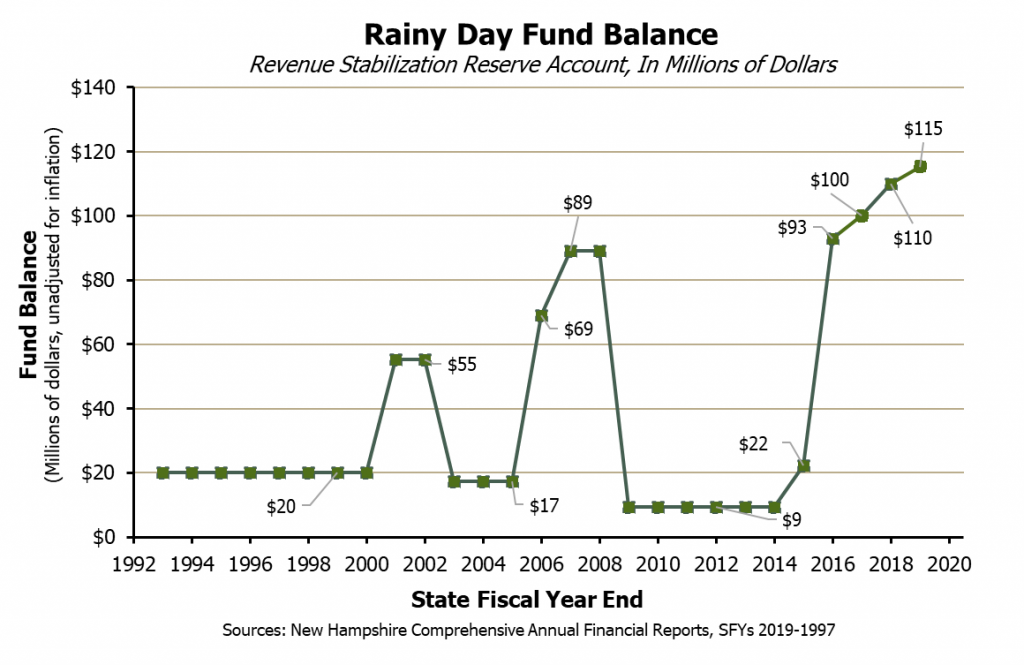

As the COVID-19 crisis continues, New Hampshire policymakers will have to muster additional resources to respond to the health and economic needs of residents. Although New Hampshire will be challenged to raise the additional resources likely needed to address this crisis, the State does currently have resources it can deploy quickly, including the $115.3 million held in the Rainy Day Fund.

Formally called the Revenue Stabilization Reserve Account, the Rainy Day Fund is an account within the General Fund. The Rainy Day Fund is designed to capture surplus at the end of a State Budget biennium and deploy it when there is a budget shortfall due to lower-than-expected revenues. Money deposited in the Rainy Day Fund would, at the end of a budget biennium, balance a General Fund operating budget deficit when it is accompanied by a shortfall in General Fund revenues relative to projections. The Rainy Day Fund may be used to fill the smaller of either the budget deficit or the revenue shortfall. All other uses of money in the Rainy Day Fund must be approved by a two-thirds supermajority of the House and the Senate and receive the governor’s approval.

The COVID-19 crisis will likely result in a revenue shortfall, which may begin to occur particularly quickly through reduced Meals and Rentals Tax revenues. However, the negative health effects and immediate economic needs generated by the COVID-19 crisis suggest that an intentional deployment of the Rainy Day Fund, before the budget shortfall formally occurs in 2021, may be warranted to help ensure health care systems and income supports continue to function. While the duration of the crisis is difficult to predict, rapid deployment of State resources may help stave off longer-term health or economic hardships for Granite Staters, especially those who are already financially vulnerable.

As the Rainy Day Fund is comprised of formerly surplus General Fund revenues, State policymakers have more flexibility to determine how to deploy these dollars than any other source of funding. While additional federal funding may become available, that funding will likely include directives for use. State policymakers are able to craft proposals with the flexibility offered by General Fund dollars around those available and purpose-designated federal funds, as well as other available funding sources from State and local governments and the private sector, to maximize the positive impact to residents of all these funding sources.

Other State funding may also be available, but have more legal restrictions on how it may be used. For example, the Governor’s recent emergency order expanding the use of unemployment benefits helps provide immediate and crisis-specific relief to workers who are sick from COVID-19, providing care to quarantined family members, or who are caring for children out of school due to virus-related closures. The funding for these additional supports will come from the Unemployment Compensation Fund; this fund had a balance of approximately $263 million at the end of State Fiscal Year 2007, before the significant payments during and following the Great Recession of 2007-2009, and ended State Fiscal Year 2019 with more than $312 million in net assets. However, this fund required federal aid during the Great Recession, and the tax rate for the contributions to this fund declined during the economic recovery. This fund is also designed to collect revenue solely for the purpose of unemployment benefits, limiting the extent to which it can be used for other types of responses to the crisis.

As of the end of State Fiscal Year 2019, the State’s Rainy Day Fund totaled $115.3 million, which is higher than the $89 million immediately prior to the Great Recession, unadjusted for inflation. Policymakers deployed savings in the Rainy Day Fund when revenues dropped substantially during SFY 2009. While policymakers will likely need to take measures beyond those that $115.3 million could pay for in response to this crisis, the current situation may constitute a sufficiently rainy day to use these funds.

For more information on the Rainy Day Fund, see NHFPI’s December 2016 Common Cents post Sun Shining on the Rainy Day Fund. For more on the COVID-19 crisis, follow NHFPI’s Common Cents blog for related research and analysis.

– Phil Sletten, Policy Analyst