The Tax Cuts and Jobs Act passed by the United States Congress on December 20 will likely lead to an increase in the federal debt, and Congress may next seek to make changes in expenditures to reduce the impact on deficits.

The official estimate from the Joint Committee on Taxation (JCT) shows the federal debt will increase by $1.46 trillion from 2018 through 2027. A macroeconomic analysis from the JCT of the U.S. House of Representative’s similar version of the bill shows that, even with potential higher levels of economic growth following reductions in individual and corporate tax rates and other changes, the debt would still increase by $1.01 trillion in the first ten years. Independent estimates also show the tax changes will very likely add to annual deficits.

Many of the tax provisions affecting individual income taxes sunset after 2025. The Center on Budget and Policy Priorities (CBPP) points out that once the individual provisions have been allowed to sunset, the average taxpayer with less than $75,000 in after-tax income would face a tax increase in 2027. Should those provisions reducing taxes for individuals be extended, the CBPP and the Committee for a Responsible Federal Budget both estimate the additions to the debt over ten years could be approximately $2 trillion. For context, the House Budget Committee’s fiscal year 2018 federal budget was $4.02 trillion.

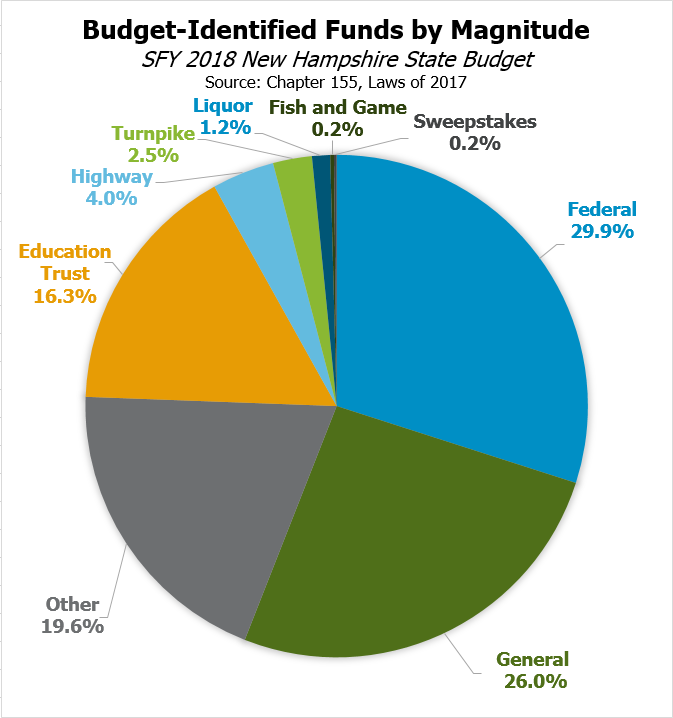

A Treasury Department discussion of the tax bill found a similar overall outcome to the JCT, but noted the increase to the debt would be offset by increased economic growth from “a combination of regulatory reform, infrastructure development, and welfare reform as proposed in the Administration’s Fiscal Year 2018 budget.” As about 30 percent of New Hampshire’s State Budget is funded through money transferred from the federal government, the proposed federal fiscal year 2018 budget proposed by the President would likely have a significant impact on New Hampshire’s ability to finance certain services related health care, housing, support for low-income people, education, and potentially transportation.

The President’s Budget would change some programs that would have a direct effect on assistance to low-income people in the state. The President’s Budget would change the Supplemental Nutrition Assistance Program (SNAP), also known as Food Stamps, to reduce expenditures by limiting eligibility and requiring certain adults to work. These changes would also require matching funds from state governments, which are currently not required for the provision of SNAP benefits, and provide states with flexibility regarding benefit level, which currently have a maximum of $1.83 per person per meal. The President’s Budget estimated SNAP expenditures would be reduced by $191.0 billion between 2018 and 2027 under these plans, with an additional $2.4 billion collected from a new fee levied against retailers accepting SNAP as payment. New Hampshire issued $122.8 million in SNAP benefits during State fiscal year (SFY) 2016, according to the State’s Division of Family Assistance. To learn more about New Hampshire’s SNAP program, see NHFPI’s fact sheet.

The President’s Budget also proposed eliminating the Low Income Home Energy Assistance Program. Dollars from this program fund New Hampshire’s State Fuel Assistance Program, which was $28.4 million in the SFY 2018 budget. If the President’s Budget were to be enacted, New Hampshire lawmakers would have to find resources elsewhere if they wish to continue the program.

Additionally, the President’s Budget includes a $610 billion reduction in federal expenditures on Medicaid between 2018 and 2027. A state-federal partnership, Medicaid helps approximately one out of every seven Granite Staters access health care and accounted for about 29 percent of all State expenditures in SFY 2016. The President’s Budget did not specify which policies would lead to the reductions; earlier proposals to reform Medicaid to a block grant payment system would have significantly reduced funding to New Hampshire, and the President’s proposed changes would have been a reduction in addition to those other proposals.

Other changes, including reducing the Temporary Assistance for Needy Families block grant by 10 percent in concert with eliminating the Social Services Block Grant, may put pressure on different components of the State Budget directly. Indirectly, changes to Social Security Disability Insurance, Supplemental Security Income, and housing assistance programs might lead to higher pressures on existing state and local social services.

While these changes are only proposals at this time, key members of Congress have indicated an interest in making changes to social assistance programs. These changes may impact policymaker decisions in New Hampshire, and legislators may be prompted to consider whether to find alternative funding for these services, reduce the scope of the programs, or discontinue key services at the state level.