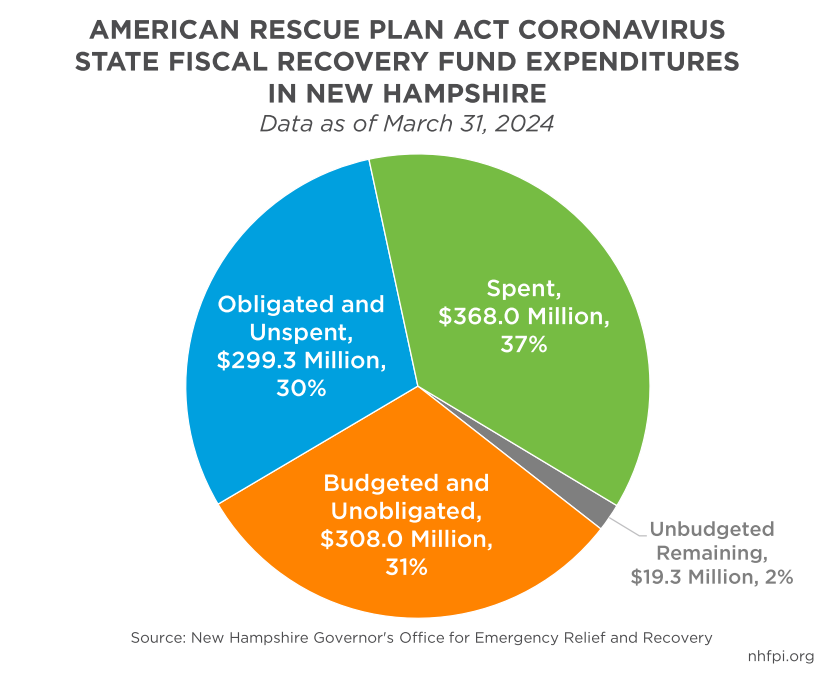

State officials are seeking to effectively reallocate funds for a wide variety of programs to avoid being required to return them to the federal government at the end of this year. While most of the funds have already been spent or are otherwise obligated to be spent, the State will have to take some additional action before December 31, 2024 on the approximately $327.2 million that were, as of the end of March, at some risk of recoupment by the federal government.

Flexible Federal Funds and Deadlines for Use

The federal government’s response to the COVID-19 crisis resulted in the New Hampshire State government receiving about $2.25 billion in flexible federal funds, including short-term funding from the Coronavirus Aid, Relief, and Economic Security (CARES) Act and long-term appropriations from the American Rescue Plan Act (ARPA). These ARPA funds, named the Coronavirus State Fiscal Recovery Funds (CSFRF), totaled $994.56 million for New Hampshire, with Coronavirus Local Fiscal Recovery Funds (CLFRF) including an additional $264.11 million for New Hampshire’s ten counties and $198.2 million for the state’s cities and towns.

The CSFRF funds must be spent by December 31, 2026, and unspent funds after that date will be returned to the federal government. More critically for policymakers this year, CSFRF and CLFRF (or CSLFRF combined) funds must be obligated by December 31, 2024. By the definition established by the federal government, obligation “means an order placed for property and services and entering into contracts, subawards, and similar transactions that require payment.” Obligation can also include certain salaries and wages to be paid to public employees, interagency agreements structured similarly to a contract or subaward, compliance costs associated with administering the CSLFRF, and instances of certain reclassifications of projects after the December 2024 deadline.

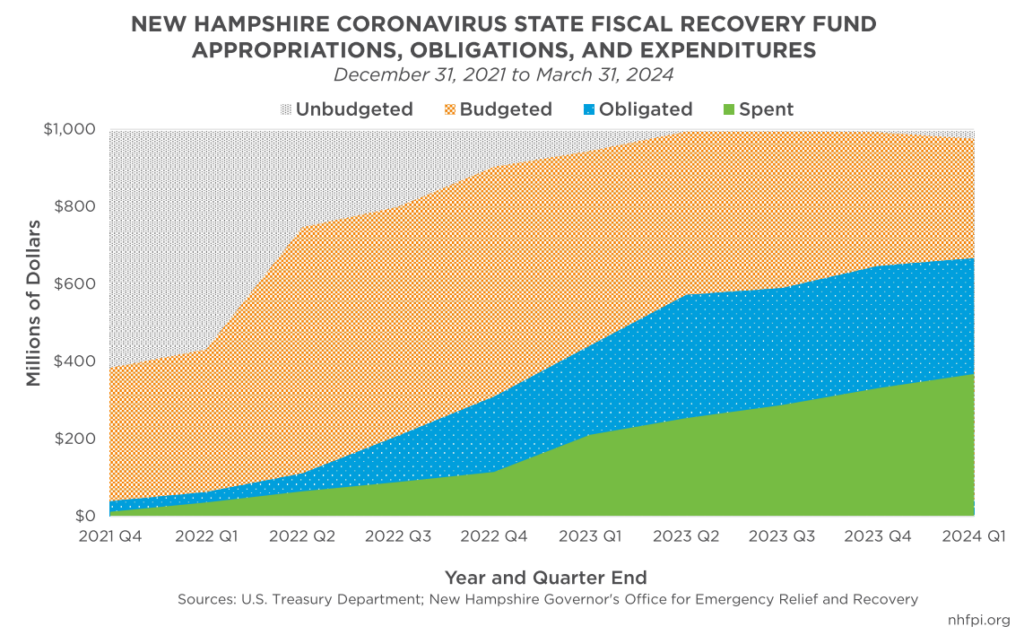

Budgeting the funds for a particular purpose through a policymaking body’s approval would likely not be sufficient to be considered obligated by the federal government. As of the end of March 2024, the State of New Hampshire reported that $327.2 million, or one-third of the original $994.56 million that the State received in payments during 2021 and 2022, had not yet been obligated or spent. Since appropriations began in June 2021, almost all CSFRF dollars have been budgeted for a wide variety of purposes at some point in time. However, unbudgeted funds and funds that are budgeted but unobligated will need some action taken relative to them this calendar year to avoid recoupment.

The Allocation Process

Since CSFRF dollars began arriving at the State government in May 2021, the State has used a pre-existing legal framework to appropriate most of these funds. The flexible funds from the CARES Act were appropriated under the Governor’s emergency powers associated with the COVID-19 pandemic, although a Stakeholder Advisory Board and a Legislative Advisory Board provided opportunities for input from members of the public. With ARPA CSFRF appropriations, however, State officials used the typical process for accepting federal funds between biennial State Budget authorizations.

In 1965, the Legislature established the Joint Legislative Fiscal Committee to manage changes to the State Budget or outside of the State Budget, including accepting federal funds that arrive in the form of grants during a State Budget biennium, without convening the full Legislature and re-opening the budget process. The Fiscal Committee can, and regularly does, approve the use of funds for State use that do not appear in the State Budget until the next budget cycle, when they are typically incorporated.

The Fiscal Committee, comprised of ten legislators drawn from the House and Senate, does not function like a regular legislative committee that considers and amends bills that could become law. Instead, the Committee meets approximately monthly to consider proposals and requests from State agencies. For example, to accept and use a federal grant from the federal Centers for Disease Control and Prevention, the New Hampshire Department of Health and Human Services would draft a description of the funds and how they would be used for consideration by the Fiscal Committee, which would then typically accept, reject, or table the proposal. Committee members may ask for changes but cannot make them as part of the Committee process. There is no opportunity for a hearing or formal public input, and agenda items are driven primarily by the needs and requests of State agencies. In addition to the Fiscal Committee, accepting federal funds for use typically requires approval of the five-member Executive Council, which also considers proposals from State agencies in an oversight capacity.

Almost all the CSFRF budgeted by policymakers has moved through the Fiscal Committee and the Executive Council rather than engaging the full Legislature. This process has generally kept funds outside of the State Budget and State law, instead relying on the regularized process established in law for use between budget cycles. Funds have remained outside of the State Budget across biennia as well, despite the adoption of new State Budgets with different sets of federal funds from other sources. In most cases, legislators seeking to allocate CSFRF through legislation have been encouraged to channel ideas for using CSFRF into recommendations from individual State agencies made to the Fiscal Committee and managed by those State agencies, rather than directing them through separate legislation.

One key exception to this practice was a bill, passed by the Legislature and signed by the Governor in 2023, that appropriated $21.6 million in CSFRF, contingent upon its availability at the time, for the design and construction of a new, secure youth development facility to succeed the Sununu Youth Services Center.

While the federal government urged recipient state and local governments “to engage their constituents and communities in developing plans to use these payments, given the scale of funding and its potential to catalyze broader economic recovery and rebuilding,” no set process for deciding how to appropriate these funds was prescribed by the federal government. As a result, processes have varied between states and among local governments. For example, in neighboring Maine, the Governor and Legislature established a plan in state law in 2021 that made appropriations from Maine’s $997.5 million in CSFRF for a variety of purposes and deployed the funds between 2021 and 2023.

Reallocations Begin

To avoid returning CSFRF dollars to the federal government, New Hampshire State officials have begun identifying funds that will not be obligated in time to meet the deadline under current budgeting plans. In consultation with other State agencies, the New Hampshire Governor’s Office for Emergency Relief and Recovery (GOFERR), which oversees these funds and reports on their use to the federal government, identified $60.1 million, as of May 8, 2024, that was available to be reallocated for other purposes.

The reallocated funds made available primarily come from programs that have either underspent their budgets or were not established in whole or part. Programs that had identified funds for reallocation in excess of $2.5 million included:

- $19.2 million from a $25.1 million initial allocation for a program designed to support youth residential treatment and transitional living facility improvements in response to COVID-19

- $15.4 million out of a $50.1 million initial allocation to support infrastructure improvements at county nursing facilities with a 40 percent match

- $7.6 million of an initial $20 million allocation to provide emergency temporary housing supports following the end of direct federal appropriations to New Hampshire for this purpose, although more federal funds were made available later for support

- $5.0 million, which was the entire initial allocation, for a substance use disorder detox bed capacity investment program intended to provide medically-managed intensive inpatient withdrawal care capacity

The Fiscal Committee began approving programs funded with these reallocated dollars at their February 2024 meeting. By the May 2024 meeting, GOFERR began incorporating contingency statements into some items put forward before the Fiscal Committee. These items empowered GOFERR to provide final authorization on the availability of funds, including the assessment that the amounts available are sufficient and “a determination of appropriate expenditure category.” While not specified, that language may be a reference to the more flexible revenue replacement component of the CSFRF and seeking to ensure that funds are only used on eligibile uses within those constraints.

Eligible Uses of These Flexible Funds

As policymakers consider other potential reallocations ahead of the deadline, they continue to enjoy the substantial and rare opportunity to deploy federal funds in a flexible manner to improve the lives of Granite Staters. The federal government has provided expansive potential purposes, and added to the list of purposes over time, for permissible uses of these funds by state and local governments. These purposes include replacing public revenue lost due to the pandemic; responding to the adverse public health and economic impacts of the pandemic; providing premium pay, including retroactive pay, for essential workers; investing in necessary water, sewer, and broadband infrastructure; supporting certain types of transportation projects and community development initiatives; and providing relief for natural disasters.

When these funds were first provided, the federal government encouraged state and local governments to “consider funding uses that foster a strong, inclusive, and equitable recovery, especially uses with long-term benefits for health and economic outcomes.” The federal government also stated that “these resources lay the foundation for a strong, equitable economic recovery, not only by providing immediate economic stabilization for households and businesses, but also by addressing the systemic public health and economic challenges that may have contributed to more severe impacts of the pandemic among low-income communities and people of color.”

As the deadline looms for New Hampshire policymakers to reallocate the remaining funds, the pace of obligating CSFRF thus far suggests significant reallocations may remain. GOFERR has indicated that more will be known about the amount of funding available for reallocation after the end of the State Fiscal Year on June 30. Legislators and State agency officials have a limited but substantial opportunity to use these one-time funds for investments that foster long-term prosperity for all Granite Staters.

– Phil Sletten, Research Director