New Hampshire’s labor force constraint, which is the limited number of workers available in the state’s economy relative to the jobs that could be filled, has been slowing economic growth from its potential well before the COVID-19 pandemic arrived.

Recovering Labor Force

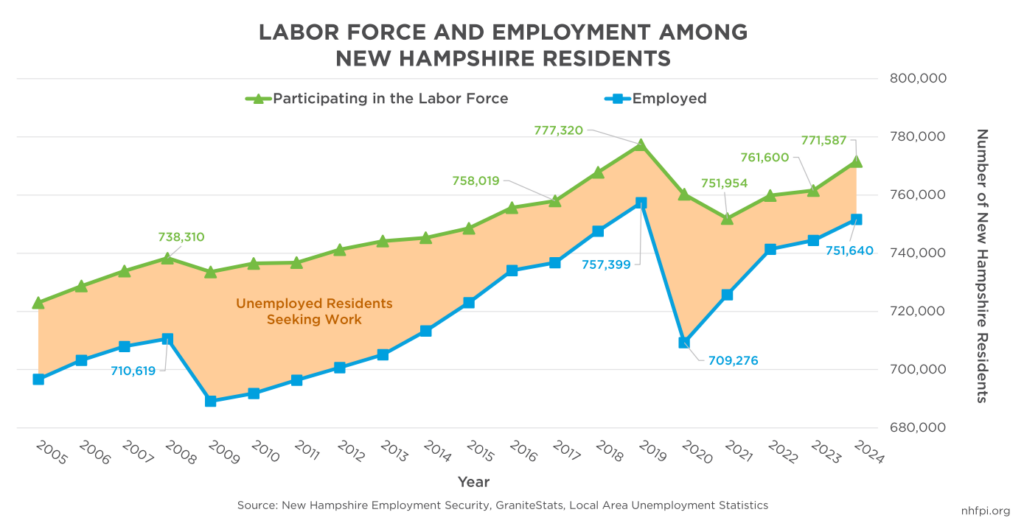

After expanding just 0.2 percent in 2023, New Hampshire’s labor force grew approximately 1.3 percent in 2024, according to benchmarked data from New Hampshire Employment Security published in March. That is the fastest growth rate in the number of people working or actively looking for work since at least 2018, which had a similar growth rate of about 1.3 percent, and was faster than the 2010-2019 annual average growth rate of 0.6 percent.

While the size of the labor force increased more slowly in the years immediately following the Great Recession of 2007-2009, annual labor force growth rates were faster than one percent during only two years, 2018 and 2019. Both years were in relatively constrained labor markets with wage growth that outpaced inflation, particularly at the lower end of the income scale.

In 2024, the total labor force was an estimated 771,600 Granite State residents, with about 751,600 indicating they were employed. Estimates from late 2024 and the first three months of this year suggest the number of people working or looking for work has expanded beyond that 2024 average, reaching approximately 775,300 by December 2024 and a preliminary total of 777,500 in March 2025. If the latest figures hold through data revisions, it would indicate New Hampshire’s labor force has returned to the pre-pandemic 2019 average five years after the pandemic.

The unemployment rate was 3.0 percent in February 2025, the first month that, outside the COVID-19 pandemic’s unemployment spike and rapid recovery, the state’s estimated unemployment rate has been at or above 3.0 percent since December 2015. Preliminary estimates place the state’s March 2025 unemployment rate at a seasonally-adjusted 3.1 percent.

Closer to a Balance, But Not There

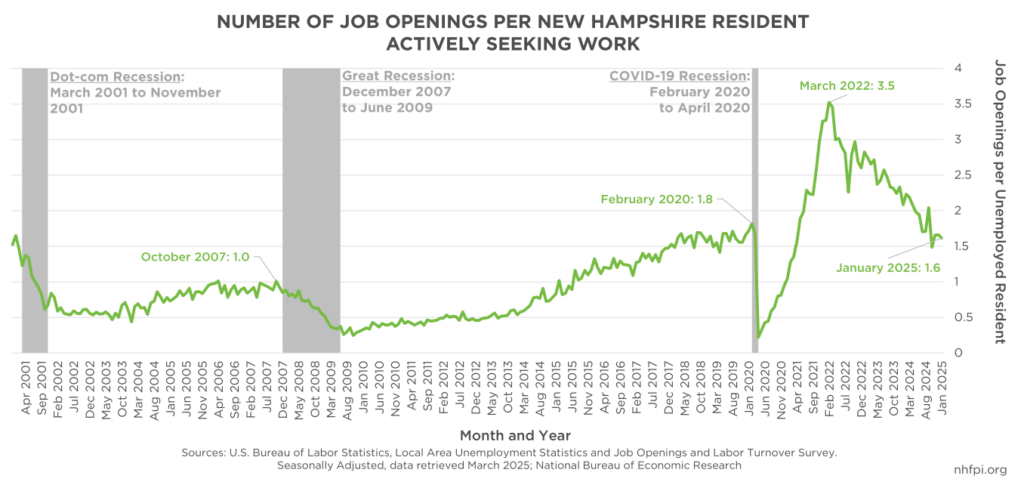

Data suggest employers can more easily find workers now compared to three years ago. In February 2020, just before the pandemic reached New Hampshire, the number of job openings in New Hampshire per unemployed person seeking work was 1.8, and it peaked at 3.5 jobs per person in February and March of 2022. Since that time, the number of jobs per unemployed worker has declined, dropping below pre-pandemic levels to an estimated 1.6 in January 2025. The revised data released in March show a smoother decline than prior estimates.

Long-Term Headwinds: Demographics, Housing, and Child Care

While the state’s workforce constraint appears to have become less severe, demographics suggest the current easing may be short-lived, barring a significant recession or other major economic event. About 31 percent of New Hampshire’s labor force is 55 or older, and 9.2 percent are 65 or older. The state does not currently have a younger population large enough to fill all the jobs left by the retirements that may come in the next decade.

Other constraints have reduced the extent to which people can participate in the workforce, or afford to move into the state. In 2024, an average of 17,300 people reported they were not working because they were caring for a child who was not in school or child care.

Limited affordable housing opportunities also challenges the state’s ability to attract new potential workers to New Hampshire and retain existing residents. The median purchase price for a single-family house continues to hover above half a million dollars. For those unable to afford the high cost of borrowing for and purchasing a home, and thus remaining in the rental market, the median cost for a two-bedroom rental unit increased 36 percent from 2019 to 2024.

With more deaths than births every year since 2017, New Hampshire relies on domestic and international migration to support workforce growth.

These challenges are not new. As NHFPI’s 2018 report New Hampshire’s Economy: Strengths and Constraints summarized, “Slower hiring due to workforce constraints is likely slowing the state economy, and aging demographics paired with limited housing availability restrict the state’s ability to add to the workforce quickly.”

These recent data indicate employers might have an easier time finding new employees in 2025 than they did in 2022. However, the long-term trajectory suggests more labor force supports, such as enhanced access to education across all ages, may be needed to sustain the New Hampshire workforce necessary for a vibrant economy.