Download the PDF version of this Fact Sheet here.

Median Household Incomes by Family Type

- The estimated 2022 median household income in New Hampshire was $89,992.

- Between 2017 and 2021, the median income for a married-couple family with at least one child in New Hampshire was $133,000, while median incomes for single male householders with children and single female householders with children were $62,000 and $40,000, respectively.

Living Costs Vary by Region and Family Composition

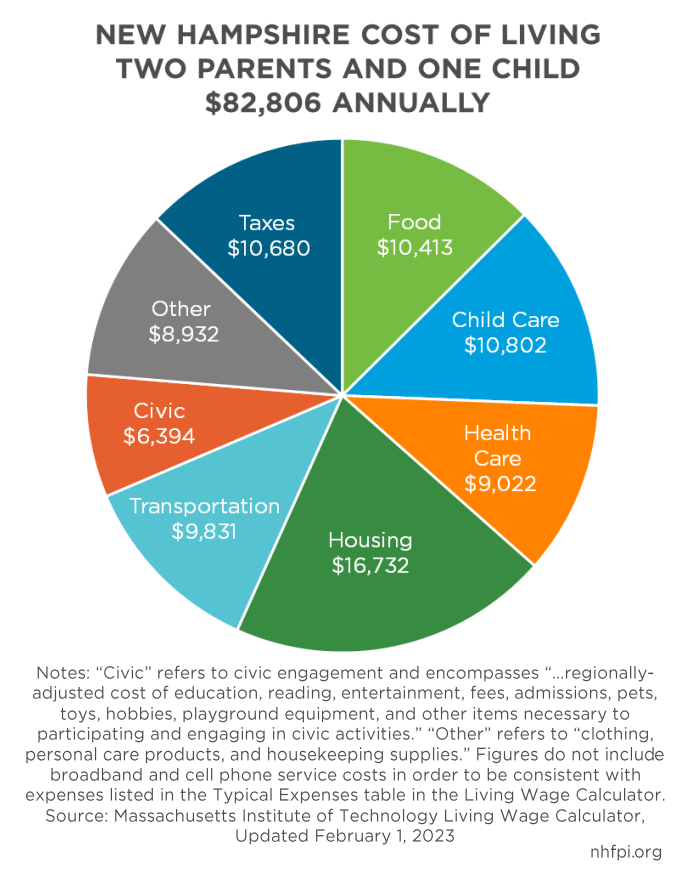

- On average, a Granite State family with one parent and one child needed $74,711 annually to have enough income for living expenses in 2022. A family with two parents and one child needed $82,806.

- Living costs vary by county: A family with two parents and one child in Coos County needed $70,514 annually to afford living expenses in 2022, while the same family in Rockingham County needed $88,306.

- Combined housing, health care, and child care prices make up a significant portion of Granite Staters’ household expenses. A family with two parents and one child would need to spend 44 percent of their household income on these three expenses combined.

Household Income, Inflation, and Poverty

• About one in four Granite State households reported income of less than $50,000 per year in 2022. About one in six had incomes below $35,000 per year, and more than half of all households had incomes below $100,000 per year.

• When adjusted for inflation, New Hampshire household income declined between 2021 and 2022.

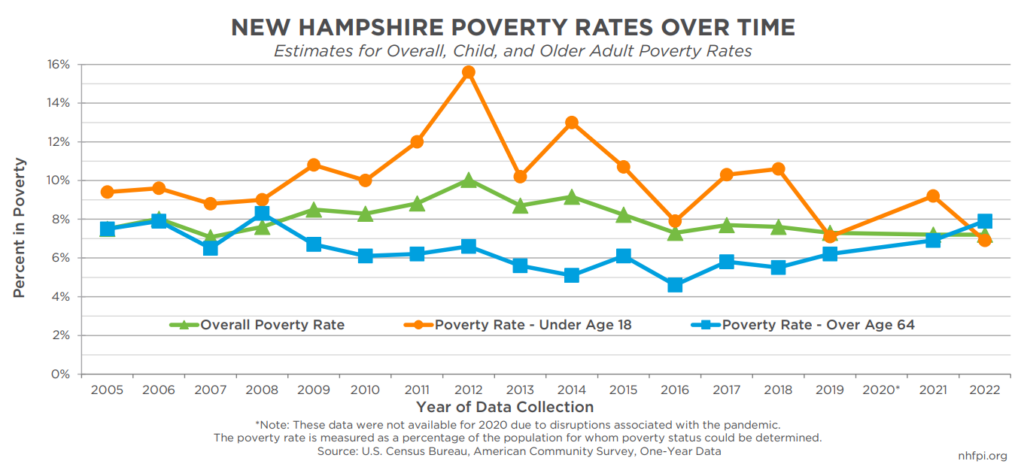

• Approximately one in every 14 New Hampshire children was living below the poverty level in 2022. The poverty rate for the population overall was 7.2 percent, or about 98,000 Granite Staters.

Financial Vulnerability and Benefits of Pandemic Direct Assistance

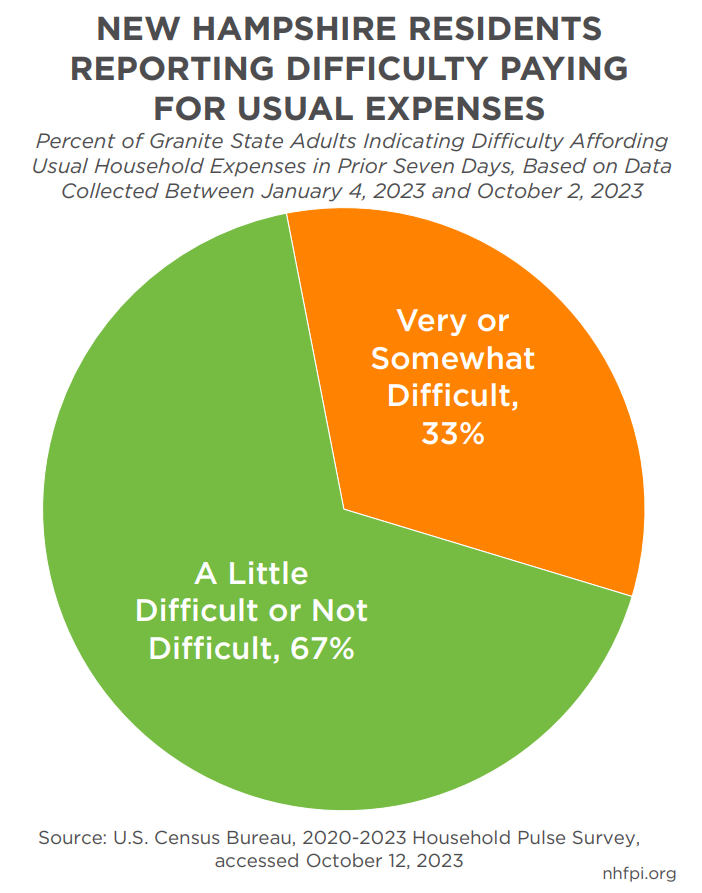

- On average, one in three New Hampshire residents reported paying their usual household expenses was somewhat or very difficult thus far in 2023.

- A lower percentage of New Hampshire adults reported difficulty paying usual household expenses during 2020 and 2021, when direct federal pandemic assistance bolstered household finances.

- An estimated 27 percent of New Hampshire households did not have at least $2,000 in emergency savings in 2019, before the COVID-19 pandemic.

- Pandemic-era assistance substantially reduced poverty and provided temporary aid to individuals and families.

- National estimates of household savings suggest most or all of the additional financial assets generated by the pandemic’s impacts on spending habits and assistance policies have been eroded away.

Download a PDF of the Fact Sheet Living Expenses, Financial Vulnerability, and Poverty in New Hampshire with citations, published at the New Hampshire Fiscal Policy Institute’s 8th Annual Conference, by clicking here.