The COVID-19 crisis poses a risk not only to the health of New Hampshire residents, but to their financial security and State revenues as well. State revenues finished the month of February ahead of the State Budget’s planned expenses, but the current revenue surplus is not nearly as significant as those the State has relied upon in recent years. The impacts of the crisis are likely to diminish State resources while also increasing the need for health and economic support services among Granite Staters.

State Revenues Through February 2020

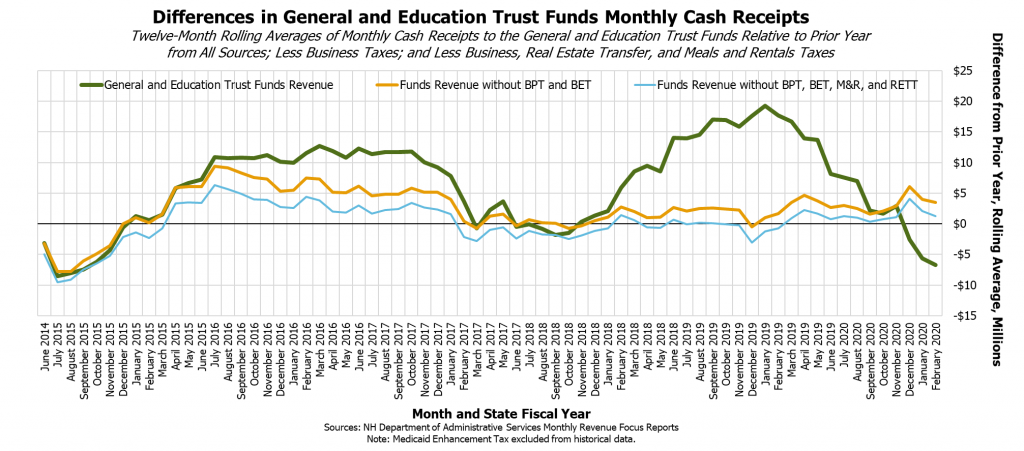

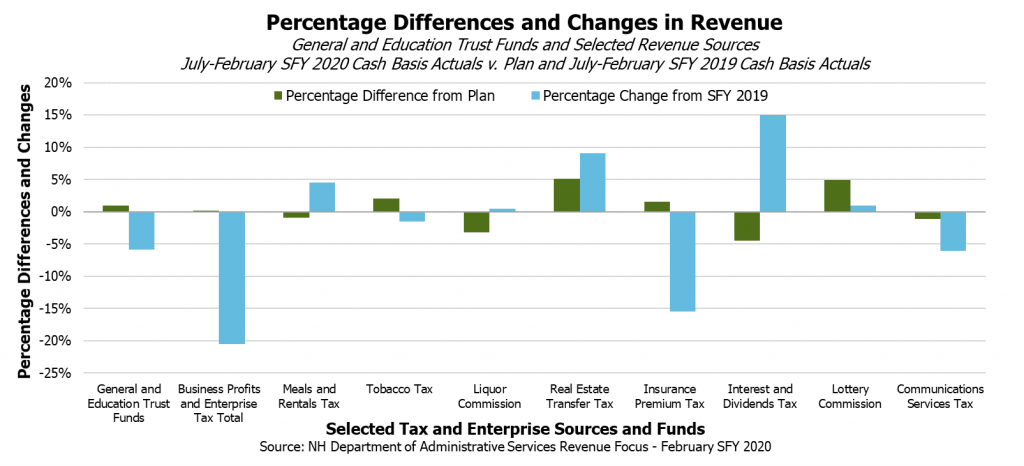

Through the end of February, revenue to the State’s General and Education Trust Funds was slightly above the State Fiscal Year (SFY) 2020 State Revenue Plan, which is based on the State Budget’s revenue projections and expenditures. Revenues were $11.0 million (0.9 percent) above the Plan for the General and Education Trust Funds in total, but remained $76.2 million (5.9 percent) below levels from this time in SFY 2019. This drop is primarily due to the State’s two primary business taxes, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), which are down a combined $95.3 million (20.5 percent) relative to this time last year and only $0.7 million (0.2 percent) above Plan as of the end of February. These receipts are lower due to the reduced impact of one-time revenues from the federal tax overhaul, which policymakers anticipated by reducing revenue projections.

Other revenue sources have been contributing to State tax revenues more steadily. The Meals and Rentals Tax (M&R) has been a reliable engine of revenue growth since the last economic recession, and has slipped just below Plan. The Tobacco Tax is likely in long-term decline but has performed better than anticipated so far this year, as has the constrained but still growing Real Estate Transfer Tax (RETT).

Potential Revenue Impacts from the COVID-19 Crisis

State revenue streams, which support the State Budget and the key services it funds, will likely be impacted by the COVID-19 crisis. While it is difficult to discern if there has already been a measurable effect on State revenues, the potential impacts are significant.

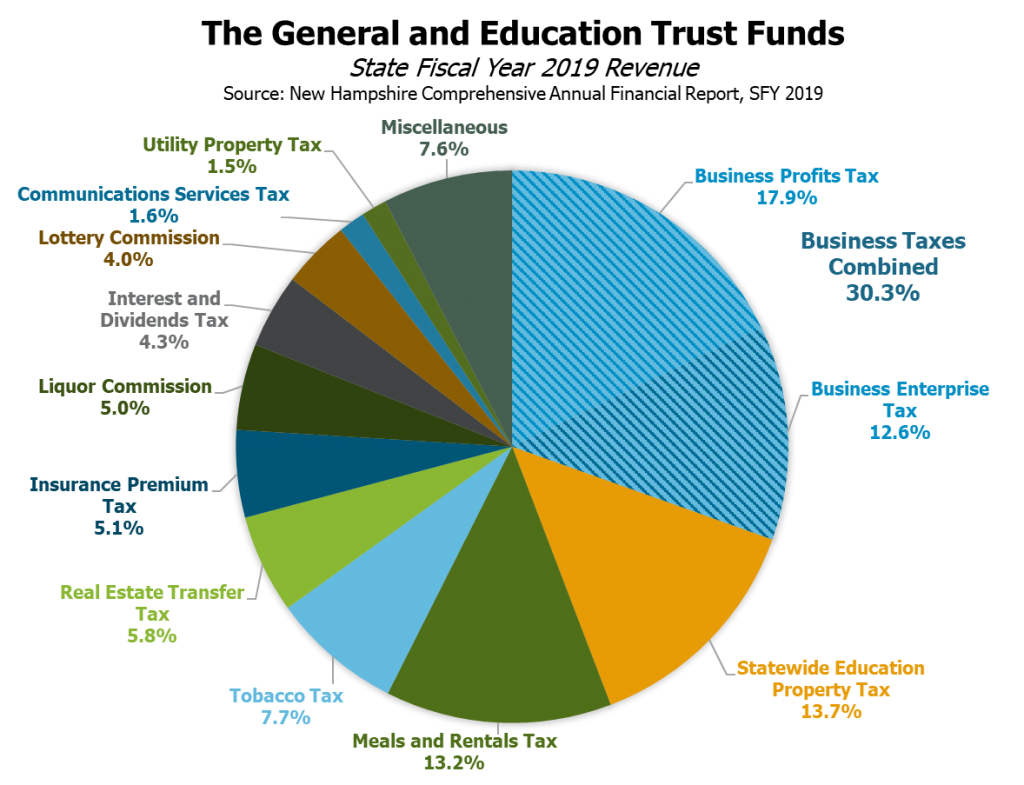

The BPT, the State’s single largest tax revenue source, may underperform expectations early relative to other sources. A significant portion of the BPT base is comprised of large, multi-national companies with operations in New Hampshire. Those companies are likely to be impacted by disruptions to global trade and other international business operations, even if the 2019 novel coronavirus does not become widespread in the state. Certain year-end components of the State’s business taxes due in March and April may not be impacted, as they reflect last year’s activity, but the quarterly estimate payments may be affected quickly.

With efforts to contain this coronavirus disrupting travel and the restaurant industry in New Hampshire, the immediate revenue impacts may be significant in the M&R. Currently the State’s third-largest tax revenue source, generating $361.3 million in SFY 2019, M&R receipts are driven primarily by meals purchased at restaurants. As people go out to eat less, M&R revenues will decline.

A broader economic slowdown would likely impact other revenue sources that are dependent on economic activity. The BET is a tax in part on compensation; if businesses are paying workers for fewer hours because of reduced business, or if employees lose their jobs due to declines in business, then BET revenues would be lower. Additionally, behavior in the stock market might negatively impact revenues from the Interest and Dividends Tax or assets available to support the New Hampshire Retirement System in the near term.

A minor potential upside for the economy and State revenues would be if more people decided to vacation locally, rather than travel by plane, or if they sought more outdoor recreation in rural areas, New Hampshire’s tourism economy could benefit relative to other parts of the travel and leisure economy. This scenario would be most likely if this coronavirus did not become widespread in northern New England, but was elsewhere in the world for an extended period of time. However, the broader negative economic impact would likely be considerably larger than any particular benefit to New Hampshire’s tourism economy, and if tourists are still avoiding restaurants and other attractions, then positive economic or revenue impacts would be more than entirely offset by the diminished economic activity overall.

Effects of an Economic Downturn on Granite Staters

The workers in the food service and accommodations industries may be among those workers most negatively impacted by efforts designed to mitigate the spread of illness through large groups of people. While some industries may have an easier time transitioning their employees to work from home and minimizing human contact, other industries must have people present to complete tasks. Workers in lower-wage occupations and parts of the goods-producing and services sectors may see business slow considerably, limiting the abilities of those companies to pay workers and absorb losses. This would likely result in reduced hours and lower incomes for the workers at these businesses, and contribute to a broader economic contraction with a significant impact on people with low incomes and relatively few resources.

Individuals in low-wage work may be less likely to have access to paid sick leave. The U.S. Bureau of Labor Statistics reported that, as of March 2019, approximately 73 percent of all U.S. workers in private industry had access to paid sick leave benefits. However, only 64 percent had access to paid sick leave benefits in sales and sales-related industries, 58 percent had access in the service industry, and 56 percent in construction and extraction industries. About 94 percent of management, business, and financial workers had access to paid sick leave benefits. Industries that appear less likely to have paid sick leave are important employment sectors in New Hampshire. The most recent published estimates from New Hampshire Employment Security indicate Retail Trade is the second-largest employment sector in the state, after Health Care and Social Assistance, and Accommodation and Food Services is the third-largest employment sector, when accounting for individual sectors within Government and Manufacturing establishments. A lack of paid sick leave may facilitate the spread of illness if people go to work when they are not feeling well to ensure they have enough money to afford monthly expenses.

As of today, the Governor has issued three emergency orders to mitigate some of the negative effects of the crisis on residents. One prohibits utilities from disconnecting services, while the second prevents landlords from beginning eviction proceedings due to tenant inability to pay. The third permits expedited access to unemployment benefits for those who have reduced hours or lose work due to the pandemic, including for those who have workplaces that close temporarily. Individuals who need to self-quarantine, or who are directed to quarantine, and those who need to care for those who are quarantined or a dependent due to school or child care facility closures, will also have access to unemployment benefits, as will self-employed individuals affected in these manners.

Despite these extraordinary efforts, more services may be needed from State and local public health infrastructures as a result of both reduced incomes and the actual impacts of COVID-19. Additionally, services that are already needed, whether in the areas of substance misuse, mental health, or care for older adults, will likely need the same or greater levels of resources as the crisis continues.

Both the immediate health and broader economic impacts of the COVID-19 crisis pose considerable risks to the physical and financial well-being of some of the New Hampshire’s most vulnerable residents. Additional State and federal assistance will help mitigate these risks and help ensure a healthier and more financially stable future for Granite Staters.

– Phil Sletten, Policy Analyst