The Low and Moderate Income Homeowners Property Tax Relief program is a rebate program operated by the New Hampshire Department of Revenue Administration that provides a relatively small amount of property tax relief to homeowners with limited incomes. Applicants have until June 30, 2022 to apply for a rebate, and may file an application or find the required forms on the Department of Revenue Administration’s website. Property taxes typically account for a greater percentage of income for people with low and moderate incomes in New Hampshire than for people with higher incomes.

Expanded Eligibility

Established by legislation in 2001 as a credit against the new Statewide Education Property Tax, the Low and Moderate Income Homeowners Property Tax Relief program provides tax relief for residents with incomes under certain thresholds. However, those income thresholds had not been raised since the program was created in 2001, and were not adjusted for inflation in the interim.

A new law passed and signed last year raised the income thresholds from the levels set in 2001, substantially expanding eligibility and boosting relief for lower-income participants. Previously, no credit was available to single individuals with more than $20,000 in income annually, or $40,000 for married couples or heads of households. These caps substantially limited the number of people eligible for the program relative to the significance of property tax costs to individuals and families with middle and lower incomes. In 2019, about one in five New Hampshire households, or approximately 110,000, had incomes below $35,000 per year.

In the 2022 iteration of the program and for future years, the income cap has been set to $37,000 for an individual and $47,000 for a married couple or a head of household.

Crucially, the program provides a credit in part based on income and in part based on the value of the home up to a certain local assessed dollar value for the claimed homestead. Under the prior statute, that dollar value of the homestead had been limited to $100,000, with an adjustment for local value equalization. For 2022 and beyond, that assessed value cap has been increased to $220,000, meaning more of a program participant’s homestead value can be used in calculating the size of the credit. This change is particularly important given the recent rapid increase in the prices of homes.

These eligibility expansions mean more residents will qualify for this tax relief.

Important But Limited Tax Relief

The eligibility expansion is the first in two decades, and participation in the program has declined significantly during that time. While there were 27,208 claims granted in Tax Year 2003, totaling about $7.5 million, claims fell to 6,865 by Tax Year 2018. Only about $821,400 in relief was provided through the program last year. This substantial drop likely reflects the lack of adjustment in the eligibility requirements over time, as inflation made a smaller portion of New Hampshire’s population eligible over time.

Dropping enrollment may also have been due to a lack of awareness among taxpayers that they are eligible. The expansion of the program means that under enrollment relative to eligibility may be even higher this year without enhanced awareness. The State has access to significant flexible federal funds through the American Rescue Plan Act that can be used to fund public benefit navigators, who could help people become aware of, and access, this property tax relief. Navigation support could disproportionately help Granite Staters in underserved populations or who have limited English proficiency and, if also used to access federal tax credits and other benefits, may boost the economy overall.

A third reason for under enrollment may be the relatively limited value of the benefit compared to the property tax owed by households. The average relief granted by the Low and Moderate Income Homeowners Property Tax Relief program in 2018, the most recent year for which detailed data are available, was $160 per filed claim. The total amount of property tax charged to residents totaled about $2,800 for every person in the state.

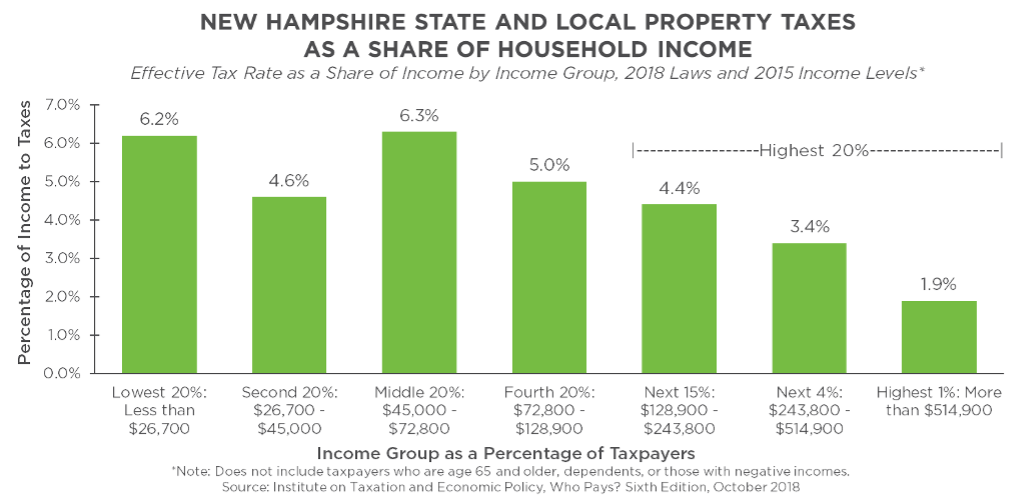

The program’s expansions for 2022 may increase the average value of relief, and expanding the program to include more middle-income and lower-income households will likely provide a welcome tax break for those households that enroll. A 2018 analysis by the Institute on Taxation and Economic Policy estimated that state and local property taxes in New Hampshire amounted to the equivalent of 6.3 percent of income for middle-income earners under age 65, and 6.2 percent for those in the lowest 20 percent of income-earners. The households with incomes in the highest one percent paid an estimated 1.9 percent of their incomes in property taxes.

Accessing Property Tax Relief

Eligible taxpayers have until June 30, 2022 to file a claim for this property tax relief. The Department of Revenue Administration now permits claims to be filed online through the Granite Tax Connect portal, but also provides forms that can be printed and mailed as an alternative. New Hampshire residents can learn more about the program, including reading the answers to frequently asked questions, on the Department’s website.

Economic modeling suggests policies that direct assistance to residents with lower incomes are among the most effective forms of economic stimulus. Connecting eligible Granite Staters to aid programs can help to build a more vibrant and inclusive economy in New Hampshire.

– Phil Sletten, Senior Policy Analyst