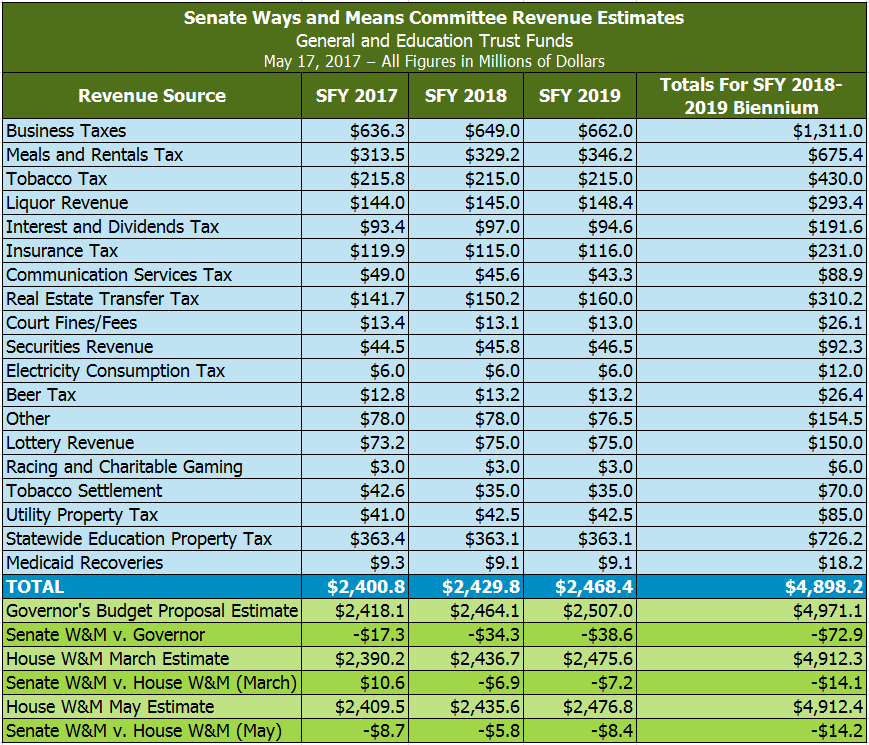

The Senate Ways and Means Committee met on May 17 to determine revenue estimates for the State’s General and Education Trust Funds, and decided that revenues would likely come in at $4,898.2 million for the State fiscal years (SFY) 2018-2019 biennium. This estimate is $14.1 million below the figure the House Ways and Means Committee produced to inform the House Finance Committee budget process. If these numbers are finalized, the Senate Finance Committee will need to use these lower figures, or add other revenue sources, to build its version of the State Budget. The Senate Ways and Means Committee has not yet created estimates for Fish and Game and Highway Fund revenues; the Committee will hold a final vote once all estimates are complete. (For more on the role of the Ways and Means Committees and the budget funds, see NHFPI’s Building the Budget resource.)

The new revenue projections may prompt additional changes to the Senate’s version of the State Budget, as the Senate has been using the Governor’s budget as the basis for its work. The Governor’s budget projected $72.9 million more in revenue for the State Budget biennium than the Senate Ways and Means Committee projected. Additionally, the Senate Ways and Means Committee revised estimates for the remainder of SFY 2017, which concludes June 30, down as well relative to the Governor and the more recent House Ways and Means Committee estimates made in May of this year (the House Committee made two estimates, one in March and one in May). As the Governor proposed using surplus revenue from SFY 2017 to fund various priorities, including infrastructure spending, increases to the Rainy Day Fund, and Medicaid payment reconciliations, this reduction of $17.3 million relative to the Governor’s estimate may also constrain Senate decisions regarding modifications to the Governor’s State Budget proposal. To learn more about the contents of the Governor’s proposed budget, see NHFPI’s Issue Brief.