Negotiators from the House and Senate agreed to a final budget proposal in the Committee of Conference for House Bill 1 and House Bill 2 last week, preserving many Senate proposals while incorporating additional education aid and removing the paid family and medical leave proposal supported by both the House and the Senate in their respective versions of the State Budget. The Committee of Conference budget proposal does not include the expansion of the Interest and Dividends Tax to include capital gains as proposed by the House, but freezes business tax rates at 2018 levels. The proposal retains the Senate’s $17.5 million appropriation for a new secure psychiatric facility and $40 million in revenue sharing to municipal governments during the biennium.

The Committee of Conference proposal for the State Budget cannot be amended any further, and will go to the floors of both the House and the Senate for final votes on Thursday, June 27. If the bills pass both chambers, they will go to the Governor for his signature, veto, or inaction, which may permit the budget bills to become law without his signature.

Education Funding

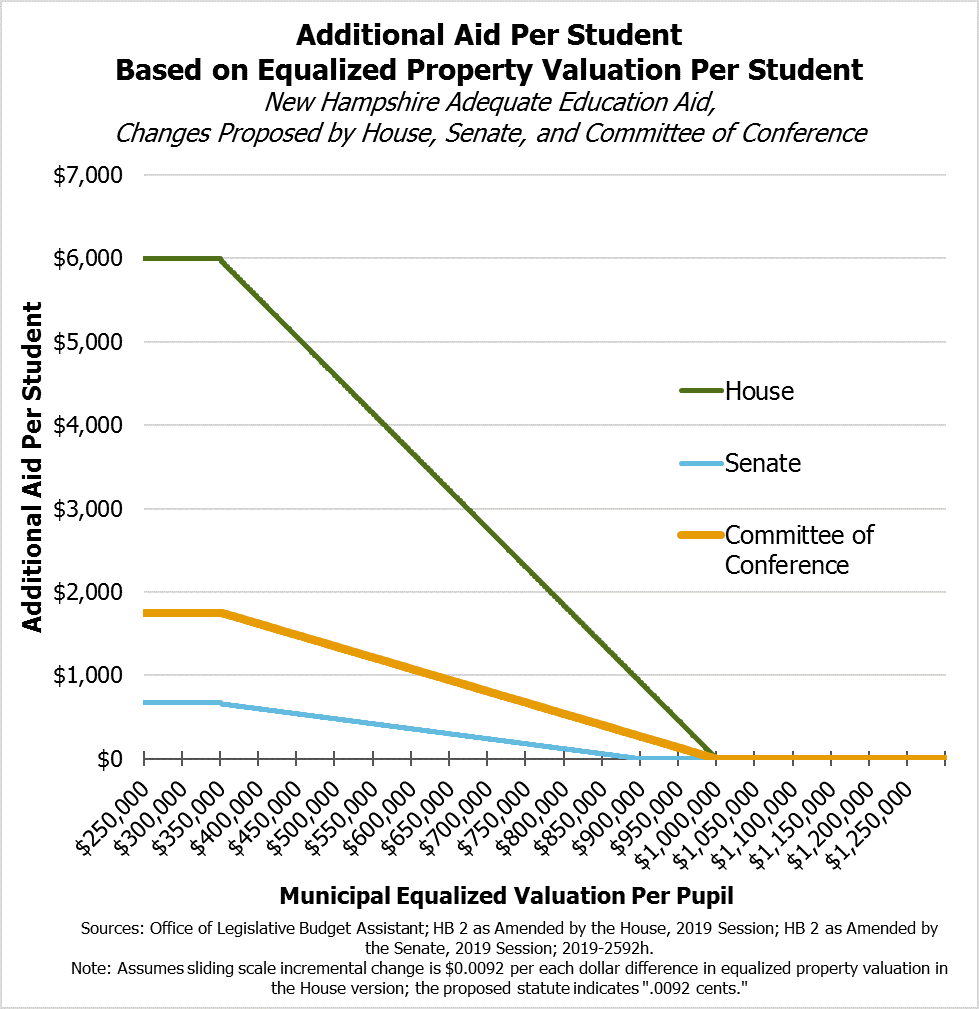

One of the largest differences between the House and Senate versions of the budget was funding for local public education. The House version of the budget contained extensive education funding provisions, adding additional aid determined by sliding scale formulas for both communities with higher concentrations of low-income students eligible for free- and reduced-price school meals and communities with lower property values per student. The Adequate Education Aid provisions in the House proposal would have appropriated $165.3 million over current law for local public education during the biennium. The Senate version of the budget restored stabilization aid to communities to their original levels in both years, and would have added a smaller amount of aid based on taxable property value per student, totaling $93.8 million more than current law in Adequate Education Aid.

The final proposal, alongside incorporating full-day kindergarten students into the full Adequate Education Aid formula as the proposals from both chambers did, would provide an additional $350 per pupil in aid for school districts where more than 48 percent of students were found eligible for free- and reduced-price school meals, and a sliding scale down to $87.50 per pupil for school districts where 12 percent of students are found eligible, with no additional aid for communities below this threshold. Relative to the taxable property value per pupil, the Committee of Conference budget proposal would allocate an additional $1,750 per student for those from municipalities with less than $350,000 in equalized valuation per pupil. A sliding scale formula would allocate additional aid, dropping as property value increased, based on municipalities with between $350,001 and $999,999 in equalized valuation per pupil. No aid would be appropriated for the children from municipalities with $1,000,000 or more in equalized property valuation per pupil.

Unlike the House Budget proposal, the additional aid would not be subject to any caps on the total increase in aid allocated on a municipal basis. Stabilization aid would also be incorporated into the State Budget at the original levels appropriated between State Fiscal Years (SFY) 2012 and 2016, prior to the recent decreases. Overall, the increase in Adequate Education Aid would total an estimated $138.1 million. The Office of Legislative Budget Assistant has calculated and published estimates of the additional aid that would be appropriated under this proposal relative to current law.

To fund these increases, the Committee of Conference budget retains the Senate’s lower levels of transportation, tuition, and school building aid, and relative to the Senate Budget reduces charter school funding and funding for the Sunny Day Fund, reduces funding for certain designated receiving facility beds and State Troopers, eliminates construction costs for a highway project and for the children’s inpatient psychiatric treatment facility by using existing infrastructure rather than constructing a new one, reduces funding for the Aid to the Permanently and Totally Disabled program, and reduces the Rainy Day Fund appropriation, among other changes. The General Fund would then transfer $49.7 million in total to the Education Trust Fund, which would be used to fund increased education aid throughout the biennium. The Committee of Conference proposal would also require that $3 million in the Education Trust Fund be saved throughout the biennium, and would expand the purpose of the Education Trust Fund to include funding school building, tuition, transportation, and special education aid for the biennium. The proposal would keep the Commission to Study School Funding as amended by the Senate Budget.

Health, Social Services, and Housing

As part of the Committee of Conference budget proposal’s investment in the health care system in New Hampshire, the proposal retains the Senate’s policy decision to increase Medicaid reimbursement rates for nearly all providers by 3.1 percent in SFY 2020 and another 3.1 percent in SFY 2021 with a $60 million appropriation, adding a reporting requirement on the New Hampshire Department of Health and Human Services (DHHS). Separately from the 3.1 percent increases, rates for those providing services for mental health and substance use disorder inpatient and outpatient services would be boosted with an $8 million nonlapsing General Fund appropriation, which was increased from $5 million in the Senate Budget and appropriated from SFY 2019 dollars, rather than with funds appropriated during the budget biennium. The proposal would also provide a General Fund backstop for the expanded Medicaid funding structure should the current system for funding the non-federal share be inadequate to cover the amount required to match the federal funding for services offered through the program.

Many of the Senate’s proposals to expand facilities to assist with mental health care were carried forward into the Committee of Conference budget proposal. Provisions in the proposal include:

- $17.5 million for the construction of a 25-bed secure psychiatric unit facility on the grounds of New Hampshire Hospital to be operated by the DHHS

- $5 million for 40 new transitional housing beds for forensic patients or those with complex behavioral health conditions

- $5 million to operate a children’s inpatient psychiatric facility, reduced from $11.5 million total in the Senate Budget as the DHHS identified an existing building that could be used, rather than requiring the construction or reconstruction of a separate building

- $4 million for repurposing the children’s unit at New Hampshire hospital to include up to 48 adult beds

- $1.708 million, half of which would be State funds and half federal funds, for at least eight new designated receiving facility beds at hospitals, modified from the Senate’s version of the budget to be implemented sooner, be funded with a smaller appropriation, and not be specific to particular counties in the state

The Committee of Conference budget also includes several bills passed independently by the Senate, including bills to increase staffing at the DHHS Division of Children, Youth, and Families and fund statewide mobile crisis units and other behavioral health and welfare supports for children.

Funding for adult dental services in Medicaid was added back into the State Budget by the Committee of Conference; the House had funded such services, and the Senate removed the appropriation but added to the policy framework. The Committee of Conference appropriated $500,000, half of which would be General Fund dollars, to fund adult dental services in Medicaid starting on April 1, 2021.

The Committee of Conference budget includes a proposal to legalize and regulate association health plans. It also includes a proposal to increase the legal age limit for purchasing or smoking tobacco to 21 years old from the current age of 18 years as well as limit the sale of vape and electronic cigarette products, and a largely unfunded requirement to develop a plan to study and close the benefit cliff effect carried forward from the Senate proposal. As with prior iterations of State Budget proposals this biennium, the Committee of Conference budget includes sufficient funds to potentially eliminate the wait list for developmental disability services.

The Committee of Conference budget retained the Senate’s proposal to allocate $5 million each year to the Affordable Housing Fund from the Real Estate Transfer Tax starting in SFY 2021, with an initial appropriation of $5 million from the General Fund for SFY 2020. The proposal retains the Senate’s appropriations for $1 million in rapid re-housing programs, $1 million over the biennium for homeless services case management, $2 million for eviction prevention assistance, and $400,000 in outreach to homeless youth. The Committee of Conference also agreed to include the Housing Appeals Board proposal, slightly modified form the Senate version, in their State Budget proposal.

Revenues and Business Tax Changes

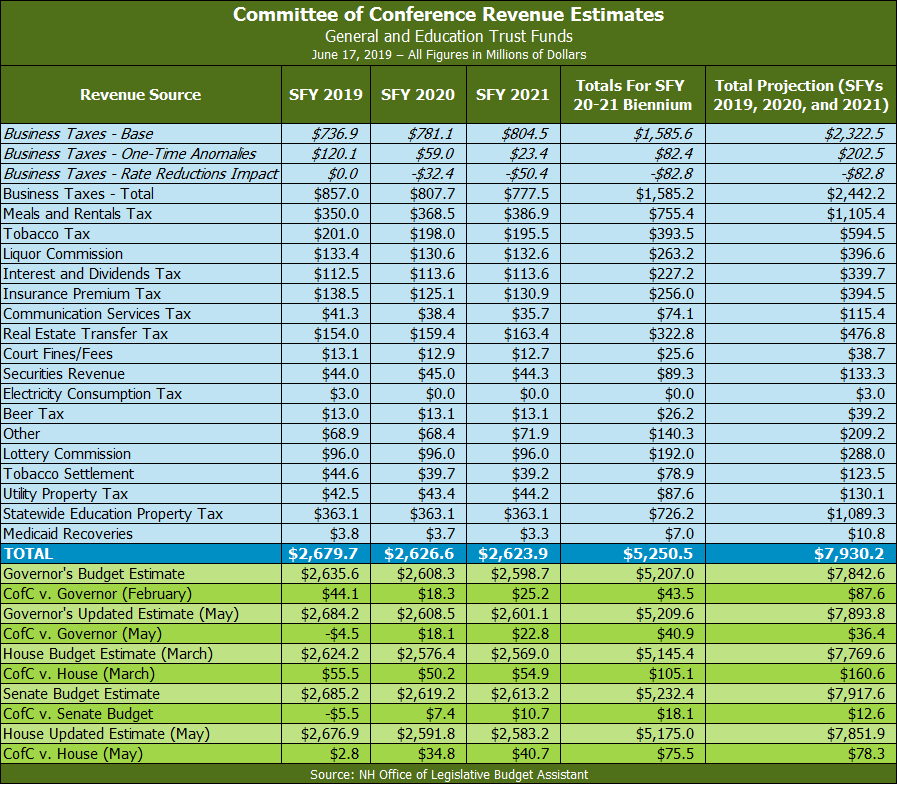

The Committee of Conference negotiators agreed to revenue estimates that increased projections from the Senate’s revenue estimates, which were higher than those used to build both the Governor’s Budget and the House Budget. In total and before any policy changes, General and Education Trust Funds revenue projections produced by the Committee of Conference were $12.6 million higher than the Senate Budget estimates, $160.6 million above estimates produced for the construction of the House Budget, and $87.6 million more than those projected by the Governor’s February budget proposal.

The Senate and the House negotiators retained the freeze in business tax rates at 2018 levels included in both of their proposals. Current law reduces the rate of the Business Profits Tax to 7.7 percent and the Business Enterprise Tax to 0.6 percent for the 2019 tax year. The tax rates for the Business Profits and Business Enterprise Taxes would be further reduced to 7.5 percent and 0.5 percent, respectively, for the 2021 tax year. The rates applied to the 2018 tax year were 7.9 percent and 0.675 percent for the two taxes. Businesses pay taxes in quarterly estimate payments throughout the year, but the final tax payments are not due in full until returns or extensions are filed in March or April of the following year, and businesses that began paying the lower business tax rates during 2019 would not be at risk for penalties from underpayment if the rate reductions for 2019 did not take effect.

The Committee of Conference budget would also make several key changes to the structure of business taxes in New Hampshire. First, the proposal would update the references to the federal tax code in New Hampshire law to conform with the federal law changes following the Tax Cuts and Jobs Act, passed by U.S. Congress in December 2017. New Hampshire’s Business Profits Tax uses part of the federal corporate income tax base as a basis for State business tax liability calculations, and currently that law conforms to the December 31, 2016 federal tax code. Following the December 2017 federal tax overhaul, several base-broadening provisions have the potential to simplify business tax filings and bring in more revenue for the State. The Committee of Conference budget would adopt all these changes with the exception of the Global Intangible Low-Taxed Income provisions, over concerns related to double-taxation, and remain decoupled from provisions allowing businesses to deduct higher amounts for certain capital expenditures and to have bonus depreciation for certain domestic production activities.

Second, the Committee of Conference proposal would change the State’s apportionment formula, which is used to determine the amount of business activity engaged in by a multi-state business that is attributable to New Hampshire and thus taxable under New Hampshire law. Currently, the apportionment formula considers the portion of total business payroll, property, and sales that are within New Hampshire. The Committee of Conference proposal would first change the way sales of services are apportioned from the current method based on the location a majority of the cost is incurred to an apportionment method based on where the markets for those sales are located. The second change to apportionment would come later, after the approval of a seven-member committee of legislators, to shift all apportionment to be determined by the percentage of sales in the state, starting for the 2022 tax year.

The proposed budget plan projects conforming to the federal tax code would result in an increase of $42.5 million during the biennium, while the market-based sourcing apportionment changes to sales would generate $10 million during the biennium. The business tax rate freeze would generate an estimated $93.1 million more than current law during the biennium.

For more information on the State Budget, and to see detailed Issue Briefs examining the Senate, House, and Governor’s versions of the State Budget, see NHFPI’s NH State Budget web page.