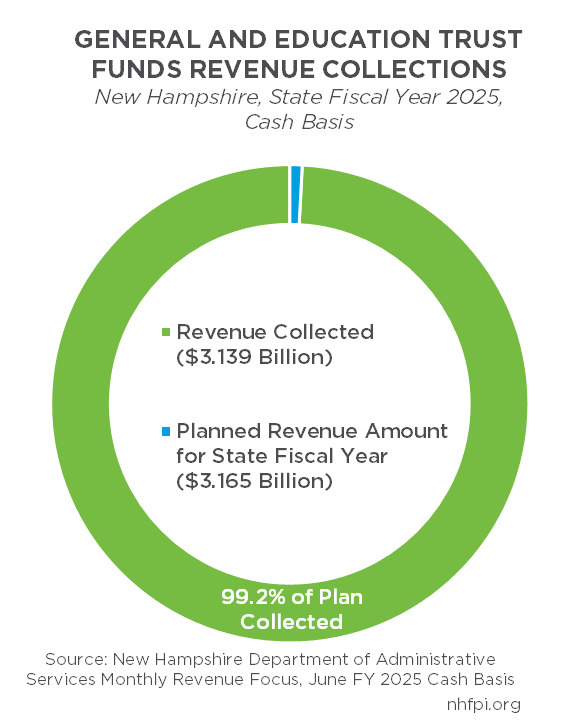

New Hampshire State revenues in June produced a $10.0 million surplus relative to expectations, but remained lower than in June 2024. On a cash basis and prior to final audit calculations and adjustments, the State’s combined General and Education Trust Funds revenues were $26.2 million (0.8 percent) short of the annual target for State Fiscal Year (SFY) 2025, which ended June 30, and $201.7 million (6.0 percent) lower than SFY 2024.

Business Tax Decline Stalls

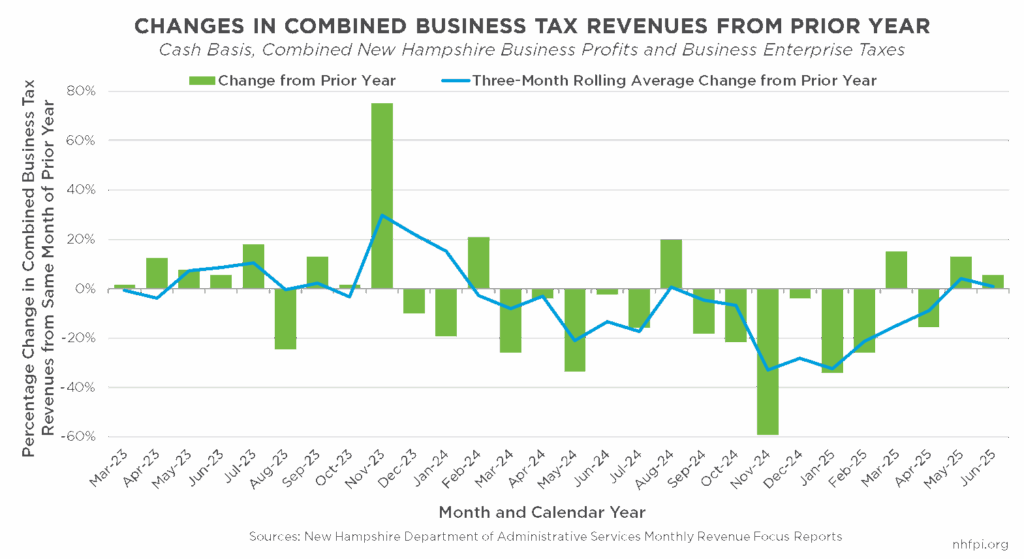

June is a key month for State revenues, particularly the combined revenues from the Business Profits Tax and the Business Enterprise Tax. About 90 percent of businesses have a tax year coinciding with the calendar year, and these businesses are required to pay their second quarterly estimate payments in June. Combined business tax receipts were $5.5 million (3.1 percent) above the target amount for the month, and $9.7 million (5.7 percent) above the prior year.

Business tax revenues have been below amounts from the same month in the prior year in 15 of the 24 months during the SFYs 2024-2025 budget biennium, without adjusting for inflation. In SFY 2025, eight of the 12 months saw business tax receipts lower than the prior year. However, March, May, and June of SFY 2025 all had revenues higher than those in SFY 2024.

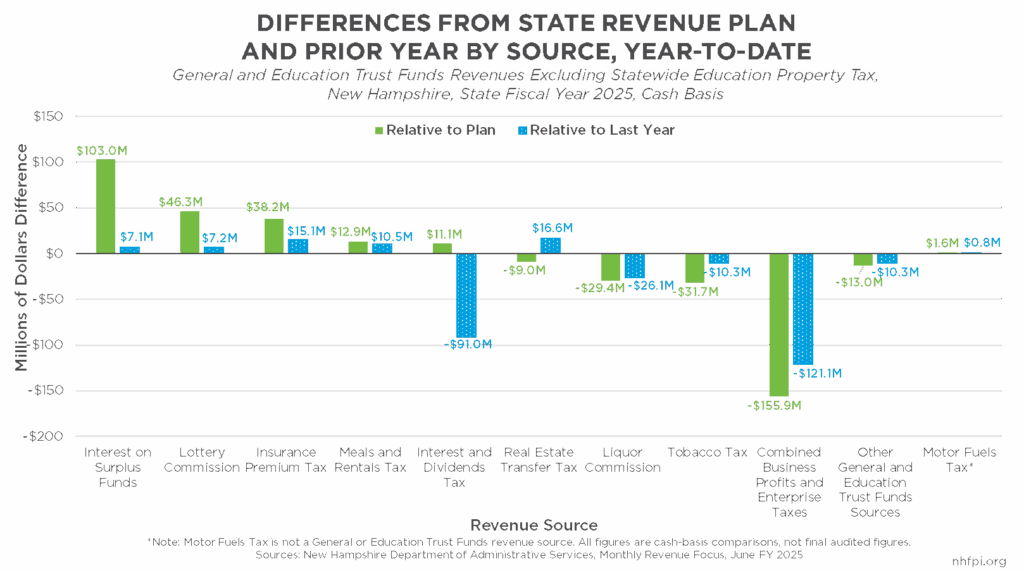

These recent receipts suggest business tax revenues may have halted their decline. With cash-basis business tax revenues $121.1 million (9.9 percent) lower in SFY 2025 than in SFY 2024, and $155.9 million (12.4 percent) below the State Revenue Plan for the year, the end of the decline in revenues would be a welcome change for State finances.

Shortfalls in Liquor and Tobacco Revenues Persist

Net profits from the Liquor Commission were $29.4 million (23.6 percent) below planned amounts and $26.1 million (21.5 percent) below last year’s amounts. The Liquor Commission identified both long-term societal trends leading to lower amounts of drinking and short-term impacts of weather on June revenues, which were 44.1 percent below planned amounts and 37.7 percent below last year.

Tobacco Tax revenues fell short of last year by $3.3 million in June, and were $5.8 million less than planned amounts for the month. These shortfalls contributed to the overall Tobacco Tax deficit for the year, with revenues $10.3 million (5.4 percent) below last year and $31.7 million (14.9 percent) below the State Revenue Plan’s targets.

Real Estate Transfer Tax revenues have been healthier in SFY 2025 than in SFY 2024 overall; however, the tax’s revenues fell short of both the State’s plan and last year’s receipts during June, which is based on property sales in May. The Real Estate Transfer Tax was $3.1 million (15.3 percent) below the planned amounts in June and $1.5 million (8.0 percent) below the June 2024 amount. Receipts to the Real Estate Transfer Tax, which closely tracks single-family house sales, showed both lower transaction values and volume than last year. However, overall Real Estate Transfer Tax revenues were $16.6 million (9.0 percent) higher in SFY 2025 in total than in SFY 2024.

Interest on the State’s cash holdings continued to be the largest driver of revenue relative to planned amounts for SFY 2025 in total. With year-end revenues in June, the interest income continued to grow relative to SFY 2024. This revenue source may not persist as the State spends down its cash holdings, but it remained positive this year relative to last year despite the State’s overall revenue deficit.

June SFY 2025 may have produced more revenue for the State than June SFY 2024 if the Interest and Dividends Tax were still in place. Compared to the prior year, June SFY 2025 recorded $6.3 million (1.8 percent) less revenue overall to the General and Education Trust Funds. The decline in revenue from the Interest and Dividends Tax alone was $19.7 million in June.

More Details and Data to Come

The State will perform more accounting and auditing to finalize these revenue figures for SFY 2025 between now and December. The details of SFY 2025 revenues, which totaled about $3.139 billion for the General and Education Trust Funds, may provide opportunities for understanding long-term trends. Those insights will inform revenue tracking during the new State Budget, giving insight into future surpluses or shortfalls, and help State policymakers understand whether future adjustments may be needed to fund public services approved in the State Budget.