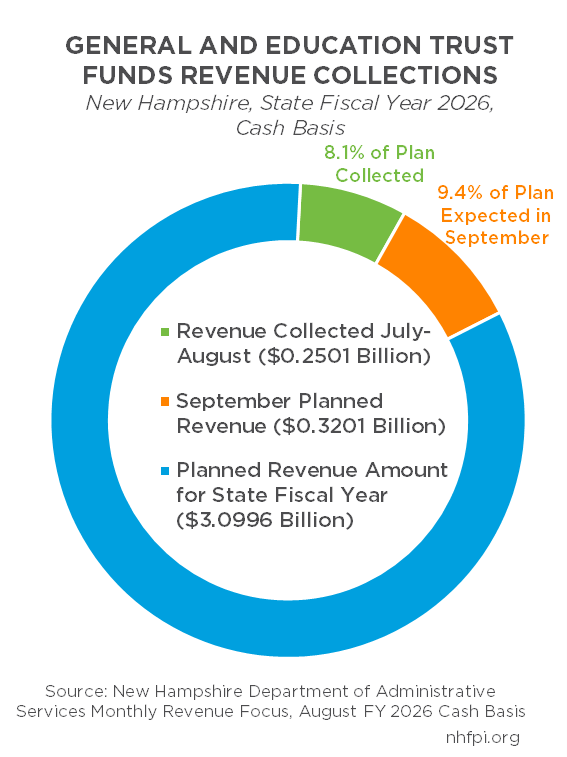

State revenues started the new fiscal year slipping behind expectations. While neither July nor August are key months for State revenues, the receipts collected since the July 1 start of the fiscal year have not been strong.

On a cash basis, the State’s combined General and Education Trust Funds revenues from July and August collections were $10.2 million (3.9 percent) short of the target for State Fiscal Year (SFY) 2026 thus far, and were $21.7 million (7.9 percent) lower than July and August of SFY 2025.

Business Tax Revenues Slipping Again

The primary driver of the decline in revenues relative to last year has been business tax revenues. The combined revenues from the Business Profits Tax and the Business Enterprise Tax are $9.5 million (17.6 percent) below the expectations of the State Revenue Plan and $10.8 million (19.6 percent) below the receipts from last July and August combined.

This dip in business tax revenues relative to last year, unadjusted for inflation, follows relatively favorable receipts in May and June that exceeded the same months in the prior year. The general decline in these revenues that began in the middle of SFY 2024 had appeared to stall. However, lackluster business tax revenues in July and August, including August revenues that were $7.8 million (35.9 percent) below August SFY 2025, suggest business tax receipts may be continuing to erode.

However, neither July or August are typically important months for business tax revenues. About 90 percent of businesses have a tax year coinciding with the calendar year, and these businesses are required to pay their third quarterly estimate payments in September. While the State Revenue Plan anticipated $33.7 million in business tax revenues in July and $20.2 million in August, the comparable revenue target for September is $191.1 million.

Shortfalls in Most Major Sources

The revenue deficit generated by July and August receipts was not limited to business tax shortfalls. Year-to-date receipts were below planned amounts for the Meals and Rentals Tax ($1.2 million, 1.7 percent), Liquor Commission transfers ($2.1 million, 16.8 percent), Lottery Commission transfers ($0.8 million, 5.3 percent), and the Real Estate Transfer Tax ($0.8 million, 1.8 percent).

Insurance Premium Tax ($0.5 million, 11.6 percent) and Tobacco Tax ($1.2 million, 3.7 percent) revenues were above planned amounts for the year thus far, although the Tobacco Tax is likely a declining source of revenue in the long term. Interest on cash surplus that the State holds continues to bring in more revenue than expected as well, generating $6.1 million (68.5 percent) more revenue than planned, but $11.3 million (43.1 percent) less than revenues from the same two months last year; with dwindling one-time federal funds, less cash on hand, and potentially lower interest rates, earned interest is likely not a durable source of State revenue.

Relative to July and August of SFY 2025, receipts from the last two months have been higher for Lottery Commission ($1.9 million, 15.3 percent), Real Estate Transfer Tax ($5.1 million, 13.0 percent), Meals and Rentals Tax ($2.4 million, 3.6 percent), and Tobacco Tax ($1.1 million, 3.4 percent) receipts. While growing year-over-year, three of these four revenue sources did not reach the State Revenue Plan’s targets, which may warrant concern this early in the fiscal year after the new State Budget’s revenue projections were crafted in June. Growth may pick up later in the fiscal year, particularly as a new revenue source, Video Lottery Terminals, begins to collect revenue in October SFY 2026.

Interest and Dividends Tax revenues are lower than last year due to the repeal of this tax on income generated from wealth and asset ownership at the beginning of 2025.

Keep Watching

September revenues will provide insights into the potential trajectory of revenues for the fiscal year. July and August offer early hints, and while those hints are not favorable, State revenue trends can change quickly. New revenue sources, such as Video Lottery Terminals and increased State fees, could produce more revenue than anticipated by the State Revenue Plan.

However, if revenues continue to fall short of the expected amounts needed to fund the new State Budget, policymakers may have to make adjustments to revenues or expenditures to help ensure public services can be fully funded.

To receive future updates on State revenues delivered to your inbox, subscribe to NHFPI’s weekly newsletter.