At a November 23 briefing, key New Hampshire State agencies provided updated revenue estimates to policymakers that revealed a much more optimistic revenue outlook than previous projections. With tax receipts performing well in the State fiscal year thus far, and agencies substantially underspending their budgets last year, the total budget shortfall may be much more manageable and put fewer programs at risk than previously anticipated. Policymakers may be able to offset much of any deficit with the Rainy Day Fund and support or expand programs and services for Granite Staters, who have seen their health and financial security put at risk during the pandemic.

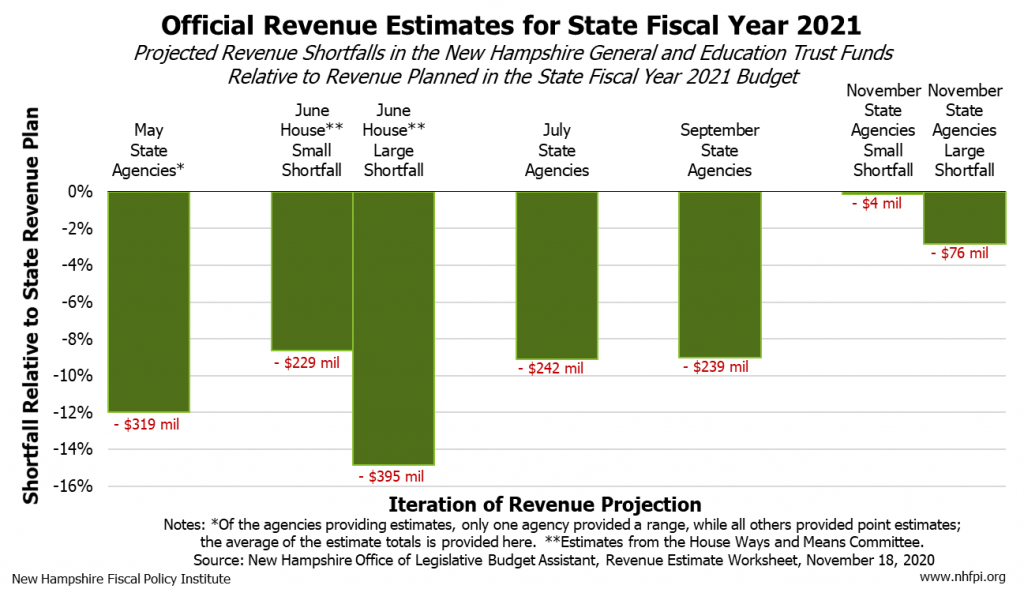

The State agencies projected an aggregate revenue shortfall in the General and Education Trust Funds of between $75.9 million (2.9 percent) and $3.7 million (0.1 percent) below the amount of revenue planned for the State Budget in State Fiscal Year (SFY) 2021. This compares to the approximately $239 million projected shortfall calculated in September, and the draft audited revenue shortfall figure of $106 million for SFY 2020. The change in estimates occurs as revenues to the General and Education Trust Funds are $15.6 million (2.5 percent) ahead of the State Revenue Plan as of the end of October even after anomalous payments are removed, and early receipts for November appear favorable as well. Other states have also seen revenue shortfalls smaller than initially expected.

The primary revisions to New Hampshire’s revenue forecast result from upward revisions to five tax revenue sources: the Business Profits Tax (BPT), the Business Enterprise Tax (BET), the Tobacco Tax, the Interest and Dividends (I&D) Tax, and the Real Estate Transfer Tax (RETT). The BPT and BET, which are typically paid together by businesses, may still end the year lower than planned, but revenue projections were revised substantially upward. The New Hampshire Department of Revenue Administration (DRA) noted that the upward revision was prompted by the strength of payments from some of the largest businesses, suggesting these companies are remaining profitable. The DRA indicated the medical and technological industries, as well as home improvement and box stores, were performing well. Unlike a traditional recession, when nearly all activity slows, tax receipts suggest some businesses have seen significant revenue losses while others had substantial increases in business.

Tobacco Tax revenues have remained elevated, which appeared to be initially due to wholesalers stocking up on tax stamps. However, a ban on mentholated tobacco and other flavored tobacco products in Massachusetts, which began in June, may have shifted some purchases to New Hampshire. Also, the stresses on individuals caused by the COVID-19 pandemic may be prompting greater use among people who would otherwise smoke less or quit smoking.

Revenues from the I&D Tax continue to be buoyed by the strong performance of the stock market, as well as savings from those earning interest on assets such as bank accounts. RETT revenues have been supported by increases in real estate sales and home prices. The number of taxable RETT transactions was up 17.5 percent in September activity relative to last year, and prices were up 32.1 percent, likely putting home purchases out of reach of many Granite Staters.

While revenues to the General and Education Trust Funds have improved, a significant deficit is still projected for the Highway Fund. This shortfall is primarily driven by lower Motor Fuels Tax receipts, which were reported as $10.4 million (8.0 percent) lower than planned in SFY 2020 and are projected to be $15.2 million (11.5 percent) short in SFY 2021. While the Highway Fund is a separate fund, General Fund surplus has been used to support the Highway Fund in the last two State Budgets.

The State’s fiscal situation is substantially better than suggested by the early indications of the pandemic’s impacts. In SFY 2020, State agencies underspent their budget allocations from the General Fund; this underspending, combined with the revenue shortfall, resulted in a preliminary budget deficit of $67 million for SFY 2020. This SFY 2020 deficit, combined with the new revenue projections for SFY 2021, suggest the Rainy Day Fund’s $115.5 million could substantially offset the budget shortfall. Policymakers have the tools and resources available to protect State services at a time when more Granite Staters are in need.

Although recent revenue estimates are less dire than earlier iterations, these projections are subject to change, and the future of the pandemic is not yet clear. If substantial limits on activity are put in place to protect public health again, tax revenues may fall closer to the levels feared previously. Additionally, a general economic slowdown resulting from widespread income losses could limit revenues in both this State Budget and the next one. Careful planning by policymakers will be required to ensure needed services are funded, economic growth is supported, and Granite Staters can recover from the COVID-19 crisis.

– Phil Sletten, Senior Policy Analyst