automatic transfer from Liquor Commission revenues

- establishing an incentive program to encourage Medicaid recipients to seek the lowest-cost outpatient procedure care, and

- the termination of the Medicaid to Schools Program if parental consent policies are changed at the federal or state-level.

Developmental Disability Services

The House Finance Committee proposed a decrease in funding for developmental disability services relative to the Governor’s budget proposal, contributing to a General Fund reduction of $8.9 million in SFY 2026 and $22.5 million in SFY 2027; with an equivalent reduction in federal funds associated with the Medicaid match, the total funding would be a reduction of $62.8 million (6.4 percent) across the biennium relative to the Governor’s proposal. Declines in funding for such services would affect the developmental disability services waitlist, impacting children aging out of school-based services, individuals with disabilities moving into the state, and anyone currently receiving services who would require enhanced or increased aid.

While there has been a proposed decrease in funding, the House Finance Committee has retained organizational footnotes included in the Governor’s State Budget proposal relative to funding the waitlist. These notes allow for the carryforward of funds up to $30.0 million in SFY 2026 and $50.0 million in SFY 2027, and also allow the DHHS to request additional funds through the Joint Legislative Fiscal Committee if spending exceeds the budgeted amounts.

Services for Older Adults and Adults with Physical Disabilities

Counties are required to contribute a certain amount of money towards funding long-term care for their residents who need those services through Medicaid, including nursing facilities and home and community-based services. Under current law, year-over-year growth in that contribution is limited to 2 percent. The House Finance Committee proposed increasing the year-over-year cap to 3 percent for the next biennium only. Under this amendment, counties would be required to contribute more dollars towards care, capped at a statewide total of $135.8 million in SFY 2026 and $139.9 million in SFY 2027.

During the COVID-19 public health emergency, the State received enhanced FMAP dollars that were distributed into the Rainy Day Fund. The House Finance Committee’s proposal includes compensation for counties’ overpayments towards their share of Medicaid costs in SFYs 2020 and 2021. A total of nearly $11.3 million would be dispersed to counties during the upcoming biennium under the proposal and may help offset cost constraints resulting from the proposed year-over-year cap increase.

Mental Health and Substance Use Disorder Services

One of the largest funding declines between the Governor’s proposal and the House Finance Committee’s proposal was in community mental health, which has a proposed reduction of $18.9 million in General Funds in each year of the biennium. The total reduction would be $37.8 million for the biennium, 37.5 percent lower than the Governor proposed, and drop funding to about $31.5 million each year, less than the $44.4 million in adjusted authorized funds for SFY 2025. Reductions in funding would primarily impact non-Medicaid contracts and services within community mental health, as well as eliminate a proposed $10 million biennial increase for uncompensated care included in the Governor’s State Budget proposal. According to DHHS testimony to members of the House Finance Committee, the Department is expected to spend elevated amounts this fiscal year due to increased services towards the Mission Zero initiative, which aims to eliminate hospital emergency department psychiatric boarding.

Public Health Services and Supports

The House Finance Committee eliminated or reduced funding for key programs supporting both the health care workforce and the public health of Granite Staters. Funding for Title X family planning and preventive care services was eliminated, equating to a total fund reduction of nearly $1.8 million in each year of the biennium. Under the proposal, the State Loan Repayment Program (SLRP), which helps to recruit health professionals to commit to working in medically-underserved and rural communities by offering assistance with student loans, would not accept new applicants for the biennium; this would reduce General Funds for this program by $800,000 for the biennium. The House Finance Committee also eliminated all General Funds for the Tobacco Prevention and Cessation Program, contributing to savings of about $1.2 million across the biennium. The House Finance Committee proposal also eliminates all funding for the Prescription Drug Affordability Board, which would reduce General Fund appropriations by about $522,000 during the biennium. A policy change attached by the House Finance Committee to the budget proposal would also allow therapeutic cannabis “alternative treatment centers,” which currently must be operated by non-profit organizations, to be for-profit entities.

Education

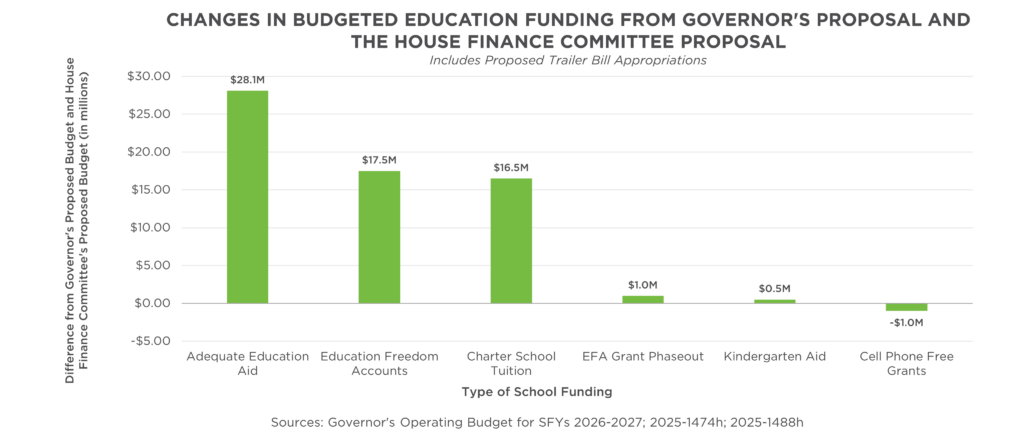

The House Finance Committee’s budget proposal includes some increases for early childhood care and education, increases for K-12 education, and decreases to both the Community College System of New Hampshire (CCSNH) and the University System of New Hampshire (USNH), relative to the Governor’s proposed budget. Changes in K-12 education funding reflect increases in Adequate Education Aid to local public schools, Education Freedom Account (EFA) funding, and charter school tuition, as well as several smaller funding changes.

The House Finance Committee also recommended several policy changes to the Department of Education and the Education Trust Fund that may help address State revenue shortfalls, create more flexible funds for non-education expenses, limit increases in local property taxes through local budget caps, and require all public K-12 and higher education institutions to eliminate contracts and remove program related to diversity, equity, and inclusion.

Early Childhood Care and Education

The House Finance Committee’s budget proposal increases overall expenditures for DHHS’s Bureau of Child Development and Head Start Collaboration by approximately $16.2 million from the Governor’s proposed budget. The increased funding is due entirely to federal funds. The largest increase of $33.5 million is proposed for the child development program activity. The majority of this increase is in the “employment related child care” line, which funds the New Hampshire Child Care Scholarship Program, a state-federal partnership that provides child care assistance to families with low and moderate incomes. The quality assurance activity was reduced by $15.7 million in federal funds mostly in the “grants for public assistance and relief,” which fund contracts for quality initiatives, including the early care and education workforce professional development, market rate surveys, the child care resource and referral program, and web-based health and safety training.

The proposed budget also reinstates $15 million dollars for the child care workforce grants that were funded using General Funds during the current budget cycle. This initiative disseminated funds to early care and education providers who could use the funds for a variety of recruitment and retention initiatives with their workforce. The House Finance Committee inserted a footnote in the budget directing this allocation come from federal Temporary Assistance for Needy Families (TANF) reserve funding. While TANF reserve funding can be converted to Child Care Development Funds (CCDF; the state-federal fund from which child care assistance is drawn), the funds must function as CCDF dollars after the conversion. Currently, it is unclear whether CCDF funds or TANF reserve funds can be used for child care workforce grants.

K-12 Education

The House Finance Committee’s budget proposed slight increases for Adequate Education Grants, distributed through the State’s education funding formula, and per student differentiated aid. The changes would increase the grant amounts to whole-dollar levels, and keep those amounts rounded up to the nearest whole dollar as they increase by 2 percent annually in the future. However, funding for each student receiving special education services would be increased substantially.

The base per student grant would be $4,351, with the following increases for each student qualifying for differential aid:

- $2,441 for students eligible for free or reduced price meals

- $849 for students who are English language learners

- $3,140 for students receiving special education services, a boost of about $911 per student relative to current policy

Compared to the Governor’s budget, the House Finance Committee recommended increasing State Adequate Education Grants by $28.1 million ($2.19 billion total, including $546.9 million of “restricted revenue” from the Lottery Commission), EFA funding by $17.5 million ($91.0 million total), and funding for public charter schools by $16.5 million ($151.5 million total).

Fiscal Capacity Disparity Aid, which was repealed as part of the education funding formula adjustments enacted through the current State Budget, would be returned under the House Finance Committee’s budget proposal. This aid would go to municipalities that have relatively low taxable property values per student. This aid would total up to $1,250 per student and have a sliding scale reduction until disappearing for municipalities with more than $1.6 million in taxable property value per pupil.

This aid would be added to the existing Extraordinary Needs Grants in the education funding formula, which are based on both relative property values and the number of free and reduced-price meal-eligible students; however, the House Finance Committee proposed capping aid for the largest communities in the state. In municipalities with more than 5,000 resident students, the total amount of Extraordinary Needs Grants and Fiscal Capacity Disparity Aid combined would be limited to $3,750 per student. Currently, only the cities of Nashua and Manchester exceed 5,000 resident students.

The House Finance Committee voted to expand EFA eligibility to 400 percent of the federal poverty guideline ($128,600 for a family of four) for Academic Year 2025-2026. The program would be expanded to universal eligibility after June 30, 2026. The Committee also increased funding to $975,000 for EFA Phase Out Grants, a program that provides partially funded adequacy grants to public K-12 schools for each student who previously attended their school and enrolls in the EFA program.

The House Finance Committee, acknowledging the passage of a separate bill in the State House of Representatives, estimated a $27 million increase in revenue in SFY 2027 from eliminating the local retention of Statewide Education Property Tax funds. Currently, when communities raise more revenue than they need to pay for the State’s Adequate Education Aid requirements through the Statewide Education Property Tax, they keep the excess funds for other local education uses. Under the proposed language, these communities would have to provide payment for these “excess” amounts to the State. While the House Finance Committee did not incorporate that separate bill into the State Budget, it assumed revenue would be collected from its potential future enactment.

A budget cap for local school districts was also included in the Committee’s State Budget recommendation. The cap would limit school budget increases to no higher than a set amount determined by the Northeast Region Consumer Price Index prior to June 30, 2027. After that date, appropriations would be limited to the five-year average percent change in the number of students, or the five-year average of past appropriations, whichever option is greater. The calculations would not include any costs associated with purchasing new facilities and construction. Districts can vote to exceed the budget caps if they achieve a 2/3rd majority vote of their legislative body, typically comprised of voters at a school district meeting.

Open public school enrollment was also recommended as part of the House Finance Committee’s budget package, which would permit parents to enroll their children in any public school in the state, provided the school has space to accommodate additional students outside of the district.

On the recommendation of the Department of Education, the House Finance Committee removed 37 unneeded, vacant, or temporary positions from the budget, saving about $7.3 million over the biennium. These positions included an early childhood coordinator, an early childhood content expert, a school nurse coordinator, and a computer science administrator that would have been funded through the General Fund.

The House Finance Committee passed an amendment that would ensure schools receive at least 80 percent reimbursement for Special Education Aid if funding runs out at the state level. Policymakers expressed hope that schools will be funded at 100 percent of their reimbursements based on the increased funding in the budget proposed by the Governor, as the House Finance Committee did not reduce Special Education Aid appropriations relative to the Governor’s proposal.

Several appropriations currently funded through the Education Trust Fund are recommended to be moved to drawing on the General Fund by the House Finance Committee, including:

- Special Education Aid

- Tuition and Transportation

- School Building Aid

- Court Order Placements

- DHHS Division of Children, Youth, and Families Court Placements

- State Testing

- Building Lease Aid

- Public School Infrastructure Fund

If the changes become law, the Education Trust Fund will house funding for kindergarten aid for full-day kindergarten, EFA phase out grants, charter school funding, low and moderate income hardship grants, education freedom accounts, State Adequate Education Aid, and the Department of Education’s Education Trust Fund administration. Shifting more revenues and expenditures away from the Education Trust Fund and to the General Fund would provide policymakers with additional flexibility to shift appropriations, as the General Fund has fewer restrictions on use. However, the House Finance Committee would also shift lottery revenues to a special restricted account to ensure those dollars are not used on EFAs and help maintain compliance with the State Constitution.

To generate additional flexibility for available funding, the House Finance Committee approved lowering the percentage of revenues collected by the Business Profits Tax, Business Enterprise Tax, Real Estate Transfer Tax, and Tobacco Tax allocated to the Education Trust Fund to 30 percent. While the split varies among these four tax revenue sources currently, a higher percentage of each flow to the Education Trust Fund, rather than the General Fund, under current law than was proposed by the Committee.

Public Higher Education

Funding for the Community College System of New Hampshire would be reduced by approximately $4.1 million over the biennium compared to the Governor’s proposed budget, a level of funding similar to the current state budget for the system. The House Finance Committee approved an earmark of $2.5 million each fiscal year for the dual and concurrent enrollment program and $200,000 for the math learning communities.

The University System of New Hampshire would have a reduction of $50 million over the biennium, totaling a 33 percent decrease appropriations for the University System from the current biennium funding levels, under the Committee’s budget proposal. The General Fund decrease for the University System totals $80 million over the biennium, but is offset partially by the proposed use of UNIQUE funds associated with 529 accounts to add $30 million to the University System appropriation during the biennium.

Diversity, Equity, and Inclusion Amendment

The House Finance Committee also proposed an amendment that prohibits “…diversity, equity, and inclusion [DEI] in public schools,” including K-12 schools, academic institutions, and institutions of higher education. DEI is defined in the proposed language as “any program, policy, training, or initiative that classifies individuals based on race, sex, ethnicity, or other group characteristics for the purpose of achieving demographic outcomes, rather than treating individuals equally under the law.”

The amendment would require all public schools to review all existing contracts for “DEI-related provisions” and provide a summary report to the commissioner of the Department of Education of any contract with DEI-related provision, along with “contract descriptions, the specific DEI-related provisions, and the total financial obligation associated with each contract.” Schools that do not complete the process will lose all public funding until they achieve compliance with the policy. Currently, the fiscal impact of public K-12 schools and institutions of higher education complying with this amendment are not clear.

Outside of education specifically, this amendment appears to require that all State Executive Branch agencies and all cities, towns, and counties do not implement DEI-related initiatives or activities, including trainings, policies, and hiring or contracting preferences. The State and local governments could not renew or enter any new contract that includes DEI-related provisions, and State agencies would be required to review all contracts for DEI-related provisions by October 2025.

Justice and Public Protection

Relative to the Governor’s budget proposal, the most significant funding changes were the result of shifts in funding structures for operations and the elimination of positions, particularly at the Department of Corrections (DOC).

The most significant policy changes included the removal by the House Finance Committee of the Governor’s proposed bail overhaul, a version of which was signed into law via a separate piece of legislation. They also included the elimination of enforcement authority for the Liquor Commission beyond licensing, with a corresponding reduction in Liquor Commission appropriations by $6.2 million (2.6 percent) during the biennium relative to the Governor’s proposal.

The largest appropriation change relative to the Governor’s proposal was to shift funds budgeted within the Liquor Commission for transfer to the Granite Advantage Health Care Trust Fund, in support of the non-federal share of Medicaid Expansion, back to the General Fund and out of the expense lines. This $47.1 million reduction was offset by the proposed imposition of premiums on certain Granite Advantage enrollees, as originally forwarded in the Governor’s budget and continued in the House Finance Committee’s proposal, as well as a General Fund appropriation proposed by the House Finance Committee to support Medicaid Expansion.

The Judicial Branch would have a back-of-the-budget reduction of $7.9 million in General Funds (3.3 percent of Governor’s proposed General Fund appropriations) during the biennium relative to the Governor’s proposal, and the Department of Justice would have a General Fund reduction of $14.7 million (25.9 percent of Governor’s proposed General Fund appropriations) through a back-of-the-budget reduction.

The Judicial Council would also receive a boost in funding of $3.5 million under the House Finance Committee’s proposal relative to the Governor’s budget for the public defender program. The House Finance Committee proposed attached language that would remove certain financial liabilities for indigent defendants.

Department of Corrections Positions

Funding for the DOC would decline by $35.4 million (10.2 percent) relative to the Governor’s budget proposal under the House Finance Committee’s budget. The SFY 2024 expenditure for the DOC was $175.0 million, and the SFY 2025 Adjusted Authorized current budget is $177.3 million; under the House Finance Committee proposal, appropriations would drop to $153.1 million in SFY 2026 and $156.7 million in SFY 2027.

This cost reduction would be achieved by eliminating positions. The House Finance Committee’s proposed State Budget would abolish 190 positions at the DOC, including 149 positions that were not listed as vacant. These positions include:

- 36 at the State Prison for Men, including 15 filled positions

- 14 at the Northern New Hampshire Correctional Facility in Berlin, including four filled positions

- 7 at the New Hampshire Correctional Facility for Women, including one filled position

- 5 at the Secure Psychiatric Unit, including two filled positions

- 9 funded for mental health services, none of which are indicated to be vacant in Committee documentation

- 12 working in medical and dental services, none of which are indicated to be vacant

- 10 positions in human resources, none of which are indicated to be vacant

While these positions will be abolished, some funding will move to support overtime payments for continuing employees.

Youth Development Center Settlements

While the Governor’s budget proposal did not specifically set aside funds for settlements with victims of alleged abuse over decades at the Youth Development Center (YDC) and associated services, the House Finance Committee voted to set aside General Funds for these purposes.

The Committee devoted $10 million to fund a specific settlement reached associated with a single court case. Separately, the Committee appropriated $20 million to the YDC Settlement Fund to provide more resources to settlements out of court. The Youth Development Center Claims Administration and Settlement Fund may pay up to $75 million per year in settlements, based on a cap in State law.

Finally, the House Finance Committee voted to require that payments made to the attorneys for victims of past abuses associated with the YDC should be made on the same schedule as the payments to the victims themselves.

Transportation

The Transportation expenditure category in the State Budget is entirely comprised of the New Hampshire Department of Transportation (DOT) budget and does not include any other departments or agencies.

The House Finance Committee’s budget for SFY 2026 keeps funding in line with the Governor’s proposed budget for most DOT activities. The largest DOT increase recommended by the House Finance Committee was $11.1 million in Highway Funds for winter mainenance operations and a retention incentive program. The DOT reported having a shortage of winter maintenance drivers in recent years, contributing to considerable personnel costs for overtime pay. This initiative may help ensure there are enough drivers to address the state’s winter needs without high personnel costs related to overtime pay or high risk of employee burnout related to extensive overtime during winter storms. The Aero, Rail & Transit expenditure lines would be allocated $3 million in General Funds for public transit operations under the Committee’s budget; these funds would be needed to draw down matching federal funds for these operations.

To help support the Highway Fund, the House Finance Committee proposed raising motor vehicle registration and license plate fees. The fee increases would generate $15 million in the first year of the biennium and $30 million in the second year, when they would be in effect for the full fiscal year.

The House Finance Committee also included text from a separate piece of legislation that would repeal the annual safety inspection requirement for automobiles as well as the emissions control and inspection requirements. Repeal would reduce State Highway Fund revenue by nearly $5 million during the biennium.

Resource Protection and Development

Changes made by the House Finance Committee primarily increased fees, which would bring in more income for State agencies without relying on the General Fund, and changes to permitting, waste, and energy policies and funding.

The most significant funding change within the Resource Protection and Development category relative to the Governor’s proposal was $14.6 million eliminated from the Division of Travel and Tourism Development’s budget within the Department of Business and Economic Affairs. These dollars would, under the Governor’s proposal, be used for promotional and marketing expenses, including to advertise to potential tourists out of state.

The next significant funding changes made within the Resource Protection and Development category was a $6 million General Fund back-of-budget reduction to the Department of Environmental Services (DES), which constitutes 10.9 percent of the total General Fund appropriation for DES proposed by the Governor. The House Finance Committee also proposed a $4.6 million (26.3 percent) reduction in State Aid Grants to local governments.

Permitting Processes

The House Finance Committee voted to modify the Governor’s proposed changes to endangered species management. The Governor had proposed requiring State agencies that are seeking to review or approve certain permits to go to the Department of Environmental Services, rather than to the Fish and Game Department or the Department of Natural and Cultural Resources, for assistance with reviews. In the House Finance Committee’s version of the State Budget, the Fish and Game Department would remain the key point of contact for agencies regarding endangered animals, but agencies would also be able to hire their own internal wildlife biologists to conduct assessments of risk.

Changes the House Finance Committee approved would also add language making the Governor’s required 60-day approval timeline, proposed to streamline the permitting process for housing construction at the State level, a de facto approval if agencies did not meet the timeline and a conclusion that a project would not appreciably jeopardize the continued existence of a threatened or endangered species. The House Finance Committee also voted to remove a $275,000 appropriation for a related DES scientist position proposed by the Governor.

Fees and Solid Waste

The House Finance Committee retained the Governor’s proposed Solid Waste Site Evaluation Committee but would modify its scope of consideration to include more factors. The moratorium on new facilities would also be extended to July 2028, although existing facilities could be expanded starting July 2026.

Relative to the Governor’s budget, the Committee’s proposal would also increase an array of DES fees, including for dams, hazardous waste generation and cleanup, oil input fees, and boat decals, while also generating revenue with a per-ton fee on solid waste disposal to help municipalities with waste reduction and recycling efforts. The Committee budget would retain the repeal an aquatic invasive species decal required on out-of-state boats proposed by the Governor, but would also retain fees applied to operational permits for public water systems that the Governor proposed repealing.

The Governor’s budget proposal would have tied many DES fees to an automatic inflation adjustment, with approval from the Joint Legislative Fiscal Committee. The Committee voted to remove these inflation-adjustment provisions.

Energy Policy and Funding Changes

The House Finance Committee voted to change the Governor’s proposed one-time $10 million appropriation from the Renewable Energy Fund to the General Fund to an appropriation of all uncommitted funds in the Renewable Energy Fund to the General Fund. This transfer amount was estimated to be $20 million by the House Finance Committee. The Committee also proposed requiring that all future funding flowing to the Renewable Energy Fund beyond certain administrative and program costs go to the General Fund during the biennium, and then be credited to electric ratepayers on a per kilowatt hour basis in future years.

The budget proposal from the House Finance Committee also includes language that would remove the solar component of the Renewable Energy Portfolio Standard requirements for electricity generation. It also incorporates a separate piece of legislation, which previously passed the House, that would change State energy policy to specifically encourage employing market forces and mechanisms to drive the use of energy resources.

General Government

Some of the most significant policy and funding changes in the General Government category resulted from eliminating agencies, consolidation of agencies, public employee retirement policies, and reductions in aid to municipalities and potential college students.

Housing

The House Finance Committee’s State Budget proposal would remove the extension of authorization for using previously-appropriated funds for the Housing Champion Designation and Grant Program, which incentivizes municipalities to change policies related to housing and density. The Governor had proposed extending authorization for the use of these funds for a year, but the House Finance Committee would require the unused funds to lapse to the General Fund at the end of SFY 2025. However, the House Finance Committee did incorporate policy language from a separate bill to create a new “Partners in Housing” program to assist local governments in developing workforce housing.

The budget crafted by the House Finance Committee would also eliminate the Housing Appeals Board, as well as several other agencies.

Elimination and Consolidation of Agencies

The House Finance Committee eliminated several State agencies, including the:

- Human Rights Commission, reducing General Fund appropriations by $3.2 million during the biennium, as well as forgoing an estimated $366,554 in federal funds

- Board of Tax and Land Appeals, reducing General Fund appropriations by $2.1 million and other appropriations by $237,982

- Office of the Child Advocate, reducing appropriations by $2.2 million in General Funds during the biennium

- Housing Appeals Board, reducing General Fund appropriations by $580,595 during the biennium

- State Commission on Aging, reducing General Fund appropriations by $560,864 during the biennium

- Division of the Arts within the Department of Natural and Cultural Resources, reducing General Fund appropriations by $1.7 million and federal funding by $2.0 million

- State welcome centers, which would be defunded in SFY 2027, reducing General Fund appropriations by $2.3 million, and must be sold or leased for commercial use by July 2026 for those centers not on State Turnpike highways

Additionally, the House Finance Committee’s budget proposal would combine the Public Employee Labor Relations Board, the Personnel Appeals Board, and the Right-to-Know Ombudsman into the new Office of State and Public Sector Relations.

The marketing requirements and funding for the Granite State Paid Family Leave Plan would be repealed and defunded, and administration of the program would shift to the private contractor. State savings would total $1.4 million in General Funds during the biennium if this House Finance Committee proposal were to become law.

Retirement Policies

The Governor’s proposal to fund additional retirement costs for certain police and firefighting employees, or “Group II” employees, who had their retirement benefits changed due to policy changes in 2011 was approved by the House Finance Committee. The funding structure changed in the Committee’s proposal, however, with appropriations rising to $27.5 million each year, or a total of $55.0 million for the biennium, a 62.2 percent increase from the Governor’s proposed total of $32.9 million during the entire biennium for this policy change.

The House Finance Committee is also proposing that State employees who were previously considered Group I, which excludes the police and firefighting employees in Group II, would now be considered part of a new Group III if they are hired after January 1, 2026. Group III State employees would have a defined contribution retirement plan, rather than a defined benefit retirement plan. Pre-existing Group I employees would be able to switch from a defined benefit retirement plan to a defined contribution plan if they chose to do so. Vesting would occur after two years of service, and any State employees who are teachers would not be required to be in Group III.

Municipal Aid Funding

While current law and the Governor’s budget proposal requires the equivalent of 30 percent of revenue collected by the State’s Meals and Rentals Tax to be distributed to municipalities on a per capita basis, the House Finance Committee’s proposal would suspend that law for the biennium. Instead, the House Finance Committee would appropriate a fixed $137 million per year for the municipal distribution. The SFY 2025 distribution was $136.6 million, so the House Finance Committee’s appropriation would be an increase. However, House revenue projections suggest having the biennium’s appropriation fixed at $137 million would result in $8.9 million less for municipalities, and the total is $11.2 million less than in the Governor’s budget plan.

Revenue Policy Changes

The House Finance Committee proposed boosting revenues in several key ways, including by retaining and expanding upon the Governor’s proposed adoption of video lottery terminals, increasing motor vehicle and other fees, and forecasting more revenue from existing State sources.

Lottery Revenue

The changes to lottery policy proposed by the House Finance Committee would generate more revenue for the State than the Governor’s proposal. The House Finance Committee voted to accept the higher revenue estimates from the Lottery Commission, which were higher than the estimates from the House Ways and Means Committee. The House Finance Committee also boosted lottery revenues by recognizing revenue from increasing maximum ticket amounts from $30 to $50, changing the splits of revenue between video lottery terminal operators, charitable organizations, and the State, adding “high-stakes” gaming options, and removing the local option for municipalities to not allow Keno gaming within their borders.

Changes to lottery commission revenues increased total revenue available for public schools via State aid by $211.1 million relative to the original House revenue projections for lottery revenues.

Changing Forecasts and More Fund Transfers

Alongside boosting projections for Lottery Commission revenues from prior estimates, the House Finance Committee also decided to increase revenue projections from the Medicaid Enhancement Tax. The House Finance Committee revised the Governor’s revenue projections for the Medicaid Enhancement Tax up by $22.6 million across the biennium, assuming three percent annual growth based on SFY 2025 numbers.

The Committee projected drug rebate program revenue would be $12.6 million higher than the Governor anticipated. The Committee also projected that, because of a $244,651 appropriation for three staff to enhance Medicaid recovery efforts, revenues from Medicaid recoveries would rise by nearly $1.1 million.

Finally, alongside the Renewable Energy Fund, the House Finance Committee would transfer funds from the Governor’s Scholarship Fund to the General Fund. This transfer would add $5.4 million to General Fund revenues.

Back of Budget Reductions

The House Finance Committee’s proposed budget would require certain agencies to find savings in their budgets without identifying specific line items through “back-of-the-budget” reductions. These reductions totaled $95.5 million in both General Funds and Other Funds. Agencies facing these reductions would include:

- The Department of Health and Human Services ($46.0 million in General Funds across the biennium, 2.0 percent of General Fund appropriations proposed in the Governor’s proposal)

- The Department of Justice ($14.7 million in General Funds, 25.9 percent of the Governor’s proposed General Fund appropriations for the Department)

- The Department of Information Technology ($10.0 million in Other Funds, the equivalent of 3.6 percent of the total Other Funds for the Department proposed by the Governor for the biennium)

- The New Hampshire Retirement System ($8.7 million in Other Funds, which was 22.5 percent of the total Other Funds appropriations proposed for the New Hampshire Retirement System by the Governor for the biennium)

- The Judicial Branch ($7.9 million in General Funds, or 3.3 percent of all General Fund appropriations to the Judicial Branch proposed by the Governor for the biennium)

- The Department of Environmental Services ($3.0 million in General Funds, or 10.9 percent of the total General Fund appropriations to the Department proposed by the Governor for the biennium)

- The Legislative Branch ($1.0 million in General Funds, or 2.3 percent of all General Fund appropriations originally proposed)

- The Department of Natural and Cultural Resources ($600,000 in General Funds, or 3.0 percent of all General Fund appropriations proposed in the Governor’s budget)

- The Secretary of State ($465,000 in General Funds, or 6.6 percent of all General Fund appropriations proposed in the Governor’s budget)

- The Governor’s Office ($100,000 in General Funds, or 1.7 percent of all General Fund appropriations to the Executive Department for the biennium)

Among these back-of-the-budget reductions, only the largest, the DHHS reduction of $46.0 million, includes a specific reporting requirement that would publicly indicate where the dollars to meet the back-of-the-budget reductions were specifically drawn from in the budget lines.

With two exceptions, the appropriation figures specified in the back-of-the-budget reductions are General Fund dollars. These reductions do not reflect potential impacts on matching federal funds.

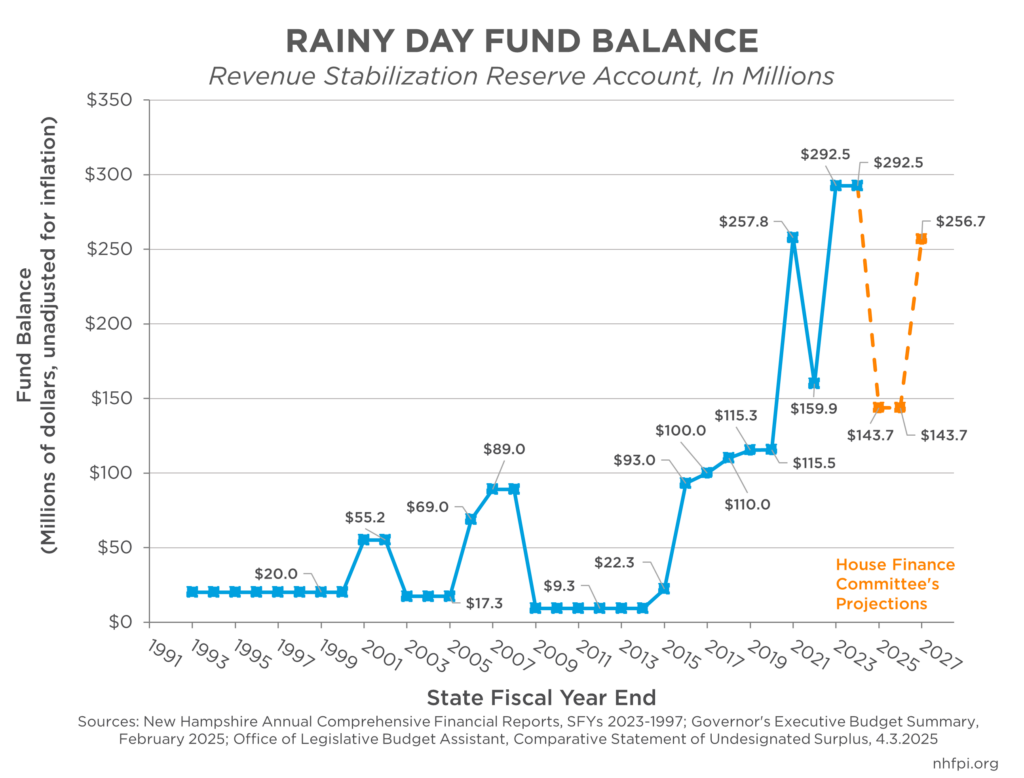

Refilling the Rainy Day Fund with Unappropriated Dollars

The House Finance Committee’s budget proposal would draw about $148.8 million from the Revenue Stabilization Reserve Account, also known as the Rainy Day Fund, at the end of SFY 2025 to offset the expected revenue shortfall compared to expenditures. The Governor, with more favorable revenue estimates, only expected to draw $81.0 million from the Rainy Day Fund.

However, the House Finance Committee’s budget proposal would boost the Rainy Day Fund balance to higher levels than those anticipated by the Governor by the end of the biennium. Whereas the Governor anticipated transferring $10.5 million to the Rainy Day Fund on June 30, 2027, the House Finance Committee left $113.0 million in General Fund dollars unappropriated in its plan and left to be returned to the Rainy Day Fund.

While the Governor’s plan would have brought the balance to a historically healthy $222.0 million by the middle of 2027, The House Finance Committee’s proposal would result in a projected balance of $256.7 million. That balance would be higher than all but three year-end balances (SFYs 2021, 2023, and 2024), all of which followed significant revenue surpluses.

The last time policymakers withdrew funds from the Rainy Day Fund, it was to support YDC settlement funds in SFY 2022. Before that, policymakers had not drawn funds from the Rainy Day Fund since SFY 2009, at the end of the Great Recession.

Next Steps in the Process

As the House Finance Committee has finished its work, the full House of Representatives will consider the amendments proposed by the Committee on Thursday, April 10. The House may consider other amendments on the floor as well. The Senate will pick up the budget process next, with its own revenue estimates from the Senate Ways and Means Committee and a new set of amendments crafted by the Senate Finance Committee. These amendments will then be considered and voted upon by the full Senate.

The Senate’s version of the State Budget will then be considered again by the House, and if the House disagrees, a Committee of Conference will create a final version of the State Budget to be given a vote in the Legislature. After the Legislature finishes its work, a final budget would go back to the Governor for consideration.

Authority granted for State spending under the current State Budget end on July 1, 2025, so policymakers will need to agree on some form of new legislation to keep State services operating beyond that date.

Note: This post was updated on April 7, 2025 to incorporate the back-of-the-budget reduction at the Department of Natural and Cultural resources and the reduction in funding at the Division of Travel and Tourism Development.