With the ongoing COVID-19 crisis dramatically impacting New Hampshire’s economy and employment in key sectors, State revenues are likely to be significantly reduced relative to expectations, threatening vital services in a time of high need. March revenues do not yet reflect the expected impacts, as many collections are based on activity from months preceding the onset of this crisis. However, sharp declines in economic activity and shifts in the timing of tax filings make future revenues more difficult to predict, and the State may need to shore up revenues in the face of substantial shortfalls even with incoming federal assistance.

March State Revenues

State tax receipts in March and April include both quarterly estimate payments for key taxes and returns based on activity from 2019. While certain businesses provide returns and quarterly estimate payments in March, most of those returns and estimates arrive in April. Additionally, certain key taxes collected monthly, such as the Meals and Rentals Tax and the Real Estate Transfer Tax, reflect economic activity from the prior month.

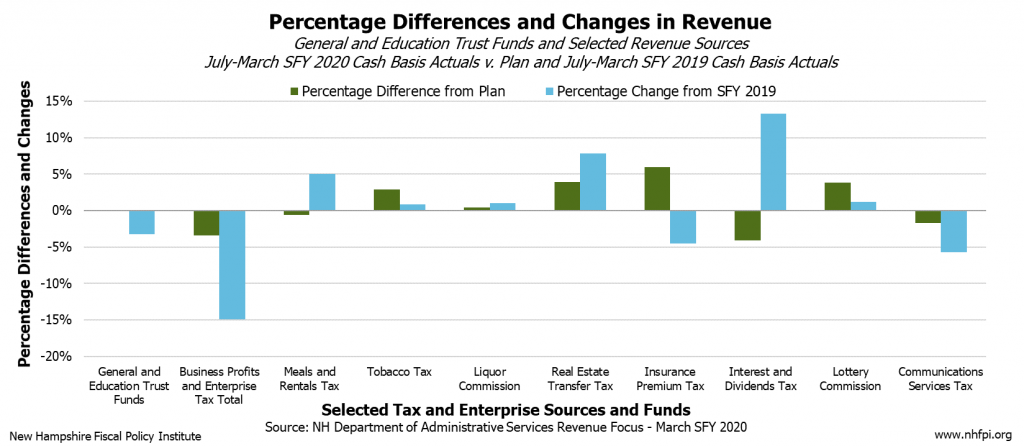

As a result, March collections for the General and Education Trust Funds provide only limited insight into the potential impacts of the COVID-19 crisis on revenues. The two primary business taxes, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), fell below the State Revenue Plan by $17.5 million (15.2 percent) combined for the month, but were still higher than in March of last year, suggesting the major impacts on business tax revenues have yet to come. Business taxes were due in March only for partnerships, which constituted about 14 percent of the business tax base in Tax Year 2017, and were due on March 15, before many of the biggest impacts to local businesses occurred. Refund requests have been elevated throughout State Fiscal Year (SFY) 2020, but were not abnormally high in March. However, this drop in business tax revenue below the State Revenue Plan brought the unrestricted revenue surplus down to approximately $900,000, suggesting the State Budget would barely be balanced even if revenues were not about to be dramatically impacted by the sudden crisis.

Other revenue sources helped push revenues higher in March and offset the lower business tax receipts, leading to a total deficit below the State’s General and Education Trust Funds Plan of $10.3 million (1.5 percent) for the month. Sources generating a surplus in March included Tobacco Tax and Liquor Commission revenues, which may have been positively impacted by Granite Staters and residents from neighboring states buying more supplies than usual, particularly when certain economic activity was restricted in other states. Timing differences relative to the State’s Plan and growth in the tax base also supported a surplus in the Insurance Premium Tax. The Meals and Rentals Tax collections from February were close to the expected amounts, but the curtailment or closure of many restaurants and hotels in New Hampshire starting in mid-March means this important revenue source will likely drop precipitously in April collections.

Turnpike System revenues are not presented in the Department of Administrative Services Monthly Revenue Focus, but traffic levels reported by the Bureau of Turnpikes suggest that tolling revenues will be down substantially, as recorded vehicle trips during the week ending March 28 were about half the levels recorded at the same time last year. Motor Fuels Tax revenues, which support the Highway Fund, are likely to be substantially reduced due to the COVID-19 crisis as well.

Federal assistance is coming to New Hampshire, and those funds will help to offset the negative revenue impacts of the COVID-19 crisis. Unfortunately, that assistance will likely not be enough to cover the combination of decreased revenues and increased need for services, especially if the resolution of the public health crisis and the subsequent economic recovery are not swift.

Relief for Business, Interest and Dividends Taxpayers

The New Hampshire Department of Revenue Administration has announced it will waive penalties and interest for late payments from certain taxpayers. For payments of the Business Profits Tax, Business Enterprise Tax, or Interest and Dividends Tax (I&D), filers may pay annual taxes due in April 2020 based on their total tax year 2018 liability if they have difficulty calculating their liability for 2019 due to the COVID-19 crisis and shifted federal tax deadlines; any remaining liability identified later must be paid over the course of the typical seven-month extension for filing these taxes. For this year, any additional taxes owed based on the 2019 tax liability that are not paid in April 2020 may be paid during the seven-month extension window without the standard penalties and interest. Taxpayers owing quarterly estimate payments may also avoid penalties if they pay estimate payments based on their 2018 or 2019 tax liabilities.

Additionally, those with limited tax liabilities can delay April payments without penalties until June 15, 2020. Businesses whose total BPT and BET liability in 2018 was less than $50,000, and I&D taxpayers with less than $10,000 in liabilities, qualify for this extended payment deadline without the typical late payment penalties.

The Department reported that this relief would incorporate 98 percent of all BPT, BET, and I&D taxpayers combined. Many businesses paying taxes may have liabilities under both the BPT and the BET, although BET paid can be used as a credit against the BPT. Data from Tax Year 2017 indicate 1.2 percent of BET filers owed more than $50,000 in BET and paid 50.5 percent of BET receipts. The 2017 data also show 2.0 percent of BPT filers owed more than $50,000 in BPT and paid 80.9 percent of BPT receipts, and I&D taxpayers owing more than $50,000 accounted for 0.3 percent of I&D payers and 29.2 percent of total I&D tax revenue. While significant portions of State revenue may be delayed due to these changes, most payments will still be within SFY 2020, and taxpayers with larger payrolls, profits, or incomes, who pay significant portions of these taxes, still must largely pay on time to avoid penalties.

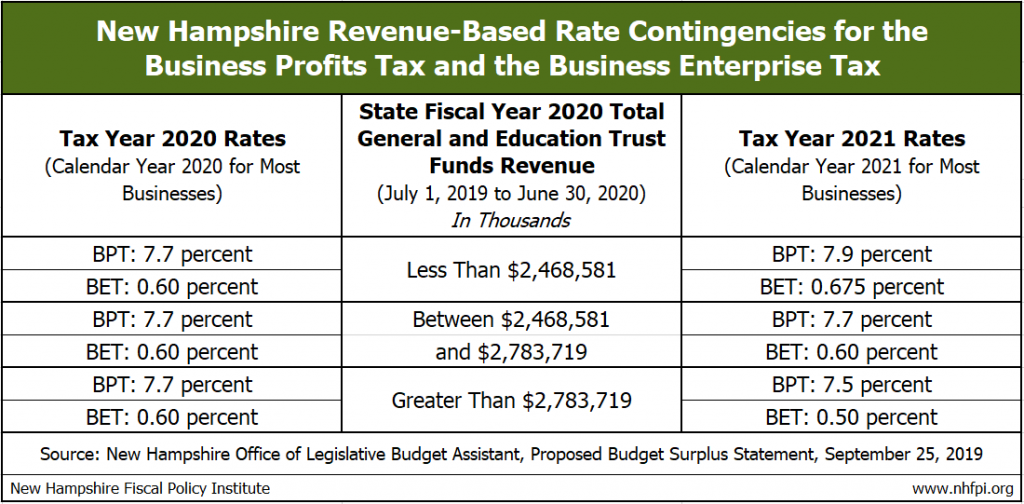

Business Tax Rate Triggers

Although the State is near to the middle of a two-year biennial budget, delaying revenue collections from SFY 2020 to SFY 2021 may have policy implications. The current State Budget includes a revenue-based trigger for business tax rates. If total revenues for the General and Education Trust Funds drop to at least six percent below the State Revenue Plan during SFY 2020, the BPT rate for 2021 will increase from 7.7 percent to 7.9 percent, and the BET rate will increase from 0.600 percent to 0.675 percent.

The future of State revenues is very uncertain right now, and while there have been no official projections for New Hampshire revenues that are adjusted for the possible effects of the COVID-19 crisis, available projections in other states suggest significant general fund revenue declines during fiscal year 2020. The Vermont Legislative Joint Fiscal Office estimated a potential decline of 14 percent for fiscal year 2020 due to both economic impacts and tax deferrals, and projections in other states for fiscal year 2021 have shown even larger percentage declines.

Future Revenue Challenges

New Hampshire will need to fully draw from available revenue streams to weather this crisis. If they are triggered, higher business tax rates may be critical to supporting services during the last six months of the biennium, depending on the length of this crisis and the speed of the economic recovery. Additional sources of revenue may be required to provide services necessary to address serious concerns that existed before the COVID-19 crisis, and respond to issues both exacerbated and generated by the public health and economic challenges currently facing Granite Staters.

– Phil Sletten, Senior Policy Analyst