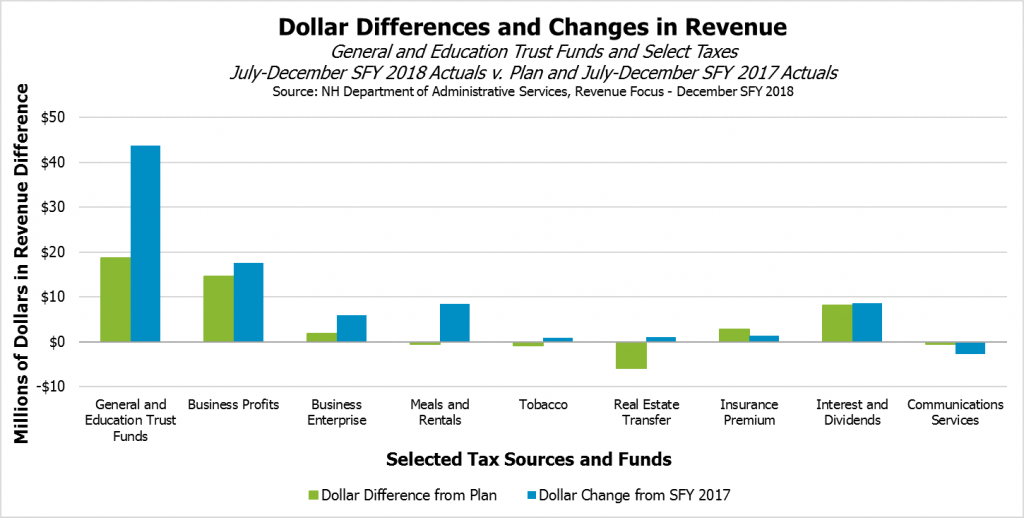

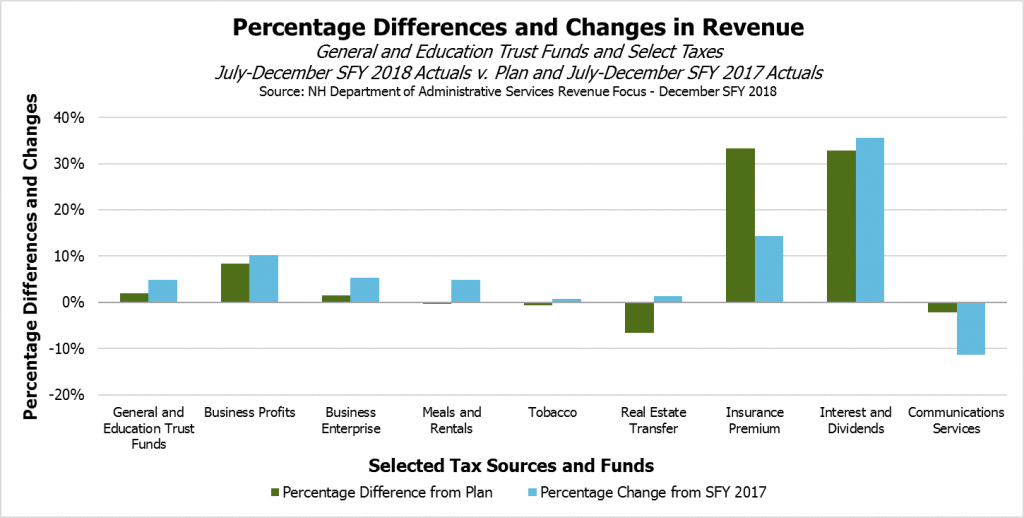

December revenues closed out the first half of State fiscal year (SFY) 2018 with a sizable increase in the surplus, but the boost’s source suggests the result might be lower receipts in the next half of the year. Revenue sources for the General and Education Trust Funds collected $7.7 million (3.3 percent) more than planned in December, which was $14.4 million (6.4 percent) more than last December and resulted in a total unrestricted revenue surplus of $18.7 million (2.0 percent) above plan for the year. However, $7.3 million of the $7.7 million surplus from December came from a single source: the Interest and Dividends Tax.

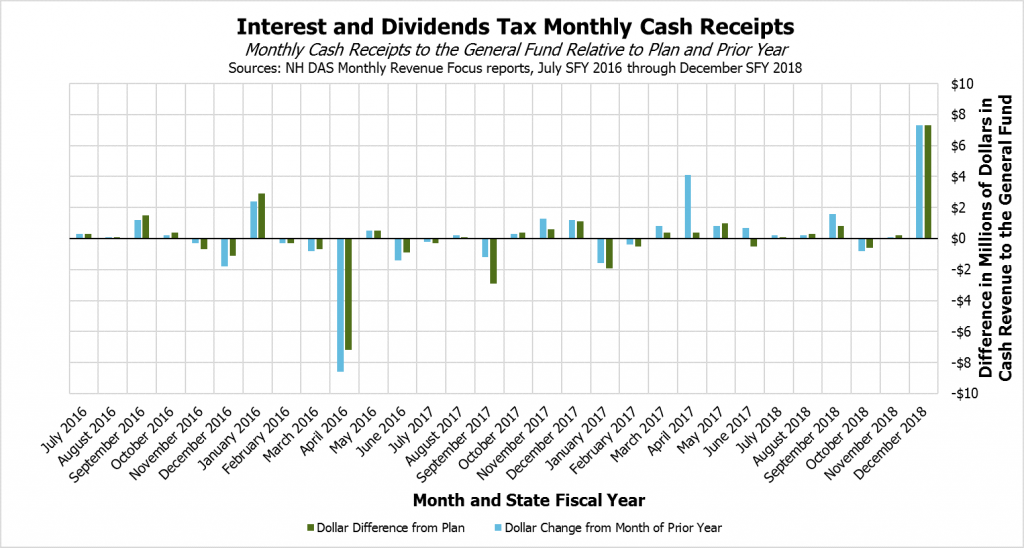

The Interest and Dividends Tax is a tax on income collected by individuals from certain passive sources, such as interest earned from bank accounts, bonds, debt payments, and dividends from certain stock ownership. Revenue from this tax exceeded both plan and prior year revenues by a substantial amount, especially relative to recent history. Larger dollar variances are more likely in the months during which returns or estimates are due, which for calendar year taxpayers are April, June, September, and January.

December’s collection was historically quite large, with $12.6 million collected relative to $5.3 million, $4.1 million, and $5.9 million during the prior three Decembers. The Department of Revenue Administration indicated this increase was due to higher estimated payments, suggesting this change may be a result of taxpayers deciding to prepay their taxes ahead of federal tax changes to the state and local tax deduction in calendar year 2018. If so, then revenue collections for the Interest and Dividends Tax may be lower than planned in the second half of this fiscal year, which may reduce the surplus.

All other revenue sources for the General and Education Trust Funds netted to approximately $0.4 million above plan in the important revenue month of December, suggesting revenues continue to be about on target without generating a substantial surplus and with uneven strengths across sources. The Business Profits Tax was about $4.9 million (7.3 percent) above plan for December and totaled $14.5 million (8.3 percent) above plan so far this year, accounting for most of the existing $18.7 million unrestricted revenue surplus. The Business Enterprise Tax slipped just below plan in December by $0.3 million (0.7 percent), and is ahead of plan by a slim $1.8 million (1.6 percent) for the fiscal year thus far.

Other revenue sources offered a mixed bag as well. The Insurance Premium Tax has overperformed plan for the year as a whole and continued to in December. However, the net surplus resulting from this performance is $2.8 million, which is dwarfed by the relative underperformance of the Real Estate Transfer Tax; receipts from this tax fell $1.1 million (8.8 percent) behind plan for December and are $5.9 million (6.7 percent) behind plan for SFY 2018 thus far. Tobacco Tax receipts were behind plan by $2.4 million (13.5 percent) in December alone, pushing this source slightly below plan for the year, while the Meals and Rentals Tax gained $0.4 million (1.8 percent) over plan in December and remained just below plan for the first half of SFY 2018. Receipts from the Communications Services Tax, which has been in long-term decline as a revenue source, fell below plan, while the Utility Property Tax came in $1.1 million (11.3 percent) above plan despite receiving $1.2 million in payments early, in November, rather than the expected December receipt month.

These figures completing the first half of SFY 2018 come as the Urban Institute’s State Economic Monitor noted that New Hampshire’s tax receipts from the year ending September 30 relative to the year prior dropped more than any other state’s receipts, adjusted for inflation, with an 8.7 percent decline. The Urban Institute attributed it primarily to a decline in revenue from the State’s business taxes. The State’s Comprehensive Annual Financial Report for SFY 2017, released December 22, 2017, also showed revenues for the General and Education Trust Funds in SFY 2017 falling $50.1 million short of revenues in SFY 2016. This is a larger gap than the $15.0 million identified in the preliminary accrual figures published in August. Revenue growth may rebound, but if growth is exceedingly sluggish, there could be constraints on the State’s ability to pay for expenditures planned in the SFYs 2018-2019 State Budget or other priorities.

For more information on State revenue sources, see NHFPI’s Revenue in Review resource.