As a result of the necessary public health steps to combat to the spread of the 2019 novel coronavirus, financial strains on individuals and families are emerging rapidly. Recommendations, guidelines, and emergency orders from federal and state officials have led to profound changes to the ways Granite Staters live and work. In order to assist those affected, the State of New Hampshire and the federal government have expanded unemployment benefits and created temporary income supplements for many individuals and families.

Minimizing interactions between individuals and limiting travel outside of home except for essentials, like groceries, has prompted the downsizing and contraction of many industries in the services sector that cannot easily adjust to a work model that minimizes physical interaction. The effects of the COVID-19 crisis place concentrated financial strains on individuals and families with lower incomes, particularly those who work in industries such as retail, food services, and hospitality.

The financial vulnerabilities of individuals working in, or newly unemployed from, industries impacted by the actions to control the spread of the virus are often substantial. Many have little in savings, with about four in ten U.S. adults in 2018 reporting being unable to cover a $400 unexpected expense with cash, savings or a credit card to be paid in full at the end of the month. Large expenses, like rent or mortgage payments, may be difficult or impossible to pay for many people if their incomes were to decrease drastically. As a result, many individuals and families will require financial assistance.

Unemployment Benefits

Traditionally, unemployment insurance benefits in New Hampshire have only been available to those who are out of work and meet specific criteria, and benefits have been paid from a fund sustained through a quarterly tax employers pay based on the wages they pay. Through an emergency order, Governor Sununu expanded unemployment benefits to many Granite Staters, including self-employed individuals and those affected directly or indirectly by the 2019 novel coronavirus and related economic impacts. Additionally, the one-week waiting period has been temporarily suspended, allowing for benefits to be collected by individuals more quickly, and the minimum benefit has been increased to $168 per week.

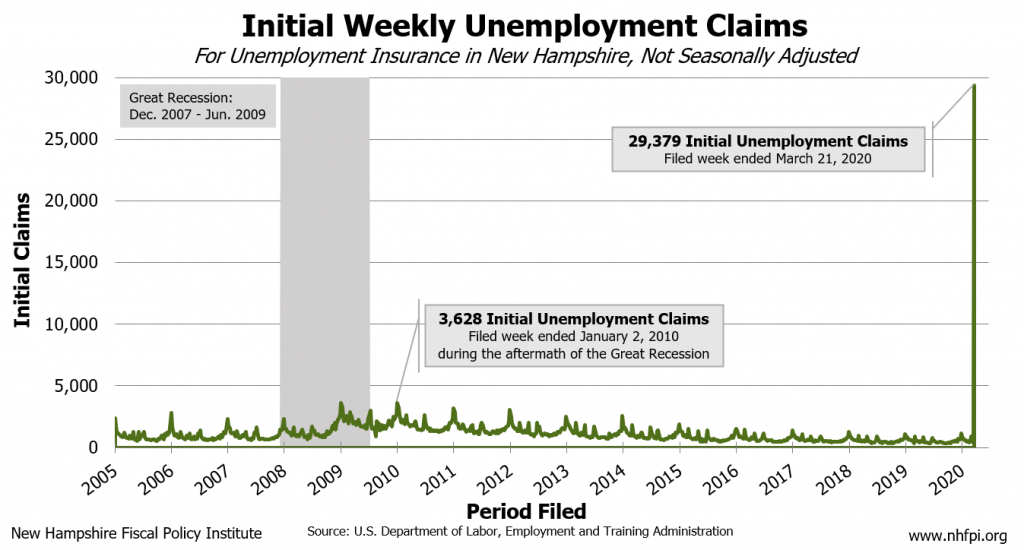

As a result of this temporary eligibility expansion combined with the economic shock from the crisis, 29,379 initial claims for unemployment benefits were submitted in New Hampshire for the week ending March 21, 2020, a 4,476 percent increase from the 642 initial claims submitted in the prior week. An analysis of previously-published advance estimated claims for the week of March 21 week in all U.S. states indicated New Hampshire had the largest one-week percentage change of any state, and subsequently-released advance estimated claims data suggest a similar number of people became unemployed and made initial filings for benefits during the week ending March 28.

Federally Expanded Unemployment Relief

The United States Congress has also approved emergency relief to individuals and states. A major piece of legislation, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, expands benefits via Federal Pandemic Unemployment Compensation, which allowed New Hampshire to extend the duration of unemployment insurance to 39 weeks. The Act also adds an additional $600 on to weekly unemployment benefits through July 31, 2020 and allows for retroactive unemployment benefits back to January 27, 2020.

Direct Cash Payments

In addition to unemployment compensation, direct income support for individuals and families is included in the CARES Act. Based on the law as passed on March 27, direct cash payments of $1,200 will be sent to individuals earning under $75,000 per year as reported on their 2018 or 2019 federal tax returns. Couples earning under $150,000 will receive this payment as well, and individuals or couples will receive an additional $500 per dependent child under the age of 17. Heads of households are eligible for the full direct cash payments if their income was less than $112,500 per year. This payment will decrease as income earned increases above the identified thresholds.

While these supports represent a needed expansion of benefits and new benefits in this crisis, public health concerns may dictate a longer time period of needed supports than are provided for in the CARES Act. Additionally, some of this aid fails to extend to all individuals in need, as some will be ineligible for portions of these benefits. For example, the direct cash payment income support doesn’t provide additional benefits for dependents age 17 or 18 years old, college students age 19 to 23 years old, and adults claimed as dependents to receive these benefits, despite many of them still potentially needing these financial supports. Also, individuals and families with very low incomes, who may not have filed federal income taxes, would also be ineligible to receive these direct cash payments.

Looking Ahead

The efforts of state and federal governments, in terms of unemployment insurance and supports to assist those who are financially strained due to job loss or reduced work opportunities from this pandemic, play a key role in helping individuals and families through this crisis. However, if negative public health impacts and the steps taken to mitigate the spread of the 2019 novel coronavirus continue for an extended period of time, more financial supports may be needed in the near future.

– Michael Polizzotti, Policy Analyst