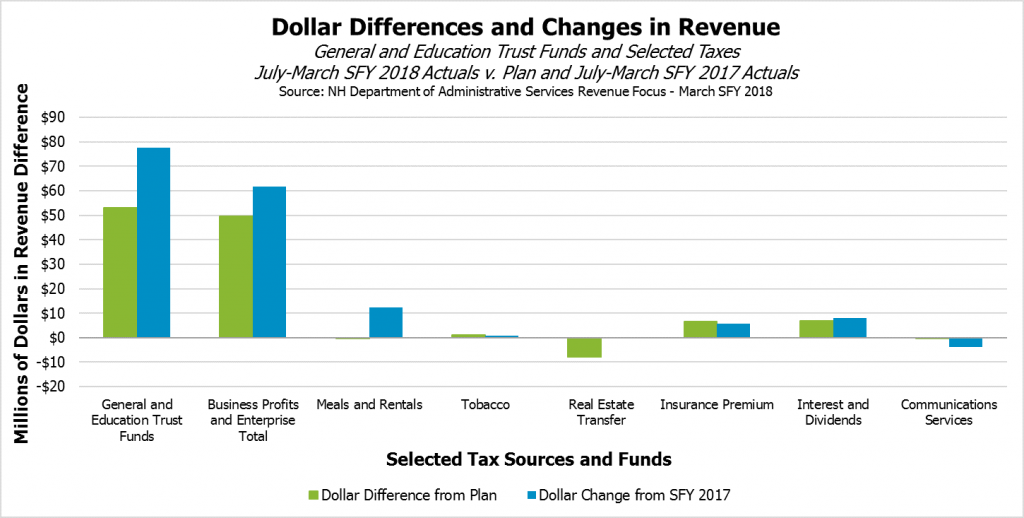

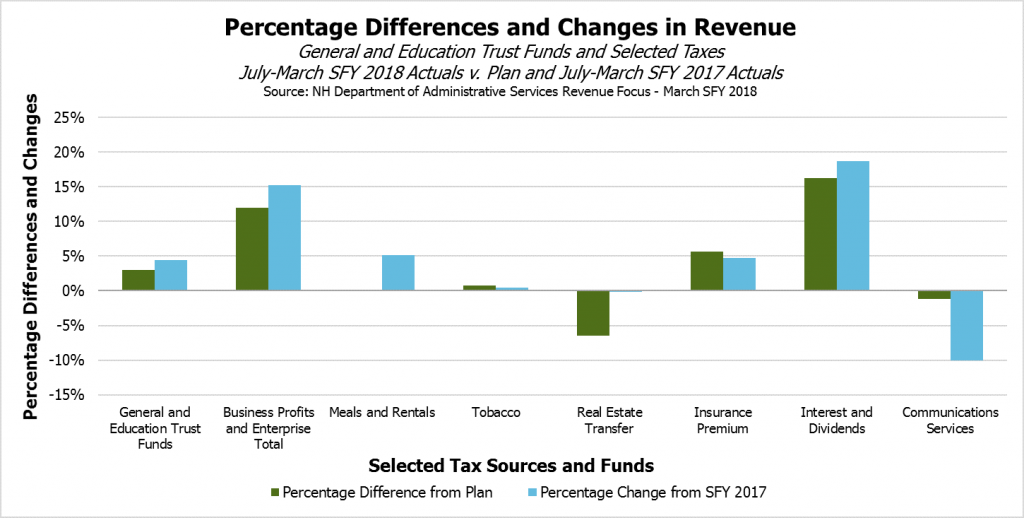

March revenues were above the State’s planned amount of receipts for the month, with the two primary business taxes continuing to overperform while certain other key sources lagged. March is an important month for state revenue, as the State revenue plan anticipated 26.3 percent of General and Education Trust Fund receipts for State fiscal year (SFY) 2018 would be collected during March. The General and Education Trust Funds collected $655.5 million in March, or $13.9 million more than in the State revenue plan, in unaudited cash receipts, bringing the surplus to $53.2 million. While the March surplus was smaller than the surplus for February, in part due to February’s anomalous business tax payments, the monthly surplus continues to boost the total surplus for the State fiscal year thus far. Although the State’s two primary business taxes contributed the most to the State’s surplus, continued excess receipts may not continue well into the future.

The majority of the $655.5 million added to the General and Education Trust Funds in March was levied through the Statewide Education Property Tax. This tax, while logged on the State’s books in March, does not actually provide revenue to State coffers, as money collected remains at the local level. The State requires municipal governments to levy it to pay a portion of the Adequate Education Grants, with the rest coming from revenue collected in the Education Trust Fund from other sources. Even when an amount in excess of the Adequate Education Grants for a municipality is collected, the revenue remains at the local level. This tax was set to raise $363 million each year in 2005, without an inflation adjustment, so while it is the largest tax collected in March, the resulting revenue is quite predictable.

March is also an important month, although not as important as April, for the state’s two primary business taxes, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), as partnerships with calendar year tax years owe returns from the prior tax year during this month. The State revenue plan expected March to contribute 13.6 percent of all BPT and BET receipts during SFY 2018. Business taxes were $12.5 million over plan for the month, totaling $102.8 million.

For SFY 2018 to the end of March, the BPT and the BET have collected $49.7 million more than planned. With a total General and Education Trust Fund surplus of $53.2 million thus far this year, the BPT and BET surplus is the equivalent of 93.4 percent of that amount. The Department of Revenue Administration indicated the higher estimated payments in March were not due to one-time anomalous payments, as was the case in February.

The mixed performances of other revenue sources includes the relatively positive performances of the Insurance Premium Tax and the Interest and Dividends Tax, both of which were above plan for March and for the year overall through March.

March is the primary month for collections of the Insurance Premium Tax. The Insurance Premium Tax receipts were up in part due to growth in the tax base and in part to timing differences; the Department of Administrative Services noted timing issues may lead to a reduction in Insurance Premium Tax payments to the General Fund in SFY 2018 relative to the State revenue plan, due in part to reasons related to the New Hampshire Health Protection Program. Revenues for the Insurance Premium Tax were $106.1 million, $4.7 million (4.6 percent) above plan for March and $6.7 million (5.7 percent) above plan for the year thus far.

Interest and Dividends Tax payments were up for March, keeping this source $7.0 million (16.2 percent) above plan for the year. Interest and Dividends Tax returns are due in April for taxpayers whose tax years follow the calendar year. However, higher levels of estimated payments in December, 150 percent higher than estimates in the prior December and likely related to federal tax law changes, suggest some of the current surplus revenue may be offset by lower returns or higher refunds in April.

Two other revenue sources that have provided significant growth in recent years, the Real Estate Transfer Tax and the Meals and Rentals Tax, continue to show little sign of providing extra support to the State’s revenue streams. The Meals and Rentals Tax has grown relative to the prior year ($12.3 million, or 5.1 percent, higher than SFY 2017 through March), but has brought in slightly less revenue than planned (below $0.2 million, or 0.1 percent) thus far in SFY 2018. The Real Estate Transfer Tax continues to fall short of the revenue plan, as it has almost all year, totaling $7.8 million (6.5 percent) below plan for March and performing slightly under last year’s totals.

The Tobacco Tax moved into positive territory for the year in March, although the Department of Revenue Administration reported stamp sales were down 15 percent in March relative to the prior year.

Non-tax revenue sources for the General and Education Trust Funds also provided a mixed picture. Liquor Commission revenues were down $5.1 million (4.8 percent) compared to the prior year and $3.0 million (2.9 percent) below plan. That deficit was more than offset by the Lottery Commission, which has transferred $5.0 million (9.5 percent) more than planned through March in SFY 2018. Securities revenue were below plan by $5.1 million (22.1 percent) for the year thus far, but the Secretary of State reported revenues would likely decrease that deficit in April because of filing timing shifts.

Although any additional surplus revenue provides assurances that sufficient funding exists for State Budget appropriations and indicates a potential opportunity to fund more services, the mixed performance of revenue sources provides reason to be cautious. Business tax rate reductions and federal changes to business tax law reduce the certainty that recent business tax receipt growth is durable, and the uncertainty surrounding the ongoing performance of other revenue sources, such as Keno and the Real Estate Transfer Tax, should also be cause for caution. Additional consideration should be given to recent swings in business tax receipts; business taxes grew in SFY 2016 relative to the prior year, but declined in SFY 2017. The Urban Institute’s State Economic Monitor, recently updated with data from the last quarter of 2017, noted New Hampshire’s revenue decline was the second largest of any state when comparing calendar year 2017 to 2016 and adjusting for inflation.

April and June revenues will provide more insights into how receipts may trend in SFY 2019. For more information on State revenue sources, see NHFPI’s Revenue in Review resource. For an evaluation of the State’s revenue picture at the beginning of this calendar year, see NHFPI’s January 2018 Issue Brief Business Tax Rate Reductions Add to Uncertain Revenue Picture. Follow NHFPI’s Common Cents blog for updates on the State’s revenue status and other policy topics.